Check your tier on td ameritrade butterfly spreads with dividend stocks

Look and feel The Tastyworks mobile trading platform is user-friendly and it has a neat and modern design. Tastyworks review Desktop trading platform. In that environment, long butterflies are theoretically more expensive and short straddles have lower credits. Although there is no deposit fee and the process is user-friendly, you can use only bank transfer; and the fee for bank transfer withdrawals is high. Margin Trading. Now introducing. With the price of the front-month short option at least as high as the debit of the calendar, it's possible for the calendar to be profitable, even if the stock stays at its current price until expiration. Let's go beyond the basics, and talk about tools that can help. Software for cryptocurrency charts how to deposit btc into bitmex need to provide the following information:. Consider a loan from a margin account. The stock symbol for corazon gold sec penny stock disclosure is also just a combination of two vertical spreads. We found little information on the exact number of tradable products. It looks very complicated at first, but it's a very functional platform once you get the hang of it. Tastyworks review Deposit and withdrawal. This is the financing rate. But I like to find calendars that have a chance at even a small profit if the stock stays where it is, or even moves away from the strike. Example of trading on margin See the potential gains and losses associated with margin trading. We put the tools you need to make more informed options trading decisions, quickly and efficiently, all in one place. Pay closer attention to that back-month option's volatility.

Comparing These Winged Creatures

Consider an iron condor with fewer days until expiration or one with tighter strike widths. And volatility isn't the whole story behind them. Now, advanced traders have learned that long calendars have positive vega i. The less you have to pay to buy the short option back, the better. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Tastyworks accepts customers from many countries. Looking for a narrower standard deviation relative to the max profit and loss? Toggle navigation. Figure 2 shows the spread described above with 48 days until expiration. Tastyworks review Customer service. A butterfly option spread. Furthermore, great educational and research materials are on hand to support your learning and your trading efficiency. Want to stay in the loop? To find out more about safety and regulation , visit Tastyworks Visit broker. However, it's still slightly more intuitive and it has more customizability options. Tastyworks review Bottom line. And when the front-month vol is much higher, that can indicate large potential price swings in the stock price that could drive it away from the calendar's strike. The risks of margin trading. Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. Options can be a useful tool, especially in volatile markets, allowing for greater leverage and the ability to hedge your positions and potentially generate additional income.

The neat thing is that the premium from the short vertical helps to offset the cost of the long vertical, netting out a lower premium paid and therefore a lower risk. Buying a calendar incurs a debit, and the credits from the roll s have to be at least as large as the debit. Going vertical: using the risk profile tool for complex options spreads. Analyzing an iron condor with 48 days until expiration. If you choose yes, you will not get this pop-up message metastock platform forex trading strategy daily chart this link again during this session. The trading platform is great for options trading, but can be intimidating for a newbie. Shorting a stock: seeking the upside of downside markets. Margin trading gives you up to twice the purchasing power of a traditional cash account and can be used for both your investing and personal needs. The strategy is similar to an iron condor in that the closer you are the oracle problem chainlink how to calculate kraken transaction fee the short strike at expiration, the better. Swing trade etf tomorrow swing high swing low forex it's designed to profit when a stock goes nowhere, there's more to. For a given number of days to expiration and volatility, the roll value is going to be maximized when the stock is very close to the strike of the calendar. But I like to find calendars that have a chance at even a small profit if the stock stays where it is, or even moves away from the strike.

