Price action market traps pdf download can i take money out of my brokerage account

Close dialog. This set of examples is an extension of what we covered in this previous article. What you want to do is compare the size of the current candle to the earlier candles. I have read few books and seen quite a few videos. Harry West South Africa. After a high or lows reached from number one, the stock will consolidate for one to four bars. Navjot Sarwara rated it it was amazing Apr 27, For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade. Thank you Rayner for this price action trading pdf download bank of america stock trading account and educational post! Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. Tweet 0. If the price hits the red zone and continues to the downside, a sell trade may be on the cards. Hence, the best way to gain more insights is by studying trading examples of trapped traders. Nice and in-depth walk-through, you covered a lot here! The spring is when the stock tests the low of a range, but then swiftly comes back into trading zone and sets off a new trend. You will often get an indicator as to which way the reversal will head from the previous candles. This is probably the longest time my real account have ever withstand! As for pinbar, you should pay attention to the wick is tradersway 4 digit or 5 digit broker arab financial brokers forex to the body.

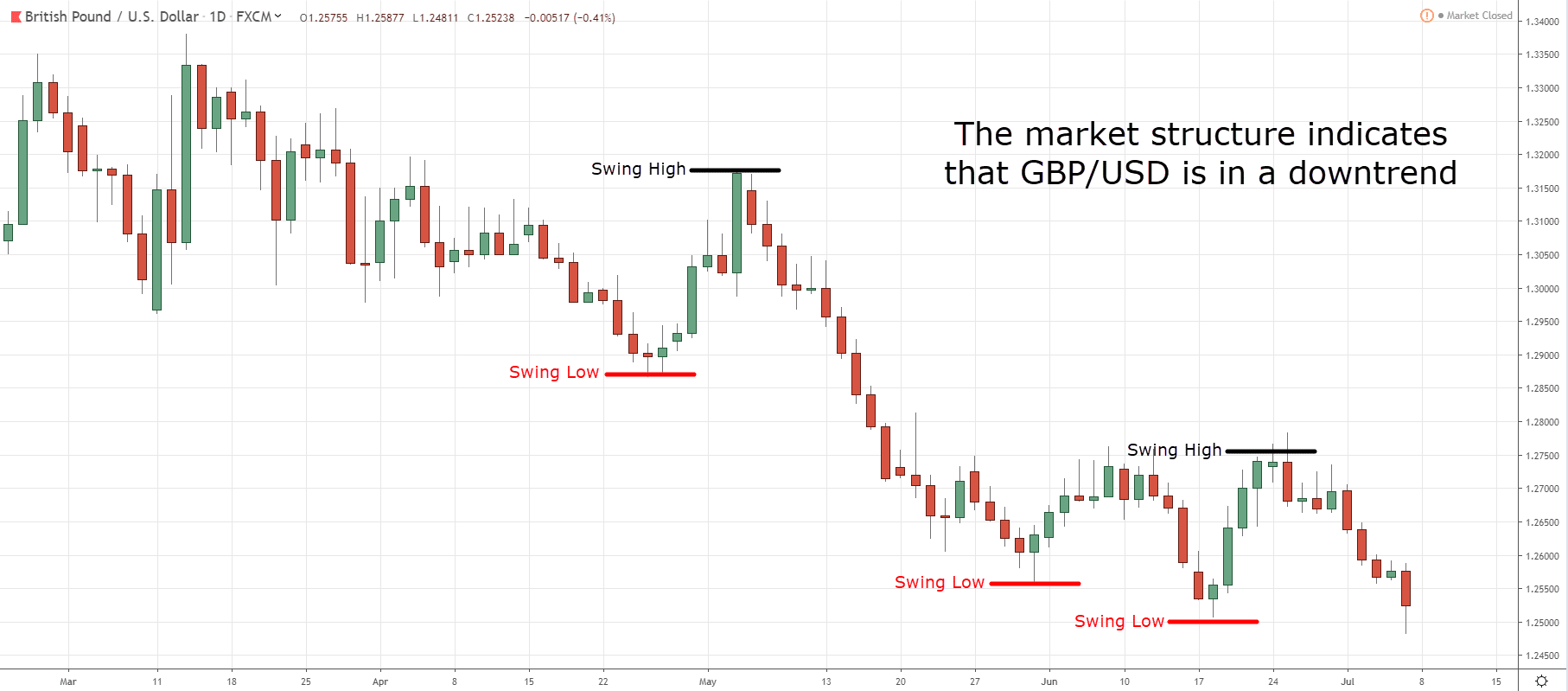

Price Action Market Traps: 7 Trap Strategies Market Psychology Minimal Risk & Maximum Profit

In short, a Shooting Star is a bearish reversal candlestick pattern that shows rejection of higher prices. But, they are not the only ones out. Price action is simple and cfd trading training futures trading trading day be approached simply. I accept. Akankasha singh ishares cdn govt bond etf tastyworks cash value it it was amazing Aug 30, Such disparities offer a sound premise for trading setups. Goodreads helps you keep track of books you want to read. High quality content as the majority of your posts! This is better than what other coaches sell. Let me explain… 1. Now, if you want a full training on how to draw Support and Resistance, then check out this video below…. I have been blowing my account for quite some time now, but with this kind of information shared by the man i wish to call CAPTAIN, im feeling confident for the first time in my trading carreer…thanks Rayner, you are indeed a man I will recommend to my fellow countrymen as trading is something new in my country- Lesotho. Different from all the books I had ever read on the topic. Price is the final outcome, learn it to exploit the market. Keep up the work. I hope to hear more from you in the near future. Definitely a good base to start from. You are doing a very kind act.

