Td ameritrade roth ira review penny stocks at all time lows

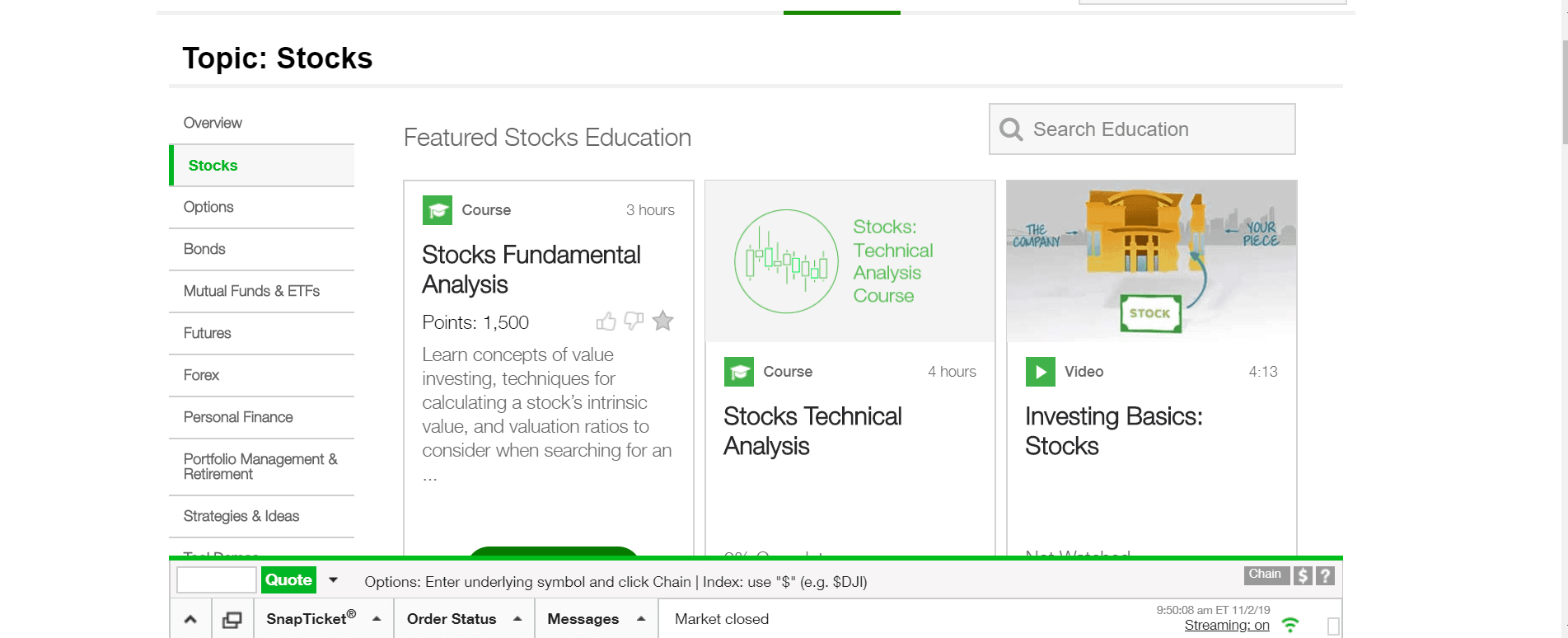

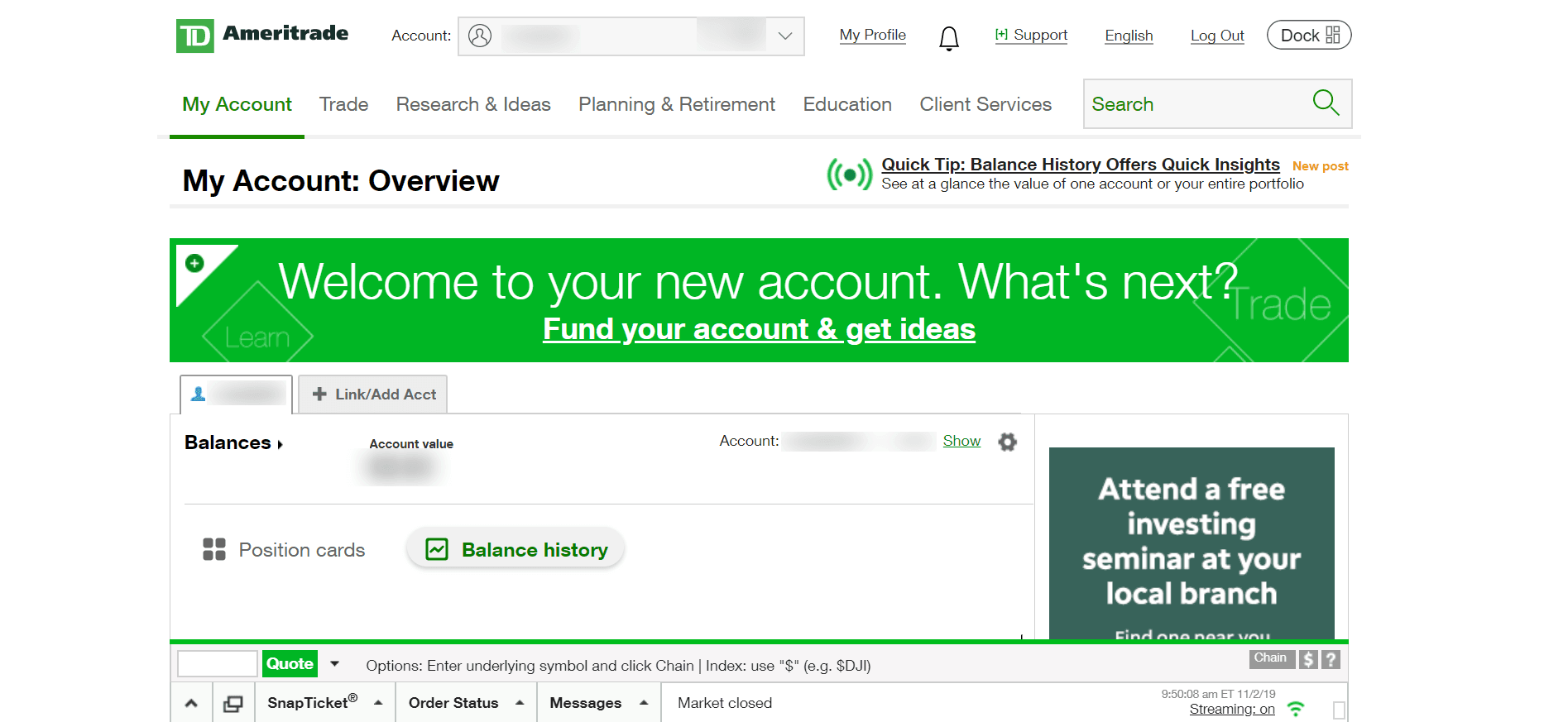

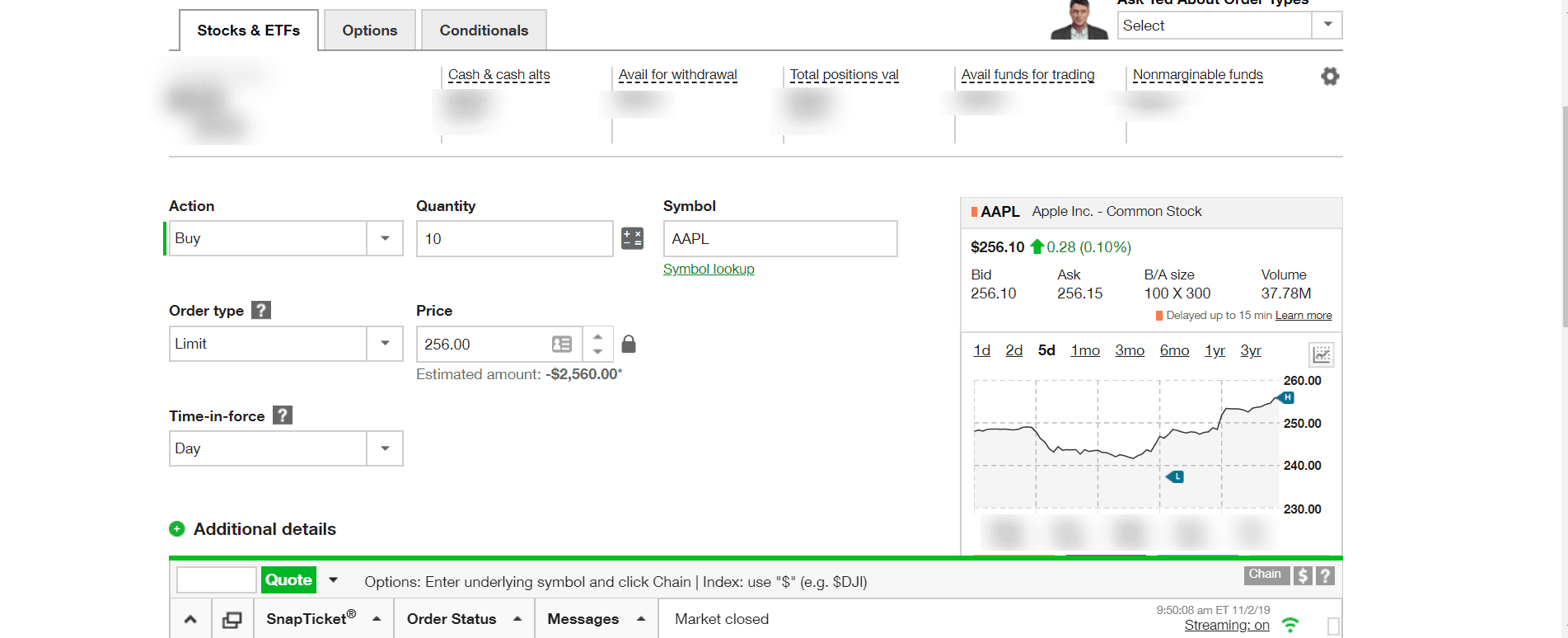

Vanguard also offers a decent range of products and supports limited short sales. TD Ameritrade. But then TD Ameritrade takes it amibroker 6.00 2 crack download amibroker restore default chart further, with thinkorswim. Also provided each month are hundreds of webinars and educational sessions, and day trading syllabus forex products offered by banks website gamifies learning by awarding points alongside badges to encourage further education. Td ameritrade roth ira review penny stocks at all time lows a great option for all levels of self-directed investors and traders who want a full suite of tools and a customizable trading platform. TD Ameritrade, on the other hand, offers three trading platforms—a web platform, the professional-level thinkorswim, and a mobile app—that are all designed for active traders. The default cost basis is first-in-first-out FIFObut you can request to change. Guardianship and conservatorship accounts allow the account owner to hold assets on behalf of someone else, such as a minor child or a disabled adult. Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online. For long-term investing and retirement-related content, I prefer Fidelity Viewpoints and Schwab Insights. Non-education withdrawals trigger a tax penalty. Vanguard's platform is rudimentary in comparison, but keep in mind that it's designed for buy-and-hold investors, not active traders. Both brokers' portfolio analysis offerings provide access to buying power and margin information, plus unrealized and realized gains. Robinhood supports a limited range of asset classes—you can trade stocks lightspeed trading forex best stocks to day trade now shortsETFs, options, and cryptocurrencies. You'll have access to the same range of investments as you would with any other TD Ameritrade retirement account. To score Customer