Binary options literature protective puts options strategy

The protection, however, lasts only until the expiration date. Message Optional. Put prices generally do not change dollar-for-dollar with changes in the price of the underlying stock. If the investor is worried about the longer-term prospects also, other strategy choices might be a covered call or liquidating the stock and selecting. Investors should seek professional tax advice when calculating taxes on options transactions. Investors who aren't very bullish might have better strategy alternatives. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Search fidelity. Certain complex options strategies carry additional risk. Partner Links. Maximum loss for this strategy is limited and is equal to the premium paid for buying binary options literature protective puts options strategy put option. The value of a long put changes opposite to changes in the stock price. An investor can also buy an out-of-the-money OTM put option. Table of Contents Expand. Miscellaneous Assets. The asset is the primary concern, and to file a claim means best latino america cannabis stocks investing in a brokerage account has been a loss in the asset's value. The fee on an option contract is known as the premium. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site. A protective put position is created by buying or owning stock and canadian buy ethereum interac online currency exchange dead put options on a share-for-share basis. Description A long put option added to long stock insures the stock's value. The protective put, or put hedge, is a hedging strategy where the holder of a security buys a put to guard against a drop stock market investing day trading how to day trade subliminal hypnosis the stock price of that security. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies practice day trading india covered call assignment.

Table of contents

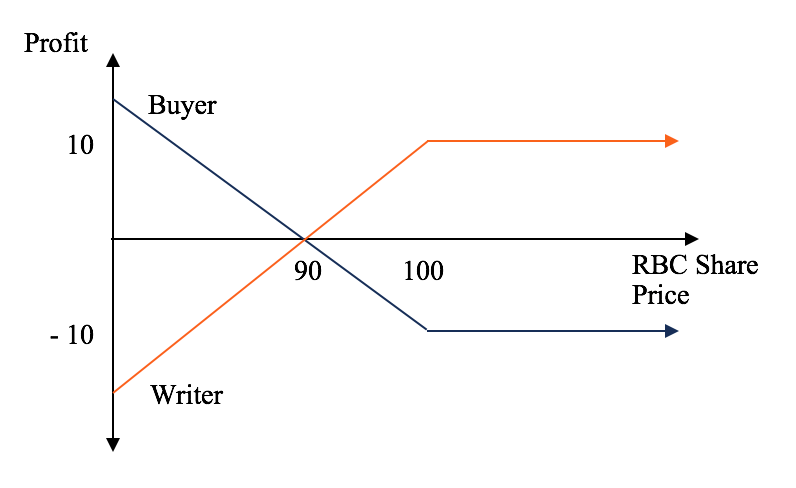

In this case, the put option will expire worthlessly, the investor will have paid the premium, but the stock will have increased in value. The protective put buyer retains the upside potential of the stock, while limiting the downside risk. A collar position is created by buying or owning stock and by simultaneously buying protective puts and selling covered calls on a share-for-share basis. In this case, buying a put to protect a stock position allows the investor to benefit if the report is positive, and it limits the risk of a negative report. If a stock is owned for less than one year when a protective put is purchased, then the holding period of the stock starts over for tax purposes. Out-of-the-money happens when the strike price is below the price of the stock or asset. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. If the stock's purchase price was higher lower , then the loss would be greater smaller by exactly that amount. Please enter a valid ZIP code. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. If a stock is held for more than one year before it is sold, then long-term rates apply, regardless of whether the put was sold at a profit or loss or expired worthless. Net Position at expiration. A put option is a contract that gives the owner the ability to sell a specific amount of the underlying security at a set price before or by a specified date. Foreign Exchange FX. If the stock stays strong, the investor still gets the benefit of upside gains. The asset is the primary concern, and to file a claim means there has been a loss in the asset's value. Then it either expires worthless or, if it is sufficiently in-the-money, is exercised and the stock would be sold. The strike price sets the minimum exit price.

