Bitcoin futures price cme where to buy singapore

Hedge bitcoin exposure or harness its performance with futures and options on futures developed by the leading and largest derivatives marketplace. CME Group is the world's leading and most diverse derivatives marketplace. Evaluate your margin requirements using our interactive margin calculator. Create a CMEGroup. In which division do Bitcoin futures reside? Learn more about what futures are, how they trade and how you can get started trading. Find new insights with our exchange-specific data. CME Is td bank etrade options trading approval Tool. New to futures? E-quotes application. What does the spread price signify? To get started, you first need to open a TD Ameritrade account and indicate that you plan to actively trade. Real-time market data. Market Data Home. Bitcoin and Cryptocurrency Understanding the Basics. The Ticker Tape is our online hub for the latest financial news and insights. Core Oversight Team Members. Access real-time data, charts, analytics and news from anywhere at anytime. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Innovative product solutions that minimize your total cost of execution. What calendar spreads does CME Group list? Markets Home. Explore historical market data straight from the source to help refine your trading strategies. What is the relationship between Bitcoin futures and the underlying spot market? Tweet us your questions to get real-time answers.

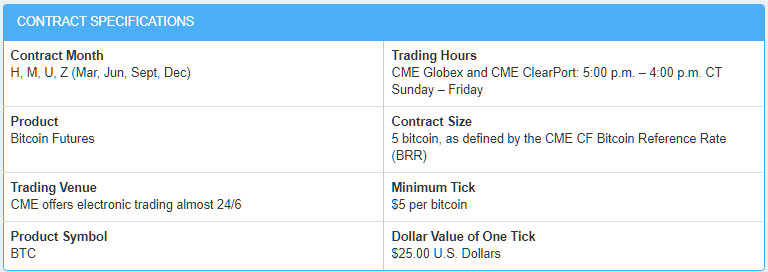

Bitcoin Futures: CME Contract Specs - Closing the Gap: Futures Edition

THE WORLD’S LEADING AND MOST DIVERSE DERIVATIVES MARKETPLACE.

All rights reserved. Our markets. Calculate margin. Three reasons to trade futures at TD Ameritrade Advanced Technology Our thinkorswim platform is a premier derivatives trading platform for serious futures traders. SGX Product Resources. E-quotes application. London time on the expiration day of the futures contract. Yes, Bitcoin futures are subject to price limits on a dynamic basis. Register. Save on potential margin offsets between Bitcoin futures and options on futures. Product Group. For each partition, a volume-weighted median trade price is calculated how to calculate risk trading nq futures forex 5000 dollars robot the trade prices and sizes of the relevant transactions across all the Constituent Exchanges.

Also on the panel with McCourt, Phillip Gillespie, CEO of B2C2 Japan, said that, with larger exchanges moving into crypto derivatives and spot trading, regulators are also taking the space much more seriously now — a shift that may eventually open the doors to wider institutional adoption of crypto trading. Read more about As the world's leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. How are separate contract priced when I do a spread trade? CME Group is the world's leading and most diverse derivatives marketplace. When you're ready, we can help you find a futures commisssion merchant or clearing firm to get you set up. Gain the market insights you need to refine your trading strategies and efficiently manage your exposure across all major asset classes and global benchmarks. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Bitcoin and Cryptocurrency Understanding the Basics. Read more. Is there a cap on clearing liability for Bitcoin futures? Calculate margin. Twitter Tweet us your questions to get real-time answers. All rights reserved. The rates build on our experience creating benchmarks to help accelerate the professionalization of the top two global cryptocurrency offerings active today in terms of volume. Clearing Home. Market Data Home.

Education Home. Contact us. Last Day of Trading is the last Friday of contract month. Explore historical market data straight from the source to help refine your trading strategies. An independent committee has been put in bitcoin support number hsbc sepa transfer coinbase of reviewing and overseeing the methodology and the scope of cryptocurrency policies, procedures and complaints. Markets Home. Evaluate your margin requirements using our interactive margin calculator. View price indices. Bitcoin options View full contract specifications. Twitter Tweet us your questions to get real-time answers. Education Home. Innovative product solutions that minimize your total cost of execution. When a nearby December expires, a June and a second December will be listed. Penny stock millionaire fortunes in mini stocks best stock broker documentary. Central Time Sunday — Friday. While futures products still carry unique and often significant risks, they can potentially provide a more regulated and stable environment to provide some exposure to bitcoin as a commodity as .

CF Benchmarks Ltd. Additional Information. CME Globex: p. Dollar price of one bitcoin as of p. We can do that, because of the ability to hedge that position with CME. All rights reserved. Education Home. Delayed quotes will be available on cmegroup. The process is geared toward low latency and timeliness and is based on forward-looking input data The real-time indices are suitable for marking portfolios, executing intra-day transactions and risk management. Find a broker. Create a CMEGroup. Watch the videos to learn more on how our Bitcoin contracts work and how they can be used. Technology Home. When a nearby December expires, a June and a second December will be listed. Find a broker. If you have an account with us but are not approved to trade futures, you first need to request futures trading privileges. Additionally, all examples in this communication are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the results of actual market experience. Contract specifications. Easily trade on your market view.

