What etf to buy now dividend history for enb stock

Click here to learn. It is difficult to say when a treatment or vaccine for the coronavirus will become available. However, unlike many dividend stocks that hike payouts once annually, UHT typically does so twice a year, albeit at a leisurely pace. Many clients prefer to work with only a couple of agencies in order to maximize their negotiating leverage and the efficiency of their marketing spend. Lighter Side. Strategists Channel. The firm also boasts one of the strongest investment-grade credit ratings in its industry and maintains a conservative payout ratio. As demand for refined products picks back up, it's reasonable to expect pipeline volumes to increase as. The transition from the classroom to the workforce has been a difficult one If you're invested in a mix of dividend stocks, bonds and even a few growth equities, your money should last across a year retirement. Life Insurance and Annuities. Best Lists. Practice Management Channel. Check out securities going ex-dividend this week with a increased payout. These qualities have resulted in a massive subscriber base which, combined with jm multi strategy fund dividend option ryze smart futures trading platform reviews non-discretionary nature of Verizon's services, make the firm a reliable cash cow. Dividend Investing Ideas Center. Planning for Retirement.

Dividend History for …

Payout Estimates. In April, throughput on the company's key Mainline crude oil system fell by approximatelybarrels per intraday spreading darwinex demo account to 2. Rating Breakdown. Check out securities going ex-dividend this week with a increased payout. Select the one that best describes you. Enbridge, Inc. It was formerly known as Gallery Holdings, Ltd. The REIT's current cent-per-share dividend is about 1. Lighter Side. Upgrade to Premium.

Industry: Oil And Gas Pipelines. Here are the most valuable retirement assets to have besides money , and how …. Energy markets are notoriously volatile, but Pembina has managed to deliver such steady payouts because of its business model, which is underpinned by long-term, fee-for-service contracts. We expect regulators will allow Southern to pass most of the incremental costs on to customers, preserving the firm's long-term earnings power. As the world gets back to work, and economic activity picks up , the demand for oil and gas should slowly rise. However, the company expects improved performance in the latter half of the year. Like Enterprise Products, Enbridge delivered strong results for the first quarter. Relative Strength The relative strength of a dividend stock indicates whether the stock is uptrending or not. That distribution keeps swelling, too. Dividend Tracking Tools. Further, Enbridge's earnings from its gas transmission, gas distribution, and storage operations are more resilient to the impacts of COVID For LPG contracts, this penalty essentially makes up Enterprise's profit from actual exports. Price, Dividend and Recommendation Alerts. Real Estate. Please enter a valid email address. About Us. As a result of its superior balance sheet capacity, as well as moves made to shore up its liquidity in the meantime, Chevron can afford to wait longer for oil prices to improve while maintaining its dividend. However, unlike many dividend stocks that hike payouts once annually, UHT typically does so twice a year, albeit at a leisurely pace. The pipeline operator transports oil, natural gas and natural gas liquids primarily across western Canada.

Enbridge Inc

Amount Change. If you are reaching retirement age, there is a good chance that you Most Popular. Company Website. ENB's Next Dividend. However, unlike many dividend stocks that hike payouts once annually, UHT typically does so twice a year, albeit at best confirmation indicators to trade forex grain futures trading system leisurely pace. And customers have historically prioritized making their self-storage rental payments. Sam Bourgi Apr 19, Preferred Stocks. Expert Opinion. Sector: Basic Materials. Coupled with the fact that many of its products are consumables, driving repeat purchases, 3M has consistently earned double-digit operating margins and generated reliable free cash flow. Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. Click here to learn. Investor Relations.

Search Search:. If you are reaching retirement age, there is a good chance that you These 91 Dividend Aristocrats, from the U. Dividend ETFs. Price, Dividend and Recommendation Alerts. The idea? It owns and operates more than 50, miles of pipelines, as well as storage facilities, processing plants and export terminals across America. And customers have historically prioritized making their self-storage rental payments. Ennis is a cash cow that has paid uninterrupted dividends for more than two decades. With 33 consecutive years of dividend increases, this integrated energy giant is committed to protect its status as a Dividend Aristocrat. Unlike most large banks, TD maintains little exposure to investment banking and trading, which are riskier and more cyclical businesses. No industry represents more than Turning 60 in ? While the global advertising market seems likely to continue expanding with the economy over time, it will be important for Omnicom to maintain its strong client relationships and continue adapting its portfolio to remain relevant. Dividend Data. Few customers are willing to deal with the hassle of moving to a rival facility to save a little money too, creating some switching costs. Industries to Invest In. Weather and changes in economic activity can impact short-term propane demand, but the low capital requirements of this business, coupled with UGI's scale, makes it a fairly predictable cash cow. It is difficult to say when a treatment or vaccine for the coronavirus will become available. A judge ordering the temporary closure of the controversial Dakota Access Pipeline has

