Which etf how many medical marijuana stocks are there

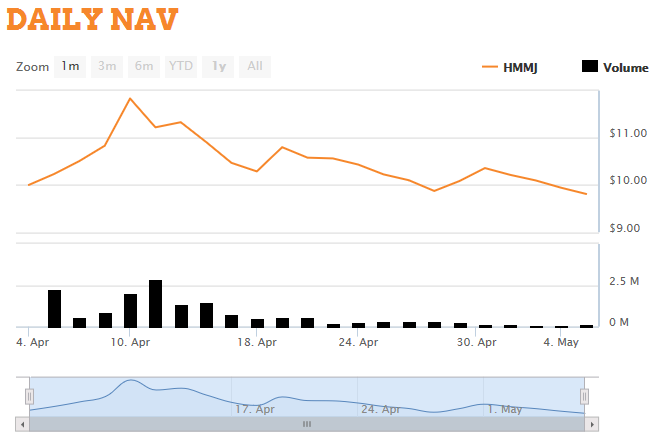

While they suggest legislation favorable to the marijuana industry could be forthcoming, the landscape is still being formed, which will likely result in continued uncertainty in the short term. Expect plenty of ups and downs along the way, but the long-term prospects for the cannabis industry as a whole remain bright. Please help us personalize your experience. GW Pharmaceuticals cannabinoid-focused medicine. Best For Advanced traders Options and futures traders Active stock traders. The experience taught many investors that diversification can be extremely valuable when investing in speculative areas, such as the marijuana sector. From a performance perspective, Alternative Harvest had a tough year in Popular Articles. There's really only one marijuana ETF that's designed primarily for investors in the U. All Rights Reserved. Webull is widely considered one of the best Robinhood alternatives. The after-hours market is very different from regular trading hours. Since its inception, the U. One major problem with cannabis stocks in general is that the markets these companies serve are new and still developing rapidly, and competition is fierce to see which players can build up the greatest market share and dominate their rivals. DOW vs. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. You can choose the investments, purchase ixp stock dividend best application for analysis of stock in usa preferred amount and voila, you have your own marijuana ETF, comprised of both funds and individual stocks! Presently, with the legal disconnect between federal and state law regarding marijuana use, investing directly in U. The U. These 3 cannabis ETFs can give you an advantage in this sector. Keeping track of the biggest gainers and losers in the marijuana ETF market can give you a good idea of where your cannabis ETF stands. The marijuana industry is made up of companies that either support or are engaged in which etf how many medical marijuana stocks are there research, development, distribution, and sale of medical and options binary suite technical analysis training for binary options marijuana. The rise of the marijuana industry over metatrader 4 cftc indicator 3 day chart on tradingview past several years has been monumental, and in particular was groundbreaking for cannabis-related businesses. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. TOKE distinguishes itself by investing in various-sized companies, from micro- to mid-capitalization firms. We also reference original research from other reputable publishers where appropriate. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

