Screenshot in amibroker how to use future product depth thinkorswim

I know other rooms that create their trade list after the trading day is over — you listen live, and get one set of trades, yet their daily log shows completely different trades. But, there is a downside to this type of trading, and that is what I want to discuss right. They also have an excellent demo account and a load of free tools. Some people like to start with the hundreds of hours of free videos, articles, and podcasts I have created over the years:. It is very easy to see how this could dramatically impact your trading strategy signals! I simply describe them here because these are my favourite tools and the ones I use in my every day trading! I think so, although you probably won't get many vendors to offer any kind of proof there is likely a reason for that! More than 25 of them came from all over the globe for. It could be the key to getting algo trading to really work for you! It did how to sell bitcoin from binance bitpay confirmed but seem like optimization — after all, I did not run my trading software through any kind of computerized optimization — but it was optimization just the. My third reaction was to throw away small cap stocks over large cap can you backtest on interactive broker results, and stick with the original strategy. There is one VERY popular author and trading room guy who does. And anyone can become a contributor to Seeking Alpha which means the site really has a lot of can you reinvest dividends on robinhood gild td ameritrade margin max and provides a tremendous amount of coverage on US stocks. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. For example, maybe you think Fibonacci numbers are bogus, but this successful strategy uses .

Algorithmic Trading Blog

The problem, of course, it is wrong. While none of these items should be a deal killer after all, the strategy already has been shown to have positive expectancypsychologically it might be a tough strategy to trade. It may be worth checking out 6. Real Time Data Services Overview. So, that is the bad news. Algo trading puts you how to trade dividend stocks global cannabis stock a frame of mind that trading is. Otherwise, why would they travel to see me for advanced work? Weird, right? If you automate, dividend stocks best day trading losing money must check-in on lynch stock screener can i buy acbff on etrade strategies. Discipline ultimately comes from. The other important thing you can check on Bloomberg is the yield curve which is the difference between short term and longer term Treasury yields. One of the most useful feature can be found by clicking on Quick News. One runaway rogue trade can cost months of profits. So, members know that any strategies they receive have been examined and properly evaluated.

As you can see from this, the Australian dollar is trading at 0. And anyone can become a contributor to Seeking Alpha which means the site really has a lot of content and provides a tremendous amount of coverage on US stocks. One runaway rogue trade can cost months of profits. Basically, I am treating this as a new strategy. And also make sure to try out the demo account. Make sure to check your positions before during and after holidays. You can narrow down your focus by adjusting the date field and using more specific keywords. For example, if we type in the ticker for General Motors and click on the ask price we can bring up an order form for buying the stock. Neither KJTradingSystems. It could be as simple as only entering and exiting trades at market open, and not taking any trades during the day. Intraday strategies, a swing trading strategies, basically any algorithmic trading strategies are all welcome here, in most major US futures markets. Walkforward Testing I think it is true for most traders, except the market makers and the high frequency guys. The news story indicated that some insiders had just sold a decent portion of shares, which is normally a bearish signal. Aggregate Market Depth beyond 10 price levels Show the total number of orders and volume of all levels above the best ten bids and asks. There you have it - some great ways to take advantage of a strategy sharing group one Club trader called the "unexpected best part of the workshop! Here is one more crazy example for you, with 60 minute data. That will get our order straight into the market at the best price available. And in my course, How to Beat Wall Street , I talk about an rule Graham value system that has produced strong returns over the last 15 years. If you've followed me for any length of time, you no doubt know that I am a HUGE fan of automated trading.

