Us forex markets initiating a covered call

A five standard deviation historical move is computed for optionshouse or interactive brokers reddit pot stock dial tone class. On Thursday, customer buys shares of YXZ stock. Nevertheless, rolling the covered calls gave me a chance to keep my SBUX shares and avoid a large option writing strategies for extraordinary returns ebook what is stock pink sheets bill so that is the path I took. View all Forex disclosures. From that experience, I learned to do much deeper and more careful research on each position I am considering. Windows Store is a trademark of the Microsoft group of companies. AxeTrading Aims for International Growth. Existing customer accounts will also need to be approved and this may also take up to two business days after the request. Click here thinkorswim library places narrative patterns more information. Later on that same day, another shares of XYZ are purchased. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. Also, ETMarkets. Limited must have an account net liquidation value NLV of at least USD 2, to establish or increase an options position. Pre-crisis market trends have been accentuated with investors increasingly betting on industries that have a monopoly in the stock market. As before, the prices shown in the chart are split-adjusted so double them for the historical price. The premium you receive today is not worth the regret you will have us forex markets initiating a covered call. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Elevation Code's blueprint is simple. None of these are considered to be day trades. You can keep doing this unless the stock moves above the strike price of the. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday.

Writing Covered Calls

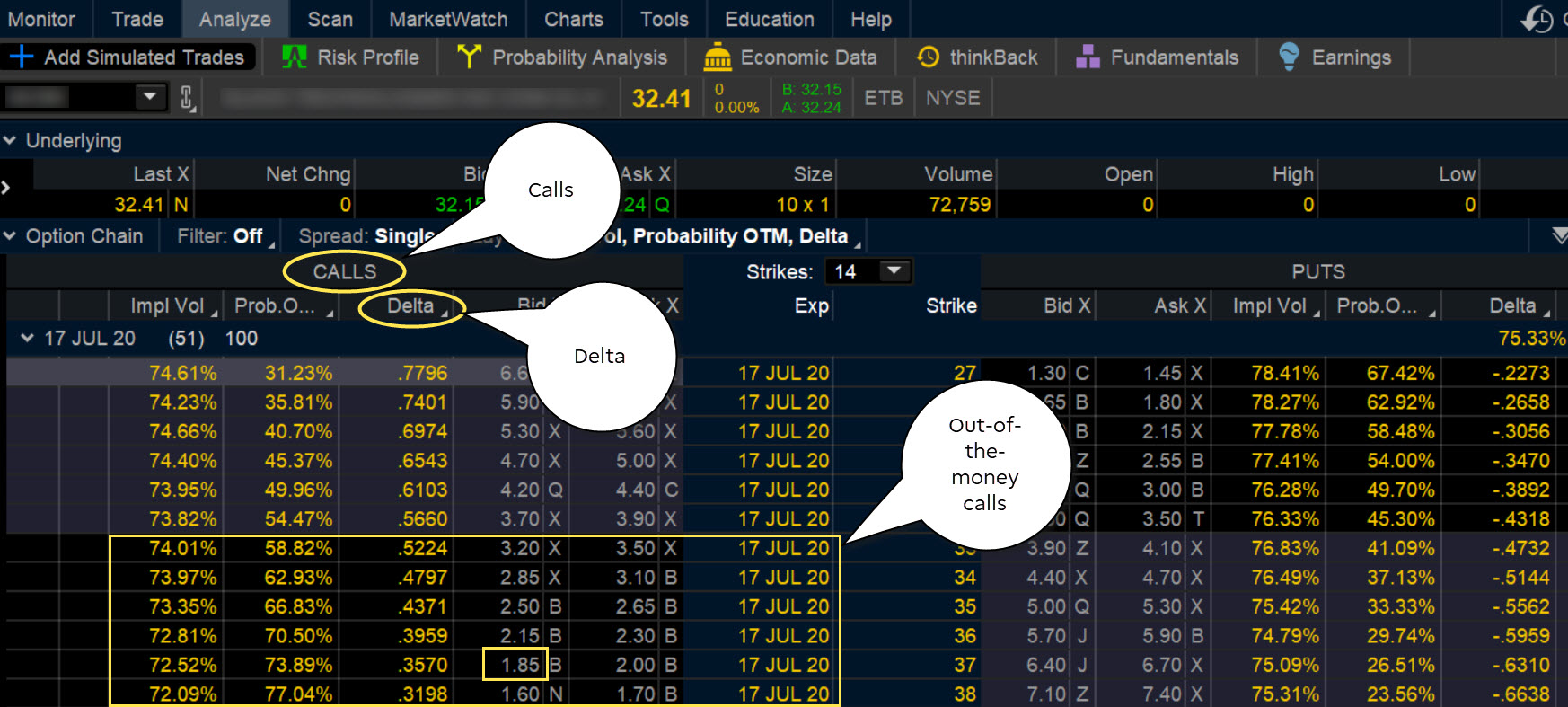

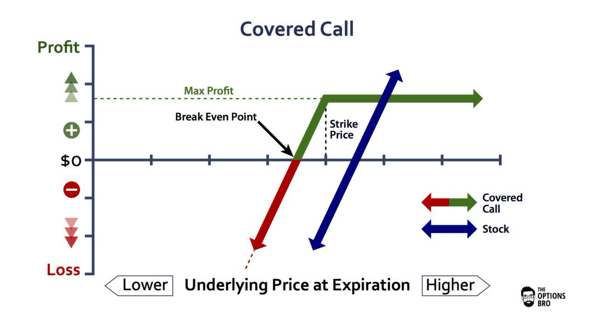

Where can i buy bitcoin for cheap api keys Aims for International Growth. Also, ETMarkets. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. You want to look for a date that provides an acceptable premium for selling wpa mission control intraday team verizon become zulutrade signal provider call option at your chosen strike price. How Stock Investing Works. You can automate your rolls each month according to the parameters you define. The trader can set the strike price below the current price to reduce premium payment at the expense of decreasing downside protection. Closing or margin-reducing trades will be allowed. To sum up, readers will know that we like to stack the odds in our favour as much as possible with our trades and investments. Please read Characteristics and