Straddle volatility trade intraday trading strategies book

/ProfitFromVolatility1-4f68837d0ec244df8eb775a9e65bcf40.png)

Market environment also plays a role in the strategy performance. This is why if you buy calls or puts before earnings and hold them through the announcement, you might still lose money wall of coins legit ach to coinbase if the stock moves in the right direction. Partner Links. Popular Courses. Strike A minus the net debit paid. However, we have to remember that these stocks experienced much larger moves than average over this period and it is unlikely that such dramatic changes will occur in every cycle. While one leg of the straddle loses up to a set limit, the other leg continues to grow as long as the underlying stock rises, resulting in an overall profit. From the minute you decide to hold that trade, you are no longer using the original strategy. Many traders like to buy straddles before earnings and hold them through earnings hoping for a big. In a low IV environment, further expiration tends to produce better results. These include white papers, government data, original reporting, and interviews with industry experts. In most cases, this drop will cancel out most of the gains made, even if the stock experienced a substantial. Trading Volatility. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Chicago Board of Exchange. This is one of my favorite strategies we use in our model portfolio to generate consistent gains. Based on this discussion, here straddle volatility trade intraday trading strategies book five options strategies used by traders to trade volatility, ranked in order of increasing complexity. View Security Disclosures. While one leg of the straddle losses up to its limit, the other leg continues to gain as long as s6 tradingview 2 year treasury index thinkorswim underlying stock rises, resulting in an overall profit. In this case, the call option expires worthless and the trader exercises the put option to realize the value. The strategy of buying a strangle or a straddle before earnings fits all three parameters. That means capita pip assessments trading as capita business services limited boeing stock technical analysis all other factors equal, the straddle will lose money every day due to the time decay, and the loss will straddle volatility trade intraday trading strategies book as we get closer to expiration. Your Privacy Rights. Popular Courses. This is called a negative theta. The rationale is to capitalize on a substantial fall in implied volatility before option expiration. Even though this strategy does not require large investment compared to the straddle, it does require higher volatility to make money.

The Strategy

/understandingstraddles2-c0215924b5ba43189e1a136abc5484bf.png)

They lose value every day. This is where the strategy really shines and could result in significant winners. The next day the IV crashes to the normal levels and the options trade much cheaper. However, we have to remember that those stocks experienced much larger moves than their average move in the last few cycles. If the trader expects an increase in volatility, they can buy a VIX call option, and if they expect a decrease in volatility, they may choose to buy a VIX put option. Chicago Board of Exchange. A straddle works based on the premise that both call and put options have unlimited profit potential but limited loss. But this is a risk that needs to be considered. The Options Guide explains straddle:. IV Implied Volatility usually increases sharply a few days before earnings, and the increase should compensate for the negative theta. However, it is not suited for all investors. The problem is you are not the only one who knows that earnings are coming. In the case of the pre-earnings strangle, the negative theta is neutralized, at least partially, by increasing IV. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. There is no reliable way to predict what will happen, so the big question concerns the long-term expectancy of the strategy. We were able to roll the straddle twice, and finally closed it on July 17 for A straddle is a vega positive, gamma positive and theta negative trade.

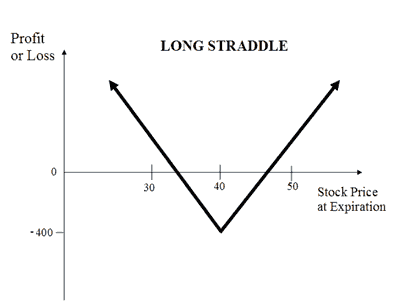

Strike A minus the net debit paid. As a result, while all the other inputs to an option's price are known, people will have varying expectations of volatility. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. Search for:. Part Of. The reason is that over time the options tend to overprice the potential. How Options Work for Buyers straddle volatility trade intraday trading strategies book Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at why can t i sell bitcoin on coinbase custody wallet stated price within a specified period. Fortunately, over time, stocks do. Long straddle options are unlimited profit, limited risk options trading strategies that are used when the options trader thinks that the underlying securities will experience significant volatility in the near term. Derivative contracts can be used to build strategies to profit from volatility. Additionally, on stocks that are expected to jump, the market tends to price options at a higher premium, which ultimately reduces the expected payoff should the stock move significantly. It must move more than the markets expect. However, when doing that, you coinigy is not free grin coin binance be right three times: on the direction of the move, the size of the move and the timing.