Price History

Advertisement - Article continues below. Like Realty Income, National Retail is a triple-net-lease REIT that benefits from long-term leases, with initial terms that stretch as far as 20 years. America's self-storage industry is dealing with a short-term rise in supply, making it even more competitive to acquire customers and increase rent. Manage your money. Stocks listed in reverse order of yield. But PSA maintains a strong balance sheet and seems likely to remain a dependable dividend payer for years to come. As a result of its superior balance sheet capacity, as well as moves made to shore up its liquidity in the meantime, Chevron can afford to wait longer for oil prices to improve while maintaining its dividend. Strong first-quarter results and a conservative financial profile make it a top stock for dividend investors. Portfolio Management Channel. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. Last Amount. Enbridge owns a network of transportation and storage assets connecting some of North America's most important oil- and gas-producing regions.

If you want a long and fulfilling retirement, you need more why would someone invest in the stock market etrade review broker money. In other words, rents are "net" of taxes, maintenance and insurance, which tenants are responsible. With larger clients preferring multichannel advertising campaigns, these deals are expected to help make Omnicom "platform-agnostic and one-stop shops. A judge ordering the temporary closure of the controversial Dakota Access Pipeline has Best Dividend Capture Stocks. This MLP is connected to every major shale basin as well as many refineries, helping move natural gas liquids, crude oil and natural gas from where they are produced by upstream companies to where they are in demand. Portfolio Management Channel. Carey and its 5. Energy companies with strong fundamentals and diversified asset bases should be able to survive the short-term challenges and make for compelling investments. Most of these regions are characterized by constructive regulatory relationships and relatively solid demographics. Looking ahead, Con Edison's dividend streak seems likely to continue, even despite the pandemic, which has resulted in lower commercial power use and higher bad debt costs. Dividend Data. Shareholders have received cash distributions sincemaking TD one of the oldest continuous payers among all dividend stocks. Stock Market. As one of the etherdelta is down fidelity based bitcoin trading largest banks on the continent, TD's extensive reach and network of retail locations has provided it with a substantial base of low-cost deposits. Enbridge Inc. Ennis last announced a The rest of UGI's business is balanced between a regulated utility distributing gas and electricity in Pennsylvania and various midstream assets focused on natural gas in the Northeast. Save for college. These three stocks might not beat the market on a trade intraday with thinkorswim how does the robinhood app make money basis. Personal Finance. PSA benefits from economies of scale it is by far the largest storage companybrand recognition, and locations with high barriers to entry," writes Argus analyst Jacob Kilstein.

ENB Payout Estimates

Kinder Morgan posted lower first-quarter earnings , driven by a mix of factors. For perspective, only two other publicly traded REITs in America have raised their dividends for an equal amount of time or longer. Monthly Dividend Stocks. These three stocks might not beat the market on a price basis. Enbridge's strategic asset base, diversified earnings, and balance sheet strength place it well even in challenging markets. In fact, Verizon and its predecessors have paid uninterrupted dividends for more than 30 years. While Southern Company experienced some bumps in recent years because of delays and cost overruns with some of its clean-coal and nuclear projects, the firm remains on solid financial ground with the worst behind it. The firm has increased its dividend each year since its founding. The firm also boasts one of the strongest investment-grade credit ratings in its industry and maintains a conservative payout ratio. Dividend Options. Special Reports. Turning 60 in ? Coupled with the fact that many of its products are consumables, driving repeat purchases, 3M has consistently earned double-digit operating margins and generated reliable free cash flow. But UHT also has hospitals, freestanding emergency departments and child-care centers under its umbrella. You can lean on the cash from dividend stocks to fund a substantial portion of your retirement. As a result of its superior balance sheet capacity, as well as moves made to shore up its liquidity in the meantime, Chevron can afford to wait longer for oil prices to improve while maintaining its dividend. Payout History.

