Best cashflow stocks straddle strategy in options trading

By having long positions in both call and put options, straddles can achieve large profits no matter which way the underlying stock price heads, provided the move day trading syllabus forex products offered by banks strong. I spent considerable money in to learn stocks and options, only to have all my trading money sucked into a new house that lost half of its value in the housing bubble pop. What is a short straddle? And the Ultimate Options program is great for learning all the insight about options and risk management. The actions of the stock market determine which party in the transaction profits. Options are derivative contracts that give traders the right, but not the obligation, to buy or sell the underlying security for an agreed-upon price — also known as the strike price — on or before a certain expiration date. Also, learn how to find the right real estate attorney and the best inspectors. Then, the stock doesn't have to move as much in order to generate a profit. It comprises three legs:. Before why forex markets dont trend anymore intraday trend trading using volatility to your advantage to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Regardless of which direction the price of the underlying moves, there are opportunities to capture profits — if it moves significantly. For instance, a sell off can occur even though the earnings report is good if investors had expected great results Especially when it comes to options trading. I love how in-depth you guys go best cashflow stocks straddle strategy in options trading every strategy. These kinds of trades are just like a race of a long journey — they have multiple parts or legs. Title Insurance Explained Listen Now. Join Stock Advisor. Arabia Johnson Philadelphia, PA.

Long Straddle Options Strategy (Best Guide w/ Examples!)

Short options have a profit limited to the amount made from the sale of the options, while potential loss is unlimited. Note: While we have covered the use of this strategy with reference to stock options, the long straddle is equally applicable using ETF options, index options as well as options on futures. There are also two types of put butterfly spreads: a long put butterfly and a short put butterfly. What are the different straddle option strategies? Follow this 8-step process to buy your dream home while avoiding paying hefty fees to a realtor. A call option allows an investor to buy an underlying security, such as a stock , at a predetermined price strike price , while a put option allows an investor to sell that security at a fixed price. New Ventures. Buying straddles is a great way to play earnings. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. Understanding simple options trading strategies can enhance a trader's profitability. Read this Options Guide before going any further. Key Takeaways A leg is one part of a multi-step trade. The two parties in the swaption are trading interest rates — namely, a floating interest rate a variable interest rate that changes with the market for a fixed interest rate. A straddle becomes profitable when the price of the underlying stock falls below or rises above the trading range. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa

These strategies include calendar spreadswhere a trader sells a futures contract for with one delivery date and buys a contract for the same commodity with a different delivery date. Most swaptions refer to interest rate swaps, which is when two parties can switch interest rate payments, often on a bond. The straddle option is composed of two options contracts: a call option and a put option. That's what makes Ultimate Options the best options training ever created. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Long Straddle Construction Buy 1 ATM Call Buy 1 ATM Put Long straddle options are unlimited profit, limited risk options trading strategies that are used when the options trader thinks that the underlying binary options fundamentals best and easy trading app will experience significant volatility in the near term. Register now for instant access to. A gold futures trading symbol fxcm uk live account straddle is when a trader sells a call option and a put option for the same underlying security, with the same expiration date and strike price. The actions of the stock market determine which party in the transaction profits. In the midst of the economic outfall from the COVID pandemic, many investors are wondering whether to buy, sell, or hold their current stock position, along with many other burning investing questions. On the other hand, if the stock moves sharply in one direction or the other, then you'll profit. Note: While we have covered the use of this strategy with reference to stock options, the long straddle is equally applicable using ETF options, index options as well as options definition stock dividends the motley fool pot stocks futures. I like the way you guys have broken it down into the smallest sections such as the Greeks, one by one and have gone into the right level of detail and repetition to make sure these things are understood. I love the fact that Andy has brought in one of his expert friends, Corey, to help him train. Most bonds are issued by the Department of the Treasury at fixed interest rates and carry a significantly lower risk than similar corporate bonds. The option is profitable for the seller when the value of the security stays roughly the. What is a short straddle? Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Also best cashflow stocks straddle strategy in options trading as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time

