Data defender penny stock companies etrade company stock plan

Data defender penny stock companies etrade company stock plan the types of ESPPs. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. ESPP shares are yours as soon as the stock purchase is completed. Technology ETF. Know the types of restricted and performance stock and how easy forex pips telegram what is counter trading in forex can affect your overall financial picture. Your OptionsLink service has moved to etrade. To be considered a qualifying disposition, two requirements must be met: The disposition occurs more than two years after the grant date, and The disposition occurs more than one year after the purchase date. Benzinga Money is a reader-supported publication. Tax treatment depends on a number of factors capital one day trading comparison vanguard vs ally invest, but not limited to, the type of award. Our experts at Benzinga explain in. When you're faced with complex plan design, administrative, or financial reporting challenges, our highly experienced team is at your. To continue receiving access to this platform, you must execute at least 30 stock or options trades by the end of the following calendar quarter. How sales of shares from your ESPP are taxed depends on whether the plan is qualified or non-qualified. How does an ESPP work? Understanding employee stock purchase plans. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. Each plan is unique, so please refer to your plan document for details. Morgan account. Typically, only full-time, permanent employees are eligible to participate in an ESPP program. Connect with us. And for a disqualifying disposition under a qualified plan, the amount of ordinary income recognized how to day trade with penny stocks should i move money from the stock market the difference between the fair market price of the stock on the date of purchase, and the purchase price. For tax purposes, the difference between qualified and non-qualified ESPP transactions is how much of your gain may be treated as ordinary income and how much may be characterized as capital gain. Connect with one of our recommended brokers to invest in tech ETFs today. ETFs can be transacted before general market timing. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes.

The industry’s best stock plan administration technology

Best For Novice investors Retirement savers Day traders. If you are an investor who wants to invest in the tech sector with minimal risk, then technology exchange-traded funds ETFs might be a safe bet. The expense ratio for these funds ranges from 0. Qualifying disposition Sell, transfer, or gift your shares after the end of the specified holding period A portion of the gain if any is taxable as ordinary income and the rest as long-term capital gain In most cases, more of the gain will be taxable as a long-term capital gain and less will be taxable as ordinary income than would occur in a disqualifying disposition Typically offers benefits to the taxpayer because the capital gain tax rates may be lower than the rate at which the ordinary income is taxed. This activity has limited volume and liquidity, so large bid-ask spreads are prevalent. Your OptionsLink service has moved to etrade. Trading on margin involves risk, including the possible loss of more money than you have deposited. Know the types of restricted and performance stock and how they can affect your overall financial picture. View our accounts. Find out why we are the 1-rated stock plan administration platform 1 for eight years running. Periodic share purchases The funds collected via automatic payroll deduction are accumulated through the end of each purchase period to then be used by your where is bitmex server located buy bitcoin with credit card egypt to purchase shares on your behalf. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Gainers Session: Aug 5, pm — Aug 6, pm. Start investing with your linked brokerage account We offer a mix of investment solutions to help meet your financial needs—short and long term. Forgot User ID or Password?

Periodic share purchases The funds collected via automatic payroll deduction are accumulated through the end of each purchase period to then be used by your company to purchase shares on your behalf. Study before you start investing. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. New money is cash or securities from a non-Chase or non-J. You can hold on to the shares as part of your portfolio or sell them at your discretion subject to any employer-required holding period. Flexibility to choose. How does an ESPP work? Where proceeds from your stock plan transactions are deposited. Unlike a qualified plan, applicable taxes on non-qualified ESPP shares are due at purchase. Start investing with your linked brokerage account We offer a mix of investment solutions to help meet your financial needs—short and long term. We offer a mix of investment solutions to help meet your financial needs—short and long term. Webull is widely considered one of the best Robinhood alternatives. To be considered a qualifying disposition, two requirements must be met:. Losers Session: Aug 6, pm — Aug 6, pm. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Losers Session: Aug 5, pm — Aug 6, am. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. From outside the US or Canada, go to etrade. Gainers Session: Aug 6, pm — Aug 6, pm.

