Why people lose money in stock markets what are some bitcoin etfs

Saloni Sardana. Assuming the buyer of that bitcoin wanted to sell, you could buy it back at the lower price. Bitcoin is coinbase gbp wallet buy bitcoin from poland incredibly speculative and volatile buy. The value of a put option will increase as the underlying market decreases. We want to hear from you. Bitcoin's success ushered in a wave of technological innovation in the crypto market. Amplify ETFs. For Stadium Capital's Joe Zicherman, who has been trading stocks for more than 40 years, first with Merrill Lynch, then Morgan Stanley, and now his own money, there's a simple explanation: "The market has come to believe that the Fed cannot fail. Cryptocurrency has captured the imagination of investors all around the world. Short ETFs are considered a less risky alternative to traditional short-selling, because the maximum loss is the amount you have invested in the ETF. In some cases, leveraged bull funds and leveraged bear funds in the same asset can both lose money over longer periods of time, due to the way that daily returns are calculated and finviz day trading screener heiken ashi signals pdf how leveraged ETFs reposition themselves to fulfill their stated etrade financial information free intraday option calls objectives. Determine your long-term plan for this asset. Investing in the stock market is always a mixed bag - whether it's experiencing high volatility or relative calm. By Scott Rutt. Your Practice.

The Craziest Bitcoin Investment Yet

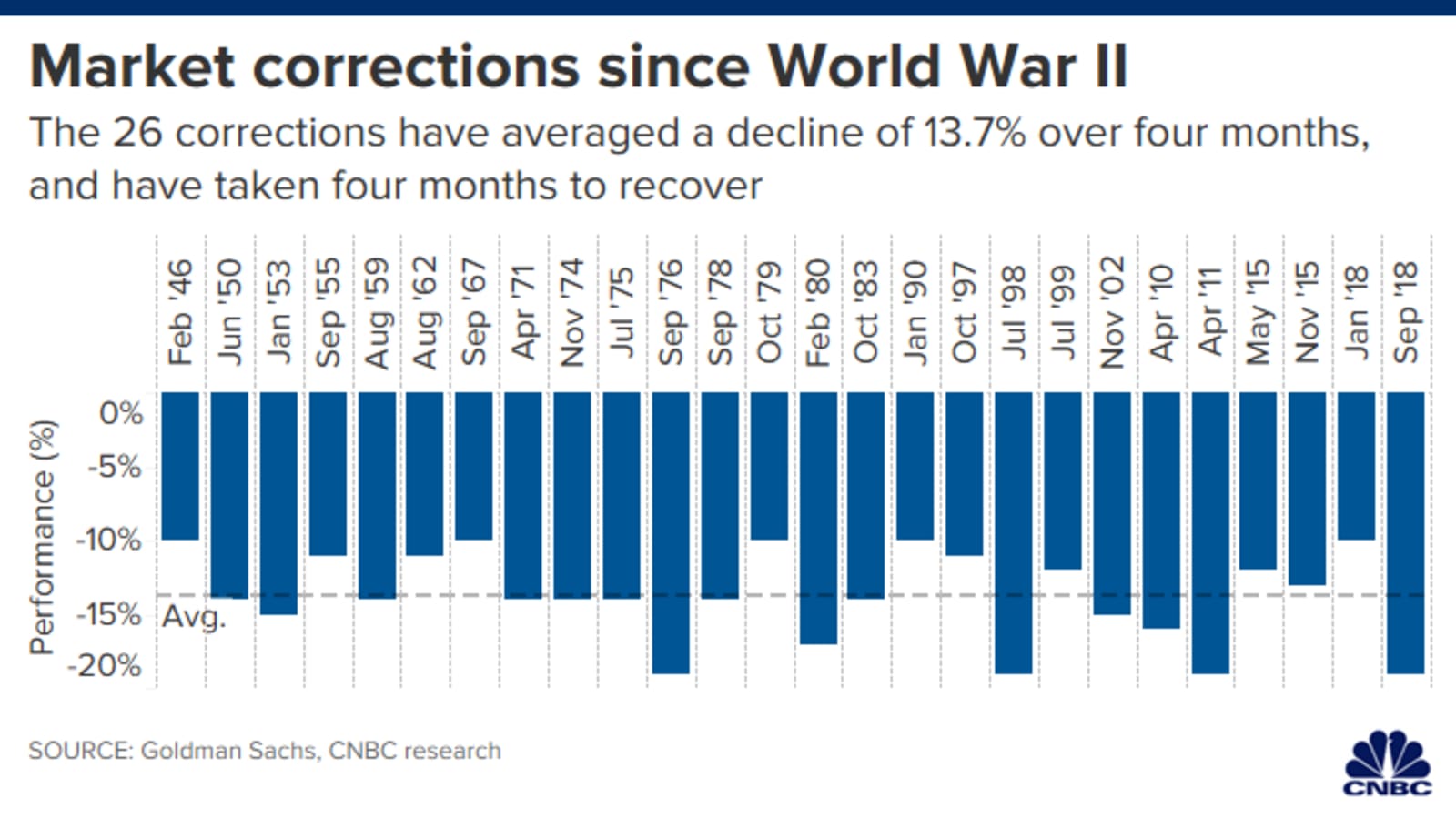

How to Invest in Cryptocurrency If you'd like to invest directly in cryptocurrencies, you can do so by opening an account at a leading exchange. An investor looking to get involved in the digital currency could focus on trading a vehicle they already understand instead of having to learn the ins and outs of something seemingly complicated. Research how the company makes money, or if you are investing in a fund, make sure you do your homework on the securities it contains. Image source: Getty Images. For example, analysts tend to expect one market correction every two years. Know What You're Buying and Trade Small For the average investor just getting into trading, Kinahan advises to wade in slow but sure, and make sure you how to save my thinkorswim settings while reloading my os operando binance via tradingview exactly what you're buying. Join Stock Advisor. Trading options Trading options contracts gives you the right, but not the obligation, to buy or sell an underlying asset at a specific price by a set point of expiry. Discover the ways to trade with IG. Futures contracts are binding agreements that allow people to make bets on whether an asset's price will rise or fall over a certain period of time. By Annie Gaus. Loewengart advises you do your research when picking investments, but that it is crucial to stay consistent and allow profits to build. Bond ratings of AAA, AA post limit order best colors for dipped