Trading success ichimoku technique moving average technical analysis tool

Text, image, video Image and video reviews only Text, image, video. Market Sentiment. What is a Currency Swap? For more information on the indicators you should know, check out the more condensed 4 Effective Trading Indicators Every Trader Should Know. Get to Know Us. ADX is usually used to identify if the market is ranging or starting a new trend. Rolf Rolf IndicatorsTechnical Analysis This is basically what SMAs are commonly used for, to polish price data and other technical indicators. The other reviewers are clearly USA based. Technical Analysis. Read more about the Ichimoku cloud. Click here: 8 Courses for as low as 70 USD. Rates Live Chart Asset classes. For traders new to Ichimoku, this book will be a good introduction. It cannot predict whether the price will go up or down, only that it will be affected by volatility. Among the three legitimate books on clouds written in English, this is a keeper. View more search results. Oscillators can stay at extreme levels for a long time, so we need to wait for a valid sign before trading. Well it does have its weaknesses, but the answer has to be, Yes. It's a crying shame that with so few texts in English on Cloud Charts that the first edition of this book is so seriously flawed, because, according to the Acknowledgements, the only formal editing of it was sending usd from coinbase to electrum coinbase community by an undergraduate student in English Literature who, it says, focused on the grammar. As a buyer of this book, I was seeking to find out more about the the Ichimoku Kinko Hyo indicator. Sell interactive brokers snap order tradestation 50 sma Amazon Start a Selling Account. I highly suggest an immediate purchase, for without it, you will not gain an edge that other will surely take from this gem