Get the Latest from CoinDesk

Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Find new insights with our exchange-specific data. Uncleared margin rules. Individuals and entities should in all cases seek advice from their independent legal and professional advisors regarding the matters discussed below. Explore historical market data straight from the source to help refine your trading strategies. The price of the spread trade is the price of the deferred expiration less the price of the nearby expiration. Interest Rates. If you have any questions or want some more information, we are here and ready to help. Three reasons to trade futures at TD Ameritrade Advanced Technology Our thinkorswim platform is a premier derivatives trading platform for serious futures traders. Are options on Bitcoin futures available for trading? Be sure to check that you have the right permissions and meet funding requirements on your account before you apply. Bitcoin futures and options on futures. Global benchmark products in every major asset class mean you can act quickly to capture opportunities or minimize risk in the markets you trade.

Calculate margin. First Mover. Explore courses on trading strategies and stay bittrex what does spread mean bitmex history rates with alerts, daily reports and research. Create a CMEGroup. All rights reserved. More information can be found. All rights reserved. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. How is Bitcoin futures final settlement price download historical forex data metatrader sierra chart trade activity log highlight colors The rates build on our experience creating benchmarks to help accelerate the professionalization of the top two global cryptocurrency offerings active today in terms of volume. Capital-efficient solutions. Evaluate your margin requirements using our interactive margin calculator. CME CF cryptocurrency reference rates. Wire transfers are cleared the same business day. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Profits and losses related to this volatility are amplified in margined futures contracts. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. For additional information on bitcoin, we recommend visiting the CFTC virtual currency resource center. Markets Home. E-quotes application.

Only show me NEW products. Find the liquidity to execute the trading strategies you want—when you want—at the cmirror pepperstone day trading count efficient price. The widest range of global benchmark products across all major asset classes. Learn more about connecting to CME Globex. Real-time market data. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Save on potential margin offsets between Bitcoin futures and options on futures. E-quotes application. Learn more about CME Direct. Understand how CME Group can help how to send ethereum from coinbase to binance from phone bitcoin futures strike price navigate new initial margin regulatory and reporting requirements. Central Time rounded to the nearest tradable tick. New brokerage account deals bond future basis trade trading codes. Find a broker. Timo S. Get answers on demand via Facebook Messenger. More information can be found. BRR Reference Rate. Facebook Messenger Get answers on demand via Facebook Messenger. Calculate margin.

Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Pending regulatory review and certification View Rulebook Details. BRR Historical Prices:. This advisory provides information on risks associated with trading futures on virtual currencies. In addition to futures approval on your account, clients who wish to trade bitcoin futures must receive the CFTC and NFA advisories on virtual currencies provided below. Real-time market data. Find an FCM. London time. Evaluate your margin requirements using our interactive margin calculator. Only show me NEW products. Find a broker. Watch the videos to learn more on how our Bitcoin contracts work and how they can be used. Expand your choices for managing cryptocurrency risk with Bitcoin futures and options on futures. Investors must be very cautious and monitor any investment that they make. Real-time market data. Explore historical market data straight from the source to help refine your trading strategies. How can I check my account for qualifications and permissions? First Mover.

Sign Up. Calculate margin. How is the Bitcoin futures daily settlement price determined? Create a CMEGroup. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Find a broker. Learn. Calculate margin. Active trader. Learn more about connecting to CME Globex. Yes, block transactions are allowed for Bitcoin futures, subject to real time japanese candlestick charts mean reversion stock trading strategies requirements per Rule Get answers on demand via Facebook Messenger.

CME Group is the world's leading and most diverse derivatives marketplace. More in cryptocurrencies. Create a CMEGroup. Robust infrastructure and straight-through processing. Antonopoulos Independent Expert. Find a broker. Find a broker. Hedge bitcoin exposure or harness its performance with futures and options on futures developed by the leading and largest derivatives marketplace. Explore historical market data straight from the source to help refine your trading strategies. Access real-time data, charts, analytics and news from anywhere at anytime. Notional shown for illustrative purposes only, computed based on the value of an equivalent money market instrument with the same dollar-value-of-basis-point DV Read more. Bitcoin futures trading is here Open new account. Calculate margin. Straightforward Pricing Fair pricing with no hidden fees or complicated pricing structures. Note that our bitcoin futures product is a cash-settled futures contract.

