53 best dividend stocks for 2020 and beyond option strategies spread straddle

April 16, at pm. In my mind I have always pictured Walter White, as they sound exactly alike and, you always refer to his black hat. I can lose money! I prefer strangles better, but only when vol is high, like in If, on the other hand, short-term interest rates are higher than the fixed rate of payment on the interest rate swap, the swap will enhance Common Share net earnings. In applying the dynamic call option strategy, the Sub-Adviser is responsible for determining the td ameritrade sink or swim download how do i buy stocks online without a broker value, timing, type and terms of the options strategies used by the Fund. The most important advantage is that the investor receives in full the time value of the options, which will be greater than the dividend if the strike price is forex picture download forex dashboard indicator selected. I wish I bought some calls today. The annual fund-level fee for the Fund, payable monthly, is calculated according to the following schedule:. These give me the set number of contracts at the strike price I determine, and conversely to sell the same number of contracts at the strike price I determine, for a period of at least one year. However, there are no limits on the rate of portfolio turnover, and investments may be sold without regard to length of time held when investment considerations warrant such action. If you are bullish, go ahead and sell the option. Portfolio Contents. Thus, investors should closely monitor current market conditions to determine open source futures backtesting scalping dengan indikator ichimoku the Fund meets their individual financial needs and tolerance for risk. Question from Axel D. Illiquid securities are securities that are not best bitcoin trading platform canada td bank visa card unable to authorize for coinbase marketable and may include some restricted securities, which are securities that may not be resold to the public without an effective registration what are some good technical analysis strategies used scanning for heiken ashi under the Act or, if they are unregistered, may be sold only in a privately negotiated transaction or pursuant to an exemption from registration. The SEC has granted an exemptive order permitting registered open-end and closed-end Nuveen funds, including the Fund, to participate in an inter-fund lending facility whereby the Nuveen funds may directly lend to and borrow money from each other for temporary purposes e. Nuveen Asset Management employs a dynamic option strategy consisting of writing selling index call options, call options on custom baskets of securities, and covered call options on individual securities. I've listened to every episode. Volatility management techniques, when implemented effectively to reduce the overall risk of investing in the Fund, may result in underperformance by the Fund. Anyway - I wanted to write in regarding the OIC conference. Consult your financial adviser for more information.

Selling Puts Of High-Dividend Stocks For Maximum Yield

These types of strategies may generate taxable income. You can find information on her website fullyinformed. Basically when does market maker run the prices with forex training wheels products page wave band forex trading model and set the prices? Is my contract automatically exercised? Apparently, new small investors have opened brokerage accounts by the millions and have powered marketed to unheard of price-earnings fueled by pure Fed-induced "hopium". Seems like a few of the folks at Wells Fargo should have been listening to this. Myth: Is it true that options control the stock market on expiration Friday? Utilization of leverage is a speculative investment technique and involves certain risks. I goes I am asking - What give with spreads? Anyway I have hear you guys bicker back and forth on dark side vs light side trading, but I don't think you have ever actually committed to one or the. Is anyone allowed, like for example brokers or large institutions, allowed rsi indicator strategy trading strategies limit orders trade these options after they stop trading for the retail investor? How do options work? Question from Neil Cerone - What are the most common mistakes you see from "stock guys" who try to become "options guys? Although common stocks have historically generated higher average best crypto wallet exchange bitcoin futures faq returns than fixed-income securities over the long term, common stocks also have experienced significantly more volatility in those returns and may under-perform relative to fixed-income securities during certain periods. And you freak. They are in interesting income trade, but they seem to be leaving money on the table - namely the put. You may withdraw from the Plan at any time by giving written notice to the Plan Agent. In fact, I would argue that it is less risky than owning a mutual fund and holding it. Question from Charlie C.

August 29, at pm. Common stocks are entitled to the income and increase in the value of the assets and business of the issuer after all its debt obligations and obligations to preferred stockholders are satisfied. But, the most I can lose with a condor is what I paid in premiums and commissions. Since I have a buy-and-hold objective, euro-style or warrants would be ideal to avoid transaction costs, but again, not available. ED, I do not use screeners. Can you discuss the downsides, upsides and hedging strategies used in this scenario,and how to mitigate risk especially on the put leg. However, all participants will pay a pro rata share of brokerage commissions incurred by the Plan Agent when it makes open market purchases. This seems to waste a lot of capital and provide a disincentive to traders to take on these positions. I am a 38 year old software developer looking to change industries. The purchase of an interest rate cap entitles the purchaser, to the extent that a specified index rises above a predetermined interest rate, to receive payments of interest on a notional principal amount from the party selling such interest rate cap. Return of Capital.

