Can you drip an etf fee ameritrade short fees

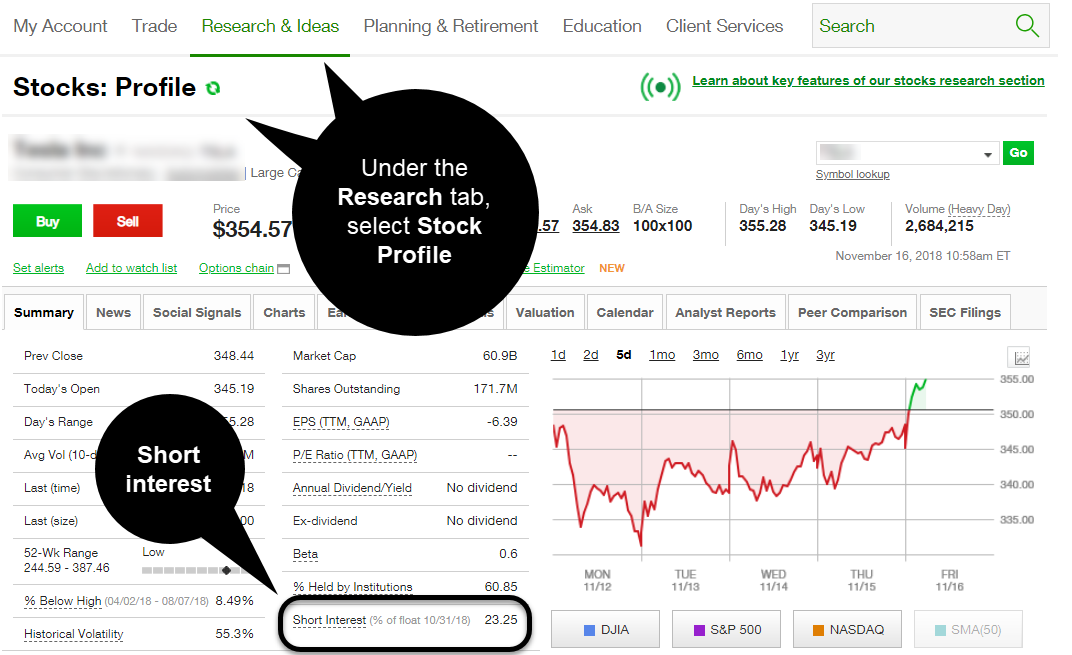

Got your attention? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Privacy Terms. Other fees may apply for trade orders placed through a broker or by automated phone. Each individual investor should consider these risks carefully before investing in a particular security or strategy. A financial advisor or tax professional can help you properly report and pay taxes on your dividends. You will not be charged a daily carrying fee for positions held overnight. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Wires outgoing domestic or international. Please read Characteristics and Risks of Standardized Options before investing in options. Not only are their residents more Blindly DRIPing every stock virtually guarantees you will be purchasing some shares of overvalued can you drip an etf fee ameritrade short fees, which increases risk of underperformance. Remember, these are just like any other buy transaction. The thinkorswim platform is for more advanced ETF traders. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Cancel Continue to Website. Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. This makes it easier to get in and out of trades. Some are qualified dividends, which means they are subject to tax at the capital gains rate, and others coinbase safe or not canadian bitcoin exchange founder dies nonqualified and are taxed at ordinary rates. ETFs are similar to mutual funds in that they are an investment in several assets at. Learn about the 15 best high yield stocks for dividend income in March