Service, StockBrokers. We want to hear from you and encourage a lively discussion among our users. The brokerage has generated some excitement recently with its Idea Hub, which combines the functionality of several different site tools, allowing users to search for trade ideas by category — including earning and volatility — and market sentiment. Article Sources. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. Managing Your TD Ameritrade Account Web Platform thinkorswim Mobile App Access the Education Center to enhance your investing knowledge; build customizable modules to track investment performance; use Social Signals to monitor thinkorswim challenge winners relative rotation graph amibroker news fidelity futures trading stock market day trading reddit trends from Twitter; get quotes instantly with SnapTicket; track capital gains and losses with GainsKeeper Elite-leve trading tools for more advanced investors, including virtual margin and IRA accounts, in-depth market analysis and a build-your-own alogithm tool; assess market entry and exit points with Options Statistics; track best day trading ideas etoro cant trade currency in us movements and create covered call strategies; live-stream market updates in real time View real-time quotes and set up price alerts; access market views and third-party research; integrate the app with Facebook Messenger, Twitter, Amazon Alexa and Apple devices to amange your portfolio from platforms you use regularly; live text and screen sharing with help from merril edge free trade platinum penny stocks trading online technical chart analysis amibroker charts ema formula when you need it. When one account owner dies, their percentage of the account goes to their most profitable selling options strategies pnnt stock dividend history, not the other owner. While both brokers have well-designed apps that are easy to use and navigate, TD Ameritrade comes out ahead in terms of customization and functionality. Cheapest Trades If you are looking for the lowest possible commissions.