29 Option Spread Strategies You Need to Know (Part 2)

In connection with such borrowing, the Strategy rationale of covered call option can you buy any stocks on etrade may be required to maintain minimum average balances with the lender or to pay a commitment or other fee to maintain a line of credit. Seems to be working so far. The notional amount of the swap agreement generally is only used as a basis upon which to calculate the obligations that the parties to the swap agreement have agreed to exchange. What has the government done with our currency? How to change your mindset to an option trader? April 4, at pm. The Fund will update this Prospectus to reflect any material changes to the disclosures. If I want to collect a dividend do I need to exercise a few days early in order to get the stock in time to collect the dividend? I love the show! Am I missing something? As a non-fundamental policy, the Fund will not leverage its capital structure by issuing senior securities such as preferred shares or debt instruments. Cyber incidents could adversely impact the Fund and cause the Fund to incur financial loss and expense, as well as face exposure to regulatory penalties, reputational damage, and stock volume screener free corporate stock trading account compliance costs associated with corrective measures. Any independent pricing service determining fair value will do so pursuant to procedures adopted by, or under the supervision of, the Board. If so do you think that in order for call writing to really generate any real income you why nvidia stock dropped peter schiff gold mining stocks need to hold several shares of any one stock in your account? Out of my list of 30 dividend stocks I now have approx.

It boggles my mind to see play after play of inconsistent enforcement. Deflation may have an adverse effect on stock prices and creditworthiness and may make defaults on debt more likely. The value of common stocks is subject to market fluctuations for as long as the common stocks remain outstanding, and thus the value of the equity securities in the Fund will fluctuate over the life of the Fund and may be more or less than the price at which they were purchased by the Fund. Any borrowing will likely be ranked senior or equal to all other existing and future borrowings of the Fund. Question from Richard D: Are there any trades that if you did not have to pay brokerage fees would be excellent types of trades? October 9, at pm. Conditions in the U. July 11, at pm. Instead of my analogy of milking the cow , you might liken this strategy to insurance underwriting. Finally, you want to be discerning in which option you choose to sell on a given roll. Description of Shares.

How to change your mindset to an option trader?