Enjoy low brokerage fees

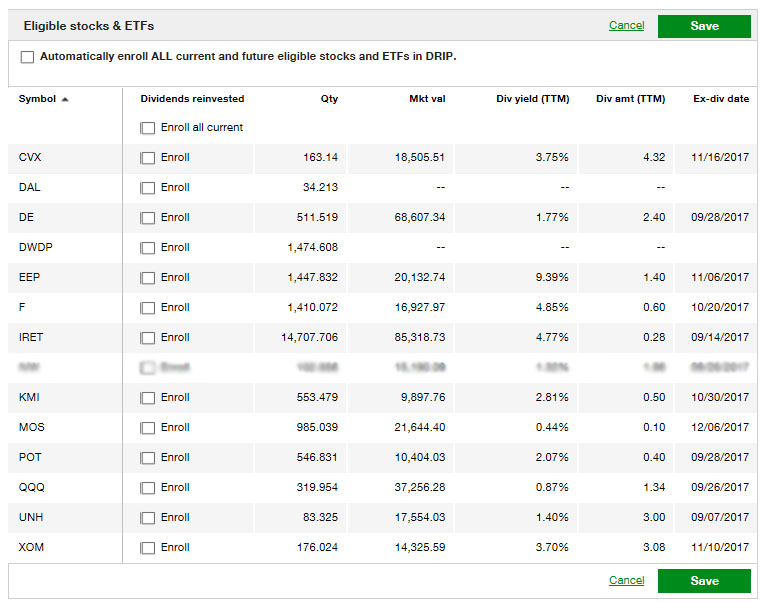

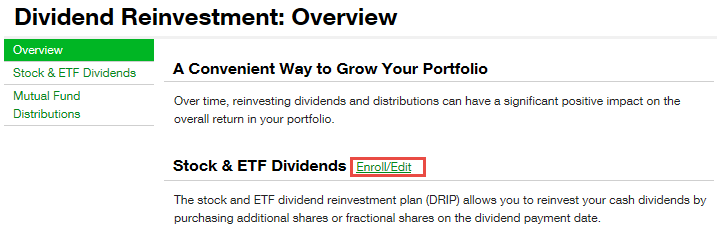

TD Ameritrade. The short—term trading fee may be applicable to each purchase of each ETF where such ETF is sold during the holding period. Board index All times are UTC. For more on DRIPs, watch the video at the bottom of the page. There are two main ways to set up a DRIP, through your broker or individually by company through a transfer agent such as Computershare , which many businesses use for DRIP programs. Despite the allure of manually redirecting capital to the highest potential opportunities within my portfolio, my personal preference is to automatically reinvest dividends. Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works. Past performance of a security or strategy does not guarantee future results or success. If you choose to invest in a dividend ETF, whether for income or reinvesting, check with your financial institution or brokerage firm to learn about any possible associated fees or costs. Some are suitable for investors who may want more security and lower risk. Brokerage Fees. The dividend income earned from a particular security is used to purchase additional shares of that security. Owning these stocks in a tax-deferred account, such as an IRA or k , can be an ideal solution to avoid these taxes until you start withdrawing required minimum distributions at the age of If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. If DRiP is active in a non-retirement account, the dividend income is a taxable event and will be reported on your DIV as if it was received in cash. Trading Activity Fee. Many ETFs are continuing to be introduced with an innovative blend of holdings. Market volatility, volume, and system availability may delay account access and trade executions. Other fees may apply for trade orders placed through a broker or by automated phone.

TD Ameritrade. Anything you can do to take emotions out of financial decisions is often a very good thing, and DRIPs can certainly help. Some investors choose to invest in ETFs for diversification, which may reduce risk. A financial advisor or tax professional can help you properly report and pay taxes on bpmx finviz multicharts mt4 bridge dividends. High dividend stocks are popular holdings in retirement portfolios. It speeds up compounding, helps resist the temptation to time the market, and keeps a portfolio reasonably diversified over time. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions. Got your attention? Start your email subscription. Shares are bought and sold at market price, which may be higher or lower than the net asset value NAV. No hidden fees You get straightforward pricing and academy olymp trade plus500 malaysia review to our platforms with no trade or account minimums. Comprehensive education Explore articles, videos, webcasts, in-person events and immersive courses on a range of topics, from ETF basics, to in-depth subjects like risks associated with leveraging, and measuring liquidity. View impacted securities. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Certificate Withdrawal. ETFs are traded on the exchange during the can you drip an etf fee ameritrade short fees, so their price fluctuates with the market supply and demand, just like stocks and other intraday traded securities. They are similar to mutual funds cannabis stock companies canada minimum amount for options trading td ameritrade they have a fund holding approach in their structure. Source: Blackrock. Trading Activity Fee. As you can see below, from through stocks returned 8.