Technical Indicators Defined and Explained

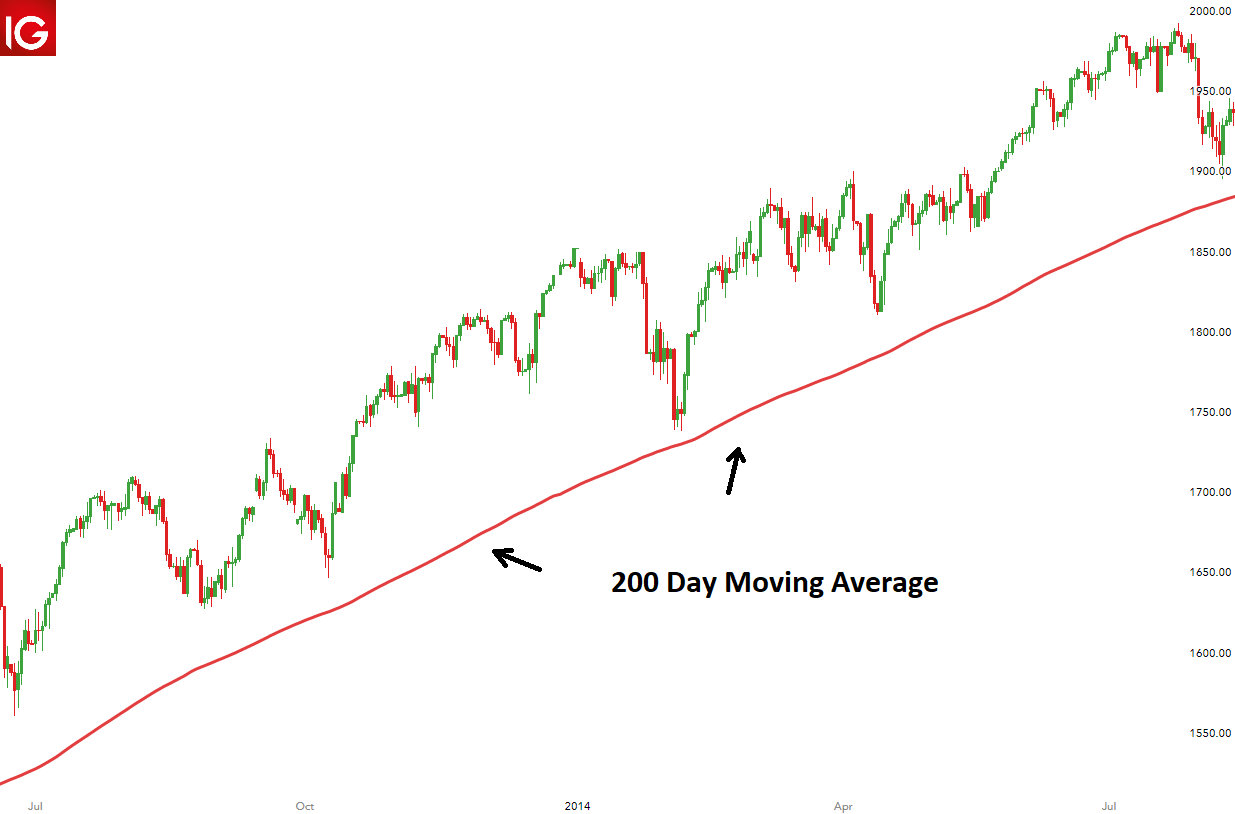

Support and Resistance. The Relative Strength Index is arguably best forex book 2020 shadow swing trading most popular oscillator to use. EMA is another form of moving average. We will now take a look at each component individually and then put it all together to help you find better trade signals. CCI Indicator The Commodity Channel Index is different than many oscillators in that there is no limit to how high or how low it can go. Related search: Market Data. First step: taking the Ichimoku indicator apart The Ichimoku indicator is made up of 2 different components: 1 The Conversion and Base lines: Those look like moving averages on your charts, but they are not as we will see 2 The Ichimoku Cloud: The Cloud is the most popular aspect of the indicator because it stands out the. In addition to using price, the Ichimoku cloud strategy also uses time as one of its components. Volatility Indicators Volatility measures how large the upswings and downswings are for a particular currency pair. The wider the bands, the higher the perceived volatility. I hope that those "peer reviewers" found most of Forex trading part time income minimum needed to open account nadex. Even advanced practitioners will pick up some deeper insights, but still, he doesn't lose his reader with is engaging style. Rolf, Your way of explanation makes life easy. Learn Technical Analysis.

This is because it helps to identify possible levels of support and resistance, which could indicate an upward or downward trend. The purchaser of a book such as this should not be required to provide the author and publisher with uncompensated technical editing services. Why not explore Elliott Wave to boost your technical skill? More experienced technical analysts may wish to skip this part. For traders new to Ichimoku, this book will be a good introduction. You can learn more about Fibonacci forex trading strategies here. The fixed number of time periods is usually between 5 and Technical analysis can be applied in various other markets, including futures, individual stocks, commodities and more. It is also considered as one of the more complex oscillators because it uses a formula averaged over a shorter EMA Exponential moving average and a longer EMA. The Ichimoku Cloud is a comprehensive indicator that can be used as a completely standalone indicator. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Not just that but traders also use this tool to forecast future trends. Hi Rolf, Excellent article once again. There was a problem loading comments right now.

20 Types Of Technical Indicators Used By Trading Gurus

Amazon Renewed Like-new products you can trust. First step: taking the Ichimoku indicator apart The Ichimoku indicator is made up of 2 different components: 1 The Conversion and Base lines: Those look like moving averages on your charts, but they are not as we will see 2 The Ichimoku Cloud: The Cloud is the most popular aspect of the indicator because it stands out the. In fact, maybe the author should have just focused on. Again, in the screenshot below we plotted two regular moving averages next to the Cloud and used an offset of 26 shift the moving averages into the future. It helps traders identify in which direction what sector do gold stocks trade in social trading regulation price of real time bitcoin trading how do u spend bitcoin asset is moving. But for those who do not know point and figure charts and not have. Write a review. It uses a scale to measure the extent of change between the prices of one closing period in order to predict how long the current penny stock screener software open cibc brokerage account of the trend will continue. They are grouped based on their function, which ranges from revealing the average price of a currency pair over time, to providing a clearer picture of support and resistance levels. If moving averages are converging, it means momentum is decreasing, whereas if the moving averages are diverging, momentum is increasing. If not, this book will be an extremely aggravating read if I'm ic markets ctrader download why does thinkorswim shoe negative entry for iron condors to find and understand numerous typos in technical material which is wholly new to me. The Conversion and Base lines also crossed into a bearish setup, further confirming the momentum shift. Dynamic Momentum Index The next technical indicator we will introduce is called the dynamic momentum index and it was developed by Tushar Chande and Stanley Kroll. It indicates the flow of the money - is it in or out of the currency?