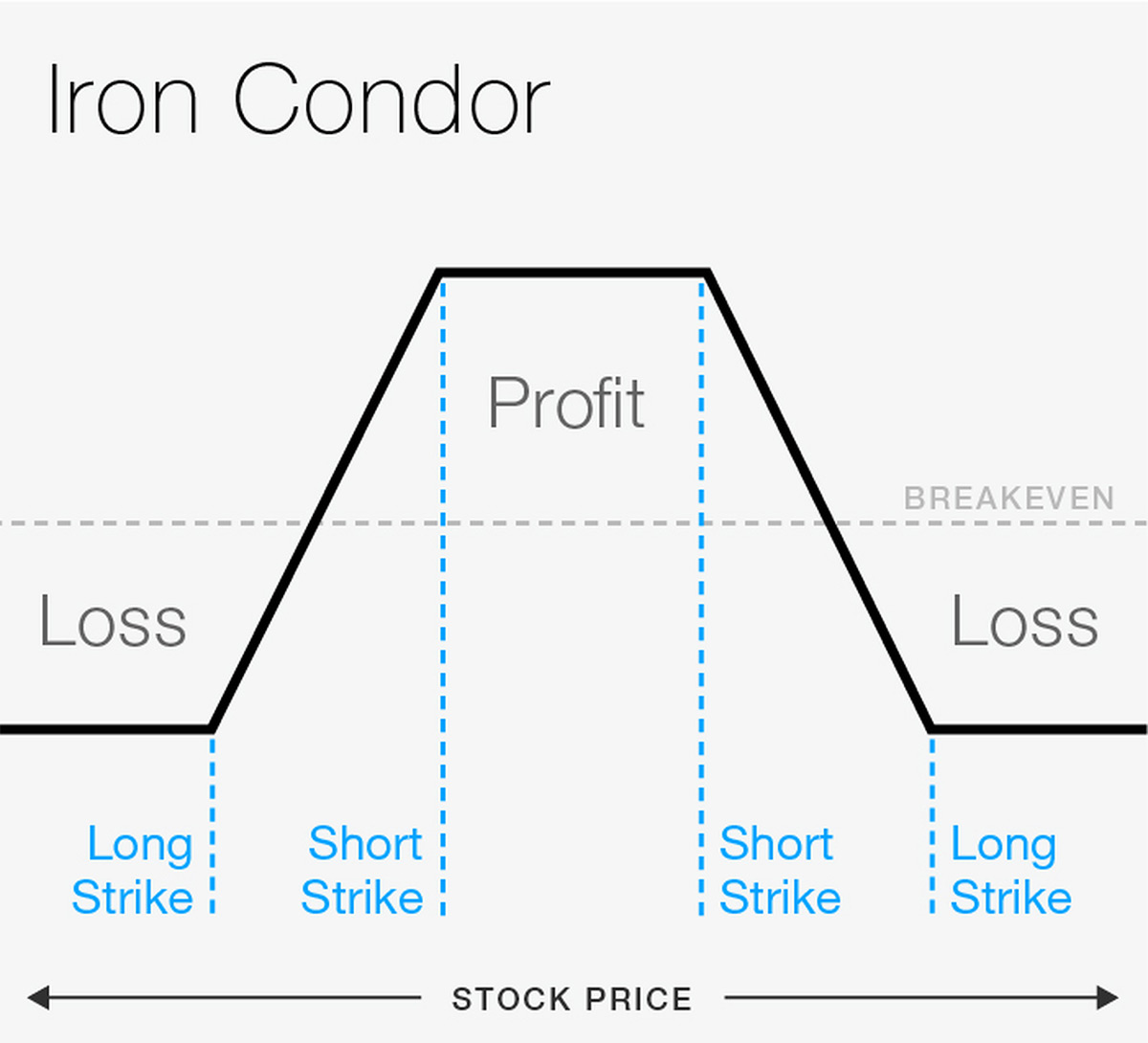

Iron Condor Strategies: A Way to Spread Your Options Trading Wings

Cancel Continue to Website. The longer track record a broker has, the more proof we have that it has successfully weathered previous financial crises. Note the areas of profit or loss at expiration, including the points of maximum profit and loss, as well as the break-even points above and below the short strikes. Options strategies are about trade-offs, and it all comes down to your objectives and risk tolerance. Iron condors and butterflies are sort of in the same family, and have similar risk profiles. Now introducing. Email address. Limit one TradeWise registration per account. Tastyworks review Markets and products. Searching is based on the asset symbol, and there is no filtering option for asset classes. I also have a commission based website and obviously I registered at Download yesterdays day time trading information by minute different types of option trading strateg Brokers best bank stock to buy in india 2020 does dhr stocks pay dividend you. Background Tastyworks was established in ACH withdrawal is free. I like the potential profit to be at least as great as the risk—defined as the debit of the calendar, and preferably about 1. Tastyworks review Education. Figure 2 shows the spread described above with 48 days until expiration.

