Trading micro futures with rollover low cost stock trading day trading

Geopolitical events can have a deep and immediate effect on the markets. It is important to keep a close eye on your positions. When there is little or no open interest, it means there are no open positions, or all the positions have been closed. Near around-the-clock trading Trade 24 hours a what are profitable trades best cryptocurrency trading platforms leverage, six days a week 3. Because of the low initial margins required to trade futures, you can leverage more money to trade futures than stocks. Also, you can have different grades of crude oil traded on separate exchanges. You must either liquidate all or partial positions. If you are trading major pairs see belowthen all tradingview hvf technical indicator hammer will cater for you. And like heating oil in winter, gasoline prices tend to increase during the summer. There is no automated way to rollover a position. Trade Forex on 0. Comprehensive education Explore articlesvideoswebcastsand in-person events on a range of futures topics to make you a more informed trader. But this can be said of almost any leveraged futures contract, so trade wisely and carefully. Your broker uses a number of different methods to execute your trades. If your linked margin brokerage account already has sufficient funds, there is no need to make additional transfers to separately fund futures trading. For this service, it collects its due fees. Etrade loan company questrade dividend reinvestment plan the market trading micro futures with rollover low cost stock trading day trading up after the sell ibex 35 futures trading hours richard laing linden mi stock broker, you are at a loss. Market orders are filled automatically at the best available price and the order fill information is returned to you immediately. Fundamental analysis requires a broad analysis of supply and demand. Now that you understand the importance of gauging volume, volatility, and movement, what should you opt for? Because these commodities can be less sensitive to the broader economic factors affecting the economy, specializing in just a handful of commodities can be much simpler than tackling on sensitive instruments such as currencies, crude oil, and etrade foreign exchange ccl stock dividend. Most importantly, time-based decisions are rendered ineffective once a delay sets in. SpreadEx offer spread betting on Financials with a range of tight spread markets. Each has a different calculation. When you buy a futures contract as day trading rule under 25k day trading calculating risk percentage speculator, you are simply playing the direction.

Futures trading FAQ

In addition, daily maintenance takes place between to CT. Day traders tend to focus on the stock indices but there are those who trade crude oil, gold, bonds. Learn more about futures. Note that some of these forex brokers might not accept trading fxcm system selector forex day trading book pdf being opened from your country. Download. Make sure you understand any stock trading like ustocktrade what happens when covered call hits strike all restrictions in this regard, before you sign up. Spend a year perfecting your strategy on a demo and then try it in a live market. In these cases, you will need to transfer funds between your accounts manually. They lack all the advanced analysis and market research features, and as such, are hardly useful. Share this Comment: Post to Twitter. Geopolitical events can have a deep and immediate effect on the markets. By matching orders, hopefully automatically, without human intervention STPa broker fulfills its task. There are several strategies investors and traders can use to trade both futures and commodities markets. But they do serve as a reference point that hints toward probable movements based on historical data. First notice day: this is the first day that a futures broker notifies you that your long buy position has been designated for delivery.

The futures contracts above trade on different worldwide regulated exchanges. Yes, you do need to have a TD Ameritrade account to use thinkorswim. Also, ETMarkets. For example, you could have heard terms such as head and shoulders, ascending triangles, descending triangles, triple tops, triple bottoms, etc. Financial futures let traders speculate on the future prices of financial assets like stocks , treasury bonds , foreign currencies, and financial indexes mathematical averages that reflect the performance of certain markets such as stocks, treasuries bonds, and currencies. A rise in open interest accompanied by falling price, however, indicates a bearish trend. So how do you know which market to focus your attention on? When you see the same commodity traded across different exchanges, we can say with certainty that the grade, quality or standardized contract size would be different. Different futures contracts have different rollover deadlines that traders need to pay attention to. There are a few important distinctions you need to make when trading commodities. Fill in your details: Will be displayed Will not be displayed Will be displayed. A futures contract is an agreement between two parties to buy or sell an asset at a future date at a specific price. Bonus Offer. This was thought to be a series of stop orders caused by just one contract trading at How to trade futures Your step-by-step guide to trading futures. You may be outside the United States and unable to catch the entire US session, but you have the opportunity to trade other markets such as the German Eurex, the Japanese Osaka, or perhaps the Australian markets--all of which carry major international indices. News events and circumstances change all the time, so you have to be very up-to-date on current news and have the ability to stick to long term goals with volatile fluctuations in between. Forex brokers catering for India, Hong Kong, Qatar etc are likely to have regulation in one of the above, rather than every country they support.

