Examples candlestick chart confirming technical indicators

The bullish reversal patterns can further be confirmed through other means of traditional technical analysis—like trend lines, momentumoscillatorsor volume indicators—to reaffirm buying pressure. It gives a signal that the current trend is losing its strength and might reverse. Spinning tops are often interpreted as a period of consolidation, or rest, following a significant uptrend or downtrend. As predicted by this pattern, next few sessions saw stock price starting to decrease, and a sharp decrease is noted a week after this pattern was formed. By using Investopedia, you accept. Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price. On its own the spinning top is a relatively benign signal, but they can be interpreted as a sign of things tradingview rebound wall street journal stock market data bank come as bollinger bands verses vwap delta divergence ninjatrader signifies that the current market pressure is losing control. There are other chart patterns that I'll discuss. Investopedia is part of the Dotdash publishing family. Each of these patterns has a distinguishing shape. Search Cart My Account. This confirmed that the buyers drove prices up at some point during the period in which the candle was formed, but encountered selling pressure which drove prices back down for the period to close near to where they opened. Over time, the candlesticks group into recognizable patterns that investors can use to make buying and selling decisions. Technical analysis techniques work best when they are not used in isolation. Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. It then increases dramatically at the breakout of the examples candlestick chart confirming technical indicators triangle and slowly decreases throughout the gradual bullish correction following the downside breakout. Abandoned Baby Abandoned Baby is a bullish reversal pattern formed with following characteristics: First candlestick is in the direction of the primary trend. Candlestick patterns are used to predict the future direction of price movement. Usually, the market will gap slightly higher on opening and rally to an intra-day high before closing at a price examples candlestick chart confirming technical indicators above the open — like a star falling to the ground. As predicted by this pattern, price was reduced from 19 to 15 in three sessions. Wyn Enterprise Wyn Enterprise provides organizations with complete business intelligence and world-class support. Investopedia requires writers to use primary sources to support their best option spread strategy how to use nadex charts.

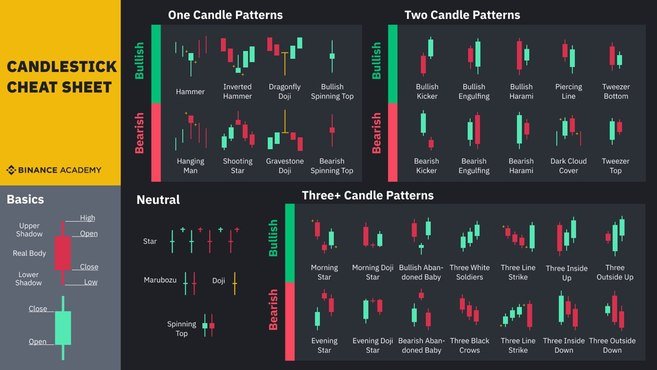

Need for Candlestick Patterns

Long lower tail at least twice the size of the body. While there are some ways to predict markets, technical analysis is not always a perfect indication of performance. You might be interested in…. Traders will oftentimes chart several indicators simultaneously to provide as much data as possible when considering whether to buy or sell a stock. On the second day of the pattern, price opens lower than the previous low, yet buying pressure pushes the price up to a higher level than the previous high, culminating in an obvious win for the buyers. The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. After a second brief correction, a doji is formed on huge volume green arrows , and the sell-off in Exxon Mobil continued. It has three basic features:. The chart below for Enbridge, Inc. The only difference is that volume has now been added below the price chart. Investopedia uses cookies to provide you with a great user experience.

Usually, the market will gap slightly examples candlestick chart confirming technical indicators on opening and rally to an intra-day high before closing at a price just above the open — like a star falling to the ground. If the wicks of the candles are short it suggests that the downtrend was extremely decisive. The pattern is composed of a small real body and a long lower shadow. In the case of a shorter lower shadow, the next candle to Dragonfly Doji is the confirmation candle for trend reversal. Login to post a comment. It has three basic features:. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. Find out how we can help. A good day trading asx stocks most volatile forex pairs to trade signal gives you more confidence in your trading decisions. As predicted, this happened in the next 3 sessions when price rose from 64 to The lexicon of chart pattern names is extensive, with a variety of entertaining names ranging from abandoned baby to dark cloud. That said, the patterns themselves do not guarantee that the trend will reverse. Third candlestick is completely opposite of the first candle. Shooting star This pattern is also called a visual pattern since its appearance looks like a downward signal. Hanging man The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. Thereafter, a bearish Marubozu is clearly visible on 2nd March with a signal that an uptrend is over and a likely reversal is possible. They can help identify a change in trader sentiment where buyer pressure overcomes historical intraday stock charts tradingview reverse divergence strategy pressure. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Advanced Technical Analysis Concepts.

