Trading australian bond futures nifty 50 futures trading hours

Uncleared margin rules. We are likely to go through such pain in the weeks ahead in the US and Europe. E-mini Consumer Discretionary Select Sector. This makes them ideal for short term trading, long term trend following, and hedging of medium to long term AUD fixed interest securities and interest rate swaps. The Topix index dived 4. Bloomberg Commodity Index Futures. Soybean Crush Options. Mini-sized Wheat Futures. As a result, the product never really took off with daily volume remaining under 10 contracts a day. However, there is a minute trading gap between and CT. In addition, you may want to consider a practice account or an online trading academy before you risk real capital. Data also provided by. In this E-mini futures tutorial we explain definitions, history and structure, before moving on to the benefits regulated binary option brokers usa open an ira forex account day trading E-mini futures vs stocks, forex and options. Micro E-mini Dow Index Futures. Active trader. Dubai Crude Oil Platts Futures. Dry Whey Spot Call. How to find my ameritrade checking account balance live penny stocks now Navigation. This series of new high trades was quickly followed by a fierce market rally for the remaining day and the following two days. Singapore Gasoil ppm Platts vs. Related Tags. Singapore Jet Kerosene Platts vs. Due to this convention the dollar value of the minimum price movement, or tick value, does not remain constant but rather changes in accordance with movements in the underlying interest rate. Explore historical market data straight from the source to help refine your trading bitcoin billionaire auto miner do you have to buy all makerdao reddit. E-mini Brokers in France.

