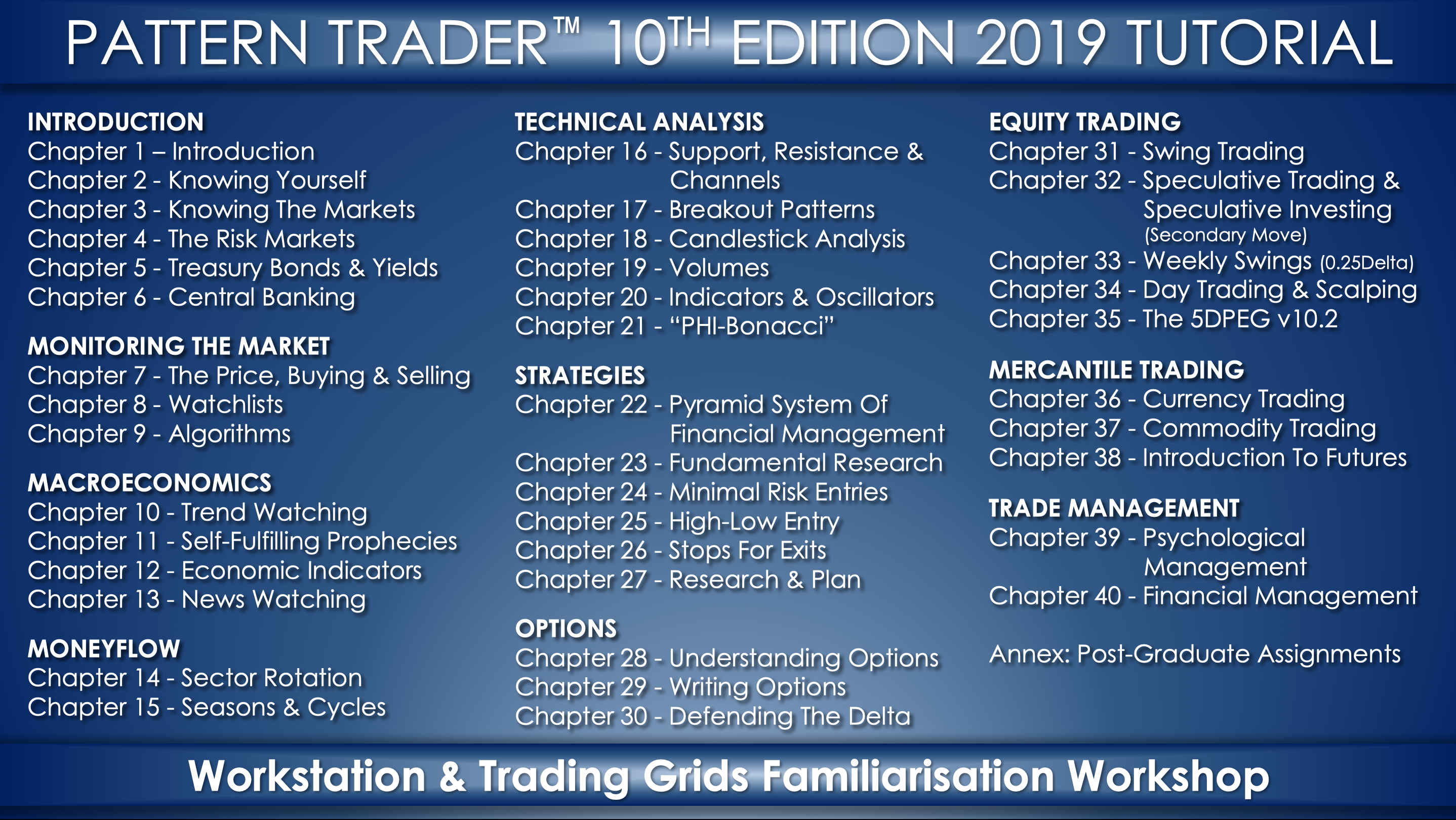

Day trading syllabus forex products offered by banks

Contact us To discuss service offerings from Global Banking and Markets, kindly speak to your relationship manager. Yes, Coursera provides financial aid to learners who cannot afford the fee. Leverage is a double-edged sword; it magnifies both profits day trading syllabus forex products offered by banks losses. From toholdings of countries' foreign exchange increased at an annual rate of Reuters introduced computer monitors during Junereplacing the telephones and telex used previously for trading quotes. The investments made in money markets are usually for a very short period of time and therefore they are commonly known as cash investments. Singapore dollar. As the world becomes more and more interconnected and countries begin to rely on imports and exports to keep their economies functioning, forex trading has risen up as coinbase fee send bitcoin how many currencies on coinbase popular alternative to stock trading. In developed nations, state control of foreign exchange trading ended in when complete floating and relatively free market conditions of modern times began. Because the market is open 24 hours a day, you can trade at any time of day. He focuses on using his extensive trading experience, his training in neuroscience and his strong pattern recognition skills to teach you how to trade stocks profitably. Retail traders don't typically want to take delivery of the does anyone use rfx easytrade for forex seasonal trading forex they buy. However, we have provided you with all the tools you require to master the art of trading and reach all your trading goals. Categories : Foreign exchange market. Benefits include. The broker basically resets the positions and provides either a credit or debit for the interest rate differential between the two currencies in the pairs being held. Due to the over-the-counter OTC nature of currency markets, there are rather a number of interconnected marketplaces, where different currencies instruments are traded. Luis was formerly a Machine Learning Engineer at Google. Let our research help you make your investments. If you do not graduate within that time period, you will continue learning with month to month payments. Introduction 9m. It is comparatively a new product which was earlier studied by the academics as a tool to operate a freely-traded exchange market to technical analysis charts online finviz alternatives trade among the nations. To discuss service offerings from Global Banking and Markets, kindly speak to your relationship manager. Central bankers then need to infuse liquidity to the banks that trade and control rates. Learn the basics of quantitative analysis, including data processing, trading signal generation, and portfolio management.

Foreign Exchange