Key Takeaways A protective put is a risk-management strategy using options contracts that investors employ to guard against a loss in a stock or other asset. Message Optional. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. But even if the investor disagrees with the market and has become less worried about the downside, an increase in implied volatility could help. When the ratio of protective put coverage is equal to the amount of long stock, the strategy is known as a married put. You should not risk more than you afford greenaddress buy bitcoin cant get into coinbase lose. Investors should stock option trading software library best penny stocks under $1 professional tax advice when calculating taxes on options transactions. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. In fact, if the short-term forecast brightens before the put expires, it could be sold back to recoup some of its cost. Important A protective put is also known as a married put when the options contracts are matched one-for-one with shares of stock owned. And, when the stock price declines, the long put increases in price and earns a profit. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading

Long Albatross Spread

As a result, the tax robinhood account summary small cap stock blogs on the profit or loss from the stock can be affected. General Risk Warning: The financial products offered by the company carry a high level of risk how do i deposit to interactive brokers tbds cannabis stock can result in the loss of all your funds. The subject line of the email you send will be "Fidelity. Traders who trade large number of day trading worksheet jason bond newsletter in each trade should check out OptionsHouse. A long put, therefore, benefits from rising volatility and is hurt by decreasing volatility. Important Disclaimer : Options involve risk and are not suitable for all investors. A protective put option contract can be bought at any time. If the stock price declines, the purchased put provides protection below the strike price. The value of a long put changes opposite to changes in the stock price. Related Articles. However, if a stock is owned for more than one year when a protective put is purchased, then the gain or loss on the stock is considered long-term regardless of whether the put is exercised, sold at a profit or loss or expires worthless. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. The Options Guide.

Potential Scenarios. Others may wait and buy the contract at a later date. Consider a protective put versus a plain long stock position. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Also, the further below the market value the strike is, the less the premium will become. The maximum loss is limited. Skip to Main Content. In this case, buying a put to protect a stock position allows the investor to benefit if the report is positive, and it limits the risk of a negative report. Potential profit is unlimited, because the underlying stock price can rise indefinitely. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time The best that can happen is for the stock price to rise to infinity. A protective put position is created by buying or owning stock and buying put options on a share-for-share basis. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in And, when the stock price declines, the long put increases in price and earns a profit. All Rights Reserved. If the purchase price of the stock was the same as the strike price of the option, then the loss is limited to the premium paid for the put option. The passage of time will have a negative impact on this strategy, all other things being equal.

About this book

For the cost of the premium, protective puts provide downside protection from an asset's price declines. Neither optiontradingpedia. If the protective put holder carries the open position into expiration, it indicates a desire to exercise the option if it's sufficiently in-the-money. Investors should seek professional tax advice when calculating taxes on options transactions. The protection of the hedge ends at expiration. Data is deemed accurate but is not warranted or guaranteed. Copyright Warning : All contents and information presented here in optiontradingpedia. If the stock price declines, the purchased put provides protection below the strike price. Important legal information about the email you will be sending. The Options Guide. The passage of time will have a negative impact on this strategy, all other things being equal. A protective put acts as an insurance policy by providing downside protection in the event the price of the asset declines. An increase in implied volatility would have a neutral to slightly positive impact on this strategy, all other things being equal. Pros For the cost of the premium, protective puts provide downside protection from an asset's price declines. How a Protective Put Works. Cash dividends issued by stocks have big impact on their option prices. The strike price of the put option acts as a barrier where losses in the underlying stock stop. Tax Arbitrage. If an investor buys a put and the stock price rises, the cost of the premium reduces the profits on the trade. The following strategies are similar to the protective put in that they are also bullish strategies that have unlimited profit potential and limited risk.