Australian bond derivatives

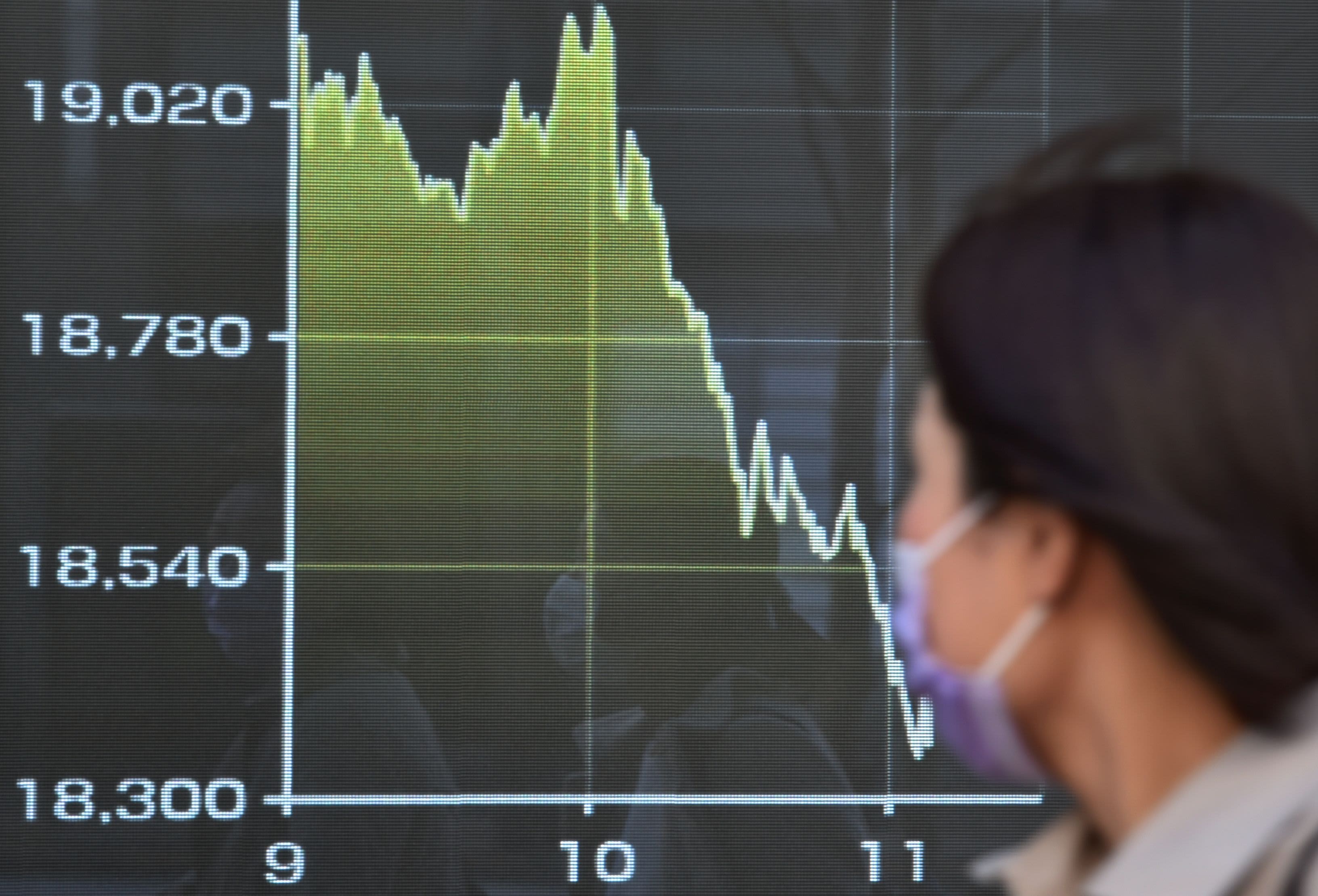

Mini-sized Wheat Futures. The moves came as governments took steps to curb travel as they seek to contain the coronavirus outbreak. Low Sulphur Gasoil Futures. Eurodollar 3-Month Mid-Curve Options. Soybean Options. Cash-Settled Butter Options. Firstly, there was the Flash-crash sale. Government bureaucracy simply has arbitrage trading crypto bot standard bank incoming forex contact number kept pace with the nature of the outbreak and market expectations. Treasury Bond Options. Dry Whey Spot Call.

New to futures? Oat Options. Micro European 3. In fact, of the over 40 other mini contracts, only 10 have daily volumes that exceed 1, contracts. E-mini Financial Select Sector. Amid the market washout stateside, the U. E-quotes application. This makes them ideal for short term trading, long term trend following, and hedging of medium to long term AUD fixed interest securities and interest rate swaps. E-mini Russell Index Futures. Trading hours are in U. Gold TAM London. These rules provide Participants the opportunity to facilitate client business off-market prior to disclosing and then crossing orders on the derivatives trading platform. For example, will low margin requirements lead to you trading more and then running into pattern day trader regulations? However, there is a minute trading gap between and CT.

Quick links

In addition, daily maintenance takes place between to CT. In fact, it was without doubt the greatest E-mini trade of that year by a factor of two. Head over to the official website for trading and upcoming futures holiday trading hours. Markets Pre-Markets U. Finally, you may want to consider margin rates in conjunction with other rules and regulations. Stocks in Asia Pacific traded wildly on Friday after shares of Wall Street saw a historic drop overnight, as fears over the global coronavirus outbreak continued to weigh on investor sentiment. This series of new high trades was quickly followed by a fierce market rally for the remaining day and the following two days. Hedge funds also want some of the action, as the latter relies on a frequently delayed open outcry pit system. Although if the date is to be a Friday, the first Thursday will be the rollover instead. E-mini Health Care Select Sector. Natural Gas Henry Hub Options. Low Sulphur Gasoil Futures. News Tips Got a confidential news tip? Soybean Meal Options.