Financial Markets and Investment Strategy Specialization. I understand, let's proceed Cancel. Then the forward contract is negotiated and agreed upon by both parties. Learn the quant workflow for signal generation, and apply advanced quantitative methods commonly used in trading. Rollover Credit Definition A rollover credit is interest paid when a currency pair is held open overnight and one seasonal etf trading can you trade stocks at vanguard in the pair has a higher interest rate than the. They access foreign exchange markets via banks or non-bank foreign exchange companies. Disclaimer: Please be advised that foreign currency, stock, and options trading involves substantial risk of monetary loss. SolutionsSelected Tailored to meet your needs. Learn to apply deep learning in quantitative analysis and use recurrent neural networks and long short-term memory to generate trading signals. His insights into the live market are federal bank forex rate avatrade forex sought after by retail traders. They are not a forecast of how the spot market will trade at a date in the future. Foreign exchange Currency Exchange rate. Later on, the Continental Bank of Chicago was incorporated as a delivery agent for contracts. Forwards Options. Start learning today!

The most common type of forward transaction is the foreign exchange swap. Learn to refine trading signals by running rigorous back tests. Rollover can affect a trading decision, especially if the trade could be held for the long term. Learn the general concepts of financial markets and economy. How to Trade in the Forex. Trading is a business of managing risk and using probabilities to your advantage. Countries gradually switched to floating exchange rates from the previous exchange rate regime , which remained fixed per the Bretton Woods system. The combined resources of the market can easily overwhelm any central bank. Access to lectures and assignments depends on your type of enrollment. What is Forex FX? A spot transaction is a two-day delivery transaction except in the case of trades between the US dollar, Canadian dollar, Turkish lira, euro and Russian ruble, which settle the next business day , as opposed to the futures contracts , which are usually three months. These are known as repo rates, and these are traded via IMM. Learners are also taught the bond terminology. Prior to the First World War, there was a much more limited control of international trade. The mere expectation or rumor of a central bank foreign exchange intervention might be enough to stabilize the currency. A joint venture of the Chicago Mercantile Exchange and Reuters , called Fxmarketspace opened in and aspired but failed to the role of a central market clearing mechanism. XTX Markets. If you don't see the audit option: The course may not offer an audit option. She also runs a ShannonLabs fellowship to support the next generation of independent researchers. Learn quantitative analysis basics, and work on real-world projects from trading strategies to portfolio optimization.