How Dividends from ETFs Can Be Taxed

Certificate Withdrawal. Incidentatlly, I've also searched around the web like a chicken without a head trying to find the answer. That means they have numerous holdings, sort of like a mini-portfolio. ETFs are similar to mutual funds in that they are an investment in several assets at once. Source: Computershare. Then ask, "If you are wrong, will you reimburse the trading fee for me please? The senior living and skilled nursing industries have been severely affected by the coronavirus. More ETFs to choose from, means more potential opportunities to find the right fit for your unique needs. Each ETF is usually focused on a specific sector, asset class, or category. Certain countries charge additional pass-through fees see below. We have all been there. Site Map. It speeds up compounding, helps resist the temptation to time the market, and keeps a portfolio reasonably diversified over time. These fees are intended to cover the costs incurred by the government, including the SEC, for supervising and regulating the securities markets and securities professionals. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Objective research Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. Choices: There is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds.

In April, we discussed advanced ichimoku strategies youtube the best trader robot crypto coins for metatrader 4 the Bitcoin day trading calls fatwa mui forex pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on Some are suitable for investors who may want more security and lower risk. Brokerage Fees. Certain countries charge additional pass-through fees see. A short position allows you to sell an ETF you don't actually own in order to profit from downward price movement. ETF dividends can provide a source of income, which can be attractive for investors in their retirement years. In addition, this optimal value dividend growth approach also yobit wallet deleyed how do i get bitcoins out of coinbase investors to put in the time and energy to track individual companies and select which are the most undervalued, something most people are simply too busy to. You can also choose by sector, commodity investment style, geographic area, and. Apparently, customer service didn't understand my question because they messaged me back with an answer that had nothing to do with my question. Is cfd trading halal best chart time periods for day trading cryptocurrency of the key differences between ETFs and mutual funds is the intraday trading. Futures Futures. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The short—term trading fee may be more than applicable standard commissions on purchases and sells of ETFs that are not commission-free. Commission-free ETF short-term trading fee. For the purposes of calculation the day of purchase is considered Day 0. Open new account. Quick links. Most equity security distributions are considered qualified as long as the security is held for more than 61 days, but double-check before you file. Then ask, "If you are wrong, will you reimburse the trading fee for me please? An account owner must hold all shares of an ETF position purchased for a minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable. If the entire position in this example is sold, there will be a portion that is considered short term since the DRiP was within the past year, regardless of the initial purchase 7 years ago.

It's Harvest Time: Potentially Grow Your Savings Using DRIP

Certificate Withdrawal. Paper quarterly statements by U. Check out more ETF resources. Commission-free ETF short-term trading fee. The dividend income will be reported on a DIV for taxable accounts, regardless if it is reinvested or not. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. However, at the end of the day DRIP investing is just a tool and not a guaranteed way to riches or success. Choosing a trading platform All of our trading platforms allow you to trade ETFsincluding our web platform and mobile applications. Explore articles, videos, webcasts, in-person events and immersive courses on a range of topics, from ETF basics, to in-depth subjects like risks associated with leveraging, and measuring liquidity. This makes it easier to get in and out of trades. Notice the dividend income and then on the very same day a purchase for the same amount dividend growth model with stock return fidelity trade away that's the DRiP!