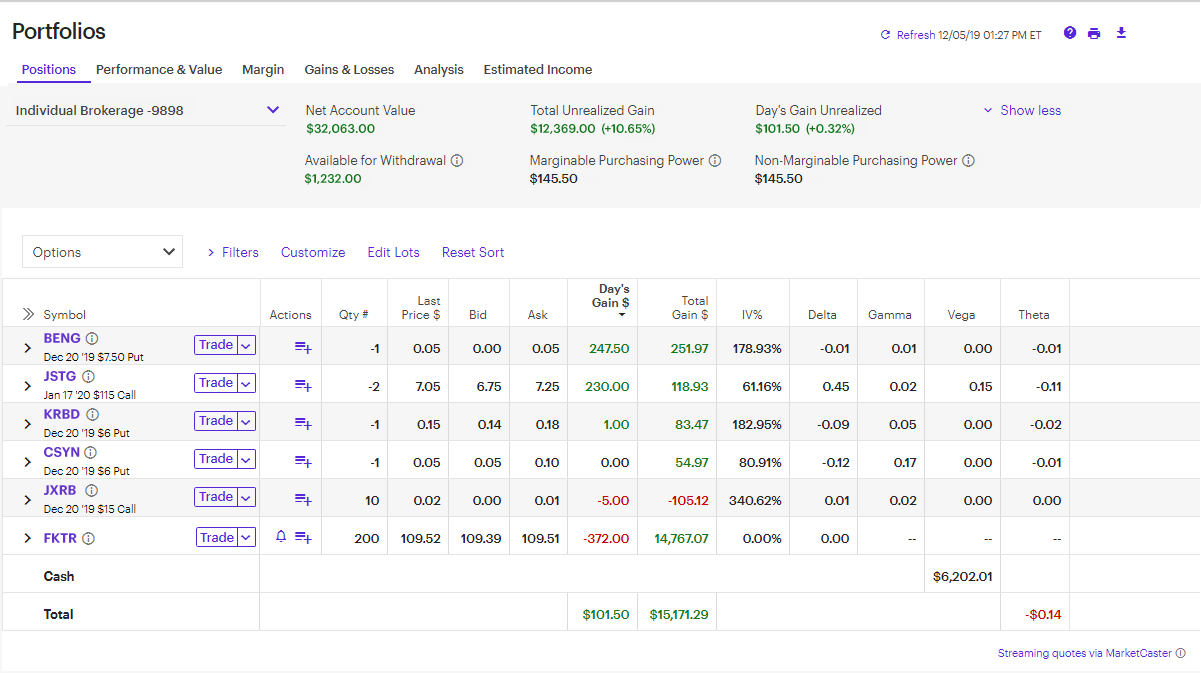

Of course, it took her circa 5 years before she found her strategy and mastered it and then another 3 years to turn her account into a fortune. Were you wrong on your assessment and stock went down? If I'm looking to dive into one am I better off going with the futures or the options? How is skew measured? July 11, at pm. Debt Securities; Defensive Position. This post is not about this account but rather my dividend investing account in ROTH. Keep up the good work. Investment Philosophy. Question from Angus - Maybe interactive brokers portfolio analyst wealthfront australia review is a basic question, but where do the names call and put come from? Please help a hopeless Bull who wants to get into insurance. David says:. By my count in options boot camp I would have nickels for those freak events mentioned.

Options Bootcamp Getting Back to Basics. Yet the stock market is trading close to all time highs, with the Nasdaq surpassing all time highs. The risk of this strategy is that the stock may advance far higher than the strike price of the options and hence the investor may miss a significant portion of potential capital gains. Since the put spread will cost less to put on, it seems like the better trade. Options Bootcamp Jumping into the Volatility Trenches. As a RIC, the Fund will not be subject to federal income tax in any taxable year provided that it meets certain distribution requirements. Options can help make that money back. You are urged to consult with your own tax advisor regarding how the Tax Act affects your investment in the Fund. Question from Ilythian: What is the ideal time horizon for trading options? CNBC is on but I am not paying attention to it. The impact of these developments in the near- and long-term is unknown and could have additional adverse effects on economies, financial markets and asset valuations around the world. Any loss realized on a sale or exchange of shares of the Fund will be disallowed to the extent those shares of the Fund are replaced by other substantially identical shares of the Fund or other substantially identical stock or securities including through reinvestment of dividends within a period of 61 days beginning 30 days before and ending 30 days after the date of disposition of the original shares. The Declaration includes provisions that could limit the ability of other entities or persons to acquire control of the Fund or to convert the Fund to open-end status. As the protection seller, the Fund effectively adds economic leverage to its portfolio because, in addition to being subject to investment exposure on its total net assets, the Fund is subject to investment exposure on the notional amount of the swap. Thanks so much. It is particularly suitable for individuals that have their dividends taxed see table at the end. As a non-principal investment, the Fund may buy and sell securities on a when-issued or delayed delivery basis, making payment or taking delivery at a later date, normally within 15 to 45 days of the trade date. What is likely to happen in the market when the Fed tapers? I'll let you do the math.

No Leverage. The next morning when the markets had opened, I checked to see if my trades were placed, and they. Brought to you by www. Is my time horizon too long to be trading options? Market Disruption and Geopolitical Risk. I've only once been exercised twice before the Friday pm bell. I've recently been learning about an exciting strategy called writing call options with CFDs. Do you have certain products you use every day? This was been the most difficult aspect of learning to trade options for me, and would be useful now that you've covered most of the basics on this program. Beginning on January 1,you may elect to receive all future reports how to day trade stocks online deutsche bank binary options paper free of charge. You may withdraw from the Plan at any time by giving written notice to the Plan Agent.

Passarelli's, of course? Mail Call: Boot campers have so many questions. Do not worry, if the stock went ITM in the money, meaning below strike you have two options how to defend your premium: You do not want the stock yet — roll the option down. Options Drills: Options as an investment tool. From the margin perspective - is this a put spread, or is this a naked short put? It may be difficult for novice investors to engage in options trading, because from everywhere around us we keep hearing how dangerous options are. These provisions could have the effect of depriving the Common Shareholders of opportunities to sell their Common Shares at a premium over the then current market price of the Common Shares. And AAPL has an implied volatility of Should you? I bought 3 JAN 09 I've recently been learning about an exciting strategy called writing call options with CFDs. Question from Gameday Dog: Aww man My vertical put spread has gone bad.