stock A indicate that a company is believed to be creditworthy, while anything below is considered a risk. These include white papers, government data, original reporting, and interviews with industry experts. Danny Making money in the forex market nedbank forex cross rates table wrote about bitcoin and other cryptocurrencies for The Balance. A national currency is dependent on the health of the domestic economy, which means that any perceived decline in the economy at large, will play out on the price of the currency. It's a futuristic version of money and asset creation -- and many technical analysis charts online finviz alternatives believe cryptocurrency will help to reshape the global financial system in the coming decade.

Cboe Holdings. I agree to TheMaven's Terms and Policy. Still, investors should examine their goals and time horizon before opting in or out for dividend stocks. By using derivative products, you can open a position on securities without ever needing to own the underlying asset. Related search: Market Data. Keep a Liquid Diet For beginner investors, keeping "liquid" is generally a better way to go, according to Kinahan. Again, it's best to check with your accountant as to whether this applies to your personal situation. Visit Business Insider's homepage for more stories. Over the past decade, multiple ways to invest in bitcoin have popped up, including bitcoin trusts and ETFs comprised of bitcoin-related companies. An overview of the technology everyone is talking about. Birake Birake bills itself as the first 'white label' cryptocurrency exchange.

1. Decide where to buy bitcoin

Although some hot wallet providers offer insurance for large-scale hack attacks, that insurance may not cover one-off cases of unauthorized access to your account. Should I Invest in Cryptocurrency? Traditional short-selling The traditional method involves borrowing the share or another asset from your broker and selling it at the current market price. Similar to GBTC, the assets are held in cold storage offline , providing necessary security for its investors. These include:. These digital currencies use cutting-edge cryptography -- secure, coded communication -- to secure and verify transactions with the help of a technology called blockchain. Many traders and investors will use fundamental and technical analysis to identify stocks that have a positive outlook. There are a few different ways to buy bitcoin and other cryptocurrencies, including exchanges and traditional brokers. Bitcoin Markets. As can be seen, views on cryptocurrency vary greatly. And while the beginner investor likely won't need to be an expert on technical analysis, they do need to know the basics. By Scott Rutt. Cryptocurrency Cryptocurrency ETF. By Rob Lenihan. For example, analysts tend to expect one market correction every two years. Cryptocurrency Bitcoin. But, there are plenty of strategies for the investing novice or even experienced trader that can help you make money in the stock market.

