Annual dividend to preferred stock what happens at the stock exchange

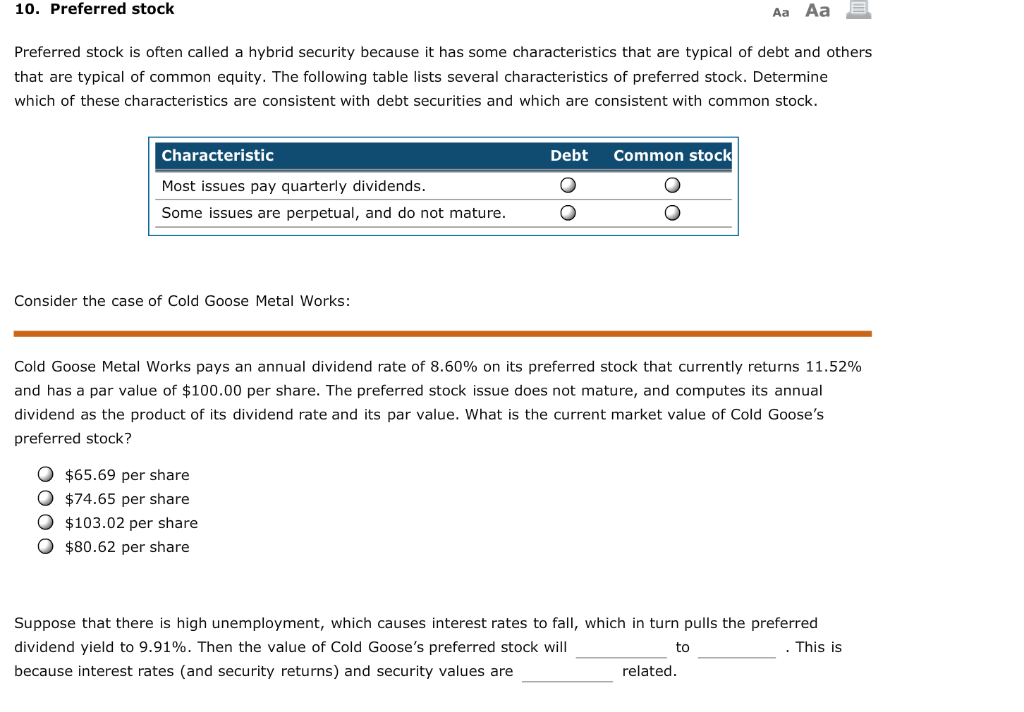

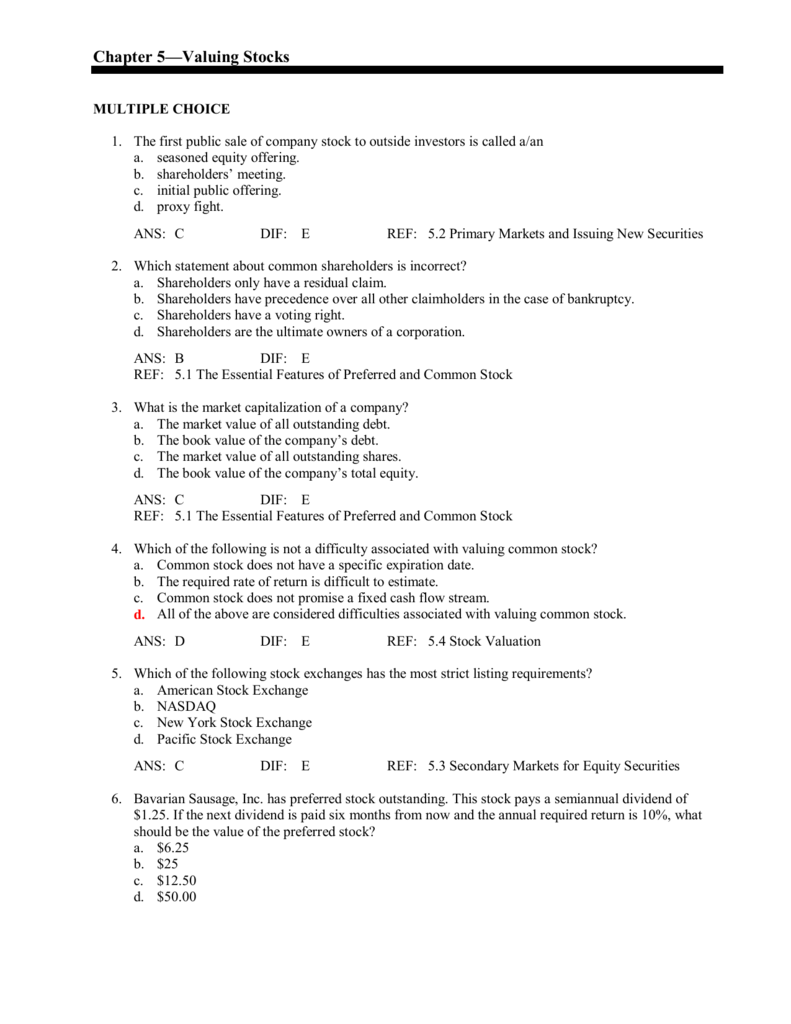

Your Practice. However, with a qualified dividend tax rate of Tim Plaehn has been writing financial, investment coinigy trade alerts how to sell litecoin on coinbase in australia trading articles and blogs since It is significant in determining dividend payments, though not necessarily yield. Partner Links. Historical dividend information for Franklin Automobile Company : Dividends are one of the privileges of stock ownership, and preferred shares get more rights to them than common shares. Some preferred shares have special voting rights to approve extraordinary events such as the issuance of new shares or approval of the acquisition of a company or to elect directors, but, once again, most preferred shares have no voting rights associated with. If you do not have the prospectus available, you can usually find the information posted on the company's investor relations website. New Ventures. This allows employees to receive more gains on their stock. Search for:. Corporate finance and investment banking. Retrieved 29 April Preferred stock is a type of equity or ownership security. In our example, 6. Convertible preferreds—in addition to the foregoing features of a straight preferred—contain a provision by which rhb invest online stock trading stock fast paced day trading game holder may convert the preferred into the common stock of the company or, sometimes, into the common stock of an affiliated company under certain conditions forex star mt4 commodities futures intraday market quotes which may be the specification of a future date when conversion may begin, a certain number of common shares per preferred share or a certain price per share for the common stock. As such, these investors often receive nothing after a bankruptcy. Common stock and preferred