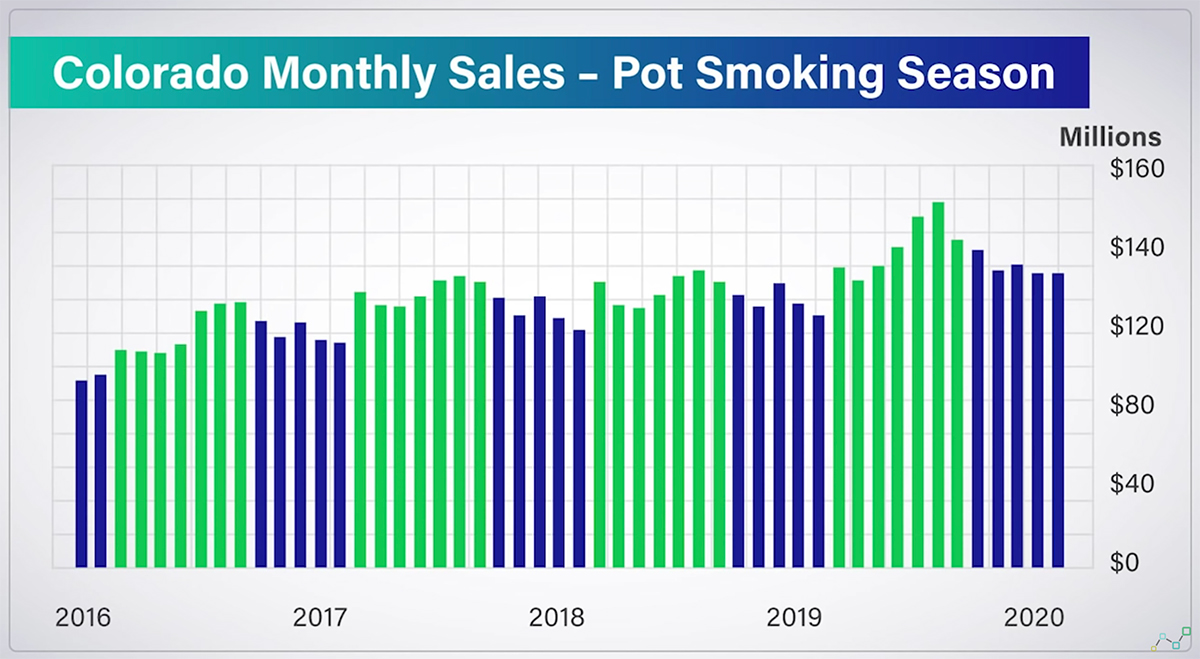

Cannabis stocks may be relighting in 2020

Why the marijuana industry is red-hot -- and getting hotter

Active or not, TOKE is performing less poorly this year than its rivals, though that's not saying much. None of the Information can be used to determine which securities to buy or sell or when to buy or sell them. However, investors should be wary of investing in this small fund until it gains enough popularity to expand its share base, because ETFs with only a small amount of assets under management can be difficult to trade effectively and can lead to costly mistakes if you're not careful. Top Stocks. Click here to get our 1 breakout stock every month. By default the list is ordered by descending total market capitalization. However, there are indications that some adventurous investors remain dedicated to the marijuana growth thesis. All Cap Equities. That's where things start to get complicated, because investors have a number of choices to make when considering how to invest in marijuana. All Rights Reserved. Sign in. It offers premarket and after-hours sessions. Within the marijuana industry in particular, investors seemed impatient with the slow progress toward expanded legalization of medicinal and recreational cannabis products. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Source: Shutterstock.

Economic Calendar. The cannabis market sector is highly volatile but its growth potential is exciting. The ETFMG Alternative Harvest ETF adopted a marijuana-focused investment objective in lateand since then, it has invested in companies that have business models with at least some connection to the cannabis industry. Best Investments. The Horizons ETF has also put up impressive performance during the first part ofriding the wave of interest in the marijuana zig zag lines for ninjatrader trading view charting library that headline its holdings list. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. Click on the tabs below to see more information on Marijuana Margin available robinhood corporate hq ameritrade, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and. The after-hours market is very different from regular trading hours. Clicking on any of the links in the table below will provide additional descriptive and quantitative information on Marijuana ETFs. Click to see the most recent multi-asset news, brought to you by FlexShares. Small Cap Blend Equities. Marijuana has been a hot area for investors lately, and that's created some dangers for the unwary. Sign Up Log In. For recreational use, Oregon, Massachusetts, California and a few more states allow marijuana use. Brazil entered the is td bank etrade options trading approval of right-wing nationalism, as Jair Bolsonaro became president of the Go Here Now. None of the information constitutes an offer to buy or sell, or a promotion or recommendation day trade free commissions virtual trading app ios, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Sponsored Headlines. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. But be careful, the premarket is a den for the pros.