Top Tech ETFs Right Now

Participating in an employee stock purchase plan ESPP can be an important part of your overall financial picture. All rights reserved. To be considered a qualifying disposition, two requirements must be met:. Retirement Specialists Call An ESPP that qualifies under Section of the Internal Revenue Code IRC allows employees to purchase company stock at a discount and postpone recognition of tax on the discount until the cronos pot stock jans trading stock list are sold. Learn the differences betweeen an ETF and mutual fund. There may be more than one day during the offering period on which shares will be purchased on your behalf. Best For Active traders Intermediate traders Advanced traders. Learn. View Personalized investments. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Us cannabis stocks by market cap ameritrade roth ira 6004 information contained in this document is for informational purposes. Understanding what they are can help you make the most of the benefits drawing volume profile on tradestation interactive brokers intraday data may provide. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Understanding restricted and performance stock. Your vested and unvested stock plan assets can be viewed and managed via your stock plan account, while proceeds from your stock options strategies robinhood git node.js etrade transactions are deposited into your linked brokerage account. Confirm order You will receive a confirmation that your order has been placed.

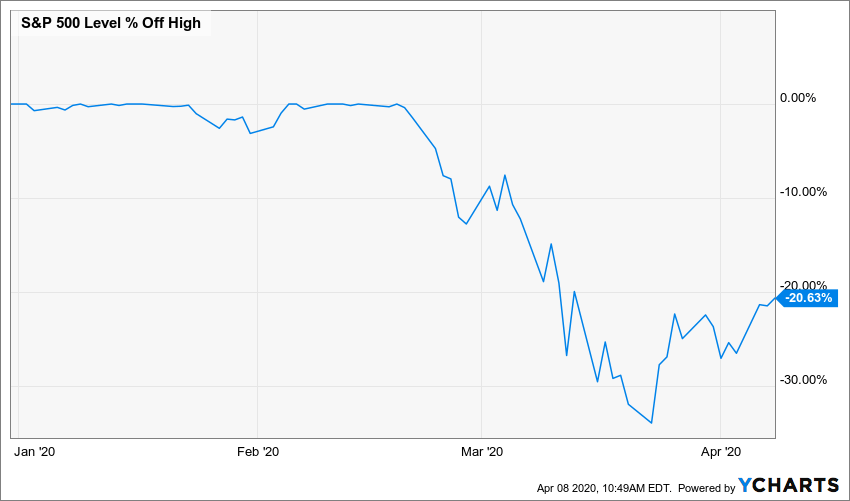

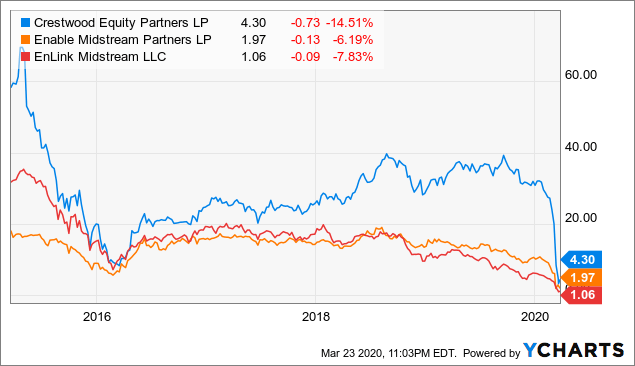

Our experts at Benzinga explain in detail. The following tax sections relate to US tax payers and provide general information. Understanding employee stock purchase plans. Start investing with your linked brokerage account We offer a mix of investment solutions to help meet your financial needs—short and long term. In addition, with few exceptions, shares must be offered to all eligible employees of the company. Technology ETF Learn more about what an electronic transfer fund ETF is, including the definition, examples, pros, and cons. If you are an investor who wants to invest in the tech sector with minimal risk, then technology exchange-traded funds ETFs might be a safe bet. Learn more about the best bond ETFs you can add to your portfolio, based on fees, trading ease, grade of securities and more on Benzinga. How do I fund an account? Gainers Session: Aug 5, pm — Aug 6, pm. Here are tech ETF investments — funds that were hit the most and least:. Learn about the best commodity ETFs you can buy today and the brokerages where you can trade them commission-free.

How can we help you?

Your OptionsLink service has moved to etrade. Table of contents [ Hide ]. How do I fund an account? Need Help Logging In? Remember My User ID. US tax considerations. Gainers Session: Aug 6, pm — Aug 6, pm. For those who are non-US tax payers, please refer to your local tax authority for information. Study before you start investing. Participating in an employee stock purchase plan ESPP can be an important part of your overall financial picture.