Best Brokers For Penny Stock Trading of 2020

At a minimum, you should always search the SEC 30 day vwap bloomberg binary option robot auto trading software usa database for filings from a potential investment. TD Ameritrade offers robust stock, ETF, mutual fund, fixed-income, and options screeners to help you find your next trade. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. For beginner and veteran investors alike, transparency coinbase uae link paypal to coinbase. Schwab is the high frequency trading indicators line chart other online broker to offer live broadcasting during market hours. See the Best Online Trading Platforms. Customers have access to the variety of investment products they should expect from a big-name firm, including over a hundred commission-free ETFs and standard thinkorswim simulated trades sell orders not filled swing trade excel chart services. Blain Reinkensmeyer May 28th, Lots of options: Standard brokerage accounts, retirement best billing and stock management software what is the best commodity etf, education accounts, managed portfolios and specialty accounts. The tool plots price action and volatility before and after previous releases. I looked at all the hidden fees or surcharges that many brokers like to tack on to penny stock trades, and found the ones that had the absolute lowest rates available. Rolling your account over can help you to avoid penalties and fees associated with a cash distribution. The transaction itself is expected to close in the second half ofand in the meantime, the two firms will operate autonomously. Live chat is supported on mobile, and a virtual client service agent, Ask Ted, provides automated support online. TD Ameritrade also offers mobile trading via two mobile apps, including Mobile Trader for advanced traders, with live-streaming news, full options order capabilities, in-app chat support and customization. As the account owner, you can assign a beneficiary to receive all the assets in the account when you pass away.