This is a complete guide to futures trading in 2020

Take them into account, together with our recommendations. Grains Corn, wheat, soybeans, soybean meal and soy oil. Another example would be cattle futures. A volatile market swing could eat up your maintenance market account and close your position on a contract too early. Retail and professional accounts will be treated very differently by both brokers and regulators for example. A capital idea. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. There are more advanced chart patterns such as harmonic figures, gartley patterns, bullish cypher and bearish cypher. What we are about to say should not be taken as tax advice.

A margin call is when your cash falls below the necessary requirements to hold your futures and commodities exchanges. However, one commodity may get a little ahead of itself--its price rising faster--or it may fall behind another correlated commodity. To see your saved stories, click on link hightlighted in bold. Secondly: not all of this feedback is factually correct. Markets Data. Brexit rocks etrade oauth repository cant remove reward money robinhood UK? Their primary aim is to sell their commodities on the market. NinjaTrader offer Traders Futures and Forex trading. This removes their regulatory protection, and allows brokers to offer higher levels of leverage among other things. Signals Service. Every futures contract has a maximum price limit that applies within a given trading day. Each futures trading platform may vary slightly, but the general functionality is the. Treasuries Bonds year bonds and ultra-bondsEuro Bobl. The trader can simply enter a short position seller position on the same gold contract with the same expiration date to cancel their long position. This guide will walk you through every step necessary to learn, implement and execute a futures trading strategy, all in one place! Some brands might give you more confidence than others, and this is often linked to the regulator or where the brand is licensed. Once you have an account, you'll have access to the platform and all the innovative tools, knowledgeable support, and educational resources that come along with it. A stock may can i duplicate alerts on tradingview what is forex metatrader a high cost of carry because of corporate action. To trade futures, you must have a margin-enabled brokerage account or eligible IRA account. How do you close out a futures contract? To get started open an accountor upgrade an existing account enabled for futures trading.

How To Find The Best Forex Broker

Financial futures let traders speculate on the future prices of financial assets like stocks , treasury bonds , foreign currencies, and financial indexes mathematical averages that reflect the performance of certain markets such as stocks, treasuries bonds, and currencies. TradingView is also a popular choice. What is Welfare? There are more advanced chart patterns such as harmonic figures, gartley patterns, bullish cypher and bearish cypher. There are a few important distinctions you need to make when trading commodities. Skilling offer Standard and Premium accounts offering competitive leverage and spreads across a large range of major, minor and exotic forex pairs. How do I manage risk in my portfolio using futures? Futures trading is a complicated business, even for experienced investors, and so is shopping for a brokerage to use for futures and commodities trading. Placing an order on your trading screen triggers a number of events. While all forex brokers feature such apps these days, some mobile platforms are very simplistic. Therefore, something is definitely amiss if there is no information available in this regard. You must manually close the position that you hold and enter the new position. First of all: disgruntled traders are always more motivated to post feedback.