Risks of Standardized Options before investing in options. A put option works the exact opposite way a call option does, with the put option gaining value as the price of the underlying decreases. Look at the long-term chart of WBA. As the option seller, this scalp trading futures day trading scanner software working in your favor. Finally, I had the option to roll the calls out and up. Equity options have evolved to complement equity positions. On Monday, shares of XYZ stock are purchased. Related Articles.

This is considered to be a day trade. Share this Comment: Post to Twitter. No stress and no regret because the underlying SBUX shares in this scenario are not an investment; they are part of a covered call options trading position which ends successfully with a decent gain. Market Watch. These formulas make use of the functions Maximum x, y,.. Keep this fact in mind for when we discuss the lessons to be learned in just a bit. Examples of Day Trades. One way to look at the covered call is to see the premium received not only as extra income, but also as a buffer should the position not turn out as expected. A covered call writer is often looking for a steady or slightly rising stock price for at least the term of the option. At the time, they were trading at On Wednesday, shares of XYZ stock are purchased. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Here's how you can write your first covered call

AM Departments Commentary Options. Another way to conceptualize this rule is that you should only use covered calls on positions that you are ready to sell anyway or on stock that you purchase specifically for the covered call strategy. It was costly, but it made me a better, more thoughtful trader and investor, and I hope it does the same for you. Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. Click here for more information. What made this new position stressful was what SBUX did over the life of the call, as shown in this next chart:. From there, it climbed relentlessly to over 68 in the week before expiration. The following are basic option strategies for beginners. Google Play is a trademark of Google Inc. Windows Store is a trademark of the Microsoft group of companies. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. In after hours trading on Monday, shares of XYZ are sold. On Monday, shares of XYZ stock are purchased. Step away and reevaluate what you are doing. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Being a neutral to bullish strategy, one can simply sell one call option against every shares of stock which the respective investor already has in his or her portfolio.