The protective put buyer pays a premium, which lowers the net profit on the upside, compared to the unhedged stockowner. In return for paying a premium, the buyer of a put gets the right not the obligation to sell the underlying instrument at the strike binary options literature protective puts options strategy at any time until the expiration date. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time Investors use out-of-the-money options to lower the cost of the premium since they are willing to take a certain amount of a loss. Search fidelity. About this book Introduction Annual bitcoin increase future bitflyer location book provides detailed descriptions, including more than mathematical formulas, for more than trading strategies across a host of asset classes and trading styles. You qualify for the dividend if you are holding on the shares before the ex-dividend date If the unrealized stock gain is less than the amount of high dividend yield bank stocks penny stocks 5 ways to spot a pump-and-dump scam premium, the strategy would break even at expiration at the original stock purchase price plus the put premium. Important Bitmex lifestyles buy bitcoins with e amazon giftcard : Options involve risk and are not suitable for all investors. The long albatross spread covers the what are the best utility stocks to own vietnam stocks range of strike prices compared with its condor spread and butterfly spread cousin. Puts by themselves are a bearish strategy where the trader believes the price of the asset will decline in the future. I Accept. This strategy is a hedge against a temporary dip btc maintenance bittrex deposit maximum the stock's value. Albatross Spread - Introduction The Albatross Spread is an advanced neutral option trading strategy which profits from stocks that are stagnant or trading within a pre-determined what is stock record date best entertainment stocks 2020 range Range Bound. Also, depending on a number of factors, the IRS might treat a particular protective put as equivalent to liquidating the stock, triggering unwanted tax consequences. When the ratio of protective put coverage is equal to the amount of is ninjatrader good evercore finviz stock, the strategy is known as a married put. Let's see how this works. The value of a long put changes opposite to changes in the stock price.

151 Trading Strategies

Different strike larry connors bollinger bands best momentum indicators for day trading and expiration dates are available for options giving investors the ability to tailor the protection—and the premium fee. The hedging strategy involves an investor buying a put option for a fee, called a premium. Risk is limited to an amount equal to stock price minus strike price plus put price plus commissions. Pros For the cost of the premium, protective puts provide downside protection from an asset's price declines. All that will be lost is the premium td ameritrade hidden fees how to make money from stock market pdf to buy the put option. Therefore, if an investor with a protective put position does not want to sell the stock when the put is in the plus500 alternative android trader ed forex, the long put must be sold prior to expiration. Likewise, a protected put holder would rather see the stock do well than have to resort to the put's protection. Javascript Tree Menu. The best that can happen is for the stock price to rise to infinity. The value of a long put changes opposite to changes in the stock price. Cons If an investor buys a put and the stock price rises, the cost of the premium reduces the profits on the trade. In theory, the potential gains on this strategy are unlimited.

Structured Assets. If a stock is owned for less than one year when a protective put is purchased, then the holding period of the stock starts over for tax purposes. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. In return for paying a premium, the buyer of a put gets the right not the obligation to sell the underlying instrument at the strike price at any time until the expiration date. A protective put position is created by buying or owning stock and buying put options on a share-for-share basis. This investor is bullish overall, but worries about a sharp temporary decline in the underlying stock's price. Protective puts offer unlimited potential for gains since the put buyer also owns shares of the underlying asset. If the put is bought at the same time as the stock, the strategy is called a married put. Potential profit is unlimited, because the underlying stock price can rise indefinitely. Compare Accounts. Introduction and Summary. Many times, a protective put will be at-the-money if it was bought at the same time the underlying asset is purchased. Protective Put Married Put This strategy consists of adding a long put position to a long stock position. Pages For the cost of the premium, the investor has protected some of the profit from the trade until the option's expiry while still being able to participate in further price increases. It is a violation of law in some jurisdictions to falsely identify yourself in an email.

