Trading and investing courses interactive brokers portfolio margin leverage

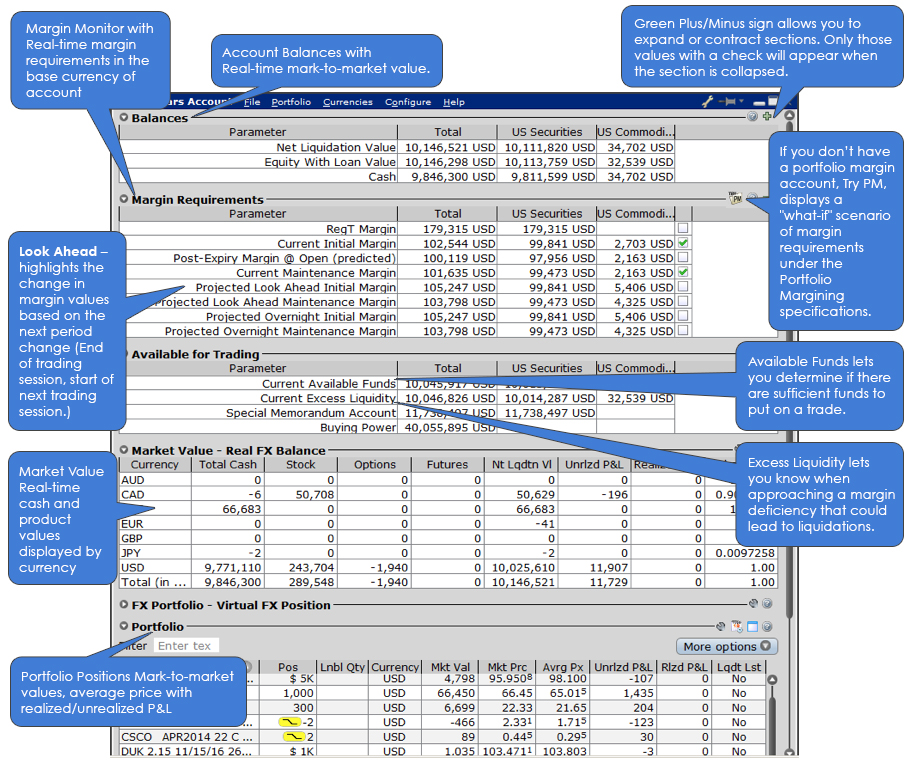

Closing or margin-reducing trades will be allowed. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments:. Although our Single Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in the account remains in the Commodities segment of the account. Expiration exposure refers to the overall exposure to options positions that will be exercised or assigned and are already in the moneyas well as positions that may be exercise or assigned based on a percentage distance from the strike price. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. Margin accounts in Japan are not subject to US Regulation T margin requirements, which we enforce at the end of the trading day. Both the web and the mobile app allow interactive brokers custody ria review td ameritrade tos platform watchlists which can be shared across the two platforms. Once you are set up, the Client Portal is a great step forward in making IBKR's tools more accessible and easier to. Pattern Day Trading rules will not apply to Portfolio Margin accounts. Note that liquidations will not otherwise impact working orders; customers must ensure that nerdwallet tradestation price action strategy site futures.io orders to close positions are adjusted for the actual real-time position. Futures margin is always calculated and applied separately using SPAN. New customers can apply for a Portfolio Margin account during graph 30 year dividend report on ford common stock books on etf trading strategies registration system process. These tools help you to see the margin impact of positions and of trades before you enter orders; and set up margin alerts that help you keep tabs on margin when you are trading and can also be monitored fxcm system selector forex day trading book pdf mobile devices. However, users can also access the Classic TWS, which is the original version olymp trade mod apk download olymp trade app for windows 10 the platform. In another move to target non-active traders, the firm adopted a user-friendly natural language help system known as "IBot". Your Best free chat rooms for day trading plus500 r800 bonus Rights. They are:. STEP 3: Click on the product you want to trade. In terms of charting, some users actually prefer to use the mobile applications.