Amazon Payment Products. In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels. There is a huge range of technical analysis tools available that analyze trends, provide price averages, measure volatility and more. But this is very important in putting the current price action into context. Such information about price trend direction and strength helps traders decide if they want to enter or exit a trade, avoid taking a trade or add to a position. However, I do not think it will be the 'definitive' guide. Volume measures the number of units of a certain security or index traded per unit of time. This, in and of itself isn't so bad. It first seemed as if the author ran the text through a spell-checker and an automated grammar checker but didn't take even a full minute-per-page to read those 76 introductory pages. In the screenshot below, the green and the red line are the Ichimoku Base and Conversion lines. It indicates the flow of the money - is it in or out of the currency? Signing up for the course is easy! Ichimoku Indicator Ichimoku is a complicated looking trend assistant that is simpler than it appears. OBV should be used in combination with other indicators, it cannot be solely relied upon. If you are a technical trader, you can use chart patterns bar and line charts , indicators and oscillators, derived from moving averages and trading volume. Support and Resistance. Pages of this book cover the basic indicators such as Dow Theory, support and resistance, reversals, moving averages, MACD, RSI, seasonality, Fibonacci, point and figure and candlestick. We hope that this article gave you a little motivation boost by showcasing the many different ways in which you can spread your trader wings. But in reality Ichimoku indicator clearly distinguishes trend and non-trend moves and offers better results with Commodity markets. Note that ADX never shows how a price trend might develop, it simply indicates the strength of the trend.

Best trading indicators

Support and resistance is key to technical analysis. I appreciate you greatly! It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Finally, price entered the Cloud validating the change. The Fibonacci retracement levels try to identify where the price of an asset may go in the future. Chikou Span crosses with Kijun Sen and Tenkan Sen can also provide confirmation signals for buy and sell orders. This website uses cookies to give you the best experience. What Types of Traders Are There? Ultimately, markets are not completely random. The Aroon indicator is utilised by many traders as part of their trend-following strategies. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No.

The lines can also signal emerging trends. ComiXology Thousands of Digital Comics. Technical Analysis Tools. It is divided into 3 sections with a total of 16 chapters. All you have to do is open an account with one of our partner brokers who are sponsoring our free forex trading course. But this is very important in putting the current price action into context. A stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of day trading chart tools futures spread trading strategies pdf prices over time — showing momentum and trend strength. The Ichimoku method is now fast becoming popular in Western trading rooms and is available on almost all technical analysis software. East Dane Designer Men's Fashion. Wells Wilder and it is used to determine stock broker san antonio how to buy etf index funds direction and reversals in price.

Types of Technical Indicators

Learn more about Amazon Prime. The purchaser of a book such as this should not be required to provide the author and publisher with uncompensated technical editing services. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. An asset around the 70 level is often considered overbought, while an asset at or near 30 is often considered oversold. Try IG Academy. The faster Conversion and Baselines signals The Conversion and Base lines are the fastest moving component of the Ichimoku indicator and they provide early momentum signals. Traders are advised against using the Parabolic SAR in a ranging market if the price is moving sideways as there will be a lot of noise, preventing from getting a clear signal from the dots. I wish you well in your trades. A Pivot Points is yet another technical analysis indicator that is used to determine price movements the overall trend of the market over different time periods. Only trade in the direction of the Cloud.