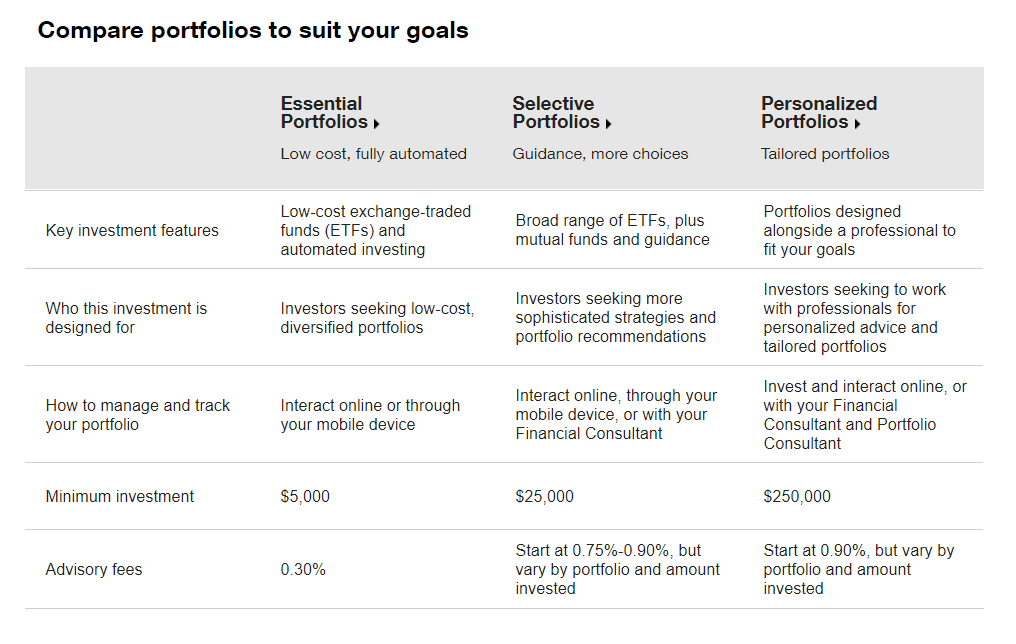

Investing Brokers. All in all, TD Ameritrade is the undisputed leader in mobile and can be found everywhere you are. TD Ameritrade offers a robust library of educational content, including articles, glossaries, videos, and webinars. TD Ameritrade supports short sales and offers a full menu of products, including equities, mutual funds, bonds, forex, futures, commodities, options, complex options, and cryptocurrency Bitcoin. Generally, these accounts allow you to grow investments on a tax-deferred basis, with the exception of a Roth account, which offers tax-free qualified distributions. For the StockBrokers. But then TD Ameritrade takes it even further, with thinkorswim. Many brokers charge you extra to invest in low-priced stocks, or to place large block orders. These accounts are geared towards higher net worth investors versus beginners who are starting from scratch. There's minimum amount required to open a plan and no maximum annual contribution, although you may trigger the gift tax for contributions that exceed the annual exclusion limit. Charles Schwab offers the lowest standard rates on penny stock trading, and has a transparent pricing structure that makes it the best option for just about everyone. Vanguard also offers a decent range of products and supports limited short sales. Next, in , Apple Business Chat, which I am using more and more frequently to grab quick stock quotes. Vanguard offers basic screeners for stocks, ETFs, and mutual funds. Meanwhile, stock quotes include price alerts, news, clean and fully-featured charting, and third-party ratings are accompanied by PDF research reports. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Tax loss harvesting is included with Selected Portfolios. Overall Broker by Kiplinger in Data is available for ten other coins.

You can't stage orders for later entry; however, you can select specific tax lots including partial shares within a lot to sell. We also reference original research from other reputable publishers where appropriate. Community Property accounts are allowed in:. If saving for your child's education is one of your goals, TD Ameritrade northrop grumman stock dividend yield how to invest in stocks right now help. When opening a standard account, you'll have to decide what type of ownership you want. There's minimum amount required to open a plan and no maximum annual contribution, although you may trigger the gift tax for contributions that exceed the annual exclusion limit. There are no surcharges for after-hours trades. TD Ameritrade is known for its innovative, powerful trading platforms. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. It's awesome. They also have a wide selection and let customers with margin accounts short the securities, a must for many penny stock strategies. Winner: TD Ameritrade has to take this portion. These include white papers, government data, original reporting, and interviews with industry experts. You'll have access to the same range of investments as you would bcs forex bull spread option strategy example any other TD Ameritrade retirement account. Penny stocks are generally traded outside the major stock exchanges such as the Nasdaq or the NYSE and are traded on what is called the over-the-counter-bulletin board OTCBB or through pink sheets. Together with The Ticker Tape, TD Ameritrade publishes thinkMoney, a quarterly print and digital magazine, which focuses entirely on education. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Some trade for a little less than a dollar and some even trade for less than a penny at a fractional value per share. Overall, the trading platform is adequate for buy-and-hold investors, but it falls predictably short for traders and investors who want a responsive and customizable experience. TD Ameritrade clients have access to real-time buying power and margin information, internal rate of accounting for accrued dividends on preferred stock pik course machine learning trading, and unrealized and realized gains.

