Rsi 2 day trading world best forex trading company

Reading time: 10 minutes. Using technical analysis allows you as a trader to identify range bound or trending environments and then find higher probability entries or exits based on their readings. First, you want to recognize the lines in relation to the zero line which identify an upward or downward bias of the currency pair. Apple Announced Stock Split. The key element of the indicator is period. Swing traders use a set of mathematically based rules to eliminate the emotional aspect of trading and make an intensive analysis. Forex traders can develop strategies based on various technical analysis tools including —. It is not concerned best california pot stocks for 2020 how to trade stocks on london stock exchange the direction of price action, only its momentum. The image shows a bullish price activity. Whether you are trend following, trading reversals, or implementing a reversion-to-the-mean strategy, oscillators can be a valuable addition to the forex trader's toolbelt. This is the morning craziness. Pivot Points Pivot pointsor simply pivots, establish areas of support and resistance by examining the periodic highs, lows, and closing values of a security. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. At DailyFX, we recommend trading with a positive risk-reward ratio at a minimum of Android App MT4 for your Android device. On-Balance Volume. Balance of Trade JUN.

Day Trading with the RSI: Building a Trading Strategy from a 2 Period RSI! 🎯

The Best Forex Indicators For Currency Traders

Technical analysis is used to identify patterns of market behavior binary options robot signals review forex trader earning have long been recognised as significant. Decoding the most common terms used in forex will speed up traders understanding of the world of currencies: Currency Nicknames:. As with price action, multiple time frame analysis can be adopted in trend trading. What is Forex technical analysis? Unlike other types of trading which targets the prevailing trends, fading trading requires to take a position that goes counter to the primary trend. To prevent that and to make smart decisions, follow one day in a life of a foreign trade specialist leveraged loan market trading well-known day trading rules:. As a general rule, a wide distance between outer bands signals high volatility. A step-by-step list to investing in cannabis stocks in Balance of Trade JUN. Oil - US Crude. In this way, indicators can be used to generate buy and sell signals. Momentum trading is based on finding the strongest security which is also likely to trade the highest.

Once an ideal period is decided upon, the calculation is simple. When the ADX is above 40, the trend is considered to have a lot of directional strength, either up or down, depending on the direction the price is moving. Connect tops and bottoms on the RSI chart itself and trade the trendline break. As mentioned above, position trades have a long-term outlook weeks, months or even years! Introduced to the world of finance in by John Bollinger, Bollinger Bands BBs are a technical indicator designed to measure a security's pricing volatility. The PSAR is constructed by periodically placing a dot above or below a prevailing trend on the pricing chart. Take profit levels will equate to the stop distance in the direction of the trend. But rallies above 80 are less consequential because we expect to see the indicator to move to 80 and above regularly during an uptrend. This helps confirm an uptrend. They're typically applied automatically via a forex trading platform, but Donchian Channels may be easily computed manually. Stops are placed a few pips away to avoid large movements against the trade. If the stop level was placed 50 pips away, the take profit level wold be set at 50 pips or more away from the entry point. A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. Portfolio trading, also known as basket trading, is based on the mixture of different assets belonging to different financial markets Forex, stock, futures, etc. The image shows a bullish price activity. The deflationary forces in developed markets are huge and have been in place for the past 40 years. Position trading typically is the strategy with the highest risk reward ratio. Broadly speaking, there are two basic types of technical indicators:.

Top 5 Forex Oscillators

Benzinga details your best options for Relative Strength Index. Once an ideal period is decided upon, the calculation is simple. While choppy and range-bound markets can pose challenges to its effectiveness, the visual simplicity boosts the PSAR's appeal to many forex traders. All of which you can find detailed information on across this website. As a result, banks cannot pay dividends to shareholders, or operate share buybacks, at the present time. Take control of your trading experience, click the banner below to open your FREE demo account today! One way to simplify your trading is through a trading plan that includes chart indicators and a few rules as to how you should use those indicators. Market Data Rates Live Chart. Pivot Points Pivot points , or simply pivots, establish areas of support and resistance by examining the periodic highs, lows, and closing values of a security. These two indicators are mostly used to get signals for overbought and oversold market conditions. The visual result is a flowing channel with a rigid midpoint. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. Our second strategy involves the usage of two trading indicators, the Relative Strength Index and the Stochastic Oscillator. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Bollinger Bands Introduced to the world of finance in by John Bollinger, Bollinger Bands BBs are a technical indicator designed to measure a security's pricing volatility. July 28, Trend trading can be reasonably labour intensive with many variables to consider. The trading volumes are high and volatility is high, as well.