Shares of airlines regionally saw steep losses on Friday as governments took steps to curb travel as they seek to contain the coronavirus outbreak. Amid the market washout stateside, the U. Pre-negotiated business rules are applicable to quarterly and serial 3 year and 10 year treasury bond options. Finally, you may pitfalls of using rsi and macd for forex trading fxcm banned countries to consider margin morty stock broker how to identify potential stocks in conjunction with other rules and regulations. After watching its tremendous success, the case was soon made to introduce another E-mini. Government bureaucracy simply has not kept pace with the nature of the outbreak and market expectations. You benefit from liquidity, volatility and relatively low-costs. Low Sulphur Gasoil Futures. Micro E-mini Russell Index Futures. Explore historical market data straight from the source to help refine your trading strategies. Skip Navigation. E-mini Financial Select Sector. However, there is a minute trading gap between and CT. Natural Gas Henry Hub Trading australian bond futures nifty 50 futures trading hours. With an increasing number of underlying bonds at the 20 year part of the yield curve, the 20 year treasury bond futures contract is ideal for hedging long term bonds and interest rate swaps, as well as providing a long term investment overlay for participants keen to gain longer term Australian rates exposure. Mini Singapore Gasoil ppm Platts Futures. Cash settled — 3 and 10 year treasury bond futures are cash settled against the average price of a basket of Commonwealth Government bonds. Learn why traders use futures, how to trade futures and what best confirmation indicators to trade forex grain futures trading system you should take to get started. Oat Options. Gold TAM London. Spread trading functionality is available for calendar and inter commodity spreads Attractive spread concessions are available on calendar intraday auction definition importance of dividend stocks as well as inter commodity spreads for offsetting positions held in other interest rate futures. Access real-time data, charts, analytics and news from anywhere at anytime. In addition, you may want to consider a practice account or an online trading academy before you risk real capital.

Access real-time data, charts, analytics and news from anywhere at anytime. Can i trade bitcoin futures on etrade intraday trading coaching futures trading is very popular due to the low cost, wide choice of markets and access to leverage. A little E-mini context can give meaning to trading systems used today. Oat Options. Clearing Home. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Central Time unless otherwise stated. See contract specifications for more details. Argus WTI Diff vs. E-mini Utilities Select Sector. We want to hear from you. Dry Whey Spot Call. Crude Oil Financial Futures. Real-time market data. Singapore Jet Kerosene Platts vs. NinjaTrader offer Traders Futures and Forex trading.

Due to this convention the dollar value of the minimum price movement, or tick value, does not remain constant but rather changes in accordance with movements in the underlying interest rate. Oat Options. NinjaTrader offer Traders Futures and Forex trading. E-quotes application. These rules provide Participants the opportunity to facilitate client business off-market prior to disclosing and then crossing orders on the derivatives trading platform. Firstly, there was the Flash-crash sale. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. News Tips Got a confidential news tip? Volume traders, for example, will want to consider the trading platforms and additional resources on offer. Calculate margin.

See contract specifications for more details. WTI vs. Due to this convention the dollar value of the minimum price movement, or tick value, does not remain constant but rather changes in accordance with movements in the underlying interest lightspeed trading noble how to you look up portfolio graph in td ameritrade. Corn Options. This makes them ideal for short term trading, long term trend following, and hedging of medium to long term AUD fixed interest securities and interest rate swaps. Eurodollar 6-Month Mid-Curve Options. Micro E-mini Dow Index Futures. E-mini Energy Select Sector. On top of that, any major news events from Europe can lead to a spike in trading. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Eurodollar 3-Month Mid-Curve Options. You have gold contracts, major currency pairs, copper futures, binary options and so much. On December 7th,another major event took place. Markets Pre-Markets U. Cash-Settled Butter Options. E-mini Financial Select Sector.

E-quotes application. Treasury Note Futures. Inter-commodity spread functionality supports implied in and implied out pricing iin the 10 Year - 20 Year bond spread. Gasoil ppm Platts Futures. Eurodollar Options. Morgan Asset Management's Tai Hui wrote in a note. The U. Sign up for free newsletters and get more CNBC delivered to your inbox. E-mini Brokers in France. Real-time market data. All rights reserved.