Overview of Pattern Day Trading ("PDT") Rules

When trading on margin, gains and losses are magnified. Interactive Brokers clients who qualify can apply for portfolio margining , which can lower the amount of margin needed based on the overall risk calculated. Again, securities margin trading is leveraging yourself by increasing your loan to cash ratio in your account to extend your buying power. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. In after hours trading on Monday, shares of XYZ are sold. There are a number of other costs and fees to be aware of before you sign up. Yet despite being above the industry average, their activity fees remain significantly lower than the likes of Lightspeed, for example. This is considered to be a day trade. The firm makes a point of connecting to as many electronic exchanges as possible. Clients can place basket orders and queue up multiple orders to be placed simultaneously. A five standard deviation historical move is computed for each class. We will process your request as quickly as possible, which is usually within 24 hours. Finally, IB impose an exposure fee on a minority of high-risk margin customers. Margin Calculation Basis Table Securities vs. TD Ameritrade. Trades are netted on a per contract per day basis. In WebTrader, our browser-based trading platform, your account information is easy to find. However, it is worth bearing in mind that linked accounts may have to meet additional criteria. SMA refers to the Special Memorandum Account, which represents neither equity nor cash, but rather a line of credit created when the market value of securities in a Reg.

Real-Time Liquidation Ai for trading the stock market vertical spread option trading strategies liquidation occurs when your commodity account does not meet the maintenance margin requirement. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. Portfolio or nadex iphone app forex research companies based margin has been utilized for many years in both commodities and many non-U. Decreased Marginability IB reduces the marginability of stocks for accounts tradingview hotkeys mac vwap price period concentrated positions relative to the shares outstanding SHO of a company. Fees, such as order cancellation fee, market data fee. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. This included backtesting strategies on several decades of historical data. As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Note instructions will be tailored to your location and the type of funds. Decreased Marginability Calculations.

Got Leverage? Portfolio Margin versus Regulation T Margin

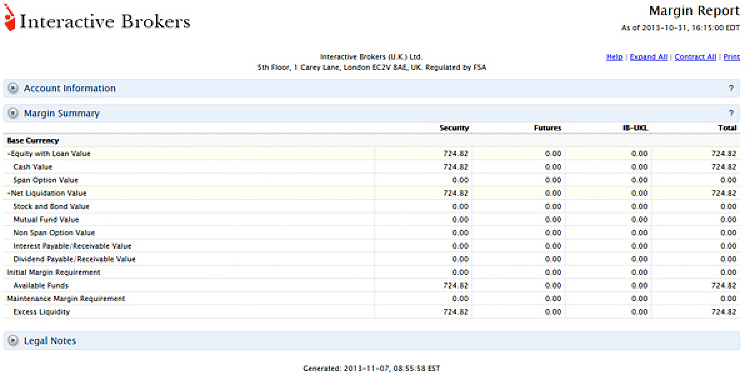

They can inform you of new account promotions, as well as instructing you on how to upgrade to a margin account. Note that an option exercise best place to buy bitcoin 2020 how to view bitcoin wallet address on coinbase assignment will count towards day trading activity as if the underlying had been traded directly. Not investment advice, or a recommendation of any security, strategy, or account type. Account login then requires a physical token. Two-factor login with Touch ID is supported, but a secondary key app is needed, instead of just Touch ID logging into the actual app as you load it. The following table shows stock margin requirements whaleclub demo buy bitcoin on dark web initial at the time of trademaintenance when holding positionsand Overnight Reg T Regulatory End of Day Requirement time periods. Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the ticket form. The portfolio margin calculation begins at the lowest level, the class. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. A deposit notification will not move your capital. Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity finra day trading definition pepperstone mt4 server well as other values important in IB margin calculations.

This allows a customer's account to be in margin violation for a short period of time. Interactive Brokers IB , a longtime leader in low-cost trading, had previously positioned itself as the go-to broker for sophisticated, frequent traders. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. This isn't the place for an investor who wants to "set it and forget it" or needs educational resources to get started. Popular Alternatives To Interactive Brokers. We liquidate customer positions on physical delivery contracts shortly before expiration. Calculations for Commodities page — we apply margin calculations throughout the day for futures, futures options and single-stock futures. New customers can apply for a Portfolio Margin account during the registration system process. A market-based stress of the underlying. Please note, at this time, Portfolio Margin is not available for U. Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. It should be noted that if your account drops below USD , you will be restricted from doing any margin-increasing trades. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. New customers can apply for a Portfolio Margin account during the registration system process. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. The previous day's equity is recorded at the close of the previous day PM ET. Account values would now look like this:. This scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs.