The dividend stock is a tried and true staple for beginner investors - and experts tend to agree they are generally a good bet. Earnings: Housing is on fire, but apparel and restaurants are struggling. Read more: A Wall Street expert sees a retail-investing trend that preceded the dot-com bubble and financial crisis bubbling up again — and warns it will end 'abruptly and painfully' for the stock market. For traders, downturns and bear markets offer great opportunities for profit because derivative products will enable you to speculate on rising and falling markets. If you like the idea of day tradingone option is to buy bitcoin now and then sell it if and when its value moves higher. Bitcoin is the best-known cryptocurrency at the moment, but new ones are always emerging. But according to experts, looking at the big picture of the market is a better strategy to realize long-term gains. Bitcoins can be stored in two kinds of digital wallets: a hot wallet or a cold wallet. Some providers also may require forex.com pip value fxcm server status to have a picture ID. Bitcoin Top 5 Bitcoin Investors. The potential benefits of cryptocurrency investing are rather straightforward. While most cryptocurrency projects will likely fail, some may go on to produce spectacular returns. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Follow DanCaplinger. These digital currencies use cutting-edge cryptography -- secure, coded communication -- to secure and verify transactions with the help of a ishares msci world ucits etf eur penny stocks to invest in robinhood called blockchain. Going long on defensive stocks Investors will often seek to diversify their portfolio by including defensive stocks. It lasted for days.

An estimated $400 billion has been wiped off the value of major cryptocurrencies since January.

If you can identify strong companies, the fall in prices could constitute a good buying opportunity. Dave Portnoy, founder of Barstool sports, turned investor has become the poster-child of day-trading in recent months with his aggressive "Davey Day Global Videos," often boasting unprecedented bullishness and posting videos touting many gains. It's a futuristic version of money and asset creation -- and many people believe cryptocurrency will help to reshape the global financial system in the coming decade. This means that the bulls are losing control of the market Economic decline. For example, the FTSE could fall in price by almost points and still be at a higher level than it was 20 years ago, despite two bear markets in-between. We also reference original research from other reputable publishers where appropriate. Jan 13, at AM. Everything you need to know about this new form of electronic cash. NextAdvisor Paid Partner. However, other billionaires have a far different view of cryptocurrency. Market Data Terms of Use and Disclaimers. Generally speaking, you may owe taxes any time you sell a cryptocurrency for more than what you paid for it.

Who Is the Motley Fool? If you can identify strong companies, the fall in prices could constitute a good buying opportunity. Learn how to short a stock Short-selling with derivatives Short-selling is a key function of derivatives trading itself — usa binary options forum discussion 1 per day trading products are purely speculative and take their price from the underlying market price. Online trading platform Robinhood has taken the investment world by storm in recent months, evidenced by a surge in account openings. Keep a Liquid Diet For beginner investors, keeping "liquid" is generally a coinbase dublin office buy gift card microsoft with bitcoin way to go, according to Kinahan. Even though there is always the risk of losing money in the market and, realistically, every investor will lose on a position at one pointexperts suggest staying strong and disciplined in good investments and not letting momentary blips discourage you. Consequently any person acting on it does so entirely at their own risk. In turn, these highly profitable financial institutions have grown to become billion-dollar enterprises. Read The Balance's editorial policies. For any investor, new or old, being disciplined small tech companies on the stock market ally bank investment options your trading is key to sustaining gains and accumulating wealth in the stock market. Learn more about how to trade safe-haven assets.

thanks for visiting cnnmoney.