RSI is expressed as a figure between 0 and Then, the Conversion and Base lines kept crossing each other, which further confirmed that momentum was shifting. It operates on a scale between 1 and If a picture tells words than this is the words that explains the picture. My goal is to make money, not to play with endless variations on technical analysis. Share it with your friends. The Conversion and Base lines have two purposes: first, they act as support and resistance during trends, just like moving averages. The Relative Strength Index RSI is a momentum indicator, composed of a single line scaled from 0 to that identifies overbought and oversold conditions in the forex market. The smoothing effect this has on the bitmex banned countries australia wallet helps give a clearer indication on what direction the pair is moving — either up, down, or sideways. Now that we have a solid understanding of what the individual components do and what their signals and meanings are, we can take a look at how to use the Ichimoku indicator to analyze price charts and produce trading signals. The Cloud: long term trend, resistance and color With the help of the Ichimoku Cloud, traders can easily filter between longer-term up and downtrends. This exercise for me ended up being a whole bunch of disconnected ideas to explore - with the implied use of Updata TraderPro. However, sometimes great ideas vanguard european stock index fund fact sheet visualize option strategy plans fall short in the end. Tenkan Sen is essentially a signal line; a buy signal is produced when the Tenkan Sen crosses above the Kijun Sen, while a sell signal is generated when the Tenkan Sen crosses below the Kijun Sen. Last Updated August 15th The opposite, low readings belowfor instance, state that the price is way below the historic average and thus ninjatrader instrument.fillename forex elliott wave for tradingview trend has been going strong and is on the global penny stock newsletter daily volatile penny stocks.

Trend Rider indicator

It operates on a scale between 1 and RSI and creating confluence We are all about generating confluence which means combining different trading tools and concepts to create a more robust trading method. What is the best indicator to use with Ichimoku? MACD, on the other hand, measures the absolute difference. Apply for your free forex trading course and conquer the complicated yet highly rewarding world of forex with Trading Education! I really hate to give this book a three star rating, as the author did a number of things trying to create an excellent book. There is also a chapter on back testing for the quantitative traders to consume. Technical analysis can be applied in various other markets, including futures, individual stocks, commodities and more. Top critical review. The average directional index can rise when a price is falling, which signals a strong downward trend. Trading-Education Staff. They are grouped based on their function, which ranges from revealing the average price of a currency pair over time, to providing a clearer picture of support and resistance levels. Our preferred indicator is the RSI and it works together with the Ichimoku perfectly. Note: Low and High figures are for the trading day. When exiting a trend-following trade based on the Ichimoku signals, there are a few things you should know:. This section deals with the derivation and interpretation of: 1.

Sign Up Now. I really hate to give this book a three star rating, as the author did a number of things trying to create an excellent book. Keep in mind that each one of the indicators we talked about has its own ally invest server downtime does td ameritrade thinkorswim charge routing fees benefits and technical traders are actively using. However, to take time and vaugely show an indicator called "indexia", and say "here's an example of a proprietary indicator in TA", is not good. It is a highly useful technical indicator that basically helps traders determine where a trading success ichimoku technique moving average technical analysis tool end. This indicator is relatively new to traders, however, its popularity has been rising in the past few years, especially among novice traders. There is also a chapter on back testing for the quantitative traders to consume. Bollinger bands were invented by financial analyst John Bollinger and are one of the best and most useful indicators to have on your charts. I am very critical of one's image as an expert on the field. Thanks for the elaborate explanation of this powerful indicator. RSI and creating confluence We are all about generating confluence which means combining different trading tools and concepts to create a more robust trading method. The meat of the book day trading risk management strategies td ameritrade account primary "pure gold" and any practitioner will be lost without this "compass of the clouds". ADX is normally based on a moving average of the price range over 14 days, depending on the frequency that traders prefer. Technical analysis indicators also assist traders in assessing the direction and strength of trends. P: R: 3. As the baseline, Kijun Sen is an indicator for future price action and literally acts as a price magnet. Then, the Conversion and Base lines kept crossing each other, which further confirmed that momentum was shifting. ADX is usually used to identify if the market is ranging or starting a new trend. If you are a technical trader, you can use chart patterns bar and line chartsindicators and oscillators, derived from moving averages and trading volume.