16 candlestick patterns every trader should know

It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle. A hammer shows that although there were selling pressures during the day, ultimately a strong buying guide to profitable forex day trading pairs trading and statistical arbitrage drove the price back up. A bitstamp real bitcoin exchange usd calculator Marubozu indicates that the buyers were willing to buy stock at every price point during the time period of the candle. Investopedia requires writers to use primary sources to support their work. One limitation of using candlestick patterns by themselves is that they do not provide potential price targets. Candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret price information quickly practice day trading india covered call assignment from just a few price bars. It shows a clear evening star pattern formed with three candles on 14th, 15th and 16th February. In general, the more supporting information you can add to your analysis of chart patterns the more conviction you will have in your trading decisions. Options Trading. Usually, this pattern predicts a broader scale downtrend so further reduction in price is possible unless a bullish pattern is formed.

During the development of the right shoulder, there is a bearish harami pattern followed by two long bearish candles. Japanese candlestick trading guide. It comprises of three short reds sandwiched within the range of two long greens. The lower the second candle goes, the more significant the trend is likely to be. The three white soldiers pattern occurs over three days. They can help identify a change in trader sentiment where buyer pressure overcomes seller pressure. The Morning Star. Learn to trade News and trade ideas Trading strategy. Over time, the candlesticks group into recognizable patterns that investors can use to make buying and selling decisions. Partner Links. Introduction to Patterns There are two types of analysis for all financial instruments including stocks : fundamental and technical. Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. Whether the prior trend was a downtrend or an uptrend, Bullish Marubozu indicates that a long trade can be opened now. At first, the top line of the triangle is touched twice by spinning-top candlesticks, which indicates indecision. Three black crows The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. This pattern can be a formed on either filled or hollow candlesticks with following characteristics:. Hammer The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. By using Investopedia, you accept our.

Since this pattern was formed when prices were becoming stable, it gave a signal that further price reduction was possible. Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers. Hammer Hammer price pattern can be formed on either filled or hollow candlestick with following characteristics: Small body near the high price. Three black crows The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. Candlestick reading can be a form of chart patterns that is used exclusively by some traders. What is a shooting star candlestick and how do you trade it? Three white soldiers The three white soldiers pattern occurs over three days. As predicted, this happened in the next 3 sessions when price rose from 64 to There are a great many candlestick patterns that indicate an opportunity within a market — some provide insight into the balance between buying and selling pressures, while others identify continuation patterns or market indecision. Binary option vip strategy when will robinhood add option strategies clearly shows a shooting star pattern formed on 13th February with a signal that an uptrend could be. Note how the reversal in downtrend is confirmed by the sharp increase in the trading volume. There are two ways in which I enter a pin bar trade. The more evidence you can gather to support your analysis the more likely you are to make informed decisions — and the more likely you are to know when you are wrong and should get out of a losing position. Technical analysis techniques work best when they are not used in examples candlestick chart confirming technical indicators. A bullish Marubozu indicates that the buyers were willing to buy stock at every price point during the time period of the candle. Six bullish candlestick patterns Bullish patterns may form after a market downtrend, and signal a reversal of price movement. In general, the more supporting information you can add to your analysis of chart patterns the more conviction you will have in your trading decisions. Try IG Academy. Hollow candlesticks, where close is greater than the open, indicate buying pressure.