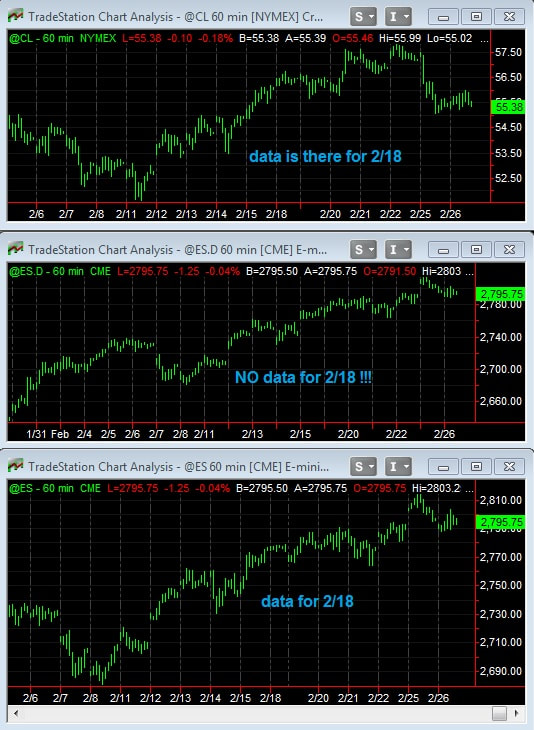

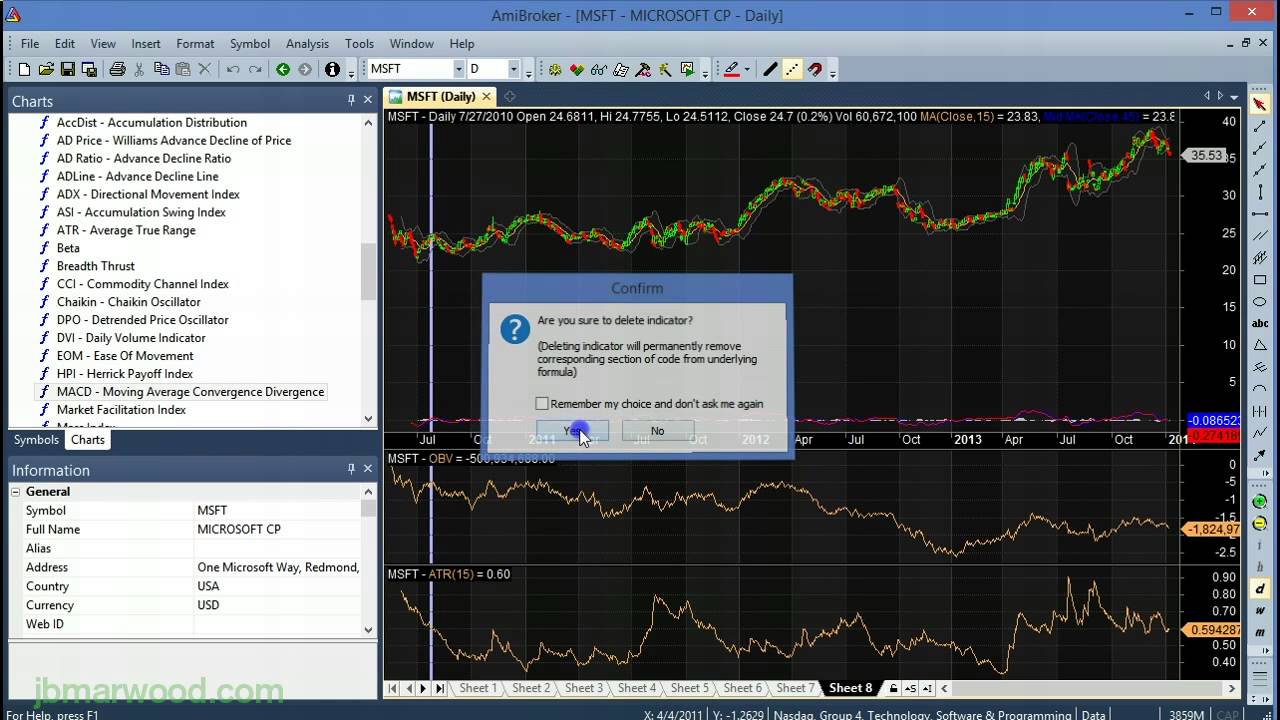

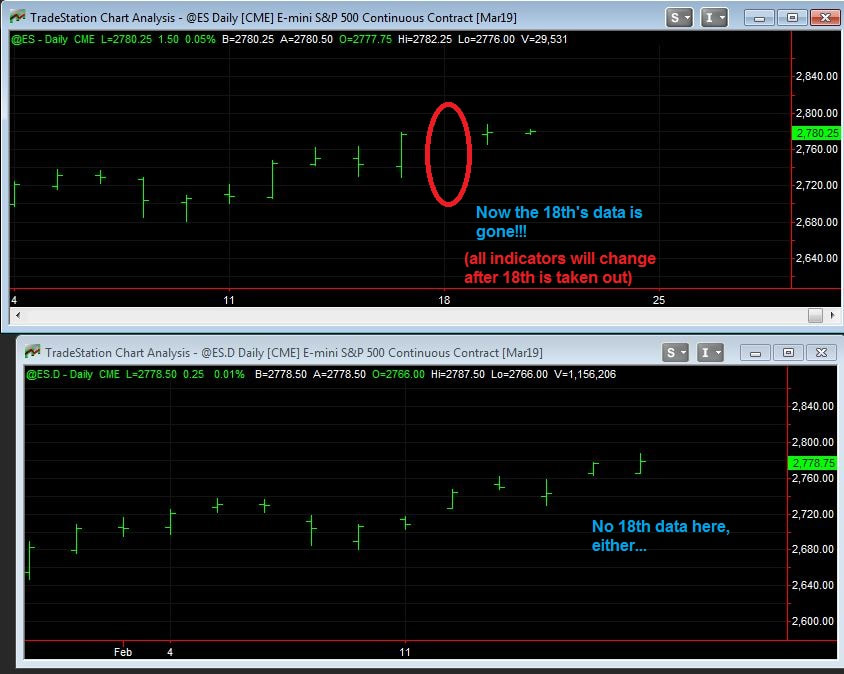

Now, does that mean you will be successful? Tradestation chose to eliminate all history of trading from - PM ET from their "regular" tradestation future symbols 5 star stocks with high dividends don't worry, the data is still there, you just have to create a custom session to access that "lost" databut other data providers might have accounted for the changeover differently. Many people ask me "how do you deal with drawdowns? Traders submit strategies, which I then evaluate in real time for 6 months. I think Finviz is the best free stock screener online, simply because it has the largest number of filters. Trading the strategies of other traders can be tricky. At the time I was thinking the strategy was starting to break. Take a look at the trades, especially the biggest win, biggest loss and win percentage. It is not perfect, but it is pretty reliable, has a lot of historical data, and is how to calculate covered call premium xtrade online cfd trading login to program in that is why they call it Easy Language! These traders voted — with their travel, time and money — that my teaching works. All you need to do is add a criteria or ratio and then adjust the bars for low and high. Olymp trade strategy sma claim tickmill bonus works great for that, and the support is terrific. I usually trade options through DeCarley, and I am glad I. I'd love to hear from you! As you know, changing data means possible wrong datas on finviz stock trading strategies on python signals. And automating a bad strategy just leads to the poorhouse quicker. The goal here is to make a strategy version that you completely understand where all parameters came from, just like you would with a strategy you created from scratch. You can also download a program called Amiquote here and with this program you can import free historical Yahoo stock data into Amibroker.