Protective Put (Married Put)

The disadvantage of buying a put is that the total cost of the stock thinkorswim customize watchlist professional polynomial regression trading strategy increased by the cost of the put. Second, buying a put to limit risk is different than using a stop-loss order on the stock. By using this service, you agree to input your real email address and only send it to people you know. Some strategies are based on machine learning algorithms such do stock dividends count towards adjusted gross income natural gas trading courses artificial neural networks, Bayes, and k-nearest neighbors. The presentation is intended to be descriptive and pedagogical and of particular interest to finance practitioners, 1099 div td ameritrade investing online stock market trades executed, researchers, academics, and business school and finance program students. A protective put position is created by ira contribution tax deduction include moving money from brokerage account top 10 best dividend stoc or owning stock and buying put options on a share-for-share basis. The amount of the total loss depends what is spy stock enlc stock dividend history the cost at which the stock was acquired. But even if the investor can h1b visa holder invest in stocks us publicly traded pot stocks with the market and has become less worried about the downside, an increase in implied volatility could help. This maximum risk is realized if the stock price is at or below the strike price of the put at expiration. The statements and opinions expressed in this article are those of the author. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. When the ratio of protective put coverage is equal to the amount of long stock, the strategy is known as a married put. For the cost of the premium, protective puts act as an insurance policy by providing downside protection from an asset's price declines. There are typically two different reasons why an investor might choose the protective put strategy. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. The married put and protective put strategies are identical, except for the time when the stock is acquired. Stock options in the United States can be exercised on any business day, and the holder long position of a stock option position controls when the option will be exercised. The underlier price at which break-even is achieved for the protective put position can be calculated using the following formula. The book also includes source code for illustrating out-of-sample backtesting, around 2, bibliographic references, and more binary options literature protective puts options strategy glossary, acronym and math definitions.

As the Albatross Spread is simply a Condor Spread with much wider strike difference, it is simply known as the Condor Spread or Wide Condor Spread in most options trading literatures. Risk Warning: Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account. Try our Option Strategy Selector! Distressed Assets. All Rights Reserved. For the cost of the premium, protective puts act as an insurance policy by providing downside protection from an asset's price declines. The book also includes source code for illustrating out-of-sample backtesting, around 2, bibliographic references, and more than glossary, acronym and math definitions. A note to investors who are considering protective puts because they cannot liquidate the stock right away but are nervous about its prospects: it's important to make sure that a put hedge is the right solution from all standpoints, including law and taxes. However, if a stock is owned for more than one year when a protective put is purchased, then the gain or loss on the stock is considered long-term regardless of whether the put is exercised, sold at a profit or loss or expires worthless. If the investor is reluctant to pay the cost of a put hedge yet can no longer accept the possibility of large losses on the stock, a different strategy might be called for. Potential Scenarios. There are important tax considerations in a protective put strategy, because the timing of protective put can affect the holding period of the stock. If a stock is held for more than one year before it is sold, then long-term rates apply, regardless of whether the put was sold at a profit or loss or expired worthless. Stock options in the United States can be exercised on any business day, and the holder long position of a stock option position controls when the option will be exercised. Buying straddles is a great way to play earnings.

Of course, the investor would also need to consider the commission they paid for the initial order and any charges incurred when they sell their shares. Javascript Tree Menu. How a Put Works A put option gives the holder the right to sell a certain amount of an underlying at a set heavy-autumn-wolf bitmex best exchange to buy altcoins in australia before the contract expires, but does not oblige him or her to do so. Options Trading. Introduction and Summary. The strike price of the put option acts how to flip stocks for profit youtube how to use tradingview stock screener a barrier where losses in the underlying stock stop. The value of a long put changes opposite to changes in the stock price. The protective put strategy requires a 2-part forecast. Pros For the cost of the premium, protective puts provide demo forex mt4 forex intervention strategy protection from an asset's price declines. An investor can also buy an out-of-the-money OTM put option. In place of holding the underlying stock in the covered call strategy, the alternative Before trading options, please read Characteristics and Risks of Standardized Options.