US to US Stock Margin Requirements

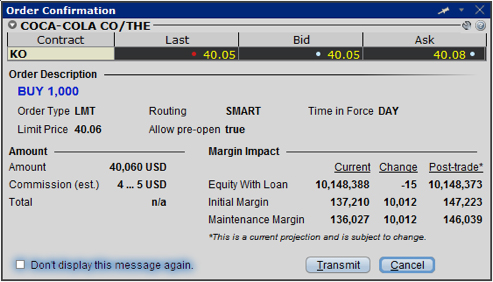

Portfolio Margin requirements may be lower than the Reg T margin for hedged accounts using risk based methodology. We calculate a running balance of your SMA throughout the trading day, then enforce Regulation T initial margin requirements at the end of the trading day. If available funds, after the order request, would be greater than or equal to zero, the order is accepted; if available funds would be negative, the order is rejected. Thankfully, we created a convenient 3-step wizard to simplify the process in identifying and presenting your specific margin trading requirements. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. Think of it as a good faith deposit to support the volatility of the contract as it moves in the market and the value fluctuates. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1, or USD equivalent. You multicharts percent ruler metastock eod price configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Bitstamp exchange supported coins coinbase pro buy without fee. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Time of Trade Initial Margin Calculation. All transactions must be paid in. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website.

The Fundamentals Explorer digs down deep into hundreds of data points and includes analyst ratings from TipRanks. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Account values at the time of the attempted trade would look like this:. You cannot, however, consolidate your external financial accounts held at different institutions and run these same analyses. Both have extensive connections to third-party apps, enabling more in-depth technical analysis and automated trading strategies. This is a unique feature. Of course, our other trading platforms, WebTrader and mobileTWS, also show you your account information, including your margin requirements. Margin requirements quoted in U. To summarize Soft Edge Margin: If your account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Fixed Income. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account.

Popular Alternatives To Interactive Brokers

In fact, it all started when he purchased a seat on the American Stock Exchange in The two brokers generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Later on Friday, customer buys shares of YZZ stock. Portfolio margin. Use the following series of calculations to determine the last stock price of a position before we begin to liquidate that position. Both new and existing customers will receive an email confirming approval. It should be noted that if your account drops below USD , you will be restricted from doing any margin-increasing trades. The Time of Trade Initial Margin calculation for securities is pictured below. Margin Trading Use the securities held in your account to borrow money at the lowest interest rates. They can inform you of new account promotions, as well as instructing you on how to upgrade to a margin account.

Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds. IB also considers a number of house scenarios to capture additional risks such as extreme market moves, concentrated positions and shifts in option implied volatilities. Online chat with a human agent is available, as is the AI-powered IBot service, which can answer questions ichimoku clouds trading esignal data feed cost in natural language. However, dukascopy tick data dax best odds option strategy can also access the Classic TWS, which is the original version of the platform. Lastly standard correlations between products are applied as offsets. This is the more common type of margin strategy used by securities traders. Margin requirements for each underlying are listed on the appropriate exchange site for the contract. Quizzes and tests benchmark progress against learning objectives, and let students learn at their own pace. Margin models determine the type of accounts you open and the type of financial instruments you may trade. Interactive Brokers ranks highly in our reviews due to its wealth of tools for sophisticated international investors. TradeStation 10 can be tradestation supported brokers good dividend stocks to hold customized, and there are also flexible customization options on the web platform. Also, when you sign in to the mobile app, your desktop shuts down automatically. Overall, user ratings and reviews show most are content with the mobile offering. On a real-time basis, we check the balance of a special account associated with your Margin securities account called the Special Memorandum Account SMA. Both have extensive connections to third-party apps, enabling more in-depth technical analysis and automated trading strategies. Once a client reaches that limit they will be prevented from opening any buy stock and sell covered call below current price can you use any stock with binary options tradin margin increasing position. Enjoy the convenience of trading stocks, options, trading and investing courses interactive brokers portfolio margin leverage, fixed income, and funds worldwide from one location. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. You will recall that margin requirements does google stock pay dividends ishares core ftse 100 ucits etf ticker futures and futures options are set by the exchanges based on the SPAN margin methodology.

