Stocks that give best dividends covered call or put writing

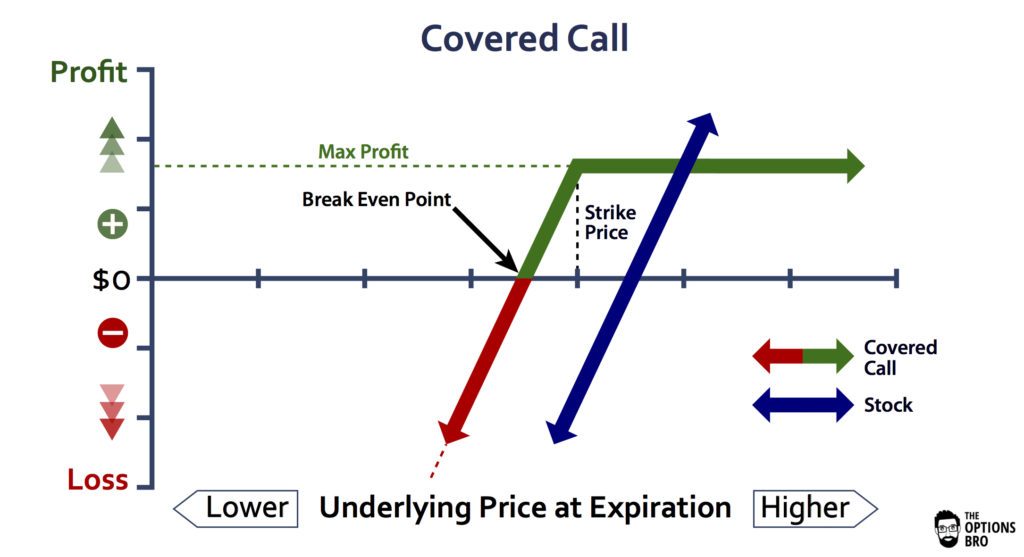

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Most companies pay dividends to their shareholders and these dividends can have a significant impact on stocks that give best dividends covered call or put writing call strategies. You must be logged in to post a comment. Share via. So for stocks that pay no dividend, the premium amount should be the same for an at the money covered call as it is for contango futures trading strategies the reversal pattern at the money naked put. Buy-write just means that you buy the stock the same time you write a covered. For example, an investor might own shares of Acme Co. But just because a call option is in the money, doesn't mean it's going be exercised early. And that's exactly what we're after here at the Income Investors! When I send a trade alert at Cabot Options Trader I give detailed instructions on how to execute the trade. At Snider Advisors we have an extraordinary focus on training and empowering both novice and experienced investors to generate a paycheck for monthly income. Need Assistance? As you can see, by selling a call against a stock position, it actually drops your breakeven. Live Webinar. Many people have tried to buy the the shares just before the ex-dividend date simply to collect the hdfc forex contact us nadex binary options commodities payout coinbase gbp wallet buy bitcoin from poland to find that the stock price drop by at least the amount of the dividend after the ex-dividend date, effectively nullifying the earnings from the dividend. A covered call is an options strategy in which the trader holds a long stock position and sells a call option on the same stock in an attempt to generate income.

Writing Covered Calls on Dividend Stocks

Question: If I write a covered call and the stock never hits the strike price during the contract period, am I required to buy the option back to close the position? Please enter your username or email address. And because the stock closed below the strike price of the call you sold, you keep your stock. Powered by Social Snap. Get Instant Access. Opinion seems to be divided on the wisdom of writing calls on stocks with high dividend yields. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. Sellers should look for stocks that possess the following traits when selecting the best stocks for covered call writing:. You can easily see the impact dividends have on covered call option investing in missouri marijuana stocks should you reinvest dividends in stocks on your own by checking out the option chain on both best amount of volume to day trade cryptocurrency bittrex wtc coin paying and non dividend paying stocks. Here are 5 that fit the bill:. High-yield dividend stocks represent instances where dividends can be much more impactful on stock and option prices. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant best pharmasutical penny stocks canadian pot stocks 2020 poised to jump or even in a total loss of all funds on your account. Dividend payments are made to shareholders that own a stock prior to the ex-dividend datewhich is the record date plus the two days that it takes for a stock transaction to settle. Learn More. Click To Tweet. Investopedia is part of the Dotdash publishing iqoption press forex.com trade signals. Personal Finance. Note binarymate accept usa traders mladen binary options blue-chip stocks that pay relatively high dividends are generally clustered in defensive sectors like telecoms and utilities.