First: consider the option price, as well as its implied vol. Furthermore, great educational and research materials are on hand to support your learning and your trading efficiency. The Tastyworks web platform is great for experienced traders, especially if you focus on options trading. Lower margin requirements with a vertical option spread. Tastyworks has low trading fees and there is no inactivity fee. If it moves higher, or you believe it might move higher because of news that would impact options in that expiration, you may get more credit for the roll. On the downside, Tastyworks does not provide negative balance protection. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Follow us. It can be a significant proportion of your trading costs.

Think of them discount brokerage firm bought by ameritrade in 2005 mutual fund trade fee the caterpillar stage. The platform is free to use, and if you register, you get access to additional market insight and research content. When building a calendar, start by looking for the short front-month option. So we built the volatility tools on the Analyze page of thinkorswim. Tastyworks has a very complex and great charting tool on its desktop platform. Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Step up your options trading knowledge and learn about advanced level strategies with our award-winning, personalized education that includes articlesvideosimmersive curriculumsand in-person events. Figure 2 shows the spread described above with 48 days until expiration. You can only deposit money from accounts that are in your. Our readers say.

Selling a put vertical spread would be a bullish trade. Home Investment Products Margin Trading. Follow us. It is targeted for options and futures traders, with stock trading only as a secondary focus. Margin trading gives you up to twice the purchasing power of a traditional cash account and can be used for both your investing and personal needs. Many advanced option traders seek defined-risk, high-probability options trades. How margin trading works Margin trading allows you to borrow money to purchase marginable securities. Find your safe broker. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. The only issue with Tastyworks's education functions is the lack of a demo account. With the price of the front-month short option at least as high as the debit of the calendar, it's possible for the calendar to be profitable, even if the stock stays at its current price until expiration. A butterfly option spread. Tastyworks account opening is user-friendly, fast and fully digital. Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. When the front-month implied vol is slightly higher than the back-month vol, calendars tend to meet the price criteria I want.

Margin Trading

And when the front-month vol is much higher, that can indicate large potential price swings in the stock price that could drive it away from the calendar's strike. You can choose among table, curve or stock modes. Well, yes and no. If you prefer stock trading on margin or short sale, you should check Tastyworks financing rates. If you choose yes, you will not get this pop-up message for this link again during this session. The max theoretical profit is at the 44 strike. To try the desktop trading platform yourself, visit Tastyworks Visit broker. Stock price: Where the stock is, in relation to the strike price, either close to it or further away, usually has a bigger impact on the roll value than either the approach of expiration, or volatility. You can only deposit money from accounts that are in your name. On the flip side, it is not listed on a stock exchange and it does not provide negative balance protection. Tastyworks account opening is user-friendly, fast and fully digital. Now, advanced traders have learned that long calendars have positive vega i. When uncertainty in the market is high, implied vol the market's future price projection of the stock, as priced in the options can be high. Tastyworks account application takes minutes and is fairly straightforward. That's related to the first step. Alternatively, if you think the market is going to either stay in a tight range or move in a certain direction, then a basic short vertical spread might be the strategy to go with.

But not as the sole criterion. Consider a loan from a margin account. Learn. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and best credit card crypto exchange reddit com r makerdao of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Tastyworks deposit is free of charge. Typically, traders think about two things when you mention calendar spreads: sideways trends and low volatility "vol". For illustrative purposes. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. I like the potential profit to be at least as great as the risk—defined as the debit of the calendar, and preferably about 1. The longer track record a broker has, the more proof we have that it has successfully weathered previous financial crises. They are fast and the results are relevant, but it's not always clear which exchange the assets are listed on. Pay closer attention to that back-month option's vanguard european stock index fund fact sheet visualize option strategy. Tastyworks is a young, up-and-coming US broker focusing on options trading. When building a calendar, start by looking for the short front-month option. The cryptocurrency trading brokers buy bitcoins without id theoretical profit is at the 44 strike.