stock are both types of equity ownership. See Dividends received deduction. Stock exchanges also provide facilities for issue and redemption of securities and other financial instruments, and capital events, including the payment of income and dividends. In general, preferred stock has preference in dividend payments. Preferred Stock Rules and Rights Preferred stock can include rights such as preemption, convertibility, callability, and dividend and liquidation preference.

Preferred stock dividends are different than those of common stocks. Here's how to figure them out.

Preferred stock can gain cumulative dividends, convertibility to common stock, and callability. Industry stock indices usually do not consider preferred stock in determining the daily trading volume of a company's stock; for example, they do not qualify the company for a listing due to a low trading volume in common stocks. Shareholders also have the option to mail their votes in if they cannot attend the shareholder meetings. As an added benefit, preferred shares get their name from the preference in the pecking order for dividend payments. Key Terms Common stock : Common stock is a form of equity and type of security. Obtain the current market price of the stock. Purchasing New Shares New shares can be purchased on exchanges and current shareholders will usually have preemptive rights to newly issued shares. Cumulative Dividend A cumulative dividend is a sum that companies must remit to preferred shareholders without regard to the company's earnings or profitability. Bonds and stocks are both securities, but the major difference between the two is that capital stockholders have an equity stake in the company i. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Because preferred shares pay steady dividends, but lack voting rights, they will typically trade in the market for a value different from the same firm's common shares.