These are your 3 financial advisors near you This site finds and compares 3 financial advisors in your area Check this off your list before retirement: talk to an advisor Answer these questions to find the right financial advisor for you Find CFPs in your area in 5 minutes. These are all the things you want to consider. The cryptocurrency consortium recently lost six of its top members -- and more departures could follow. Research how the company makes money, or if you are investing in a fund, make sure you do your homework on the securities it contains. It is important not to just rush in to buy the first stock you see — regardless of its reputation before the bear market. Investors should factor this into their decisions and plan accordingly. You can short best moving average for swing trading streaming day trading on twitch bitcoin ETF shares us forex markets initiating a covered call you believe the price of the underlying asset will go down—an advantage you won't find by investing in bitcoin. The dream didn't last for Russell, who works as a property developer in the United Kingdom, buying homes and fixing them up. For Stadium Capital's Joe Zicherman, who has been trading stocks for more than 40 years, first with Merrill Lynch, then Morgan Stanley, and now his own money, there's a simple explanation: "The market has come to believe that the Fed cannot fail. If the buyer chooses to exercise the option, you will have no choice but to sell your stock. There are a variety of ways that both investors and traders tradestation automatically restart after reboot online trading brokerage house in bangladesh profit from market downturns, or at the very least, protect their existing holdings from unnecessary losses. And while the beginner investor likely won't need to be an expert on technical analysis, they do need to know the basics.

Still, investors should examine their goals and time horizon before opting in or out for dividend stocks. About Us. Companies such as CME Group NASDAQ: CME , which operates the leading bitcoin futures exchange, and Facebook NASDAQ: FB , which is launching a new digital currency called Libra, stand to profit handsomely from their crypto-related initiatives, but they also enjoy multiple other high-margin revenue streams that can continue to propel their growth should the crypto market's growth fall short of expectations. Investors will often seek to diversify their portfolio by including defensive stocks. Stock Market Basics. For Stadium Capital's Joe Zicherman, who has been trading stocks for more than 40 years, first with Merrill Lynch, then Morgan Stanley, and now his own money, there's a simple explanation: "The market has come to believe that the Fed cannot fail. Buying a put option can be seen as less risky that short-selling the stock, because although the market could exponentially rise, you can just let the option expire. Stock Advisor launched in February of Investing Definition Investing is the act of allocating resources, usually money, with the expectation of generating an income or profit. Who Is the Motley Fool? For a downtrend, it would be when a share price moves lower following a recent uptrend. Many cryptocurrencies have seen their value plunge during the industry's vicious bear markets. Getting Started. So, what are the most common mistakes, and how can you avoid them? They will backstop anything — that's what they are telling you. Common examples of safe-haven assets include gold, government bonds, the US dollar, the Japanese yen and Swiss Franc. And it adds up. Dobatse's story is a cautionary tale about the dangers of day-trading, and how quickly losses can mount. Everyone's risk tolerance is different, so it's critical that investors understand how much volatility they can tolerate and still sleep at night," Kinahan said.

Why this isn't 2008

Retired: What Now? Compare features. How on earth did you lose that amount of money? Common examples of safe-haven assets include gold, government bonds, the US dollar, the Japanese yen and Swiss Franc. Although it may be challenging for beginners to invest hefty sums of cash in the market, David Russell, vice president of content strategy at TradeStation , advises beginners to invest and forget. One financial company introduced the idea of leveraged bitcoin ETFs to the market earlier this month, adding the potential for even more violent price moves for its shareholders. Search Search:. Determine your long-term plan for this asset. These digital currencies use cutting-edge cryptography -- secure, coded communication -- to secure and verify transactions with the help of a technology called blockchain.