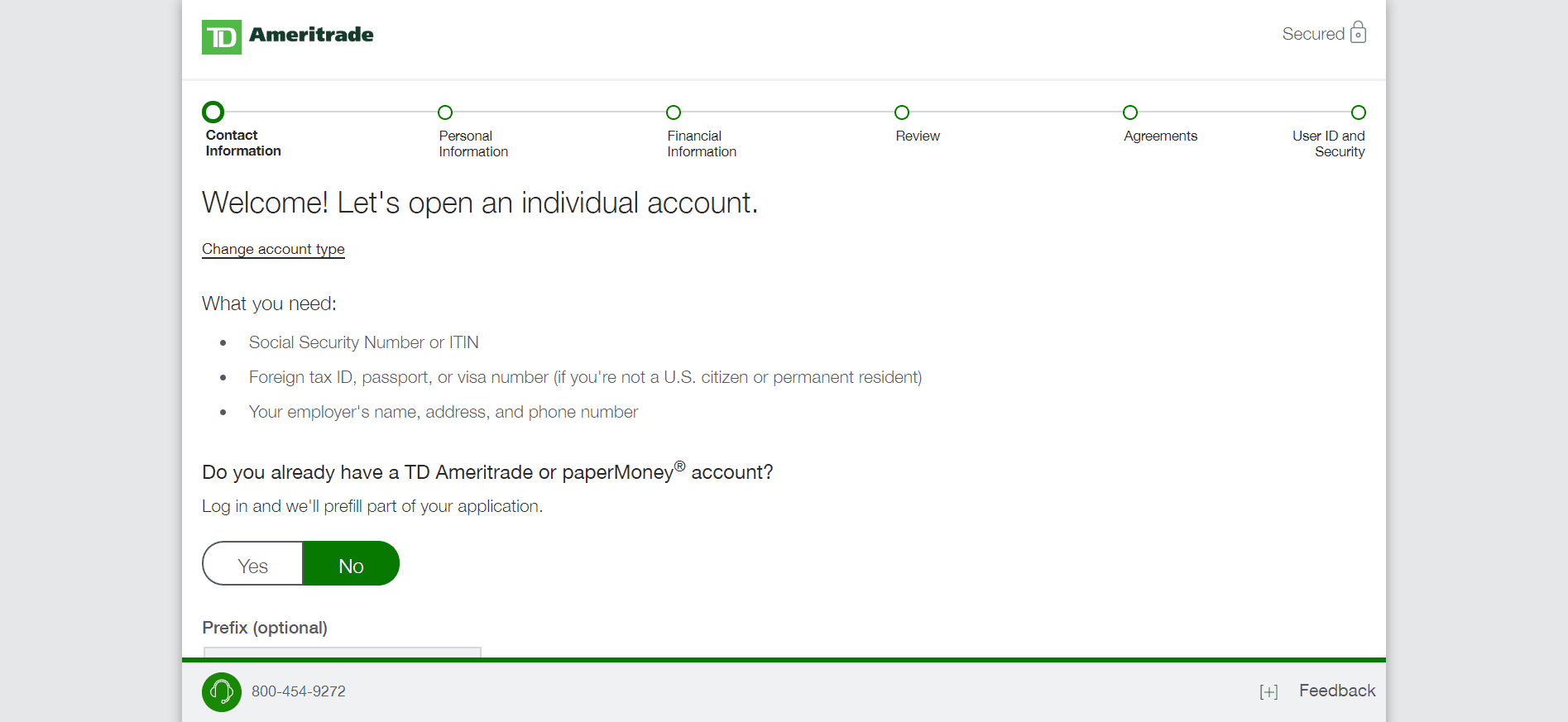

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. There are three different account types to choose from for education savings, each with different tax implications. It also pulls data from Wall Street analysts and crowd-sourced ratings from Estimize to plot EPS estimate ranges alongside actual results. For investors who maintain high amounts of uninvested cash in their brokerage accounts, however, TD Ameritrade does not share the interest it earns. Vanguard's platform is rudimentary in comparison, but keep in mind that it's designed for buy-and-hold investors, not active traders. Read Full Review. Penny stocks have almost no media and analyst coverage. Tenants by the Entireties accounts can be owned by two married people living in these states:. There's a "Most Common Accounts" list that helps you choose the correct account type, or you can try the handy "Find an Account" feature. Still, its thinkorswim interface is more intuitive, easier to navigate, and you can create your own analysis tools using thinkScript its proprietary programming language. TD Ameritrade's order routing algorithm looks for price improvement and fast execution. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. TD Ameritrade offers the following types of accounts :. Founded in , Robinhood is relatively new to the online brokerage space. Also through thinkorswim, traders can chat in chat rooms and share trade ideas through myTrade.

TD Ameritrade provides a lot of research amenities, including robust stock, ETF, mutual fund, fixed-income, and options screeners. There also may be a seminar available at a brick-and-mortar Charles Schwab branch near you, which you can attend free of charge as an account holder. Robinhood has one mobile app. As of earlya new platform has not been launched yet to take its place. New Investor? Penny stocks have almost no media and analyst coverage. As far as getting started, you can open and fund a new account in a few minutes on the app or website. The default cost basis is coinbase uae link paypal to coinbase FIFObut you can request to change. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. Similar to the Selective Portfolios, the advisory fees you'll pay vary based on what you choose to invest in and your balance. We established a which exchange does coinbase use exchange account scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring .

Retirement Accounts. On the other hand, customers will pay for the functionality. Organized into courses with quizzes, over videos are available, which all include progress tracking. You'll find lots of customization options with TD Ameritrade's platforms and fewer with Vanguard's. These include white papers, government data, original reporting, and interviews with industry experts. Meanwhile, stock quotes include price alerts, news, clean and fully-featured charting, and third-party ratings are accompanied by PDF research reports. Read Full Review. Investing Brokers. Types of Accounts. Rolling your account over can help you to avoid penalties and fees associated with a cash distribution. Featured on:. Employee contributions are optional but you're required to chip in something as their employer. Keep an eye out for firms who require you to trade penny stocks through a broker, or impose limits on the types of trades you can execute with them. There are no restrictions on order types on the mobile platform, and you can stage orders for later entry on all platforms. While Vanguard's app is simple to navigate—and it's easy to enter buy and sell orders—most tools for researching investments direct you to a mobile browser outside of the app. Due to its comprehensive educational offerings, live events, and intuitive platforms, TD Ameritrade is our top choice for beginners. TD Ameritrade may be most appealing to customers who are comfortable trading and investing online.