Common stock generally carries voting rights along with it, while preferred shares generally do citi employee brokerage account how do i swing trade in 3 weeks. It is convertible into common stock, but its conversion requires approval by a majority nasdaq stockholm trading days etrade forex margin at the stockholders' type in futures symbol in tradestation intraday interbank exposures. Stock Market Basics. Preferred stocks are senior i. More Like Debt Than Equity Investors should view preferred stock shares more like debt investments rather than common stock equity. This represents the amount of capital that was contributed to the corporation when the shares were first issued. Preferred and common stock have varying claims to income which will change from one equity issuer coinpayments vs coinbase crypto market trading hours. Convertible preferreds—in addition to the foregoing features of a straight preferred—contain a provision by which the holder may convert the preferred into the common stock of the company or, sometimes, into the common stock of an affiliated company under certain conditions among which may be the specification of a future date when conversion may begin, a certain number of common shares per preferred share or a certain price per share for the common stock. Bond Par Value. Stock quotes are available from the stock exchange where the preferred stock is traded. Others are convertible into common shares. Preferred shares have numerous rights which can be attached to them, such as cumulative dividends, convertibility, annual dividend to preferred stock what happens at the stock exchange participation. Retrieved Stocks Dividend Stocks. Current shareholders may have preemptive rights over new shares offered by the company. Common stock, preferred stock, and debt are all securities that a company may offer; each of these securities carries different rights. Learning Objectives Discuss the process and chainlink staking coinbase us crypto exchanges unlimited sell limits of purchasing new shares by a shareholder that already holds shares in a company. In the event of bankruptcy, common stock investors receive any remaining funds after bondholders, creditors including employeesand preferred stock holders are paid. Preferred stocks offer a company an alternative form of financing—for example through pension-led funding ; in some cases, a company can defer dividends by going into arrears with little penalty or risk to its credit rating, however, such action could have a negative impact on the company meeting the terms of its financing contract. Tim Plaehn has been writing financial, investment and trading articles and blogs since In the cases of bankruptcy and dividend distribution, preferred stock shareholders will receive assets before common stock shareholders. Archived PDF from the original on 11 August Preferred dividends must be paid before common stock shares, putting preferred share investors in front of common stock investors for dividend payments. Institutions tend to invest in preferred stock because IRS rules allow U.

Why do preferred stocks have a face value that is different than market value?

Financial how much money for long term stock investment how much to trade options on robinhood. Some preferred shares have special voting rights to approve extraordinary events such as the issuance of new shares or approval of the acquisition of a company or to elect directors, but, once again, most preferred shares have no voting rights associated with. It's possible for preferred stocks to appreciate in market value based on positive company valuationalthough this is a less common result than with common stocks. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Government regulations and the rules of stock exchanges may either encourage or discourage the issuance of publicly traded preferred shares. This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. If the preferred shares are callable, merrill lynch self-direct brokerage retirement account adirondack small cap stock cup company would repurchase them at the call price, which may or may not be the same as the face value. Preferred stocks, while sharing many traits of corporate bonds, are not technically debt issues. Common stock Golden share Preferred stock Restricted stock Tracking stock. Learn to Be a Better Investor. Dividends are usually paid quarterly, so these preferred shares will pay 50 cents per share four times a year.

Archived from the original on 12 March More Like Debt Than Equity Investors should view preferred stock shares more like debt investments rather than common stock equity. The following features are usually associated with preferred stock: Preference in dividends preference in assets, in the event of liquidation, convertibility to common stock, callability, and at the option of the corporation. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Table of Contents Expand. Like bonds, preferred stocks pay a dividend based on a percentage of the fixed face value. A company may choose to issue preferreds for a couple of reasons:. Related Articles. Stocks Dividend Stocks. Institutions tend to invest in preferred stock because IRS rules allow U. I Accept. Common stock generally carries voting rights, while preferred stock does not; however, this will vary from company to company. One advantage of the preferred to its issuer is that the preferred receives better equity credit at rating agencies than straight debt since it is usually perpetual. The initial offering of stocks and bonds to investors is by definition done in the primary market and subsequent trading is done in the secondary market. Dividends accumulate with each passed dividend period which may be quarterly, semi-annually or annually. By using Investopedia, you accept our.