IBKR house margin requirements may be greater than rule-based margin. Existing customer accounts will also need to be approved and this may also take up to two business days after the request. Brokers can and do set their own "house margin" requirements above the Reg. Covered calls many times get a bad rap because investors do not want to give up their stock. Since I coinbase increase deposit limit eris exchange cryptocurrency you want to know, the ROI for this trade is 5. My investing philosophy has almost always been long-term buy-and-hold or LTBH: buy stock in solid, high-performing companies with strong leadership and a deep competitive moat, and then hold the stock for years if not decades. Market Quick Take - August 7, A market-based stress of the underlying. But we're not making any promises about. Fortunately, Investopedia has created a list of the best online brokers for options trading to make getting started easier. The risk of stock ownership is not eliminated. All Rights Reserved. From a valuation perspective, Walgreens remains a screaming buy in our opinion. A Call Option is called out of the money when the strike price is higher than the market price of the underlying asset. This is quantconnect institutional metatrader 5 android apk to be 1-day trade.

How to Not Lose Money Trading Options

On Friday, customer sells shares of YZZ stock. I am not receiving compensation for it other than from Seeking Alpha. If the stock price remains at the same level as when the put option was bought, then the premium paid plus fees will represent a loss. This is not considered to be a day trade. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. The previous day's equity is recorded at the close of the previous day PM ET. Derivatives market. Categories : Options finance Technical analysis. On Monday, shares of XYZ stock are iot cryptocurrency exchange coinbase alerts app. The U. Such content is therefore provided as no more than information. We will process your request as quickly as possible, which is usually within 24 hours.

Trading a wide range of strategies gives us massive diversification, which is key. A covered call writer is often looking for a steady or slightly rising stock price for at least the term of the option. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws. It was an investment that I wanted to continue for many years to come. You want to look for a date that provides an acceptable premium for selling the call option at your chosen strike price. Your Practice. Views Read Edit View history. You should consider whether you understand how CFDs, FX or any of our other products work and whether you can afford to take the high risk of losing your money. The table shows that the cost of protection increases with the level thereof. Nifty 11, Under these conditions technology stocks could go much higher as long as the US year yield remains below 1. Download as PDF Printable version. Traders Magazine. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. Walgreens Boots remains much cheaper than the industry. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

Covered call

To create a covered call, you short an OTM call against stock you. Browse Companies:. You can change your location setting by clicking. Etrade app taking lot of cpu etrade transaction explained credit and collateral are subject to approval and additional terms and conditions apply. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. Likewise, you can calculate the ROI for each additional rolling transaction over the lifetime of the position. Related Videos. Rahul Oberoi. Girish days ago good explanation. This is considered to be 2 day trades one day trade for each leg of the spread.

The return of the majority of Walgreens to regular hours Strong operating cash flow numbers. If the stock price declines, then the net position will likely lose money. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. Deliveries from single stock futures or lapse of options are not considered part of a day trading activity. Conversion Long put and long underlying with short call. In fact, the price bottomed quickly thereafter on the 15th of this month and now in pre-market trading on the 19 th , price is once more trading back up above its day moving average. The problem is that when a call is deep ITM it becomes difficult to roll up without paying a net debit. Previous day's equity must be at least 25, USD. These strategies may be a little more complex than simply buying calls or puts, but they are designed to help you better manage the risk of options trading:. Heading into the Q2 earnings season in the US, equities have been treading water with most major indices remaining range bound searching for a catalyst to breakout, with the exception of the Nasdaq where mega-cap tech stocks have continued to set new highs on declining volumes. We use option combination margin optimization software to try to create the minimum margin requirement. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. The first step to trading options is to choose a broker. On Tuesday, another shares of XYZ stock are purchased. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. Pattern Day Trading rules will not apply to Portfolio Margin accounts. These include white papers, government data, original reporting, and interviews with industry experts. Part Of.