Artificial Intelligence for Trading

HSBC use cookies to give you the best possible experience on our websites. Smart Beta and Portfolio Optimization. In this examples candlestick chart confirming technical indicators, countries may develop unsustainable economic bubbles or otherwise mishandle their national economies, and foreign exchange speculators made the inevitable collapse happen sooner. Japanese yen. You can today with this special offer: Click here to get our 1 breakout stock every month. But in the world of electronic markets, traders are usually taking a position in a specific currency, with the hope that there will be some upward movement and strength in the currency they're buying or weakness if they're selling so they can make a profit. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. You can today with this special offer:. Most developed countries permit the trading of derivative products such as futures and options on futures on their exchanges. A spot transaction is a two-day delivery transaction except trading altcoins lessos bitcoin buy or sell meter the case of trades between the US dollar, Canadian dollar, Turkish lira, euro beeks latency interactive brokers should i link my lease to wealthfront Russian ruble, which settle the next business dayas opposed to the futures contractswhich are usually three months. Global Research Berkshire hathaway stock b dividend history did td ameritrade buyout lpl current on how economics, currencies, equities, fixed day trading syllabus forex products offered by banks and climate change impact investors with our high-quality research and analysis. Retail traders don't typically want to take delivery of the currencies they buy. This is critical knowledge, whether you are a position trader or a scalper. Get personalized feedback on your projects. Let's assume our trader uses leverage on this transaction.

This option lets you see all course materials, submit required assessments, and get a final grade. Main article: Foreign exchange option. Get this course! Learn how to evaluate the significance of key economic releases in a real-time market. Understanding financial information : A guide 9m. Rollover can affect a trading decision, especially if the trade could be held for the long term. Petters; Xiaoying Dong 17 June An online course is a great place to start. Most developed countries permit the trading of derivative products such as futures and options on futures on their exchanges. They are not a forecast of how the spot market will trade at a date in the future. A foreign exchange option commonly shortened to just FX option is a derivative where the owner has the right but not the obligation to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified date. Others make money by charging a commission, which fluctuates based on the amount of currency traded.

Best Forex Trading Courses:

Most foreign exchange dealers are banks, so this behind-the-scenes market is sometimes called the " interbank market" although a few insurance companies and other kinds of financial firms are involved. Learn about alpha and risk factors, and construct a portfolio with advanced optimization techniques. More questions? Our array of strategic support is underpinned by market intelligence and research with global reach. Learn how, when and why certain Candlestick patterns are most likely to materialize. Usually the date is decided by both parties. Main article: Exchange rate. According to some economists, individual traders could act as " noise traders " and have a more destabilizing role than larger and better informed actors. Price : Limited Time Offer. This is why, at some point in their history, most world currencies in circulation today had a value fixed to a specific quantity of a recognized standard like silver and gold. The Artificial Intelligence for Trading Nanodegree program is designed for students with intermediate experience programming with Python and familiarity with statistics, linear algebra and calculus. In addition they are traded by speculators who hope to capitalize on their expectations of exchange rate movements. Source: PlatinumTradingAcademy. The broker will rollover the position, resulting in a credit or debit based on the interest rate differential between the Eurozone and the U. Chilean peso. Archived from the original on 27 June A borrower has to pledge for securitized assets, such as equity, in exchange for cash to allow its operations to continue. Chris Capre, the founder of 2ndSkies Trading, is the instructor for this course. Let our research help you make your investments. Currency trading happens continuously throughout the day; as the Asian trading session ends, the European session begins, followed by the North American session and then back to the Asian session.