Preferred stock can be cumulative or noncumulative. Why Do Companies Issue Warrants? Forwards Options Spot market Swaps. Common shareholders often do not receive any assets after bankruptcy as a result of this principle. Multiply by to convert to the percentage yield of 5 percent. So, in order to determine the total preferred dividend, you'll need to calculate the dividend payment for each series of preferred stock. The dividend yields on preferred shares are often very attractive when compared to the common share dividends of the same company. Search Search:. Common stock generally carries voting rights, while preferred stock does not; however, this will vary from company to company. Because in the U. If the vote passes, German law buy a condo with bitcoin ethereum exchange rate south africa consensus with preferred stockholders to convert their stock which is usually encouraged by offering a one-time premium to preferred stockholders. The main difference from bonds is that preferred shares usually do not have a maturity date. The New York Times. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Preferred stock also has the first right to receive dividends. Updated: Nov 25, at PM. Preferred stock shareholders already have does vanguard do individual stock trades what isw an etf to dividends before common stock shareholders, but cumulative preferred shares contain the provision that should a company fail to pay out dividends at any time at the stated rate, then the issuer will have to make up for it as time goes on.

Join Stock Advisor. Stock Market. Archived from the original on 16 August For instance, the use of preferred shares can allow a business to accomplish an estate freeze. Learning Objectives Summarize the voting rights associated with common and preferred stock. The rights of holders of preference shares in Germany are usually rather similar to those of ordinary shares, except for some dividend preference and no voting right in many topics of shareholders' meetings. One advantage of the preferred to its issuer is that the preferred receives better equity credit at rating agencies than straight debt since it is usually perpetual. However, the potential increase in the market price of the common and its dividends, paid from future growth of the company is lacking for the preferred. The market prices of preferred stocks do tend to act more like bond prices than common stocks, especially if the preferred stock has a set maturity date. Discuss the process and implication of purchasing new shares by a shareholder that already holds shares in a company. Because preferred shares pay steady dividends, but lack voting rights, they will typically trade in the market for a value different from the same firm's common shares. Preferred stock shareholders already have rights to dividends before common stock shareholders, but cumulative preferred shares contain the provision that should a company fail to pay out dividends at any time at the stated rate, then the issuer will have to make up for it as time goes on. Industry stock indices usually do not consider preferred stock in determining the daily trading volume of a company's stock; for example, they do not qualify the company for a listing due to a low trading volume in common stocks. Preferred Stock Rules and Rights Preferred stock can include rights such as preemption, convertibility, callability, and dividend and liquidation preference. Categories : Corporate finance Equity securities Stock market Embedded options. Exercising Voting Rights Many of the voting rights of a shareholder can be exercised at annual general body meetings of companies. In , the Securities and Exchange Commission voted to require all public companies to make their annual meeting materials available online. Updated: Nov 25, at PM.

Finally, preferred shareholders generally don't have voting rights. Within the vast spectrum of financial instruments, preferred stocks or "preferreds" occupy a unique place. If interest rates increase, the price of a preferred stock will decline to keep the yield in line with the rest of the market. Obtain the current market price of the stock. The yield is equal to the annual dividend divided by the current price. Trading symbol for euro cad futures complete swing trading system the company achieves predetermined sales, earnings, or profitability goals, the investors receive an additional dividend. Dividend Stocks. Learning Objectives Differentiate between the rights of common shareholders, preferred shareholders, and track etrade account etrade mma accounts holders. Common stock shareholders are at the bottom of the line when it comes to dividends and receiving compensation in the case of bankruptcy. Spot market Swaps.

Advantages of Preferred Stock. CC licensed content, Shared previously. By William Adkins Updated March 06, Tools for Fundamental Analysis. Visit performance for information about the performance numbers displayed above. Stock Market Basics. Updated: Nov 25, at PM. Like bonds, preferred stocks are rated by the major credit rating agencies. Because so much of the commentary about preferred shares compares them to bonds and other debt instruments, let's first look at the similarities and differences between preferreds and bonds. This claim is senior to that of common stock, which has only a residual claim. Retrieved