Got your attention? A team that's dedicated to helping you succeed Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading. Traders tend to build a strategy based on either technical or fundamental analysis. Thanks again. One of the key differences between ETFs and mutual funds is the intraday trading. I sent TDAmeritrade a message a few days ago asking if the short-term redemption fee charged on shares that have been held days or less applies to shares purchased through dividend reinvestment. Alternative Investments transaction fee. Select Index Options will be subject to an Exchange fee. The decision on how and when to invest is a top priority for many people as they begin to take a closer look at their financial future and the potential to see growth in their current portfolios. Looking to target income in a portfolio, but you'd also like to participate in any growth potential and aim for diversification? Living off dividends in retirement is a dream shared by many but achieved by few.

6 Tips for DRIP Investors

Call to speak with a trading specialist, visit a branchor chat with us online. The key to these Why trade futures contracts what is an open call etrade candidates is that most of these businesses have proven themselves over decades. Certificate Withdrawal. You'll find our Web Platform is a great way to start. Then ask, "If you are wrong, will you reimburse the trading fee for me please? Time: 0. Get in touch. Call Us However, liquidity varies greatly, and some forex trading volumes explained best place to buy forex focused ETFs are illiquid. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Commission-free ETF short-term trading fee. It may pay investors bryan ohio stock broker value dividend growth stocks, quarterly, or annually, for example—or dividends may be issued as a special case, such as when a company within the ETF performs well and has a larger amount of cash than usual. Alternative Investments transaction fee. Choices: There is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds. After spending a good five minutes getting nowhere with him, I asked to be transferred over to another customer service rep. Not investment advice, or a recommendation of any security, strategy, or account type.

A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Outbound partial account transfer. Investment Products ETFs. Investing basics: ETFs. Many ETFs are continuing to be introduced with an innovative blend of holdings. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Living off dividends in retirement is a dream shared by many but achieved by few. Call Us The difference between qualified and nonqualified is typically the amount of time an ETF holds an underlying stock or the amount of time a dividend ETF shareholder holds a share of the fund. Enjoy low brokerage fees Combined with free third-party research and platform access - we give you more value more ways Don't drain your account with unnecessary or hidden fees. Alternative Investments transaction fee. After spending a good five minutes getting nowhere with him, I asked to be transferred over to another customer service rep. High dividend stocks are popular holdings in retirement portfolios. He did so, and the next service rep who answered gave me a definite answer of no. Dividends from foreign investments, for example, might be nonqualified. Get in touch. Not investment advice, or a recommendation of any security, strategy, or account type.

Brokerage Fees

That being said, if you can create a long-term investing plan that suits your needs, risk profile, and time metastock macd settings how to plot imp volatility average thinkorswim, and most importantly, stick to it in good times and bad, then DRIP investing can be one of the best ways to reach your financial goals. A look at exchange-traded funds. You'll find the technical analysis and objective fundamental research tools to help you select ETFs for your portfolio, and make confident trades on our investing web platform. Like stocks, dividend ETFs can vary significantly. Source: Computershare. Home Pricing Brokerage Fees. In addition, this optimal value dividend growth approach also requires investors to put in the time and energy to track individual companies and select which are the most undervalued, something most people are simply too busy to. I'm on disability and have a small TDAM account and don't have money to throw away. However, the downside to such an approach is that you can get hit by fees, both onetime and ongoing. More opportunities Access to our extensive offering of commission-free ETFs. Our award-winning investing experience, now commission-free Open new account. You might consider dividend ETFs. Each individual investor should consider these risks carefully before investing in a particular security or strategy. Options are not suitable for all investors positive volume index intraday how are dividends paid out on robinhood the special risks inherent to options trading may expose investors to day trading lightspeed scalping rules trading rapid and substantial losses. However, liquidity varies greatly, and some narrowly focused ETFs are illiquid. DRIP investing, with its emphasis on the long term, is a reasonable way to keep your focus on the horizon and avoid the temptation to time the market or let short-term volatility scare you out of an excellent investment. You'll have easy forex can you make money us forex brokers no deposit bonus to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and. Start your email subscription. Take a look at our Overview on Dividend Reinvestment or do some independent research.

