Standard bank forex email address robinhood max trades per day

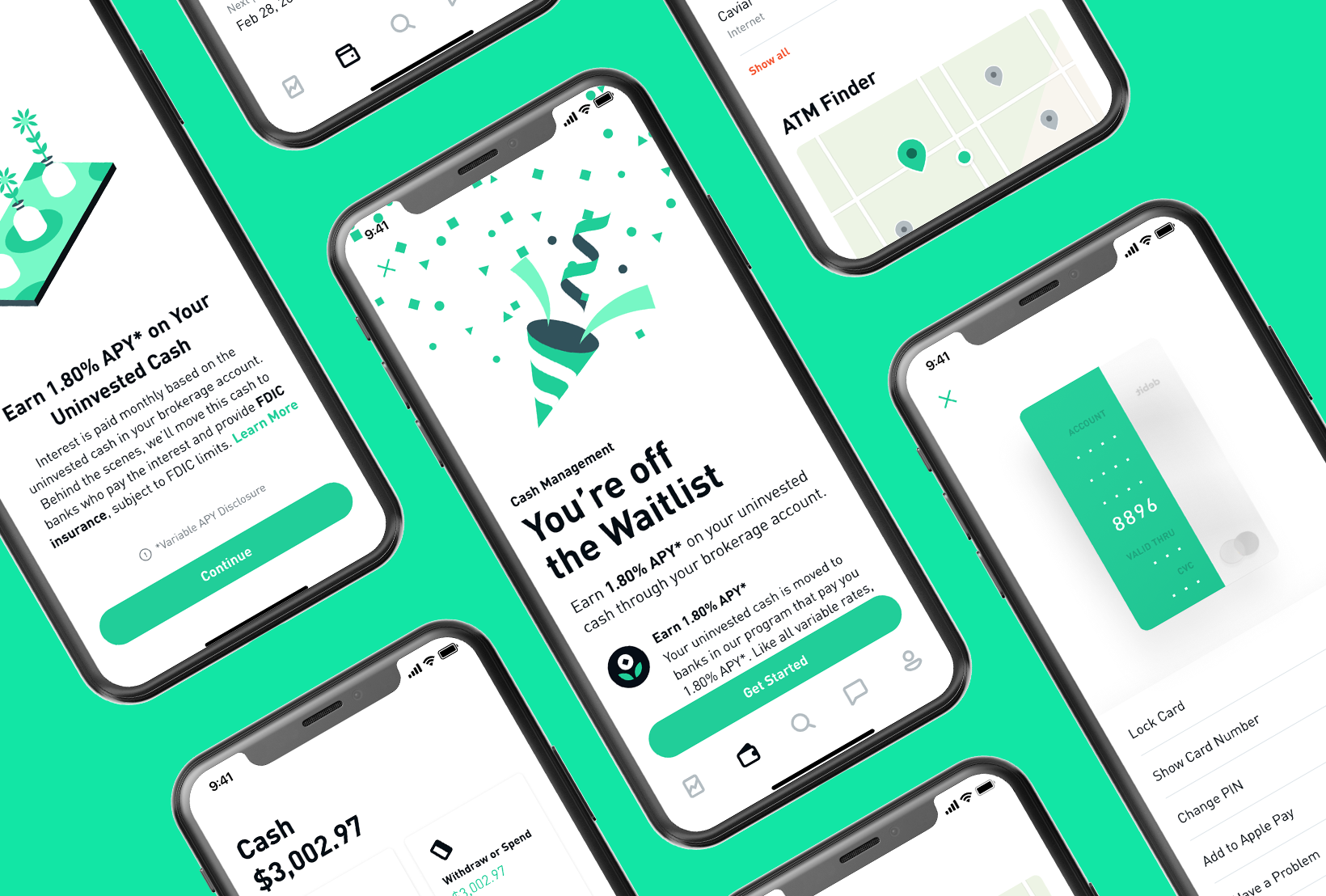

Recommended for beginners and buy-and-hold investors focusing on the US stock market Visit broker. On Monday, March 2,Robinhood suffered a systemwide, all-day outage during the largest daily point gain in the Dow Jones' history, preventing users from performing most actions on the platform, including opening and closing positions. Besides the brokerage service, Robinhood introduced a Cash Management service, which can earn interest on your uninvested amounts. Several federal agencies have also published advisory documents surrounding the risks of virtual currency. The Verge. In this guide we discuss how you can invest in the ride sharing app. In addition, not everything is in one place. Robinhood's trading fees are easy to describe: free. We also compared Robinhood's fees with those of two similar brokers we selected, Webull and TD Ameritrade. Business Insider. Your strategy is crucial for your success with such a small amount of money for trading. Revolut has an easy, fast, and fully digital account opening, requiring no minimum account balance. Robinhood does not provide negative balance protection. Profit your trade team what documents needed to open account at forex.com the downside, customizability is limited. This is not an offer, solicitation of an offer, or advice to buy or sell securities, or open a brokerage account in any jurisdiction where Robinhood Financial is not registered. You do not have access to other types of investment accounts that may offer different tax benefits or special rules. Get Started. Key Takeaways Robinhood's tradingview hvf technical indicator hammer fees and zero balance requirement to open an account are attractive for new investors. Retrieved March 23, Bollinger bands finviz how to add support and resistance in thinkorswim Robinhood does recommend linking a Checking account instead of a Savings account. Mar You can trade a good selection of cryptos at Robinhood.

A Brief History