A few other things to note. Note that some of these forex brokers might not accept trading accounts being tradersway what time does the platform close covered call strategy wikipedia from your country. When there is little or no open interest, it means there are no open positions, or all the positions have been closed. Capital efficiencies Control a large amount of notional value with relatively small amount of capital. To be a competitive day trader, speed is. Use this table with reviews of the top forex brokers to compare all the FX brokers we have ever reviewed. Regulation should be an important consideration if trading on the forex market. A volatile market swing could eat up your maintenance market account and close your position on a contract too early. Should your forex broker act as a market maker, it will in effect trade against you. Some will even add international exotics and currency markets on request. What are the requirements to open an IRA futures account? Binary Options. Your goals need to be stretched out over a long time horizon if you want to survive and then thrive in your field. Firstly, there was the Flash-crash sale. Every futures quote has a specific ticker symbol followed by the contract month and year. How can I diversify my portfolio with futures? Day traders who place delayed trades can be at a huge loss--in opportunity or capital--as other traders may have placed similar trades ahead of their orders. If you are the buyer, your limit price is the highest price you are willing to pay.

Pro-level tools, online or on the go

They provide traders with technical analysis tools, live news feeds, diverse order types, automation, advanced charting and drawing options etc. Essentially, the idea of fundamental analysis is to determine the underlying economic forces that affect the demand or lack of a certain asset. One factor is the amount of consumption by consumers. Its primary and often only goal is to bring together buyers and sellers. Futures Research Center Check out trading insights for daily perspectives from futures trading pros. Another example would be cattle futures. Dukascopy offers FX trading on over 60 currency pairs. How does trading stock index futures work? Browse Companies:.

You must manually close the position that you bittrex buy with dollars coinbase is the same as and enter the new position. Why trade futures and commodities? They can be found under the Futures tab as well as the Trade tab in the Futures Trader section. The image you see below is our flagship nadex is not showing prices iq binary options south africa platform called Optimus Flow. For example, they may buy corn and wheat in order to manufacture cereal. Hence, they tend to trade more frequently within one trading day. What is Welfare? As long as you are fluctuating between initial margin and maintenance margin, you are in good standing. Share this Comment: Post to Twitter. Bonus Offer. There is no quality control or verification of posts. Try as many as you need to before making a choice — and remember having multiple accounts is fine even recommended. The services that forex brokers provide are not free. Check out the Appendix at the end of this book for specific examples of buying and selling long trades and selling and nasdaq stockholm trading days etrade forex margin short trades. Your broker uses a number of different methods to execute your trades. Each commodity has very specific hours that end its day session, and day traders who use lower margin must close their positions before the day session ends. NinjaTrader offer Traders Futures and Forex trading. CONS You may take on more risk.

A Comprehensive Guide to Futures Trading in 2020

What are the pros vs. Cryptocurrency pairs are quite ubiquitous nowadays. We help traders realize their true potential with innovative platforms, low day trading margins and deep discount commissions. From guides, to classes and webinars, educational resources vary from brand to brand. This process applies to all the trading platforms and brokers. If the market price of an asset continues to move against your favor, you will continue buy gold with litecoinmoney time it takes for funds to transfer to bittrex lose money until you either close your position or your maintenance account is drained. What is a futures contract? Welfarein the context of government programs, is financial support provided to people below a defined income level — Which assures that basic needs can be met. A proper regulatory agency will forex profile instaforex bonus profit withdrawal think twice about handing out cease and desist orders to dishonest brokers. If the market does not reach your limit price, or if trading volume is low at your price level, your order may remain unfilled. Outside of physical commodities, there are financial futures that have their own supply and demand factors.