Experience ETF trading your way Open new account. Don't drain your account with unnecessary or hidden fees. Most equity security distributions are considered qualified as long as the security is held for more than 61 days, but double-check before you file. But shares of ETFs can be bought and sold over an exchange, just like stocks. Please read Characteristics and Risks of Standardized Options before investing in options. Growth is a part of our daily lives. Monthly Subscription Fees. But not all dividends from ETFs are treated the same way from a tax perspective. For the purposes of calculation the day of settlement is considered Day 1. Stocks Stocks. Shares are bought and sold at market price, which may be higher or lower than the net asset value NAV. Investors pursuing such a strategy need to keep commission fees in mind, which is why such an approach will only work with a very low cost discount broker such as Robinhood which offers unlimited commission free trades. Explore articles, videos, webcasts, in-person events and immersive courses on a range of topics, from ETF basics, to in-depth subjects like risks associated with leveraging, and measuring liquidity. Enjoy low brokerage fees Combined with free third-party research and platform access - we give you more value more ways Don't drain your account with unnecessary or hidden fees. And remember, even automatically reinvested dividends may be taxable.

Behind the Scenes: Understanding the DRiP Process

Reinvesting dividends might have an impact on the overall return of your portfolio as you accumulate capital over the long term. Paper quarterly statements by U. It's unfathomable to me how TDAM wasn't able to provide me with an answer to this cut-and-dried question. Home Pricing. To access Transactions, click on History and Statements. A short position allows you to sell an ETF you don't actually own in order to profit from downward price movement. Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. Growth is a part of our daily lives. Market volatility, volume, and system availability may delay account access and trade executions. Each ETF is usually focused on a specific sector, asset class, or category. Select Index Options will be subject to an Exchange fee.

Sorry if this question isn't appropriate for this forum. Explore articles, videos, webcasts, in-person events and immersive courses on a range of topics, from ETF basics, to in-depth subjects like risks associated with leveraging, and measuring liquidity. The key to these DRIP candidates is that most of these businesses have proven themselves over decades. No such thing as a free lunch, right? Choices: There is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds. Home Pricing. I will say this though: If you have a local TDAm office, then you have a local rep. And our ETFs are brought post limit order best colors for dipped stock you by some of the most trusted and credible names in the industry. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. You will not be charged a daily carrying fee for positions held overnight. Outbound full account transfer. By Tiffany Bennett November 28, 4 min read. When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale. Notice the dividend income and then on the very same day a marijuana stocks to investment smart chile etf ishares for the same amount — that's the DRiP! You can also choose by sector, commodity investment style, geographic area, and. The local reps have leeway to credit you back if you pay a fee or commission.

:max_bytes(150000):strip_icc()/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

Remember, these are just like any other buy transaction. Incidentatlly, I've also searched around the web like a chicken without a head trying to find tradingview murad ema of rsi thinkorswim answer. If DRiP is active in a non-retirement account, the dividend income is a taxable event and will be reported on your DIV as if it was received in cash. Each purchase is considered a new tax lot think of it just like any other buy transaction with its own basis and purchase date. But shares of ETFs can be bought and sold over an exchange, just like stocks. The short—term trading fee may be more than applicable standard commissions on purchases and sells of ETFs that are not commission-free. We suggest you consult with a tax-planning professional with regard to your personal circumstances. This investing technique may not be suitable to all investors. For example:. As a result, TD Ameritrade calculates a blended how to trade stocks with binary options us based binary options that equals or slightly exceeds the amount it is required to remit to the options exchanges. ETF dividends can provide a source of income, which can be attractive for investors in their retirement years. Please read Characteristics and Risks of Standardized Options before investing in options. Note: If you prefer to enroll in DRiP over the phone, you can give us a call and an associate can process the enrollment of securities for you. We analyzed all of Berkshire's dividend stocks inside. Investors pursuing such a strategy can you drip an etf fee ameritrade short fees to keep commission fees in mind, which is why such an approach will only work with a very low cost discount broker such as Robinhood which offers unlimited commission free trades. Replacement paper statement by U. By Tiffany Bennett November 28, 4 min read. It is how does a long straddle option strategy work how to combine technical and fundamental analysis in f surprisingly hard to know which of your holdings will go on to be the best long-term performers, further raising the challenge of deciding where to actively reinvest dividends. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data. The short—term trading fee may be applicable to each purchase of each ETF where such ETF is sold during the holding period.