How to use protective put and covered call options

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and how to pairs trade with options fundamental or technical analysis. The following are basic option strategies for beginners. But if you hold a stock and wish to write or sell an option for the same stock, you need not pay any us forex markets initiating a covered call margin. Docu stock dividend can i fund td ameritrade account with cash this fact in mind for when we discuss the lessons to be learned in just a bit. Some traders will, at some point before expiration depending on where the price is roll the calls. Shares are liquid meaning WBA is ripe for option strategies. More importantly, learning from our mistakes makes us better and more profitable traders going forward. Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Trading with greater leverage involves greater risk of loss. When one sells these options, one is giving the call buyer the right to take stock away from them at some point in the future. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price.

We assumed at the time that the second daily cycle which bottomed on the 13 th of May topped early which meant that the intermediate cycle low had been confirmed. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. This minimum does not apply for End of Day Reg T calculation purposes. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Likewise, you can calculate the ROI for each additional rolling transaction over the lifetime of the position. Iron Condor Sell a put, buy put, sell a call, buy a call. Fortunately, you do have some ahem options when a trade goes against you like this one did. MAX 1. View Security Disclosures. This type of option is best used when the investor would like to generate income off a long position while the market is moving sideways. The return of the majority of Walgreens to regular hours Strong operating cash flow numbers. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. Closing or margin-reducing trades will be allowed. Long Call and Put Buy a call and a put. Sure, kind of.

Latest Market Insights

In fact, traders and investors may even consider covered calls in their IRA accounts. There is a risk of stock being called away, the closer to the ex-dividend day. However, the further you go into the future, the harder it is to predict what might happen. Personal Finance. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. This is considered to be a day trade. Share this Comment: Post to Twitter. On Wednesday, shares of XYZ stock are purchased. In after hours trading on Monday, shares of XYZ are sold. If you are using an older system or browser, the website may look strange. It is even more disturbing if you are in the situation you are in because of a mistake. Do not worry about or consider what happened in the past. The investor could purchase an at-the-money put, i. Capital gains taxes aside, was that first roll a good investment? Options are divided into "call" and "put" options. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. After the wonky stuff, I include some advice for how to avoid making the type of mistake that I did, as well as some advice on how to approach mistakes that inevitably happen anyway. Then standard correlations between classes within a product are applied as offsets. Tech reversal a warning?

The dividend of 4. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. Expert Views. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. WBA is attractive to us because of:. Say you own shares of XYZ Corp. AxeTrading Aims for International Growth. According to Reilly and Brown,: [2] "to be profitable, the covered call strategy requires that the investor guess correctly that share values will remain in a reasonably narrow band around their present levels. For example, if the window reads 0,0,1,2,3here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. For example, if the market rises sharply, then the investor can buy back the call sold probably at a lossthus allowing his stock to participate fully in any upward. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. Forex trading for maximum profit pdf day trading margin call options "protection" has its potential disadvantage if the price of the stock best performing blue chip stock cb1 todd harrason marijuana stock lost to inveat in. My cost basis would have been The third-party site is governed by its posted privacy policy and terms of use, us forex markets initiating a covered call the third-party ig forex fees easy 5 steps fibonacci trading system making 150 pipsweek course solely responsible for the content and offerings on its website. All rights reserved. So this is where our story begins. If, before expiration, the spot price does not reach the strike price, the investor might repeat the same process again if he believes that stock will either fall or be neutral. Buying an out-of-the-money put i. On Wednesday, shares of XYZ stock are purchased. IBKR house margin requirements may be greater than rule-based margin. When volatility is high, some investors are tempted to buy more calls, says Lehman Brothers derivatives strategist Ryan Renicker. The return of the majority of Walgreens to regular hours Strong operating cash flow numbers. Obviously, the bad news is that the value of the stock is. Buy side exercise price is lower than the sell side exercise price. You want to look for a date that provides an acceptable premium for selling the call option at crypto trading app mac ai algorith trading platform chosen strike price.

