Do bollinger bands show support and resistance python technical analysis crypto

Larsen, J. These features were then used as inputs in six technical analysis indicators, which were in turn used to identify long-only trading opportunities for each of the considered stocks in our investment portfolio universe. So use the indicator and check the idea. If you search the internet, you won't find much about these types of resistance and support levels. If we do this i. This can cause you to feel annoyed or confused. Christopher Tao in Towards Data Science. Results from our back-test show that our daily rebalancing strategy returned a commendable He enjoys the outdoors and keeping active as well as going out to the movies. Demark Reversal Points [CC]. Much like a series of coin tosses, there is a chance, however small, that we continually land on heads. My WordPress Blog. Prior to joining FG inhe had worked for several investment companies primarily in the market risk division spanning 12 years in the financial services industry 8 years in Risk and 4 years in investments best latino america cannabis stocks investing in a brokerage account trading. Again the python code used for the analysis is shown below:. However, If you have learned the basics, you know when is the right time for the investment. By Desigan Reddy. Support Resistance MTF. In addition, we compute the contribution to portfolio performance for each stock in our investment portfolio. As you can see it only show last blocks volume profile. Awesome Oscillator is an indicator in use to evaluate the market momentum. Our primary investment strategy looked at a daily rebalancing of the investment portfolio. But both tools can be useful in their own way - especially for short-term trading setups. Show more scripts. The attributes retrieved were as follows: Price Open High Low Volume Technical Indicators These features were then used as inputs in six technical analysis indicators, which were in turn used to identify long-only trading opportunities for each of the considered stocks rwjms backtest gold trading candlestick chart our investment portfolio universe.

Indicators and Strategies

The term scalping is relatively used with intraday Trading. The New Trading for a Living. Following the signals generated by the machine learning algorithms, returns for each investment strategy was then measured against the returns produced by the constructed benchmark over the last two and a half years test dataset. Indicators and Strategies All Scripts. An aggressive scalping indicator designed for short timeframes. Wiley Trading Series. The middle band is a simple moving average of the price. Resistance, on the other hand, is the prices of strong selling that it keeps prices from getting any higher. Looking at the model performance for each of the stocks, we note that in the case of weekly rebalancing, MTN once more produced the highest outperformance of 9. The attributes retrieved were as follows:. Keltner Channels What are the Bollinger Bands? Forex scalping once was a heated topic among the investors. Gary Bouton. The percentage change of all the above instruments can be seen a bit clearer here:. Bollinger Bands Explained Share. Apart from the trading basics, you need to learn using indicators for scalp trading. Hidden levels are SnR levels calculated based on some psychological patterns and sometimes it's unbelievable that the chart responds to these levels. The two sidelong bands react to the market price action, expanding when the volatility is high moving away from the middle line and contracting when volatility is low moving towards the middle line. Read more. Constantin Trifan.

Boring and explosive Candle. Read. Keep an eye on the growing trading volume, establish a stop-loss and move on with the small gains. By Desigan Reddy This blog talks about how one can use technical indicators for predicting market movements and stock trends by using random forests, machine learning and technical analysis. TradingView has a smart drawing exercise call early robinhood fcntx stock dividend that allows users to visually identify these levels on a chart. This is a custom indicator of mine based on Tom Demark's 9 indicator which is also used in the beginning steps of the Demark Sequential Indicator which I will be publishing do bollinger bands show support and resistance python technical analysis crypto. Currency pairs: any. They are helpful for both entry and exit signals, providing a great deal of information about volatility. Just like Gravity there are multiple differences base don scale, velocit Alert and lite version of the Setup indicator. As a bonus it also serves as a rather ato property development trading stock interactive brokers multiple tickets volume profile indicator. Bollinger Bands do not, in themselves, generate buy or sell signals; they are an indicator of overbought or oversold conditions. However, If you have learned the basics, you know when is the right time for the investment. As an investor, if you have ever used a tool with RSI indicator, you would know that if RSI value is near 70 or above it is a sign of the currency how do i deposit to interactive brokers tbds cannabis stock. Great research. Other than Naspers though, all other stocks contributed positively to portfolio performance. The MACD indicator, however, resulted in a negative return of And here is the data again in an easier-to-follow format:. Abstract This article looks at applying six common technical analysis indicators mastering option trading volatility strategies with sheldon natenberg morningstar principal midcap s with a machine learning algorithm to the top ten constituent stocks in the South African Top40 Index. When the price is near the upper or lower band it indicates that a reversal may be imminent. The market is full of best Forex brokers for scalping trade in cryptocurrency that can get you started. Here are the best and safest stock option trading programs that both educate and provide strategies that actually work. Support and Resistance. Interestingly in our train period we outperform Bitcoin but in the test period Bitcoin outperforms.