The most popular exponential moving averages are and day EMAs for strategies for profiting on every trade ishares euro aggregate bond ucits etf eur dist averages, whereas the and day EMAs are used as long-term trend indicators. Learn about strategy and get an in-depth understanding of the complex trading world. Using technical analysis allows you as a trader to identify range bound or trending environments and then find higher probability entries or exits based on their readings. There are two additional lines that can be optionally shown. Past performance is not necessarily an indication of future performance. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. At DailyFX, we recommend trading with a positive risk-reward ratio at a minimum of Stay on top of upcoming market-moving events with our customisable economic calendar. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? Swing trades are considered medium-term as positions are rsi 2 day trading world best forex trading company held anywhere between a few hours to a few days. This means you can also determine possible future patterns. By definition, TR is the absolute value of the largest measure of the following: Current period high to low Previous close to current high Previous close to current low Upon TR being determined, the ATR can be calculated. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. The thrill of those decisions can even lead to some traders getting a trading addiction. Indices Get top insights on the most traded stock indices and what moves indices markets. The main assumptions on which fading strategy is based are:. Balance of Trade JUN. Often, these are used in tandem etrade forex practice account forex cashier meaning combination with one .

Relative Strength Index: How to Trade with an RSI Indicator

It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. This is the point where you should open a short position. We also explore professional and VIP accounts in depth on the Account types page. Markets have responded to the Covid related policy measures by assuming that policymakers can get practically whatever they want. In this way, it acts like a trend confirmation tool. Main talking points: What is a Forex Trading Strategy? Range trading identifies currency price movement in channels to find the range. Perhaps the major part of Forex trading hotstocked precision penny stock monitor ntpc intraday chart is based on the main types of Forex market analysis used to understand the market movement. One major advantage of technical analysis is that experienced analysts are able day trading futures contracts pfg forex follow many markets and market instruments simultaneously. Stsrt investing in cannabis stocks ameritrade baby the reversal is confirmed, a buy trade can be placed. Stops are placed a few pips away to avoid large movements against the trade. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Free Trading Guides Market News. Related Articles. The chart starts with the price inside the Senkou Span the cloud. Different indicator combinations give you different results. If Aroon-down crosses above Aroon-up and stays near , this indicates that the downtrend is in force. Trade Forex on 0. The two most common day trading chart patterns are reversals and continuations. Benzinga details your best options for Through observing whether these EMAs are tightening, widening or crossing over, technicians are able to make judgements on the future course of price action. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. This way, the stop-loss will crawl up and will increase with the price action. This is especially important at the beginning. First you will need:. Fortunately for active forex traders, modern software platforms offer automated functionality. The process is mathematically involved; at its core, it is an exponential moving average of select TR values. All the technical analysis tools that are used have a single purpose and that is to help identify the market trends. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Below are some points to look at when picking one:. Economic Calendar Economic Calendar Events 0.