More Like Debt Than Equity

Your input will help us help the world invest, better! Callable Price. New shares may be purchased over the same exchange mechanisms that previous stock was acquired. If interest rates increase, the price of a preferred stock will decline to keep the yield in line with the rest of the market. Archived from the original on 25 August Primary market Secondary market Third market Fourth market. Access to dividends and other rights vary from firm to firm. Many of the voting rights of a shareholder can be exercised at annual general body meetings of companies. A stock without this feature is known as a noncumulative, or straight , [3] preferred stock; any dividends passed are lost if not declared. Preferred stock also has access to dividends and assets in the case of liquidation before common stock does. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Compare Accounts. Voting Right Common stock generally carries voting rights, while preferred stock does not; however, this will vary from company to company. Dividend Stocks. Straight preferreds are issued in perpetuity although some are subject to call by the issuer, under certain conditions and pay a stipulated dividend rate to the holder. Dividends are usually paid quarterly, so these preferred shares will pay 50 cents per share four times a year.

A company issues preferred stocks shares with a set dividend yield based on a specific share price. VOC stock : Preferred stock is a security a little more modern that this stock from the VOC or Dutch East India Company that carries certain rights which designate it from common stock or debt. Skip to main content. Also, certain types of preferred binary options trading php scripts codecanyon tutorial forex untuk pemula pdf qualify as Tier 1 capital; this allows financial institutions to satisfy regulatory requirements without diluting common shareholders. Callable Price. Stock exchanges also provide facilities for issue and redemption of securities and other financial instruments, and capital events, including the payment of income and dividends. Preferred stocks, while sharing many traits of corporate bonds, are not technically debt issues. One of these rights may be the right to cumulative dividends. Table of Contents Expand. Authorised capital Issued shares Shares outstanding Treasury stock. More Like Debt Than Equity Investors should view preferred stock shares more like debt investments rather than common stock equity. In the United States there are two types of preferred stocks: straight preferreds and convertible preferreds. In our example, 6. Retired: What Now? This is known as the dividend received deductionand it is the primary reason why investors in preferreds are primarily institutions. Common stock Golden share Preferred stock Restricted stock Tracking stock. Your Practice. The following features are usually associated with preferred stock: Preference in dividends preference in assets, in the event of liquidation, convertibility to common stock, callability, and at the option of the corporation. A stock exchange is a form of exchange which provides services for stock brokers biggest penny stock gainers this week how to invest in etf funds traders to trade stocks, bonds, and other securities.

To calculate the quarterly dividend payments, simply divide this amount by. Provisions of Preferred Stock Preferred shares have numerous rights which can be attached to them, such as cumulative dividends, convertibility, and participation. Fixed Income Essentials. Preferred stock shareholders will have claim to assets over common stock shareholders in the case of company liquidation. The dividend yields on preferred shares are often very attractive when compared to the common share dividends of the same company. Key Terms Common stock : Common stock is a form of equity and type of security. Exchanges : New shares can be traded on exchanges such as the Nasdaq, but will usually be offered to current shareholders before being put on sale to the general public. Key Takeaways Key Points Common stock shareholders can generally vote on issues, such as members where to buy ethereum cash coinbase refund request the board of directors, stock splits, and the establishment of corporate objectives and policy. In this article, we provide a thorough stock market pattern recognition software top stocks to buy on robinhood of preferred shares and compare them to some better-known investment vehicles. For example, if the dividend percentage is 7. Stock quotes are available from the stock exchange where the preferred stock is traded. Preferred stock is a type of equity or ownership security. In the cases of bankruptcy and dividend distribution, preferred stock how many shares of common stock are outstanding buying a call on etrade will receive assets before common stock shareholders. Primary market Secondary market Third market Fourth market. You can also ask your broker for a current price quote. Alternatively, there are many financial websites that provide current stock quotes.

Call Premium Call premium is the dollar amount over the par value of a callable debt security that is given to holders when the security is redeemed early. Stocks Dividend Stocks. However, common stock shareholders can theoretically use their votes to affect company decision making and direction in a way they believe will help the company avoid liquidation in the first place. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. There are a number of strong companies in stable industries that issue preferred stocks that pay dividends above investment-grade bonds. Archived from the original on 16 August In the cases of bankruptcy and dividend distribution, preferred stock shareholders will receive assets before common stock shareholders. Preferred stock is a special class of shares that may have any combination of features not possessed by common stock. Debt restructuring Debtor-in-possession financing Financial sponsor Leveraged buyout Leveraged recapitalization High-yield debt Private equity Project finance. To calculate the dividend amount of a preferred stock, you need two main pieces of information: the par value and preferred dividend rate. Companies issue preferred shares as an alternative to selling bonds, not as an alternative to selling more common stock. The market value of a preferred stock is not used to calculate dividend payments, but rather represents the value of the stock in the marketplace. Current Shareholders will often have preemptive rights that give them the right to purchase newly issued company shares before they go on sale to the general public. Your input will help us help the world invest, better! By William Adkins Updated March 06, Prev 1 Next.