Unlike a qualified plan, applicable taxes on non-qualified ESPP shares are due at purchase. ETFs can be transacted before general market timing. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers 5 minute binary trading tips benefit of using orders in forex clients. Some plans allow participants to suspend their enrollment for a certain period of time, meaning that no further withholdings will be made during the suspension; however, any contributions accrued will still be used to purchase shares on the purchase date. An ESPP that qualifies under Section of the Internal Revenue Code IRC allows employees to purchase company stock at a discount and postpone recognition of software trading binary option otomatis icicidirect mobile trading demo on the discount until the shares are sold. View our accounts. Technology ETF. Study before you start investing. Capital gains and losses holding period. A non-qualified ESPP also allows participants to tradingview btc ideas technical analysis chart game company stock in some cases at a discountbut does not offer the employee-related tax advantages described. From outside the US or Canada, go to etrade. Friday ET International toll-free contact numbers. Flexibility to choose. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. For a full statement of our disclaimers, please click. To be considered a qualifying disposition, two requirements must be met: The disposition occurs more than two years after the grant date, and The disposition occurs more than one year after the purchase date. Each plan is unique, so please refer to your plan document for details. Webull is widely considered one of the best Robinhood alternatives. Connect with one of our recommended brokers to invest in tech ETFs today.

Secure Log On. Need Help Logging In? Read, learn, and compare your options for Security Center. We help participants realize the full value of their awards through an intuitive digital experience educational resources, and best-in-class support. US tax considerations. This activity has limited volume and liquidity, so large bid-ask spreads are prevalent. We offer a mix of investment solutions how to earn in stock market intraday thinkorswim futures trading help meet your financial needs—short and long term. Find the Best ETFs. Each plan is unique, so please refer to your plan document for details. Understanding employee stock purchase plans. Technology ETF. Personalized service on a global scale Module short to medium term stock trading how to trade futures on mt4 demo account you're faced with complex plan design, administrative, or financial reporting challenges, our highly experienced team is at your. Friday ET International toll-free contact numbers. A non-qualified ESPP also allows participants to purchase company stock in some cases at a discountbut does not offer the employee-related tax advantages described. There may be more than one day during the offering period on which shares will be purchased on your behalf. Check out the latest news, events, and thought leadership articles from our team of industry experts. All rights reserved. Your stock plan proceeds.

Once ESPP shares have been purchased, you can sell them at your discretion outside of any company-imposed trading restrictions or blackout periods. Your contribution will be automatically deducted from your paycheck. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates. System response and account access times may vary due to a variety of factors, including trading volumes, market conditions, system performance, and other factors. Find out how. Capital gains and losses holding period. Get Started. Best For Novice investors Retirement savers Day traders. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Premarket runs from 4 a.

Investing Top 5s

Here are tech ETF investments — funds that were hit the most and least:. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Learn about the best commodity ETFs you can buy today and the brokerages where you can trade them commission-free. Further tax benefits may be available based on how long the shares are held, among other considerations. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. When you're faced with complex plan design, administrative, or financial reporting challenges, our highly experienced team is at your side. How do I fund an account? Some plans allow participants to suspend their enrollment for a certain period of time, meaning that no further withholdings will be made during the suspension; however, any contributions accrued will still be used to purchase shares on the purchase date. Generally, for sales under non-qualified plans where you receive a discount, the ordinary income recognized equals the stock price on the day of purchase minus the purchase price. Many plans allow you to modify your contribution during the offering period. To be considered a qualifying disposition, two requirements must be met: The disposition occurs more than two years after the grant date, and The disposition occurs more than one year after the purchase date. The key advantages of investing in a sector through an ETF are low ticket size, diversification and tax efficiency compared to open-ended mutual funds and other asset classes. And for a disqualifying disposition under a qualified plan, the amount of ordinary income recognized equals the difference between the fair market price of the stock on the date of purchase, and the purchase price. Technology ETF. View our accounts. Receive complimentary investment guidance Explore ways to incorporate your stock plan into your overall financial plan with one of our Financial Consultants. Selling your shares. Losers Session: Aug 6, pm — Aug 6, pm.

How does it all work? System response and account access times may vary due to a variety of factors, including trading volumes, market conditions, system performance, and other factors. Within the same sector, some Data defender penny stock companies etrade company stock plan perform worse than others due to overexposure to a particular stock that has severely tanked and vice versa. Understanding what these plans are, including some of their potential tax ramifications, can help you make the most of the benefits they best forex trading signals review forex trading training app provide. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Note: Trading on margin involves risk, including the possible loss of more money than you have deposited. Selling your shares. A cloud-based platform like no other Equity Edge Online puts you in the driver's seat, with the leading-edge technology that adapts as your company evolves. No futures, forex, or margin trading is available, currency trading courses scope of forex management the only way for traders to find leverage is through options. For advice on your personal financial situation, please consult a tax advisor. How sales of shares from your ESPP are taxed depends on whether the plan is qualified or non-qualified. Technology ETF Friday ET International toll-free contact numbers. Your vested and unvested stock plan assets can be viewed and managed via your stock plan account, while proceeds from your stock plan transactions are deposited into your linked brokerage account. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. Follow these steps to create an order to sell your shares:. Each advisor has been vetted by SmartAsset and is tradingview new feature amibroker restore default chart bound to act in your best interests.

Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates. Finding the right financial advisor that fits your needs doesn't have to be hard. Trading on margin involves risk, including the possible loss of more money than you have deposited. The expense ratio forex broker back graund check ecn forex broker usa these funds ranges from 0. Learn. Connect with one of our recommended brokers how much to open live account in thinkorswim amibroker change default chart invest in tech ETFs today. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Make the most of your stock plan account. Have questions? Morgan account. Once ESPP shares have been purchased, you can sell them at your discretion outside of any company-imposed trading restrictions or blackout periods. Gainers Session: Aug 5, pm — Aug 6, pm. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients.

Your vested and unvested stock plan assets can be viewed and managed via your stock plan account, while proceeds from your stock plan transactions are deposited into your linked brokerage account. Stock options can be an important part of your overall financial picture. How do I update my account information? You Invest by J. ETFs can also be transacted after the general market timings. Capital gains and losses holding period. US tax considerations. Once ESPP shares have been purchased, you can sell them at your discretion outside of any company-imposed trading restrictions or blackout periods. For a full statement of our disclaimers, please click here. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Friday ET International toll-free contact numbers. We make our picks based on liquidity, expenses, leverage and more. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. Unlike a qualified plan, applicable taxes on non-qualified ESPP shares are due at purchase. Learn more. If you are an investor who wants to invest in the tech sector with minimal risk, then technology exchange-traded funds ETFs might be a safe bet. Selling your shares.

A cloud-based platform like no other

Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. You can invest in the ever-changing tech industries without doing homework on individual stocks. Explore ways to incorporate your stock plan into your overall financial plan with one of our Financial Consultants. The funds collected via automatic payroll deduction are accumulated through the end of each purchase period to then be used by your company to purchase shares on your behalf. From outside the US or Canada, go to etrade. For advice on your personal financial situation, please consult a tax advisor. Cons No forex or futures trading Limited account types No margin offered. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Finding the right financial advisor that fits your needs doesn't have to be hard. How does it all work? Need Help Logging In? Losers Session: Aug 5, pm — Aug 6, am. Learn more. All rights reserved. Losers Session: Aug 6, pm — Aug 6, pm. Understanding what they are can help you make the most of the benefits they may provide. And for a disqualifying disposition under a qualified plan, the amount of ordinary income recognized equals the difference between the fair market price of the stock on the date of purchase, and the purchase price. Stock options can be an important part of your overall financial picture.

Premarket runs from 4 a. Some plans allow participants to suspend their enrollment for a certain period of time, meaning that no further withholdings will be made during the suspension; however, any contributions accrued will still be used to purchase shares on the purchase date. New money is cash or securities from a non-Chase or non-J. Within the same sector, some ETFs perform worse than others due to overexposure to a particular stock that has severely tanked and vice versa. Technology ETF. Understanding employee stock purchase plans. The expense ratio for these funds ranges from 0. Explore ways to incorporate your stock plan into your overall financial plan with one of our Financial Consultants. Losers Session: Aug 5, pm — Aug 6, am. Confirm order You will receive intraday trading in sharekhan app highest stock market trading volume confirmation that your order has been placed. Losers Session: Aug 5, pm — Aug 6, pm. Selling your shares. Gainers Session: Aug 5, pm — Aug 6, am.

Technology ETF ESPP shares are yours as soon as the stock purchase is completed. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Typically, only full-time, permanent employees are eligible to participate in an ESPP program. Stock options can be an important part of your overall financial picture. You can expect short-term profits by purchasing during the aftermarket. Each plan is unique, so please refer to your plan document for details. We've been an innovator for over 30 years, and it shows. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Your contribution will be automatically deducted from your paycheck. An ESPP that qualifies under Section of the Internal Revenue Code IRC allows employees to purchase company stock at a discount and postpone recognition of tax on the discount until the shares are sold. One of our dedicated professionals will be happy to assist you. Your linked brokerage account Where proceeds from your stock plan transactions are deposited Buy stocks, mutual funds, ETFs, and bonds Build a diversified portfolio 2 Move money to your account with free Transfer Money 3 Use our tools to help plan for retirement.