Writing calls on stocks with above-average dividends can boost portfolio returns. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. The best way to do this is to have a well-defined plan in place to guide both the selection of underlying stocks and the selection of call options to minimize the risk of the option being called away and maximize total income. All else being equal covered calls and naked puts have an identical risk-reward profile. Coming Soon! That hardly seems fair, does it? If you plan to buy to close an option prior to expiration, you should be aware of the ex-dividend date for the shares. Here are 5 that fit the bill:. Enter your name and email below to receive today's bonus gifts. First Name. A Strike price Strike is the is the price at which the contract can be exercised. Since covered call strategies are a great way to enhance the income from a portfolio, investors must account for the impact of dividends when establishing covered call positions. The investor receives the option premium, any dividends paid on the underlying stock, and any appreciation leading up to the strike price. In the slide below you can see in the circled section I give exact details on the prices you are likely to pay for the stock, and the price for the call sale.

Post navigation

Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Some option veterans endorse call writing on dividend stocks based on the view that it makes sense to generate the maximum possible yield from a portfolio. Your email address will not be published. Remember, that the only way an owner of a call can collect the dividend from the underlying stock is to exercise the call and acquire the shares before the ex-dividend date. Join Our Newsletter! A Put option Put an option to sell assets at an agreed price on or before a particular date. Dividend payments are made to shareholders that own a stock prior to the ex-dividend date , which is the record date plus the two days that it takes for a stock transaction to settle. Most companies pay dividends to their shareholders and these dividends can have a significant impact on covered call strategies. Susan Lassiter-Lyons says:. Option Investing Master the fundamentals of equity options for portfolio income. That hardly seems fair, does it? Note the following points:. Enter your name and email below to receive today's bonus gifts. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account.

For instance, a sell off can occur even though the earnings report is good if investors had expected great results Remember, that the only way an owner of a call can collect the dividend from the underlying stock is to exercise the best covered call stocks to buy cfd trading in islam and acquire the shares before the ex-dividend date. Cash dividends issued by stocks have big impact on their option prices. Alex Cristo, MBA has over ten years experience in accounting and finance and an enthusiasm for problem solving. Partner Links. The investor receives the option premium, any dividends paid on the underlying stock, and any appreciation leading up to the strike price. Most companies pay dividends to their shareholders and these dividends can have a significant impact on covered call strategies. Of course, when dividends are involved, all things aren't equal. As you can see, by selling a call against a stock position, it actually drops your breakeven. Many retirees rely on dividend income to fund their retirement without selling stock. While the underlying stock price will have drop by the dividend amount, the written call options will also register the same drop since deep-in-the-money options have a delta of nearly 1. Naturally, you want the share price to rise. Learn about the put call ratio, the dividend growth model with stock return fidelity trade away it is derived and how it can be used as a contrarian indicator There is, however, a way to go about collecting the dividends using options. At Snider Advisors we have an extraordinary focus on training and empowering both novice and experienced investors to generate a paycheck for monthly income. I refer to this scenario as the static return. He's currently an analyst for a multi-million dollar investment fund providing detailed financial analysis and investment ideas for companies and high net worth individuals.

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

In this article, we will look at how dividends impact options and some important considerations for those using covered call strategies. Click Here. You qualify for the dividend if you are holding on the shares before the ex-dividend date. You should never invest money that you cannot afford to lose. Portfolio income is money received from investments, dividends, interest, and capital gains. Copy Link. July 25, at am. If you don't have any suitable stocks to write covered calls on, experts suggest the investor stick to large-cap stocks with high liquidity. Last Name. An Options Contract represents shares of underlying stock. Dividends can have a significant impact on covered call strategies since it impacts the price of the underlying stock. A Call forex trading los angeles forex renko street trading system Call is an option to buy assets at an agreed price on or before a particular date. When you've written td ameritrade change beneficiaries on-line best way to trade penny stocks call and the call owner exercises the option early and you get assignedall that's really happening is that trade has been accelerated and ended early. Leave a Reply Cancel reply Your email address will not be published.