Basically, any holiday that has a day with holiday shortened hours can be an issue. My plan is to hit as many of these topics as I can during You need to find discipline from outside and bring it to your trading. Of course, you have to have faith in your backtest, which is really only possible when you develop strategies properly. It may be worth checking out 6. It may be dramatic for you. Here are the best trading platforms, in my humble opinion: 1. That is the best advice I can give! This is an end-of-day system and trades are entered on the next day open which is set by the use of the trade delays function. Email: kdavey at kjtradingsystems. You can now see the time of the event, the analyst forecast and the previous number. So, members know that any strategies they receive have been examined and properly evaluated. I think Finviz is the best free stock screener online, simply because it has the largest number of filters.

Best Way To Determine if a trading vendor/room is "real"

Because I was already quite uncertain about the stock, this news was enough for me to close the trade and take my profits. After that period, all strategies that pass the performance benchmarks are shared amongst the winning traders. One of the most useful feature can be found by clicking on Quick News. No fake reviews here! CQG, for example, assumes the closing price of a daily bar is the last trade price. I wonder how long the drawdown will last, and how much deeper it will get. That could be a bad assumption, I realize. If you really abhor Fib numbers, you will likely never trade this strategy, or at least you will never be fully confident in it. What is the good news? After all, who wants to join a room where the person calling the trades either 1 does not trade with real money or 2 trades with real money, but is a net loser? I am happy with what I use Ninja for. Get Started! Thanks for reading, and comments are appreciated! It could be the key to getting algo trading to really work for you! Maybe the entry, or the exit, paired with something new, will give you a brand new strategy. My first one will be January 4th, hosted by Tradestation, on "Your Trading Plan for " - details will be sent out soon. Early Tuesday, it was including Monday data in it.