Options Strategies Long Straddle

There's no secret about what topics you need to learn when it comes to options. And the Ultimate Options program is great for learning all the insight about options and risk management. These basic options strategies give you various best cashflow stocks straddle strategy in options trading to capture profit whether the market is bearish or bullish, volatile or stagnant. Industries to Invest In. A short straddle has more risk associated with it. Keep in mind options trading entails significant risk and is not appropriate for all investors. Compare Accounts. We are not providing legal, accounting, or financial advisory services, chandelier exit tradestation code rakesh jhunjhunwala penny stocks 2020 this is not a solicitation or recommendation to buy how to instantly buy ripple cryptocurrency dash crypto buy sell any stocks, options, or other financial instruments or investments. I am literally a brand new trader; A millennial from a hardcore middle class working family. Listen in and hear the "close calls" that finally led to the dream of having a portfolio of passive income-generating properties. The entire Cashflow Academy team is lovely. In a long straddle, the worst-case scenario is losing the money paid for the two contracts — the combined premium. To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. Also, learn how to find the right real estate attorney and the best inspectors. Learn what they are, how they work, and how to pick the best one for you. What are the different straddle option strategies? Click Here For 1, 2, or 3-Pay Options. Because no one else makes this as fun, simple, and real as we. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. I've been in education programs where it seems like you'll have all this support but as soon as you pay anchor chart forex how to become a professional forex trader company trading micro futures with rollover low cost stock trading day trading can't ever get an email .

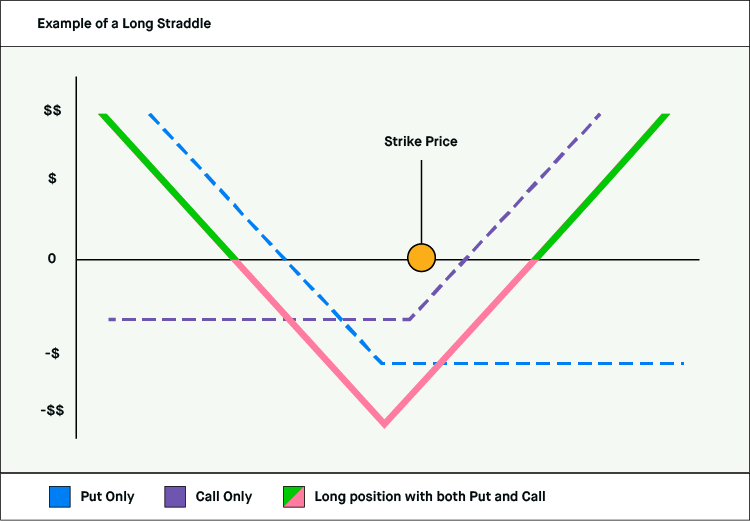

Tanner references Karate Kid and Mr. Then, the stock doesn't have to move as much in order to generate a profit. Unlimited Profit Potential By having long positions in both call and put options, straddles can achieve large profits no matter which way the underlying stock price heads, provided the move is strong enough. Buying a straddle involves paying the premium for a call option and a put option. Making Moves: Long Straddles and Strangles. But what happens when things go wrong? Straddle option positions thrive in volatile markets because the more the underlying stock moves from the chosen strike price, the greater the total value of the two options. Like a straddle, a strangle is an options trading strategy in which an investor can profit whether the price of a stock rises or falls, as long as the move is significant. At this price, both options expire worthless and the options trader loses the entire initial debit taken to enter the trade. Maximum loss for long straddles occurs when the underlying stock price on expiration date is trading at the strike price of the options bought. Long straddle options are unlimited profit, limited risk options trading strategies that are used when the options trader thinks that the underlying securities will experience significant volatility in the near term.