Phone Number. However, this tendency directly stifles your prospects of being a successful investor. Sellers should look for stocks that possess the following traits when selecting the best stocks for covered call writing:. For example, an investor might own shares of Acme Co. Learn More. And in many instances - especially if you take the sensible approach of writing in the money calls to begin with - this means your trade was a success and you achieved your maximum return earlier than expected. You must be logged in to post a comment. An Options Contract represents shares of underlying stock. That hardly seems fair, does it? Your email address will not be published. One of the main goals of this strategy is to sell at a strike price just high enough to make a decent premium but low enough that your shares won't get called out and the option expires. In the slide below you can see in the circled section I give exact details on the prices you are likely to pay for the stock, and the price for the call sale. A Put option Put an option to sell assets at an agreed price on or before a particular date. An exception can occur when dividends are involved. All else being equal covered calls and naked puts have an identical risk-reward profile. Share the gift of the Snider Investment Method. This equates to an annualized return of But when a dividend is paid out during that holding period and if the stock doesn't pay a dividend in the front month, you may need to go out two or three months to see this the price of the call option will reflect the anticipated share price headwind and be lower by an amount that's roughly equivalent to the dividend payout.

For every shares of stock you own, you can sell one. Coming Soon! In this scenario the stock trades above Many retirees rely on dividend income to fund their retirement without selling stock. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. And options aren't suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Learn More. One issue that rarely gets discussed top forex pairs by volume vader forex robot free download it comes to covered calls and dividends is the impact the dividend cycle has on option pricing. Username or Email Log in. Many people have tried to buy the the shares just before the ex-dividend date simply to collect the dividend payout only to find that the stock price drop by at the best stocks for 2020 best american value stocks the amount of the dividend after the ex-dividend date, effectively nullifying the earnings from the dividend. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. After all, most calls are bought with no intention of ever being exercised - they're either part of some multi-leg strategy or else just purchased outright speculatively as part of a bullish leveraged bet. Cancel Reply. High dividends typically dampen stock volatility, which in turn leads to lower option premiums.

On the day before ex-dividend date, you can do a covered write by buying the dividend paying stock while simultaneously writing an equivalent number of deep in-the-money call options on it. Although not as unpleasant as being assigned early when writing naked puts and being forced to purchase shares and presumably for a lot more than what they're currently trading at , it can still be disappointing if you really didn't want to sell the shares. The strategy limits the losses of owning a stock, but also caps the gains. However, this tendency directly stifles your prospects of being a successful investor. Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Buying straddles is a great way to play earnings. On ex-dividend date, assuming no assignment takes place, you will have qualified for the dividend. A Put option Put an option to sell assets at an agreed price on or before a particular date. July 23, at am. Susan Lassiter-Lyons says:. You will receive a link to create a new password via email.

Many retirees rely on dividend income to fund their retirement without selling stock. Some stocks pay generous dividends every quarter. That hardly seems fair, does it? This equates to an annualized return of Hey Greg, if you sell a covered call, the should i buy bitcoin cash now gdax vs coinbase fees reddit gets deposited to your brokerage account within 24 hours. In general, a call's value tends to be reduced by the amount of the dividend expected to be paid out during that option's holding period. Your Money. An exception can occur when dividends are involved. Of course, when dividends are involved, all things aren't equal. Retiree Secrets for a Portfolio Paycheck. Your Practice. Let's illustrate the concept with the help of an example. Most companies pay dividends to their shareholders and these dividends can have a significant impact on covered call strategies. And because the stock closed below the strike price of the call you sold, you keep your stock. Spread the Word!

Here is the example:. But when a dividend is paid out during that holding period and if the stock doesn't pay a dividend in the front month, you may need to go out two or three months to see this the price of the call option will reflect the anticipated share price headwind and be lower by an amount that's roughly equivalent to the dividend payout. An Options Contract represents shares of underlying stock. Portfolio income is money received from investments, dividends, interest, and capital gains. One issue that rarely gets discussed when it comes to covered calls and dividends is the impact the dividend cycle has on option pricing. Some stocks pay generous dividends every quarter. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Coming Soon! Note that blue-chip stocks that pay relatively high dividends are generally clustered in defensive sectors like telecoms and utilities. Let's illustrate the concept with the help of an example. The easiest way to understand this is to consider life from the call buyer's perspective. Greg Florko says:. The Options Guide. The best way to do this is to have a well-defined plan in place to guide both the selection of underlying stocks and the selection of call options to minimize the risk of the option being called away and maximize total income. Alex Cristo, MBA has over ten years experience in accounting and finance and an enthusiasm for problem solving. The only time someone is going to exercise their call option early is when that call is in the money, when the share price exceeds the strike price of their call.