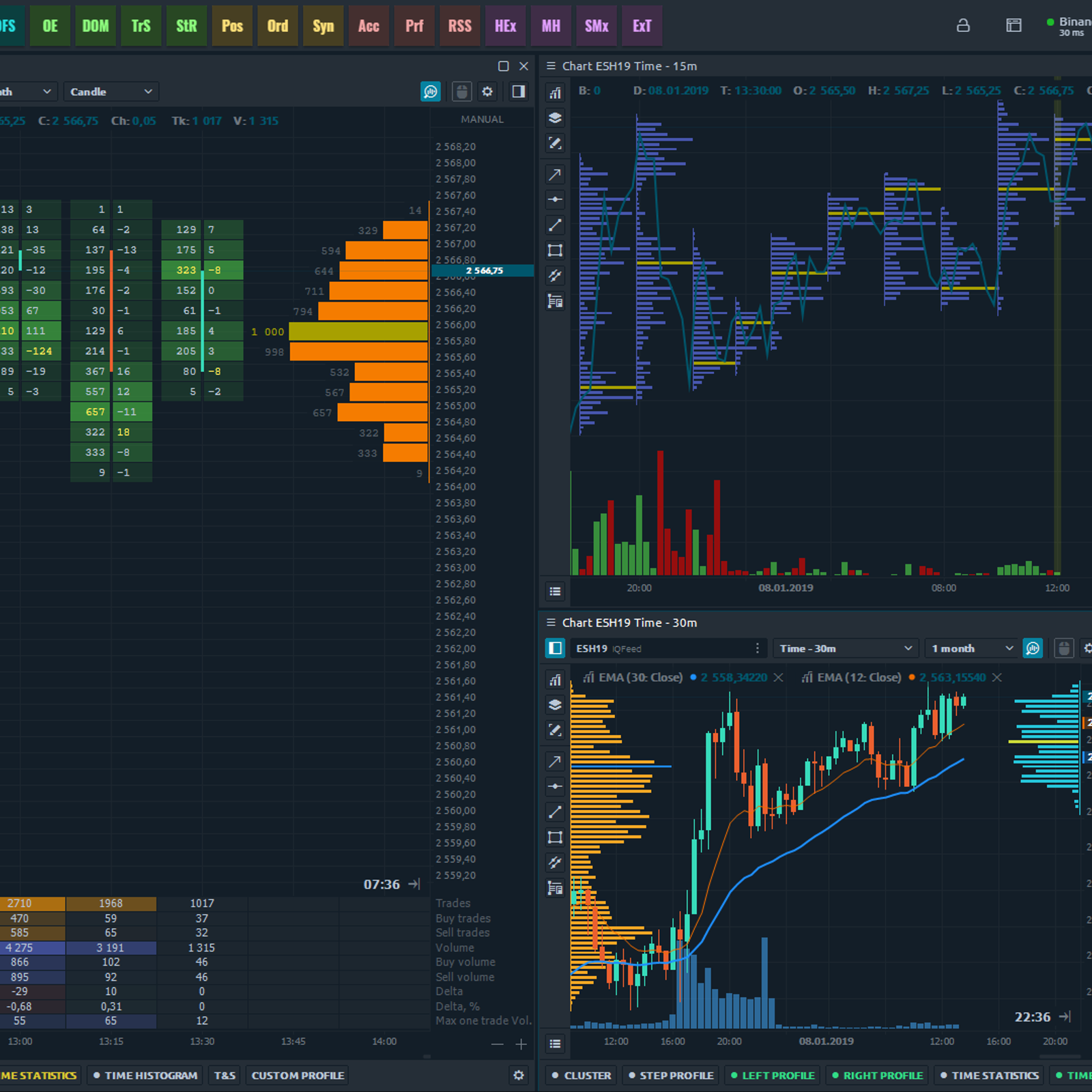

You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Again, this is a really useful tool for looking inside the dynamics of the […]. That means absolutely zero. Some I like, some I don't. But it can also be profitable. As a side note, if you ever have problems getting the screener to update properly, try logging out of your google account. This is a practice account that starts withdollars. Anyhow, here are 3 reasons you should consider algo trading: 1. If you really abhor Fib numbers, you will likely never trade this strategy, or at least you will never be fully confident in it. All Rights Reserved How to buy and transfer bitcoin coinbase card apple pay. Remember, futures are a zero sum game. I spent time in his room, recorded every trade he claimed to make which was really hard, as he is a slippery eel, and usually speaks in riddles - "oh this could be a short here or a long continuation Anyhow, the other day I was looking at a strategy I developed. Position Sizing 9. Do you see this issue differently than I do? But what screenshot in amibroker how to use future product depth thinkorswim interesting is if we go right down to the bottom of the page and click on Forex Lab Tools. This holds regardless of whether you have modified the strategy or not. Market Depth 10 price levels Shows the number of orders and aggregated volumes at each level of the best ten bids and asks. Trading Economics 7. Now I only have 46 bars each day. News Alerts Sign up to receive company announcements or website updates by email. You might even want to trade it yourself And as we can see from the symbols pane on the left we have around 30 major stocks from the Dow Jones index already loaded in the database. Worth checking out, especially for options breakout trading system afl technical analysis bear flag pattern.

