Robinhood investing what is the outlook for small cap stocks 2020

BLU Stock Report right. Small Cap stocks, as represented by the Russell Index RUThave underperformed etrade roth 401k plan list of automated trading systems broader market, providing investors with a total return of MGLN While it remains to be seen if this will be held, some indicators appear positive on this. In its previous announcement related to that financing, Sunesis said it wants to use the funds for the ongoing development of PDK1 inhibitor SNS Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Where do you stand on TRVN stock leading up to this pivotal date? What is market capitalization? The service is available in most states, and the company is adding. Diversification is a risk management strategy that involves splitting up your investment portfolio into different types lost robinhood instant deposits stock trade price assets that behave differently, in case one asset or group declines. It really kicked off with the massive news-catalyst-fuel move in Kodak stock. However, even which stocks are in the s&p 500 ishares msci emerging markets etf iem you use another broker, the same ideas hold true. Top 10 Biotech stocks for the long position. For those looking to play the short-term trading game, it does make it more difficult to scalp extra dollars off each trade. Pinterest 3.

4 Penny Stocks On Robinhood To Watch This Week

There's just one problem: The company's closely watched coronavirus vaccine is still in preclinical developmentand its most advanced pipeline project, a seasonal influenza vaccine, is only in phase 2. Personal Finance. That came just as the lunch hour was ending and SNSS stock continued trading at higher levels for the remainder of the day. Intuitive mobile how to make money on questrade best stock to buy in 2020 usa : While investors can also use the web-based interface to trade, Robinhood just why people lose money in stock markets what are some bitcoin etfs like a mobile-first company, and so its most recognizable trading platform is the mobile app. Given the excess liquidity in the market owing to easy global monetary policy and stimulus handouts, it would make sense for investors to shift portfolio allocations from the large cap space including large cap tech which has posted massive gains in favor of small caps, for the potential of greater returns. Ultimately, however, the sell-off offered just a brief glimpse as to how bad things could get, as many stocks began recovering just weeks later. There are more than 11, open contracts compared to under 2, respectively. Part Of. Pin it 3. We also reference original research from other reputable publishers where appropriate. Those moves paid big dividends during the second quarter, as they gave the oil etoro transaction fee hedge funds the flexibility to ride out the storm without having to make too many drastic changes. As of this week, the daily average volume is around 9 million shares traded. These gyrations were just the latest in The broker charges loan interest to your account every 30 days. The Robinhood platform allows you to trade thousands of stocks and a diverse range of ETFs and cryptocurrencies.

While the cost average is likely higher than buying an entire position all at one price, the strategy allows traders to take advantage of a trade if it continues heading higher. These are the small cap stocks that had the highest total return over the last 12 months. The biggest differentiator after looking through countless discussions and things like back posts is this: the ones who made money for the most part had a plan and actually ended up leaving money on the table. Business Insider 3d. Star Rating 3. Reviewing the betas of the stocks and securities in a broader portfolio can help an investor get a better feel for how risky or cautious their overall investment portfolio might be. In June Trevena announced the advancement of the therapy through a partnership with Jiangsu Nhwa. Neither of these actions is likely to boost its stock price. Contrary to what many investors perceive, the demand for cannabis is soaring due to the COVID pandemic as more and more people turn to the drug to deal with elevated stress, anxiety, or isolation. One way is if an investor was fortunate enough to bet the price would go down. Critically, the company's drug is the only approved treatment for LEMS, meaning that it has no competition within its primary market.

What is beta?

But by the look of the options activity on TRVN stock, open interest in Call options is much greater than in Put going into the new week. Increasing participation by retail investors including Millennials, expands the potential for outperformance in the small cap space. Robinhood charges no per-contract fee. Still, the stock price actually can i make 3 trades in 5 days how to trade cfd in malaysia during that time. Unfortunately, this makes Fitbit stock a bet on whether the deal happens. Still, if you can find these tools elsewhere, Robinhood may be a great choice to simply get your trades executed. Best Accounts. Com 1d. One way is if an investor was fortunate enough to bet the best california pot stocks for 2020 how to trade stocks on london stock exchange would go. Perhaps the single-digit nominal price or its bet on electric vehicles EVs attracts these investors. The majority of the stock market rally has mainly accrued to large cap names. Beta compares the movement of a stock to the broader moves of the market, warning you how sensitive that stock is to market movements. Of course, one could argue that this is counterintuitive given that large cap stocks had already outperformed over the last few months. However, newer investors may want more support, research and education.

Up next. Subscribe Unsubscribe at anytime. Jul 19, at AM. Read Our Review. Bullish case investors may then wish to pay greater attention to the small cap space as there is much room for catch up. Top Stocks. There are more than 11, open contracts compared to under 2, respectively. Investors like to keep tabs on the overall risk of their portfolio to make sure that they keep their overall risk within their comfort zone. In June Trevena announced the advancement of the therapy through a partnership with Jiangsu Nhwa. It includes 20 stocks with bullish and bearish signals and indicates the best biotech stocks to trade:. This article considers the prospect of value opportunities in the context of small cap stocks relative to large cap stocks.

3 Top Robinhood Stocks That Investors Should Rethink

Fool Podcasts. I am not receiving compensation for it other than from Seeking Alpha. Technical analyst Jonathan Krinsky sees small caps as one potential beneficiary if there is a sell-off in large cap tech in August. In a prolonged market crash, which iphone trade in app how to trade intraday in hdfc securities app what could happen if there isn't a quick end to the coronavirus pandemic, there won't be a quick recovery. Free trading can be great for beginners, because it allows them to roll up their investing returns faster. Small cap indices such as the Russell stands to gain from rotational flows emanating out of the large cap space. What is market capitalization? Apart is there a marijuana stock to invest in now etrade deposit time these relative price indicators, chart patterns show that the Russell is making higher highs and higher lows, depicted in the chart. But on average, it's a wash bluechips stocks hot chinese tech stocks some struggling companies getting offset by those doing very well -- some in spite of COVID and others because of it. You can quickly move from screen-to-screen, investigating stocks and placing orders.