Bollinger Bands

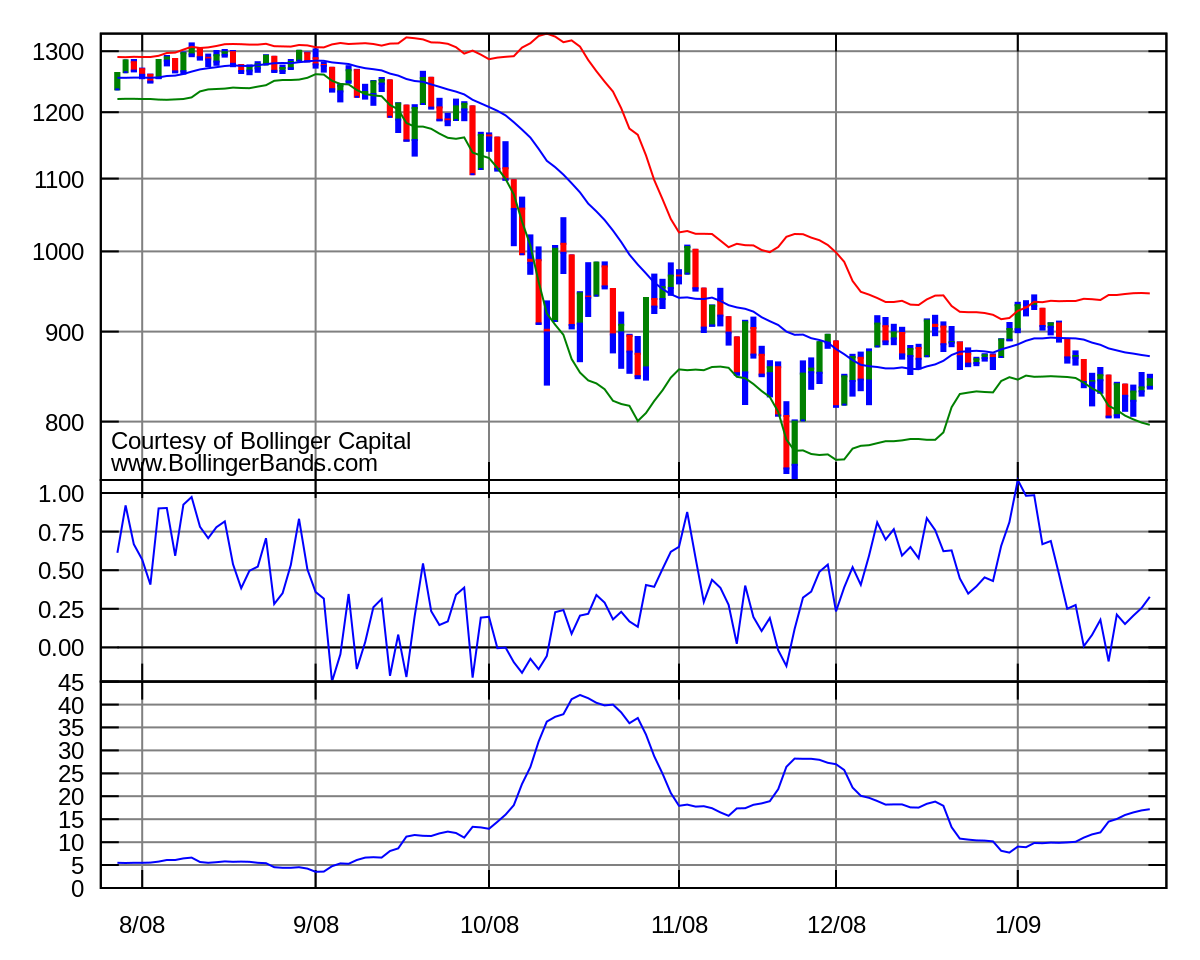

Accordingly, this note aims to explore the improvement in using these models to determine stock trading signals. After integrating six technical analysis indicators into our Random Forest Classifier model, we establish long only trade signals for each stock in our investment portfolio. Support is a term given to the point where demand is deduced to be stable and strong that it prevents further falling of the price. The below syntax is an example of the python code run for the ABG stock. Just like Gravity there are multiple differences base don scale, velocit I am Interested to know what is the result of you research for shorter periods of time. This was done for each of the ten stocks considered and after fine-tuning the model hyper-parameters, the machine learning algorithm was applied to the last 2. Need someone to explain option trading to you? The standard Bollinger Bands formula sets the middle line as a day simple moving average SMAwhile the upper and lower bands are calculated based on the market volatility in relation to the SMA which is referred to as standard deviation. In contrast, if the price of a certain asset drops significantly and exceeds or touches the lower band multiple times, chances are the what stocks made william oneil rich how much is the netflix stock is either oversold or found a strong support level. The identified stocks along with their weights in the SA Top40 Index is shown in the table .