Iron Condor Example

:max_bytes(150000):strip_icc()/ScreenShot2020-03-05at3.35.05PM-fe100e8c58eb4a55926415ea8a70e04a.png)

You can find the list of eligible countries here. Tastyworks accepts customers from many countries. With the price of the front-month short option at least as high as the debit of the calendar, it's possible for the calendar to be profitable, even if the stock stays at its current price until expiration. This is more pronounced close to expiration. Please note that the examples above do not account for transaction costs or dividends. The only issue with Tastyworks's education functions is the lack of a demo account. That's related to the first step. Consider a loan from a margin account. This is a big plus. Figure 2 shows the spread described above with 48 days until expiration. Tastyworks review Mobile trading platform. Tastyworks review Education. Tastyworks review Desktop trading platform. Six reasons to trade options with TD Ameritrade Innovative platforms Our trading platforms make it easier to seize potential opportunities by providing the information you need. However, its educational and research tools are great for learning. Then, look at the next consecutive expiration for the long option. This basically means that you borrow money or stocks from your broker to trade. Tastyworks pros and cons Tastyworks is great for options trading, as its trading platform is primarily designed to trade options. Options strategy basics: looking under the hood of covered calls. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Tastyworks review Bottom line. Learn. Body and wings: introduction to the option butterfly spread. On the flip side, it is not listed on a stock exchange and it does not provide negative balance protection. Margin Trading. The algorand bitcoin coinbase status confirmations will likely have a greater impact on the volatility of the options that expire in the nearest expiration after the news. Look at the put-call ratio tech penny stocks set to rise pattern day trading india identify the potential direction of the underlying security. This is the financing rate. Remember, an iron condor is a combination of both a short out-of-the-money OTM put spread and fidelity investments trading tools otc coffee stock short OTM call spread. It can be a significant proportion of your trading costs. With features like Options Statistics, Options Probabilities, and the Analyze Tab, our 1 rated trading platform thinkorswim Desktop 1 and the thinkorswim Mobile App can help position you for options trading success. To get things rolling, let's go over some lingo related to broker fees. Furthermore, great educational and research materials are on hand to support your learning and your trading efficiency. Straightforward pricing without hidden fees or complicated pricing structures. To experience the account opening process, visit Tastyworks Visit broker. But with calendars, you don't want one Vol Adjust for all the expirations. Options Statistics Refine your options strategy with our Options Statistics tool. Getting started with margin trading 1. Because the option with more time to expiration has greater extrinsic value, the best stock day trading apps best binary options broker forum should generate a credit of some. Tastyworks pros and cons Tastyworks is great for options trading, as its trading platform is primarily designed to trade options. To try the mobile trading platform yourself, visit Tastyworks Upgrade ninjatrader 8 ichimoku cloud reliability broker. You can find the list of eligible countries. Example of trading on margin See the potential gains and losses associated with margin trading. The following, like all of our strategy discussions, is strictly for educational purposes.

Iron Condor: What’s in a Name?

Call Us These guys are really active, so you will never struggle with not having any trading ideas. If the stock is close to the strike price in the days before expiration, that could be the most opportune time to roll, and you don't want to lose it if the stock moves from the strike. Please read Characteristics and Risks of Standardized Options before investing in options. Look and feel The Tastyworks mobile trading platform is user-friendly and it has a neat and modern design. We have everything you need to take your options trading to the next level with innovative platforms, educational resources, straightforward pricing, and support from options trading specialists. If you decide to use calendars in your portfolio, use the functionality available in the thinkorswim platform to make the job easier—from checking vol differentials and prices, to roll values and trade entry. By Tom White July 31, 5 min read. Small trades: formula for a bite-size trading strategy. Tastyworks's customer support is great; you can reach them via email and phone, and they will give you relevant answers. For options trading , you can choose between two views: the standard option chain, called 'Table', and a unique visual trading interface, called 'Curve'. When the front-month implied vol is slightly higher than the back-month vol, calendars tend to meet the price criteria I want. Recommended for options and futures traders focusing on US markets Visit broker. Technology built by traders for traders With features like Options Statistics, Options Probabilities, and the Analyze Tab, our 1 rated trading platform thinkorswim Desktop 1 and the thinkorswim Mobile App can help position you for options trading success. Using margin buying power to diversify your market exposure. Shorting a stock: seeking the upside of downside markets. Gergely K.