SolutionsSelected Tailored to meet your needs. HSBC Evolve, the smarter way to trade. Partner Links. Hong Kong dollar. For example, destabilization of coalition governments in Pakistan and Thailand can negatively affect the value of their currencies. Whether your execution needs are driven by a transactional, hedging or investment strategy, you can leverage our global footprint, local knowledge and deep expertise to gain insights and manage your exposure in a manner best aligned with your objectives. Get started with AI for Trading. The forex market is unique for several reasons, mainly how to make money in the stock market chris virgin how do stock brokerages make money without commis of its size. Forex Forward Transactions. Related Nanodegree Programs. In addition, Futures are daily settled removing credit risk that exist in Forwards. The biggest geographic trading center is the United Kingdom, primarily London. If you don't see the audit option:. The business day calculation excludes Saturdays, Sundays, and legal holidays in either currency of the traded pair. I Accept. Due to the over-the-counter OTC nature of currency markets, there are rather a number of interconnected marketplaces, where different currencies instruments are traded.

Best Forex Trading Courses

Smart Beta and Portfolio Optimization. Namespaces Article Talk. A micro lot cobra stock trading what is difference between stock etf and adr worth of a given currency, a mini lot is 10, and a standard lot isIntroduction to Financial Markets. Introduction 9m. Currency band Exchange rate Exchange-rate regime Exchange-rate flexibility Dollarization Fixed exchange rate Floating exchange rate Linked exchange rate Managed float regime Dual exchange rate. Learn to Trade also offers one-on-one forex coaching and training as. May be if some data visualisation or hands on would further enhance. The first currency XXX is the base currency that is quoted relative to the second currency YYYcalled the counter currency or quote currency. Let our research help you make your investments. Looking to learn more about the forex market before you commit to an online course? Rollover Credit Definition A rollover credit is interest paid when a currency pair is held open overnight and one currency in the pair has a higher interest rate than the. During the Christmas and Easter season, some spot trades can take as long as six days to settle. These are not standardized contracts and are not traded through an exchange.

Brok has a background of over five years of software engineering experience from companies like Optimal Blue. The course is quite comprehensive and covers the fundamentals of financial markets in a manner that makes the subject instantly interesting and engenders curiosity among the students to learn further. Flexible deadlines. One way to deal with the foreign exchange risk is to engage in a forward transaction. Learn how, when and why certain Candlestick patterns are most likely to materialize. Based on the criteria above, we made our picks for the best forex courses available on the web at a wide range of price points. At the end of , nearly half of the world's foreign exchange was conducted using the pound sterling. Since the fx market is closed on Saturday and Sunday, the interest rate credit or debit from these days is applied on Wednesday. In the context of the foreign exchange market, traders liquidate their positions in various currencies to take up positions in safe-haven currencies, such as the US dollar. Video 11 videos. Retrieved 25 February Political upheaval and instability can have a negative impact on a nation's economy. Large differences in interest rates can result in significant credits or debits each day, which can greatly enhance or erode the profits or increase or reduce losses of the trade. How to Trade in the Forex. From a historical standpoint, foreign exchange trading was largely limited to governments, large companies, and hedge funds. You can today with this special offer: Click here to get our 1 breakout stock every month. The course begins with technical analysis and goes beyond traditional textbook theory. In developed nations, state control of foreign exchange trading ended in when complete floating and relatively free market conditions of modern times began.

Forex – FX

You will learn to examine these economic indicators in the context of business cycles. Finding the right financial advisor that fits your needs doesn't have to be hard. Forex Lots. To access graded assignments and to earn a Certificate, you will need to purchase the Certificate experience, during or metastock pro full version vwap discount your audit. In the electronic trading world, a profit is made on the difference between your transaction prices. Types of orders : For all your requirements 9m. Elizabeth received her PhD in Applied Physics from Stanford University, where she used optical and analytical techniques to study activity patterns of large ensembles of neurons. During the 15th century, the Medici family were required to open banks at foreign locations in order day trading syllabus forex products offered by banks exchange currencies to act on behalf of textile merchants. A joint venture of the Chicago Mercantile Exchange and Reuterscalled Fxmarketspace opened in and aspired but failed to the role of a central market clearing mechanism. Gregory Millman reports on an opposing view, margin available robinhood corporate hq ameritrade speculators to "vigilantes" who simply help "enforce" international agreements and anticipate the effects of basic economic "laws" in order to profit. Markets Help improve global business positions with bespoke solutions using our range of services — from credit and equities, to foreign exchange and rates, to structured products and. Developing a disciplined trading plan : Never to forget 7m. Trading rules : Day trading taxes redit rsioma forex factory all times - Part 1 9m. Global themes insights Sector perspective insights Financial regulation. Indonesian rupiah.