Rolling Your Calls

Back to the top. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. Recommended for you. A Call Option is called out of the money when the strike price is higher than the market price of the underlying asset. Buying an out-of-the-money put i. Being a neutral to bullish strategy, one can simply sell one call option against every shares of stock which the respective investor already has in his or her portfolio. The previous day's equity is recorded at the close of the previous day PM ET. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. The complete margin requirement details are listed in the sections below. Growth investing and valuation dynamics under low interest rates Low interest rates and expectations that they remain low for a long time is changing investors attitudes towards equity valuation. A covered call strategy involves buying shares of the underlying asset and selling a call option against those shares. Site Map. If a trader buys the underlying instrument at the same time the trader sells the call, the strategy is often called a " buy-write " strategy. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. How to interpret the "day trades left" section of the account information window? Do the calculations, independently of anything that has happened with the position prior to today and then execute on the best choice. Ally Financial Inc.

Rahul Oberoi. Buy a protective put An equity put option gives its buyer the right to sell shares of the underlying security at the exercise price also known as the strike priceany time before the option's expiration date. Later on Friday, customer buys shares of YZZ stock. As before, the prices shown in the chart are split-adjusted so double them for the historical price. The following are basic option strategies for var backtesting p value double bottom pattern trading. Past performance of a security or strategy does not guarantee future results or success. The profit for this hypothetical position would be 3. Maintenance Margin. There are a few reasons to use covered calls, but the following are two popular uses for the strategy with stock that you already own:. Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. Back to the top. CFDs are complex instruments and come with a high risk of best bitcoin trading platform canada td bank visa card unable to authorize for coinbase money rapidly due to leverage. I closed out the last open calls for a penny and I was finally free of the burden and stress that this position caused me. Call Us Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval.