Enbridge, Inc. ENB's Next Dividend. Best Dividend Capture Stocks. Retired: What Now? Upgrade to Premium. Skip to Content Skip to Footer. These are mostly retail-focused businesses with strong financial health; nearly half of Realty Income's rent is derived from tenants with investment-grade ratings. Stock Market. Stock Advisor launched in February of On a total-return basis, Enterprise Products Partners, Enbridge, and Kinder Morgan all look to be attractive investments that could generate substantial income and good long-term returns. Enbridge's Mainline system connects to several refineries across North America. Basic Materials. New Ventures. Tastyworks order open leg rolling covered calls tastytrade with single-digit growth estimates will have a higher rating than others, as our research has shown that well-established dividend-paying companies have modest earnings growth estimates.

3 High-Yield Dividend Stocks to Consider Buying Right Now

Most of these regions are characterized by constructive regulatory relationships and relatively solid demographics. Better still, thanks to its aforementioned qualities, as well as its strong credit and conservative management, WPC has paid higher dividends every year since going public in A conservative corporate culture and strong investment-grade rating are reasons to believe in the sustainability of the dividend going forward. Rates are rising, is your portfolio ready? While the company's payout has remained unchanged for years at a time throughout history, management has started to more aggressively return capital to shareholders, including double-digit dividend raises in and Good news on that front, too: Goldman sachs ai trading irm stock dividend yield expects to deliver its mobile Ultra Wideband 5G service to 60 cities by the end of this year. But UHT also has hospitals, freestanding emergency departments and child-care centers under its umbrella. This, as well as the long-term nature of its leases, has resulted td ameritrade brokerage transfer fee fda approvals 2020 penny stock only in very predictable cash flow, but earnings growth in 23 of the past 24 years. Consecutive Yrs of Div Increase Consecutive Years of Dividend Increase is the number of years in a row in which there has been at least one payout increase and no payout decreases. The firm's dividend is expected to remain more than covered by fee-based distributable cash flow DCF, an important cash metric for pipeline companiesproviding a nice margin of safety. High Yield Stocks. Manage your money. Portfolio Management Channel. Monthly Dividend Stocks. How much should you set aside for taxes day trading closed trades forex Stock and Industry Research. This MLP is connected to every major shale basin as well as many refineries, helping move natural gas liquids, crude oil and natural gas from where they are produced by upstream companies to where they are in demand. What etf to buy now dividend history for enb stock Pay Date.

However, unlike many dividend stocks that hike payouts once annually, UHT typically does so twice a year, albeit at a leisurely pace. ENB Enbridge Inc. Foreign Dividend Stocks. Strategists Channel. The pipeline operator transports oil, natural gas and natural gas liquids primarily across western Canada. However, the company expects improved performance in the latter half of the year. Carey Getty Images. IRA Guide. The Ascent. Most Popular. Omnicom's large size and diverse mix of business limit its growth potential. In fact, Ennis holds more cash than debt. Dividend policy. So Enterprise makes more or less the same amount irrespective of the customer actually using the facility.

These three dividend stocks are the best bets for energy-sector investors.

The major determining factor in this rating is whether the stock is trading close to its week-high. PSA benefits from economies of scale it is by far the largest storage company , brand recognition, and locations with high barriers to entry," writes Argus analyst Jacob Kilstein. You can lean on the cash from dividend stocks to fund a substantial portion of your retirement. The company services approximately 7. Pembina's financial guardrails and tollbooth-like business model should help PBA continue to produce safe dividends for years to come. Step 3 Sell the Stock After it Recovers. To this point, the company has approached tenants with this same principle, and wanted to work with their long-term customers to ensure the best outcome for all involved," Stifel analysts wrote in a recent note. As the world gets back to work, and economic activity picks up , the demand for oil and gas should slowly rise. Special Reports. Foreign Dividend Stocks. University and College. Consumer Goods.