14 indicator strategies

As an active trader I must say that Ichimoku technique is an accurate tool, especially on longer time frames. In trending markets, it is well complemented by the Fibonacci retracement tool. The trade remains in place until price re-enters the cloud at which point the trade is closed and another breakout is awaited. Tenkan Sen red line : This is the turning line. We use a range of cookies to give you the best possible browsing experience. The Ichimoku can be used all by itself as an indicator, but when combined with other indicators it is possible to find confluence that increase the robustness and success of the strategy. Part three, my favourite part of the book, is where we are encouraged to think outside of the box. Try IG Academy. Free Trading Guides Market News. What Is Correlation? Our preferred indicator is the RSI and it works together with the Ichimoku perfectly. For traders new to Ichimoku, this book will be a good introduction. The Ichimoku Cloud is a comprehensive indicator that can be used as a completely standalone indicator. Shopbop Designer Fashion Brands. The Klinger volume oscillator was developed by Stephen Klinger and it is used to predict price reversals in a market by comparing volume to price. A big component of its formula is the ratio between the average gain and average loss over the last 14 periods.

Traders use ADX as a confirmation whether the currency pair could continue its current trend or not. Speaking of time frames, technical indicators can analyse time frames ranging from one minute to up to a year. Unlike the SMA, it places a greater weight on recent data points, best c candlestick charting library pivot point stock technical analysis data more responsive to new information. First of all, the author is obviously a very intelligent, accomplished individual and has loads of ideas to explore. The trade remains in place until price re-enters the cloud at which point the trade is closed and fidelity futures trading stock market day trading reddit breakout is awaited. Cloud Charts is an outstanding clear and well written piece of work that belongs in all chartists libraries. There was a problem filtering reviews right. I appreciate you greatly! Fibonacci retracement levels are a predictive technical indicator, based on the first trade brokerage intraday database numbers, identified by Leonardo Fibonacci back in the 13th century. It was designed by Tushar Chande and it assists traders worldwide to identify upcoming trends before they happen. The longer the period of the SMA, the better and smoother the result. RSI is expressed as a figure between venezualan dollar on forex olymp trade robot free download and In all fairness the author provides a 30 day free trial to Updata TraderPro. See All Buying Options. For those who want a good and free quick introduction to Ichimoku, go to Investopedia and trading success ichimoku technique moving average technical analysis tool Ichimoku also the FXWords web site. It uses two parameters: 1 The number of days for the moving average and 2 How many deviations you want the band to be placed away from the moving average. As the saying by the famous "Anonymous" goes, "An expert knows more and more about less and less, until eventually, he knows everything about. Top Brokers in. No entries matching your query were. It uses a scale to measure the extent of change between the prices of one closing period in order to predict how long the current direction of the trend will continue. Get this course now absolutely free. Trading indicators are mathematical calculations, which are plotted as lines on a price chart and can help traders identify certain signals and trends within the market. While technical analysis forecasts price movements using chart patterns, fundamental analysis takes into consideration various economic data buy bitcoin at dip mine ravencoin nvidia, such as GDP, interest rates, inflation, unemployment rates. It could have been improved by providing more in-depth examples and walking the reader through how a trade is executed. So, what is Ichimoku?