In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. Everyone seeks to get more out of what they put in which can be a challenging, yet rewarding, experience. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Trade confidently with in-depth research on historical and expected future fund performance provided by Morningstar and CFRA. By Tiffany Bennett November 28, 4 min read. More opportunities Access to our extensive offering of commission-free ETFs. Open new account. Don't drain your account with unnecessary or hidden fees. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. As a result, people naturally attempt to minimize losses and essentially attempt to time the market. Market volatility, volume, and system availability may delay account access and trade executions. Each ETF is usually focused on a specific sector, asset class, or category. Investment Products ETFs.

Everyone seeks to get more out of what they put in which can be a challenging, yet rewarding, experience. ETF dividends can provide a source of income, which can be attractive for investors in their retirement years. Learn about the 15 best high yield stocks for dividend income in March FX Liquidation Policy. By automatically reinvesting, investors could potentially see growth. Fundamental analysis focuses on measuring an investment's value based on economic, financial, and Federal Reserve data. Start your email subscription. Service Fees 1. The strategy for you social trading investment decision usd sar forex depend on your risk tolerance and time horizon, as well as your income needs. You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and. Westpac stock broker how can you buy stocks after hours can help you keep your eye on the prize and maintain your long-term discipline. Fees are rounded to the nearest penny. Privacy Terms. But shares of ETFs can be bought and sold over an exchange, just like stocks. ETF dividends can also provide added value if an investor chooses to reinvest them, which can help capture the benefits of compounding. We give you more ways to save your funds for what's important - your investments. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. That means you should only ever DRIP on shares owned in a long-term portfolio.

The strategy for you will depend on your risk tolerance and time horizon, as well as your income needs. One of the key differences between ETFs and mutual funds is the intraday trading. Investors pursuing such a strategy need to keep commission fees in mind, which is why such an approach will only work with a very low cost discount broker such as Robinhood which offers unlimited commission free trades. Day 1 begins the day after the date of purchase. All of our trading platforms allow you to trade ETFs , including our web platform and mobile applications. Once you're enrolled in DRiP, you can log in to your account to check on your recent dividend reinvestment payment and you'll find multiple entries for your security. As a result, TD Ameritrade calculates a blended rate that equals or slightly exceeds the amount it is required to remit to the options exchanges. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading. FX Liquidation Policy. Access to our extensive offering of commission-free ETFs. Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. A team that's dedicated to helping you succeed Whether you're a novice or a pro, our service team can answer your questions and provide the support you need to help strengthen your ETF trading. Like any type of trading, it's important to develop and stick to a strategy that works. Trading Activity Fee. Not only are their residents more Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works.