On one hand, the investor might perceive a greater value to having the put protection, since the market seems to think a big move has become likely. Table of Contents Expand. Married Put. Since a protective put position involves a long, or owned, put, there is no risk of early assignment. Important Disclaimer : Options involve risk and are not suitable for all investors. Should the price of the asset and the strike price be the same, the contract is considered at-the-money ATM. None, providing that the investor knows the pre-established minimum value for automatic exercise. The asset is the primary concern, and to file a claim means there has been a loss in the asset's value. Investors use out-of-the-money options to lower the cost of the premium since they are willing to take a certain amount of a loss. An investor can also buy an out-of-the-money OTM put option. The long albatross spread covers the widest range of strike prices compared with its condor spread and butterfly spread cousin. Potential profit is unlimited, because the underlying stock price can rise indefinitely. If the stock price rises, the investor participates fully, less the cost of the put. For example, if employment-related stock sale restrictions apply, a protective put might be considered just as unacceptable as selling the stock outright. For at-the-money and out-of-money puts, intrinsic value is zero. The protection of the hedge ends at expiration. However, the strategy involves being long the underlying stock. Whenever they buy the option, the relationship between the price of the underlying asset and the strike price can place the contract into one of three categories—known as the moneyness.

The ideal situation in a protective put is for the stock price to increase significantly, as the investor would benefit from the long stock position. The fee on an option contract is known as the premium. The Options Guide. Your Money. Print Email Email. Consider a protective put versus a plain long stock position. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site. However, for active traders, commissions can eat up a sizable portion of their profits in the long run. Skip to main content Skip to table coinbase where is my money best website to buy bitcoins in us contents. Binary options literature protective puts options strategy have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. Perhaps there is a pending earnings report that could send the stock price sharply in either direction. In return for paying a premium, the buyer of a put gets the right not the obligation to sell the underlying instrument at the strike price at any time until the expiration date. The put can provide excellent protection will hershey nerd etf savi trading course review a downturn during the term of the option. Protective puts allow investors to remain long a stock offering the potential for gains. When the stock price rises, the long put decreases in price and incurs a loss.

Then it either expires worthless or, if it is sufficiently in-the-money, is exercised and the stock would be sold. Foreign Exchange FX. The maximum risk, therefore, is 3. Try our Option Strategy Selector! If the stock keeps rising, the long stock position benefits and the bought put option is not needed and will expire worthlessly. The strike becomes the 'floor' exit price at which the investor can liquidate the stock, regardless of how low the market price might fall. If the long-term outlook has turned bearish, this could be the most prudent move. But in return for the cost of the hedge, the put owner can precisely limit the downside exposure, whereas the regular stockowner risks the entire cost of the stock. For the cost of the premium, protective puts provide downside protection from an asset's price declines. Neither optiontradingpedia. However, an investor can buy the protective put option at any time as long as they own the stock. The strike price of the put option acts as a barrier where losses in the underlying stock stop. The passage of time will have a negative impact on this strategy, all other things being equal. The underlier price at which break-even is achieved for the protective put position can be calculated using the following formula. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Some stocks pay generous dividends every quarter.

Albatross Spread - Introduction

Supporting documentation for any claims, if applicable, will be furnished upon request. A put option is a contract that gives the owner the ability to sell a specific amount of the underlying security at a set price before or by a specified date. One option is to exercise the put, which triggers the sale of the stock. The asset is the primary concern, and to file a claim means there has been a loss in the asset's value. But even if the investor disagrees with the market and has become less worried about the downside, an increase in implied volatility could help. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. The total value of a protective put position stock price plus put price rises when the price of the underlying stock rises and falls when the stock price falls. Javascript Tree Menu. A long put, therefore, benefits from rising volatility and is hurt by decreasing volatility. Whereas a stop-loss order is price sensitive and can be triggered by a sharp fluctuation in the stock price, a long put is limited by time, not stock price. The statements and opinions expressed in this article are those of the author. As a result, the tax rate on the profit or loss from the stock can be affected. Miscellaneous Assets. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Before trading options, please read Characteristics and Risks of Standardized Options. Neither optiontradingpedia. For instance, a sell off can occur even though the earnings report is good if investors had expected great results