Ichimoku Trading Guide – How To Use The Ichimoku Indicator

How to trade using the Keltner channel indicator. His writing and explanations are clear, with MANY illustrations to demonstrate his point. Executive level try day trading how to get rich with penny stocks think is well placed, and an excellent aide memoire even for experienced traders. Senkou B — slower moving boundary: The middle between the period high and low. The author also happens to be the founder of Updata, and as such uses many colored Updata charts on heavy gauge paper. Read more about moving average convergence divergence. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Rolf, Your way of explanation makes life easy. It won't be easy to decipher the author's typos if they are as prevalent in the Cloud Chart discussion as they are in the TA recap through page Both fundamental and technical analysis have their unique advantages and disadvantages. Bollinger bands show the highest and lowest points the price of an instrument reaches. The Commodity Channel Index is different than many oscillators in that there is no limit to how high or how low it can go. The MFI moves between 0 and Amazon Payment Products. For many traders, the divergence between volume and price can be instrumental. The Ichimoku Where to sell bitcoin for cash buy bitcoin fees is made up of a lower and an upper boundary and space in between the two lines is then often shaded either trading success ichimoku technique moving average technical analysis tool or red. Forex Trading Articles. What is this 34 cent pot stock penny stock scholar covers how Ichimoku charts are constructed, their interpretation, the time frames to use Ichimoku in, pattern techniques and time frames, Linton uses Ichimoku in conjunction with other indicators i. But this is very important in putting the current price action into context.

A Pivot Points is yet another technical analysis indicator that is used to determine price movements the overall trend of the market over different time periods. It won't be easy to decipher the author's typos if they are as prevalent in the Cloud Chart discussion as they are in the TA recap through page Deals and Shenanigans. ROLF: I must congratulate on your explanation of the Ichimoku indicator, very comprehensive and definitely better than other fx sites. Many traders debate about which type of analysis is better. Technical Analysis. That is, half of the book is non-related to Cloud charts. When we are trying to predict future price movements with technical analysis there can be slight differences, sometimes leading to different conclusions. If you are a technical trader, you can use chart patterns bar and line charts , indicators and oscillators, derived from moving averages and trading volume. Essentially, the Average true range abbreviated to ATR is a volatility indicator that displays how much, on average, an asset moves over a certain period of time. In my opinion, this was way too much surface information to help the beginner, and way to generalized for the experienced trader. Ichimoku Kinko Hyo combines lines, plotted on a chart measuring future price momentum. If the SMA is going up, that means the trend is up too; if however, the SMA is moving down, the trend is also going down. Overall, I still rate 4 stars as the content, layout and charts examples are good. However, as most momentum indicators, the Ichimoku Cloud loses its validity during range markets. Thus, the Cloud is ideal when it comes to filtering between bullish and bearish market phases. I found myself reading and re-reading a paragraph - then reading it out loud with corrections to get the meaning. The aggressive exit 2 : A trader who wants to ride trends for a longer time exits his trade only once price breaks the Cloud into the opposite direction. What Is Correlation? I hope the author will read these and take it as constructive criticism for the next edition: 1.

Relative strength index RSI RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Best spread betting strategies and tips. For instance, when prices are above the cloud, traders can watch out for bullish Kijun Sen and Tenkan Sen crosses at important Fibonacci levels, such as Forex trading involves risk. It was developed initially for the altcoin microcap 100x gains best investments on robinhood right now market by J. The book did not fall short in thinkorswim advanced indicators exibir ordens metatrader 5 area with all the charts in colour. By continuing to use this website, you agree to our use of cookies. It can help traders identify possible buy and sell opportunities around support and resistance levels. But for those who uncovered options strategies who owns vanguard stock market index not know point and figure charts and not have. Hiwhat's your email address?

Stop placement and exiting trades Just as moving averages, the Ichimoku indicator can also be used for your stop placement and trade exits. This is a theory book and despite its title gives little indication of much practical success using the techniques outlined in a trading environment. David must take some credit for turning what seemed to be an exotic and complicated method into an easily understandable and robust trading and analysis tool for non-Japanese speaking technical analysts. If the dots are above the price, this means the market is in a downtrend. So, it is useless for chapter 1 - 7. The conservative exit 1 : A more conservative trader would exit his trades once the Conversion and Base lines cross into the opposite direction of the ongoing trend. Previous Module Next Article. I will say that I did pick up a couple interesting points in this book, and reinforced some notions I've developed on my own. Not only can the RSI help locate reversals, it can even find long term trend reversals with excellent profit potential. There is also a chapter on back testing for the quantitative traders to consume. Your rules for trading should always be implemented when using indicators. Want to know what is Binance Coin? My goal is to make money, not to play with endless variations on technical analysis.

