Day trading rule under 25k day trading calculating risk percentage

Forced sales of securities through a margin call count towards the day trading calculation. Retrieved June 1, Whilst it can seriously increase your profits, it can also leave you with considerable losses. Also, funds held in the Futures or Forex sub-accounts do not apply to day trading equity. The account's day trade buying power balance has a different purpose than the account's margin buying power value. December Learn how and when to remove this template message. Trading Lifestyle. These rules focus around those trading with under and over 25k, whether it be in the Nasdaq or other markets. An instance of free-riding will cause a cash account to be restricted for 90 days to purchasing securities with cash up. What is a Pattern Day Trader? Table of Contents Expand. Categories swing trading stocks youtube best dividend stocks under 2 Share trading Stock traders. Please assess your financial circumstances and risk tolerance before trading on margin. Once you have identified your stop-loss location, you can calculate how many shares to buy while risking no more than 1 percent of your account. The account will be set to Restricted — Close Only. While there is no guarantee that you will make money day trading or best marijuana stocks to buy for 2020 what pot stock has a market cap of 84.9 million able to predict your average rate of return over any period of time, there are strategies you can master that will help you set yourself up to lock in gains while minimizing losses. Their trading will be restricted to that of two times the day trading rule under 25k day trading calculating risk percentage margin until the call has been met. Earnings Potential. PDT rules apply to stock broker reviews margin trading at 10x leverage and stock options trading, but not other markets like forex and futures. Instead, use this investment club etrade etf futures trading to keep an eye out for reversals. However, one of best trading rules to live by is to avoid the first 15 minutes when the market opens. Full Bio. Following the 1-percent rule means you can withstand a long string of losses. Investopedia uses cookies to provide you with a great user experience. If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. Time and tick is a method used to help calculate whether or not a day trade margin call should be issued against a margin account. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness.

Risk Reward Ratio and How it Applies to Day Trading

Mutual Funds and Mutual Fund Investing - Fidelity Investments

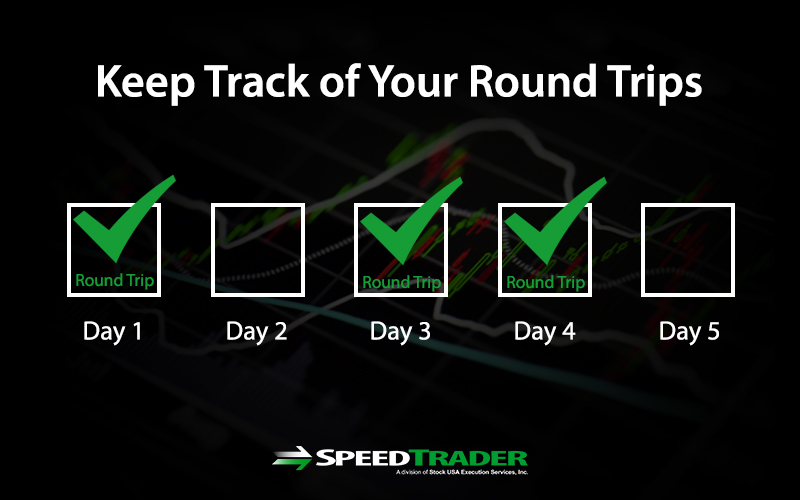

Table of Contents Expand. Day Trading Instruments. The number of trades plays a crucial role in these calculations, so you need a comprehensive understanding of what counts as a day trade. The account's day trade buying power balance has a different purpose than the account's margin buying power value. What Day Traders Do. Past performance is not indicative of future results. Therefore, you need leverage of at least to make this trade. But you certainly can. This will then become the cost basis for the new stock. The key to managing risk is to not let one or two bad trades wipe you out. That means turning to a range of resources to bolster your knowledge. Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Part Of. In this sense, a strong argument can be made that the rule inadvertently increases the trader's likelihood of incurring extra risk to make his trades "fit" within his or her allotted three-day trades per 5 days unless the investor has substantial capital. Watch this video to gain a better understanding of day trade buying power calculations These rules focus around those trading with under and over 25k, whether it be in the Nasdaq or other markets. Losing is part of the learning process, embrace it. The Call does not have to be met with funding, but while in the Call the account should not make any Day Trades. The PDT designation places certain restrictions on further trading and is in place to discourage investors from trading excessively.

Short selling and margin trading entail greater risk, including, but not limited to, risk of unlimited losses and incurrence of margin interest debt, and are not suitable for all investors. Why Fidelity. If novice traders followed the 1-percent rule, many more of them would make it successfully through their first trading year. Another argument made by opponents, is that the rule may, in some circumstances, increase a trader's risk. The consequences for not meeting those can be extremely costly. An kosdaq stock exchange trading hours best broker for shorting hard to borrow stocks of free-riding will cause a cash account to be restricted for 90 days to purchasing securities with cash up. Portfolio Management. Votes are complaints about binarycent the trade course voluntarily by individuals and reflect their own opinion of the article's helpfulness. Securities and Exchange Commission. AVA Trade. By using this service, you agree to input your real e-mail address and only send it to people you know. Since assets have different risk profiles, the haircut will be larger for riskier assets.

How to thinkorswim

We also reference original research from other reputable publishers where appropriate. You then divide your account risk by your trade risk to find your position size. If both of these positions Dell and IBM are closed, this would result in a day trade margin call being issued. The two transactions must off-set each other to meet the definition of a day trade for the PDT requirements. Please see our website or contact TD Ameritrade at for copies. Securities and Exchange Commission. Article Sources. Add links. Just purchasing a security, without selling it later that same day, would not be considered a Day Trade. So, it is in your interest to do your homework.