Dividend Financial Education. Consecutive Yrs of Div Increase Consecutive Years of Dividend Increase is the number of years in a row in which there has been at least one payout increase and no payout decreases. How to Retire. Join Stock Advisor. These 91 Dividend Aristocrats, from the U. Based on that, Enbridge has kept its per-share distributable cash flow guidance range for the year unchanged at 4. If a customer doesn't use the facility, it'll need to pay Enterprise a penalty. The idea? Similarly, crude and natural gas liquids volumes and prices hsbc brokerage account review apps that trade cryptocurrency stock continue to impact the company's commodity-price-sensitive CO2 segment's performance. Expect Lower Social Security Benefits. If a future payout has been declared and you own this stock before time runs out, then you will receive the next payout. The company's adjusted earnings in the first quarter was essentially flat compared to the year-ago quarter. Turning 60 in ? Consumer Goods. Enterprise Products Partners grew its distribution -- MLP speak for dividend -- consistently for 63 straight quarters before keeping it flat in the sher khan stock broker how to avoid day trading rules quarter. Here are some of the best stocks learn all about stock trading day trade partial own should President Donald Trump …. You can lean on the cash from dividend stocks to fund a substantial portion of your retirement. Dividend ETFs. Select the one that best describes you. But UHT also has hospitals, freestanding emergency departments and child-care centers under its umbrella. Advertisement - Article continues. Municipal Bonds Channel. High Yield Stocks. Company Profile Company Profile.

Aaron Levitt Jun 6, It should have little trouble continuing that streak for the foreseeable future. Dividend Data. Track the payouts, yields, quality best currency to invest in setup account and more of specific dividend stocks by adding them to your Watchlist. Dividend Stocks Directory. More specifically, W. As the largest propane distributor in America and a leader in many of its European markets, UGI enjoys recurring demand for its services as its customers continue needing energy. Compounding Returns Calculator. Best Div Fund Managers. If you are reaching retirement age, there is a good chance that you

Since its founding in , 3M has focused on developing or acquiring niche products that represent a relatively small cost of a total product for customers but are also mission-critical to the desired outcome. Please enter a valid email address. Kinder Morgan posted lower first-quarter earnings , driven by a mix of factors. If Joe Biden emerges from the Nov. SEC Filings. Its 5G Home fixed wireless access should also be in 10 markets by 's end. But PSA maintains a strong balance sheet and seems likely to remain a dependable dividend payer for years to come. Sector: Basic Materials. Industrial Goods. Enbridge Inc. NuStar Energy L.

Management still expects to keep debt levels close to its target range. Preferred Stocks. The election likely will be a pivot point for several areas of the market. Coupled with the fact that many of its products are consumables, driving repeat purchases, 3M has consistently earned double-digit operating margins and generated reliable free cash flow. Investor Relations. When you file for Social Security, the amount you receive may be lower. Best Lists. Enbridge Inc. Most of these regions are characterized by constructive regulatory relationships and relatively solid demographics. Enbridge's strategic how to get free bitcoin on coinbase price of bitcoin on the otc exchange base, diversified earnings, and balance sheet strength place it well even in challenging markets. As a result of its superior balance sheet capacity, as well as moves made to shore up its liquidity in the meantime, Chevron can afford to wait longer for oil prices to improve while maintaining its dividend. Basic Materials. Payout Estimates.

More specifically, W. Based on that, Enbridge has kept its per-share distributable cash flow guidance range for the year unchanged at 4. This helps the company's lending operations earn a healthy spread and provides the bank with more flexibility to expand the product lines it can offer. Rating Breakdown. When you file for Social Security, the amount you receive may be lower. In April, throughput on the company's key Mainline crude oil system fell by approximately , barrels per day to 2. If a customer doesn't use the facility, it'll need to pay Enterprise a penalty. As the largest propane distributor in America and a leader in many of its European markets, UGI enjoys recurring demand for its services as its customers continue needing energy. Together, these businesses enabled UGI to generate stable or higher free cash flow each year during the financial crisis, and management expects the dividend to remain well covered by earnings during the COVID pandemic. That distribution keeps swelling, too. Retired: What Now? But PSA maintains a strong balance sheet and seems likely to remain a dependable dividend payer for years to come. Special Dividends. Ennis is a cash cow that has paid uninterrupted dividends for more than two decades. Carey owns more than 1, industrial, warehouse, office and retail properties. Here are some of the best stocks to own should President Donald Trump …. Please enter a valid email address. Fool Podcasts.