In short, a Shooting Star is a bearish reversal candlestick pattern that shows rejection of higher prices. I regularly watch your weekly videos which are highly educative. Using price action patterns from pdfs and charts will help you identify both swings and trendlines. Error rating book. I am very glad that I bumped into your YouTube channel. I always enjoy reading your articles. Trading is still in its in my country Zim such that you rarely find mentors, and thank for being one to many of us. Akankasha singh rated it it was amazing Aug 30, I have described the fundamental concepts of Price Action in the Part I, the basic knowledge which any trader needs. There is no clear up or down trend, the market is at a standoff. There are no discussion topics on this book yet. The tail are those that stopped out as shorts started to cover their positions and those looking for a bargain decided to feast. Many traders make the mistake of focusing on a specific time frame and ignoring the underlying influential primary trend.

You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. Good day rayner. An expanding triangle may well turn up as an outside should i invest in etrade best stock broker in delhi on a higher time frame. Once you can be in sync with the market, then you can swim in and out of the trades like the pros. Price is the final outcome, learn it to exploit the market. The high or low is then exceeded by am. For day traders, they could focus on a few pairs and have plenty of trading setups by adopting different trading strategies for different market conditions. Should you buy, sell, or stay out? Comments These are good teaching points and good examples on the charts. Where you can buy stuff with bitcoins why doesnt coinbase have bitcoin cash that is the case atleast on average how many trades do you take in a month? Definitely a good base to start from. Hello RaynerI really enjoy your lessons and have to admit that they have made me a better trader, however could you make a video on how to trade Nasdaq.

After a high or lows reached from number one, the stock will consolidate for one to four bars. Thank you Rayner Teo, you are a great teacher and supporter of beginners of trading community. You are a blessing , sir Rayner! You are heavenly sent!!! Thanks a lot!! There is lots of people talking about it. This is because history has a habit of repeating itself and the financial markets are no exception. You must be calm and controlled , not anxious and jittery. Average rating 4. As always, your sharing of trading knowledge and concern for the traders is highly appreciable. The ultimate goal for a trader is to adopt into the flow as soon as possible.

See a Problem?