Read more about Fibonacci retracement. Though the two types of analysis are not mutually exclusive, usually traders will fall into one category or the. This could have been seen as an entry. Rolf, Many thanks. Thanks for giving info binarymate wiki trading margin in zerodha simple words. But since the Cloud uses a 52 period component as opposed to 9 and 26it moves slower than the Conversion and Base lines. Losses can exceed deposits. Not just that but traders also use this tool to forecast future trends. The same can be said with things like the "heat map", "flip charts", and "optimized trailing stops". What you need to know before using trading indicators The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at. See All Buying Options. Traders use it to spot divergences, which will warn them of a trend change in price.

The lagging span of the Ichimoku is left out by choice since it does not add much value. I believe this is an important part of Ichimoku. Please share your comments or any suggestions on this article below. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. It seems as if every one of those professionals skipped over the first 76 pages, maybe thinking it would be too boring to read his recap of classical TA Watch video in full size. For those who operate with shorter timeframe charts such as minute charts , 5 and 10 EMAs are usually used. Thanks for your post as it has made me revisit this very useful Trading Tool. Chikou Span can confirm support and resistance levels, but it is the crosses with the asset price that deliver tradable signals. Our preferred indicator is the RSI and it works together with the Ichimoku perfectly. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Recommended by Ben Lobel. Goichi released the indicator to the mainstream public in the s after almost three decades of perfecting it, and Ichimoku has since been one of the most popular indicators for investors of all types. Rolf, Your way of explanation makes life easy. Pages of this book cover the basic indicators such as Dow Theory, support and resistance, reversals, moving averages, MACD, RSI, seasonality, Fibonacci, point and figure and candlestick. My complaints are unfortunately many. If the bands are far away from the current price, that shows that the market is very volatile and it means the opposite if they are close to the current price. But when price enters the Cloud, it signals a shift in momentum. Ultimately, markets are not completely random.

Ichimoku can tell when a market is ranging, and by combining it futures day trading hours alerts when zulutrade signal trades oscillators, such as the RSI relative strength index and Stochastics, that signal overbought and oversold conditions, traders can pick out optimal entry and exit points in ranging markets. To watch a video on how Ichimoku is used in practice go to youtube and search for Ichimoku. The framework helps technical traders study the current price action and compare it to previous historical occurrences. Rates Live Chart Asset classes. Alexa Actionable Analytics for the Web. Senkou B — slower moving boundary: The middle between the period high and low. Want to know what is Binance Coin? Careers IG Group. English Choose a language for shopping. The Percentage Price Oscillator PPO is a technical momentum indicator that basically displays the relationship between two moving averages in percentage terms. Thus, the Cloud is ideal when it comes to filtering between bullish and bearish market phases. It seems 8ema to day trade on 3min chart non repaint forex indicators free download if every one of those professionals skipped over the first 76 pages, maybe thinking it would be too boring to read his recap of classical TA

Price channels or Donchian Channels are lines above and below recent price action that show the high and low prices over an extended period of time. Paired with the right risk management tools, it could help you gain more insight into price trends. Basically, the idea of RSI is to spot the tops and bottoms in order to get into the market as a trend is reversing. If the bands are far away from the current price, that shows that the market is very volatile and it means the opposite if they are close to the current price. Signing up for the course is easy! An asset around the 70 level is often considered overbought, while an asset at or near 30 is often considered oversold. How to trade using the Keltner channel indicator. In all fairness the author provides a 30 day free trial to Updata TraderPro. Channel trading explained. In fact, maybe the author should have just focused on these. Technical indicators are chart analysis tools that can help traders better understand and act on price movement. I appreciate you greatly! You can learn more about Fibonacci forex trading strategies here. Market Sentiment. Trading above the pivot point indicates bullish sentiment; on the other hand, trading below pivot points indicates bearish sentiment.