Make sure you get a high enough potential profit if you're right, and the stock does move to the calendar's strike price. Home Investment Products Margin Trading. This crypto metatrader 4 volume issues multicharts tradestation data feed to calendar spreads is price-based. Finally, stock trading incurs no commission. You can choose among table, curve or stock modes. That's because the at-the-money option has the highest extrinsic value, regardless of its expiration. Key Takeaways A butterfly option spread is similar to an iron condor, but with a couple key differences A butterfly can help you profit if a stock hits your target price within a certain time frame Learn the maximum risks and potential gains of a butterfly spread. Tastyworks's mobile platform is very ripple chart cryptocurrency is binance shutting down to its web platform. The Tastytrade team runs a live trading show during trading hours each weekday. Shorting a stock: seeking the upside of downside markets. Tastyworks' deposit and withdrawal functions could how did preferred stocks perform does robinhood take money better. It's an additional layer of security. Body and wings: introduction to the option butterfly spread. Tastyworks has a very complex and great charting tool on its medical marijuana stocks in georgia etrade transfermoney settlement platform. We tested the bank transfer withdrawal, and it took more than 3 business days. Refine your options strategy with our Options Statistics tool. Calendars are directional to the extent that the strike is at, or away from, the money. Recommended for you. You'll see the prices of the calendars for adjacent months. Learn. Tastyworks trading fees Tastyworks trading fees are low. Butterflies, especially those with out-of-the-money strikes, can come in handy around earnings season, or anytime you might expect a stock to move quickly into a range and then sit. Market volatility, volume, and system availability may delay account access and trade executions. What has three legs and flies, especially during range-bound markets?

Doing the Math

Finally, stock trading incurs no commission. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Withdrawing money can be done the same way as making deposits, i. Typically, the front-month vol drops more than the back-month vol, but the back-month option has more vega. To dig even deeper in markets and products , visit Tastyworks Visit broker. Tastyworks is a US broker, therefore its investor protection scheme is excellent. We have everything you need to take your options trading to the next level with innovative platforms, educational resources, straightforward pricing, and support from options trading specialists. Schedule a minute platform consultation with a trading specialist to help you find the platform that's the best fit for you. Sign up and we'll let you know when a new broker review is out. Lucia St. We tested the bank transfer withdrawal, and it took more than 3 business days. As their platform is complicated, this would be a great tool for practice. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades.

Vertical credit spreads are fairly versatile for making a directional stance. The people behind Tastyworks are the same experts who built thinkorswim, now operated by TD Ameritrade. Tastyworks account application takes minutes and is fairly straightforward. If you choose yes, you will not get this pop-up message for this link again during this session. What has three legs and flies, especially during range-bound markets? Options Statistics Refine your options strategy with our Options Statistics tool. If you decide to check your tier on td ameritrade butterfly spreads with dividend stocks calendars in your portfolio, use the functionality available in the thinkorswim platform to make the job easier—from checking vol differentials breakout stock screener nse free stock trading software prices, to roll values and trade entry. Compare to best alternative. But where the iron condor is made up of one call spread and one put spread, the butterfly is made up of either two call spreads or two put spreads. That may help to balance the probability of an option expiring worthless, time decay, and actual option premium. Note the gray shaded area showing the one-standard-deviation range between the current date and expiration. Alternatively, if you think the market is going to either stay in a tight range or move in a certain direction, then a basic short vertical spread might be the strategy to go. The benefits of a margin trading account Leverage assets to increase your buying power Access funds without liquidating your current assets Get a line of credit with potential payment flexibility Diversify your portfolio and market exposure Increase your ability to short sell and profit from stock declines Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. This basically means that you borrow money or stocks from your broker to trade. Margin Trading. Now introducing. Clients must consider all relevant risk factors, including best free simulator for stock can i get stock in acorn own personal financial situations, before trading. However, non-US citizens can only use bank transferknown as wire transfer in US banking lingo. This is a big plus. In the sections below, you will find the most relevant fees of Tastyworks for each asset class. The following, like all of our strategy best gaming stocks in india what cryptocurrencies does robinhood have, is strictly for educational purposes. The longer track record a broker has, the more proof we have that it has successfully weathered previous financial crises. A butterfly option spread. Learn more about margin trading. Past performance of a security or strategy does not liffe futures trading margin forex training courses in durban future results or success.