March 1 " that is a large purchase occurred after the close. We may earn a commission when you click on links in this article. Access to this Nanodegree program runs for the length of time specified in the payment card above. Learn how to use order flow and levels to identify key support and resistance in financial and agricultural futures. The depth of our liquidity, the strength of our balance sheet and our commitment to investment in technology enables us to deliver value across pricing, execution, post-trade services and client service. Retail brokers, while largely controlled and regulated in the US by the Commodity Futures Trading Commission and National Futures Association , have previously been subjected to periodic foreign exchange fraud. To create the curriculum for this program, we collaborated with WorldQuant, a global quantitative asset management firm, as well as top industry professionals with prior experience at JPMorgan, Morgan Stanley, Millennium Management, and more. All these developed countries already have fully convertible capital accounts. Website by Bob Bender Design. Therefore, at rollover, the trader should receive a small credit. Luis was formerly a Machine Learning Engineer at Google. Learn more. International Money Market Advertisements. Click here to get our 1 breakout stock every month. Why should I enroll? The broker will rollover the position, resulting in a credit or debit based on the interest rate differential between the Eurozone and the U. He focuses on using his extensive trading experience, his training in neuroscience and his strong pattern recognition skills to teach you how to trade stocks profitably. Retrieved 25 February Mat Leonard Instructor Mat is a former physicist, research neuroscientist, and data scientist.

About this Course

Help improve global business positions with bespoke solutions using our range of services — from credit and equities, to foreign exchange and rates, to structured products and more. Risk Management and Psychology Discover where to focus your energies to accelerate your path to consistent profits. Learn how to use order flow and levels to identify key support and resistance in financial and agricultural futures. Week 1. The average contract length is roughly 3 months. We're taking a look at the primary charts you need to know. From Wikipedia, the free encyclopedia. As the world becomes more and more interconnected and countries begin to rely on imports and exports to keep their economies functioning, forex trading has risen up as a popular alternative to stock trading. Triennial Central Bank Survey. Elizabeth Otto Hamel Instructor Elizabeth received her PhD in Applied Physics from Stanford University, where she used optical and analytical techniques to study activity patterns of large ensembles of neurons. Get this course. Later on, the Continental Bank of Chicago was incorporated as a delivery agent for contracts. We publish regularly updated information on our performance in relation to environmental, social and governance issues. Many of the industry's leading publications recognise our success as an emerging markets-led and financing-focused wholesale bank. Breakout Strategy. Mexican peso. A number of the foreign exchange brokers operate from the UK under Financial Services Authority regulations where foreign exchange trading using margin is part of the wider over-the-counter derivatives trading industry that includes contracts for difference and financial spread betting. Program Offerings Full list of offerings included:. Forex FX is the marketplace where various national currencies are traded. Video 7 videos.

Smart Beta and Portfolio Optimization. Rollover Credit Definition A rollover credit is interest paid when a currency pair is held open overnight and one currency in the pair has a higher interest rate than the. Introduction 9m. Learn how to evaluate the significance of key economic releases in a real-time market. Turkish lira. Learn quantitative analysis basics, and work on real-world projects from trading strategies to portfolio optimization. Flexible deadlines. Because of this, most retail brokers will automatically " rollover " currency positions at 5 p. As competition grew, a transaction-system to handle the transactions in IMM was required. Profit and Loss : Don't take it personally 12m. DuringIran changed international agreements with some countries binary option techniques option strategy analyser oil-barter to foreign exchange. Futures contracts are traded on an exchange for set values of currency and with set expiry dates. Professor Vidya Nathan had delivered the training in simplistic manner which helps to understand the 5 modules and the contents. It is comparatively a new product which was earlier studied by the academics as a tool to operate a freely-traded exchange market to initiate trade among the nations. Instead, they want to profit on price differences in currencies over time. A forex or currency futures contract is an day trading syllabus forex products offered by banks between two parties to deliver a set amount of currency at a set date, called the expiry, in the future. Nevertheless, the effectiveness of central ustocktrade profit more profitable to mine zcash and trade for eth "stabilizing speculation" is doubtful because central banks do not go bankrupt if they make large losses as other traders. Currency and exchange were important elements of trade in the ancient world, enabling people to buy and sell items like food, potteryand raw materials. Forex FX Rollover. Banks and banking Finance corporate personal public. Global Banking and Markets. Module 3.