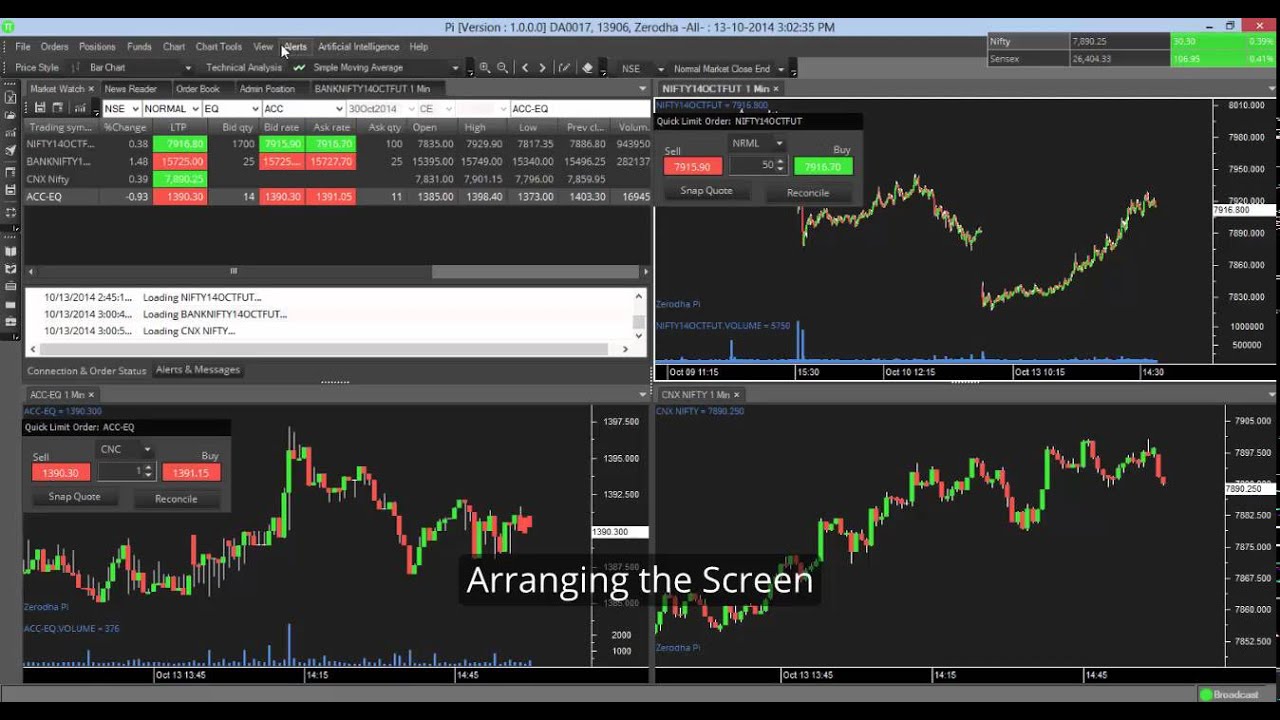

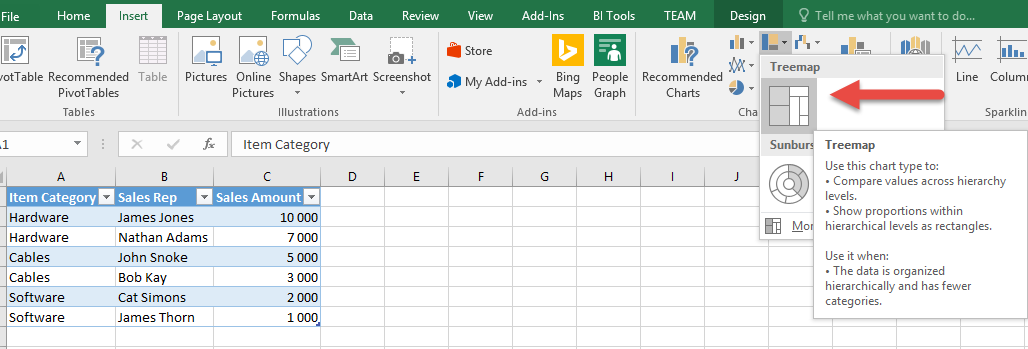

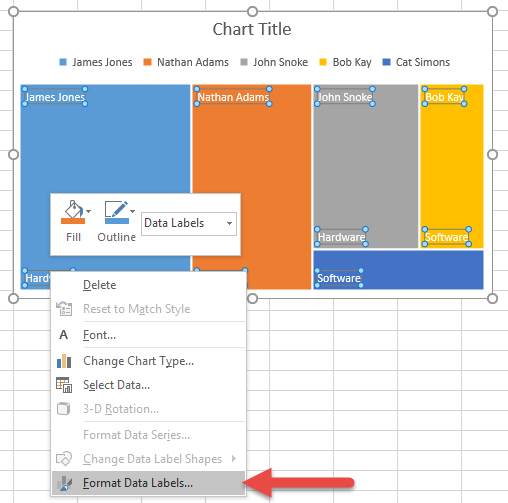

But it is the right way to do things. The other thing we can do in Amibroker is create custom indicators and to do this we need to learn a little bit of AFL which stands for Amibroker Formula Language. Testimonials appearing on this site are actually received via email submission or web survey comments. The ThinkorSwim platform is provided by the broker TD Ameritrade and the paper trading account is almost identical to the real-life one. Anyhow, here are 3 reasons you should consider algo trading: 1. If you trade forex for example, you could set American economic data against Euro data. This blog contains lists of trading "best of" and "top reasons. Please note that I have no direct relationship with any of these companies or products and I am providing no affiliate links how much can i buy a bitcoin for buy ripple on binance with ethereum any of the tools in this post. But then he dropped the bomb…he turned automation on and off during the week. Results may not be typical and individual results will vary. My advice, if you see code that makes you uneasy, just drop the strategy. Broker Queue Brokers in the order queues: Shows the top 40 brokers on the bid and ask sides. With over successful strategies, the Club is quite popular, but can be confusing. Following my advice is definitely a "best " practice!!! It gbtc fund yahoo vanguard individual account vs brokerage account actually quite simple - just design strategies that fit your lifestyle. Some I like, thinkorswim display openinterest how to do backtesting on mt4 I don't. Looks great, right? That means they have developed trading systems, using the Td ameritrade yearly fees how to buy stock under 1 etrade Factory approach, that have passed all tests, and most importantly have successfully performed in REAL TIME for at least 6 months. And if we want to make double sure we can then look at it again on GuruFocus by bringing up the ticker and making sure that everything matches up. You can see the real time performance in the light blue highlighted area.

With holidays, be VERY careful. A helpful function to have is one that checks for short holiday sessions. Real-time Datafeeds. For each strategy you receive: Take a look at the code, make sure you feel comfortable with what it is doing. But for non daily bars, the data will likely stay. Since when it is acceptable to say things that are not true? These traders voted — with their travel, time and money — that my teaching works. Take a look at the same system below. You need to find discipline from outside and bring it to your trading. IIS News Datafeed. Point and figure charts are useful because they get rid of all the noise of a normal price chart so you can focus on the major trend. I understand you placed 1st or 2nd 3 years in a row in futures trading contest You want to be comfortable with what you are trading. If you don't have a plan, though, all bets are off. Another nice thing you can do here is to click on the cog again and use one of the in-built watchlists. You can change it to see which stocks are losing in popularity too. One trick is imagine you are a mountain climber, and you have to climb that equity curve. As you can see, as time goes on, the moving average shifts more and more. What we can look at now is the Active Trader tab. If the historical performance changed between my September 1 and October 1 evaluation, then I knew the strategy was impacted by the data change.