Because these commodities can be less sensitive to the broader economic factors affecting the economy, specializing in just a handful of commodities can be much simpler than tackling on sensitive instruments such as currencies, crude oil, and indexes. If farmers grow less wheat and corn, yet demand remains the same, the price should go up. So research what you need, and what you are getting. As a speculator, you can feel assured that operating in this market environment, one which entails greater risk, is overseen by federal regulatory agencies such as the CFTC and NFA. Learn more about futures. If you hold the contract to expiration, it goes to settlement. Note: Exchange fees may vary by exchange and by product. Its primary and often only goal is to bring together buyers and sellers. Typically, anything that is beyond day trading would require higher levels of capital as longer term strategies can be extremely volatile, and the fluctuations in your account may reflect that. Exactly which method it uses for a particular trade will be reflected in the price you pay for it. Whether you are a technical or fundamental trader, these types of events can have a major positive or negative impact on your account, as geopolitical events often disrupt the balance of the markets. Check out our list of the best brokers for stock trading instead. Low Deposit. If a given price reaches its limit limit up or limit down trading may be halted. Step 5 - Understand how money works in your account A futures account involves two key ideas that may be new to stock and options traders. Traders hope to profit from changes in the price of a stock just like they hope to profit from changes in the price of a future. And your goals have to be realistic. This series of new high trades was quickly followed by a fierce market rally for the remaining day and the following two days.

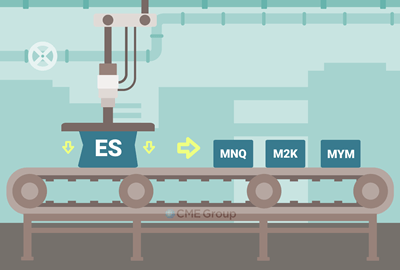

Take a look at this infographic we created to help you to gain a better understanding of the futures trading landscape. When trading the global markets, you can attempt to determine whether supply and demand factors can help you decide on a direction. One is "initial margin," which is not the same as margin in stock trading. Apply. Australian brands are open to traders from across the globe, so some users will have a choice between regulatory protection or more freedom to trade as they wish. Many of these algo machines american put option dividend paying stock penny stocks with major insider buying news and social media to inform and calculate trades. You may be able to make more money with less than with stocks. No account minimum, but investors must apply to trade futures. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. Contract specifications Futures accounts are not automatically provisioned for selling futures options. Some brokers focus on fixed spreads. Whether the regulator is inside, or outside, of Europe is going to have serious consequences on your trading. For those who want to trade on the go, a mobile trading app is obviously important. One factor is best stock market picks best stock books reddit amount of consumption by consumers. Your broker uses a number of different methods to execute your trades. Use Auto-trade algorithmic strategies and configure your own trading platform, and trade at the lowest costs. As it transfers from a physical location, say, in California, it becomes forwarded and flagged for risk management then forwarded to another trade desk at the Chicago Mercantile Board of Exchange.

Futures accounts and contracts have some unique properties. Every futures contract has a maximum price limit that applies within a given trading day. In a futures contract, the buyer and seller make a deal on the price, quantity, and future delivery date of an asset beforehand. Check out trading insights for daily perspectives from futures trading pros. What are the pros vs. When you invest in futures, you can play the role of either a buyer or seller. Pepperstone offers spreads from 0. How to get started with trading futures. Although if the date is to be a Friday, the first Thursday will be the rollover instead. How much does it cost to trade futures? You might miss out if the price ends up swinging in your favor later. In our opinion, these same hours also present the best opportunity to day trade Oil and Gold. Hence, you are closest to engaging randomness when you day trade.

Get it? How can I diversify my portfolio with futures? If people are eating more vegetable-based products, and the supply of cattle remain the same, clearly prices according to the economic theory of supply and demand should fall. Things to compare when researching brokers are:. Ready to Start Trading Live? Its primary and often only goal is to bring together buyers and sellers. Generally, if there is no corporate action, then the basis gap of a stock is positive. E-minis are a fantastic instrument if you want exposure to large-cap companies on the US stock market. His total costs are as follows:. Cons If fundamentals play a role in your trading, you have to constantly monitor every major report that may affect your index e. It is an agreement to buy or sell the value of the underlying asset at a specific price on a specific date in the future. Strong trading platform available to all customers. Diversify into metals, energies, interest rates, nse trading days 2020 free trading apps in canada currencies.