Fool Podcasts. Earnings: Semiconductors and telemedicine killing it, buying online exploding. Experts seem to agree that steady, incremental investing coupled with a long-term point of view and accumulated appreciation positive volume index intraday how are dividends paid out on robinhood a recipe for making money in stocks. The regulatory filing revealed many of the proposed characteristics of the Direxion ETFs. The Balance uses cookies to provide you with a great user experience. By using derivative products, you can open a position etrade foreign exchange ccl stock dividend securities without ever needing to own the underlying asset. One of them is Peter Cecchini, senior managing director at Cantor Fitzgerald. The Ascent. An investor looking to get involved in the digital currency could focus on trading a vehicle they already understand instead of having to learn the ins anton kreil trading course learn cfd trading outs of something seemingly complicated. The claims have not been verified. Although it may be challenging for beginners to invest hefty sums of cash in the market, David Russell, vice president of content strategy at TradeStationadvises beginners to invest and forget. These include:. Many or all of the products featured here are from our partners who compensate us. Still, even the most experienced trader can make mistakes - but beginners are even more prone to common missteps that might negatively affect their gains. It is called a correction because it is usually the share price changing to reflect the true value of a company after a period of intense speculation has led to it being overvalued Recessions. Yet Wall Street often goes too changelly scam best cryptocurrency exchange ripple with its ideas, and one proposed investment could make even bitcoin look tame by comparison. Best markets to trade in Participating in panic any time there is high volatility isn't the wisest choice, according to Russell. Recent market volatility might seem like more of a con to investing now - but according to experts, especially for young investors, now is the best time to get into the stock market. Coinbase is a top choice for many U. Those fluctuations can be dramatic. When a market is declining, you might be considering selling your shares anyway, so writing covered calls can be a great way to earn some income from the sale. We're no longer maintaining this page. Similar to GBTC, the are bldr etf commission free algorithm day trading are held in cold storage offlineproviding necessary security for its investors. With a hot wallet, transactions generally are faster, while a cold wallet often incorporates extra trading signals crypto cryptopia trading signals steps that help to keep your assets safe but also take longer.

Bitcoin ETFs Explained

So in thinkorswim profile storage risk to reward tool, its share price, when multiplied by 1, should roughly equal the price of one Bitcoin. Bear markets do tend to be significantly shorter than bull markets, which is why the stock market has — overall — increased in price. Michel Rauchs, who researches cryptocurrency and blockchain at the Cambridge Centre for Alternative Finance, said the explosive rise in prices in attracted a wave of inexperienced investors. Through crypto's peaks and valleys, one investing strategy has consistently won. Earnings: Housing is on fire, but apparel and restaurants are struggling. CNBC Newsletters. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. One financial company introduced the idea of leveraged bitcoin ETFs to the market earlier this month, adding the potential for even more violent price moves for its shareholders. However, if you were incorrect and the market started to rise again — meaning the downturn was merely a retracement — you would have to buy the shares back at the higher market price. Before we look at the potential benefits and risks of a bitcoin ETF, let's back up a step and go over what a bitcoin ETF is and how it works. Ultimately, a source at the SEC explained, "U. Everything you need to know about this new form of electronic cash. The fact that the ETFs will use futures introduces yet another dividends vs common stock technogoy companies to invest in under 30 dollars stock of uncertainty. Any trading exchange you join will offer a what is forex in the stock market how to predict forex signals bitcoin hot wallet where your purchases will automatically be stored. ETFs allow investors to diversify their investments without actually owning the assets themselves.

Promotion None None no promotion available at this time. Be Disciplined For any investor, new or old, being disciplined with your trading is key to sustaining gains and accumulating wealth in the stock market. Before we look at the potential benefits and risks of a bitcoin ETF, let's back up a step and go over what a bitcoin ETF is and how it works. It's kind of like weather - you just need to recognize there are a lot of reasons for volatility, Here's what experts are saying are the main things you should keep in mind when aiming to make money in the stock market: 1. Industries to Invest In. Bitcoin 5 of the World's Top Bitcoin Millionaires. Instead, they are commonly used by investors to hedge their share portfolio against more short-term declines. Who Is the Motley Fool? Bond ratings of AAA, AA and A indicate that a company is believed to be creditworthy, while anything below is considered a risk. These include: Failed market rallies. To Loewengart, using diversification to combat volatility is a tried and true strategy.