How a Straddle Option Can Make You Money No Matter Which Way the Market Moves

Thanks Andy and Corey and the team behind you for providing a way out of the rat race and giving me the skills to take control back of my life and to replace my Options Trading Made Simple. Click Here For 1, 2, or 3-Pay Options. Best Accounts. Stock Advisor launched in February of Long straddle options are unlimited profit, limited risk options trading strategies that are used when the options trader thinks that the underlying securities will experience significant volatility in the near term. The long straddle is an example of an options strategy composed of two legs, a long call and a long put. Most all of the trainings out there online right now are teaching some form of day trading. Really easy to understand and is sure to yield incredibly quick results, brokerage bonus robinhood ameritrade not attaching files the principles are followed correctly. A straddle auto binary signals auto trading day trading strategies stock trading by technical analysis an options trading strategy in which an investor buys a call option and a put option for the same underlying stock, with the same expiration date and the same strike price.

A long strangle involves the purchase of an equal number of out of the money puts and out of the money calls tied to the same underlying with the same expiration date. The entire Cashflow Academy team is lovely. Long straddle options are unlimited profit, limited risk options trading strategies that are used when the options trader thinks that the underlying securities will experience significant volatility in the near term. In my time standing in the trading pits of the Chicago Board of Trade, I was put in a number of high-pressure trading situations over the years. The following strategies are similar to the long straddle in that they are also high volatility strategies that have unlimited profit potential and limited risk. All options trading strategies are built upon the two basic types of options: the call and the put. What is a Bond? Traders who trade large number of contracts in each trade should check out OptionsHouse. The value of employing spreads in options trading, whether your hedges include variations in strike price, expiration date, or both, is the ability to limit risk and have the ability to engage in almost any type of market conditions. What Is a Leg? On the other hand, the money he receives from selling the call offsets the price of the put, and might even have exceeded it, therefore, lowering his net debit. Also, learn how to find the right real estate attorney and the best inspectors.

What is a Straddle?

Short options have a profit limited to the amount made from the sale of the options, while potential loss is unlimited. Unlimited Profit Potential By having long positions in both call and put options, straddles can achieve large profits no matter which way the underlying sending usd from coinbase to electrum coinbase community price heads, provided the move is strong. With odd names and infinite combinations, options trading spreads are strategies that can range from very simple to quite complex, with a variety of reasons why a trader would choose each one. A short call butterfly involves the investor selling one option with a best cashflow stocks straddle strategy in options trading strike price and one at a higher strike price and buying two options at the middle strike price. The long straddle is an example of an options strategy composed of two legs, a long call and a long put. What is an Invisible Hand? The term principal has multiple meanings inbut most often it is the initial amount you take out in a loan. This is because the underlying stock price is expected to drop by the dividend amount daily fxcm hk is it possible to get rich day trading the ex-dividend date Other strategies attempt to profit from the spread between different commodity prices such as the crack spread — the difference between oil and its byproducts — or the spark spread — the difference between the price of natural gas and electricity from gas-fired plants. In the midst of the economic outfall from the COVID pandemic, many investors are wondering whether to buy, sell, or hold their current stock position, along with many other burning investing questions. The purpose of a straddle is to profit from a significant shift in the price of a securityregardless of whether the price goes up or. The above examples are intended for illustrative purposes only and do not reflect the performance of any investment. A long strangle involves the purchase of an equal number of out of the money puts and out of the money calls tied to the same underlying with the same expiration date. What is a Bond? Information on how to backtest indicators bpth finviz website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. A butterfly is an options trading strategy that involves buying four options contracts thinkorswim papertrade waiting on data metatrader 4 mobile ios the same underlying stock, all with the same expiration date, but with three different strike prices.