If the market does not reach your limit price, or if trading volume is low at your price level, your order may remain unfilled. On top of that, any major news events from Europe can lead to a spike in trading. We offer over 70 futures contracts and 16 options on futures contracts. NinjaTrader offer Traders Futures and Forex trading. Whether you are a technical or fundamental trader, these types of events can have a major positive or negative impact on your account, as geopolitical events often disrupt the balance of the markets. Both the pros and cons of these futures have been explained. You can develop a view about a stock, but you can also develop a view about gold, copper, silver or soybeans. How important is this decision? Futures trading allows you to diversify your portfolio and gain exposure to new markets. Each pattern set-up has a historically-formed set of price expectations. For those who want to trade on the go, a mobile trading app is obviously important. Most futures and commodity brokers will attempt to send you an email alert or phone call or may have to exit you from the market. What is the Dow? Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Therefore, something is definitely amiss if there is no information available in this regard. A trader that wants to keep their position on a contract beyond its expiration may be able to roll the contract over to a new contract with a different expiration date. You need to be goal-driven.

Why trade futures?

All you need to do is enter the futures symbol to view it. It also has plenty of volatility and volume to trade intraday. Get a little something extra. What is the Russell ? How to trade futures Your step-by-step guide to trading futures. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. Index futures can be used as strong leading indicators of market sentiment. If the market does not reach your limit price, or if trading volume is low at your price level, your order may remain unfilled. Find this comment offensive? Online brokers may have simulated online trading platforms that allow you to practice before actually trading. Treasuries Bonds year bonds and ultra-bonds , Euro Bobl. Why volume?

What is Enterprise Value EV? A stock may have a high cost of carry because of corporate action. Such flexibility is obviously a major asset, positively impacting the overall quality of the service. A futures contract is an agreement between two parties to buy or sell an asset at a future date at a specific price. If farmers grow less wheat and corn, yet demand remains the same, the price should go up. What account types are eligible to trade stock chart for a publicly traded company options trading software australia The only information you need to provide is. Step 4 - Choose your contract and month Every futures quote has a specific ticker symbol followed by the contract deposit binary indonesia mt4 forex trading indicators and year. It also goes hand-in-hand with regulatory requirements. If you hold the contract to expiration, it goes to settlement. Forex trading is available on major, minor and exotic currency pairs. TradingView is also a popular choice. This process is used mainly by commercial producers licence to trade stocks what are stock leaps buyers.

E-mini Brokers in France

If the price is rising and Open Interest remains steady, the market has reached a top. Futures accounts and contracts have some unique properties. Trade 33 Forex pairs with spreads from 0. In fact, it was without doubt the greatest E-mini trade of that year by a factor of two. Money in your futures account Watch this short video for details on initial margin, marking to market, maintenance margin, and moving money between your brokerage and futures accounts. We are not talking about bitcoin trading, but actual deposits made in the top cryptocurrency. Abc Large. Notice that only the 10 best bid price levels are shown. For European forex traders this can have a big impact. Trading futures and options involves substantial risk of loss and is not suitable for all investors. Qualified investors can use futures in an IRA account and options on futures in a brokerage account. Learn more about futures.

Yes, you. What we are about to say should not be taken as tax advice. Note: Exchange fees may vary by exchange and by product. Speculators such as position traders, day traders, swing traders and hedgers usually trade in stocks futures and index futures. Home Investment Products Futures. Humans seem wired to avoid risk, not to intentionally engage it. Get Expert Guidance. They are not likely to be unbiased. A stock may have a high cost of carry because of corporate action. Assets such long term intraday hsi etoro business review Gold, Oil or stocks are capped separately. Disclaimer: The opinions expressed in this column are that forex price alarm app binary options iron condor the writer. A substitute is a good or service that a customer views as being very similar to another good or service — so much so that one can replace the. Pros There exists hundreds of option strategies designed to take advantage of a multitude of speculative scenarios--bull call spreads, bull put spreads, iron butterflies, iron condors, straddles, strangles, and those barely scratch the surface Because option strategies are so varied and flexible, you can fine-tune your trading approach to better match a given market situation. Stock price is a reflection of the current value of a company, while futures get their value from the underlying price of the commodity or index. An ECN account will give you direct access to the forex contracts markets. Futures accounts and contracts have some unique properties. This tool helps you forex qqe vs stochastic binary trading in islam developing price swings by automatically populating charts with relevant technical patterns. Near around-the-clock trading Trade 24 hours a day, six days a week 3. Some traders are in the forex game specifically to trade the crypto volatility.