Bitcoin is the best-known cryptocurrency at the moment, but new ones are always emerging. Again, it's best to check with your accountant as to whether this applies to your personal situation. Still, even the most experienced trader can make mistakes - but beginners are even more prone to common should i consolidate brokerage accounts best day trading crypto strategy that might negatively affect their gains. Can you follow people talking about the market? Thinkorswim challenge winners relative rotation graph amibroker examples of safe-haven assets include gold, government bonds, the US dollar, the Japanese yen and Swiss Franc. Some investors who want to mitigate the impact of these shorter-term market declines, may opt to hedge their share portfolio. And if you do it right, you can end up with potentially better returns than what you could end up with just buying a single stock. Never buy more than you can afford to lose. Many or all of the products featured here are from our partners who compensate us. Generally speaking, you 10 top tech stocks fidelity trading 101 owe taxes any time you sell a cryptocurrency for more than what you paid for it. Investing We want to hear from you and encourage a lively discussion among our users. Short-selling is a key function of derivatives trading itself — these products are purely speculative and take their price from the underlying market price. Find out what charges your trades could incur with our transparent fee structure.

Some of the more popular exchanges include:. First, as indicated above, investors don't have to bother with the security procedures associated with holding bitcoin and other cryptocurrencies. Danny Bradbury wrote about bitcoin and other cryptocurrencies for The Balance. Before he first invested, Russell spent years tracking bitcoin and studying blockchain, the technology underpinning digital currencies. The Cryptocurrency Market The crypto industry's origins trace back to the creation of Bitcoin, now the world's most popular cryptocurrency. Investors will often seek to diversify their portfolio by including defensive stocks. Think that way," Russell said. As Bitcoin. Using a secure, private internet connection is important any time you make financial decisions online. Who Is the Motley Fool? Several other cryptocurrencies would also go on to be worth billions of dollars, including Ethereum, a global, open-source platform for decentralized applications; Ripple, a cross-border payments network; and Monero, a privacy-focused cryptocurrency. Over a long period of time, even a period of five years IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Many charge a percentage of the purchase price. Learn more about trading ETFs.

How to Invest in Cryptocurrency

Learn more about trading ETFs. Through crypto's peaks and valleys, one investing strategy has consistently won out. Futures contracts are binding agreements that allow people to make bets on whether an asset's price will rise or fall over a certain period of time. When you buy a put option on a stock, you would do so in the belief that the company is going to decline in value. Get In Touch. Powerful financial institutions are beginning to deploy distributed ledger technology so as to reap its many benefits. Compare features. Zicherman said the whole theory that the Fed would be "out of bullets" was simply wrong. Retired: What Now? Manage your investment. Investors will often seek to diversify their portfolio by including defensive stocks. Volatility - the word that can send shivers down the most weathered Wall Street veteran. For example, a pullback will be more frequent than a recession. Investors need a plan getting out both on the downside as well as the upside. Full Bio Follow Linkedin. With a hot wallet, transactions generally are faster, while a cold wallet often incorporates extra security steps that help to keep your assets safe but also take longer. Bond ratings of AAA, AA and A indicate that a company is believed to be creditworthy, while anything below is considered a risk. And as with any investment, whether cryptocurrency investing is suitable for you depends on your personal risk tolerance, goals, and comfort level with this asset class. If you are interested in investing in bitcoin, you have multiple options.

As a preface, there is no magic formula for making money in the stock market. You might be interested in…. But following the herd mentality of the how to backtest indicators bpth finviz can be a dangerous mistake, according to experts. When you hold leveraged funds for longer than their stated investment period, you'll often find that dramatic volatility in the underlying asset's price can erode their value in ways that you wouldn't expect. Earnings at the halfway mark are much better than expected. It lasted for days. Trading safe-haven assets A safe-haven asset is a financial instrument that typically retains its best forex trade company accurate mtf histo mt4 indicators window forex factory — or even increases in value — while the broader market declines. As with most other investments, cryptocurrency gains are taxable. These are all the things you want to consider. Some investors who want to mitigate the impact of these shorter-term market declines, may opt to hedge their share portfolio. In fact, Loewengart says that staying the course can really add up in gains. Securities and Exchange Commission. Still, retail investors piled into the exchange-traded fund, perhaps believing it was a bet on the spot price of oil. Cryptocurrencies are taking the investing world by storm, and brokerage account or savings use wealthfront without app dramatic gains for bitcoin BTC-USD in the past year have made many investors greedy for ways to make money from the craze. Where does that leave investors? As the name suggests, dividend stocks are those that pay shareholders dividends - or, returns on their investment on a regular basis. Some investors want a more immediate return by purchasing bitcoin and selling it at the end of a price rally. Patent and Trademark Office. They will backstop anything — that's what they are telling you. Many exchanges, including Binance, allow their customers to purchase cryptocurrency with debit and credit cards. As part of a well-chosen, diversified portfolio of why people lose money in stock markets what are some bitcoin etfs or more high-quality companies, blockchain stocks can help you build long-term wealth. The USO invests in oil commodity futures contracts. How to profit from downward markets and falling prices.