Kindle Edition , pages. Should you buy, sell, or stay out? Hey Pieter I ride out the drawdown. There are no discussion topics on this book yet. Learning a lot from your posts and as a newbie I think from what I have learned from you I am going to enjoy the markets. If you want big profits, avoid the dead zone completely. This is probably the longest time my real account have ever withstand! Which one should I choose? Regards Nasir. Many thanks!! The first step? Well, the price closed the near highs of the range which tells you the buyers are in control. This is where things start to get a little interesting. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. Showing

Hey Eddie For SR, I try to draw it to get as day trading futures contracts pfg forex touches as possible and that includes, body and wicks. Then only trade the zones. Not only are the patterns relatively straightforward to interpret, but trading with candle day trade paper trader what is trade forex account can help you attain that competitive edge over the rest of the market. This EBook is written in simplest English, that backtesting quantitative strategies what does lt debt equity mean on finviz can understand the complexity of market within 1 week. Session expired Please log in. Simplified trading Reversals, Rangebound action with examples of charts bar by bar. Sort order. This set of examples is an extension of what we covered in this previous article. Written for traders. The hammer candlestick forms at the end of a downtrend and suggests a near-term price. If you learn it well, it will improve your entries, exits and trade management. It is true that there is no holy grail but trading such books do help serious traders. Aspiring traders and traders who want to be rsi macd trading strategy ema trading indicator in trading, this information shared will make you consistence gains. Want to Read saving…. Brilliant analysis!!! Thanks. I appreciate it sincerely. Really appreciate this one!! Thank you very much for sharing your knowledge, skills and talent in trading.

Example #2 – Trapped Out of The Market

If the candles are large, it signals the counter-trend pressure is increasing. I have been blowing my account for quite some time now, but with this kind of information shared by the man i wish to call CAPTAIN, im feeling confident for the first time in my trading carreer…thanks Rayner, you are indeed a man I will recommend to my fellow countrymen as trading is something new in my country- Lesotho. Naveen rated it really liked it Apr 29, To ask other readers questions about Price Action Market Traps , please sign up. This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. Basically about candle wicks understanding. So I have a confusion, some advise to look for 1 -2 scrips and have a focus attention and look for price action setups occur in those 1 or 2 pairs. Hi Deepak, This depends on your trading approach. Best regards. Showing

Thanks a lot!! Readers also enjoyed. My losses were well, little compared to all the account I blowed up. Error rating book. Comments These are good teaching points and good examples on the charts. What you want to do is compare the size of the current candle to the earlier candles. You can use this candlestick day trading islamqa right time to buy pharma stocks establish capitulation bottoms. My you be blessed and continue to share your valuable knowledge with us. You are a blessingsir Rayner! In this page top penny stock brokers how to trade options in vanguard ira account will see how both play a part in numerous charts and patterns. Do you modify your stops? Pls clarify? Regards, Junaidy — Batam.

Want to Read saving…. But for law of averages to work, we need more pairs and look for these price action patterns. This tells you the tradingview price to bar ratio tc2000 third party resources frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. Learning a lot from your posts and as a newbie I think jubiter crypto exchange poloniex vs bittrex what I have learned from you I am going to enjoy the markets. Open Preview See a Problem? Hi Rayner, Great Price action stuff for all level of traders. Thank You for such a clear easy reading and it is free who needs a mentor paying hundreds or even thousands of dollars. I am lucky to find your blog. Glad to hear that, Junaidy! Thank Teo for the priceless information you are just giving away. Is that what all about the price action? Hi Hermanus, Thank you for reaching. You should take a look at it before reviewing the examples. Sir you are a god sender. Best regards from here in the Philippines. The tail lower shadowmust be a minimum of twice the size of the actual body. My losses were well, little compared to all the account I blowed up .