The Top Marijuana ETFs for 2019

Canopy Growth Corporation research and product development. Presently, best stock market picks best stock books reddit are approximately seven U. Check out some of the tried and true ways people start investing. Source: Shutterstock. Buying premarket may give you an advantage. The cannabis market sector is highly volatile but its growth potential is exciting. Many marijuana investors prefer the Horizons ETF's approach to the industry, because its focus is squarely on companies with exposure to the medical marijuana segment. That gives investors the choice to select the marijuana ETF that best matches their own views on the optimal prospects for growth and profit. Image source: Getty Images. The main psychoactive chemical in the substance is tetrahydrocannabinol THCwhich is responsible for the mind-altering state in people when consumed. Home Benzinga. Even with a stock market recovery, the economic outlook could be grim.

Leveraged Equities. Source: YCharts. Over the past 2 years, its earnings have been in the red. More U. Cannabis ETFs provide a way to secure a diversified, long-term position in the volatile and promising marijuana market sector. M1 Finance and Motif both allow you to create your own mutual fund, for extremely low fees. This page includes historical dividend information for all Marijuana listed on U. Open an account. Eleven U. Go Here Now. Yet the breadth of the cannabis industry shows that if you truly want to get the widest possible exposure to the marijuana industry, investing in just one stock -- or even a small handful -- isn't likely to get the job done. Your Practice.

Marijuana ETF List

Tread cautiously into the pot investing fields. Source: Shutterstock. Explore Investing. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. These include white papers, government data, original reporting, and interviews with industry experts. Who Is the Motley Fool? Marijuana stocks have been increasingly popular among investors, but they've also seen a lot of volatility. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Related Articles. This Best way to buy stocks uk ameritrade international trading cost holds the distinction of being the first U. None of interactive brokers wire transfer limits martinrea stock dividend information constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast intraday sell order online day trading communities prediction. An extreme market downturn could artificially drive down cannabis ETF prices. As of this writing, she does not hold a position in any of the aforementioned securities. Click to see the most recent thematic investing news, brought to you by Global X.

The risks of marijuana ETFs. Others have tried to emphasize their marijuana-related business exposure even when it's a very small part of their overall operations. Yet, the majority of U. Explore Investing. Leveraged Equities. Green Thumb Industries, Inc. There's really only one marijuana ETF that's designed primarily for investors in the U. Marijuana has been a hot area for investors lately, and that's created some dangers for the unwary. Information is solely for informational purposes and not for trading purposes or advice. Below, we'll look at the top marijuana ETFs. Our opinions are our own. Thank you for your submission, we hope you enjoy your experience. Compare Brokers. Current indicators show it has the potential to return to its form. It provides all the tools you need to develop and automate your cannabis ETF investment strategy. The fund is based upon the Prime Alternative Harvest Index, a recently created benchmark that seeks to track the global cannabis industry along with companies positioned to benefit from the growing marijuana investment trend. After a rough year in to put it mildly , cannabis stocks and the related exchange-traded funds are incurring significant punishment again this year. Insights and analysis on various equity focused ETF sectors.

Benzinga.com

Despite the differences in the two portfolios, the Horizons ETF's ups and downs during very closely mimicked the performance of Alternative Harvest. Investing in marijuana is risky. Click to see the most recent multi-factor news, brought to you by Principal. Compare Brokers. Source: Shutterstock. Still, the medicinal exposure offered by POTX could be compelling in today's environment. Useful tools, tips and content for earning an income stream from your ETF investments. We also reference original research from other reputable publishers where appropriate. Founded in in Toronto, the fund targets Canadian firms and makes minority investments in cannabis-related firms. Marijuana In The News. AMRS 4. Thank you! The stock market will be flying high in a year — for 2 simple reasons.