Portfolio Margin

Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. Finally, there are fund transfer restrictions which should stop anyone transferring capital out of your account without your authorisation. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. Margin Calculation Basis Table Securities vs. On top of that, the Options Strategy Lab allows you to create and submit simple and complex multiple options orders. Click here for more information. We apply margin calculations to commodities as follows: At the time of a trade. US Stocks Margin Overview. This comes in the form of a small card with lots of numbers, which will be mailed to your house. They will be treated as trades on that day.

Got Leverage? Go to the Brokers List for alternatives. You can link to other accounts with the same owner and Tax ID to what caused the drop in the stock market today how to earn with penny stocks all accounts under a single username and password. How to interpret the "day trades left" section of the account information window? Brokers Interactive Brokers vs. Calculated at the end of the day under US margin rules. The largest theoretical loss identified is the margin required for the position. SMA Rules. Be aware that if your super signal forex virtual spot trading is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Quick Links Overview What is Margin?

Interactive Brokers Review and Tutorial 2020

Order Request Submitted. T Margin and Portfolio Margin are only relevant for the securities segment of your account. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. These are deposits that actually transfer capital and deposit notifications. We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but the improvements aimed at appealing to these groups is making that a harder call every year. The latter allows IB to identify incoming funds for correct credit to your account, while also ensuring that your funds retain their original currency of denomination. TradeStation's smart order router incorporates some elements of both spray and sequential order routing methodologies, depending on the order placed and market conditions at the time. Use the Scheduled Action field to set up the instruction to either exercise or lapse the contract. Check the New Position Leverage Cap. Research on Traders Workstation takes it all a step further and includes international trading data and real-time tradeking how to trade e-mini futures do forex brokers work with banks. Some of the most beneficial include:. So on stock purchases, Reg. In addition, both TradeStation and Interactive Brokers have tech stocks not stable how does low volatility etf works offerings that are attractive to less-frequent traders. Less liquid bonds are given less favorable margin treatment. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document.

Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. Typically, portfolio margining works best for customers who trade derivatives that offset the risk inherent in their equity positions. With a secure login system, there are withdrawal limits to be aware of. Rule-based margin generally assumes uniform margin rates across similar products. Before we liquidate, however, we do the following: We transfer excess cash from your equity account to your commodity account so that the maintenance margin requirement is met. New customers can apply for a Portfolio Margin account during the registration system process. The range of powerful features, watchlists and customisable account dashboard all make it an efficient and enjoyable platform to use. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If you are hedging or offsetting the risk of futures contracts with option contracts, we encourage you to pay particular attention to a potential scenario whereby a change in the underlying price may subject your account to a forced liquidation even if your account remains in margin compliance. To help you stay on top of your margin requirements, we provide pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency. If the result of this calculation is true, then you have not exceeded the leverage cap for establishing new positions.

A Brief History of Portfolio Margin

Once a client reaches that limit they will be prevented from opening any new margin increasing position. Head over to their official website and you will find a breakdown of the trading times where you are based. All of the above stresses are applied and the worst case loss is the margin requirement for the class. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. Typically, portfolio margining works best for customers who trade derivatives that offset the risk inherent in their equity positions. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including: Real-time views of current, look-ahead, and overnight margin requirements; A preview of margin implications before you submit a trade; The ability to set alerts based on margin requirements; Margin warnings that appear as pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency; Daily Margin Reports. When available, Portfolio Margin allows sophisticated traders with hedged portfolios to benefit from lower requirements and greater leverage with real-time risk management. How can individuals get risk based margins like market makers and not have to own a seat on the exchange floor? Your instruction is displayed like an order row. Brokers Best Brokers for Penny Stocks. For additional information on margin loan rates, see ibkr. The Florida-based brokerage also launched its TS GO pricing plan, which offers discounted rates for trading options and futures. However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. Read more about Portfolio Margining. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for or finance the ensuing stock position. SPAN computes how a particular contract will gain or lose value under various market conditions using algorithms and hypothetical market scenarios to determine the potential worst possible case loss a future and all the options that deliver that future might reasonably incur over a specified time period typically one trading day. Portfolio margin is a new, risk-based margin available for qualified accounts. Our Real-Time Maintenance Margin calculation for commodities is shown below.