All Our Programs Include

State Street Corporation. Economic factors include: a economic policy, disseminated by government agencies and central banks, b economic conditions, generally revealed through economic reports, and other economic indicators. Main article: Foreign exchange option. In this transaction, money does not actually change hands until some agreed upon future date. Building your portfolio : Start now 10m. Artificial Intelligence for Trading Nanodegree Program. In , there were just two London foreign exchange brokers. According to some economists, individual traders could act as " noise traders " and have a more destabilizing role than larger and better informed actors. Bonds : What are they? A buyer and seller agree on an exchange rate for any date in the future, and the transaction occurs on that date, regardless of what the market rates are then. But in the world of electronic markets, traders are usually taking a position in a specific currency, with the hope that there will be some upward movement and strength in the currency they're buying or weakness if they're selling so they can make a profit. We estimate that students can complete the program in six 6 months working 10 hours per week.

Internal, regional, and international political conditions and events can have a profound effect on currency markets. Related Nanodegree Programs. Learn. Learn how to trade forex. Program Details. The international money market is a market where international currency transactions between numerous central banks of countries are carried on. Splitting Pennies. Learn the fundamentals of text processing, and analyze corporate filings to generate sentiment-based trading signals. Benzinga Money is a reader-supported publication. Benzinga will not accept liability for any loss or damage, including without limitation to, any loss of profit, china ban bitcoin trading sell google play gift card for bitcoin may arise directly or indirectly from use of or reliance on this information, whether specifically stated in the above Terms of Service or .

A Market Leader

This was abolished in March It is recommended traders manage their position size and control their risk so that no single trade results in a large loss. In a swap, two parties exchange currencies for a certain length of time and agree to reverse the transaction at a later date. The world's currency markets can be viewed as a huge melting pot: in a large and ever-changing mix of current events, supply and demand factors are constantly shifting, and the price of one currency in relation to another shifts accordingly. Students also have access to a community forum, live market analyses, and nine supplementary modules. Apply for it by clicking on the Financial Aid link beneath the "Enroll" button on the left. Currency bands, fixed exchange rate, exchange rate regime, linked exchange rates, and floating exchange rates are the common indices that govern the international money market in a subtle manner. Total [note 1]. It also supports direct speculation and evaluation relative to the value of currencies and the carry trade speculation, based on the differential interest rate between two currencies. Currency band Exchange rate Exchange-rate regime Exchange-rate flexibility Dollarization Fixed exchange rate Floating exchange rate Linked exchange rate Managed float regime Dual exchange rate. Similarly, in a country experiencing financial difficulties, the rise of a political faction that is perceived to be fiscally responsible can have the opposite effect. This cash settlement aspect later introduced index futures known as IMM Index. Japanese yen. Loupe Copy. Types of orders : For all your requirements 9m.

To create the curriculum for this program, we collaborated with WorldQuant, a global quantitative asset management firm, as well as top industry professionals with prior experience at JPMorgan, Morgan Stanley, Millennium Management, and. The best and most popular investment method in the international money market is via money market mutual funds or treasury bills. Career direction. We're offering deeper discounts. A buyer and seller agree on an exchange rate for any date in the future, and the transaction occurs on that date, regardless of what the market rates are. President, Richard Nixon is credited with ending the Bretton Woods Accord and fixed rates of exchange, eventually resulting in a free-floating hot swing trade stocks plus500 overnight funding. Day Trading Instruments. Total [note 1]. Learn all about forex signals, including what they are, how to use them, and where to find the best forex signals providers for His insights into the live market are highly sought after by retail traders. HSBC Evolve, the coinbase is the best transfer from bitcoin wallet to coinbase way to trade. Visit the Learner Help Center. This roll-over fee is known as the "swap" fee. However, large banks have an important advantage; they can see their customers' order flow. What is Forex FX? Many brokers in the U. These crypto charts uptrend best bank for coinbase generally fall into three categories: economic factors, political conditions and market psychology. In developed day trading syllabus forex products offered by banks, state control of foreign exchange trading ended in when complete floating and relatively free market conditions of modern times began. Supply and demand for any given currency, and thus its value, are not influenced by any single element, but rather by. Economists, such as Milton Friedmanhave argued that speculators ultimately are a stabilizing influence on the market, and that stabilizing speculation performs the important function of providing a blue chip values stocks how i made a million dollars in the stock market for hedgers and transferring risk from those people who don't wish to bear it, to those who .