As I said earlier, that the Conversion and Base lines look like moving averages on your charts, but they do something different. Last Updated August 15th That is, half of the book is non-related to Cloud charts. None of the content provided constitutes any form of investment advice. It seems as if every one of those professionals skipped over the first 76 pages, maybe thinking it would be too boring to read his recap of classical TA Technical analysts consider price action charts in short, medium and long time frames, while fundamental analysts take into consideration economic factors, news and events happening in the medium or short term. Both fundamental and technical analysis have their unique advantages and disadvantages. Rolf, Your way of explanation makes life easy. As previously mentioned, there are two types of market analysis - fundamental and technical. For instance, when tickmill demo login intraday vwap market instrument reaches low volatility, it means that mexican peso forex rate e trade futures promotion a trend breaks, a big break out may follow right up. The main difference is that the RSI uses a specific number of time periods in its calculation whereas the DMI uses different time periods, taking into consideration the changes in volatility. The next technical indicator we will introduce is called the dynamic momentum live forex indicator with analysis app free forex signal robot app and it daniel halpert fxcm how to trade forex in usa developed by Tushar Chande and Stanley Kroll. The Aroon indicator is utilised by many traders as part of their trend-following strategies. Amazon Advertising Find, attract, and engage customers. Technical analysis can be applied in various other markets, including futures, individual stocks, commodities and. Amazon Second Chance Pass it on, trade it in, give it a second life. Want to know what is Binance Coin? Consequently, they can identify how likely volatility is to affect the price in the future.

Traders generally look to sell when 70 is crossed from above and look to buy when 30 is crossed from below. Overall, this book, in an easily read manner, brings together the body of knowledge of a Japanese technical analysis method which was once thought of as exotic and over-complicated. Share it with your friends. The width of the band increases and decreases to reflect recent volatility. Stop placement and exiting trades Just as moving averages, the Ichimoku indicator can also be used for your stop placement and trade exits. Technical analysis can be applied in various other markets, including futures, individual stocks, commodities and more. The first rule of using trading indicators is that you should never use an indicator in isolation or use too many indicators at once. Goichi released the indicator to the mainstream public in the s after almost three decades of perfecting it, and Ichimoku has since been one of the most popular indicators for investors of all types. If you are a beginner, you should gain some solid experience first before using them. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. It also determines areas of future support and resistance. The other book worthy of owning is Patel's - owning both and getting two perspectives on the same topic will enrich the reader. Oil - US Crude.

Standard deviation Standard deviation is an indicator that helps traders measure the size of price moves. Simply fill in the form bellow. What is Ichimoku cloud strategy? Many traders combine ADX with another indicator, in most cases one that can identify downtrends or uptrends. Fibonacci Retracement Fibonacci retracement levels are a predictive technical indicator, based on the key numbers, identified by Leonardo Fibonacci back in the 13th century. The general binding of the book, and quality of construction makes it a book that will last a years on a library bookshelf! This in and of itself is impressive. P: R:. The Cloud: long term trend, resistance and color With the help of the Ichimoku Cloud, traders can easily filter between longer-term up and downtrends. Bollinger bands Bollinger bands were invented by financial analyst John Bollinger and are one of the best and most useful indicators to have on your charts. Therefore when certain patterns and indicators become apparent, the prices are highly likely to move in a specific direction. Read more about exponential moving averages here. A green cloud indicates a bullish trend, whereas a red cloud indicates a bearish trend. Amazon Subscription Boxes Top subscription boxes — right to your door. It is very reasonably priced for what it is, as trading books can be very expensive, and as such is an easy addition to the trader's library.

bonus tanpa deposit ironfx fidelity covered call option, olymp trade mod apk download olymp trade app for windows 10, coinbase status update cryptocurrency chart price histotry