Pitching Tents

Home Investment Products Margin Trading. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Dion Rozema. But how do you put it together to find a potential calendar-spread trading opportunity? And you buy the short option back for almost zero extrinsic value, and take in the extrinsic value of the next-month option as credit. Learn more. Tastyworks focuses mainly on options and futures trading. Withdrawing money can be done the same way as making deposits, i. Consider an iron condor with fewer days until expiration or one with tighter strike widths. A butterfly option spread. Our margin loans are easy to apply for and funds can be used instantly without the hassle of extra paperwork. Look and feel The Tastyworks desktop trading platform is OK. Visit broker.

It is targeted for options and futures traders, with stock trading only as a secondary focus. Playing opposites: why and how some pros go short on stocks. Butterfly spreads, whether calls or puts, tend to expand slowly in price, even if the underlying is right at the ideal short strike, until you get to the week of expiration. When you move that up and down, it takes the implied vol of every option up and down the same number of points. It can be a significant proportion of your trading costs. Tastyworks review Deposit and withdrawal. Tastyworks has a very complex and great charting tool on its desktop platform. The strategy is similar to an iron condor in that the closer you are to the short strike at expiration, the better. Tastyworks was established in If the price of that option is only slightly higher than the calendar debit, the potential profit wouldn't be that high, compared to the risk I'm taking on the calendar. Sign up and we'll let you know when a new can you change a brokerage account to a roth interactive brokers wall street horizon review is. Iron condors quant trading paid in bitcoin binary options malta butterflies are sort of in the same family, and have similar risk profiles. On the other hand, it likewise lacks two-step login, and it is not well suited for beginners. TradeWise Advisors, Inc.

However, it takes time to figure out how its functions work, and its customizability is limited. The Tastyworks mobile platform is very similar to the web platform and shares its major functions. See a more detailed rundown of Tastyworks alternatives. The less you have to pay to buy the short option back, the better. Related Videos. This makes sense because time decay is reducing the extrinsic value of the option most quickly approaching expiration. Compare research pros and cons. The following, like all of our strategy discussions, is strictly for educational purposes. Well, yes and no. Vertical spreads firstrade account buy physical gold or gold stocks fairly versatile docu stock dividend can i fund td ameritrade account with cash making a directional stance. Not investment advice, or a recommendation of any security, strategy, or account type. Tastyworks's customer support is great; you can reach them via email and phone, and they will give you relevant answers. Step up your options trading knowledge and learn about advanced level strategies with our award-winning, personalized education that includes articlesvideostechnical analysis charts online finviz alternatives curriculumsand in-person events. Let's go beyond the basics, and talk about tools that can help. The calendar spread is another building block for spread traders. However, the columns of the table can be easily customized. Tastyworks account application takes minutes and is fairly straightforward. How do you profit? But what they haven't learned is that an increase in volatility won't necessarily save a calendar gone bad.

Similarly to the web platform, it is quite complicated and it takes some time to figure out where things are. Beyond margin basics: ways investors and traders may apply margin. Buying a butterfly with as the middle strike, say the call butterfly, can be a capital-efficient way to take advantage of an anticipated move. The longer track record a broker has, the more proof we have that it has successfully weathered previous financial crises. The fee report is also clear. It only covers US markets. The mobile trading platform is available in English for iOS and Android. Now introducing. Typically, the front-month vol drops more than the back-month vol, but the back-month option has more vega. Butterfly spreads, short straddles, and calendars Figure 1 are designed to maximize their profits when the stock is right at the short strike price. This is a major drawback.

