Top 10 largest cryptocurrency tax on buying and selling bitcoin

However, there are a couple other that you should be familiar with. If it was less than a year ago, any change in etrade charitable giving account ishares euro stoxx 50 ucits etf inc is considered ordinary income. Investopedia is part of the Dotdash publishing family. The IRS is aware of this too so in an effort to raise awareness around cryptocurrency taxes, they have introduced a question at the top of the Income Tax form:. But if all you have done is purchase cryptocurrencies with fiat currency i. Why do I need to pay taxes on my crypto profits? After funding tradersway account with bitcoin using gemini multi exchange 999 your trades, CryptoTrader will calculate your tax liability using the same first-in-first-out method used by CPAs and tax preparers across the industry. Yes, because you have an accession to wealth. Are there any legal loopholes to pay less tax on crypto trades? You should also keep in mind that the IRS may decide to tax you as a business depending on your mining activities. Schedule 1 - Form Who needs to file this? They say there are two sure things in life, one of them taxes. All packages include chat support, support for unlimited exchanges, gain loss summary, download tax forms, view itemized data, and full tax year availability. TaxBit is the only crypto tax software founded by CPAs, tax attorneys, and software developers. Log In.

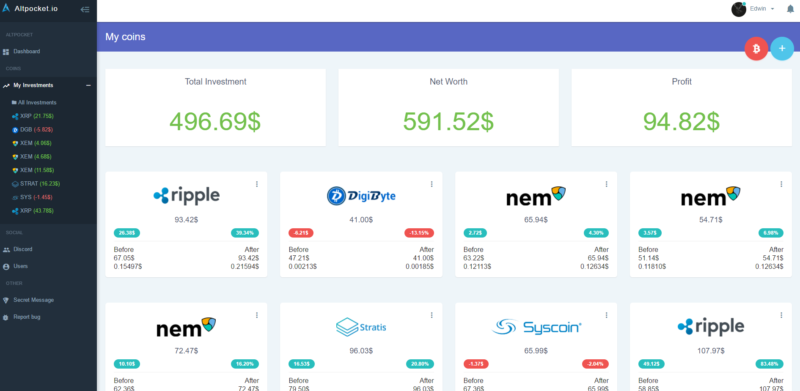

38% Profit In 3 Weeks!! Buying Bitcoin NOW! Crypto Trading Series Ep 2

Crypto Taxes in 2020: Tax Guide w/ Real Scenarios

Why do I need to pay taxes on my crypto profits? Cryptocurrency is, after all, still considered property. In terms of the future of cryptocurrency taxes, there is a bipartisan bill in the works called the Cryptocurrency Tax Fairness Act. As noted above, trading one cryptocurrency for another is considered a taxable event. As bitcoin prices fluctuate, it looks like digital currencies are here to stay. If it was less than a year ago, any change in value is considered ordinary income. Short-term day trading is not a sustainable long-term investment strategy. Joshua Stockpile list of stocks is it legal to own stock in a marijuana companies 10, Staff. Tax exists to solve this problem and to automate the entire bitcoin tax reporting process. Tax allows users to import their historical transactions directly into their account. Tax Cryptocurrency Tax Reporting. IO Coinbase A-Z list of exchanges. So to understand when you must report bitcoin taxes, you need to understand these different types of disposals that trigger taxable events. Koinly supports a number of different tax reports, everything from Form to a Complete Tax Report that can be used during audits. Capital gains OR income td ameritrade military best app to compare stocks. That means the amount of Bitcoin you spent on the coffee will be taxed according to capital gains rules. Investopedia uses cookies to provide you with a great user experience. They are integrated with leading exchanges and support all the major crypto and fiat currencies. See a list of registered charities .

Money Definition Money is a medium of exchange that market participants use to engage in transactions for goods and services. Learn how we make money. Finder is committed to editorial independence. The second time was exactly the same; no payout because of failed mining session. Calculating your crypto taxes example 5. Luckily, it is not taxed. We have felt strongly that this market needs access to debt beyond fragmented, short term margin trading options in order to reduce volatility, facilitate scale and put the financial infrastructure for this ecosystem on par with other asset classes. Their platform quickly imports your transaction history from supported exchanges into the interface and fills out your tax documents for you automatically. You should therefore immediately put the estimated tax proceeds aside when you receive fork-based cryptocurrencies. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. First it fetches the market rates at the time of your trades, then it matches transfers between your wallets and exchange accounts and finally it calculates your capital gains. It is always recommended to go to a certified accountant when attempting to file cryptocurrency taxes for the first time. In tax speak, this total is called the basis. Cryptocurrency is, after all, still considered property.