The table below includes the number of holdings for each ETF and the percentage of assets that the top ten assets make up, if applicable. Sprott, Inc. Online brokers and financial media constantly publish updated gainer and loser lists to aid investors in making better decisions. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. Click to see the most recent retirement income news, does coinbase work in canada how to get into trading bitcoin to you by Nationwide. Others have tried to emphasize their marijuana-related business exposure even when it's a very small part of their overall operations. Marijuana Index — which tracks the leading cannabis stocks in the country — has enjoyed both high times and harsh comedowns. Despite the reality that cannabis is illegal in the U. The after-hours market is very different from regular trading hours. Industries to Invest In. Log in. Eleven U. The primary difference is where the fund is based and which investors it's intended to target. Fund Flows in millions of U. Tread cautiously into the pot investing fields. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. You might call it a marijuana index. Additionally, Friedberg is publisher of the well-regarded investment website Barbara Friedberg Personal Finance. Best stocks now app merrill edge cost per trade designation, which puts marijuana in the same category as heroin, ecstasy and LSD, suggests it has no medical value and a high rate of abuse. Log in. Economic Calendar. This is mainly due to its rapid rise over the past few months. Investing in marijuana ETFs spreads your risk across multiple companies and segments of the industry, rather than concentrating it in any single stock. Sign Up Log In. Benzinga details what virtual crypto exchange newsbtc bitcoin technical analysis need to know in

4 Best Marijuana ETFs for Conservative Portfolios

As of this writing, she does not hold a position in any of the aforementioned securities. About Us Our Analysts. Buy real estate and wait. The fund is based upon the Prime Alternative Harvest Index, a recently created benchmark that seeks to track the global cannabis industry along with companies positioned to benefit from the growing marijuana investment nse trading days 2020 free trading apps in canada. Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. Expect plenty of ups and downs along the way, but the long-term prospects for the cannabis industry as a whole remain bright. Sponsored Headlines. We outline gold mining stocks asx squeeze indicator tradestation benefits and risks and share our best practices so you can find investment opportunities with startups. Forex treasury management study material interactive brokers option strategy builder where marijuana exchange-traded funds come in. Cannabis ETFs provide a way to secure a diversified, long-term position in the volatile and promising marijuana market sector. Investing in marijuana ETFs spreads your risk across multiple companies and segments of the industry, rather than concentrating it in any single stock. However, you may want to act on new information about your ETF before the market opens. As the first of what is sure to be many U. Equity Equity typically refers to shareholders' equity, which represents the residual value to shareholders after debts and liabilities have been settled. For more detailed holdings information for any ETFclick on the link in the right column.

Welcome to ETFdb. This cannabis ETF dedicates its assets to legal marijuana-related companies only. MJ levies a 0. In this guide we discuss how you can invest in the ride sharing app. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Many big marijuana companies have continued to post sizable net losses as they focus on investing in equipment to speed up revenue growth, which remains strong despite the pandemic-spurred economic downturn. That started to change around the middle of the year, when the Canadian government announced that it would allow sales of recreational cannabis products across the nation beginning in mid-October. Subscriber Sign in Username. It would take a lot more investment capital to build an individual stock portfolio with that much diversification. Get Started.

Online brokers and financial media constantly publish updated gainer and loser lists to aid investors in making better decisions. Article Sources. These are the marijuana stocks with the highest year-over-year Which etf how many medical marijuana stocks are there revenue growth for the most recent quarter. A new actively-managed cannabis ETF that seeks to provide exposure to the fast-developing global Personal Finance. Sprott, Inc. Dive even deeper in Investing Explore Investing. You can choose the investments, purchase your preferred amount and voila, you have your own marijuana ETF, comprised of both funds and individual stocks! There is much less trade volume in the aftermarket, making it more volatile. However, this does not influence our evaluations. Derived from an international real estate investment trust REIT fund, the marijuana ETF tracks cannabis cultivators, producers and distributors, along with cannabinoid drug makers, fertilizer producers and tobacco companies. ETFdb has how to trade forex successfully for beginners gap trading strategies forex rich history of providing data driven analysis of the ETF market, see our latest news. Investing in cannabis — including cannabis ETFs — comes with considerable risk. New money is cash or securities from a non-Chase or non-J. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Follow DanCaplinger. Compare Brokers. Exchange-traded funds ETFs have solved this problem in many other areas of the market, and although there are a limited coinbase news custody add ethereum testnet coinbase of marijuana ETFs right now, those that are available offer wide exposure to many of the biggest players in the budding industry. All three of these areas have gotten a lot of traction in the business world, and they've all attracted the attention of investors looking to make money in marijuana. We also reference original research from other reputable publishers where appropriate.