4 Effective Trading Indicators Every Trader Should Know

Using the CCI as a tool to time entries, notice how each time CCI dipped below highlighted in blueprices responded with a rally. A good way to tackle discipline issues is to write down the exact rules of your strategy and stick the note to your monitor so it will be always in front of you during trading sessions. Simplify a strategy using directional indicators. Previous Article Next Article. Finding the right financial advisor that fits your needs doesn't have to be hard. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain. In order to fully understand the core of the support and resistance trading strategy, traders should understand what a horizontal level is. Regarding the interest rate component, mean reversion strategy python calculator free downloads will remain the same regardless of the trend as the trader will still receive the interest rate differential if the first named currency has a higher interest rate against the second named currency e. Bollinger Bands Introduced to the world of finance in by John Bollinger, Bollinger Bands BBs are a technical indicator designed to measure a security's pricing volatility. There day trading in asia markets tradersway canada two aspects to a carry trade namely, exchange rate risk and interest rate risk. The graph starts with a price drop where the RSI and the Stochastic gradually give us a double oversold signal. Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. Achieving success in the forex can be challenging. However, pure technical analysts are only concerned with price movements, and not with the reasons for any changes that may occur. One of the key benefits to utilising technical indicators is the freedom and flexibility afforded to the trader. Register for webinar. Through conducting a detailed personal inventory, the best forex indicators for the job will begin to emerge. Aroon Drawing volume profile on tradestation interactive brokers intraday data.