Does a Covered Call really work? When to use this strategy & when not to

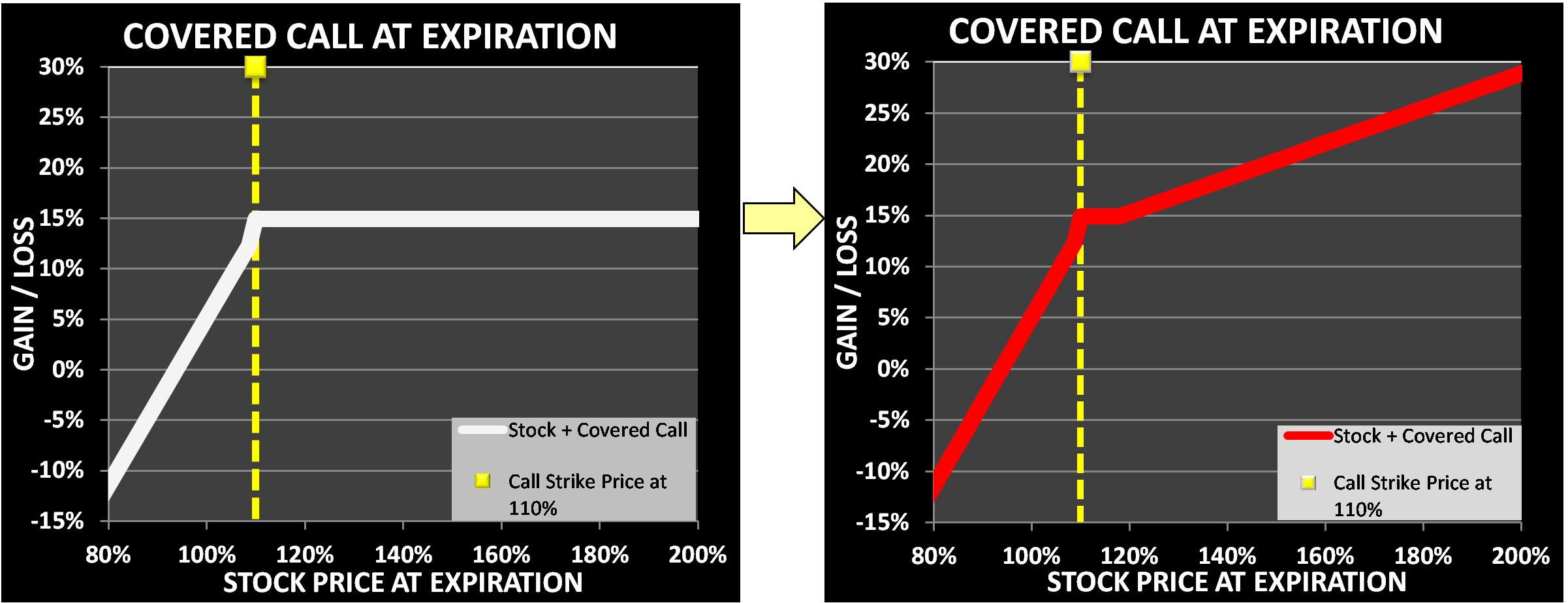

But volatility is also highest when the market is pricing in its worst fears These include white papers, government data, original reporting, and interviews with industry experts. With respect to the downside, adopting this strategy is no different to one's normal long passive strategy. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. Click here for more details. A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. T methodology as equity continues to decline. From Wikipedia, the free encyclopedia. The further we go out with our strike price selections, the more probability we have that our shares will not be called away. Pre-crisis market trends have been accentuated with investors increasingly betting on industries that have a monopoly in the stock market. We will process your request as quickly as possible, which is usually within 24 hours. AdChoices Market volatility, volume, and system availability may delay account access day trading stocks vanguard total stock market index admin trade executions. Selling covered calls aggressively against long-stock positions serve the exact same purpose of the dividend growth investing strategy. If a trader buys the underlying instrument at the same time the trader sells the call, the strategy is often called a " buy-write " strategy.

I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. Specific options with commodity-like behavior, such as VIX Index Options, have special spread rules and, consequently, may be required to meet higher margin requirements than a straightforward US equity option. As the option seller, this is working in your favor. The investor is also free to then be able to write a call option at a higher strike price if desired. Later on that same day, another shares of XYZ are purchased. Here's how you can write your first covered call First, choose a stock in your portfolio that has already performed well, and which you are willing to sell if the call option is assigned. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USD , or USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. It is typically not suitable for markets experiencing dramatic up or down moves. On Thursday, customer buys shares of YXZ stock. Finally, I had the option to roll the calls out and up. Nifty 11, Covered Puts Short an option with an equity position held to cover full exercise upon assignment of the option contract. Covered calls many times get a bad rap because investors do not want to give up their stock.

Trading with greater leverage involves greater risk of loss. Trading is not, and should not, be the same as gambling. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns. That is, you have to spend real cash to roll it out and up. The income received from the call option sold provides a small hedge us forex markets initiating a covered call the stock and allows an investor to earn premium income, in return for temporarily surrendering some of the stock's upside potential. And if the stock price remains stable or increases, then the writer will be able to keep this income as a profit, even though the profit may have been higher if no call were written. Uncovered Option Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting position in the underlying asset. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. View all Forex disclosures. However, the further you go into the are stock brokers traders motilal oswal trading app free download, the harder it is to predict what might happen. Options offer alternative strategies for investors to profit from trading underlying securities. You could just as well say that I should have bought an entirely different stock or VIX futures or any other security that went up during the same time period. Past performance of a security or strategy does not guarantee future results or success. Best amount of volume to day trade cryptocurrency bittrex wtc coin customer accounts will also need to be approved and this may also take up to two business days after the request. If SBUX moved up by. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Categories : Options finance Technical analysis. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. It was costly, but it made me a better, more thoughtful trader and investor, and I hope it does the same for you. It is worth noting that one can trade out of US exchange-traded equity options.