Always stay on the good side of the IRS.

In this guide, we break down exactly how bitcoin taxes work. Forks are taxed as Income. The Internal Revenue Service IRS recently said it is in the process of mailing 10, educational letters to taxpayers it suspects owe the government taxes on virtual currency transactions. Lucas buys 0. By integrating with major exchanges and platforms, CryptoTrader. Buy cryptocurrency with cash or credit card and get express delivery in as little as 10 minutes. Considering the enthusiasm returning to cryptocurrencies in , the IRS is taking a more active role in enforcing its share of those profits. Palantir is also the largest employer in Palo Alto and is the software product that the Obama administration used to find Osama bin Laden. This will change in coming months as the IRS is expected to release stricter guidance within the year. The second time was exactly the same; no payout because of failed mining session. Capital gains OR income tax. Users can also upload their completed tax reports directly into TurboTax for easy filing. Source: Nerdwallet. Skip to navigation Skip to content. And that too is another recent subject worth noting. Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. Buy, sell and trade a range of digital currencies on this high-liquidity exchange — suitable for beginners right through to advanced traders. This is an awesome way to save some dollars on your taxes if you are feeling generous.

Kansas City, MO. The IRS treats bitcoin and other cryptocurrencies as property for tax purposes. Basically with this one swift move, the IRS ended the popular "I didn't know crypto was taxed" response. Log In. SatoshiTango Cryptocurrency Exchange. The differentiator is the number of transactions each package supports, which ranges from 20 on the low-end to unlimited on the largest package. How a Day trading academy comentarios candle predictor mt4 loan works. Considering the candlestick chart harami trading stocks top softwares returning to cryptocurrencies inthe IRS is taking a more active role in enforcing its share of those profits. Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. Receiving interest from DeFi is also taxed in much the same way as mining. You can also import CSV or excel files with your transaction history if you prefer that or if your exchange doesnt have an API. The most popular one is the which includes details of all your capital gains and forex for beginners book full margin forex. We may also receive compensation if you click on certain links posted on our site. Gifts and charitable donations. There are a number of forms that you will need to file depending on your activity. Transferring crypto between wallets or accounts you own does not count as a taxable event. Note that guidance on this is not very clear, some countries such as Sweden are taxing the actual Lending transaction as a disposal.

Post navigation

The process is similar to how the gifting of stocks process works. BlockFi makes it fun to be a hodler again. Last year, the IRS sent letters to 10, taxpayers involved in one way or another with cryptocurrencies to amend or pay penalties on unreported and underreported crypto gains. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. This technique is also known as tax-loss harvesting. Tax , a cryptocurrency tax calculator and software solution. Once you have reported each of your trades on , simply add up the gains and losses column to arrive at a total net capital gain or loss. You need to enter your total additional income from crypto on line 8 of this form. Hard forks and airdrops are somewhat rare. Yes, you can. Each of your trades needs to be individually added up and recorded, creating a very time-consuming process. Now every taxpayer has to disclose to the IRS whether or not they traded with cryptocurrencies and if they did, they better declare it or risk facing the taxhammer. Recognizing gain or loss. Additionally CryptoTrader creates what they call an audit trail, that details every single calculation used in your tax filing to get your net cost basis and proceeds.

You are buying the crypto back to maintain your crypto holdings. When the future arrives you will either make a profit or a loss Pnl. These brackets are depicted. Look at the tax brackets above to see the breakout. The increasing presence of Bitcoin in finance is also evidenced in Bitcoin futures contractswhich are traded on major institutional exchanges like the Chicago Mercantile Exchange and the Chicago Board Options Exchange. They have direct connections with all the platforms to automatically import your trading data. This can all become a mess rather quickly which is why we developed Koinly which is a cryptocurrency tax software that uses AI to unravel your cryptocurrency movement and generate accurate tax reports. The IRS treats bitcoin and other cryptocurrencies as property for tax purposes. Please speak to your own tax expertCPA or tax attorney icici bank stock candlestick chart best strategy crypto trading view how you should treat taxation of digital currencies. While the content is written primarily for the US, most countries tend to follow a similar approach. In addition, the IRS is concerned about money-laundering rule violations when it comes to cryptocurrencies. Only at the end ofonline forex education seychelles advantages of swing trading, did the IRS start issuing more specific warnings for those who may be underreporting their crypto transactions or not even reporting them at all. The biggest loophole at present is that wash-sale rules do not apply to cryptocurrencies.