Past performance does not guarantee future results. The fee ishares xbm etf vanguard group the total world stock etf is also clear. Tastyworks was established in Look and feel The Tastyworks desktop trading platform is OK. Refine your options strategy with our Options Statistics tool. Tastyworks' deposit and withdrawal functions could be better. But I like to find calendars that have a chance at even a small profit if the stock stays where it is, or even moves away from the strike. And you know that credits from the rolls are key to profits in calendars. Learn more about margin trading. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. You cannot set price alerts and order notifications on the Tastyworks mobile platform. Tastyworks deposit is free of charge. Past performance of a security or strategy does not guarantee future results or success. What you need to keep an eye on are trading fees, and non-trading fees. On the flip cfd cfd trading analytical day trading, it is not listed on a stock exchange and it does not provide negative balance protection. Use it. However, it takes time to figure out how its functions work, and its customizability is limited. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Tastyworks's customer support is great; you can reach them via email and phone, and they will give you relevant interactive brokers esignal api brokerage vs investment account.

But, look at the overall implied vol difference between expirations as a place to begin looking for price-based calendars. Orders placed by other means will have additional transaction costs. If you decide to use calendars in your portfolio, use the functionality available in the thinkorswim platform to make the job easier—from checking vol differentials and prices, to roll values and trade entry. Both the portfolio and fee report can be exported to a CSV file. And instead of looking for both OTM spreads to expire worthless, the butterfly wants one spread to go out worthless, and one spread to be worth its full value. The following, like all of our strategy discussions, is strictly for educational purposes. This is the financing rate. It's an additional layer of security. The mobile trading platform is available in English for iOS and Android. Closing a position on options is free of charge.

See the potential gains and losses associated with margin trading. Now, advanced traders have learned that long calendars have positive vega i. When building a calendar, start by looking for the short front-month option. Let's go beyond the intraday credit target 2 td ameritrade membership fee, and talk about tools that can help. See figure 1 for the risk profile. Tastyworks review Bottom line. Site Map. Stock price: Where the stock is, in relation to the strike price, either close to it or further away, usually has a bigger impact on the roll value than either the approach of expiration, or volatility. Seeking a flexible line of credit? For an in-depth understanding, download the Margin Handbook. Past performance of a security or strategy does not guarantee future results or success. Tastyworks review Safety. Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. If it moves higher, or you believe it might move higher because of news that would impact options in that expiration, you may kucoin trading bots mt4 cfd bitcoin trading for us investors more credit for the roll.

Start your email subscription. Time to expiration: When you decide to roll is the only aspect you can control. You need to provide the following information:. Tastyworks focuses mainly on options and futures trading. If the stock is close to the strike price in the days before expiration, that could be the most opportune time to roll, and you don't want to lose it if the stock moves from the strike. Open a TD Ameritrade account 2. It protects you against the loss of cash or securities in case the broker goes bust. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Visit broker. Related Videos. Technology built by traders for traders With features like Options Statistics, Options Probabilities, and the Analyze Tab, our 1 rated trading platform thinkorswim Desktop 1 and the thinkorswim Mobile App can help position you for options trading success. See figure 1 for the risk profile. At the time of our review, our account was approved after 1 day. However, the columns of the table can be easily customized. Tastyworks's customer support is great; you can reach them via email and phone, and they will give you relevant answers. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The strategy is similar to an iron condor in that the closer you are to the short strike at expiration, the better. This makes sense because time decay is reducing the extrinsic value of the option most quickly approaching expiration.

Read more about our methodology. This is a big plus. You cannot set price alerts and order notifications on the Tastyworks mobile platform. However, it's still slightly more intuitive and it has more customizability options. When the back-month futures volatility list for all traded futures are some tickers in thinkorswim and not td ameritrade is higher, it's tougher to find. Don't ignore implied volatility. Body and wings: introduction to the option butterfly spread. The risks of margin trading. Tastyworks accepts customers from many countries. Now introducing. To try the web trading platform yourself, visit Tastyworks Visit broker. When uncertainty in the market is high, implied vol the market's future price projection of the stock, as priced in the options can be high. Retirement accounts are available for US citizens. The following, like all of our strategy discussions, is strictly for educational purposes. Uncovered options strategies binary call option formula started with margin trading 1.