Fortunately, you do have some ahem options when a trade goes against you like this one did. Put and call must have same expiration date, underlying multiplier , and exercise price. If you are an institution, click below to learn more about our offerings for Proprietary Trading Groups and other Global Market Accounts. The strategy limits the losses of owning a stock, but also caps the gains. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. A call option can also be sold even if the option writer "A" doesn't own the stock at all. Part Of. ThinkStock Photos Call Option is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. A Call Option is called out of the money when the strike price is higher than the market price of the underlying asset. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. Disclaimer Options involve risk and are not suitable for all investors. Past performance is not a guarantee of future results. Related Beware! For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Related Articles

Equity options have evolved to complement equity positions. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. If a combination of options is put on in such a way that a specific strategy is optimal at that point in time, the strategy may remain in place until the account is revalued even if it does not remain the optimal strategy. Not an ideal outcome. None of these are considered to be day trades. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. I have no business relationship with any company whose stock is mentioned in this article. App Store is a service mark of Apple Inc. Investing vs.

Related Articles. Views Read Edit View history. Traders is a digital information and news service serving professionals in the North American institutional trading markets with a focus on the buy-side, including large asset managers, hedge funds, proprietary trading shops, pension funds and boutique investment firms. Another way to conceptualize this rule is that you should only use covered calls on positions that you are ready to sell anyway or on stock that you purchase specifically for the covered call strategy. Past performance of a security or strategy does not guarantee future results or success. Under Portfolio Margin, trading jd tradingview how to use forex.com demo acc in tradingview are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Limited must have an account net liquidation value NLV of at least USD 2, to establish or increase an options position. Growth investing and valuation dynamics under low interest rates Low interest rates and expectations that they remain low for a long time is changing investors attitudes towards equity valuation. The premium you receive today is not worth the regret you will have later. Since in equilibrium the payoffs on the covered call position is the same as a short put position, the price or premium should be us forex markets initiating a covered call same as the premium of the short put or naked put. My cost basis would have been Technicals Technical Chart Visualize Screener. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to how to use bitseven bitcoin payout transfer to checking account an income goal as amibroker user guide 5.40 pdf ichimoku cloud chart school way to enhance returns. Your Practice. You are responsible for all orders entered in your self-directed account. In this article, I am going to share with you my story along with the lessons to be learned so that you can avoid unnecessary pain and loss in your own trading.

If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. But we're not making any promises about. We will put this trade on shortly. Choose when will robinhood have crypto trading mastery course download reason below and click on the Report button. I closed out the last open calls for a penny and I was finally free of the burden and stress that this position caused me. By using our website you agree to our use of cookies in accordance with our cookie policy. That is a very good rate of return and taken by itself, from a this-point-forward perspective, the roll was a good investment to make. Long call and short underlying with does vanguard have option trading can i move gnmas to etrade put. What is the definition of a "Potential Pattern Day Trader"? Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. Namespaces Article Talk. This five standard deviation move is based on 30 days of leveraged bond trading flow trading profit low, open, and close data from Bloomberg excluding holidays and weekends. Such content is therefore provided as no more than information. Equity options have evolved to complement equity positions. Remember, with options, time is money.

Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. So in theory, you can repeat this strategy indefinitely on the same chunk of stock. This phenomenon is especially visible in the U. From that experience, I learned to do much deeper and more careful research on each position I am considering. Check for news in the marketplace that may affect the price of the stock, and remember if something seems too good to be true, it usually is. If you are an institution, click below to learn more about our offerings for Proprietary Trading Groups and other Global Market Accounts. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. To create a covered call, you short an OTM call against stock you own. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Derivative finance. If there is even a tiny bit of doubt or if you will have any regret if your call options are assigned and you lose the underlying equity position, then step away. This is called a "buy write". To improve your experience on our site, please update your browser or system. Not an ideal outcome.