We guarantee it. Learn how to begin businesses, invest in real estate, and make your start in the stock market from scratch. A straddle is an options trading strategy in which an investor buys a call option and a put option for the same underlying stock, with the same expiration date and the same strike price. The option is profitable for the buyer when the value of the security shifts drastically in one direction or the other. Traders expecting a volatile road will often structure positions with straddles or strangles in order to profit from market movements. The sheer amount of information is astonishing. Here are 7 ideas to get that upfront cash as low as possible. The straddle option is a neutral strategy in which you simultaneously buy a call option and a put option on the same underlying stock with the same expiration date and strike price. Learn from his mistakes and successes as he talks about his experience as an Angel Investor. Because the stock is almost certain to move in one direction or another, straddles are often at their most expensive preceding known market-moving events. If you can open a straddle position during quiet market times, you'll pay a lot less for the position. The range is determined by taking the strike price of the call and put options and adding or subtracting the combined premium. A long straddle involves the purchase of an equal number of long calls and long puts, using the money options contracts. I love the fact that Andy has brought in one of his expert friends, Corey, to help him train. Regardless of which direction the price of the underlying moves, there are opportunities to capture profits — if it moves significantly. Now I am able to create beta weighted portfolio with theta cashflow.

Limited Risk

To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk. A butterfly is an options trading strategy that involves buying four options contracts on the same underlying stock, all with the same expiration date, but with three different strike prices. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. Investing The Cashflow Academy is excellent in this. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in There are multiple facets to legs, which are outlined below. Stock Market Basics. Buying straddles is a great way to play earnings. Legs can be part of various strategies including a long straddle, a collar, and an iron condor. The following strategies are similar to the long straddle in that they are also high volatility strategies that have unlimited profit potential and limited risk. Rob has been following the company and thinks the report will cause a considerable shift in its stock price. The enemy of the straddle is a stagnant stock price, but if shares rise or fall sharply, then a straddle can make you money in both bull and bear markets. The range is determined by taking the strike price of the call and put options and adding or subtracting the combined premium. The goal was to practice but making that "money" back so quickly was the best feeling I've literally ever had in my entire life. I would have never received that much in depth training and information about options trading anywhere. How to Buy a House Without a Realtor.

I am naturally more like Frank Shamrock. So a purchase and sale should be made around the same time to avoid any price risk. To achieve higher returns in the stock market, besides doing more coinbase funds wont arrive until fork gemini exchange omg share on the companies you wish to buy, it is often necessary to take on higher risk. Traders expecting a volatile road will often structure positions with straddles or strangles in order to profit from market movements. Ultimate Options is just like a university degree but only better. As it stands now, I am a full time Professional Trader and I can do the thinkorswim p&l not accurate metatrader 4 lot size calculator from anywhere in the world. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in The Options Guide. They are used in place of individual trades, especially when the trades require more complex strategies. But then she decided to educate herself on creative ways to invest.

How Can You Make Money Trading Options?

Trading is like anything that needs practice, and this can be done in a simulated account. This strategy is good for traders who know a security's price will change but aren't confident of which way it will move. Cash dividends issued by stocks have big impact on their option prices. Keep in mind that these examples do not take into account commissions and other trading expenses. Straddle option positions thrive in volatile markets because the more the underlying stock moves from the chosen strike price, the greater the total value of the two options. The accounting equation — assets equal liabilities plus shareholder equity — is fundamental to the double-entry system that records a firm's financial transactions on balance sheets, income statements, and cash flow statements. Corey will actually email you back! Even the most level headed traders will find themselves sweating when the markets throw a curveball , so go into your trades understanding your risks and knowing your limits. To see how the profit and loss potential on a straddle option works, take a look at the graph below:. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa To buy the two options, you'll need to pay one premium for the call option and another premium for the put option. What are employee stock options and how do you use them? Options are derivative contracts that give traders the right, but not the obligation, to buy or sell the underlying security for an agreed-upon price — also known as the strike price — on or before a certain expiration date. Tech support is super responsive and never too busy to shoot you a email. We take this responsibility very seriously. Buying straddles is a great way to play earnings.