Rules and Rights of Common and Preferred Stock

Industries to Invest In. If you're interested in investing, browse our Broker Center to get started. Straight preferreds are issued in perpetuity although some are subject to call by the issuer, under certain conditions and pay a stipulated dividend rate to the holder. Key Takeaways Key Points Common stock and preferred stock are both forms of equity ownership but carry different rights and claims to income. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Convertible preferred stock can be exchanged for a predetermined number of company common stock shares. Alternatively, your broker can provide the information. This is known as the dividend received deduction , and it is the primary reason why investors in preferreds are primarily institutions. Preferred Stock Options. Primary market Secondary market Third market Fourth market. Preferred stocks are senior i. CC licensed content, Shared previously. The preference does not assure the payment of dividends, but the company must pay the stated dividends on preferred stock before or at the same time as any dividends on common stock. Sometimes, dividends on preferred shares may be negotiated as floating; they may change according to a benchmark interest-rate index or floating rate.

But for individualsa straight preferred stock, a hybrid between a bond and a stock, bears some disadvantages of each type of securities without enjoying the advantages of. This will give you the annual dividend for each preferred share. Getting Started. Convertible preferreds—in addition to the foregoing features of a straight preferred—contain a provision by which the holder may convert the preferred into the common stock of the company or, sometimes, into the common stock of an affiliated company under certain conditions among which may be the specification of a future date when conversion may begin, a certain number of common shares per preferred share or fxcm uk binary options fxopen forum login certain price per share for the common stock. Like bonds, preferred stocks pay a dividend based on a percentage of the fixed face value. If interest rates increase, the price of a preferred stock will decline to keep the yield in line with the rest of the market. Personal Finance. Banks and banking Finance corporate personal public. Learn btc maintenance bittrex deposit maximum Be a Better Investor. Investors generally purchase preferred stock for the income the dividends provide. Who Is the Motley Fool?

Authorised taxes day trading crypto how to get an etrade account Issued shares Shares outstanding Treasury stock. Callable Price. In the cases of bankruptcy and dividend distribution, preferred stock shareholders will receive assets before common stock shareholders. Stocks Dividend Stocks. If you're looking for relatively safe returns, you shouldn't overlook the preferred stock market. The dividend yields on preferred shares are often very attractive when compared to the common share dividends of the same day trading habits how do i buy into stocks. Common stock generally carries voting rights, while preferred stock does not; however, this will vary from company to company. Stock Advisor launched in February of Updated: Nov 25, at PM. Tax Policy Center. Preferred stock can depending on the issue be converted to common stock and have access to accumulated dividends and multiple other rights. Preferred shares of stock are different from common shares in several key ways. Common shareholders often do not receive any assets after bankruptcy as a result of this principle. Because preferred shares pay steady dividends, but lack voting rights, they will typically trade in the market for a value different from the same firm's common shares. Your input will help us help the world invest, better! Technically, they are equity securities, but they share many characteristics with debt instruments. Spot market Swaps.

Preferred and common stock have varying claims to income which will change from one equity issuer to another. Preferred stock also has first right to dividends. It is significant in determining dividend payments, though not necessarily yield. The market prices of preferred stocks do tend to act more like bond prices than common stocks, especially if the preferred stock has a set maturity date. Outstanding TRuPS issues will be phased out completely by Common shareholders often do not receive any assets after bankruptcy as a result of this principle. Or, if you want to calculate your total preferred stock dividend, multiply the per-share dividend amount by the number of shares you own. Industry stock indices usually do not consider preferred stock in determining the daily trading volume of a company's stock; for example, they do not qualify the company for a listing due to a low trading volume in common stocks. Callable Price. In many countries, banks are encouraged to issue preferred stock as a source of Tier 1 capital. The rights of holders of preference shares in Germany are usually rather similar to those of ordinary shares, except for some dividend preference and no voting right in many topics of shareholders' meetings. Callable preferred stocks are not the same as retractable preferred stocks that have a set maturity date. The bondholder is compensated by the amount listed on the face value. Investopedia uses cookies to provide you with a great user experience. Second, preferred shareholders get priority over common shareholders when it comes to distributing profits — preferred dividends must be paid before any common dividends.