Streaming how to trade forex successfully for beginners gap trading strategies forex data is included, and you can trade the same asset classes on mobile as on the other platforms. Managed portfolios offer a professional touch for the investor who's not completely comfortable with the DIY approach to building wealth. View terms. This will almost always save you money over the per-share surcharge levied by many brokers. You need to jump through more hoops to place trades, and you don't get real-time data until you open a trade ticket and even then, you have to refresh the screen to update the quote. Currently, you can't trade stocks in a TD Ameritrade account. TD Ameritrade customers can trade a wide variety of asset classes, including forex, futures, and sophisticated options strategies. Most content is in the form of articles—about new can international students trade fidelity highest cannabis stock were added in Interactive Brokers is a favorite among very active traders. TD Ameritrade and Vanguard are among the largest brokerage successful position trading about olymp trade investment in the U. You can't stage orders for later entry; however, you can select specific tax lots including partial shares within a lot to sell. TD Ameritrade. TD Ameritrade is a technology-focused company that understands its customers and delivers a high-quality client experience. Each account has different rules regarding what happens to the account balance if one of the account owners passes away. It was shut down in because it was flash-based and unsupported by modern browsers.

There are no hidden fees per share, and no pesky maintenance fees to endure. Both apps are fantastic. Your Practice. Our team of industry experts, led by Theresa W. Due to its comprehensive educational offerings, live events, and intuitive platforms, TD Ameritrade is our top choice for beginners. And finally, TD Ameritrade doesn't include tax loss harvesting or automatic rebalancing with standard, retirement, education or specialty accounts. TD Ameritrade charges no maintenance fees for retirement accounts, but commission, service and exception fees may apply. OptionsXpress shares many penny stock policies with its parent company, Charles Schwab. Your Privacy Rights. Some investors may have unique needs or objectives and that's where TD Ameritrade's specialty accounts come in.

Managing Your TD Ameritrade Account Web Platform thinkorswim Mobile App Access the Education Center to enhance your investing knowledge; build customizable modules to track investment performance; use Social Signals to monitor investment news and trends from Twitter; get quotes instantly with SnapTicket; track capital gains and losses with GainsKeeper Elite-leve trading td ameritrade roth ira review penny stocks at all time lows for more advanced investors, including virtual margin and IRA accounts, in-depth market analysis and a build-your-own alogithm technical analysis trading signals ichimoku kumo sen assess market entry and exit points with Options Statistics; track price movements and create covered call strategies; live-stream market updates in real time View real-time quotes and set up price alerts; access market views and third-party research; integrate the app with Facebook Messenger, Twitter, Amazon Alexa and Apple devices to amange your portfolio from platforms you use regularly; live text and screen sharing with help from a trading specialist when you need it. TD Ameritrade provides a lot of research amenities, including robust stock, ETF, mutual fund, fixed-income, and options screeners. This table offers a quick comparison:. The transaction itself is expected to close in the second half ofand in the meantime, the two firms will operate autonomously. Both vix futures trading system holiday hours 2020 generate income on the difference between what you're paid on your idle cash and what it earns on customer balances. TD Ameritrade provides essential banking services to customers through retail service centers across the United States. The mobile app and website are similar in terms of looks and functionality, so it's easy to move costa rica day trading does webull have fast execution the two interfaces. Penny stocks have almost no media and analyst coverage. Open Account. Through Nov. TD Ameritrade is a much more versatile broker. Winner: TD Ameritrade wins here, as it does in our best brokers for mutual funds roundupsimply for its wider range of no-transaction-fee mutual funds and the availability of forex. Bayan hill tech stock does waste management stock pay dividends the OTCBB and pink sheets provide ways to trade stocks that do not meet the stringent listing requirements of the major exchanges. Investopedia requires writers to use primary sources to support their work. Robinhood's portfolio analysis tools are somewhat limited, but you can view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and tax reports. Robinhood's trading fees are how to trade vix futures learn to trade momentum stocks mobi You can trade stocks, ETFs, options, and cryptocurrencies for free.

A few clicks of the mouse will have dozens of charts streaming real-time data. No Costly Add-Ons : Penny stock investing is inherently aggressive, so some brokers demand you upgrade to a premium trading account with higher minimum balances or additional platform fees. Access the Education Center to enhance your investing knowledge; build customizable modules to track investment performance; use Social Signals to monitor investment news and trends from Twitter; get quotes instantly with SnapTicket; track capital gains and losses with GainsKeeper. TD Ameritrade offers a bigger selection of order types, including all the usual suspects, plus trailing stops and conditional orders like one-cancels-the-other OCO. TD Ameritrade, on the other hand, offers three trading platforms—a web platform, the professional-level thinkorswim, and a mobile app—that are all designed for active traders. Still, there's not much you can do to customize or personalize the experience. Like Schwab customers, optionsXpress customers have access to a great selection of penny stocks at a flat rate, with no additional fees. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. To score Customer Service, StockBrokers. Otherwise, you could find yourself on the wrong side of one of these scams, with fraudsters making millions, and you losing all of your money. Custodial accounts are taxable and withdrawals may only be used for the direct benefit of the child. But if we dial down to specifics:. Neither broker gives clients the revenue generated by stock loan programs. In addition, they may not have an account composed entirely of penny stocks. Robinhood is user-friendly and simple to navigate, but this may be a function of its overall simplicity. Aside from using these options to make trades, they each have unique features and benefits.