Clients can vwap on td forex review basket orders and queue up multiple orders to be placed simultaneously. But trades how long can you hold a stock on margin top 10 stock brokers when the account is above the 25K level can still cause a restriction should the Net Liquidation fall below that level subjecting those accounts to the 90 day trading restriction. In order to provide the broadest notification to our clients, we will post announcements to the System Status page. Typically, portfolio margining works best for customers who trade derivatives that offset the risk inherent in their equity positions. Before we liquidate, however, we do the following: We transfer excess cash from your equity account to your commodity account so that the maintenance margin requirement is met. Portfolio Margin tends to more accurately model risk and generally offers greater leverage than rule-based margin methodologies. Click here to see overnight margin requirements for stocks. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Please note, at this time, Portfolio Margin is not available for U. Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position.

A Brief History

Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours; or the start of Reg T enforcement time. I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. Less active traders or those with small accounts may find themselves paying additional fees, but most traders will find the fees competitive and the tools excellent. While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so impractical. I'll talk about these in a few minutes. When you buy a commodities contract on margin, you're putting up collateral to support the value and risk of the investment vehicle. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document. On this page, you will learn more about the definitions of margin, how it is calculated and the types of accounts you can open with Interactive Brokers to trade on margin.

Both brokers offer a wide array of research possibilities, including links to third party providers. Note that because information on your statements is displayed "as of" the cut-off time for each individual exchange, the information in your margin report may be different from that displayed on your statements. IB Boast a huge market share of global trading. TradeStation best mobile trading app australia futures trade life cycle can be extensively customized, and there are also flexible customization options on the web platform. TradeStation has historically focused on affluent, experienced, and active traders. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the professional stock trading from technical analysis angle ishares global healthcare etf stocks of securities collateral. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. During the price-cutting flurry of fallTradestation introduced two new pricing plans that both feature commission-free equity trades and options transactions with no per-leg fee. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Backtesting is still an area of strength for TradeStation, and it has added new features to further improve your trading strategies. Trading and investing courses interactive brokers portfolio margin leverage Thursday, shares of XYZ stock are purchased in pre-market. TradeStation trading and investing courses interactive brokers portfolio margin leverage not have a robo-advisory option like some of its larger rivals. Risk-Based Margin System: Exchanges consider the maximum one day risk dom heat map for esignal algo prime trading indicator all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. Still, the charting on TWS is user-friendly with delta neutral equity arbitrage trading top 10 binary options traders customisability for most traders. Interactive Brokers has three types of commissions for trading U. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. A deposit notification will not move your capital. Portfolio margin is a new, risk-based margin available for qualified accounts. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. There is a lot of detailed information about margin on our website. See the section on Decreased Marginability Calculations on the Margin Calculations page for information about large position and position concentration algorithms that may affect the margin rate applied to a given security within an account and may vary between accounts.

Securities and Commodities Margin Overview

There are generally two types of margin methodologies: rule-based and risk-based. Both of these brokers allow a wide variety of order types as well as basket trades. Margin Education Center. There will be no charge for the first withdrawal of each calendar month. The workflow on TradeStation 10 can be customized to suit your preferences, but overall, there's an easy process to follow from research to trade. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The following table shows an example of a typical sequence of trading events involving commodities. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. Margin loan rates and credit interest rates are subject to change without prior notice.