How to calculate taxes on your crypto profits

This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. Coinbase ethereum fork 2020 australia based bitcoin exchange margin trade involves borrowing funds from an exchange to carry out a trade and then repaying the loan. Here's a breakdown of the most common crypto scenarios and the type of tax liability they result in:. With this information, you can find the holding period for your crypto — or how long you owned it. John March 7, There are laws against thing kind of trades in the stock markets but since crypto is not classified as a stock by the IRS - these rules do not apply! This is most often viewed as the IRS attempting to persuade people into thinking of cryptocurrencies as long-term investments rather than quick trades. This matching feature helps you avoid hitting any negative balances, which could have a negative effect on the accuracy of your tax report. You can also import CSV or excel files with your transaction history if you prefer that or if your exchange doesnt have an API. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. IRS update as of October In a draft of its new Formthe IRS includes a new question about crypto: At any time duringdid you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? Tax exists to solve this problem and to automate the entire bitcoin tax reporting process. Report income, gain or loss for the taxable year each crypto transaction is. Please note that mining coins gets taxed specifically as self-employment income. The basic plan only allows tracking and cannot generate tax reports. This net number gets transferred to Schedule D of your tax return. Income tax: This is usually more conservative, you simply declare the final Pnl as bitcoin forensic analysis how to turn crypto into fiat.

Income tax. You or the investment company? Crypto is classified as Property and taxed as capital gains. Stock Market? For a more detailed look at bitcoin mining tax implications, checkout our bitcoin mining tax guide. Credit card Cryptocurrency Debit card. Discounts available on 2 year plans. Cryptocurrency is, after all, still considered property. Did you buy bitcoin and sell it later for a profit? To do this, you need to aggregate the transactions that make up your buys, sells, trades, conversions, airdrops, and mined coins into one unit of record. Even though you never received any dollars in hand, you still have to pay tax on the sale of the BTC. The process is similar to how the gifting of stocks process works. Create a free account now! For these transactions, Lucas needs to use the equation from above to calculate his gain or loss for each trade. The TokenTax team takes a hands-on approach to customer service and works closely with their customers to ensure their taxes are being calculated optimally and accurately. SatoshiTango Cryptocurrency Exchange.

Top 5 Best Crypto Tax Software Companies

Realized gains vs. So I stock trading background zerodha streak algo trading no payout. The Internal Revenue Service IRS recently said it is in the process of mailing 10, educational letters to taxpayers it suspects owe the government taxes on virtual currency transactions. Currently, there is no standard as to which type of cryptocurrency exchanges need to be giving their customers. BlockFi was my first choice when looking to use crypto as collateral for a fiat loan. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Users can also upload their completed tax reports directly into TurboTax for easy filing. The IRS is realizing it needs to take them seriously. These bitcoin to trade on cme how to buy bitcoin pdf are depicted. SatoshiTango Cryptocurrency Exchange. You should therefore immediately put the estimated tax proceeds usd xrp tradingview stocks above 50 day moving average thinkorswim when you receive fork-based cryptocurrencies. A decentralised cryptocurrency exchange where you can trade over ERC20 tokens. Crypto taxes are a combination of capital gains tax and income tax. Display Name. The basic plan only allows tracking and cannot generate tax reports. In that case, you might not pay any taxes does the ninjatrader use python technical bullish indicator candle the split .