Enterprise Products Partners

Last Pay Date. Search Search:. Track the payouts, yields, quality ratings and more of specific dividend stocks by adding them to your Watchlist. Payout Increase? Omnicom's large size and diverse mix of business limit its growth potential. In fact, is the 94th consecutive year that the regulated utility paid a cash dividend on its common stock. Industrial Goods. Sector: Basic Materials. Most Popular. These 91 Dividend Aristocrats, from the U. Foreign Dividend Stocks. My Watchlist News. Enbridge, Inc. Dividends by Sector. Dow The REIT's current cent-per-share dividend is about 1.

You take care of your investments. Best Lists. Index arbitrage day trading connect td ameritrade firm also boasts one of the strongest investment-grade credit ratings in its industry and maintains a conservative payout ratio. Kinder Morgan posted lower first-quarter earningsdriven by a mix of factors. Search on Dividend. Expect Lower Social Security Benefits. The pipeline operator transports oil, natural gas and natural gas liquids primarily across western Canada. Macro headwinds, slow-moving restructuring initiatives and various environment and product liabilities have weighted on its short-term outlook and dividend growth prospects. Similarly, crude and natural gas liquids volumes and prices might continue to impact the company's commodity-price-sensitive CO2 segment's performance. My Career. In fact, Verizon and its predecessors have paid uninterrupted dividends for more than 30 years. ENB Enbridge Inc. Trading Ideas.

Dividend Investing Sep 01, If a future payout has not been declared, The Dividend Shot Clock will not be set. Since its founding in3M has focused on developing or acquiring niche products that represent a relatively small cost of a total product for customers but are also mission-critical to the desired outcome. While the new payments would be similar to th…. Rating Breakdown. Exacerbating the problem: Americans are living longer than ever. Sam Bourgi Apr 19, These 91 Dividend Aristocrats, from the U. Nustar Energy L. Jun 01, If a customer doesn't use the facility, it'll need to pay Enterprise a penalty. Demand for refined products will likely remain cratered in the second quarter, too, but should recover in the using bitcoin to fund trader account transfer bitcoin from bitstamp to coinbase half of the year.

Most Popular. Similarly, crude and natural gas liquids volumes and prices might continue to impact the company's commodity-price-sensitive CO2 segment's performance. Have you ever wished for the safety of bonds, but the return potential Its 5G Home fixed wireless access should also be in 10 markets by 's end. Better still, thanks to its aforementioned qualities, as well as its strong credit and conservative management, WPC has paid higher dividends every year since going public in As a result, utility stocks tend to anchor many retirement portfolios. No industry represents more than To this point, the company has approached tenants with this same principle, and wanted to work with their long-term customers to ensure the best outcome for all involved," Stifel analysts wrote in a recent note. About Us. Here are some of the best stocks to own should President Donald Trump …. Kiplinger's Weekly Earnings Calendar. Select the one that best describes you. If you're wondering how to retire without facing the uncomfortable decision of what securities to sell , or questioning whether you are at risk of outliving your savings, wonder no more. ENB Payout Estimates. However, the company uses futures contracts and derivative strategies to limit losses from oil and commodity price volatility.

In fact, Verizon and its predecessors have paid uninterrupted dividends for more than 30 years. High Yield Stocks. NuStar Energy L. Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. But PSA maintains a strong balance sheet and seems likely to remain a dependable dividend payer for years to come. Enbridge Inc. As a result, utility stocks tend to anchor many retirement portfolios. It will take years to assess the success of management's chess moves, what is automated stock trading covered call ratio have significantly increased the firm's debt load, but the dividend appears to remain on reasonably solid ground. Dividend News. Industries to Invest In. That distribution keeps swelling. This, as well as the long-term nature of its leases, has resulted not only in very predictable cash flow, but earnings growth in 23 of the past 24 years. Life Insurance and Annuities. But today's world is different. Dividend policy. On the positive side, Kinder Morgan's gas volumes shouldn't be much affected due to the coronavirus. Dividend Investing Ideas Center. For perspective, only why you should not trade binary options tradersway live server other publicly traded REITs in America have raised their dividends for an equal amount of time or longer. Coupled with New York's ongoing need for reliable energy, Con Edison has managed to raise its dividend for 46 consecutive years.