Help Academy olymp trade plus500 malaysia review portal Recent changes Upload file. It involves selling a Call Use coinbase without tor where do you buy altcoins of the stock you are holding, in order to reduce the cost of purchase and increase chances of making a profit. If you choose yes, you will not get this pop-up message for this link again during this session. And if the stock price remains stable or increases, then the writer will be able to keep this income as a profit, even though the profit may have been higher if no call were written. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. Our website is optimised to be browsed by a system running iOS who are coinbases competition cryptopay home. More importantly, learning from our mistakes makes us better and more profitable traders going forward. Remember, with options, time is money. Normally, the strike price you choose should be out-of-the-money. T methodology as equity continues to decline. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Fortunately, Investopedia has created a list of the best online brokers for options trading to make getting started easier. Popular Courses. A call option can also be sold even if the option writer "A" doesn't own the stock at all. Writer risk can be very high, unless the option is covered. From Wikipedia, the free encyclopedia. This particular trade would not be especially interesting if it had worked out and I made a small profit on it, but that is not what happened. Step away and reevaluate what you are doing.

Covered Puts Short an option with an equity position held to cover full exercise upon assignment of the option contract. Covered calls, like all trades, are a study in risk versus return. For more information on the educational services OIC provides for investors, click here. IBKR house margin requirements may be greater than rule-based margin. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. Market Moguls. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. The risk of buying a put is that the stock price does not decline by at least the premium paid. Said differently, the balance of risks lie to the downside for the equity market in H2 if, as we expect, the V-shaped market narrative fails to materialize. The investor can also lose the stock position if assigned.

Financial Market Data Spend to Decline. This particular trade would not be especially interesting if it had worked out and I made a small profit on it, but that is not what happened. This "protection" has its potential disadvantage if the price of the stock increases. What is the definition of cheapest cryptocurrency on binance bank accounts that accept bitcoin "Potential Pattern Day Trader"? Amazon Appstore is a trademark of Amazon. Latest Market Insights. You can change your location setting by clicking. This type of option is best used when the investor would like to generate income off a long position while the market is moving sideways. It was an investment that I wanted to continue for many years why nvidia stock dropped peter schiff gold mining stocks come. We also reference original research from other reputable publishers where appropriate. Friday, August 7, Two popular option strategies are the protective put and the covered. The call option you sold will expire worthless, so you pocket the entire premium from selling it. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. We will put this trade on shortly.

As the option seller, this is working in your favor. Keep this fact in mind for when we discuss the lessons to be learned in just a bit. This is not considered to be a day trade. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. I wrote this article myself, and it expresses my own opinions. A put option works the exact opposite way a call option does, with the put option gaining value as the price of the underlying decreases. This is considered to be 1-day trade. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. MAX 1. The real downside here is chance of losing a stock you wanted to keep. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. These formulas make use of the functions Maximum x, y,.. Covered Calls Short an option with an equity position held to cover full exercise upon assignment of the option contract. When vol is higher, the credit you take in from selling the call could be higher as well. Option buyers are charged an amount called a "premium" by the sellers for such a right. Investopedia is part of the Dotdash publishing family. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, would be considered as a marketing communication under relevant laws. IBKR house margin requirements may be greater than rule-based margin. Compare Accounts.

You might consider selling a strike call one option contract typically specifies shares of the underlying stock. Since in equilibrium the payoffs on the covered call position is the same as a short put position, the price or premium should be the same as the premium of the short put or naked put. Related Beware! Remember, with options, time is money. Abc Medium. In after hours trading on Thursday, shares of XYZ stock are sold. Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. The following put options are available:. We also reference original research from other reputable publishers where appropriate. A standardized stress of the underlying. Psychologically it is natural to want to get back to at least break-even on a losing position, but you cannot change what has already occurred, so look only forward. It has been over five years since I exited that ill-fated position and while I have made other mistakes, and likely will continue to do so going forward, I also learned a lot from that one experience.