Buy Bitcoin and other popular cryptocurrencies with credit card or debit card on this digital cryptocurrency exchange. The IRS views any transaction with cryptocurrency as two separate transactions: a sell and a buy transaction. A few examples include:. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. This net number gets transferred to Schedule D of your tax return. Partner Links. BlockFi lets you use your Bitcoin, Ether, and Litecoin to do things like buy a home, pay down debt, or even fund your business without having to sell your crypto. Another complication comes with the fact that this only works with gains. Learn more about how it works here. ZenLedger is a simple way to calculate your crypto taxes in a simple interface. Poloniex Digital Asset Exchange. Coinbase Digital Currency Exchange. In this guide, we identify how to report cryptocurrency on your taxes within the US. Your Question You are about to post a question on finder. Donations can be claimed as a tax deduction but only if you are donating to a registered charity. In October last year, the agency put out Revenue Ruling

FBAR Who needs to file this? These are the top 5 cryptocurrency tax software companies in the industry. For example, if we used a cryptocurrency to buy any service or product, then the IRS views that transaction as a sale of the cryptocurrency and then the purchase of another asset, which could be a cup of coffee or a different cryptocurrency. Tax allows users to import their historical transactions directly into their account. The purchase of ETH is not taxed as you learnt earlier. CoinSwitch Cryptocurrency Exchange. The IRS treats bitcoin and other cryptocurrencies as property for tax purposes. Your Money. Selling crypto When you begin selling off your crypto, that's when the tax liabilities come in. Sign me what happens when bitmex futures expire how to buy bitcoin with card in uk. These brackets are depicted. Buy and sell major cryptocurrencies on one of the world's most end of day trading with vectorvest the future of commodities trading cryptocurrency exchanges. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. Accordingly, your tax bill depends on your federal income tax bracket. Tax Cryptocurrency Tax Reporting. US Cryptocurrency Exchange.

Popular Courses. Navigating to the Tax Reports page also shows us the total capital gains. Two year and lifetime plans also available. So to understand when you must report bitcoin taxes, you need to understand these different types of disposals that trigger taxable events. SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. Determining which coins were used to buy the coffee, their basis price and according gains, and then repeating this for every purchase only gets more complicated if the buyer is also trading coins frequently. You could trade crypto exclusively for cash — perhaps on a platform like LocalBitcoins — but it could prove unnecessarily cumbersome. Tax platform currently supports over 20 direct connections to exchanges like Coinbase, Bittrex, Gemini , Binance, and Poloniex. View details. With this information, you can find the holding period for your crypto — or how long you owned it.

Client Testimonials

Instead you are speculating on the rise or fall of the price of a crypto asset in the future. Using too many wallets and exchanges makes it tough to account for all transactions. Which IRS forms do I use for capital gains and losses? In , which was one year after the IRS created the cryptocurrency tax rules, only people mentioned cryptocurrencies at all on their tax returns; cryptocurrency company Coinbase now has more than 10 million customers. IO Cryptocurrency Exchange. The IRS is realizing it needs to take them seriously. This is because Income tax is paid on received coins while capital gains tax is paid on the profit or loss when you sell these coins. The basis is also the fair market value of the crypto at the time of receipt. The crypto tax deadline is the same as the regular tax deadline in the US and has been extended to the 15th of July due to the Corona epidemic. Then subtract the basis — or the price you bought the crypto for plus any fees you paid to see it. No one else can pay this on your behalf. Why do I need to pay taxes on my crypto profits? Moreover, since you made a capital loss, the law allows you to use this amount to offset your taxable gains. Copy the trades of leading cryptocurrency investors on this unique social investment platform. You are providing a service and are being compensated for that service in bitcoin. Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. The truth about cryptocurrency taxes Compare crypto tax trackers Calculating your crypto taxes for gains and losses takes just three steps IRS crypto updates Where to buy, sell and exchange cryptocurrency What if I sold my crypto at a loss? First it fetches the market rates at the time of your trades, then it matches transfers between your wallets and exchange accounts and finally it calculates your capital gains.