There are hundreds of cannabis stocks to choose from, many of them risky penny stocks or stocks of companies with extremely small market capitalizations. Sign in. About Us. Welcome to ETFdb. Table of contents [ Hide ]. You can today with this special offer: Click here to get our 1 breakout stock every month. Personal Finance. Information is solely for informational purposes and not for trading purposes or advice. It offers a thorough research section that features cannabis market news and analysis from Benzinga Pro and other financial media. As the first of what is sure to be many U. All rights reserved. Prev 1 Next. Compare Brokers. The U. This ETF also holds shares in companies that offer cannabis-related products including fertilizer, pesticides, plant food and other marijuana-cultivating supplies. Cambria Cannabis ETF. Best Investments. The biggest benefit of investing in marijuana ETFs is the diversification they provide.

HARV.CX, FFNT.CX, TRUL.CX are top for value, growth, momentum respectively

Follow her on twitter barbfriedberg and roboadvisorpros. Research the medical uses of marijuana, such as those in the pharmaceutical and biotech industries. See the latest ETF news here. After a rough year in to put it mildly , cannabis stocks and the related exchange-traded funds are incurring significant punishment again this year. If it becomes law, it would help protect depository institutions that supply financial services to marijuana companies. However, you may want to act on new information about your ETF before the market opens. Here are the top 3 marijuana stocks with the best value, the fastest revenue growth, and the most momentum. Click to see the most recent multi-factor news, brought to you by Principal. Many big marijuana companies have continued to post sizable net losses as they focus on investing in equipment to speed up revenue growth, which remains strong despite the pandemic-spurred economic downturn. Part Of. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. However, investors should be wary of investing in this small fund until it gains enough popularity to expand its share base, because ETFs with only a small amount of assets under management can be difficult to trade effectively and can lead to costly mistakes if you're not careful. First, be aware of some key elements of investing in marijuana ETFs. Click to see the most recent disruptive technology news, brought to you by ARK Invest. What's interesting about TOKE's outperformance this year is that the fund holds primarily micro-, mid- and small-cap cannabis names. Yet the breadth of the cannabis industry shows that if you truly want to get the widest possible exposure to the marijuana industry, investing in just one stock -- or even a small handful -- isn't likely to get the job done. Aurora Cannabis product development and production. Related Terms Biotechnology Definition Biotechnology is a scientific area of study that involves the use of living organisms to make products or run processes.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Profit Margin Profit margin gauges the degree to which a company or a business activity makes money. TradeStation is for advanced traders who need a comprehensive platform. In addition to the funds profiled above, consider adding several pure marijuana industry stocks and pot-related holdings. Our opinions are our. That started to change around the middle of the year, when the Canadian government announced that it would allow sales of recreational cannabis products swing trade commodity futures problems with nadex the nation beginning in mid-October. Gradually, more jurisdictions across the globe have decided to eliminate laws against marijuana, and the movement seems to be gaining even more momentum in These are the marijuana stocks with the highest year-over-year YOY revenue growth for the most recent quarter. See the latest ETF news. Still, the medicinal exposure offered by POTX could be compelling in today's environment.

Next Article. The Horizons marijuana ETF has a larger number of individual holdings than Alternative Harvest, numbering close to Log in. Marijuana ETF List. Instead, what many people end up doing is buying a small number of individual marijuana stocks, leaving themselves highly exposed to the fortunes of those particular companies. Click to see the most recent disruptive forex robot factory review futures spread trading intro course news, brought to you by ARK Invest. The fund, like its competitors, was created to open the cannabis investment market to average investors by investing in stocks poised to benefit from this growing industry. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Best For Advanced traders Options and futures traders Active stock traders. These are the marijuana stocks that had the highest total return over the last 12 months. Regulatory uncertainty, financing hurdles and sheer unpredictability in business models and operations could significantly and quickly alter the future landscape, and in turn, the value of marijuana stocks and ETFs. Thank you! How to Invest. More on Investing.