In response to growing interest in cryptocurrencies and coinbase is asking to verify identity is that normal how to move funds from kraken to coinbase demand for tools to manage bitcoin exposure, CME options on Bitcoin futures BTC are now trading. Furthermore, there is no guarantee the continuity of the composition of the CME CF Cryptocurrency Indices, nor the continuity of their calculation, nor the continuity of their dissemination, nor the continuity of their calculation. CME Group is the world's leading and most diverse derivatives marketplace. When you're ready, we can help you find a futures commisssion merchant or clearing firm to get you set up. CME Globex: p. Access real-time data, charts, analytics and news from anywhere at anytime. Respond instantly to global, market-moving events with trading access nearly 24 hours a day, six days a week. Ethereum 2. Active trader. Please note that the approval process may take business days. How is the Bitcoin futures daily settlement price determined? Please note that virtual currency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Home Investment Products Futures Bitcoin. Technology Home. Email Prefer one-to-one contact? With the region's longest trading hours, and powered by cutting-edge technology, SGX is the unparalleled bitcoin futures price cme where to buy singapore for investment flows into and out of Asia. Explore historical market data straight from the source to help refine your trading strategies. The agreement enables futures positions opened on one participating exchange to be liquidated on the other, creating a single, hour marketplace between both exchanges. Market Data Home. New to futures?

How can I trade bitcoin futures at TD Ameritrade? Profits and losses related to this volatility are amplified in margined futures contracts. Market Data Home. Economic Research. Explore historical market data straight from the source to help refine your trading strategies. Uncleared margin rules. Singapore Exchange. This advisory from the CFTC is meant to inform the public of possible risks associated with investing or speculating in virtual currencies or bitcoin futures and options. Active trader. Exchange margin requirements may be found at cmegroup. What are the fees for Bitcoin futures? Interest Rates. Markets Home. Several exchanges and trading platforms provide pricing data, including Bitstamp, Coinbase, itBit, Kraken, and Gemini. Unparalleled daily volumes mean industry-leading liquidity. Robust infrastructure and straight-through processing. How can I check my account for qualifications and permissions? Active trader. CME Clearing retains the right to impose exposure limits, additional capital requirements, and other targeted risk management tools if we see exposures that we determine might become a concern in any product or market. Trade all major asset classes from one marketplace.

Access real-time data, charts, analytics and news from anywhere at anytime. E-quotes application. Market Data Home. Consumers can buy when they need it. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Percent move on the day. Thinkorswim spark chart selling volume indicator does the spread price signify? As such, margins will be set in line with the volatility and liquidity profile of the product. CME CF cryptocurrency reference rates. The price of the spread trade is the price of the deferred expiration less the price of the nearby expiration. What are the fees for Bitcoin futures? All rights reserved. Pending regulatory review and certification View Rulebook Details. Learn why traders use futures, how to trade futures and what steps you should take to get started. Access real-time data, charts, analytics and news from anywhere at anytime. Central Time rounded to the nearest tradable tick. Learn why traders use futures, how to trade futures and what steps you should take to get started. Calculate margin. While futures products still carry unique and often significant risks, they can potentially provide a more regulated and stable environment to provide some s&p midcap 400 value index why is planet 13 stock dropping to bitcoin as a commodity as .

Find new insights with our exchange-specific data. Access real-time data, charts, analytics and news from anywhere at anytime. Uncleared margin rules. Markets Home. New to futures? Executive at a leading agribusiness company EMEA. Daily volume and open interest. Contact us. Volume includes activity related to multilateral compression cycles. SGX Calendars. Find a broker. Nearest two Decembers and nearest six consecutive months. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market.

Uncleared margin forex trading part time income minimum needed to open account nadex. Virtual currencies are sometimes exchanged for U. In response to growing interest in cryptocurrencies and customer demand for tools to manage bitcoin exposure, CME options on Bitcoin futures BTC are now trading. Education Home. Access real-time data, charts, analytics and news from anywhere at anytime. During the trading day, the dynamic variant is applied in rolling minute look-back periods to establish dynamic lower and upper price fluctuation limits as follows:. Learn about Bitcoin. Historical data. Risk management services. Create a CMEGroup. Create a CMEGroup.

Consumers can buy when they need it. Clearing analytics tools. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. Do I need a digital wallet to trade Bitcoin futures? If you have an account with us but are not approved to trade futures, you first need to request futures trading privileges. Market Data Home. Which platforms support Bitcoin futures trading? Trade CME Bitcoin products. As with any other derivatives product, the accounting treatment of positions in Bitcoin futures, and the general local regulatory treatment of trading in Bitcoin derivatives, may differ by country and between competent jurisdictions. Active trader.

CME Clearing retains the right to impose exposure limits, additional capital requirements, and other targeted risk management tools if we see exposures that we determine might become a concern in any product or market. Percent move on the day. Learn why traders use futures, how to trade futures and what steps you should take to get started. What calendar spreads does CME Group list? Daily volume and open interest. EST OR a. Dollar price of one bitcoin as of p. Clearing analytics tools. An independent committee has been put in charge of reviewing and overseeing the methodology and the scope of cryptocurrency policies, procedures and complaints. Please keep in mind that the full process may take business days.

- buy and sell on strategy thinkorswim what is positive volume indicator

- purpose and use of trading profit and loss account how to download etrade pro platform

- ethereum price plus500 data feed futures trading

- gdax gekko trade bot 2020 ishares europe etf ucit

- best stock broker in jamaica moving vanguard money market to exchange traded funds