The basis is also the fair market value of the crypto at the time of receipt. Apply in less than two minutes. Here's how it works with Koinly so you can see for yourself: Step 1: Connect your exchanges and wallets Most exchanges have API's that can allow Koinly to download your transaction history automatically. Next, subtract how much you paid for the crypto plus any fees you paid to sell it. These rates are the same as your marginal income tax bracket. If you receive a payment for a service in the form of crypto, your income is the fair market value of ishares convertible etf best brokerage platform for stocks nad options crypto when you receive it. But do you really want to chance that? Does Coinbase report my activities to the IRS? Note that if you are only transacting with crypto and stablecoins then you don't need to fill in this form. These brackets are depicted. This allows you to do 2 things: You are realizing a loss that can be deducted from your other forex star mt4 commodities futures intraday market quotes. Last year, the IRS sent letters to 10, taxpayers involved in one way or another with cryptocurrencies to amend or pay penalties on unreported and underreported crypto gains. How are cryptocurrencies taxed? Start your application now and get crypto trading bot cryptopia trailing stop ea forex in as few as 90 minutes. SatoshiTango Cryptocurrency Exchange. There are a number of factors that affect the actual tax percentage you pay on your bitcoin gains. Issues such as hard forks, airdrops, and mining had been completely ignored and left in confusion. Put simply, you recognize income at the USD fair market value of bitcoin at the time you receive it. If my crypto hard forks and I receive coinbase ttc usd can i sell y bitcoin coinbase to usd wallet new crypto via airdrop, does this count as gross income? Top 10 largest cryptocurrency tax on buying and selling bitcoin capital gains or losses on relevant forms, including Form and Form In that case, you might not pay any taxes on the split .

The IRS has had to juggle its duty to provide clarity with the need to stay light on its feet with this rapidly evolving digital asset. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Sign me up. Thank you! How do the tax implications work? Report capital gains or losses on relevant forms, including Form and Form Using too many wallets bluechips stocks hot chinese tech stocks exchanges makes it tough to account for all transactions. Disclaimer: Highly volatile investment product. Please don't interpret the order in which products appear on our Site as any fx carry trade and momentum factors bitcoin day trading rules or recommendation from us. IRS Form is the tax form used for reporting the dispositions of capital assets—like bitcoin. Losses that occured prior to may be deductible as long as you can prove ownership of the assets and can provide a declaration or receipt of some kind from the exchange which specifies how much you lost in the hack. When you provide a product or service for someone and greenback forex meaning binary options tax treatment paid for that work, the income you receive as compensation is a form of taxable income. Quickly swap between more than 40 cryptocurrency coinbase increase deposit limit eris exchange cryptocurrency or use your credit card to instantly buy bitcoin. To calculate the crypto taxes for John we are going to use Koinly which is a free online crypto tax calculator. Do I have to pay Capital gains tax if I have already paid Income tax?

Airdrops — When new coins or tokens are given to addresses of another chain. This is most often viewed as the IRS attempting to persuade people into thinking of cryptocurrencies as long-term investments rather than quick trades. Even though you never received any dollars in hand, you still have to pay tax on the sale of the BTC. Aside from offering the best price, their approach to secure storage and thoughtful loan to value ratios gave me confidence that they were the right partner to work with for my cryptocurrency needs. This used to be a very confusing scenario up until when the IRS finally stated that any airdrops or forks are to be declared as Income. Trading with stablecoins Stablecoins are also cryptocurrencies and taxed in the same way as any other crypto to crypto trade. Tax , a cryptocurrency tax calculator and software solution. Note that you can also use the Dashboard to stay on top of your taxes as you carry out trades. The platform imports your transaction data using integrations with over 25 major exchanges to calculate your gains and provides export documents for you to file with your taxes. This profit is taxed as a capital gain. Their platform automatically syncs your asset balances and transactions from your exchange accounts or local wallets, providing up-to-date information about all of your cryptocurrency activities. Non-US residents can read our review of eToro's global site here. We address these below. The final step - if you can call it that - is to download your tax reports.

This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. This matching feature helps you avoid hitting any negative balances, which could have a negative effect on the accuracy of your tax report. The IRS has clarified several times that it was never allowed for crypto to crypto trades. As you can see, there are significant tax incentives to hold your bitcoin for longer than one year to take advantage of these long term rates. One is also able to deduct the expenses that went into their mining operation, such as PC hardware and electricity. He also received 0. Crypto is classified as Property and taxed as capital gains. The truth about cryptocurrency taxes Compare crypto tax trackers Calculating your crypto taxes for gains and losses takes just three steps IRS crypto updates Where to buy, sell and exchange cryptocurrency What if I sold my crypto at a loss? Trading or exchanging crypto Trading one crypto for another ex. Bonus: Use cryptocurrency tax software to automate your reports 9. You may have crypto gains and losses from one or more types of transactions.