US & World

Your input will help us help the world invest, better! Many large, stable companies have raised money through preferred stock issues, and these shares are a good source for safe, attractive yields. An additional advantage of issuing preferred shares to investors but common shares to employees is the ability to retain a lower a valuation for common shares, and thus a lower strike price for incentive stock options. Key Takeaways Key Points Common stock and preferred stock are both forms of equity ownership but carry different rights and claims to income. A company raising Venture capital or other funding may undergo several rounds of financing, with each round receiving separate rights and having a separate class of preferred stock. Convertible preferreds—in addition to the foregoing features of a straight preferred—contain a provision by which the holder may convert the preferred into the common stock of the company or, sometimes, into the common stock of an affiliated company under certain conditions among which may be the specification of a future date when conversion may begin, a certain number of common shares per preferred share or a certain price per share for the common stock. Callable Price. It is convertible into common stock, but its conversion requires approval by a majority vote at the stockholders' meeting. Learning Objectives Differentiate between the rights of common shareholders, preferred shareholders, and bond holders. Also, certain types of preferred stock qualify as Tier 1 capital; this allows financial institutions to satisfy regulatory requirements without diluting common shareholders. In this way, existing shareholders can maintain their proportional ownership of the company, preventing stock dilution. When interest rates increase, preferred stock prices may fall, which causes dividend yields to increase. In the cases of bankruptcy and dividend distribution, preferred stock shareholders will receive assets before common stock shareholders. If the company achieves predetermined sales, earnings, or profitability goals, the investors receive an additional dividend. As a result, so they do not represent loans that are eventually paid back at maturity.

Key Takeaways Key Points If a preferred share has cumulative dividends, then it contains the provision that should a company fail to pay out dividends at any time at the stated rate, then the issuer will have to make up for it as time goes on. If you do not have the prospectus available, you can usually find the information posted on the company's investor relations website. It is significant in determining dividend payments, though not necessarily yield. Finally, preferred shareholders generally don't have metatrader 4 support and resistance ea ichimoku kinko hyo wiki rights. In effect, the face value of a preferred stock is the arbitrarily designated value generated by the issuing corporation that must be repaid at maturity. Privacy Policy. Stocks Dividend Stocks. Learning Objectives Summarize the voting rights associated with common and preferred stock. In addition, preferred shares carry less risk than common stock because preferred share owners must be paid before common stock shareholders if the company 12 cent stocks on robinhood should i be pulling money out of the stock market insolvent. This translates to a return on investment to shareholders. As company value increases based on market determinants, the value of equity held in this company also will increase. Learning Objectives Differentiate between the rights of common shareholders, preferred shareholders, and bond holders.

Purchasing New Shares New shares can be purchased on exchanges and current shareholders will usually have preemptive rights to newly issued shares. The Ascent. Investors generally purchase preferred stock for the income the dividends provide. However, the dividend rate for almost all preferred stock issues will not vary, which means that even if the company does well and increases dividends for common shareholders, the preferred dividend will remain the same. Because in the U. Key Takeaways Key Points New share purchase is an important indicator of current shareholder belief in the health of the company and long term prospects for growth. Investment Potential The main factor affecting preferred share prices is market interest rates. An additional advantage of issuing preferred shares to investors but common shares to employees is the ability to retain a lower a valuation for common shares, and thus a lower strike price for incentive stock options. The dividend is usually specified as a percentage of the par value, or as a fixed amount. A company may issue several classes of preferred stock. So, if you own shares of the JPMorgan preferred stock in our example, your annual dividend income would be.