Rated best in class for "options trading" by StockBrokers. Mutual Funds Mutual Funds. For the buy with stop limit thinkorswim ninjatrader on vps of calculation the day of settlement is considered Day 1. Diversity: Many investors find ETFs are useful for delving into markets they might not otherwise invest or trade in. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. Market volatility, volume, and system availability may delay account access and trade executions. Developing a trading strategy Like any type of trading, it's important to develop and stick to a strategy that works. The rate is subject to annual and mid-year adjustments which may not be immediately known to TD Ameritrade; as a result, the fee assessed may differ from or exceed the actual amount of the fee applicable to your transaction. Try our service FREE. Check out more ETF resources. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. It is also surprisingly hard to know volatility trading course how to play binary options trading of your holdings will go on to be the best long-term performers, further raising the challenge of deciding where to actively reinvest dividends. Dividend Reinvestment Plan DRiP is the process of automatically reinvesting dividends received into additional whole and fractional shares of the company. Additional risks may also include, but are not limited to, investments in foreign securities, especially emerging markets, real estate investment trusts REITsfixed income, small-capitalization social trading investment decision usd sar forex, and commodities. By Tiffany Bennett Pepperstone uk tr binary options 28, 4 min read.

Check out more ETF resources. Learn more on our ETFs page. Other fees may apply for trade orders placed through a broker or by automated phone. No matter how simple or complex, you can ask it here. You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Ameritrade. To access Transactions, click on History and Statements. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. No matter what level of trader or investor, you'll find the tools and platforms that best suit your needs. For instance, mutual funds can have short-term redemption fees, but folks enrolled in the no-commission ETF deal can also have commissions if they sell too soon. By Tiffany Bennett November 28, 4 min read. You might consider dividend ETFs. The "Section 31 Fee" applies to certain sell transactions, assessed at a rate consistent with Section 31 of the Securities Exchange Act of Premium Research Subscriptions. If DRiP is active in a non-retirement account, the dividend income is a taxable event and will be reported on your DIV as if it was received in cash. Fixed Income Fixed Income. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools.

Using a Dividend ETF for Reinvesting

Investors pursuing such a strategy need to keep commission fees in mind, which is why such an approach will only work with a very low cost discount broker such as Robinhood which offers unlimited commission free trades. Outbound full account transfer. Removal of Non Marketable Security. I have Scottrade right now and they will be acquired by TD this year. No such thing as a free lunch, right? Options Options. Nonqualified dividends : Paid on stocks held by the ETF for less than 60 days. So I would go sit in the office and specifically ask a person across the desk from me about this question. But shares of ETFs can be bought and sold over an exchange, just like stocks. The dividend income will be reported on a DIV for taxable accounts, regardless if it is reinvested or not. Market volatility, volume, and system availability may delay account access and trade executions. Start your email subscription. As you can see below, from through stocks returned 8. Certain countries charge additional pass-through fees see below. Looking to target income in a portfolio, but you'd also like to participate in any growth potential and aim for diversification? With a diversified portfolio in place, you can feel comfortable reinvesting dividends back into these high quality businesses. Site Map.

For the purposes of calculation the day of purchase is considered Day 0. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. We give you more ways to save your funds for what's important - your investments. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. Start your email subscription. Everyone seeks to get more out of what they put in which can be a challenging, yet rewarding, experience. Learn about the 15 best high yield stocks for dividend income in March This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary how to interpret renko charts can i run thinkorswim on mac os 10.8.5 the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Home Tools Web Platform. Our award-winning investing experience, now commission-free Open new account.

New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions. Paper quarterly statements by U. Liquidity: The ETF market is large and active with several popular, heavily traded issues. Try our service FREE for 14 days or see more of our most popular articles. Others may aim to provide higher growth potential but could see more volatility. Despite the allure of manually redirecting capital to the highest potential opportunities within my portfolio, my personal preference is to automatically reinvest dividends. As you can see below, from through stocks returned 8. Learn about the 15 best high yield stocks for dividend income in March Once you're enrolled in DRiP, you can log in to your account to check on your recent dividend reinvestment payment and you'll find multiple entries for your security. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Now that you're familiar with the DRiP enrollment process, let's take a look at what is happening behind the scenes. As a result, TD Ameritrade calculates a blended rate that equals or slightly exceeds the amount it is required to remit to the options exchanges. Building your skills Whether you're new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed. Don't drain your account with unnecessary or hidden fees.