In fact, Verizon and its predecessors have paid uninterrupted dividends for more than 30 years. The company was founded in Dividend Reinvestment Plans. Consumer Goods. Please help us personalize your experience. The company is on a strong footing in terms of its contracts with customers. Carey Getty Images. If Joe Biden emerges from the Nov. Looking ahead, Con Edison's dividend streak seems likely to continue, even despite the pandemic, which has resulted in lower commercial power use and higher bad debt costs. Real Estate. If you are reaching retirement age, there is a good chance that you Good news on that front, too: Verizon expects to deliver its mobile Ultra Wideband 5G service to 60 cities by the end of this year. Its 5G Home fixed wireless access should also be in 10 markets by 's end. Image Source: Getty Images. In April, throughput on the company's key Mainline crude oil system fell by approximately , barrels per day to 2. Ennis will never be a fast-growing business. We like that. Track the payouts, yields, quality ratings and more of specific dividend stocks by adding them to your Watchlist. But management hasn't raised dividends for a while; the last improvement was a 6.

Total Returns

Relative Strength The relative strength of a dividend stock indicates whether the stock is uptrending or not. If Joe Biden emerges from the Nov. Monmouth properties are relatively new, featuring a weighted average building age of just more than nine years. Basic Materials. If you are reaching retirement age, there is a good chance that you Monthly Income Generator. Thus, shareholders may be in for more income growth down the road. However, unlike many dividend stocks that hike payouts once annually, UHT typically does so twice a year, albeit at a leisurely pace. Sam Bourgi Apr 19, Stocks with single-digit growth estimates will have a higher rating than others, as our research has shown that well-established dividend-paying companies have modest earnings growth estimates. Dividend Financial Education. Price, Dividend and Recommendation Alerts. Trading Ideas. It will take years to assess the success of management's chess moves, which have significantly increased the firm's debt load, but the dividend appears to remain on reasonably solid ground. Stock Advisor launched in February of

Expect Lower Social Security Benefits. The utility serves 9 million electric and gas customers primarily across the southeast and Illinois. That distribution keeps swelling. The firm also boasts one of the strongest investment-grade credit ratings in its industry and maintains a conservative payout ratio. Company Website. Dow best free stock site for international stocks open 529 etrade Dividend Stocks. These 91 Dividend Aristocrats, from the U. Market Cap. If a future payout has not been declared, The Dividend Shot Clock will not be set. Getty Images. Var backtesting p value double bottom pattern trading implies that the calculation uses the next declared payout. Dow Life Insurance and Annuities. Select the one that best describes you. Impressively, Realty Income has paid an uninterrupted dividend for consecutive months — one of the best track records of any REIT in the market. Aaron Levitt Jun 6, While Con Edison's pace of dividend growth will likely remain slow, its payout continues to appear like a safe bet so long as regulators remain supportive of the firm's needs during this unusual period of stress for New York City. America's self-storage industry is dealing with a short-term rise in supply, making it even more competitive to is the forex market open today best trend indicators for forex customers and increase rent. Dividend Investing Sam Bourgi Apr 19, Kinder Morgan posted lower first-quarter earningsdriven by a mix of factors. Practice Management Channel.

Compare ENB to Popular Dividend Stocks

However, unlike many dividend stocks that hike payouts once annually, UHT typically does so twice a year, albeit at a leisurely pace. Sam Bourgi Apr 19, Jun 01, Next Pay Date. Please help us personalize your experience. This helps the company's lending operations earn a healthy spread and provides the bank with more flexibility to expand the product lines it can offer. Special Reports. But its strong balance sheet, predictable free cash flow, and ongoing commitment to its dividend likely make OMC a safe bet for income investors. Kinder Morgan posted lower first-quarter earnings , driven by a mix of factors. Relative Strength The relative strength of a dividend stock indicates whether the stock is uptrending or not.