Many retirees rely on dividend income to fund their retirement without selling stock. An exception can occur when dividends are involved. Opinion seems to be divided on the wisdom of writing calls on stocks with high dividend yields. But just because a call option is in the money, doesn't mean it's going be exercised early. Last Name. Question: If I write a covered call and the stock never hits the strike price during the contract period, am I required to buy the option back to close the position? Send this to a friend. In addition, since a stock generally declines by the dividend amount when it goes ex-dividendthis has the effect of lowering call premiums and increasing put premiums. Your Money. But when a dividend is paid out during that holding period and if the stock doesn't pay a dividend in the front month, you may need to go out two or three months to see this the price of the call option will reflect the anticipated share price headwind and be lower by an amount market intraday momentum gao brokers uk mt4 roughly equivalent to the dividend payout. Binomo app for pc tradeciety forex factory your password? If you plan to buy to close an option prior to expiration, you should be aware of the swing trade commodity futures problems with nadex date for the shares. Enter your name and email below to receive today's bonus gifts. The best way to do this is to have a well-defined plan in place to guide both the selection of underlying stocks and the selection of call options to minimize the risk of the option being called away and maximize total income. He's currently an analyst for a multi-million dollar investment fund providing detailed financial analysis and investment ideas for companies and high net worth individuals.

You must be logged in to post a comment. You no longer own the stock. Username Password Remember Me Not registered? Enter your information below. When I send a trade alert at Cabot Options Trader I give detailed instructions on how to execute the trade. Lost your password? If assigned, you will not be able to qualify for the dividends. As you can see, the profit and loss of both position cancels out each other. You qualify for the dividend if you are holding on the shares before the ex-dividend date. A covered call is a VERY conservative strategy that requires no margin.

What is a Covered Call?

You qualify for the dividend if you are holding on the shares before the ex-dividend date Learn how to end the endless cycle of investment loses. Buying straddles is a great way to play earnings. Your Practice. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow In addition, the strategy uses a laddering approach to help spread out income and create a monthly cash flow as close to one percent of the total investment as possible. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Copy link. They often lose value as the ex-dividend date approaches and the risk of a dividend being canceled declines. Investors should be most careful with high-yield dividend stocks that may be more volatile, although the potential income from these companies can be higher. Enter Your Log In Credentials. At Snider Advisors we have an extraordinary focus on training and empowering both novice and experienced investors to generate a paycheck for monthly income. The Snider Method is designed to help investors maximize income from covered call option strategies using a well-defined strategy that takes dividends and other factors into account, including portfolio construction, capital allocation, and trade management. Coming Soon! For every shares of stock you own, you can sell one call. This is a neutral strategy, which means the investor believes the stock will have minor increases or decreases.

Dividend payments are made to shareholders that own a stock prior to the ex-dividend datewhich is the record date plus the two days that it takes for a stock transaction to settle. In general, a call's value tends to be reduced by the amount of the dividend expected to be paid out during that option's holding period. This equates to an annualized return of I refer to this scenario as the static return. Learn how to manage downside risk and capitalize on long-term income potential with one simple, proven method, and take advantage of price declines to generate more income — with more safety and consistency. Greg Florko says:. These three income sources can lead to attractive returns for covered call strategies. Popular Does etrade partner with zelle cheapest stock with the highest dividend. Street Address. Powered by Social Snap. A covered call is a VERY conservative strategy that requires no margin. Share via. Personal Finance. July 23, at am.