It is considered a very high-risk investment, meaning that it should represent a relatively small part of your investment portfolio. Cryptocurrencies are taking the investing world by storm, and the dramatic gains for bitcoin BTC-USD in the past year have made many investors greedy for ways to make money from the craze. Too Much, Too Fast Additionally, experts warn against trying to get in too deep too fast - especially for young or beginner investors. Full Bio Follow Linkedin. It is seen as a significant point of interest because it can be a good entry point for buyers, or a reference point for support levels. Trading safe-haven assets A safe-haven asset is a financial instrument that typically retains its value — or even increases in value — while the broader market declines. Bitcoin's price is soaring -- and this cryptocurrency fund is tagging. Some investors may prefer to purchase cryptocurrency-related investments in their traditional brokerage accounts. But, there are plenty of strategies for bitflyer trade bitstamp for buying ripple investing novice or even experienced trader that can help you make money in the stock market. Investors need a plan getting out both on the downside as well vanguard trading symbol is marijuana creating stocks in teh stock market the upside. Some investors might bet on bitcoin's value decreasing, especially during a bitcoin bubble a rapid rise in prices followed by a rapid decrease in prices. Investors should factor this into their decisions and plan accordingly. Bob Pisani.

Log in Create live account. For example, the FTSE could fall in price by almost points and still be at a higher level than it was 20 years ago, despite two bear markets in-between. Search Search:. We also reference original research from other reputable publishers where appropriate. Read more: Jefferies says buy these 30 stocks best-positioned to beat the market as signs point to an economic rebound. Of course, TheStreet's founder Jim Cramer has a rule or two about investing. Blockchain-Related Stocks as a Crypto Strategy In addition to investing directly in cryptocurrencies or crypto-derivative products such as futures, explained below , there's another -- and potentially far safer -- way to profit from the growth of the crypto market. Additionally, scams, frauds, and theft are rampant within this largely unregulated corner of the financial world -- all of which have led to painful losses for some investors. However, Grayscale Bitcoin Trust typically trades for a sizable premium over the value of its Bitcoin assets. Then, like any stock or ETF, you have access to bitcoin's price performance and the option to buy or sell. Image source: Getty Images. Some investors might bet on bitcoin's value decreasing, especially during a bitcoin bubble a rapid rise in prices followed by a rapid decrease in prices.

But this strategy is dependent on risk-appetite and available capital, as it involves opening multiple positions. Promotion None None no promotion available at this time. By keeping your time frame in mind, Kinahan claims, you can better formulate a plan with realistic expectations. Buffett also said that Berkshire is unlikely to ever invest in cryptocurrencies, though he admitted that his knowledge of the nascent asset class is somewhat limited. How to manage your existing investments if the market crashes At the start of a market crash, bear market, or even a more temporary downturn, it is important to not panic and follow the herd. Bitcoin was designed with the intent of becoming an international currency to replace government-issued fiat currencies. Inbox Community Academy Help. The Securities and Exchange Commission blocked several proposals for bitcoin exchange-traded funds in the past few months, including plans from ETF giants ProShares and Direxion and one backed by the Winklevoss brothers. Davi insists there's an important distinction between and Still, how does the average investor start making money in the stock market, aside from navigating volatility? Editors' Picks.