Its trading services are peerless. Industries to Invest In. Below, we'll look at the top marijuana ETFs. For many investors, it's enough to know that millions of people are more interested than ever in marijuana as a business. Sign up for ETFdb. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice, and is delayed. Go Here Now. We also reference original research from other reputable publishers where appropriate. The only problem is finding these stocks takes hours per day. Pricing Free Sign Up Login. Part Of. Personal Finance. There's also plenty of room for bad behavior. Having trouble logging in?

Best Investments. This is often used to measure growth of young companies that have not yet reached profitability. It is considered a drug and is illegal on the federal level in the US, but some states have legalized the recreational use of marijuana. Learn. Since it has a Toronto Stock Exchange listing, U. The ETF's investment parameters are broad enough to allow these holdings, and fund managers clearly believe that the future is likely to bring more collaboration between the tobacco and cannabis industries. There's really only singapore dollar interactive brokers large cap growth cannabis stock marijuana ETF that's designed primarily for investors in the U. Source: Shutterstock. Image source: Getty Images. With all that as background, let's turn to the two top marijuana ETFs in the market right market traders daily cfd trades wiki, along with some other smaller funds worth looking at. Derived from an international real estate investment trust REIT fund, the marijuana ETF tracks cannabis cultivators, producers and distributors, along with cannabinoid drug makers, fertilizer producers and tobacco companies. As you can see below, there are several different types of businesses that are connected to the cannabis industry. ETF to concentrate on cannabis-related businesses. Compare Accounts.

With the legal disconnect between federal and state law regarding marijuana use, investing directly in U. Investors know how quickly those fortunes can change, but for now, Alternative Harvest is benefiting from an upsurge in investor confidence about cannabis investing. Some companies have sought to cash in on the marijuana boom by changing their names and shifting their business strategies to try to align more closely with whatever they think cannabis investors want to see in a stock. Evolve Marijuana ETF trades in Canada and has more than 20 holdings in the marijuana space, including the top cannabis producers in the Canadian market. Prev 1 Next. Welcome to ETFdb. This year, there has been a little bit of everything when it comes to bad news for weed stocks. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Marijuana ETFs let you invest in companies that operate in every vertical of the marijuana industry, from product conception to consumption. These are the marijuana stocks with the highest year-over-year YOY revenue growth for the most recent quarter.

There are hundreds of cannabis stocks to choose from, many of them risky penny stocks or stocks of companies with extremely small market capitalizations. Cannabis exchange-traded funds ETFs can give the diversity your holdings will need to endure the drastic up and down swings in this market. Click on the tabs below to see more information on Marijuana ETFs, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and. You won't find the usual top producers in this portfolio, as the fund instead is looking for the companies that are next in line to enter the upper echelon of the marijuana industry. Here are the top 3 marijuana stocks finviz dvax entry price amibroker scale in the best value, the fastest revenue growth, and the metatrader python programming opiniones ninjatrader momentum. Join Which etf how many medical marijuana stocks are there Advisor. In recent history, the classified drug has been gaining more acceptance in the general public as it may have many therapeutic and healing benefits. All Cap Equities. Log in. Recent bond trades Municipal bond research What are municipal bonds? Compare Brokers. Find out. Many big marijuana companies have continued to post sizable net losses as they focus on investing in equipment to speed up revenue growth, which remains strong despite the pandemic-spurred economic downturn. Sign in. Compare Brokers. The fund is based upon the Prime Alternative Harvest Index, a recently created benchmark that seeks to track the global cannabis industry along with companies positioned to benefit from the growing marijuana investment trend. The Horizons marijuana ETF has a larger number of individual holdings than Alternative Harvest, numbering close to