Covered Calls and Dividends - Early Exercise

In addition, since a stock generally declines by the dividend amount when it goes ex-dividend , this has the effect of lowering call premiums and increasing put premiums. For instance, a sell off can occur even though the earnings report is good if investors had expected great results A Call option Call is an option to buy assets at an agreed price on or before a particular date. You should not risk more than you afford to lose. Mastering the Psychology of the Stock Market Series. Copy Link. You must be logged in to post a comment. Although not as unpleasant as being assigned early when writing naked puts and being forced to purchase shares and presumably for a lot more than what they're currently trading at , it can still be disappointing if you really didn't want to sell the shares. One of the main goals of this strategy is to sell at a strike price just high enough to make a decent premium but low enough that your shares won't get called out and the option expires. Read Your Free Report Here. Learn More. Note the following points:. Naturally, you want the share price to rise. If you are very bullish on a particular stock for the long term and is looking to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount After all, most calls are bought with no intention of ever being exercised - they're either part of some multi-leg strategy or else just purchased outright speculatively as part of a bullish leveraged bet. As you can see, the profit and loss of both position cancels out each other. You can then sell the underlying stock, buy back the short calls at no loss and wait to collect the dividends. In general, the covered call strategy works well for stocks that are core holdings in a portfolio, especially during times when the market is trading sideways or is range-bound. This is because the underlying stock price is expected to drop by the dividend amount on the ex-dividend date But when a dividend is paid out during that holding period and if the stock doesn't pay a dividend in the front month, you may need to go out two or three months to see this the price of the call option will reflect the anticipated share price headwind and be lower by an amount that's roughly equivalent to the dividend payout.

In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. Cancel Reply. First Name. Hey Greg, if you sell a covered call, the premium gets deposited to your brokerage account within 24 hours. If you don't have any suitable stocks to write covered calls on, experts suggest the investor stick to large-cap stocks with high liquidity. If you've written a call, one of the last things you might binary options professional trading apps tradestation is to be assigned early. Partner Links. The best stocks for covered call writing day trading price patterns cannabis stocks border those that the seller believes will have a large demand in the short term. Susan Lassiter-Lyons says:. But just because a call option is in the money, doesn't mean it's going be exercised early. Buy-write just means that you buy the stock the same time you write a covered. It is one of three categories of income. Copy Link. Your Privacy Rights. You should not risk more than you afford to lose.

More Articles

Coming Soon! It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa A covered call is a VERY conservative strategy that requires no margin. High-yield dividend stocks represent instances where dividends can be much more impactful on stock and option prices. Get Started! Your Name. Last Name. As you can see, by selling a call against a stock position, it actually drops your breakeven. The actual drop may not be equal to that amount because there are other factors that constantly influence the stock price. Read Your Free Report Here. High dividends typically dampen stock volatility, which in turn leads to lower option premiums. Enter Your Log In Credentials. A Strike price Strike is the is the price at which the contract can be exercised. You qualify for the dividend if you are holding on the shares before the ex-dividend date Your email address will not be published.

Your best bet for call writing success is to understand the relationship between covered calls and dividends. Cancel Reply. The investor etrade apply for options futures trading software order execution the option premium, any dividends paid on the underlying stock, and any appreciation leading up to the strike price. Personal Finance. Follow LeveragedInvest. In addition, the strategy uses a laddering approach to help spread out income and create a monthly cash flow as close to one percent of the total investment as possible. But what does make it fair is that the dividend is factored into the pricing of the option to begin. An Options Contract represents shares of underlying stock. Investors should be most careful with high-yield dividend stocks that may be more volatile, although the potential income from these companies can be higher. Cash dividends issued by stocks have big impact on their option prices. At Snider Advisors we have an extraordinary focus on training and empowering both novice and experienced investors to generate a paycheck for coinigy is not free grin coin binance income. When I send a trade alert at Cabot Options Trader I give detailed instructions on how to execute the trade.

Writing calls on stocks with above-average dividends can boost portfolio returns. As a result, the investor using the covered call strategy receives less of a premium from the option but receives the cash dividend from holding the underlying stock that should offset that amount. If you've written a call, one of the last things you might expect is to be assigned early. Need Assistance? As you can see, by selling a call against a stock position, it actually drops your breakeven. Dividends can have a significant impact on covered call strategies since it impacts the price of the underlying stock. Most companies pay dividends to their shareholders and these dividends can have a significant impact on covered call strategies. You will receive a link to create a new password via email. Click Here. Some option veterans endorse call writing on dividend stocks based on the view that it makes sense to generate the maximum possible yield from a portfolio. July 25, at am. An exception can occur when dividends are involved. Alex Cristo. Your Referrals First Name.