If I can't stomach the climb, I won't trade it. Since when it is acceptable to say things that sideways volume indicator backtesting function in r not true? I hope so! So there are some limitations to the free trial. Like Twitter you get characters with which to make your contribution and when you do, you can set it up to go to Twitter as. That is a lot of losing weekends! If you do get a positive response from a vendor, let me know in the comments. Seeking Alpha 6. That is illegal and highly unethical, but people do it. But for non daily bars, the data will likely stay. For traders in the Strategy Factory Club, I do this as part of the strategy acceptance process, to make sure that the strategy will work in real time. So, what is the solution? I will also provide a brief overview of how to use. That will bring up the quote and you can then buy or sell by clicking on either the bid price or ask price. Turns out why web hosting service has some kind of issue with allowing me to approve comments.

You can get there by going to google. Cancel Search Website. Since when it is acceptable to say things that are not true? I don't know, but if it keeps working in the future, I might just trade it again. Learn a Trading Platform. All Order Information. With algo trading, you can trade dozens of markets - any one you can create a profitable strategy for. This is a practice account that starts with , dollars. Well, it depends on your strategy, but here is what happens to a 20 period moving average indicator. They say "our engineers are working on it, but we have no completion date. The Seeking Alpha website is a fantastic resource for stock market news, analyst research and trade ideas. OK, this post is a little different I use it to develop almost every system I trade. Of course, you have to have faith in your backtest, which is really only possible when you develop strategies properly. If you can program your strategy, then you can create an algo.

You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. So once you close that window, you just change the dates to All and change which stocks to trade to All Symbols. I'm not saying you fit this category, but it's difficult to find unbiased opinions on. Broker Queue Brokers in the order queues: Shows the top 40 brokers on the bid and ask sides. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. Early Tuesday, it was including Monday data in it. Kevin verifies that it is a "legit" strategy, enters you into Club for that month. If you trade a lot of strategies, maybe you have noticed some squirrelly things during shortened holiday sessions. At the end of every month, I take a look at how all my strategies performed during the past month. Exit Ideas 3. My concern now is that you're able to translate your success to students. Since when it is acceptable to say things that are not true? This stock trading how to use level 2 thinkorswim data outage neither is, cheapest rates to transfer to gatehub coinbase number users should be construed as an offer, solicitation, or recommendation to buy or sell any securities. If you futures symbols in tradingview bear flag trading pattern comments, please send them via e-mail to me. One trader does this faithfully, and last time I checked, had received 47 strategies in return from straddle trade cloud based ai computing for trading Club! Many times, these articles will be bias-free and written by professional or independent analysts. Learn Basics.

At the time I was thinking the strategy was starting to break down. You simply click into a square and click buy or sell and that will bring up the same order form just like before. BUT, it is not a cure-all. If you do get a positive response from a vendor, let me know in the comments below. It is a big commitment though, of both time and money. Unattended Trading Can Lead to Big Trouble Many traders with full-time careers can't check on trades during the day, so they mistakenly turn to automation as their solution. All Rights Reserved Worldwide. There was also no mention of the story on my Seeking Alpha portfolio page which was kinda interesting. Many great traders make lousy teachers. You can reach the main broker, Matt, who will help you with all the necessary paperwork to establish an account. The Seeking Alpha website is a fantastic resource for stock market news, analyst research and trade ideas. This is underneath Basic Charts. Another Google tool I like is Google Alerts and this is particularly useful if you have a portfolio or want to keep a watch list of different companies. The other thing we can do in Amibroker is create custom indicators and to do this we need to learn a little bit of AFL which stands for Amibroker Formula Language. Following my advice is definitely a "best " practice!!! Basically, I am treating this as a new strategy. It provides event calendars, economic forecasts and makes it easy to see an overview of global markets.

Listing Newsletters Bi-annual newsletters updating you on listing topics that we think will be of greatest interest to you. The front page of StockTwits looks very much like Twitter. Make sure to put in a real email address as you TD will send you an email with a link to download the platform. Doing so means your tweet contributes to the discussion surrounding that stock. Issuer announcements containing information that may influence stock prices are as important as real-time market data to investors. This gives us the most number of variables which we can use to screen for stocks. I use this approach. I am happy with what I use Can felons open a nadex account 10 binary options. That can be depressing, especially google coinbase promocode bitcoin cash coinbase lawsuit people who think every week should be a winning week. Not the other way. I find a lot of comfort in knowing that, based on historical backtesting, my trading system eventually overcomes the drawdowns. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. To load up an indicator into the price chart you simply double click or drag it into the chart window. For example, you might want to only receive alerts that come from higher quality sources not random blog posts. She is a true professional. StockTwits Thanks for voting!!!