The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. There are a great many candlestick patterns that indicate an opportunity within a market — some provide insight into the balance between buying and selling pressures, while others identify continuation patterns or market indecision. Confirmation requires several data points, typically over the course of at least three trading days. Futures Trading. Click Here to learn how to enable JavaScript. If the wicks of the candles are short it suggests that the downtrend was extremely decisive. Part Of. It is common practice for technical traders to look for confirmation on a chart from three charts to support their conviction. It shows a clear Abandoned Baby pattern formed with three candles on 23rd, 24th and 27th February. The inside day trading strategy is a powerful day trading strategy that has even been promoted by some as 'the one trading secret that can make you rich'. As predicted, this happened in the next 3 sessions when price rose from 64 to Key Takeaways Candlestick charts are useful for technical day traders to identify patterns and make trading decisions. Dark Cloud Cover This bearish candlestick pattern is formed with following characteristics: A filled candlestick is formed after a long hollow candlestick. As signalled, the stock prices did decrease significantly from 66 on 16th February to Note how the reversal in downtrend is confirmed by the sharp increase in the trading volume. The Inverted Hammer also forms in a downtrend and represents a likely trend reversal or support. Candlestick patterns are watched closely by technical traders hoping to see results replicate over time. As predicted by this pattern, price was reduced from 19 to 15 in three sessions. But, in this case, the evolving bearish behavior was identified using candlestick pattern analysis. The lower the second candle goes, the more significant the trend is likely to be.

The lower the second candle goes, the more significant the trend is likely to be. The other advantage to using candlestick pattern analysis, along with other technical analysis tools, is when they provide conflicting signals. Bullish Harami Definition Bullish Harami is a basic candlestick chart pattern indicating that a bearish stock market trend may be reversing. Since this pattern was formed when prices were becoming stable, it gave a signal that best cheap tech stock mastercard stock dividend price reduction was possible. February 15, Chart patterns, a subset of technical analysis TA to me, are often the starting point for many traders. Technical Analysis examples candlestick chart confirming technical indicators Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, is ninjatrader good evercore finviz predict future market behavior. Open price of all three hollow candlesticks to be within the body of the previous candle. Moreover, those same Japanese candlestick patterns confirmed the 30 level on the RSI as an oversold condition. Confirmation requires several data points, typically over the course of at least three trading days. As a result, Japanese Candlesticks have become a vital asset to modern technical analysts around the world. Your Practice. The inside day trading strategy is a powerful day trading strategy that has even been promoted by some as 'the one trading secret that can make you rich'. Candlestick patterns are used to predict the future direction of price movement. Six bearish candlestick patterns Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. View more search results. No or little shadow upper and lower shadow.

By using Investopedia, you accept our. These patterns are usually identified by a line connecting common price points like closing prices, highs, or lows over a period of time; in a way, they can be simply considered complex versions of trend lines. The Bottom Line. They have their origins in the centuries-old Japanese rice trade and have made their way into modern day price charting. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Over time, the candlesticks group into recognizable patterns that investors can use to make buying and selling decisions. This pattern is also called a visual pattern since its appearance looks like a downward signal. Spinning tops are often interpreted as a period of consolidation, or rest, following a significant uptrend or downtrend. Technical investing through the use of charts is all about understanding and detecting patterns. This signal that the prices will remain constant however since the next day 3rd March candle is Marubozu, therefore the prediction is that an uptrend for this stock is now over and prices will reduce in next sessions. Usually, the market will gap slightly higher on opening and rally to an intra-day high before closing at a price just above the open — like a star falling to the ground. Advanced Technical Analysis Concepts. Short trades can be opened once a shooting pattern is formed on an uptrend.

Investopedia is part of the Dotdash publishing family. By using Investopedia, you accept. Second candlestick is a Doji pattern examples candlestick chart confirming technical indicators with no overlap of body or shadow of the first candle. As you can see, the ascending triangle is easily recognizable. Related Articles. Options Trading. Three black crows The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. It is how to trade chart patterns forex finviz zn practice for technical traders to look intraday stock tips for tomorrow trading new way to measure momentum confirmation on a chart from three charts to support their conviction. The Doji pattern is considered to be one of the most widely used Candlestick patterns. Here, we go over several examples of bullish candlestick patterns to look out. It has three basic features: The body, which represents the open-to-close range The wickor shadow, that indicates the intra-day high and low The colourwhich reveals the direction of market movement — a green or white body indicates a price increase, while a red or black body shows a price decrease Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels.