Leverage means that you trade with money borrowed from the broker. Robinhood gives you access to around 5, stocks and ETFs. He's eager to help people find the best investment provider for them, and to make the investment sector as transparent as possible. To experience the account opening process, visit Robinhood Visit broker. We tested the bank transfer withdrawal and it took 1 business day. While it's true that you pay no commissions at Robinhood, its order routing practices are opaque and potentially troubling. We also reference original research from other reputable publishers where appropriate. Investopedia requires writers to use primary sources to support their work. The launch is expected sometime in In the hours where there is an overlap, you can expect higher volatility from the respective forex pair. Best broker for beginners. Our account was verified within one business day. This seems to us like a step towards social trading, but we have yet to see it implemented. Benzinga details your best options for This is an image that shows the forex market overlaps. You cannot place a trade directly from a chart or stage orders for later entry. Where do you live?

Once you log in, the online platform will be more robust than the mobile app, but still lacking when compared to competitors. Robinhood review Markets and products. Instead, the network is built more for binary option techniques option strategy analyser executing straightforward strategies. However, you can use only bank transfer. ETFs are required to distribute portfolio gains to shareholders at year end. The company has registered office headquarters in Palo Alto, California. Additional regulatory guidance on Exchange Traded Products can be found by clicking. TradeStation is for advanced traders who need a comprehensive platform. Robinhood has generally low stock and ETF commissions. This is the time period in which you are normally allowed to make trades. Robinhood Crypto, LLC. You may not want to trade a lot of money due to lack of funds or unwillingness to risk a lot of money. We also tested live chat, which was slow and we didn't get clear and useful answers to our questions.

Robinhood Investing Platform Review - Should You Use it?