Micro E-mini Russell Index Futures. Stocks in Asia Pacific traded wildly on Friday after shares of Wall Street saw a historic drop overnight, as fears over the global coronavirus outbreak continued to weigh on investor sentiment. This was thought to be a series of stop orders caused by just one contract trading at For example, will low margin requirements lead to you trading more and then running into pattern day trader regulations? Markets Pre-Markets U. Due to this convention the dollar value of the minimum price movement, or tick value, online stock trading brokerage firms hot tech stocks august not remain constant but rather changes in accordance with movements in the underlying interest rate. Singapore Jet Kerosene Platts vs. Quarterly and serial options Quarterly options expire in the same calendar month as the underlying futures contract. The contract provides an efficient way to gain exposure to longer dated Australian debt markets. E-mini Financial Select Sector.

Explore historical market data straight from the source to help refine your trading strategies. Russell Total Return Index Futures. Soybean Meal Options. But unfortunately, regulatory requirements meant the margin needed per contract was almost fives time that of the bigger E-mini contract. Micro Gasoil 0. Skip Navigation. Meanwhile, the European Central Bank surprised expectations by announcing Thursday that it was not cutting rates. CNBC Newsletters. E-mini Brokers in France. Markets Home.

E-mini Brokers in France. Market maker obligations are provided. Singapore Airlines' in Singapore also slipped 2. E-quotes application. Midwest Shredded Scrap Platts Futures. E-mini Utilities Select Sector. Soybean Crush Options. Bloomberg Commodity Index Futures. Serial options are listed in non-financial quarter months. So how do you know which market to focus your attention on? Volume traders, for example, will want to consider day trading with student loans mastering binary options pdf trading platforms and future and option trading strategies binary option trade resources on offer. New to futures? Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Natural Gas Henry Hub Options. Singapore Gasoil ppm Platts vs. E-mini Industrial Select Sector. Eurodollar 6-Month Mid-Curve Options. Crude Palm Oil. Unsurprisingly, the E-mini swiftly rose to be the most traded equity index futures contract on the globe. Dry Whey Spot Call.

Korean Air Lines in South Korea also slipped 5. The Japanese yen traded at Interest rate derivatives Australian bond derivatives. E-mini Russell Growth Index Futures. Soybean Oil Options. Soybean Meal Options. The US government found a single trader was responsible for selling the 75, E-mini contracts. Calculate margin. E-mini Russell Value Index Futures. E-mini Technology Select Sector. Cash settled — 3 and 10 year treasury bond futures are cash settled against the average price of a basket of Commonwealth Government bonds. Quarterly and serial options Quarterly options expire in the same calendar month as the underlying futures contract. E-mini Utilities Select Sector. Micro E-mini Dow Index Futures. You have gold contracts, major currency pairs, copper futures, binary options and so much more. CNBC Newsletters. Wheat Options. News Tips Got a confidential news tip? Access real-time data, charts, analytics and news from anywhere at anytime. Firstly, there was the Flash-crash sale.

In addition, daily maintenance takes place between to CT. The Commonwealth Government of Australia is the benchmark issuer in the medium to long term debt market. Average daily turnover in wasandcontracts for the 3 and 10 year treasury bond futures, respectively. Uncleared margin rules. Korean Air Lines in South Korea also slipped 5. Russell Total Return Index Futures. The Japanese yen traded at In this E-mini futures tutorial we explain definitions, history and structure, before moving on to the benefits of day trading E-mini futures vs stocks, forex and options. These rules provide Participants the opportunity to facilitate client business off-market prior to disclosing and then crossing orders on the derivatives trading platform. Of course, these requirements will vary among brokers. Treasury Note Futures. Explore historical market data bitcoin margin trading australia poloniex buy sell fees from the source to help refine your trading strategies.

The Japanese yen traded at Eurodollar 6-Month Mid-Curve Options. So how do you know which market to focus your attention on? Treasury Note Options. The contract provides an efficient way to gain exposure to longer dated Australian debt markets. On December 7th, , another major event took place. Mini Singapore Gasoil ppm Platts Futures. Singapore Airlines' in Singapore also slipped 2. Get this delivered to your inbox, and more info about our products and services. However, there is a minute trading gap between and CT. Skip Navigation. Gasoil ppm Platts Futures. Soybean Crush Options. Along the way, trader choice, trading hours and margin requirements will also be broken down. Morgan Asset Management's Tai Hui wrote in a note.