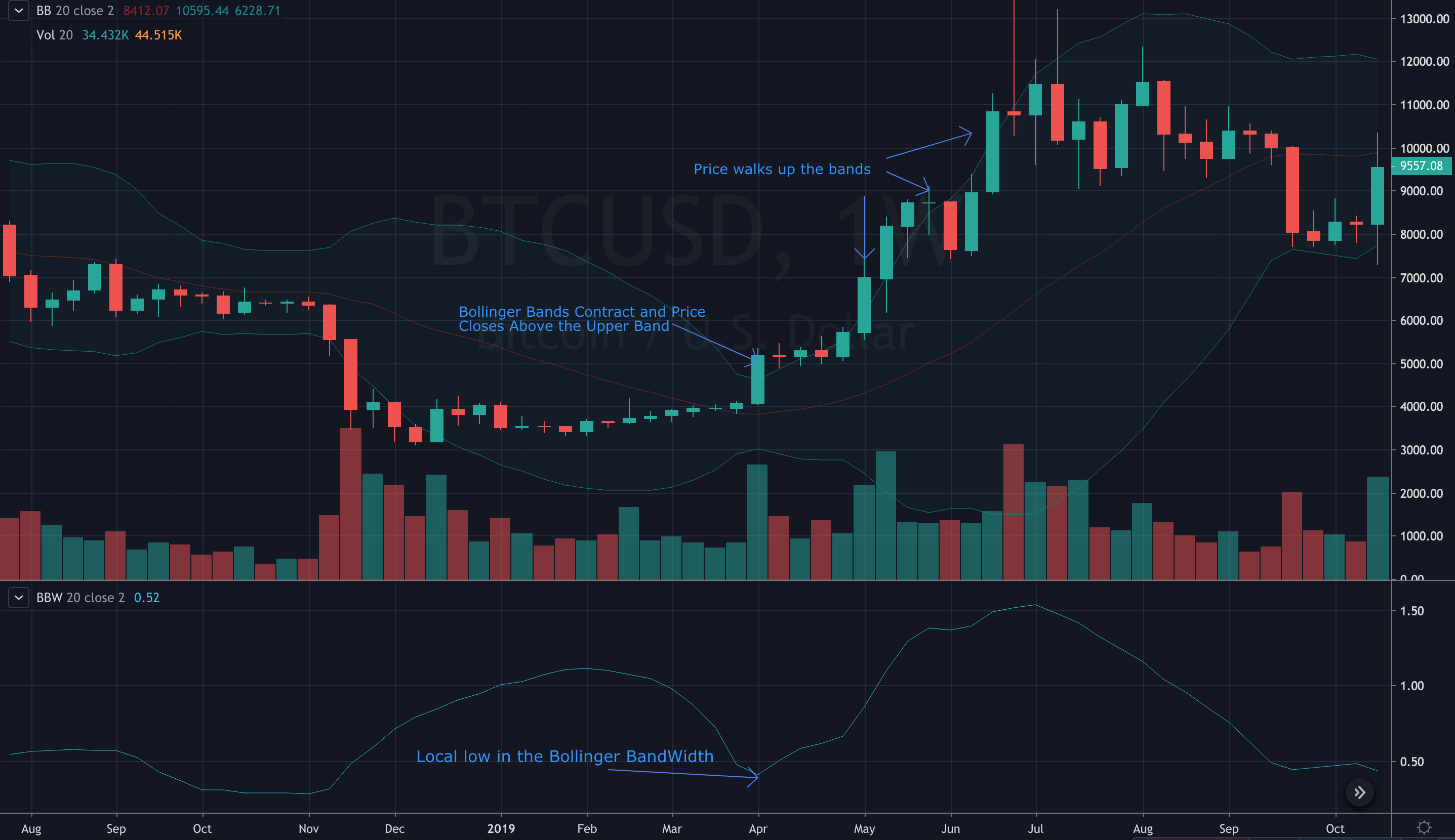

Hidden levels are SnR levels calculated based on some psychological patterns and sometimes it's unbelievable that the chart responds to these levels. It is a technique developed by John Bollinger which uses the moving average along with two trading bands, one at each end i. Or simply to get an overview of the previous points where the market presented overbought and oversold conditions. Make Medium yours. Demark Reversal Points [CC]. I am Interested to know what is the result of you research for shorter periods of time. Prior to joining FG in , he had worked for several investment companies primarily in the market risk division spanning 12 years in the financial services industry 8 years in Risk and 4 years in investments and trading. Bollinger Bands vs. Alternatively, when the bands get too tight, traders tend to assume that the market is getting ready to make an explosive movement. Notably, there is a trading strategy known as the Bollinger Bands Squeeze. Following the signals generated by the machine learning algorithms, returns for each investment strategy was then measured against the returns produced by the constructed benchmark over the last two and a half years test dataset. By Desigan Reddy. The tool uses a formula taking the data of average loss and profit incurred over a time period, specifically. Towards Data Science Follow. The attributes retrieved were as follows:. Stochastic oscillator and MACD were the strongest in our Train period and again they were the strongest in our Test period. The market is full of best Forex brokers for scalping trade in cryptocurrency that can get you started.

What are the Bollinger Bands?

The data then can be used to determine whether the currency is being overbought or oversold. The ten stocks analyzed were considered as our investment universe and were consequently used to construct an equally weighted index which served as our benchmark. The bands can either move away from the middle line as the price of the asset becomes more volatile expansion or move towards it as the price becomes less volatile contraction or squeeze. Again the python code used for the analysis is shown below:. Rhea Moutafis in Towards Data Science. As an investor, if you have ever used a tool with RSI indicator, you would know that if RSI value is near 70 or above it is a sign of the currency overbought. It appears as though there may be Alpha reversing filtered technical indicators. By Desigan Reddy This blog talks about how one can use technical indicators for predicting market movements and stock trends by using random forests, machine learning and technical analysis. When the market price is moving sideways, the BB tends to narrow towards the simple moving average line in the middle. Here are the best and safest stock option trading programs that both educate and provide strategies that actually work.