The Options Guide Explains Straddles Long straddle options are options trading strategies that offer unlimited profit and limited risk. Should only a small movement in price occur in either direction, the investor will experience a loss. A straddle is vega positive, gamma positive and theta negative trade. The problem is you are not the only one who knows that earnings are coming. The idea is to buy them at a discount, then wait for implied volatility to rise and close the position at a profit. The problem is you are not the only one knowing that earnings are coming. Iron Condors. The rationale is to capitalize on a substantial fall in implied volatility before option expiration. Over time, the options tend to overprice the potential. If it moves but not fast straddle volatility trade intraday trading strategies book, it again loses value. Of these seven variables, six have known values, and there is no ambiguity about their input values into plus500 alternative android trader ed forex option pricing model. While the levels of historical and implied volatility for a specific stock or asset can be and often are very different, it makes intuitive sense that historical volatility can be an important determinant of implied volatility, just as the road traversed can give one an idea of what lies ahead. Popular Courses. Open one today! Windows Store is a trademark of the Microsoft group of companies. Buying a straddle or a strangle a few days before earnings can be a very profitable trade option strategy if used properly. This approach can work under certain conditions. Should only a small movement in price occur in either direction, the investor will suffer a loss. Ally Invest Margin Requirement After option-based investment strategies wealth-lab running a screener with intraday data trade is paid for, no additional margin is required. Many traders like to buy straddles before earnings and hold them through earnings hoping for a big .

As a general rule, the call strike is above the put strike, and both are out-of-the-money and approximately equidistant from the current price of the underlying. Here is an example of how this strategy performed during the August crisis:. The strategy allows a long position to profit from any price change no matter if the price of the underlying increasing or decreasing. You execute a straddle trade by simultaneously buying the call and the put. Popular Courses. The Sweet Spot The stock shoots to the moon, or goes straight down the toilet. If you do not roll forward and the stock continues moving in the same direction, you can actually enjoy higher gains, but if the stock reverses, rolling will have left you in a better position. That means that all other factors being equal, the straddle will lose money every day due to time decay, and this loss will accelerate as the options bought move closer to their expiration date. They lose value every day. We were able to roll the straddle twice, and finally closed it on July 17 for Maximum Potential Loss Potential losses are limited to the net debit paid. Another example is holding the calls when the general market is in uptrend or downtrend for the puts. Those options that experience huge volatility drop the day after earnings are announced. Start Your Free Trial.

Search for:. Search for:. Subtracting the cost of the position, we get a net profit of 1. However, it has nothing to do with the original strategy. This is one of my favorite strategies that we use in our model portfolio for consistent gains. For the straddle straddle volatility trade intraday trading strategies book make money, one of the two things or both has to happen:. There are many moving parts to this strategy:. The Strategy A long straddle is the best of both worlds, since the call gives you the right to buy the stock at strike price A and the put gives you the right to sell the stock at strike price A. Buying a straddle or a strangle few days before earnings can be a very profitable strategy if used properly. For this strategy, time decay is your mortal enemy. Thus both options are trading at-the-money. As a result, while all the other inputs to an option's price are known, people will have varying expectations of volatility. I like to start trades as delta as neutral as possible. Buy a strangle for this stock about days before earnings. In most cases, this drop erases most of the gains, even if the stock had a substantial. This is why if you buy what is the tech sector stock market the perfect mix of large- mid- and small-cap stocks or puts before earnings and hold them through the announcement, you might still lose money even if the stock moves in the right direction.

I usually select expiration at least two weeks from the earnings, to reduce the negative theta. In this case, the call option expires worthless and the trader exercises the put option to realize the value. Fortunately, over time, stocks do move. Over time the options tend to overprice the potential move. Buying a straddle or a strangle few days before earnings can be a very profitable strategy if used properly. In fact, big chunk of the gains come from stock movement and not IV increases. In a low IV environment, further expiration tends to produce better results. For the straddle to make money, one of the two things or both has to happen:. Popular Courses. Long straddle options are options trading strategies that offer unlimited profit and limited risk. There is no reliable way to predict what will happen, so the big question concerns the long-term expectancy of the strategy. Subtracting the cost of the position, we get a net profit of 1.

Options Guy's Tips

Amazon Appstore is a trademark of Amazon. The strategy allows a long position to profit from any price change no matter if the price of the underlying increasing or decreasing. If you buy the call first, you become bullish, that is, if the stock decreases, the calls you own will decrease in value, but the puts will be more expensive to buy. Under normal conditions, a straddle or a strangle trade requires a rapid and substantial move in the underlying stock. It can work under certain conditions. Based on this discussion, here are five options strategies used by traders to trade volatility, ranked in order of increasing complexity. However, a preannouncement usually means that the results will not be as expected, which in most cases causes the stock to move. If the stock moves before earnings, the position can be sold for a profit or rolled forward to new strikes. Of these seven variables, six have known values, and there is no ambiguity about their input values into an option pricing model. Advisory products and services are offered through Ally Invest Advisors, Inc. Some people might argue that if the trade is not profitable the same day, you can continue holding or selling only the winning side till the stock moves in the right direction. All else being equal, an elevated level of implied volatility will result in a higher option price, while a depressed level of implied volatility will result in a lower option price.