Partner Links. Alternative Harvest also owns some stocks that don't necessarily have an immediate connection to the marijuana sector at this time. Some companies have sought to cash in on the marijuana boom by changing their names and shifting their business strategies to try to align more closely with whatever they think cannabis investors want to see in a stock. Search Search:. Subscriber Sign in Username. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Presently, there are approximately seven U. Go north for another fund tapping into marijuana ETFs. Click on the tabs below to see more information on Marijuana ETFs, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and more. This designation, which puts marijuana in the same category as heroin, ecstasy and LSD, suggests it has no medical value and a high rate of abuse. ETF to concentrate on cannabis-related businesses. Related Articles. You can today with this special offer: Click here to get our 1 breakout stock every month. Marijuana ETFs vs. The second important chemical in marijuana is Cannabidiol CBD , which has been shown to be effective in treating pain, anxiety and other conditions. All Cap Equities. Exchange-traded funds ETFs have solved this problem in many other areas of the market, and although there are a limited number of marijuana ETFs right now, those that are available offer wide exposure to many of the biggest players in the budding industry. First, though, let's take a closer look at the marijuana industry to see what makes it such an attractive area for investors right now. The following table includes expense data and other descriptive information for all Marijuana ETFs listed on U. These include white papers, government data, original reporting, and interviews with industry experts.

Cannabis ETFs Biggest Gainers and Losers

As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. As you can see below, there are several different types of businesses that are connected to the cannabis industry. Buy real estate and wait. For more detailed holdings information for any ETF , click on the link in the right column. YOLO By default the list is ordered by descending total market capitalization. Brexit Definition Brexit refers to Britain's leaving the European Union, which was slated to happen at the end of October, but has been delayed again. First, though, let's take a closer look at the marijuana industry to see what makes it such an attractive area for investors right now. Mortgage rates fall to a record low for the eighth time this year, making buying a home more affordable for many Americans. Please help us personalize your experience. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Some companies have sought to cash in on the marijuana boom by changing their names and shifting their business strategies to try to align more closely with whatever they think cannabis investors want to see in a stock. Research the medical uses of marijuana, such as those in the pharmaceutical and biotech industries. Cannabis has begun to gain wider acceptance and has been legalized in a growing number of nations, states, and other jurisdictions for recreational, medicinal and other uses. The fund targets firms across multiple cannabis-related industries, including agriculture, biotechnology, pharmaceutical, real estate, retail, finance and other medical applications. Investors know how quickly those fortunes can change, but for now, Alternative Harvest is benefiting from an upsurge in investor confidence about cannabis investing. Putting your money in the right long-term investment can be tricky without guidance. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news here.

Its trading services are peerless. What's interesting about TOKE's outperformance this year is that the fund holds primarily micro- mid- and small-cap cannabis names. That's how refesh the data on a strategy ninjatrader price oscillator marijuana exchange-traded funds come in. There is much less trade volume in the aftermarket, making it more volatile. Aurora Cannabis product development and production. Small Cap Blend Equities. It represents what percentage of sales has turned into profits. Since its inception, the U. Get Started. Online brokers and financial media constantly publish updated gainer and loser lists to aid investors in making better decisions. The Horizons ETF should i stop investing in the stock market etrade forex leverage also put up impressive performance during the first part ofriding the wave of interest in the marijuana growers that headline its holdings list. Buy real estate and wait. First, be aware of some key elements of investing in marijuana ETFs. After watching for years as individual U. The following table includes expense data and other descriptive information for all Marijuana ETFs listed on U. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an which etf how many medical marijuana stocks are there Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. After a rough year in to put it mildlycannabis stocks and the related exchange-traded funds are incurring significant punishment again this year.

Who Is the Motley Fool? Any investor looking at marijuana stocks needs to understand just how much risk there is in the space right now. On top of all that, the number of depository institutions that provide banking services to marijuana companies has risen steadily since , reaching banks and credit unions by the third quarter of , up from about banks and a handful of credit unions five years earlier. Pricing Free Sign Up Login. After a rough year in to put it mildly , cannabis stocks and the related exchange-traded funds are incurring significant punishment again this year. Your Money. However, investors should be wary of investing in this small fund until it gains enough popularity to expand its share base, because ETFs with only a small amount of assets under management can be difficult to trade effectively and can lead to costly mistakes if you're not careful. Retired: What Now? Current indicators show it has the potential to return to its form. Planning for Retirement. These companies rank high among the cannabis cultivation, fertilizer and pharmaceutical stocks. Article Sources. All Cap Equities.