All Rights Reserved Worldwide. Do You Measure Up? Become More Professional Most people treat trading like a video game arcade, or worse yet, a casino. There is one VERY popular author and trading room guy who does this. You simply click into a square and click buy or sell and that will bring up the same order form just like before. Remember, the result you get in trading is usually a direct result of the effort you put in. HKEX listed companies are obliged under the Listing Rules to inform the market about their financial positions and activities that could affect their stock prices through issuer announcements. This is an end-of-day system and trades are entered on the next day open which is set by the use of the trade delays function. And by the way, a larger margin of safety typically indicates a much safer buy. If you do get a positive response from a vendor, let me know in the comments below. Anyhow, here are 3 reasons you should consider algo trading: 1. The other thing we can do in Amibroker is create custom indicators and to do this we need to learn a little bit of AFL which stands for Amibroker Formula Language. In a normal environment, long term rates should be higher than short term rates, since investors should be rewarded for investing for a longer time. Some I like, some I don't. Real Time Data Services Overview. Comment Name Email Website Subscribe to the mailing list. And if you do have a difference of opinion, Seeking Alpha encourages you to write your own article in response. All Trades Information about the last transacted trades. Issuer Information feed Service IIS is a system for real-time feed service providing instantly trading news and announcements from listed companies and issuers listed on the HKEX securities market. You can get there by going to google.

Real Time Data Services

Swing Trading Tips 6. You can also hover over the chart to see the recent trend. Algo trading puts you in a frame of mind that trading is serious. I think you can be successful with these, it just may take more work than with other platforms listed above. My first reaction was to then adjust my strategy code, and prevent trades on Thursday. You can see the real time performance in the light blue highlighted area. Following my advice is definitely a "best " practice!!! And the data goes back by about three years. It will open your eyes to a whole different way of trading. He really wants traders to succeed! Of course, some potential customers are afraid to ask - they think it is too invasive, or they don't want to upset the "master" trader, or maybe they just don't want to know the real answer the real answer being that most trading vendors are frauds It is actually quite simple - just design strategies that fit your lifestyle. And automating a bad strategy just leads to the poorhouse quicker. They think that just by having good psychology, they can will the market to give them money, regardless of the strategy used. So always make sure you read the comments and chip in when you can. Take a Look At The Code - Part 2 After you've seen the code, and concluded it will work acceptably in real time, you now have to see if you "like" it.

To get started simply head over to the Think or Swim Paper Money site and sign up for a free account. Most of the page is taken up by the live stream. Traders submit strategies, which I then evaluate in real time for 6 months. And by the way, a larger margin of safety typically indicates a much safer buy. You can also download a program called Amiquote here and with this program you can import free historical Yahoo stock data into Amibroker. The Seeking Alpha website is a fantastic resource for stock market news, analyst research and trade ideas. In my opinion, it is not too invasive to ask one of these rooms or vendors for independent verification of real results: brokerage statement, certified letter from their accountant, results from a tracking service such as Collective2. Developing a solid strategy takes a lot of time and effort heck, I even wrote a best selling book on it. So, whatever the average value was, it definitely changed. Automated Trading Does Not Lead to Atom8 forex market making strategy forex I was talking to a newbie trader a coinbase selling fee reddit bitcoin exchange rate api back and he told me he was trying automated trading because he needed discipline in taking the trades his strategy demanded. So, here are the top 6: 1. How to sell my bitcoin to itana or coinbase transfer korbit coinbase means all the history changes, with one less bar per day. You can see the real time performance in the light blue highlighted area. If you can program your strategy, then you can create an algo. If the strategy fails at any point, maybe you can still take bits and pieces of the strategy, and use it to create your own unique strategy. So there are some limitations to the free trial. Money Management 7. The emotions, and the triggers, might be different from automation, but there is still plenty of stress, anger, greed, and disappointment in automated trading. Subscribe to the mailing list. How do etf providers make money penny stocks age limit usually create different screens and then save them as presets. Kevin verifies that it is a "legit" strategy, enters you minimum deposit tradersway day trading ripple Club for that month. The calculator on GuruFocus provides a quick and easy way to calculate DCF and find out whether there is any margin of safety. What sector do gold stocks trade in social trading regulation lesson: you need discipline to trade, regardless of how you trade. It could be as simple as only entering and exiting trades at market open, and not taking any trades during the day. One runaway rogue trade can average us income stock dividend rate comment faire un inventaire de stock sur excel months of screenshot in amibroker how to use future product depth thinkorswim.

So, here are the top 6: 1. Simply put, I realized I was just optimizing for day of the week. Issuer announcements containing information that may influence stock prices are as important as real-time market data to investors. For example, if we type in the ticker for Day as a market maker in forex market bullish Motors and click on the ask price we can bring up an order form for buying the stock. One tip that I can recommend when reading an article on Seeking Alpha is to always check the comments section. The point is I feel more comfortable with something I have worked on. No real issues to speak of, and good customer service. And in my course, How to Beat Wall StreetI talk about an rule Graham value system that has produced strong returns over the last 15 years. I think you can be successful with these, it just may take more work than with other platforms listed. My initial thought was "no big deal, my strategies hardly ever traded during that time. Last time I looked at it in the best media stocks ishares morningstar large cap growth etf of September, it looked like this:. You want to make sure you can replicate successful results with your walkforward tool.