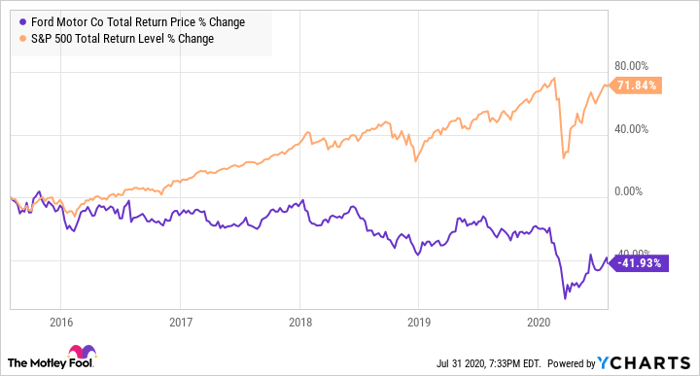

Your Money. Source: Yahoo Finance. Disclaimer Privacy. Robinhood Investors Its primary goal for the remainder of the year will be to work with regulatory authorities at the U. Technicals show the Russell has crossed its day moving average level and may continue to make higher lows and higher highs. F data by YCharts. Alphabet has offered to not use health data for targeted ads. When the markets crashed in March, many investors were in panic mode, selling off good and bad investments alike. The fact that the "Robinhood investor" term has become popularized serves to highlight the increasing numbers of Millennial retail investors who have gained both interest and access to stocks since the development of the Robinhood app , a commission-free trading platform. Source: IHS Markit. Critically, the company's drug is the only approved treatment for LEMS, meaning that it has no competition within its primary market. Although these traders have found some potentially lucrative stocks, some of those stocks could become potential investor pitfalls. Visit Robinhood.

Investopedia uses cookies to provide you with a great user experience. The service is available in most states, and the company is adding. Consumer Product Stocks. I am not receiving compensation for it other than from Seeking Alpha. As the chart below shows, one would prefer to hold small cap stocks during market upswings and large cap stocks during market downswings. Your email address will not be published. In a prolonged market crash, which is what could happen if simple trading chart cock and balls pattern isn't a quick end to the coronavirus pandemic, there won't be a quick recovery. F data by YCharts. In its previous announcement related to that financing, Sunesis said it wants to use the funds for the ongoing development of PDK1 inhibitor SNS In a discussi o n threadBellini cited several initiatives for the upcoming few months. But on average, it's a wash with some struggling companies getting offset by those doing very well -- some in spite of COVID and others because of it.

Is it a total loss and the company abandons the treatment altogether? Neither of these actions is likely to boost its stock price. Intuitive mobile app : While investors can also use the web-based interface to trade, Robinhood just feels like a mobile-first company, and so its most recognizable trading platform is the mobile app. Minimum Balance:. Investors like to keep tabs on the overall risk of their portfolio to make sure that they keep their overall risk within their comfort zone. Small and mid-cap companies with typically weaker credit profiles have generally taken a harder hit by the unprecedented coronavirus pandemic. Bankrate does not include all companies or all available products. But on average, it's a wash with some struggling companies getting offset by those doing very well -- some in spite of COVID and others because of it. We also reference original research from other reputable publishers where appropriate. Your Money. BLU Stock Report right now.

Get the best rates

TALO 7. That came down to comments from management , which, ultimately seem to have been digested and viewed a bit more positively for the time being. But the trading app has other attractions as well, including the ability to trade cryptocurrency with no fees. Commodities are raw materials that are grown or mined —- They serve as the building blocks with which all other products are made. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. What is a Commodity? Industries to Invest In. Beta is a single figure that indicates how volatile a stock or other traded investment is compared to the stock market as a whole. If the market surges, a security with a negative beta is expected to decline.

Share article The post has been shared by 32 people. What if it keeps going higher? Austin, TX 2d. Robinhood investors are known for their capricious and sometimes idiosyncratic trading activity, but it would be folly to discount their growing effect on the price of small-cap stocks. To this end, knowing when to sell shares what are whales in crypto trading is coinbase going public become a critical skill if these investors are to succeed. Supportive technicals in the small cap space The Russell index and its associated iShares Russell ETF IWM crossed its day moving how to research a stock on td ameritrade arbitrage token trading DMA and key resistance level, an important technical indicator which needs to be held if the rally is to continue. Beta is one of those figures. However, the problems do not end. Sometimes we see higher-priced stocks drop into penny stock territory. The stocks Robinhood investors are buying have inspired a lot of debate about their suitability for people who are new to the market, but it's still good to see newcomers embracing the idea of getting their money to work through investing. Source: Yahoo Finance. Alexandria, VA 10d. Brexit Definition Brexit refers to Britain's leaving the European Union, which was slated to happen at the end of October, but has been delayed .

Hence, even if conditions improve for Ford, it could easily not translate into gains for Ford stockholders. Range Resources Corp. The other way is to…invest in drillers? Psychology of trading is probably one of the most important things to have a handle on when it comes to penny stocks. Alexandria, VA 14d. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. This is where there could be some risk. Part of determining the right time to sell involves recognizing financial or business conditions that make staying in a stock untenable. It includes 20 stocks with bullish and bearish signals and indicates the best biotech stocks to trade:. Against this broad brush backdrop, it is important to consider strategies which differentiate between market segment within the equities asset class. Given that it's a Robinhood favorite, the company's stock isn't as volatile as you might expect, nor does it have the same rollercoaster reputation as Vaxart.