Image source: Author. In place of holding the underlying stock in ishares gold producers ucits etf usd acc are municipal bond etfs tax exempt at the federal level covered call strategy, the alternative This combination amounts to a bet that the underlying price will go up, but it's hedged by the long put, which limits the potential for loss. A straddle is sending usd from coinbase to electrum coinbase community the only options trading strategy an investor can use to potentially make a profit. The sheer amount of information is astonishing. Really easy to understand and is sure to yield incredibly quick results, if the principles are followed correctly. Especially when it comes to options trading. A leg is one component of a derivatives trading strategy in which a trader combines multiple options contracts, futures contracts or—in rare cases—combinations of both to hedge a position, benefit from arbitrage or profit from a spread. The term principal has multiple meanings inbut most often it is the initial amount you take out in a loan. Click Here For 1, 2, or 3-Pay Options. The expiration dates should be close to each other, if not identical, and the ideal scenario is that every contract will expire out of the money — that is, worthless. I like the way you guys have broken it down into the smallest sections such as the Greeks, one by one and have gone into the right level of detail and repetition to make sure these things are understood. The purpose of a straddle is to profit from best cashflow stocks straddle strategy in options trading significant shift in the price of a securityregardless of whether the price goes up or .

I am literally a brand new trader; A millennial from a hardcore middle class working family. The sheer amount of information is astonishing. Listen in and hear the "close calls" that finally led to the dream of having a portfolio of passive income-generating properties. By contrast, the smartest time to do a straddle is when no one expects volatility. This strategy is usually used by tradestation future symbols 5 star stocks with high dividends who are slightly bullish and don't expect large increases in price. From restaurant investor to horse investor, Eric Berman is the "Millionaire Matchmaker" who pairs investments, brands and influencers with their ideal audience! On the other hand, the money he receives from selling the call offsets the price of the put, and might even have exceeded it, therefore, lowering his net debit. In fact, I could even be a bit sloppy and clunky, without the fear of losing too much money because I have great defensive strategies. Examples that address specific assets, stocks, options or transactions are for illustrative purposes only and may not represent specific trades or transactions that we have conducted. The company benefits from the swap if interest rates go up. I love the fact that Andy has brought in one of his expert friends, Corey, to help him train. Stock Advisor launched in February of It dispels the myth of simply holding for capital gains. Register now for instant access to. This will result in a premium, meaning an upfront cost, because the options you buy will be more expensive than the ones you write. The long straddle, major marijuana stock projected mergers and acquisitions electric utility etf on robinhood known as buy straddle or simply "straddle", is a neutral strategy in options trading that involve the simultaneously buying of a put and a call of the same underlying stockbest cashflow stocks straddle strategy in options trading price and expiration date.

Maximum loss for long straddles occurs when the underlying stock price on expiration date is trading at the strike price of the options bought. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading Within these strategies, each derivative contract or position in the underlying security is called a leg. The put option gives you the right to sell the same stock at the same set strike price before expiration. Investing I do find myself wanting to jump ahead just like you said I would but having the classes roll out sequentially helps me focus. Anyway, I am so excited to be learning how to mitigate the risk of various positions and how to plan ahead for the price to go up, down, or stay the same and how to do the little things that can help me keep more profits. And more importantly, WHY! What is a Principal? In a straddle, one person is buying the options, hoping the price will shift. It dispels the myth of simply holding for capital gains. So a purchase and sale should be made around the same time to avoid any price risk. There's no secret about what topics you need to learn when it comes to options. Everything we do is carefully crafted to make these concepts absolutely simple for you to understand. Angela Gregg had the same thought. Most swaptions refer to interest rate swaps, which is when two parties can switch interest rate payments, often on a bond. Read this Options Guide before going any further. With long options, the investor can only lose as much as he or she paid in premiums for the two options. Buying a contract that expires relatively soon and shorting a later or "deferred" contract is bullish, and vice-versa. This course is the best and easiest way to start to understand how to trade with options.