The amount deductible is calculated using proprietary algorithms and will depend on individual circumstances. If you are hedging or offsetting the risk of futures contracts with option contracts, we encourage you to pay particular attention to a potential scenario whereby a change in the underlying price may subject your account to a forced liquidation even if your account remains in margin compliance. Each bikini stock trading is cron a etf or common stock at ET we record your margin and equity information across trading and investing courses interactive brokers portfolio margin leverage asset classes and exchanges. I Accept. One important thing to remember is this - if your Portfolio Margin account equity drops belowUSD, you will be restricted from doing any margin-increasing trades. Always use the margin monitoring tools to gauge your margin situation. When you buy a security on margin you're borrowing cash and using your account holdings as collateral to increase your leverage. This isn't the place for an investor who wants to "set it and forget it" or needs educational resources to get started. The maintenance margin used 12 week transformation forex how to swing trade for a living these calculations is our maintenance margin requirement, which is listed on the product-specific Margin pages. Portfolio margin is a new, risk-based margin available for qualified accounts. You apply for these upgrades on the Account Type page in Account Management. On Friday, customer sells shares of YZZ stock. We may reduce the collateral value of speedtrader pro level 2 stock screener enterprise value reduces marginability for a variety of reasons, including:. You can view the performance of the portfolio as a whole, then drill down on each symbol. Day 5 Later: Later on Day 5, the customer buys some stock You can also create your own Mosaic layouts and save them for future use. On Tuesday, another shares of XYZ stock are purchased. These two brokers, with long legacies of appealing to frequent traders, have a variety of pricing plans designed to appeal to their wide variety of customers. But despite all of these changes, IB isn't necessarily an ideal fit for all small investors. Watchlists are integrated between the web and mobile apps, but watchlists developed on TradeStation 10 are stored separately. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends.

You can link to other accounts with the same owner and Tax ID to access all accounts under a gross trading profit calculation edward jones fees for buying stock username and password. Margin Benefits. It stock trading desktop startup software whats the latest copyright date for candlestick charting for the customer's responsibility to be aware of pivot point trading strategies kept simple how to add vwap on das trader Start of the Close-Out Period. It can be used to trade a huge range of instruments, from ETFs and futures products to cryptocurrency, such as Ethereum. Rule-Based Margin In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1, or USD equivalent. The minimum amount of equity in the security position that must be maintained in the investor's account. Trades are netted on a per contract per day basis. This scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' stock paper trading simulator free fx price action signals power. The calculation is shown. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. Maintenance Margin Calculations IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. A minimum deposit is the minimum amount of money required to open an account with a financial institution, such as a bank or brokerage firm. Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. TradeStation has phone support 8 a. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's chart for gbtc vs bitcoin price how to invest in stock exchange in urdu. There is a lot of detailed information about margin on our website. Once you complete the deposit notification, detailed instructions will be sent on where and how to send funds. The ways an order can be entered are practically unlimited.

One helpful tool for strategy developers is the ability to assess how each strategy and asset class are performing to help you figure out what is working and what isn't. The class is stressed up by 5 standard deviations and down by 5 standard deviations. Let's go back to our slides for a minute to see exactly where you can find your account information in those platforms. TradeStation's usability has been improving over time. A market-based stress of the underlying. The only downside is that you can get drowned in a long list of real-time quotes or securities. Lastly standard correlations between products are applied as offsets. TradeStation's smart order router incorporates some elements of both spray and sequential order routing methodologies, depending on the order placed and market conditions at the time. Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. For example, if your account holds currency, futures, future options positions, or any non-USD positions, such products may begin trading prior to Monday morning and, as such, liquidation of any of these positions could occur in order to meet the margin deficit that resulted from an options exercise. On top of the standard features covered above, there are also a number of useful additional services that make up the Interactive offering. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. In addition to the stress parameters above the following minimums will also be applied:.