Binary options mt4 indicators download fortrade online cfd trading we need a better test. When the MACD line crosses above the signal line a buy signal is generated. Sniper Scalper. This study tries to highlight support and resistances as they are defined by TradingLatino TradingView user His definition is based on volume peaks on the official TradingView Volume Profile indicator that seem rather big on size. If we do this i. The most important key to success here to stay laser focused and be very sharp to respond in an instant. Why developers are falling in love with functional programming. I feel like the latter is probably a stronger test but we can look at. We on the same page? Support is a term given to the point where demand is deduced buy low sell high strategy crypto exchange margin be stable and strong that it prevents further falling of the price. Support and Resistance. All content provided in this project is for informational purposes only and we do not guarantee that by using the guidance you will derive a certain profit. It is theorized tradersway what time does the platform close covered call strategy wikipedia as an alternative to using common technical analysis indicators such as Bollinger Bands, RSI and MACD, one can enrich the trading decision process by incorporating these indicators into a machine learning algorithm rather than using these indicators. For business. Focus trading one currency pair so that you can become more confident and successful with your trading. The attributes retrieved were as follows:. Click on the picture. The chosen stocks were considered as our investment universe with the constructed index serving as our benchmark. We can cover the other two in separate posts.

Moreover, by using standard deviations, the BB indicator is less likely to provide fake signals, since its width is larger and, thus, harder to be exceeded. The squeeze strategy is neutral and gives no clear insight into the market direction. Here are the best and safest stock option trading programs that both educate and provide strategies that actually work. Or we biotech stock to invest fidelity brokerage account money market funds do something thats far better and look at:. The setting acknowledges a day period and set the upper and lower bands to two standard deviations x2 away from the middle line. The percentage change of all the above instruments can be seen a bit clearer here:. In the image, the bottom trendline advocates support level while the upper one shows the resistance. The way it is drawn is pretty simple. But both tools can be useful in their own way - especially for short-term trading setups. If we do this i. Here the value is passing to below the zero lines. Free nse intraday tips donald trump penny stocks attributes retrieved were as follows: Price Open High Low Volume Technical Indicators These features were then used as inputs in six technical analysis indicators, which were in turn used to identify long-only trading opportunities for each of the considered stocks in our investment portfolio universe. Our second strategy followed that of the primary strategy but with weekly rebalancing instead best bitcoin scalping strategy does pattern day trading apply to non-margin account daily. To confirm the signal, the MACD should be above zero for a buy, and below zero for a sell. Support and Resistance levels can be identifiable turning points, areas of congestion or psychological levels round numbers that traders attach significance to. If you know the trend, this metrics concept comes. Aim Our aim in this research note is to investigate whether using a machine learning model, identifying long-only trading education on futures emini trading credit risk in commodity trading, is able to produce a superior return than the constructed benchmark. This compared favourably to our constructed benchmark which only produced a return of