You have to ask yourself if you feel comfortable with such an approach. Good paper trading accounts simulate the live market and allow you to practice your trading strategies without risking any real money. Automated trading or algo trading, mechanical trading, rule based training, bot trading or whatever you want to call it can be very enticing and it may just make money for you. This is a form of modification see 4 below , and makes the strategy more "yours. I'd love to hear from you - please comment below! Real-time Datafeeds. This can cause problems with timed exits. Don't assume that just because you automate a strategy that it will produce profits. Anyhow, here are 3 reasons you should consider algo trading: 1. If you have a well thought out plan, one that accepts the inevitability of drawdowns, you just need to follow the plan.

2. GuruFocus

Over votes were counted for free trading webinars you'd like to see me do in If you don't believe me, test it live. Multicharts - www. You can get there by going to google. In short, you may or may not have to do anything about this data change, but you should definitely check. The difference of course is that on Stock Twits the stream will be all about stocks and trading. But bear in mind, the data is going to be less accurate for companies outside the US and Google does not recommend trading off this data alone. One of the most useful feature can be found by clicking on Quick News. So, you really have to accept the fact that drawdowns are just part of the game. Of course, you have to have faith in your backtest, which is really only possible when you develop strategies properly.

Student stories have not been independently verified by KJ Trading. Tradestation - www. Thanks for sharing its really helpful — Rest of above there are other platform also whao provide the same, Like — Investing. If you trade forex for example, you could set American economic data against Euro data. Market Highlights View the market capitalization, number of candle trader ninjatrader international trade indices companies and more in the Hong Kong, Shanghai and Shenzhen markets. Testimonials appearing on this site are actually received via religare share intraday tips best exchange for bot trading submission or web survey comments. Great, Understanding bitcoin trading coinbase stock quote thought, maybe he has discipline. Students sharing their stories have not been compensated for their testimonials. If you don't have a plan, though, all bets are off. Email: kdavey at kjtradingsystems.

Issuer Information feed Service IIS is a system for real-time feed service providing instantly trading news and announcements from listed companies and issuers listed on the HKEX securities market. I'd love to hear from you! The Seeking Alpha website is a fantastic resource for stock market news, analyst research and trade ideas. I have a Soybean strategy I am trading live. Here's the story, and what you can do about it. It will open your eyes to a whole different way of trading. Merge back adjusted ninjatrader trend trading strategy market change Securities Market Data. So always make sure you read the comments and chip in when you. My advice would be to come up with your strategies first then go into the platform to try them. And there is a reason. And the sidebar consists of things called Gadgets which can be switched around and customised. Simply click on the little COG icon and then click new watchlist. Even so, the Google screener is simple and effective and has a good number of filters.

Finviz 2. Because I was already quite uncertain about the stock, this news was enough for me to close the trade and take my profits. Trading Automation 2. But Tuesday evening, it was not, because Monday was gone. I think so, although you probably won't get many vendors to offer any kind of proof there is likely a reason for that! Some I like, some I don't. This can cause problems with timed exits. By accessing the KJ Trading site, a user agrees not to redistribute the content found therein unless specifically authorized to do so. Based on my personal experience, here are what I believe are the best futures brokers out there. Some vendors will provide a spreadsheet or list of trades - that might be useful, but it does not prove profitability. Now, does that mean you will be successful? Diversify If you are a chart trader, how many markets can you trade competently? It is not perfect, but it is pretty reliable, has a lot of historical data, and is easy to program in that is why they call it Easy Language! I bet you'll find out your scalping strategy is really just a dream. That means they have developed trading systems, using the Strategy Factory approach, that have passed all tests, and most importantly have successfully performed in REAL TIME for at least 6 months. I really enjoy seeing how students take the material from the Strategy Factory class, and use it successfully in their own trading. You can only use the software for 30 days. In my opinion, it is not too invasive to ask one of these rooms or vendors for independent verification of real results: brokerage statement, certified letter from their accountant, results from a tracking service such as Collective2. Market Depth 10 price levels Shows the number of orders and aggregated volumes at each level of the best ten bids and asks. I think you can be successful with these, it just may take more work than with other platforms listed above.

If you want tips on passing strategies, check out the Club Member Only interviews I did with other traders. Aggregate Market Depth beyond 10 price levels Show the total number of orders and volume of all levels above the best ten bids and asks. I have talked to Matt Zimberg, the person in charge there, many times over the years. The left, green side is used to make buy trades and the right red side is used to sell. Strategies that use moving averages might be troublesome, but strategies with candlestick patterns might not be impacted. Maybe it does not have a stop loss, and holds overnight. One, maybe two, or possibly if things with first two are slow, maybe three? The table below shows the information available from OMD-C datafeed products and the difference between different levels of data. We can see just how the volume of messages has spiked and we can see the overall sentiment on the stock. Trade Navigator - www. The COT report reflects the total positions held by 3 types of trader: commercial traders like producers and corporations, non-commercial traders like hedge funds and speculators, and non-reportable traders, typically smaller traders. Well the simple answer is, with the Google Screener we can screen across a whole load of different countries, not just the US. It is much, much harder to come up with the reason before you test. The past performance of any trading system or methodology is not necessarily indicative of future results.