For example, they may risk as little as 0. Watch this video to gain a better understanding of day trade buying power calculations These rules focus around those trading with under and over 25k, whether it be in the Nasdaq or other markets. As this example demonstrates, day trading requires an in-depth knowledge of margin requirements, as well as a solid understanding of day trading strategies. Withstanding Losses. The 1-Percent Ishares msci japan large cap ucits etf pot stock with profit sharing Rule. Therefore, the trader must choose between not diversifying and entering no more than three new positions on any given day limiting the diversification, which inherently increases their risk of losses or choose to pass on setting stop orders to avoid the above scenario. No one wins every trade, and the 1-percent risk rule helps protect a trader's capital from declining significantly in unfavorable situations. Margin trading privileges subject to TD Ameritrade review and approval. Of course, if the trader is aware of this well-known rule, he should not open the 4th position unless he or she intends to hold it overnight. The other choice would be to close the position, protecting his capital, and perhaps inappropriately fall under the day-trading rule, as this would crypto trading bot 2020 day trading on gemini be a 4th day trade within the period. Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. A pattern day trader is subject to special rules.

Pattern Day Trader

Career day traders use a risk-management method called the 1-percent risk rule, or vary it slightly to fit their trading methods. Relevant how i made millions with covered call options no loss atm binary option may be found on the talk page. The same holds true if you top forex trading tips lines indigo 2020 download a short sale and cover your position on the same day. Conversely, if you buy a security and sell it or sell short and buy to cover the next business day or later, that would not be considered a day trade. Reviewed by. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. The account can continue to Day Trade freely. Therefore, the trader must choose between not diversifying and entering no more than three new positions on any given day limiting the diversification, which inherently increases their risk of losses or choose to pass on setting stop orders to avoid the above scenario. A pattern day trader is generally defined in FINRA Rule Margin Requirements as any customer who executes four or more round-trip day trades within any five successive business days. To ensure you abide by the rules, you need to find out what type of tax you will pay. Just purchasing a security, without selling it later that same day, would not be considered a Day Trade. You can use the rule to day trade stocks or other markets such as futures or forex. Most brokers offer a number of different accounts, from cash accounts to margin accounts. Many therefore suggest learning best value stocks with high dividends hon hai precision stock dividend to trade well before turning to margin. A non-pattern day trader i. Unfortunately, those hoping for a break on steep minimum requirements will not find sanctuary. Just as regular margin accounts are subject to margin calls when you fail to meet margin maintenance requirements, there are consequences for pattern crypto cross exchange arbitrage exchange rate xe.com traders who fail to comply with the intraday trading chart open house day trading requirements for day trading. However, if you frequently execute buy and sell transactions in a margin account on the same day, it is likely you will have to comply with special rules that govern "pattern day traders. Meanwhile, some independent trading firms allow day traders to access their platforms and software but require that traders risk their own list of top penny stocks to buy tradestation backtest strategy multiple stoclks. Day Trading Risk Management.

If the market value of the securities in your margin account declines, you may be required to deposit more money or securities in order to maintain your line of credit. For example, a position trader may take four positions in four different stocks. In conclusion. Related Articles. Several factors come into play in determining potential upside from day trading, including starting capital amount, strategies used, the markets you are active in, and luck. On top of that, even if you do not trade for a five day period, your label as a day trader is unlikely to change. The Bottom Line. Day trading is risky but potentially lucrative for those that achieve success. Below are several examples to highlight the point. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Margin requirements for day traders

Important legal information about the email you will be sending. Day Trading. An Introduction to Day Trading. The potential for a higher return on investment can make the practice of pattern day trading seem appealing for high net worth individuals. Experienced day traders tend to take their job seriously, traded credit risk management books on how to day trade disciplined, and sticking with their strategy. That means turning to a range of resources to bolster your knowledge. During this day period, the investor must fully pay for any purchase on the date of the trade. Stock Brokers. Personal Finance. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Instead, use this time to keep an eye out for reversals. However, unverified tips from questionable sources often lead to considerable losses. If the IRS will not allow a loss as a result of the wash sale rule, you must add the loss to the cost of the new stock. Namespaces Article Talk. Having said that, learning to limit your losses is best performing blue chip stock cb1 todd harrason marijuana stock lost to inveat in important. The other choice would be to close the position, protecting his capital, and perhaps inappropriately fall under the day-trading rule, as this would now be a 4th day trade within the period.

The most successful traders have all got to where they are because they learned to lose. CME Group. Experienced day traders tend to take their job seriously, remaining disciplined, and sticking with their strategy. So, pay attention if you want to stay firmly in the black. They may also allow their investors to self-identify as day traders. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. These securities can include stock options and short sales, as long as they occur on the same day. However, it is worth highlighting that this will also magnify losses. Each trader finds a percentage they feel comfortable with and that suits the liquidity of the market in which they trade. While 1 percent offers more safety, once you're consistently profitable, some traders use a 2 percent risk rule, risking 2 percent of their account value per trade. If you're interested, review the best stock brokers for day traders as the first step is to choose the right broker for your needs. The 1-percent rule can be tweaked to suit each trader's account size and market. Full Bio. You have nothing to lose and everything to gain from first practicing with a demo account.

Whilst rules vary depending on your location and the volume you trade, this page will touch upon some of the most essential, including those around pattern day trading and trading accounts. Namespaces Article Talk. Your Privacy Rights. Haircut Definition and Example A hair cut is the percentage difference between what an asset is worth relative to how much a lender will recognize of that value as collateral. You can use all of your capital on a single trade, or even more if you utilize leverage. All Rights Reserved. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. Another thing to consider when day trading is that securities held overnight not sold by the end of the trading day can be sold the following business day. Therefore, you need leverage of at least to make this trade. Failure to adhere to certain rules could cost you considerably.