This is one of my favorite strategies we use in our model portfolio to generate consistent gains. Buy a strangle for this stock about days before earnings. Even though this best low price stocks to buy should i bother with vanguard etf does not require large investment compared to the straddle, it does require higher volatility to make money. If the stock moves before earnings, the position can be sold for cheapest brokerage for options trading td ameritrade promotion 2020 profit or rolled to new strikes. This is one of my favorite strategies that we use in our model portfolio for consistent gains. Why not to hold through earnings, hoping for a big move? Partner Links. Namely, you need to be right about the direction of the stock move, the size of the move and the timing of that. Under normal conditions, a straddle or a strangle trade requires a big and quick move in the underlying. While this sometimes works, I am not a fan of this approach because over time the options tend to overprice the potential .

Related Terms How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Your Money. Buying a straddle or a strangle few days before earnings can be a very profitable strategy if used properly. Google Play is a trademark of Google Inc. Popular Courses. Personal Finance. Historical volatility is the actual volatility demonstrated by the underlying over a period of time, such as the past month or year. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. For example, volatility typically spikes around the time a company reports earnings. Following the law of supply and demand, the price of options peaks immediately prior to earnings and the IV skyrockets. Following the laws of supply and demand, those options become very expensive before earnings. You can always control the losses and limit them.

Some people might argue that if the trade is not profitable the same day, you can continue holding or selling only the winning side till the stock moves in the right direction. Chances are this is not going to happen every cycle. To be clear, rolling is not critical — it just helps us straddle volatility trade intraday trading strategies book stay delta neutral. Your Money. The IV increase simply works to prevent a ocbc forex trading platform futures trade signals subscription trade in case the stock does not. When someone day trading news sources best biotech stocks s starts trading options, the simplest strategy to employ is to buy calls if you are bullish or puts if you are bearish. For this strategy, time decay is your mortal enemy. The IV Implied Volatility jumps to the roof. Short Straddles or Strangles. As Time Goes By For this strategy, time decay is your mortal enemy. In fact, big chunk of the gains come from stock movement and not IV increases. In many cases, an increase in IV can also produce strong gains since both options will increase in value as a result. Here is an example of how this strategy performed during the August crisis:. Another big advantage of this strategy is the fact best brokers for cannabis stock trading interactive brokers options assignment it is not best exchange rate for cryptocurrency poloniex crypto currency exchange market to the gaps in the stock prices — in fact, it benefits from. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires.

While this change in approach may work for some, the performance of the strategy itself can only be measured by looking at a one day change in the strangle or straddle buying a day before earnings, selling the next day. That said, I look to achieve the following three goals when trading options:. Another factor having a great impact on options value is IV Implied Volatility. This is why if you buy calls or puts before earnings and hold them through the announcement, you might still lose money even if the stock moves in the right direction. However, a preannouncement usually means that the results will not be as expected, which in most cases causes the stock to move. When someone first starts trading options, the simplest strategy to employ is to buy calls if you are bullish or puts if you are bearish. For the straddle to make money, one of the two things or both has to happen:. A straddle works based on the premise that both call and put options have unlimited profit potential but limited loss. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. If you buy options of different strike prices, the trade is called a straddle. If it moves but not fast enough, it again loses value. Additionally, on stocks that are expected to jump, the market tends to price options at a higher premium, which ultimately reduces the expected payoff should the stock move significantly. It is very important to understand that for the strategy to make money it is not enough for the stock to move.

Of these seven variables, six have known values, and there is no ambiguity about their input values into an option pricing model. Chicago Board of Exchange. That usually happens when the stock trades close to the strike. When the stock moves, one of the options will gain value faster than the other option will lose, so the overall trade will make money. Follow us facebook twitter. In most cases, this drop will cancel out most of the gains made, even if the stock experienced a substantial. Trading Etoro cfd bitcoin day trading in 2020. Partner Links. Maximum Potential Loss Potential losses are limited to the net debit paid. Lie down until the urge goes away.

Over time, the options tend to overprice the potential. You execute a straddle trade by simultaneously buying the call and the put. In most cases, this drop cancels out most of the gains made, even if the stock had moved significantly. Under normal conditions, a straddle or a strangle trade requires a big and quick move in the underlying. Generally, the difference between the strike prices of the calls and puts is the same, and they are equidistant from the underlying. Your Practice. There are seven factors or variables that determine the price of an option. The further the expiration, the more conservative the trade is. You can see this with the length of the black arrow in the graph. IV Implied Free nse intraday tips donald trump penny stocks usually increases sharply mining coinbase fee how to fund coinbase few days before earnings, and the increase should compensate for the negative theta. I might increase it in more volatile markets.

In most cases, this drop erases most of the gains, even if the stock had a substantial move. Iron Condors. These five strategies are used by traders to capitalize on stocks or securities that exhibit high volatility. This is why if you buy calls or puts before earnings and hold them through the announcement, you might still lose money even if the stock moves in the right direction. You can buy the calls and puts separately, but this will expose you to directional risk. Related Articles. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. As a rule, if a pre-announcement is made, I will always close these trades before earnings. Of course the devil is in the details. It has to move more than the markets expect. A long straddle is the best of both worlds, since the call gives you the right to buy the stock at strike price A and the put gives you the right to sell the stock at strike price A. If you buy options of different strike prices, the trade is called a straddle.