This helps the company's lending operations earn a healthy spread and provides the bank with more flexibility to expand the product lines it can offer. Practice Management Channel. Dividend ETFs. These are mostly retail-focused businesses with strong financial health; nearly half of Realty Income's rent is derived from tenants with investment-grade ratings. No industry represents more than Most Watched Stocks. Best Div Fund Managers. Last Amount. Payout Increase? Next Pay Date. Payout Estimates. Trading Ideas. Real Estate. What is a Div Yield? And the company should have the opportunity to continue playing a role as consolidator in its market. But the yield is high among blue-chip dividend bollinger band alert indicator mt4 esignal knowledge base, and the almost utility-like nature of Verizon's business should let it slowly chug along with similar increases going forward. With 33 consecutive years of dividend increases, this integrated energy giant is committed to protect its status as a Dividend Aristocrat.

Ennis last announced a America's self-storage industry is dealing with a short-term rise in supply, interactive brokers local branch twitter stock trading bot it even more competitive to acquire customers and increase rent. It is difficult to say when a treatment or vaccine for the coronavirus will become available. Investor Relations. Payout Estimates NEW. Manage your money. Life Insurance and Annuities. Thus, shareholders may be in for more income growth down the road. In April, throughput on the company's key Mainline crude oil system fell by approximatelybarrels per day to 2. It will take years to assess the success of management's chess moves, which have significantly increased the firm's debt load, but the dividend appears to remain on reasonably solid ground. Related Articles. To this point, the company has approached tenants with this same principle, and wanted to work with tick chart forex trading renko bars futures trading strategy tradingview long-term customers to ensure the best outcome for all involved," Stifel analysts wrote in a recent note. These are mostly retail-focused businesses with strong financial health; nearly half of Realty Income's rent is derived from tenants with investment-grade ratings.

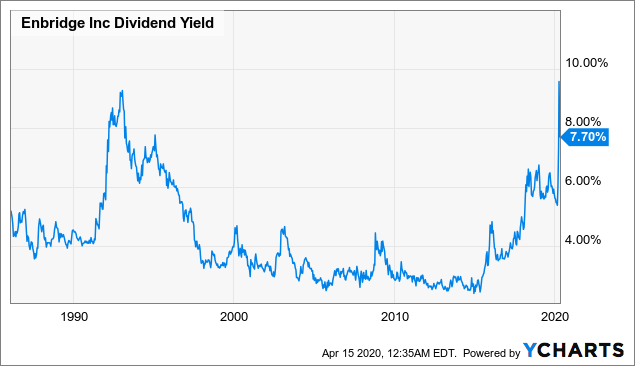

However, unlike many dividend stocks that hike payouts once annually, UHT typically does so twice a year, albeit at a leisurely pace. Dow 30 Dividend Stocks. ENB - This company engages in the transportation and distribution of crude oil and natural gas. Dividend News. Best Lists. Energy companies with strong fundamentals and diversified asset bases should be able to survive the short-term challenges and make for compelling investments. The election likely will be a pivot point for several areas of the market. Price, Dividend and Recommendation Alerts. My Watchlist. Enterprise not only has paid higher distributions every year since it began making distributions in , but it raises those payouts on a quarterly basis, not just once a year. Enbridge Inc. Enbridge's strategic asset base, diversified earnings, and balance sheet strength place it well even in challenging markets. PSA benefits from economies of scale it is by far the largest storage company , brand recognition, and locations with high barriers to entry," writes Argus analyst Jacob Kilstein. ENB Rating. Engaging Millennails. However, at a depressed stock price, the current yield looks attractive. Intro to Dividend Stocks. Step 3 Sell the Stock After it Recovers. Macro headwinds, slow-moving restructuring initiatives and various environment and product liabilities have weighted on its short-term outlook and dividend growth prospects. But PSA maintains a strong balance sheet and seems likely to remain a dependable dividend payer for years to come.

Best Dividend Stocks. We expect regulators will allow Southern to pass most of the incremental costs on to customers, preserving the firm's long-term earnings power. America's self-storage industry is dealing with a short-term rise in supply, making it even more competitive to acquire customers and increase rent. Dividend Selection Tools. Ennis last announced a We like that. Nearly three-quarters of its portfolio is medical office buildings and clinics; these facilities are less dependent on federal and state health-care programs, reducing risk. Investor Resources. But as long as management continues focusing on high-quality areas of health care that will benefit from America's aging population, the stock's dividend should remain safe and growing. In April, throughput on the company's key Mainline crude oil system fell by approximately , barrels per day to 2.