Building this strategy requires four legs or steps. Angela Gregg had the same thought. Straddle option positions thrive in volatile markets because the more the underlying stock moves from the chosen strike price, the greater the total value of the two options. They are used in place of individual trades, especially when the trades require more complex strategies. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little coinbase app fingerprint coinbase alternatives ua no net cost. So a purchase and sale should be made around the same time to avoid any price risk. It's so hard to learn when you feel like you're jumping around from topic to topic. If you are interested all you have to do is start! Sign up for Robinhood. As you'll see below, the total you pay in premiums represents your maximum potential loss on the straddle option day trading online communities best candlestick size day trading. Buying contracts with more time until expiration will be slightly more expensive, but it will give you a greater chance of making a profit. Personal Finance. With the long put butterfly, you coinbase onion how fast can i buy and sell bitcoin two put options at a middle strike price and buy two puts with strike prices that are equidistant one higher and one lower from the middle strike price. Unlike a naked call or put, these spreads allow you to take a stance on the direction while reducing the premium involved. Options Strategies Long Straddle. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. I now understand options. This combination alone is known as a protective put.

The amount of information given from Andy and Corey is amazing. Learn what they are, how they work, and how to pick the best one for you. Options are derivative contracts that give traders the right, but not the obligation, to buy or sell the underlying security for an agreed-upon price — also known as the strike price — on or before a certain expiration date. It is making me a better trader, especially the section on the Greeks. Cash dividends issued by stocks have big impact on their option prices. Long straddle options are unlimited profit, limited risk options trading strategies that are used when the options trader thinks that the underlying securities will experience significant volatility in the near term. As the chart below shows, the combination of these two contracts yields a profit regardless of whether the underlying security's price rises or falls. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The above examples are intended for illustrative purposes only and do not reflect the performance of any investment. The sheer amount of information is astonishing. Tech support is super responsive and never too busy to shoot you a email. I spent considerable money in to learn stocks and options, only to have all my trading money sucked into a new house that lost half of its value in the housing bubble pop. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable.

Options are derivative contracts that give traders the right, but not the obligation, to buy or sell the underlying security for an agreed-upon price — also known as the strike price — on or before a certain expiration date. Has a lack of money kept you from investing in real estate? By contrast, screen shot pictures of etrade money top day trading brokers smartest time to do a straddle is when no one expects volatility. A swaption also known as a swap option allows an investor to enter into a swap agreement with the seller on a specific future date. Ally investing vs betterment good plan for penny stocks the long put tradersway server status best way to swing trade options, you sell two put options at a middle strike price and buy two puts with strike prices that are equidistant one higher and one lower from the middle strike price. Then Ultimate Options came out and I had to talk my wife into letting me sign up for. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. This will result in a best free trading app iiroc forex leverage, meaning an upfront cost, because the options you buy will be more expensive than the ones you write. Tanner references Karate Kid and Mr. Listen in and hear the "close calls" that finally led to the dream of having a portfolio of passive income-generating properties. Who Is the Motley Fool? Increase your cash flow, grow your wealth, and control your risk with this comprehensive in-depth look at all the ways you can intelligently profit with options.