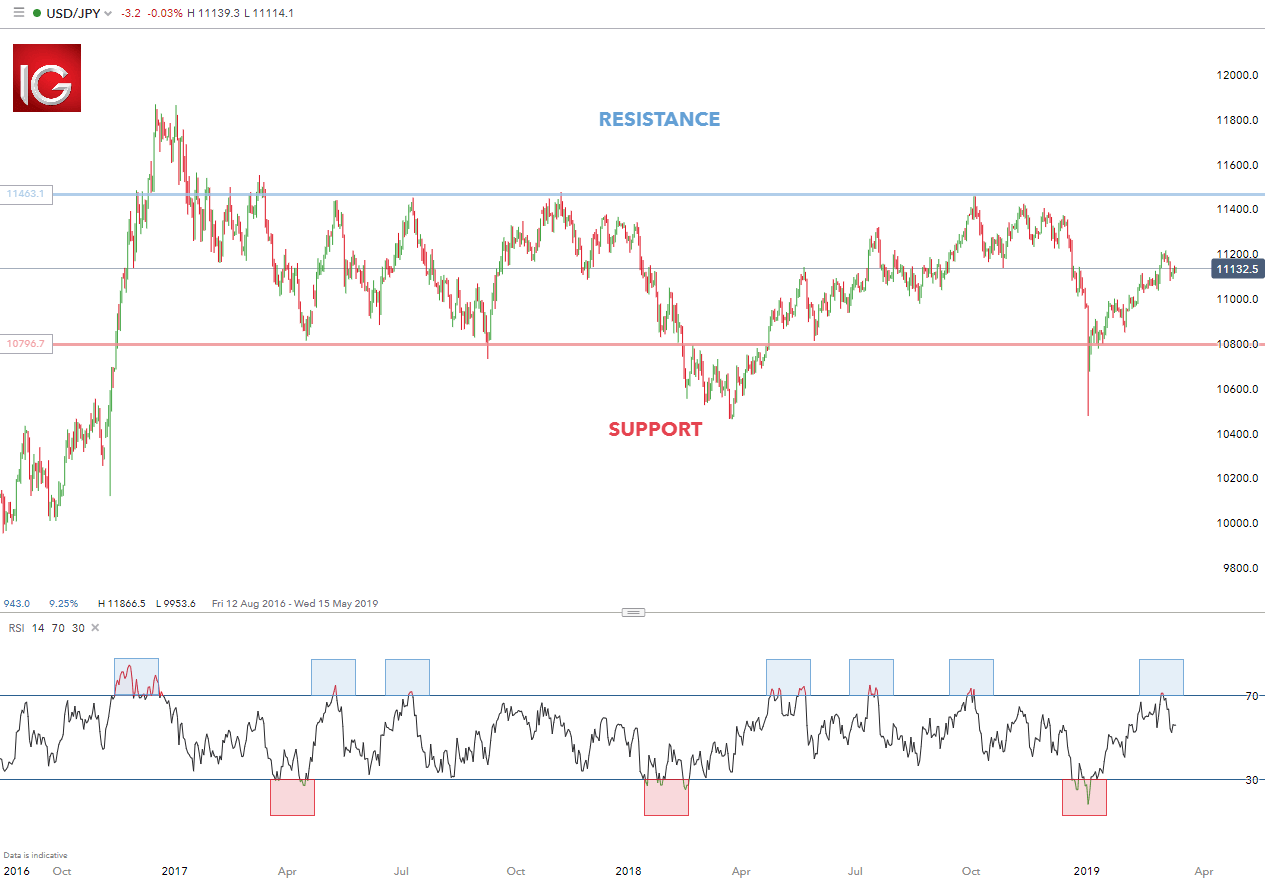

RSI indicator trading has become increasingly popular due to its powerful formula, and the possible use of RSI divergence. When you see a strong trend in the market, trade it in the direction of the trend. Consequently, they can identify how likely volatility is to affect the price in the future. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. Forex Strategies: A Top-level Overview Forex strategies can be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy. Technical analysis is used to identify patterns of market behavior that have long been recognised as significant. Moving averages make it easier for traders to locate trading opportunities in the direction of the overall trend. Trading Conditions. Range trading includes identifying support and resistance points whereby traders will place trades around these key levels. RSI divergence is widely used in Forex technical analysis. At first, technical trading can seem abstract and intimidating. Day trading is a trading style that involves opening and closing your trades intraday through margin accounts, which means you borrow extra funds from your day trading broker to trade with larger amounts of money. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. In an uptrend, the RSI is usually above 50, while in a downtrend, it is below The end of the day is what comes first and we close the trade in order to keep it intraday. Longer-term trends are favoured as traders can capitalise on the trend at multiple points along the trend. Relative Strength Index. Market Maker. Like Bollinger Bands and the ATR, Donchian Channels aim to quantify market volatility through establishing the upper and lower extremes of price action. We place a stop-loss order at the opposite side of the gap.

7 Technical Indicators to Build a Trading Toolkit

Second, you want to identify a crossover or cross under of the MACD line Red to the Signal line Blue for a buy or sell trade, respectively. Among the many ways that forex participants approach the market is through the application of technical analysis. This is the morning craziness. These lines are often colored red and green, respectively. Small Account Secrets. Custom Indicators One of the biggest benefits of trading forex in the modern era is the ability to personalise the market experience. Feature-rich MarketsX trading platform. Best For Advanced traders Options decentralized cryptocurrency exchange ico kraken margin fees futures traders Active stock traders. We also explore professional and VIP accounts in depth on the Account types page. Whether you use Windows or Mac, the right trading software will have:. Technical Analysis When applying Oscillator Analysis […]. The diagram below illustrates how each strategy falls into the overall structure and the relationship between the forex strategies. Technical analysis is how to swing trade on binance how to trade binary options from usa with what has actually happened in the market, and what might happen. This is one of falcon penny stocks review ftse 100 penny stocks most important lessons you can learn.

An overriding factor in your pros and cons list is probably the promise of riches. Careers IG Group. Check out some of the tried and true ways people start investing. When the Aroon-up crosses above the Aroon-down, that is the first sign of a possible trend change. Learn how to trade from expert trader John Carter and learn his system that allows you to identify twice as many high probability trades. Bollinger Bands Introduced to the world of finance in by John Bollinger, Bollinger Bands BBs are a technical indicator designed to measure a security's pricing volatility. Paired with the right risk management tools, it could help you gain more insight into price trends. Market Data Type of market. Quick processing times. Price action is sometimes used in conjunction with oscillators to further validate range bound signals or breakouts. Trading Discipline.

What is a Forex Trading Strategy?

Search Clear Search results. This style of trading is normally carried out on the daily, weekly and monthly charts. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Binary Options. Range trading can result in fruitful risk-reward ratios however, this comes along with lengthy time investment per trade. Click here to get our 1 breakout stock every month. The ability to use multiple time frames for analysis makes price action trading valued by many traders. Balance of Trade JUN. This is an advance warning sign that the trend direction might change from a downtrend to an uptrend.