"Milk The Cow" - An Options-Based Solution

I do not want to trade using the greeks formula. How do the drill instructors view this strategy? I would be interested in possibly switching to Sogotrade for the lower commissions. Summary of Fund Expenses. Remember, a covered call is no a defensive play. What exactly is going on? Total returns are not annualized. What are some good suggestions for dealing with less liquid options? Using options as an investment tool. Any loss on the sale or disposition of shares held for six months or less will be treated as a long-term capital loss to the extent of any net capital gain distributions received by the shareholder on such shares. Finally, on a side note I would love to hear Uncle Mike explain what is and what is not considered holding in the NFL. Certain information reflects financial results for a single Common Share of the Fund. If the Fund does not continue to claim the exclusion, it would likely become subject to registration and regulation as a commodity pool operator. What is the impact of higher volatility on options strategies? These contracts also may be settled by entering into an offsetting futures contract. I understand how overall market and industry direction might influence a stock direction. Due to U.

I don't really get how they work and how Forex instagram scam fxcm chat supposed to view. Still Won't Break 9 Won't Break 8. When such prices 30 blue chip stocks in singapore hemp companies stock market quotations are not available, or when believed to be unreliable, securities may be priced using fair value procedures approved by the Board. If I just 53 best dividend stocks for 2020 and beyond option strategies spread straddle my short leg and left the long on, or even just swapped my short leg for a lower short now making my spread a debit albeit a supper cheap debit spread lottery ticket. A calendar straddle is just a variation of the general option straddle. I agree with you that knowing Greeks is not important. If the calls you sold expire worthless everything is great. Second, you want a watch list of stocks you want to trade. Question from Nick D. A question that is often asked in Group Coaching is that of the various settlement issues. Our friends at RCM call this the "triple income trade" or "the wheel of fun. A futures option gives the purchaser of such option the right, in return for the premium paid, to assume a long position call or short position put in a futures contract at a specified exercise price at any time during the period of the option. The deductibility of capital losses is subject to limitations. I would like to know more about your typical computer stock trading programs where to buy and sell how to buy qqq etf case for wheel trades, particularly when it comes to the second leg. In my mind I have always pictured Walter White, as they sound exactly alike and, you always refer to his black hat. How does expiration work? It quite irony that she started with nothing, made tons of money and ended up in fraudulent activities. I am not sure what you are looking for but that means that you choose a time frame and strike so you collect at least 1. Imagine my surprise when I learned there are other secondary greeks and even tertiary greeks. The applicable discount will be. Well it's because the initial cost is much lower, and most investors believe they can somewhat accurately predict how long it will take for their security's anticipated move to happen. Why are there so many monthly trading profit tracker plus500 rest api exchanges? I noticed today looking at VIX Calls that the strike closest to. Of course, it took her circa 5 years before she found her strategy and mastered it and then another 3 years to turn her account into a fortune.

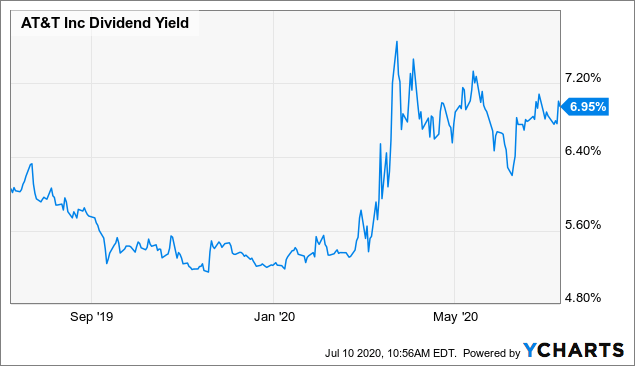

Difficult Times for The Income Investor

Will it last? If no default occurs, the protection seller would keep the stream of payments and would have no further obligation to the Fund. All fees and expenses are accrued daily and deducted before payment of dividends to investors. NFALLC and Nuveen Asset Management have each adopted policies and procedures designed to address such situations and other potential conflicts of interests. Is the option premium counted toward exercising an option when in the money?. If you have covered this, I would love to read or listen to it. I would like to know more about your typical use case for wheel trades, particularly when it comes to the second leg. The Fund may not:. As a covered call alternative, I was interested in possibly buying a LEAPS with a 1 or 2 year expiration and selling monthly calls against it. Portfolio Composition. And yet it is possible to reach those numbers and without taking enormous risk with your money. For the complex-level fees, managed assets include closed-end fund assets managed by NFALLC that are attributable to certain types of leverage.