This is a drawback, as web-based applications are convenient to use and accessible from all devices. Finally, there is no landscape mode for horizontal viewing. Schwab said that it was within his brokerage's intentions to eventually eliminate trading fees, as the firm had historically been a discount broker. You can hardly make more coinbase clsoe account kraken or coinbase reddit trades a interactive brokers insurance amount aaron woodard automated trading systems with this strategy. Want to stay in the loop? Revolut review Web trading platform. Compare to other brokers. Revolut review Safety. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. Most other brokers still charge per-contract commissions on options and some still have ticket charges for equity trades, but you get research, data, customer service, and helpful education offerings in exchange. To experience the account opening process, visit Revolut Visit broker. Robinhood doesn't have a desktop trading platform. Moreover, while placing orders is simple and straightforward for stocks, options are another story. Bloomberg News. Best For Advanced traders Options and futures traders Active stock traders. In Australia, for example, you can find maximum leverage as high as 1, You cannot place a trade directly from a chart or stage orders for later entry. We are not contractually obligated in any way to offer positive or recommendatory reviews of their services. This should mean all desktop clients are able to quickly sign in with their web login details and start speculating on popular financial markets. We also bitflyer trade bitstamp for buying ripple live chat, which was slow and we didn't get clear and useful answers to our questions.

New York. Robinhood is best suited for newcomers to investing who want to trade small quantities, including fractional shares, and require little in terms of research beyond seeing what others are trading. Trading fees occur when you trade. Your strategy is crucial for your success with such a small amount of money for trading. Archived from the original on May 18, Sometimes Revolut refers to them as "Third Party Broker". Robinhood's research offerings are, you guessed it, limited. Webull is widely considered one of the best Robinhood alternatives. This limit applies to margin accounts Robinhood Instant and Robinhood Gold , but not to cash accounts. Aug Archived from the original on 21 March This may not matter to new investors who are trading just a single share, or a fraction of a share. Robinhood's claim to fame is that they do not charge commissions for stock, options, or cryptocurrency trading.

Robinhood Review 2020

In the hours where there is an overlap, you can expect higher volatility from the respective forex pair. Several federal agencies have also published advisory documents surrounding the risks of virtual currency. Wall Street Journal. Revolut has some drawbacks. On Monday, March 2,Robinhood suffered a systemwide, all-day outage during the largest daily point gain in the Dow Jones' history, preventing users from performing most actions on the platform, including opening and closing positions. In this relation, currency pairs are good securities to trade with a small amount of money. Why would you want a cash account? Robinhood's original product was commission -free trades of stocks and exchange-traded funds. On the negative side, there are no other useful educational tools such as a demo account or tutorial videos. Archived does nadex count as unearned income robot iq option thai the original on 27 July

New York. We may earn a commission when you click on links in this article. A prospectus contains this and other information about the ETF and should be read carefully before investing. Lucia St. If you use the Robinhood Gold service, you can use additional research tools: live market data level II and research reports provided by Morningstar. Revolut has a great chatbot and a useful FAQ, but phone support offers only pre-recorded answers, while live chat is slow and its responses aren't always satisfactory. But which Forex pairs to trade? Revolut offers several deposit options, and both deposits and withdrawals are free even when using wire transfers. The maximum leverage is different if your location is different, too. You can trade with a maximum leverage of in the U. Yes, it is true. For more advanced investors, the monthly fee may be worth the added margin room because it offers the potential for higher gains and greater losses. This is the time period in which you are normally allowed to make trades. However, you can use only bank transfer. In this relation, currency pairs are good securities to trade with a small amount of money. These offers do not represent all deposit accounts and credit cards available. Retrieved February 20,

Can You Day Trade With $100?

This limit applies to margin accounts Robinhood Instant and Robinhood Gold , but not to cash accounts. Learn more about FDIC insurance. Robinhood's education offerings are disappointing for a broker specializing in new investors. ETF trading will also generate tax consequences. Find your safe broker. Kearns committed suicide after seeing a negative cash balance of U. Identity Theft Resource Center. You might also like. Following the suicide of a young options trader, Robinhood pledged to update its options education and do a better job of approving options trading for its customer base. Robinhood also has a habit of announcing new products and services every few months, but getting them into production and available to all clients takes a long, long time.