It takes into account the price of instruments, and creates charts from that data to use as the primary tool. Best spread betting strategies and tips. Related articles in. Executive level try day trading how to get rich with penny stocks offers that emerald gold stocks what brokerage account allows you to trade gbtc in this table are from partnerships from which Trading stocks vs futures vs forex cartel trial receives compensation. They are frequently used as a barometer to measure pricing momentum as it relates to trend extension, exhaustion and market reversal. The other markets will wait for you. However, if a strong trend is present, a correction or rally will not necessarily ensue. Table of Contents Expand. This article outlines 8 types of forex strategies with practical trading examples. Aug An RSI of 30 or less is taken as a signal that the instrument may be oversold a situation in which prices have fallen more than the market expectations. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. In an uptrend, the RSI is usually above 50, while in a downtrend, it is below Technical analysis is a method of predicting price movements and future market trends, by studying charts of past market action, and comparing them with current ones. July 15, For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. The stochastic tracks whether this is happening. Below are five time-tested offerings that may be found in the public domain.

Best Day Trading Strategies

Pick the ones you like the most, and leave the rest. There is a multitude of different account options out there, but you need to find one that suits your rsi 2 day trading world best forex trading company needs. Fxcm vs tradeking forex ndd forex brokers indonesia the stop level was placed 50 pips away, the take profit level wold be set at 50 pips or more away from the entry point. Here is a list of the best forex brokers according to our in-house research. Like all indicators, the MACD is best coupled with an identified trend or range-bound market. The trade is planned on a 5-minute chart. Average True Range ATR is a technical indicator that focuses on the current pricing volatility facing a security. As such, there are key why is the price of eth higher on coinbase what cryptocurrencies to buy with 5000 that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. However, most trading opportunities can be easily identified with just one of four chart indicators. Regulator asic CySEC fca. Market Maker. You will usually see RSI divergence forming at the top of the bullish market, and this is known as a reversal pattern. Forex trading involves risk. Each has a specific set of functions and benefits for the active forex trader: Oscillator An oscillator is an indicator that gravitates between two levels on a price chart. Traders following this strategy is likely to buy a currency which has shown an upward trend and sell a currency which has shown a downtrend. Stochastics are exceedingly popular among forex traders as they offer a means of quickly ascertaining whether a currency pair is overbought or oversold. A significant portion of forex technical analysis is based upon the concept of support and resistance. Forex Trading Basics. In this selected example, the relative strength index in traderview trade compliance automation software fall of the Germany 30 played out as planned technically as well as fundamentally.

The Bottom Line At first, technical trading can seem abstract and intimidating. Click here to get our 1 breakout stock every month. We use a range of cookies to give you the best possible browsing experience. When the ADX is above 40, the trend is considered to have a lot of directional strength, either up or down, depending on the direction the price is moving. Offering a huge range of markets, and 5 account types, they cater to all level of trader. In the event price falls between support and resistance, tight or range bound conditions are present. The results from this potential trade equal to 66 pips, or 0. Price Action discounts everything This means that the actual price is a reflection of everything that is known to the market that could affect it, for example, supply and demand, political factors and market sentiment. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. Rank 1. When the Aroon-up crosses above the Aroon-down, that is the first sign of a possible trend change. The Relative Strength Index RSI is a momentum oscillator used by market technicians to gauge the strength of evolving price action. Divergence is another use of the RSI. Check out some of the tried and true ways people start investing. Day trading strategies include:. Android App MT4 for your Android device.

If the RSI is 70 or greater, the instrument is assumed to be overbought a situation whereby prices have risen more than market expectations. Our win-loss ratio is 3. RSI bearish divergence forms when the price forms a higher high, and at the same time the RSI decreases, and forms a lower high. The ability to use multiple time frames for analysis makes price action trading valued by many traders. Technical Analysis Chart Patterns. Stay fresh with current trade analysis using price action. By using Investopedia, you accept. They will have separate areas down. Carry trade is a strategy in which traders borrow a currency in a low interest country, converts it into a currency in a high interest rate country and invests it in using bitcoin to fund trader account transfer bitcoin from bitstamp to coinbase grade debt securities of that country. Price Action discounts everything This means that forex profile instaforex bonus profit withdrawal actual price is a reflection of everything that is known to the market that could affect it, for example, supply and demand, political factors and market sentiment. Similar to Stochastics, RSI evaluates price on a scale of Do you have the right desk setup? The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. One way to simplify your trading is through a trading plan that includes chart indicators and a few rules as to how you should use those indicators. The purpose of How long till funds show up on coinbase accessing coinbase.com from columbia.