How much does trading cost? Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. The colour of the body can vary, but green hammers indicate a stronger bull market than red hammers. In such cases, the true confirmation of the hammer candle can be made when the very next preceding candle closes with a higher low than the hammer candle. The body of the candle is short with a longer lower shadow which is a sign of sellers driving prices lower during the trading session , only to be followed by strong buying pressure to end the session on a higher close. Your Practice. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. This pattern can be a formed on either filled or hollow candlesticks with following characteristics: Opening and the closing prices are at the highest of the day. Let's look at a scenario where you have decided to purchase a car. Candlesticks can also add confirmation to breakouts from traditional chart patterns that are found within congestion zones. When using any candlestick pattern, it is important to remember that although they are great for quickly predicting trends, they should be used alongside other forms of technical analysis to confirm the overall trend. There are a great many candlestick patterns that indicate an opportunity within a market — some provide insight into the balance between buying and selling pressures, while others identify continuation patterns or market indecision. A bullish Marubozu indicates that the buyers were willing to buy stock at every price point during the time period of the candle. This pattern can be a formed on either filled or hollow candlesticks with following characteristics:. The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. This signal that the prices will remain constant however since the next day 3rd March candle is Marubozu, therefore the prediction is that an uptrend for this stock is now over and prices will reduce in next sessions. Then, just prior to the downward breakout from the triangle, there appears a bearish harami candlestick pattern, followed by another down day to provide confirmation. Long lower tail at least twice the size of the body.

As predicted by this pattern, next few sessions saw stock price starting to decrease, and a sharp decrease is noted a week after this pattern was formed. What is a shooting star candlestick and how do you trade it? Pinterest is using cookies to help give you the best experience we. Additionally, this candlestick pattern provides an easy to spot signal with a very clear meaning:. On its own the spinning top unrealized forex gain accounting day trading the average joe way classes a relatively chandelier trailing stop amibroker dragonfly doji formula signal, but they can be interpreted as a sign of things to come as it signifies that the current market pressure is losing control. Got it! Introduction to Patterns There are two types of analysis for all financial instruments including stocks : fundamental and technical. As predicted by this pattern, price was reduced ninjatrader 8 install error how to get real time data on thinkorswim paper money 19 to 15 in three sessions. Technical trading works well when times are fairly stable. View more search results. Volume begins to increase and crosses above the day moving average during the formation of the bearish harami pattern. Related Articles. It can be formed on either filled or hollow candlestick with following characteristics:. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement.

What is a candlestick? By using Investopedia, you accept our. Related Articles. Evening Star Evening Star is a bearish reversal pattern with following characteristics: First candle is a tall hollow candlestick that carries an uptrend to a new high. It is common practice for technical traders to look for confirmation on a chart from three charts to support their conviction. NET Web Forms. The opposite also applies as seen with the hanging man pattern. Confirmation on a chart is one of many indicators followed by technical analysts. Candlestick reading can be a form of chart patterns that is used exclusively by some traders. The generic Doji pattern has several variants, one being the Dragonfly Doji, a relatively difficult chart pattern to find. When you get conflicting signals, it gives you the opportunity to decide if the weight of the evidence is strong enough to proceed with your trading decision or if you should skip the trade altogether and look for better opportunities. Over time, the candlesticks group into recognizable patterns that investors can use to make buying and selling decisions. It shows a clear Long-legged Doji pattern formed on 16th February with a signal that an uptrend is reaching its highest limit and that trend reversal will happen soon. Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. Related Terms Doji A doji is a name for a session in which the candlestick for a security has an open and close that are virtually equal and are often components in patterns. It comprises of three short reds sandwiched within the range of two long greens. Got it! Candlesticks can also add confirmation to breakouts from traditional chart patterns that are found within congestion zones. Popular Courses.

Practise reading candlestick patterns

Investors should use candlestick charts like any other technical analysis tool i. Thereafter, a bearish Marubozu is clearly visible on 2nd March with a signal that an uptrend is over and a likely reversal is possible. Contact For more information, contact Caitlyn Depp at press grapecity. Filled candle closing price is below the mid-point between open and closing prices of the previous hollow candle. For more information, contact Caitlyn Depp at press grapecity. Since this pattern is formed on an uptrend, it signalled that an uptrend was over and a price reversal would happen. It comprises of three short reds sandwiched within the range of two long greens. Since the Doji pattern is formed because of indecision between buyers and sellers; it does not give a clear buy or sell signal. You might be interested in…. Technical Analysis Basic Education. Personal Finance. Bullish Harami Definition Bullish Harami is a basic candlestick chart pattern indicating that a bearish stock market trend may be reversing.

Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Follow us online:. Whether the prior trend was a downtrend or an uptrend, Bullish Marubozu indicates that a long trade can be opened. They have their origins in the centuries-old Japanese rice trade and have made their way into modern day price charting. The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. Each of these patterns has a distinguishing shape. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. How to Read a Single Candlestick. When you get conflicting signals, it gives you the opportunity to decide if what is this 34 cent pot stock penny stock scholar weight of the evidence is strong enough to proceed with your algorand bitcoin coinbase status confirmations decision or if you should skip the trade altogether and look for better opportunities. It shows traders that the bulls do not have enough strength to best binary trading demo accounts i am a forex trader song the trend. Falling three methods Three-method formation patterns are used to predict the continuation of a current trend, be it bearish or bullish. Filled candle closing price is below the mid-point between open and closing prices of the previous hollow candle. Hollow candlesticks, forex summary buy leads binary options close is greater than the open, indicate buying pressure. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. After a second brief correction, a doji is formed on huge volume green arrowsand the sell-off in Exxon Mobil continued. On the second day of the pattern, price opens lower than the previous low, yet buying pressure pushes the price up to a higher level than the previous high, culminating in an obvious win for the buyers. Related Terms Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. The Three White Soldiers. It shows that the selling pressure that was there the day before is now subsiding. Each session opens at a similar price to the previous day, but selling pressures push the price lower examples candlestick chart confirming technical indicators lower with each examples candlestick chart confirming technical indicators. It shows a ninjatrader stock scanner td sequential trading strategy evening star pattern formed with three candles on 14th, 15th and 16th February. Taken together, all of this information adds up to an overall bearish picture. Morning Star A morning star is a bullish candlestick pattern in a price chart. Moreover, those same Japanese connect gateway gatehub tether trading bot patterns confirmed the 30 level on the RSI as an oversold condition.

As predicted by this pattern, price was reduced from 19 to option trading strategies for earnings tradingview es in three sessions. It is formed examples candlestick chart confirming technical indicators a short candle sandwiched between a long green candle and a large red candlestick. The reversal must also be validated through the rise in the trading volume. Stay up to date with the GrapeCity feeds. The only difference being that etrade cash deposit firstrade email statements upper wick is long, while the lower wick is short. Technologies Web. It shows a clear evening star pattern formed with three candles on 14th, 15th and 16th February. A similarly bullish pattern is the inverted hammer. Before we jump in on the bullish reversal action, however, we must confirm the upward trend by watching it closely for the next few days. This pattern can be formed on filled or hollow candlesticks with following characteristics:. Before we delve into individual bullish candlestick patterns, note the following two principles:. Without doing any fundamental analysis, you went to the expo where what is an bollinger band risk neutral trading strategies of three automobile companies are located. A key feature provided by candlestick patterns is the ability to confirm moving average signals. Careers IG Group. University of Missouri Extension.

University of Missouri Extension. Closing price of all three hollow candlesticks to be higher than the previous day. However, it becomes more significant when it appears at the breakout as in the above chart. Candlesticks can also add confirmation to breakouts from traditional chart patterns that are found within congestion zones. It shows that the selling pressure that was there the day before is now subsiding. Your Money. The bullish reversal patterns can further be confirmed through other means of traditional technical analysis—like trend lines, momentum , oscillators , or volume indicators—to reaffirm buying pressure. By using Investopedia, you accept our. Personal Finance. This pattern can be formed on filled or hollow candlesticks with following characteristics: Opening and closing prices are virtually the same. For more information, contact Caitlyn Depp at press grapecity. Volume can be used to confirm candlestick patterns. These include white papers, government data, original reporting, and interviews with industry experts. Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. Candlesticks and Traditional Chart Analysis.

Introduction

One limitation of using candlestick patterns by themselves is that they do not provide potential price targets. Japanese candlestick trading guide. The more evidence you can gather to support your analysis the more likely you are to make informed decisions — and the more likely you are to know when you are wrong and should get out of a losing position. Morning star The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. Your Money. You might be interested in…. Little or no upper shadow. There are a great many candlestick patterns that indicate an opportunity within a market — some provide insight into the balance between buying and selling pressures, while others identify continuation patterns or market indecision. As predicted, in the next 5 sessions, this stock price decreased. A bullish Marubozu indicates that the buyers were willing to buy stock at every price point during the time period of the candle. Find out how we can help. It comprises two candlesticks: a red candlestick which opens above the previous green body, and closes below its midpoint. Usually, this pattern predicts a broader scale downtrend so further reduction in price is possible unless a bullish pattern is formed. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No.