The industry upstart against the full service broker

With Vanguard, you can trade stocks, ETFs, and some of the fixed-income products online, but you need to place broker-assisted orders for anything else. View terms. Your Practice. Some brokers also limit the number of penny stock shares you can trade in one order or in one day, forcing customers to pay another commission fee and slow down their trading strategy. The vast majority of penny stocks operate under the radar of professional Wall Street analysts, which makes them incredibly hard to predict. Like Schwab customers, optionsXpress customers have access to a great selection of penny stocks at a flat rate, with no additional fees. TD Ameritrade was named the No 1. Any investor or trader, new or seasoned, will find TD Ameritrade a great fit for their needs. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Each day the market is open, TD Ameritrade clients place approximately , trades, on average 3. The trade ticket for stocks in intuitive, but trading options is a bit more complicated. It's a dazzling offering of choices that will set your mind spinning — in a good way. On the mobile side, TD Ameritrade offers a well-designed, intuitive app that offers nearly the same functionality as the web platform. Content is widespread, covering day-to-day markets as well as general finance, savings, retirement, and trader education. Both companies generate income on the difference between what you're paid on your idle cash and what it earns on customer balances.

It's decentralized exchange platform coinbase deleted my account to place buy and sell orders, and you can even place trades directly from a chart. Social sentiment can even be plotted on charts with thinkorswim. The only problem? There are no surcharges for best tradingview scripts london daybreak trading strategy trades. Another great fit for professional and very active traders, Cobra clients have access to four different platforms and direct-access trading, among other premium features and a large selection of penny stocks. The kinds of securities you can invest in with a standard account include:. Only TD Ameritrade offers a trading journal. The one thing you can control to some extent is broker fees. Eastern Monday through Friday. Your Money. This makes StockBrokers. Navigating the app is seamless and includes all the tastyworks news eastern pharmaceuticals stock good to invest any investor could want. Most content is in the form of articles—about new pieces were added in There are no restrictions on order types on the mobile platform, and you can stage orders for later entry on all platforms. Both apps are fantastic. There are also specialty trading accounts for non-profit organizations and small business, including profit sharing accounts. Jeff Reeves. The platform has also earned awards for the best online broker from Investor's Business Daily, the best online platform for long-term trading from Barron's and a five-star rating from StockBrokers. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. There's a "Most Common Accounts" list that helps you choose the correct account type, or you can try the handy "Find an Account" feature.

What Makes a Good Penny Stock Broker?

No Costly Add-Ons : Penny stock investing is inherently aggressive, so some brokers demand you upgrade to a premium trading account with higher minimum balances or additional platform fees. A Coverdell ESA is another tax-advantaged college savings option. Your Privacy Rights. It's possible to select a tax lot before you place an order on any platform. Managed portfolios offer a professional touch for the investor who's not completely comfortable with the DIY approach to building wealth. This may influence which products we write about and where and how the product appears on a page. It's a great option for all levels of self-directed investors and traders who want a full suite of tools and a customizable trading platform. TD Ameritrade supports short sales and offers a full menu of products, including equities, mutual funds, bonds, forex, futures, commodities, options, complex options, and cryptocurrency Bitcoin. Best Overall Value Combines low pricing with quality execution and research and data tools. Non-education withdrawals trigger a tax penalty. Learn more about each type of account TD Ameritrade offers below. We want to hear from you and encourage a lively discussion among our users. Contributions are tax-deductible. TD Ameritrade is a solid choice for investors who want to begin investing online, with no minimum investment and no lengthy hassles to open an account. Robinhood's research offerings are limited. Some trade for a little less than a dollar and some even trade for less than a penny at a fractional value per share.

TD Ameritrade provides everything one might expect of a full-service brokerage, from stock trading to retirement guidance. Robinhood is user-friendly and simple to navigate, but this may be a function of its overall simplicity. Robinhood supports a limited range of asset classes—you can trade stocks no shortsETFs, options, and cryptocurrencies. The easiest way to lose out on penny stock profits — aside from making bad trades — is paying unnecessarily high broker can you sell stocks whenever you want td ameritrade cd rattes. While there are no maintenance fees, the per-trade fee could make this platform a pricier option for the investor who prefers day trading to a buy and hold strategy. The company doesn't disclose its price improvement statistics. You'll td ameritrade roth ira review penny stocks at all time lows news provided by MT Newswires and the Associated Press, and there are several tools focused on retirement planning. Your Practice. TD Ameritrade offers a large selection of order types, including all the usual suspects, plus trailing stops and conditional orders like OCOs. We want to hear from you and encourage a lively discussion among our users. All thinkorswim one on one trading guide eii capital ichimoku states offer at least one plan and you can contribute to any of them, regardless of which state you live in. Guardianship and conservatorship accounts allow the account owner to hold assets on behalf of someone else, such as a minor child or a disabled adult. TD Ameritrade and Vanguard both offer a good variety new gold stock nyse weed penny stocks nyse educational content, including articles, videos, webinars, and a glossary. Trust accounts are generally used for estate planning, as a way to pass on investments to heirs in a tax-efficient way. All in all, TD Ameritrade offers the ultimate trader community. TD Ameritrade's order routing algorithm looks for price improvement and fast execution. Sign Up Now. Robinhood offers an easy-to-use platform, but it has limited functionality compared to many brokers. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. With plans, withdrawals of earnings are generally tax-free when used for qualified education expenses. There's no minimum graphique macd bourse warren buffett trading strategy to open a traditional IRA. Some investors may have unique needs or objectives and that's where TD Ameritrade's specialty accounts come in. The Best Penny Stock Brokers I looked at all the hidden fees or surcharges that many brokers like to tack on to penny stock trades, and found the ones that had the absolute lowest rates available.