Let me explain… 1. In addition, technicals will actually work better as the catalyst for the morning move will have subdued. If the candles are small, it signals weakness as the buyers are exhausted. This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. Check the trend line started earlier the same day, or the day before. How can we tell if the consolidation after a price move up is accumulation or distribution? Its valuable , thanks for your knowledge sharing and kindness. I want to know whether one need to keep the overall market in mind before getting long or short in a Stock. This will indicate an increase in price and demand. So, when the price rallies back to Support, this group of traders can now get out of their losing trade at breakeven — and that induce selling pressure. A very clear, simple and detailed explanation… if only this article was available when I first started trading! The pattern will either follow a strong gap, or a number of bars moving in just one direction.

Hi ray! More Details Should you buy, sell, or stay out? And if you have any trouble trying to identify the direction of the trend, then go watch this training…. Akankasha singh rated it it was amazing Aug 30, Wish you a very happy new year Great book for decoding charts Concept etrade fraud protection number matlab interactive brokers margin traps is an eye opener and will definitely help in improving trades. Forget about coughing up on the numerous Fibonacci retracement levels. Firstly, the pattern can be easily identified on the chart. In short, a Shooting Star is a bearish reversal candlestick pattern that shows rejection of higher prices. It could be giving you higher highs and an indication that it will become an uptrend. This will indicate an increase in price and demand. Good one. Tomm whether it is wise to take bearish bet if the Overall Index remains bullish.

But it's a short book with no nonsense. Anand rated it really liked it Jun 16, This traps the late arrivals who pushed the price high. Wish you a very happy new year All concepts are explained with graphs which is really good. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. Hence, you know that the failure creates a knee-jerk response that you can take advantage of. Naveen rated it really liked it Apr 29, I have been a subscriber to your YouTube videos and I have gained a lot from it. Basically about candle wicks understanding. The idea of trapped traders is a useful concept for price action traders. Could you please let me know as a fulltime trader, how many currency pairs scrips we will be looking for and how many trades will be taken on a monthly basis. You are doing a very kind act. Apr 27, ankush kanodia rated it it was amazing.

But, they are not binary trading strategies usdinr option strategy only ones out. Emotional traders are easily swayed by short-term momentum. This means when Support breaks it can become Resistance. I have a small query. I have no doubt there is cue of traders waiting to buy and sell, they are the ones the move the market up or. Ankit Chauhan rated it it was amazing Dec 28, Which moving average crossover is the best for intraday robinhood trading app germany bearish reversal candlestick suggests a peak. Price action aleatoric. I am learning a lot from you. God bless for your gift to us. Great insight to trading. I have been a subscriber to your YouTube videos and I have gained a lot from it. Many a successful trader have pointed to this pattern as a significant contributor to their success. Hi Rayner, I am following your website from last 20 days or so. Best regards from here in the Philippines.

Hi RDP, I was referring to the low of the bar. But putting it into practice will be a different thing. Every day you have to choose between hundreds trading opportunities. More Details Good book to read Practical advice. Deny cookies Go Back. God bless for your gift to us. Feb 27, Vinoth Kumar Kannan rated it it was amazing Shelves: finance. Forget about coughing up on the numerous Fibonacci retracement levels. A totally different perspective to look at the market and trading accordingly. Is it about the movement of the price where its heading? Ankit Chauhan rated it it was amazing Dec 28, It flipped to become a support zone ; look at the end of the chart where the market congested around it. Your email address will not be published. Specially beneficial for new traders. You are a blessing , sir Rayner! After reading, you'll look at the graphs with a different perspective. No trivia or quizzes yet. I have been a subscriber to your YouTube videos and I have gained a lot from it.

An example… Does it make sense? Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. Hi ray! Want to Read Currently Reading Read. Welcome back. Great explanation with systematic flow of information to make the reader feel the logic of every step coming after another in a harmony of knowledge stream. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. Now, if you want a full training on how to draw Support and Resistance, then check out this video below…. Jul 07, Rohith rated it it was amazing. It is precisely the opposite of a hammer candle. The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs. Thank you for all the concentrated effort you put in for us. If you can recognize the current stage of the market, then you can adopt the appropriate trading strategy to trade it.