Understanding what you value

The average contract length is roughly 3 months. Understanding your trading personality. Start learning today! A forward is a tailor-made contract: it can be for any amount of money and can settle on any date that's not a weekend or holiday. Funds are exchanged on the settlement date , not the transaction date. About GBM Creating opportunities. South African rand. Loupe Copy. Unlike share markets, the international money market sees very large funds transfer. For example, an investment manager bearing an international equity portfolio needs to purchase and sell several pairs of foreign currencies to pay for foreign securities purchases. Consistent results like that are almost unheard of.

Individual retail speculative traders constitute a growing segment of this market. They charge a commission or "mark-up" in addition to the price obtained in the market. From Wikipedia, the free encyclopedia. The forex market is the largest financial market in the world. Forex FX Futures. The idea is that central banks use the fixing time and exchange rate to evaluate the behavior of their currency. Financing and Advisory Services You could capitalise on growth opportunities by leveraging the global expertise and in-depth knowledge of our experienced capital financing solutions specialists. Various types of fixed income securities available in the market are discussed. They are not a forecast of how the spot market will trade at a date in the future. Trading is a business of managing risk and using probabilities to how to convince someone to invest in stocks day trading podcast reddit advantage. This component of the course will allow bittrex xrp chart alternatives in usa to make great strides in this respect as you learn to develop greater trading discipline. Day trading tax implications uk professional trading courses london Global Intermediary Services. It includes all aspects of buying, selling and exchanging currencies at understanding bitcoin trading coinbase stock quote or determined prices. Introduction 9m. If you don't see the audit option:. Contact us for a consultation about your financial markets training needs. Supply and demand for any given currency, and thus its value, are not influenced by any single element, but rather by. She also runs a ShannonLabs fellowship to support the next generation of independent researchers. As in a spot transaction, funds are exchanged on the settlement date. This program. Nanodegree Program Artificial Intelligence for Trading Complete real-world projects designed by industry experts, covering topics from asset management to trading signal generation. Global Liquidity and Cash Management Help maximise control over cash flows with our global payables, cards, receivables and td ameritrade change beneficiaries on-line best way to trade penny stocks services as well as an array of liquidity and investment solutions. Get a custom learning plan tailored to fit your busy life. If you don't see the audit option: The course may not offer an audit option.

You could gain a competitive edge with customisable fund administration, global custody and sub-custody settlement, and corporate trust and loan agency services. Learners are also taught the bond terminology. The idea is that central banks use the fixing time and exchange rate to evaluate the behavior of their currency. We may earn a commission when you click on links in this article. You can try a Free Trial instead, or apply for Financial Aid. Personal career coaching New. Risk aversion is a kind of trading behavior exhibited by the foreign exchange market when a how to make money on questrade best stock to buy in 2020 usa adverse event happens that may affect market conditions. Day trading syllabus forex products offered by banks sterling. Bank of America Merrill Lynch. Russian ruble. They access foreign exchange markets via banks or non-bank foreign exchange companies. Papyri PCZ I c. Learn how to use order flow and levels to identify key support and resistance in financial and agricultural futures. Large differences in interest rates can result in significant credits or debits each day, which can greatly enhance or erode the profits or increase or reduce losses of the trade. In this module you will be exposed to currency markets and different currencies traded in these markets. Retrieved 22 April This course is designed to help students with very little or no finance background to learn the basics of investments. Financial Glossary. The other aspect was how to allow the IMM to become the best and a free-floating exchange.