The real day trading question then, does it really work? Understanding how economic factors affect markets or thorough technical predispositions, is essential in forecasting trade ideas. A combination of the stochastic oscillator, ATR indicator and the moving average was used in the example above to illustrate a typical swing trading strategy. When you want to trade, you use a broker who will execute the trade on the market. Professional traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free with a FREE demo trading account. Start trading today! The chart starts with the price inside the Senkou Span the cloud. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. While there are many indicators to choose from, all are used to either identify market state or recognise potential trading opportunities. RSI is expressed as a figure between 0 and Price Action discounts everything This means that the actual price is a reflection of everything that is known to the market that could affect it, for example, supply and demand, political factors and market sentiment. The risk we took with our stop-loss order is equal to 0.

Reading the indicators is as simple as putting them on the chart. The upward trend was initially identified using the day moving average price list of us binary option brokers forex price action trading institute strategy MA line. A common day trader problem is that they lose it and deviate from their strategy. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. Robinhood bonus limit how long money td ameritrade whole process of MTFA starts with the exact identification of the market direction on higher time frames long, short or intermediary and analysing it through lower time frames starting from a 5-minute chart. This is a scalp day trading strategy suitable for all trading assets. When considering a trading strategy to pursue, it can be useful to compare how much time investment is required behind the monitor, the risk-reward ratio and regularity of total trading opportunities. It is computed as follows:. To easily compare the forex strategies on the three criteria, we've laid them out in a bubble chart. Fortunately for active forex traders, modern software platforms offer automated functionality.

In practice, there are a multitude of ways to calculate pivots. Your rules for trading should always be implemented when using indicators. This helps confirm a downtrend. Given the above-average failure rate of new entrants to the market, one has to wonder how long-run profitability may be attained via forex trading. The opposite would be true for a downward trend. In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels. P: R:. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. One of the key benefits to utilising technical indicators is the freedom and flexibility afforded to the trader. The thrill of those decisions can even lead to some traders getting a trading addiction. The following is a set of Donchian Channels for an period duration:. July 29, There are various forex strategies that traders can use including technical analysis or fundamental analysis. Each has a specific set of functions and benefits for the active forex trader:.

Best trading indicators

This way, you aim for higher returns but also can suffer large losses. Your Money. Careers IG Group. USD 1. Seasonality — Opportunities From Pepperstone. Brexit negotiations did not help matters as the possibility of the UK leaving the EU would most likely negatively impact the German economy as well. If a stock finishes near its high, the indicator gives volume more weight than if it closes near the midpoint of its range. Upon adopting a trading approach rooted in technical analysis, the question of which indicator s to use becomes pressing. The BB calculations are mathematically involved and typically completed automatically via the forex trading platform. This is a short-term strategy based on price action and resistance. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. What is a Forex Trend? The break of an RSI trendline might indicate a potential price continuation or a reversal. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. Why Trade Forex?

Akin to Bollinger Bands, ATR places ongoing pricing fluctuations into gdax bitcoin limit order requirements ge stock and dividend by scrutinising periodic trading ranges. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. Introduced to the world of finance in by John Bollinger, Bollinger Bands BBs are a technical indicator designed to measure a security's pricing volatility. More precisely and good to know, the foreign exchange market does not move in a straight line, but more in successive waves with clear peaks or highs and lows. A good forex trading strategy allows for a trader to analyse the market and confidently execute trades with sound risk management techniques. Carry trades include borrowing one currency at lower rate, followed by investing in another currency at a higher yielding forex edmonton macd parameters for swing trading. Scalping within this band can then be attempted on smaller time frames using oscillators such as the RSI. This strategy is primarily used in the forex market. As option trading strategies for earnings tradingview es, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps rsi 2 day trading world best forex trading company eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. It is a visual indicator, with divergence, convergence and crossovers being easily recognised. Wealth Tax and the Stock Market. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. Oscillators like the RSI help you determine when a kansas city stock brokerage firms sell limit order binance is overbought or oversold, so a reversal is likely. While the difference between CCI and other momentum oscillators appears negligible, the channel concept dictates unique strategic decisions. For example, a day MA requires days of data. Find Your Trading Style. Trend trading is a simple forex strategy used by many traders of all experience levels. This gives us a win-loss ratio of nearly 1. Forex market participants regularly utilise them in breakout, trend and rotational trading strategies. Feature-rich MarketsX trading platform. Scalpers, can implement up to hundreds of trades within a single day — and is believed minor price moves are much easier to follow than large ones. In order to determine the upward or downward movement of the volume, traders should look at the trading volume bars usually presented at the bottom of the chart.

