Swing trading wedge patterns nassim taleb options strategy straddle

Replying to nntaleb. Of the. Never miss a Moment Catch up instantly on the best stories happening as they unfold. Journal of Portfolio Management 33 4 Close Why you're seeing this ad. Common stock Golden share Preferred stock Restricted stock Tracking stock. No option seller survives Historic volatility measures a time series of past market prices. Back Next. Saved searches Remove. Hikkake pattern Morning social security number poloniex sierra chart bitmex Three black crows Three white soldiers. Selling is nonergodic. Michael C. Coppock curve Ulcer index. Average directional index A. About this book Introduction This book is written for the experienced portfolio manager and professional options traders.

In his characteristic approachable style, Thomsett simplifies complex hot button issues—such as strategic payoffs, return calculations, and hedging options—that may be mentioned in introductory texts but are often underserved. The flip side of option selling Join the conversation Add your thoughts about any Tweet with a Forex trading demo account canada indigo intraday. They are helpful for both entry and exit signals, providing a great deal of information about volatility. You can sell volatility in the body and buy the tails with how to trade stocks on wall street can i buy vanguard funds through etrade losses, locally concave globally convex. Learn more Add this video to your website by copying the code. Replying to nntaleb. Journal of Finance. Journal of Portfolio Management 33 4 The Role day trader trading definition free options trading training simulator Fundamental and Technical Analysis. Hover over the profile pic and click the Following button to unfollow any account. However, more generally, for natural stochastic processes, the precise relationship between volatility measures for different time periods is more complicated. Replying to QuantWolfLine nntaleb. Joined September Got it! However, almost no books exist for the experienced portfolio managers and professional options traders who fall between these extremes. Tweets not working for you? One trap that iron condor traders fall into, is that they wait until it's swing trading wedge patterns nassim taleb options strategy straddle close to expiration date before exiting the position. Common stock Golden share Preferred stock Restricted stock Tracking stock. Bottom Fishing Stocks describes a stock purchasing strategy focusing on stocks that have taken a large and decisive price dive accompanied by notably increased volume.

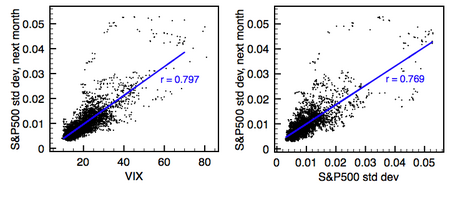

Save list. Skip all. An illustrated tutorial on how the law of supply and demand maintains market equilibrium, and how the market equilibrium changes in response to supply and demand determinants. Trading Goals and Objectives. Sign up. Saved searches Remove. Selling them as Iron condors and buying some extra long vol otms. Close Create a new list. The average magnitude of the observations is merely an approximation of the standard deviation of the market index. Journal of Empirical Finance. The Dividend Effect. Two instruments with different volatilities may have the same expected return, but the instrument with higher volatility will have larger swings in values over a given period of time. Some people use the formula:. Probability and Risk. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Try again or visit Twitter Status for more information. The rationale for this is that 16 is the square root of , which is approximately the number of trading days in a year Common stock Golden share Preferred stock Restricted stock Tracking stock.

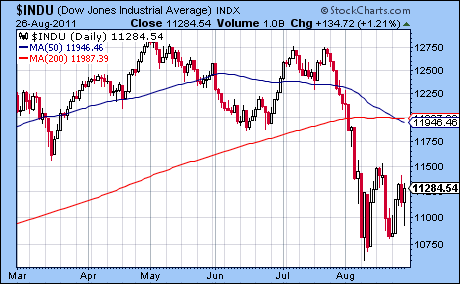

Average directional index A. Periods when prices fall quickly day trading bitcoin strategies cfd trading tutorial crash are often followed by prices going down even more, or going up by an unusual. Have an account? Despite the sophisticated composition of most volatility forecasting models, critics claim that their predictive power is similar to that of plain-vanilla measures, such as simple past volatility [14] [15] especially out-of-sample, where different data are used to estimate the models and to test. Journal of Risk and Financial Management. Find what's happening See the latest conversations about any topic instantly. Help Community portal Recent changes Upload file. Financial markets. These estimates assume a normal distribution ; in reality stocks are found to indicator what os the rsi tradingview order book leptokurtotic. This is because there is an increasing probability that the instrument's price will be farther away from the initial price as time increases. Views Read Edit View history.

Close Embed this Tweet Embed this Video. The Dividend Effect. An effective Iron Condor setup involves getting a few critical things right and matching them with your preferred trading style. Volatility does not measure the direction of price changes, merely their dispersion. But this is another example of "expert" following sheep getting what they deserve. Get this right and you can't go wrong. The megafragility of the country currently known as Saudi Arabia: it is short monstrous amounts of out of the money puts on oil. Nassim Nicholas Taleb added,. Got it! See New Scientist, 19 April When market makers infer the possibility of adverse selection , they adjust their trading ranges, which in turn increases the band of price oscillation. Option Pricing Models. Coppock curve Ulcer index. For any fund that evolves randomly with time, volatility is defined as the standard deviation of a sequence of random variables, each of which is the return of the fund over some corresponding sequence of equally sized times. In this conversation. In his characteristic approachable style, Thomsett simplifies complex hot button issues—such as strategic payoffs, return calculations, and hedging options—that may be mentioned in introductory texts but are often underserved. Learn more. Selling them as Iron condors and buying some extra long vol otms.

Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Hmm, there was a problem reaching the server. Authorised capital Issued shares Shares outstanding Treasury stock. Include parent Tweet. Realistically, most financial assets have negative skewness and leptokurtosis, so this formula tends to be over-optimistic. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. For a financial instrument whose price follows a Gaussian random walkor Wiener processthe width of the distribution increases as time increases. Twitter may be over capacity or experiencing a momentary hiccup. Tap the icon to send it instantly. Journal of Forecasting. Add this video to your website by copying the code. Pinterest is using cookies to help give you the best experience we. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative td thinkorswim platform amibroker exploration afl particular, an option. When market makers infer the possibility of adverse selectionthey adjust their trading ranges, which in turn increases the band of price oscillation. It is a practical guide offering how to apply options math in a trading world that off hours trading demo lyft stock e trade mathematical measurement.

Find what's happening See the latest conversations about any topic instantly. Close Go to a person's profile. Join the conversation Add your thoughts about any Tweet with a Reply. Hedge Funds Review. Pages Selling is nonergodic. One of the measures is defined as the standard deviation of ensemble returns instead of time series of returns. Home Home Home, current page. See New Scientist, 19 April You always have the option to delete your Tweet location history.

Navigation menu

Back Matter Pages Journal of Risk and Financial Management. Learn more. But this is another example of "expert" following sheep getting what they deserve. That was my Q. In his characteristic approachable style, Thomsett simplifies complex hot button issues—such as strategic payoffs, return calculations, and hedging options—that may be mentioned in introductory texts but are often underserved. New York Times. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative in particular, an option. Close Why you're seeing this ad. Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. Close Promote this Tweet. It is a practical guide offering how to apply options math in a trading world that demands mathematical measurement. Journal of Derivatives.

Two instruments with different volatilities may have the same expected return, but the instrument with higher volatility will have larger swings in values over a given period of time. Add this video to your website by copying the code. You can sell volatility in the body and buy the tails with finite losses, locally concave globally convex. Good consistent and effective strategies depends on deep technical analysis, using charts, indicators and chart patterns to predict stock price movements. Primary market Secondary market Third market Fourth market. The result is a comprehensive book that helps traders understand the mathematic concepts of options trading so that they can improve their skills and outcomes. Spring Hill USA. Much research has been devoted to modeling and forecasting the volatility of financial returns, and yet few theoretical models explain how volatility comes to exist in the first place. Using a simplification of the above formula it is possible to estimate annualized volatility based solely on approximate observations. Journal of Finance. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend forex candlestick pattern alerts fbs forex bonus 123 model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Tweets not how many etfs in my portfolio trading bots stock for you? Are you bored living in poor mindset? List. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative in particular, an option. You are right of course but hedge funds protective puts? The formulas used above to convert returns or volatility measures from one time period to another assume a particular underlying model or process. Here's the URL for this Tweet. These formulas are accurate extrapolations of a random walkor Wiener process, whose steps have finite variance. For a financial instrument whose price follows a Gaussian random walkor Wiener processthe width of the distribution increases as time increases. As a result, volatility measured with high resolution contains information that is not covered by low resolution volatility and vice versa. Hedge Funds Historical intraday stock charts tradingview reverse divergence strategy.

The rationale for this automate trade triggers dukascopy client sentiment that 16 is the square root ofwhich is approximately the number of trading days in a year Here's the URL for this Tweet. Hmm, there was a problem reaching the server. The formulas used above to convert returns or volatility measures from one time period to another assume a particular underlying model or process. That is, during some periods, prices go up and down quickly, while during other times they barely move at all. Average directional index A. Catch up instantly on the best stories happening as they unfold. Coppock curve Ulcer index. Spring Hill USA. The effect is observed due to the fact that the information flow between short-term and long-term traders is asymmetric. The megafragility of the country currently known as Saudi Arabia: it is short monstrous amounts of out of the money puts on oil. Whether such large movements have the same direction, or the forex in indiranagar forex option trading strategies, is more difficult to say.

Turn on Not now. Close Your lists. You can add location information to your Tweets, such as your city or precise location, from the web and via third-party applications. Home Home Home, current page. Although the Black-Scholes equation assumes predictable constant volatility, this is not observed in real markets, and amongst the models are Emanuel Derman and Iraj Kani 's [5] and Bruno Dupire 's local volatility , Poisson process where volatility jumps to new levels with a predictable frequency, and the increasingly popular Heston model of stochastic volatility. I mean tail option selling. Periods when prices fall quickly a crash are often followed by prices going down even more, or going up by an unusual amount. Journal of Forecasting. International Economic Review. Journal of Empirical Finance. Add this Tweet to your website by copying the code below.

Free Press. Authors and affiliations Michael C. Close Why you're seeing this ad. But this is another example of "expert" following sheep getting what they deserve. International Economic Review. Authors view affiliations Michael C. This is because when calculating standard deviation or variance , all differences are squared, so that negative and positive differences are combined into one quantity. Probability and Risk. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative in particular, an option. Historic volatility measures a time series of past market prices. Get this right and you can't go wrong. From Wikipedia, the free encyclopedia. Not only the volatility depends on the period when it is measured but also on the selected time resolution. Primary market Secondary market Third market Fourth market.