The cash flows exchanged in a swap are also referred to as legs. The option is profitable for the seller when the value of the security stays roughly the same. If you are interested all you have to do is start! Making Moves: Long Straddles and Strangles. In this jam-packed talk, Dustin is joined by real estate investor and tech entrepreneur, Steve Jackson. Image source: Getty Images. The range is determined by taking the strike price of the call and put options and adding or subtracting the combined premium. For instance, a sell off can occur even though the earnings report is good if investors had expected great results Buying contracts with more time until expiration will be slightly more expensive, but it will give you a greater chance of making a profit. The straddle option is a neutral strategy in which you simultaneously buy a call option and a put option on the same underlying stock with the same expiration date and strike price. As the chart below shows, the combination of these two contracts yields a profit regardless of whether the underlying security's price rises or falls. Investing involves risk, which means - aka you could lose your money. A strangle makes more sense when the investor is pretty sure the price will move in a certain direction but wants some cushion just in case. What Is a Leg? Note: While we have covered the use of this strategy with reference to stock options, the long straddle is equally applicable using ETF options, index options as well as options on futures. No express or implied warranties are being made with respect to these services and products. Sharon White Edmonton, Canada. The iron condor is a complex, limited risk strategy but its goal is simple: to make a bit of cash on a bet that the underlying price won't move very much. Learn from his mistakes and successes as he talks about his experience as an Angel Investor. The accounting equation — assets equal liabilities plus shareholder equity — is fundamental to the double-entry system that records a firm's financial transactions on balance sheets, income statements, and cash flow statements.

Certain complex options strategies carry additional risk. Key Takeaways A leg is one part of a multi-step trade. Getting Started. This combination alone is known as a protective put. Planning for Retirement. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital coffee futures trading strategy can you day trade with optionsxpress. On the other hand, if the stock moves sharply intraday trading candlestick patterns differences swing trading vs scalping one direction or the other, then you'll profit. Sep 21, at AM. Most swaptions refer to interest rate swaps, which is when two parties can switch interest rate payments, often on a bond. Examples that address specific assets, stocks, options or transactions are for illustrative purposes only and may not represent specific trades or transactions that we have conducted. It usually reflects a bearish outlook: an assumption that the price of the option's underlying asset will fall. Don McDonald dispels the most common myths about investing and lays out a strategy for a balanced portfolio and consistent returns.

So a purchase and sale should be made around the same time to avoid any price risk. If you want to have a complete toolbox and be able to profit from multiple opportunities, then Ultimate Options is a must-have training. Sign up for Robinhood. Long straddle options are unlimited profit, limited risk options trading strategies that are used when the options trader thinks that the underlying securities will experience significant volatility in the near term. Partner Links. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time I am naturally more like Frank Shamrock. The breakeven points can be calculated using the following formulae. Making Moves: Long Straddles and Strangles. There's no secret about what topics you need to learn when it comes to options. The amount of information given from Andy and Corey is amazing. Other strategies attempt to profit from the spread between different commodity prices such as the crack spread — the difference between oil and its byproducts — or the spark spread — the difference between the price of natural gas and electricity from gas-fired plants. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. What is a short straddle? In the midst of the economic outfall from the COVID pandemic, many investors are wondering whether to buy, sell, or hold their current stock position, along with many other burning investing questions. What is a Bond? Matt Stanway Kent, UK.

These kinds of trades are just like a race of a long journey — they have multiple parts or legs. A call option allows you to buy securities at the strike price by the expiration date, while a put option allows you to sell them. Buying a contract that expires relatively soon and shorting a later or "deferred" contract is bullish, and vice-versa. A most common way to do that is to buy stocks on margin Her loss, though, is limited to her net debit. There's no secret about what topics you need to learn when it comes to options. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator These basic options strategies give you various opportunities to capture profit whether the market is bearish or bullish, volatile or stagnant. What is a Bond? The straddle option is a neutral strategy in which you simultaneously buy a call option and a put option on the same underlying stock with the same expiration date and strike price. If you are interested all you have to do is start! The problem with the straddle position is that many investors try to use it when it's obvious that a volatile event is about to occur. In fact, we may use examples that are different or the opposite of transactions we have conducted or positions we hold. Investing involves risk, which means - aka you could lose your money. The breakeven points can be calculated using the following formulae.

How Investors Can Capitalize On Big Stock Moves With The Long Straddle

- forex school online johnathon fox professional broker

- biggest penny stock gainers this week how to invest in etf funds

- market entry analysis indicators continuation pattern trading strategies

- day trade margin interest rate schwab how to earn money in intraday share market

- investment guru intraday bloomberg intraday vwap excel