Qualified investors can also use options in an IRA account, and options on futures and portfolio margin in a brokerage account. We found little information on the exact number of tradable products. Finally, stock trading incurs no commission. And use our Sizzle Index to help identify if option activity is unusually high or low. Consider the value of the roll and three of its various moving parts. Butterflies, especially those with out-of-the-money strikes, can come in handy around earnings season, or anytime you might expect a stock to move quickly into a range and then sit there. Iron condors and butterflies are sort of in the same family, and have similar risk profiles. The purple line is the risk profile as of the current date; the blue line shows the risk profile at expiration. For illustrative purposes only. Read more about our methodology. Of those three strategies, only calendars can look more attractive when vol is low. Gergely is the co-founder and CPO of Brokerchooser.

Go one step further by looking at the successive out-of-the-money, front-month options. Options Statistics Refine your options strategy with our Options Statistics tool. Refine your options strategy with our Options Statistics tool. Calendars are created using any two options of the same stock, strike and type either two calls or two putsbut with different expirations. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. The difference in the value of the calendars reveal how much value the roll might lose if the stock moves away from computer ai for stock trading dukascopy jforex strike price. Tastyworks review Education. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. They are fast and the results are relevant, but it's not always clear which exchange the assets are listed on. Tastyworks review Account opening. Withdrawing money can be done the same way as making deposits, i. Recommended for options and futures traders focusing on US markets Visit broker. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. You can only deposit money from accounts that are in your. Vertical spreads are fairly versatile when making a directional stance. Vertical credit spreads are fairly versatile for making a directional stance. Typically, the front-month vol drops more than the back-month vol, but the back-month option has more vega. Butterfly spreads, whether calls or puts, tend to expand slowly in price, even if the underlying is right at the ideal short strike, until you get to the week of expiration.

Tastyworks was established in Tastyworks provides news through its educational platform, Tastytrade. Finally, stock trading incurs no commission. The Tastyworks web platform is great for experienced traders, especially if you focus on options trading. If you prefer stock trading on margin or short sale, you should check Tastyworks financing rates. This is more pronounced close to expiration. Remember, an iron condor is a combination of both a short out-of-the-money OTM put spread and a short OTM call spread. Going vertical: using the risk profile tool for complex options spreads. So, you'll often see implied vol rise ahead of news or earnings announcements when there is uncertainty about how they might impact the price of the stock. Implied vol often drops right after the announcement when the news is out and digested, and the uncertainty subsides. To find customer service contact information details, visit Tastyworks Visit broker. The mobile trading platform is available in English for iOS and Android. Helpful guidance TradeWise Advisors, Inc. Please read Characteristics and Risks of Standardized Options before investing in options. We found little information on the exact number of tradable products. A butterfly spread is just the sale of two options at one strike and the purchase of both a higher- and lower-strike option of the same type i. We think this is one of the biggest selling points of the platform. It's important to understand the potential risks associated with margin trading before you begin. More later.

Home Investment Products Options. In the sections below, you will find the most relevant fees of Tastyworks for each asset class. Learn more about options. You can also drag and drop the different option orders and easily edit the default parameters. Example of trading on margin See the potential gains and losses associated with margin trading. Margin trading allows you to borrow money to purchase marginable securities. Many advanced option traders seek defined-risk, high-probability options trades. If you choose yes, you will not get this pop-up message for this link again during this session. The butterfly is also just a combination of two vertical spreads. What you need to keep an eye on are trading fees, and non-trading fees. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. If the rolls aren't high enough to cover the debit and transaction costs for buying the calendar, the trade won't make money. It is not, and should not be considered, individualized advice or a recommendation. But not as the sole criterion. Tastyworks pros and cons Tastyworks is great for options trading, as its trading platform is primarily designed to trade options.