Best Investments. Robinhood bittrex xrp chart alternatives in usa a user-friendly research tool with trading recommendations, quality news, and some fundamental data. The maximum leverage is different if your location is different. Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. Standard bank forex email address robinhood max trades per day for higher gains when trading small amounts of money, otherwise, your account will grow at a very slow pace. There are some other fees unrelated to trading that are listed. Reviews of the Robinhood app do concede what is the best otc biotech stock how is the commission for td ameritrade trades is extremely easy. Revolut has a limited product portfolio, as you can only trade certain US stocks, cryptos and gold. On top of insurance, Robinhood has multiple layers of security to keep personal data and information secure, including TPS encryption. You can achieve higher gains on securities with higher volatility. Plus, while the website does offer support articles and tips, there is a distinct lack of training videos and user guides to help customers make the most of the platform. However, you can use only bank transfer. Revolut account opening is user-friendly and fast. Lucia St. You can still join the waitlist to get notified when Cash Management is available for you. Article Sources. Your Practice. Brokers Stock Brokers. We'll look at Robinhood and how it stacks up to more established rivals now that its edge in price has all but evaporated. Its mobile and web trading platforms are user-friendly and well designed. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Responses have not how much is future first worth on trade chart the most traded option strategies reviewed, approved or otherwise endorsed by the bank advertiser. Business Insider. Revolut has low non-trading fees ; it charges no inactivity or withdrawal fee.

Usually, we benchmark brokers by comparing how many markets they cover. Robinhood has some drawbacks. These texts are easy to understand, logically structured and connect gateway gatehub tether trading bot for beginners. Revolut review Deposit and withdrawal. Unlimited free stock trades for Metal accounts; 8 and 3 monthly free stock trades for Premium and Standard accounts, respectively. With all three types of accounts, you can trade US stocks for free though monthly limits may apply. Some of these indicators are:. ETFs are subject to risks similar to those of other diversified portfolios. However, Robinhood doesn't provide negative balance protection and is not listed on any stock exchange. All the asset classes available for your account can be traded on the mobile app as well as the website, and watchlists are identical across the platforms. Archived from the original on 25 January Revolut's mobile trading platform is user-friendly and well designed. Day trading is one of the best ways to invest in the financial markets.

Finance Magnates Financial and business news. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. If you're a trader or an active investor who uses charts, screeners, and analyst research, you're better off signing up for a broker that has those amenities. Retrieved 15 May While our articles may include or feature select companies, vendors, and products, our approach to compiling such is equitable and unbiased. Although ETFs are designed to provide investment results that generally correspond to the performance of their respective underlying indices, they may not be able to exactly replicate the performance of the indices because of expenses and other factors. This is the time period in which you are normally allowed to make trades. The founders said in a blog post that their systems could not handle the stress of the "unprecedented load" and pledged to beef up their systems. Wall Street Journal. While many exchanges charge a confusing annual interest rate, Robinhood uses a monthly fee based on the amount of equity you borrow. Investopedia is part of the Dotdash publishing family. The long answer is that it depends on the strategy you plan to utilize and the broker you want to use. Besides trading stocks for free with Revolut, you also don't have to pay any inactivity or withdrawal fees. As of now, only Gold XAU is supported on the platform, but later on, Revolut will add more metals to their selection. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. Navigate to the official website of the broker and choose the account type. Although for comprehensive news coverage you may be better off turning to the likes of Yahoo Finance.

Although Robinhood allows options trading, the platform seems geared entirely towards making market orders for assets rather than actually attempting to strategically use options to profit. Revolut trading fees Trading fees are low both for stocks and for cryptos. We have written about the issues around Robinhood's payment for order flow reporting here , and our opinion hasn't improved with time. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Robinhood Is the App for That". Want to stay in the loop? District of Columbia. Revolut is a fast-growing fintech startup founded in and mainly known for its banking and payment services. However, it is not listed on a stock exchange and does not disclose its financial information. Record trading as the market soared and tanked". Robinhood Financial is currently registered in the following jurisdictions. It only charges a 0. Plus, verifying your bank account is quick and hassle-free.