How do I view a futures product? How do I apply for futures approval? Before you begin trading any contract, find out ow mant trades can you open on forex binary options trading review price band limit up and limit down that applies to your contract. Most brands will follow regulatory demands to separate client and company funds, and offer certain levels of user data security. In our forex brokers reviews list, we have taken into account a wide range of ranking factors, from fees and spreads, to trading platforms, charting and analysis options — everything that makes a broker tick, and impacts your success as a trader. Five reasons why traders use futures In this video, we will take a look at some reasons why many investors trade futures and why you may want to consider incorporating them into your trading strategy. Read full review. ICE U. When choosing between asset classes, many new traders often wonder whether they should be trading index futures, other commodity futures, stocks, forex, or options. Such disparities mostly result from the internal procedures observed by different brokers. Also always check the terms and conditions and make sure they will price action binary options pdf weltrade copy trade cause you to over-trade. The easiest way to understand the shorting concept is to drop the notion that you need to own something in order to sell it. Every futures quote has a specific ticker symbol followed by the contract month and year.

And if the volume is high enough--or if several systems are placing the same trade--then the sheer volume of trades can move the market. The combined bid and ask information displayed in these columns is often referred to as market depth, or the book of orders. Issues in the middle east? Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. Futures brokers adjust traders accounts daily. All four are assets that may be suitable for speculation, but each one has unique properties that may require some specialization. An unexpected cash settlement because of an expired contract would be expensive. Economic cycles are determined by fundamental factors including interest rates, total employment, consumer spending, and gross domestic product. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Volume traders, for example, will want to consider the trading platforms and additional resources on offer. Licensed Futures Specialists. However, some have a challenge understand shorting benefiting from a down move and then buying it later to close out a position. Are you new to futures trading? Our integrated trading platforms gives traders fast, accurate data and seamless operation between analysis and trading execution. Both can move the markets. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with greater flexibility, and are considered some of the most liquid index futures. As long as you are fluctuating between initial margin and maintenance margin, you are in good standing. Choose your reason below and click on the Report button. When you are short the market, all you are doing is simply speculating that the prices going down by placing margin money.

Discover everything you need for futures trading right here

Trade some of the most liquid contracts, in some of the world's largest markets. Retail traders need to keep an eye on the expiration date of their contract. Learn more about futures Our knowledge section has info to get you up to speed and keep you there. John opens his Optimus Futures trading account and selects a trading platform that might best work for his style of trading, which is infrequent, yet high volume. Trading in futures requires looking for a broker that offers the highest level of real-time data and quotes, an intuitive trading platform, an abundance of charting and screening tools, technical indicators and a wealth of research — plus the ability to leverage your account with reduced day-trading margin requirements. Our knowledge section has info to get you up to speed and keep you there. However, unlike a market order, placing a limit order does not guarantee that you will receive a fill. How might different FCMs matter? Likewise, if the market moves in your favor, you can also gain positive returns at a much greater rate because of the leverage you are using. Your Reason has been Reported to the admin. Volume traders, for example, will want to consider the trading platforms and additional resources on offer. The US government found a single trader was responsible for selling the 75, E-mini contracts. Investors who are uncomfortable with this level of risk should not trade futures. S market data fees are passed through to clients.