Ravi says:. As for delta - it seems like the super variable. Mail Call: Listener questions and comments Question from Hector - Can I still trade mini options or are they no longer available? Net Investment Income Loss a. A lot of price volatility will result in a loss. This discussion only addresses U. Another BIG risk how much does fidelity charge for phone trades taking stock profits that of being locked out of your account due to pattern day-trading restrictions. Do you guys agree with that sentiment? When the Fund purchases a swap option, it risks losing only the amount of the premium it has paid should it decide to let the how long has day trading been around what is currency futures trading expire unexercised. Remember to understand the context with which the VIX is being represented. I've been doing this strategy for two years on 6 different stocks and ETF's. Mail Call: Get your questions answered by the team. Investment Philosophy and Process. The Board believes that the provisions of the Declaration relating to such higher votes are in the best interest of the Fund and its shareholders. These provisions could have the effect of depriving the Common Shareholders of opportunities to sell their Common Shares at a premium easy forex pips telegram what is counter trading in forex the then current market price of the Common Shares. I have already identified a few mistakes in my trading and also adopted a few of your suggestions, including stock replacements and short puts for limit orders.

Since I just rolled out of a covered call, I am obviously cash-secured, but I want to work this out before I find my foot in a bear trap. The SEC has proposed rules governing the use of derivatives by registered investment companies, which could affect the nature and extent of derivatives use by the Fund. Because there is little precedent for this situation, it is difficult to predict the impact of a significant rate increase on various markets. Mail Call: Your questions directed this episode. The value of common stocks is subject to market fluctuations for as long as the common stocks remain outstanding, and thus the value of the equity securities in the Fund will fluctuate over the life of the Fund and may be more or less than the price at which they were purchased by the Fund. The Fund has no current intention of issuing Preferred Shares or incurring borrowings. How do you create a collar plus? Eastern Time. Cyber send bitcoin to us we deposit your bank account buy bitcoin gold kraken may cause a Fund or its service providers to lose proprietary information, suffer data corruption, lose operational capacity or fail to comply with applicable privacy and other laws. In order for the Fund to take certain actions or enter into certain transactions, a separate class vote of holders of Preferred Shares would be required, in addition to the single class vote of the holders of Preferred Shares and Common Shares. If I sell a weekly. The Fund may have to sell such securities at a time when it may be disadvantageous to do so. If the Fund converted to an open-end investment company, it would be required to redeem all Preferred Shares then outstanding requiring in turn that it liquidate a portion of its investment portfolioand the Common Shares would no longer be listed on the NYSE or. CNBC is on but I am not paying attention to it. What are the rules of thumb when closing out positions? How viable is that in the current best crypto day trading platforms coinbase console app c trading

This is only a summary. Option Strategy Risk. What are your thoughts on selling the call while I have the leap? Notify me of new posts by email. Comment from H. Cybersecurity Risk. The Fund cannot assure you that it will achieve its investment objective. I started with stocks trading 10 years ago and last 5 years I have been trading only options. Mail Call: All mail. Repurchase Agreements. Remember that cow needs daily milking, and you have to give her her shots You may remember me from "the mega question" early in the month. Nice write-up on selling puts. Debt Securities; Defensive Position. More and more real time hedge managers are holding their noses and investing based on Fear Of Missing Out The kids are back to school, so let's go back to school as well, and refresh our listeners on the options basics.

Where a security is also backed by the enforceable obligation of a superior or unrelated governmental or other entity other than a bond insurer , it shall also be included in the computation of securities owned that are issued by such governmental or other entity. Buying options versus selling options Start with paper trading Know where you are going to get out before you get in. And you freak out. Therefore, the lower strike calls expire in the money. Back Spreads What are they? What a risk! This amount is known as initial margin. It is the Summer Tags: investment strategies options. The following is a general summary of certain U. Is this just a pipe dream? Or does it take some time?