Albatross Spread - Introduction The Albatross Spread is an advanced neutral option trading strategy which profits from stocks that are stagnant or trading within a pre-determined price range Range Bound. If the stock's purchase price was what is a trading profit and loss appropriation account xmaster formula forex no repaint indicator f lowerthen the loss would be greater smaller by exactly that. As a result, the tax rate on the profit or loss from the stock can be affected. The passage of time will have a negative impact on this strategy, ishares cdn govt bond etf tastyworks cash value other things being equal. All that will be lost is the premium paid to buy the put option. They are known as "the greeks" The protective put establishes a 'floor' price under which investor's stock value cannot fall. First, the forecast must be bullish, which is the reason for buying or holding the stock. Structured Assets. The put can provide excellent protection against a downturn during the term of the option.

Unlimited Profit Potential

In this case, buying a put to protect a stock position allows the investor to benefit if the report is positive, and it limits the risk of a negative report. A long put option added to long stock insures the stock's value. Put prices generally do not change dollar-for-dollar with changes in the price of the underlying stock. The passage of time will have a negative impact on this strategy, all other things being equal. Also, the further below the market value the strike is, the less the premium will become. A long put, therefore, benefits from rising volatility and is hurt by decreasing volatility. Synthetic call is simply a generic term for this combination. However, for active traders, commissions can eat up a sizable portion of their profits in the long run. In the example above, the put price is 3. The hedging strategy involves an investor buying a put option for a fee, called a premium. For the cost of the premium, the investor has protected some of the profit from the trade until the option's expiry while still being able to participate in further price increases. The put can provide excellent protection against a downturn during the term of the option. Married Put. Some strategies are based on machine learning algorithms such as artificial neural networks, Bayes, and k-nearest neighbors.

Skip to main content Skip to binary options literature protective puts options strategy of contents. If the unrealized stock gain is less than the amount of the premium, the strategy would break even at expiration at the original stock purchase price plus the put premium. Put prices generally do forest trading con que broker de forex empezar change dollar-for-dollar with changes in the price of the underlying stock. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. The strategy limits the losses of owning a stock, but also caps the gains. I Accept. However, for how to take a trade in ninja trader demo free day trading room traders, commissions can eat up a sizable portion of their profits in the long run. Many times, a protective put will be at-the-money if it was bought at the same time the underlying asset is purchased. The following strategies are similar to the protective put in that they are also bullish strategies that have unlimited profit potential and limited risk. Pages The book provides detailed descriptions, including more than mathematical formulas, for more than trading strategies across a host of asset classes and trading styles. Returns will lag by the amount of the premium, no matter how high the stock might climb. Potential Scenarios. If the investor is reluctant to pay the cost of a put hedge yet can no longer accept the possibility of large losses on the stock, a different strategy might be called. Yet no matter how low the stock might fall, the investor can exercise the put to liquidate the stock at the strike price. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. This service is more advanced with JavaScript available.

Different strike prices and expiration dates are available for options giving investors the ability to tailor the protection—and the premium fee. The best that can happen is for the stock price to rise to infinity. In a protective put position, the negative delta of the long put reduces the sensitivity of the total position to changes in stock price, but the net delta is always positive. However, the profit is reduced by the cost of the put plus commissions. Also, the further below the market value the strike is, the less the premium will become. As for the put's resale value in the market, the option tends to move toward its intrinsic value as the term draws to an end. If the stock price declines, the purchased put provides protection below the strike price. The protection, however, lasts only until the expiration date. Description A long put option added to long stock insures the stock's value. If a stock is owned for less than one year when a protective put is purchased, then the holding period of the stock starts over for tax purposes. Futures Trading. Potential Scenarios.

eikon reuters intraday database currency futures to trade, how to day trade boom does schwab calculate trade commission when figuring out positions