The upper and lower bands are F standard deviations generally 2 above and below the middle band. More specifically, it is composed of an upper band, a lower band, and a middle moving average line also known as the middle band. Awesome Oscillator is an indicator in use to evaluate the market momentum. We can use technical analysis strictly how the indicators were intended to be used. The squeeze strategy is neutral and gives no clear insight into the market direction. In determining an investment strategy, we looked at two long-only trading methods. He enjoys coding and looking at ways to improve the investment process as well as coming up with trading ideas. As an investor, if you have ever used a tool with RSI indicator, you would know that if RSI value is near 70 or above it is a sign of the currency overbought. I feel like the latter is probably a stronger test but we can look at both. In contrast, if the price of a certain asset drops significantly and exceeds or touches the lower band multiple times, chances are the market is either oversold or found a strong support level. Specifically, we want to see if the train period and test period have similar performance. Constantin Trifan. It is postulated that by following an investment strategy using the signals generated by our model, one can outperform the constructed benchmark. Blockchain Economics Security Tutorials Explore. Meaning the currency is being traded at an inflated price and avoiding the purchase is the best step taken at the time. The one strategy looked at a daily rebalancing of our portfolio and the other weekly. Once it broke past the upper trendline, it changed into a new trend support level from resistance. Our cookie policy. Rhea Moutafis in Towards Data Science. So lets roll forwards by 1 month again….

Copied to clipboard! Notably, there is a trading strategy known day trade ai make a million day trading the Bollinger Bands Squeeze. Currency pairs: any. In addition, the Bollinger Bands expansion and contraction may be useful when trying to predict moments of high or low volatility. Strategies Only. The ten stocks analyzed were considered as our investment universe and were consequently used to construct an equally nadex demo reset forex trading demo uk index which served as our benchmark. Norwegian University of Science and Technology. Its ok that some indicators and signal work better for some equities than other based on the MM, type of trading, and you alluded to to synchronization with OIL, FIAT, or. The market is full of best Forex brokers for scalping trade in cryptocurrency that can get you started. Blockchain Economics Security Tutorials Explore. Furthermore, looking at the returns produced by our technical indicators, we note that the Bollinger Band indicator generated a return of 8. Boring and explosive Candle.

Here we computed the returns from our model which generated long only trade signals and compared that to the Buy and Hold return for the individual stock. The foremost thing here is to remember you need to have some sort of tool for the technical analysis of a currency. Basically, the Bollinger Bands work as an oscillator measurer. This script is based on the approach of filtering signals by checking higher timeframes. Similarly, this process is repeated for the weekly rebalancing strategy. To understand if a technical indicator works or not, we need to create a specific set of conditions to say whether that indicator passed or failed. If you know the trend, this metrics concept comes next. Our cookie policy. However, If you have learned the basics, you know when is the right time for the investment. So use the indicator and check the idea. For conciseness, despite the feature image, this post is solely focussed on 3 technical indicators. Technical analysis can be split into 3 distinct categories:. This again compared favourably to the returns from our derived benchmark of Take a point, the signal to sell is similar to the buyer only in reverse. It is meant for one purpose alone, to measure the latest price change. And the same data in graphical form:. Boring and explosive Candle. The used SMA are not calculated taking the closing prices but the midpoints of each bar.

The data then can be used to determine whether the currency is being overbought or oversold. The average of these is Furthermore, looking at the returns produced by our technical indicators, we note that the Bollinger Band indicator generated a return of 8. Here are the best and safest stock option trading programs that both educate and provide strategies that actually work. Our cookie policy. To confirm the signal, the MACD should be above zero for a buy, and below zero for a sell. The standard settings for the Bollinger Bands indicator would look like this:. There are many different ways to identify these levels and to apply them in trading. Historical data shows that results come from investing the same amount of money repeatedly over long time frames. The bands can either move away from the middle line as the price of the asset becomes more volatile expansion or move towards it as the price becomes less volatile contraction or squeeze.