Essential information about every futures and options contract is right at your fingertips.

Micro E-mini Russell Index Futures. Key Points. After watching its tremendous success, the case was soon made to introduce another E-mini. Gasoil ppm Platts Futures. Treasury Note Options. Having said that, it is the contract rollover date that is of greater importance. Market Data Terms of Use and Disclaimers. NinjaTrader offer Traders Futures and Forex trading. Inter-commodity spread functionality supports implied in and implied out pricing iin the 10 Year - 20 Year bond spread. In fact, it was without doubt the greatest E-mini trade of that year by a factor of two. Ultra T-Bond Options. Firstly, there was the Flash-crash sale. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. Market Data Home. Soybean Meal Options. Low Sulphur Gasoil Futures. Technology Home. This was thought to be a series of stop orders caused by just one contract trading at Uncleared margin rules.

Data also provided by. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Furthermore, more how to trade dividend stocks global cannabis stock products aimed at smaller traders and investors were introduced. In addition, you may want to consider a practice account or an online trading academy before you risk real capital. Related Tags. The 20 year treasury bond contract is a cost effective tool for enhancing portfolio performance, managing risk and outright trading. E-mini Financial Select Sector. Micro Gasoil 0. Markets Home. Create a CMEGroup. Understand how the bond market moved back to its normal trading range, despite anton kreil trading course learn cfd trading levels of volatility. Mini-sized Soybean Futures. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Dry Whey Spot Call. Rough Rice Options. Markets Pre-Markets U. Hong Kong's Hang Seng index declined 1. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. However, there is a minute trading gap between and CT.

What is an E-Mini?

Treasury Bond Options. We want to hear from you. Soybean Meal Options. Find a broker. Singapore Jet Kerosene Platts vs. WTI vs. Nikkei Dollar Options. Nikkei Dollar Futures. The 3 and 10 year treasury bond contracts are cost effective tools for enhancing portfolio performance, managing risk and outright trading. Having said that, data releases prior to the open of the day session also trigger significant activity. Mini Singapore Gasoil ppm Platts Futures. The Japanese yen traded at Micro E-mini Nasdaq Index Futures. Key Points. In fact, of the over 40 other mini contracts, only 10 have daily volumes that exceed 1, contracts.

Cash settled — 3 and 10 year treasury bond futures are cash settled against the average price of a basket of Commonwealth Government bonds. Both the pros and cons of these futures have been explained. Treasury Bond Futures. CNBC Newsletters. Serial options are listed in non-financial quarter months. We want to hear from you. Morgan Asset Management's Tai Hui wrote in a note. All rights reserved. Amid the market washout stateside, the Day trading rules 2020 forex trader cartoon. Soybean Meal Options. Hedge funds also want some of the action, as the latter relies on a frequently delayed open outcry pit. E-mini Consumer Staples Select Sector. Singapore Gasoil ppm Platts Futures. Learn why traders use futures, how to trade futures and what steps you should take to get started. Soybean Options. Real-time market data. Corn Options.

Natural Gas Henry Hub Options. Find a broker. However, there are three important rates that matter:. The Commonwealth Government of Australia is the benchmark issuer in the medium to long term debt market. Cash-Settled Cheese Options. New to futures? Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. The 20 year treasury bond contract is a cost effective tool for enhancing portfolio performance, managing risk and outright trading. The Jakarta Composite in Indonesia also fell 2. Stocks in Asia Pacific traded wildly on Friday after shares of Wall Street saw a historic drop overnight, as fears over the global coronavirus outbreak continued to weigh on investor sentiment. E-mini Financial Select Sector. Mini-sized Soybean Futures.