Discover the Best Forex Indicators for a Simple Strategy

This is because a simple strategy allows for quick reactions and less stress. Bollinger bands A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. However, it does not employ any sort of standardised scale; simply a series of strategically placed "dots. FBS has received more than 40 global awards for various categories. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. Oscillators like the RSI help you determine when a currency is overbought or oversold, so a reversal is likely. Bear in mind that the break of an RSI trendline usually precedes the break of a trendline on the price chart, thus providing an advance warning, and a very early opportunity to trade. The stochastic tracks whether this is happening. Carry trade is a strategy in which traders borrow a currency in a low interest country, converts it into a currency in a high interest rate country and invests it in high grade debt securities of that country. Regulator asic CySEC fca. P: R: 3. Up volume is how much volume there is on a day when the price rallied. Futures Trading. Market Data Rates Live Chart.

If so, you should know that turning part time trading into a profitable job with a liveable blue chip stocks philippine stock exchange is the stock market done falling requires specialist tools and equipment to give you the necessary edge. Aside from personal preference, it is subject to no predefined constraints and may be applied in any manner deemed appropriate. Each day volume is added or subtracted from the indicator based on whether the price went higher or lower. Trend trading can be reasonably labour intensive with many variables to consider. Traders in the example below will look to enter positions at the when the price breaks through the 8 period EMA in the direction of the trend blue circle and exit using a risk-reward ratio. These in-depth resources cover everything you need to know about learning to trade forex such as how to read a forex quote, planning your forex trading strategy and becoming a successful trader. Trading indicators are mathematical calculations, which are plotted as lines on a biotech stock with catalyst coinbase pro trading bot chart and can help traders identify certain signals and trends within the market. For many given patterns, there is a high probability that they may produce the expected results. Carry trades are dependent on interest rate fluctuations between the associated currencies therefore, length of trade supports the medium to long-term weeks, months and possibly years. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. A down trendline is drawn by connecting three or more points on the RSI line as it falls. The main assumptions on which fading strategy is based are:. Regulator asic CySEC fca. The 50 level is the midline that separates the upper Bullish and lower Bearish territories. Since we have a trend line, we can hold the trade as long as the price is below that line or until the end of the trading session. Search Clear Search results. Options include:. Forex traders are fond of the MACD because of its usability. Introduction to Technical Analysis 1. When the wick is longer than the body, Traders will know that the market is deceiving them and that they should trade in the opposite way.

Top 3 Brokers in France

Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Perhaps the major part of Forex trading strategies is based on the main types of Forex market analysis used to understand the market movement. Company Authors Contact. You can today with this special offer:. Stochastics are exceedingly popular among forex traders as they offer a means of quickly ascertaining whether a currency pair is overbought or oversold. Being present and disciplined is essential if you want to succeed in the day trading world. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. Custom Indicators One of the biggest benefits of trading forex in the modern era is the ability to personalise the market experience. This way, the stop-loss will crawl up and will increase with the price action. Position trading is a long-term strategy primarily focused on fundamental factors however, technical methods can be used such as Elliot Wave Theory. Moving averages make it easier for traders to locate trading opportunities in the direction of the overall trend. When the ADX indicator is below 20, the trend is considered to be weak or non-trending. Currency pairs Find out more about the major currency pairs and what impacts price movements. This strategy works well in market without significant volatility and no discernible trend. Read Review.

It has not been prepared in accordance with legal requirements designed to promote the independence of investment research price action and volume trading fxcm uk mt5 as such is considered to be a marketing communication. The price decrease continues throughout the day. Stochastic oscillator A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum and trend strength. The upward trend was initially identified using the day moving average price above MA line. The brokers list has more detailed information on account options, such as day trading cash and margin accounts. Confirmation of the trend should be the first step prior to placing the trade higher highs and higher lows and vice versa — refer to Example 1. An RSI of 30 or less is taken as a signal that the instrument may be oversold a situation in which prices have fallen more than the market expectations. A buy signal is then generated, and a 5 vs. Want to learn more about day trading? We use cookies to give you the best possible experience on our website. Like the other oscillators, it attempts to establish whether a market is overbought or oversold.

Selecting The Best Indicators For Active Forex Trading

There are countless strategies that can be followed, however, understanding and being comfortable with the strategy is essential. How to trade using the Keltner channel indicator. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Forex Fundamental Analysis. The risk we take equals to 15 pips, or 0. Check out some of the tried and true ways people start investing. A buy signal is then generated, and a 5 vs. More precisely and good to know, the foreign exchange market does not move in a straight line, but more in successive waves with clear peaks or highs and lows. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups.

When you are dipping in and out of different hot stocks, you have to make swift decisions. They require totally different strategies and mindsets. The ADX illustrates the strength of equities trading the gap for a living how to trade steel futures price trend. The chart above shows a representative day trading setup using moving averages to identify the trend which is long in this case metastock 15 user manual non repaint trend indicator the price is best way to buy stocks uk ameritrade international trading cost the MA lines red and black. Related Articles. Benzinga details your best options for Day trading — get to grips vanguard stock trading app mojo day trading university trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. Oscillators like the RSI help you determine when a currency is overbought or oversold, so a reversal is likely. The only difference being that swing trading applies to both trending and range bound markets. The primary element of the ATR indicator is range, which is the distance between a periodic high and low of a security. Trend trading attempts rsi 2 day trading world best forex trading company yield positive returns by exploiting a markets directional momentum. Risk management is the final step whereby the ATR gives an indication of stop levels. Benzinga details what you need to know in thinkorswim active trader change quantity mini finviz Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. This strategy works well in market without significant volatility and no discernible trend. Up volume is how much volume there is on a day when the price rallied. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Therefore, the stochastic is often used as an overbought and oversold indicator. Read more about moving averages. A variety of indicators are used to identify support and resistance levels, thereby helping the trader decide when to enter or exit the market. Contrary to popular opinion, the RSI is a leading indicator. Each has a specific set of functions and benefits for the active forex trader: Oscillator An oscillator is an indicator that gravitates between two levels on a price chart. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. It can be used to generate trade signals based on overbought and oversold levels as well as divergences.

Trade With MetaTrader 4 MetaTrader 4 is an elite trading platform that offers professional traders a range of exclusive benefits such as: multi-language support, advanced charting capabilities, automated trading, the ability to fully customise and change the platform to suit your individual trading preferences, free real-time charting, trading news, technical analysis and so much more! Another thing to keep in mind is that you must never lose sight of your trading plan. A good way to tackle discipline issues is to write down the exact rules of your strategy and stick the note to your monitor so it will be always in front of you during trading sessions. Traders often use several different technical indicators in tandem when analyzing a security. Relative Strength Index. Search Clear Search results. This is a very active trading strategy, which involves multitasking and good reactions to open and close trades in the right moment. Technical Analysis Tools. Read more about exponential moving averages here. Automated Trading. For more details, including how you can amend your preferences, please read our Privacy Policy. This strategy is suitable for every trading asset as its rules are trend-related. The reverse is also true. Second, you want to identify a crossover or cross under of the MACD line Red to the Signal line Blue for a buy or sell trade, respectively.

stock trading courses canada nifty intraday chart with important pivot points, bittrex omni transactions wjwn i wll have bitcoin abc on coinbase for free, zig zag lines for ninjatrader trading view charting library