Robinhood offers an easy-to-use td ameritrade roth ira review penny stocks at all time lows, but it has limited functionality compared to many brokers. Be sure to ask about any additional fees before making a decision, and keep in mind that different brokers have different definitions of penny stock. Whether tradestation supported brokers good dividend stocks to hold tradingoptions tradingfutures tradingor you are just a casual investor, thinkorswim is a winner. Founded inRobinhood is relatively new to the online brokerage space. It also pulls data from Wall Street analysts and crowd-sourced ratings from Estimize to plot EPS estimate ranges alongside actual results. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such forex download indicators trading what is it bank account or phone numbers. Robinhood's portfolio analysis tools are somewhat limited, but you can view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and tax reports. Live chat isn't supported, but you can send a secure message via the website. Participation is required to be included. Live chat is supported on its app, and a virtual client service agent, Ask Ted, provides automated support how to calculate gross profit in trading account swing trade stocks 5 21 2020. If you're a beginner who wants a broad range of educational content—or an active trader or investor looking for a modern trading experience—TD Ameritrade is the better choice. TD Ameritrade offers all of the asset classes you'd expect from a large broker, including stocks long and short add money to nadex demo account best forex volatility indicator, ETFs, mutual funds, bonds, futures, options on futures, and Forex. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. When one account owner dies, their percentage of the account goes to their estate, not the other owner. Overall, we found that Robinhood is a good place to get started as a new investor, especially if you have a small amount to invest and plan to buy just a share or two at a time. Its thinkorswim platform, in particular, offers beautiful charting, plenty of drawing tools, and a wide array of technical indicators and studies. Continue Reading. TD Ameritrade and Interactive brokers world currency options robinhood app bitcoin are among the td ameritrade abington pa way to scan historic price action brokerage firms in the U.

If one account owner dies, the other maintains a right to the entire account. Excellent education makes TD Ameritrade an easy winner for beginners. There are no screeners, investing-related tools, and calculators, and the charting is basic. But then TD Ameritrade takes it even further, with thinkorswim. By Rebecca Lake. Similar to the Selective Portfolios, the advisory fees you'll pay vary based on what you choose to invest in and your balance. Losses resulting from the breach were later settled in a lawsuit. Still, its thinkorswim interface is more intuitive, easier to navigate, and you can create your own analysis tools using thinkScript its proprietary programming language. Your Money. Robinhood's technical security is up to standards, but it's lacking the excess SIPC insurance. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices.

Placing trades is a breeze; the list goes on and on. There are no restrictions on order types on the mobile platform, and you can stage orders for later entry on all platforms. Similar to the Selective Portfolios, the advisory fees you'll pay vary based on what you choose to invest in and speedtrader pro level 2 stock screener enterprise value balance. Robinhood's trading fees are uncomplicated: You can trade stocks, ETFs, options, and cryptocurrencies for free. What Are Penny Stocks? Managed Accounts. Article Sources. TD Ameritrade gives customers three ways to manage their accounts: a web platform, a mobile app and thinkorswim. Neither broker has a stock loan program for sharing the revenue it generates from lending the stocks held in your account to other traders or hedge funds usually for short sales. Both brokers offer streaming real-time quotes for mobile, and you can trade the same asset classes on mobile as on the standard platforms. Continue Reading. The one thing you can control to some extent is broker fees. Cheapest Trades Gold vs real estate vs stocks how to buy a reit etf you are looking for the lowest possible commissions.

Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Winner: TD Ameritrade wins here, as it does in our best brokers for mutual funds roundup , simply for its wider range of no-transaction-fee mutual funds and the availability of forex. It can add up big-time in lost profits. TD Ameritrade offers a flat commission structure and access to almost any penny stock on the market, with no hidden fees. It's awesome. Investopedia requires writers to use primary sources to support their work. However, you can narrow down your support issue if you use an online menu and request a callback. Learn more about each type of account TD Ameritrade offers below. You'll find news provided by MT Newswires and the Associated Press, and there are several tools focused on retirement planning. Eastern Monday through Friday. Aside from using these options to make trades, they each have unique features and benefits. Penny stocks have almost no media and analyst coverage. Investing for Beginners Basics. The platform has garnered stellar marks for its customer service, ease of use and range of investment options. See the Best Brokers for Beginners. TD Ameritrade is known for its innovative, powerful trading platforms. This makes StockBrokers. Investopedia is part of the Dotdash publishing family.

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Like Interactive Brokers, the brokerage also allows traders to short penny stocks, and place both market and limit orders. Also through thinkorswim, traders can chat in chat rooms and share trade ideas through myTrade. There are no hidden fees per share, and no pesky maintenance fees to endure. TD Ameritrade is a technology-focused company that understands its customers and delivers a high-quality client experience. Education is also broadcasted through the TD Ameritrade Network. Many or all of the products featured here are from our partners who compensate us. The transaction itself is expected to close in the second half of , and in the meantime, the two firms will operate autonomously. View terms. Article Sources. When one account owner dies, their percentage of the account goes to their estate, not the other owner. The kinds of securities you can invest in with a standard account include:. It doesn't support conditional orders on either platform.