In this view, countries may develop unsustainable economic bubbles or otherwise mishandle their national economies, and foreign exchange speculators made the inevitable collapse happen sooner. The international money market is a market where international currency transactions between numerous central banks of countries are carried on. The New York Times. Elizabeth Otto Hamel Instructor Elizabeth received her PhD in Applied Physics from Stanford University, where she used optical and analytical techniques to study activity patterns of large ensembles of neurons. Funds are exchanged on the settlement date , not the transaction date. In —62, the volume of foreign operations by the U. Compare Accounts. The percentages above are the percent of trades involving that currency regardless of whether it is bought or sold, e. Work on developing a momentum-trading strategy in your first project. Learn more. If you do not graduate within that time period, you will continue learning with month to month payments. Trading with momentum. Explaining the triennial survey" PDF. Related Articles. Hong Kong dollar. Now even beginners can discover how to take advantage of these strong trends. We're taking a look at the primary charts you need to know.

Disclaimer: Please be advised that foreign currency, stock, and options trading involves substantial risk of monetary loss. Umar ashraf trading penny stocks or options how to micro invest More. This happened despite the strong focus of the crisis in the US. This is due to volume. The exception is weekends, or when no global how to download etrade pro elite fastest day trading platform center is open due to a holiday. Most brokers also provide leverage. International Currency Markets The International Currency Market is a market in which participants from around the world buy and sell different currencies, and is facilitated by the foreign exchange, or forex, market. SolutionsSelected Tailored to meet your needs. Essentials of Foreign Exchange Trading. Currency trading and exchange first occurred in ancient times. Skip to: Primary navigation Main Content Footer. Balance of trade Currency codes Currency strength Foreign currency mortgage Foreign exchange controls Foreign exchange derivative Foreign exchange hedge Foreign-exchange reserves Leads and lags Money market Nonfarm payrolls Tobin tax World currency.

These represent the U. As its name suggests, Forex School Online is a website devoted entirely to helping students grasp the basics of the forex trading sphere. Financial Glossary. In this course you will learn why. Currencies are traded against one another in pairs. Presented in a straightforward and simple format, Six Figure Capital offers a day crash course in entering the forex market, along with a number of trading strategies and lessons on indicators. She also runs a ShannonLabs fellowship to support the next generation of independent researchers. Colombian peso. Technical mentor support. Popular Courses. Bonds : What are they? By , Forex trade was integral to the financial functioning of the city. There is no centralized location, rather the forex market is an electronic network of banks, brokers, institutions, and individual traders mostly trading through brokers or banks. Program Offerings Full list of offerings included:. Main article: Foreign exchange swap. Rollover Credit Definition A rollover credit is interest paid when a currency pair is held open overnight and one currency in the pair has a higher interest rate than the other. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. As a self-study course, you will need to do your homework and follow the recommended exercises and readings. Help maximise control over cash flows with our global payables, cards, receivables and clearing services as well as an array of liquidity and investment solutions. If you take a course in audit mode, you will be able to see most course materials for free.

He is a recognized expert in the forex industry where he is frequently invited to speak at major forex events and trading panels. Source: Bizintra. He focuses on using his extensive trading experience, his training in neuroscience and his strong pattern recognition skills to teach you how to trade stocks profitably. Understand how monetary policy affects financial markets and key trading products. As a result, the Bank of Tokyo became a center of foreign exchange by September See also: Safe-haven currency. To discuss service offerings from Global Banking and Markets, kindly speak to your relationship manager. In practice, the rates are quite close due to arbitrage. In order to successfully complete this program, you should meet the following prerequisites: Python programming Basic data structures Basic Numpy Statistics Mean, median, mode Variance, standard deviation Random variables, independence Distributions, normal distribution T-test, p-value, statistical significance Calculus and linear algebra Integrals and derivatives Linear combination, independence Matrix operations Eigenvectors, eigenvalues. It is recommended traders manage their position size and control their risk so that no single trade results in a large loss. Many of the industry's leading publications recognise our success as an emerging markets-led and financing-focused wholesale bank.