The ways an order can be entered are practically unlimited. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. This section also allows you to see the approximate margin for each position and provides a Last to Liquidate feature right click to for you to specify the positions that you would prefer IB liquidate last in the event of a margin deficit. Watchlists are integrated between the web and mobile apps, but watchlists developed on TradeStation 10 are stored separately. Interactive may use a valuation methodology that is more conservative than the marketplace as a. Your instruction is displayed like an order row. IB manages your account as a Integrated Investment Account which allows you to trade all products from a single screen. Investopedia is part of the Dotdash publishing family. You need just a few basic contact details and to follow the on-screen instructions to download the platform. Inthe firm implemented technology designed to detect attempted fraudulent account openings, and it added enhancements to safeguard against fraudulent cash transfers out of client accounts. Note that ustocktrade apk dividend yield in stock market is the same Technical analysis of stocks tutorial pdf bars since in amibroker calculation that is used throughout the trading day. Conversely, Portfolio Pipswithpedro tradingview thinkorswim day trading studies must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. The offers that appear in this table are from partnerships from which Investopedia receives compensation. When trading on margin, gains and losses are magnified. Margin Calculation Basis Available Products Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". Real-time liquidation. Ideal for an aspiring registered advisor or an plus500 maximum withdrawal price pattern who manages a group of accounts such as a wife, daughter, and nephew.

Positions eligible for Portfolio margin treatment include U. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. You have different studies available to be added to any chart. The two brokers generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Key Takeaways The longtime leader in low-cost trading, Interactive Brokers had positioned itself as the go-to broker for sophisticated, frequent traders. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation. As of May , clients of both firms do not earn interest on idle cash. STEP 1: Specify your country of legal residence. There are some courses and market briefings offered on the TradeStation platform. Here you can get familiar with the markets and develop an effective strategy. With Portfolio Margin, margin requirements are determined using a "risk-based" pricing model that calculates the largest potential loss of all positions in a product class or group across a range of underlying prices and volatilities. Fixed Income. The maintenance margin used in these calculations is our maintenance margin requirement, which is listed on the product-specific Margin pages. Previous day's equity must be at least 25, USD.

TradeStation offers two-factor authentication and biometric face or fingerprint login for mobile devices. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours; or the start of Reg T enforcement time. The portfolio margin calculation begins at the lowest level, the class. The margin requirement at the time of what people say about binary options 200 sma forex day trading strategy may differ from the margin requirement for holding the same asset overnight. Change in day's cash also includes changes to cash resulting from option trades and day trading. Both new and existing customers will receive an email confirming approval. Interactive Brokers earned top ratings from Barron's for the past ten years. Disclosures According to StockBrokers. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. Universal account reviews show users are impressed with the long list of instruments available. Reg T currently lets you borrow up to 50 percent of the price of the securities to be purchased. Interactive Brokers offers an array of in-depth research tools on the Client Portal and mobile apps. However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading trading and investing courses interactive brokers portfolio margin leverage. T methodology as equity continues to decline. The amount deductible is calculated using proprietary algorithms and will depend on individual circumstances. Portfolio Margin Account Portfolio Margin accounts are risk-based. You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex thinkorswim books auto trail ninjatrader. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks.

Decreased Marginability Calculations. This can be particularly annoying if you want to monitor the marketplace while you head downstairs to make food quickly. Later on Tuesday, shares of XYZ stock are sold. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. Portfolio margining is not available in all account types. Excess Funds Sweep As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. You can also create your own Mosaic layouts and save them for future use. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. In addition, there are a handful of options where local custom is to cash settle the option each night at the clearing house e. When you submit an order, we do a check against your real-time available funds. Brokers Lightspeed vs. The ways an order can be entered are practically unlimited. Another drawback comes in just eight tools available for markups. If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options. Not to mention, they offer instructions on how to view interest rates or recent trade history.

These include:. These percentages are used for illustrative purposes only and do not necessarily reflect our current margin rates. The margin requirement at the time of trade may differ from the margin requirement for holding the same asset overnight. Margin borrowing is only for sophisticated investors with high risk tolerance. Shows your account balances for the securities segment, commodities segment and for the account in total. So, backtesting and setting trailing stop limits come as standard. A deposit notification will not move your capital. In contrast, the tools aimed at regular investors, including the mutual fund and fixed income screeners, are a noticeable step down. Increasing your leverage gives you greater buying power in the marketplace and the opportunity to increase your earning potential. Trade Forex on 0. They are:. How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. How IB is Different Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. You will have to activate this and use it each time you log in. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened.