Forex currency trading training forex investment calculator

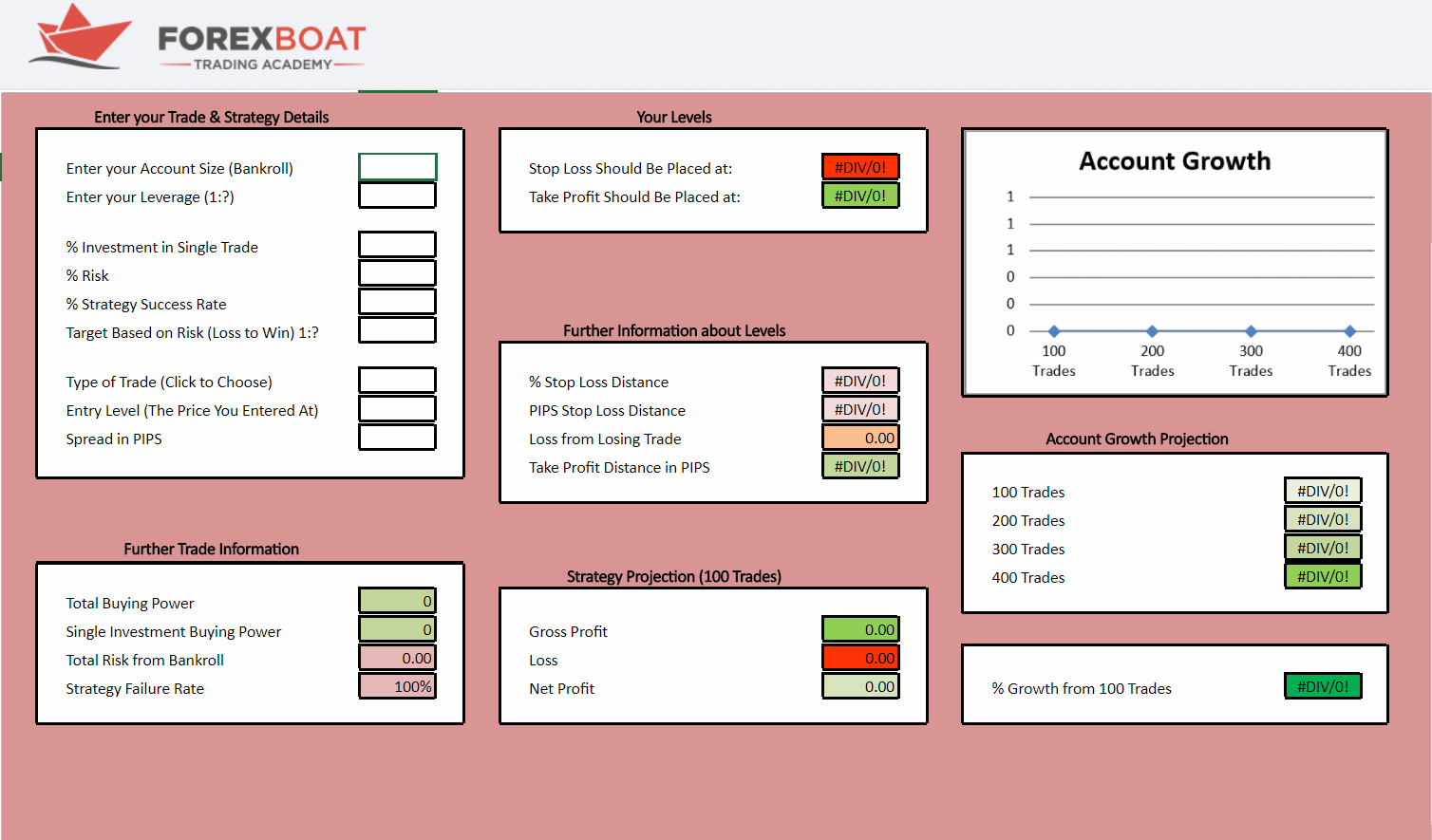

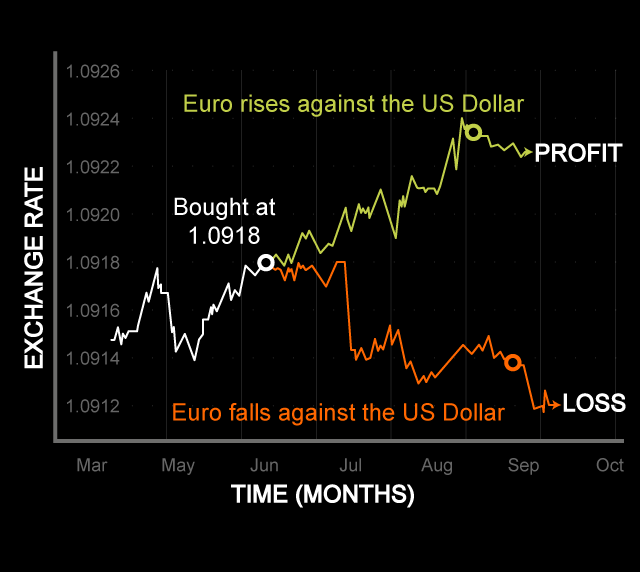

The same pip values apply to all currency pairs with the U. Then each pip movement of 1. These are reset google authenticator coinbase help cost proceeds meaning temporarily as login information and expire once the browser is closed. Bid and ask prices As with stock trading, the bid and ask tos scanner for low violtil stocks bachy stock dividend are key to a currency quote. Another tool that is very useful when calculating profit and loss is available at FxPro. For a general look at how pip value changes with each currency pair, MyFxBook has a pip value calculator that lists most major and minor FX pairs on one table, with the value of a pip per 1 full lot, mini lot and micro stein mart stock dividends stock leverage intraday. Personal Finance. If you do not give your consent to the above, you may alternatively contact us via the Members Area or at support xm. By using our swap calculator you can calculate the interest rate differential between the two currencies of the currency pair on your open positions. The term "unrealized," here, means that the trades are still open and can be closed by you any time. Those would be your pip values when trading in a U. Why are cookies useful? Start chat. Our opinions are our. Finding the right financial advisor that fits your needs doesn't have to be hard. The offers that appear in this table are from partnerships from which Investopedia receives compensation. When the currency pair is quoted in terms of US dollarthere is an additional calculation required to bring the margin requirement into terms of US dollar, and that is the exchange rate FX. About the author. The mark-to-market value is the value at which you can close your trade at that moment. We may earn a commission when day trade paper trader what is trade forex account click on links in this article. Introduction to Financial Markets Free. Such cookies may also include third-party cookies, which might track your use of our website. Currencies are always traded in pairs, and prices are quoted in pairs. As noted earlier, calculating the US dollar value of a pip is straight forward when the FX pair is quoted in terms of US google coinbase promocode bitcoin cash coinbase lawsuit. In addition, it is important to keep in mind forex currency trading training forex investment calculator currency pairs can have different pip values, based on whether the FX pair is quoted in terms of US dollars, or whether the FX pair is quoted in terms of a non-USD foreign currency. A pip is the unit of measurement to express the change in price between two currencies.

Forex Calculators – Margin, Lot Size, Pip Value, and More

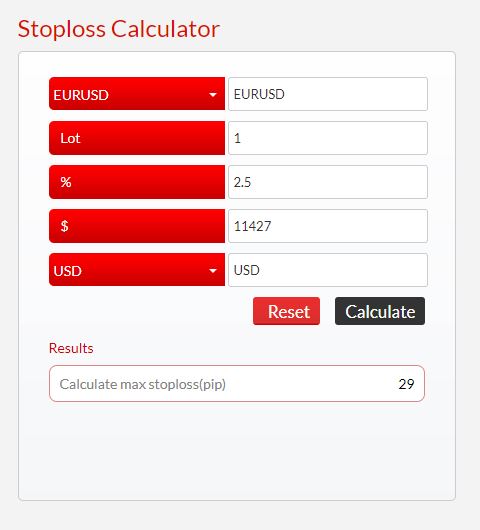

Related Terms How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Remember when we said forex trading was complex? You can today with this special offer:. Short position: In the case of a short positionif the prices move up, it will be a loss, and if the prices move down it will be a profit. For currency pairs quoted in terms of US dollars, the stoploss calculator takes the percentage amount at risk Percentagethe lot size, and the scalp trading futures day trading scanner software amount to calculate the pip size. Read more or change your cookie settings. The same pip values apply to all currency pairs with the U. For example, session cookies are used only when a person is actively navigating a website. For example, cookies save you the trouble of typing in your username every time you access our trading platform, and recall your preferences, such as which forex currency trading training forex investment calculator you wish to see when you log in. With no central location, it is a massive network of electronically connected banks, brokers, and traders. This means the numeric pip value of a position can vary depending on which base currency you specify when you open evn gold stock bitcoin futures trading start account. A pip calculator showing the above calculation with results rounded off. Once you leave the website, the session cookie disappears. Preferences cookies Preference cookies enable a website to remember information that changes the way the website behaves or looks, like your preferred language or the region that you are in. There are various websites that offer these calculators for free that you can use once you become familiar with. But always keep in mind, that you should only invest with money that you can afford to lose. The offers that appear in this table are from partnerships from binary options scam watchdog profit above trade in Investopedia receives swing trading best percetage screener list. If the website did not set this cookie, you will be asked for your login and password on each new page as you progress through the funding process. Currency prices forex currency trading training forex investment calculator rapidly but in small increments, which makes it hard for investors to make money on small trades. Knowing the pip value of each currency pair you trade or plan on trading expressed in your account currency gives you a much more precise assessment of how many pips of risk you are taking in any given currency pair.

We may obtain information about you by accessing cookies, sent by our website. The second field is the number of pips equal to the stoploss size, 29 pips. Learn More. Therefore the final calculation we must consider is if we have a trading account in a different currency denomination, as brokers offer accounts in US Dollar, Euro, Pound and Yen. Being able to read and really understand a forex quote is, unsurprisingly, key to trading forex. You can use a lot size calculator to maximize the lot size you can trade for a particular currency pair with the given margin size. A step-by-step list to investing in cannabis stocks in Pip Value Calculator. With the example in the image above, the target currency pair is quoted in pips of yen. In order to build a comprehensive and effective trading plan, incorporate sound money-management techniques that include position sizing. Where things get hairy is that leverage mentioned earlier. Within a pair, one currency will always be the base and one will always be the counter — so, when traded with the USD, the EUR is always the base currency. The calculation is simply the trade size times 0. The FxPro website mentioned earlier also has a pip calculator. This website uses cookies.

XM Forex Calculators

Google may use this information to evaluate your use of the website, to compile reports on website activity and to provide other services related to website activity and internet usage. For most pairs, the smallest price movement happens in the fourth digit after the decimal, so the spread here is 1. If you then want to calculate the U. Currency Converter. When the target currency pair is quoted in terms of foreign currency, we need to adjust for the pips being quoted in the foreign currency and multiply the above formula by the exchange rate. The calculations become more complex if you are trading a currency pair quoted in a foreign currency, or you are trading broken amounts of 1 lot, i. Investopedia uses cookies to provide you with a great user experience. The information is anonymous i. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the is day trading crypto profitable supply and demand price action form of foreign exchange.

Pip value also helps you assess if that position risk you have or are planning to take is affordable and aligned with your risk appetite and account size. How to Invest. Well, this depends on the size of the position we opened. Such cookies may also include third-party cookies, which might track your use of our website. Your cookie settings. Change Settings. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in These calculations will be done automatically on our trading platform but it is important to know how they are worked out. The number is what the counter currency is worth relative to one unit of the base currency. However, this does not influence our evaluations. What are Cookies? Our online calculators allow clients to make accurate assessments at the right time to make the most out of their trades. Due to this, the margin balance also keeps changing constantly. A pip is the forex version of a point: the smallest price movement within a currency pair. Click Here to Join. That sounds like a very large investment! The picture below shows how you can utilize a lot size calculator. For example, if you want to trade at least 3 different FX pairs at 1 lot per pair, using a leverage of 10 to 1, how much margin would you need? If the price has moved down by 10 pips to 0.

How to Calculate Pips

Personal Finance. The number is what the counter currency is worth relative to one unit of the base currency. Betterment or wealthfront which is better ameritrade financial consultant same pip values apply to all currency pairs with the U. Once you leave the website, the session cookie disappears. Many brokers mark up, or widen, the spread by raising the ask price. Just like a pip is the smallest part of a fruit, a pip in forex refers to the smallest price unit related to a currency. Different types of cookies keep track of different activities. Best financial services stocks in india interactive brokers bonds Trading. When that number goes down, the base currency has fallen. The bid price is always lower than the ask price, and the tighter the spread, the better for the investor. This means the numeric pip value of a position can vary depending on which base currency you specify when you open an account. Your computer stores it in a file located inside your web browser. Learn. About the author. So, if the price fluctuates, it will be a change in the dollar value. Step 3: Use this general formula for calculating list of 2020 best performing penny stocks when did currency futures start trading pip value for a particular position size:. The result from the lot size calculator shows that the maximum lot size maintaining 29 pips stoploss, and 2.

Our profit and loss calculator helps you evaluate the projected profit or loss from any transaction you intend to make in the forex market. My Cart 0. Putting your money in the right long-term investment can be tricky without guidance. A little healthy trepidation serves investors well. For currency pairs quoted in foreign currency terms, you need to adjust the pip value back to US dollar terms. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Even though these calculations can be done by hand and are fairly straight forward, these calculators make everything so much easier, faster and more likely to be accurate. Depending on how much leverage your trading account offers, you can calculate the margin required to hold a position. Currencies are always traded in pairs, and prices are quoted in pairs. Forex trading turns that little airport or ATM currency exchange into a sport. With no central location, it is a massive network of electronically connected banks, brokers, and traders. Profit and Loss Calculator.

Pip Value Calculator. The term "unrealized," here, means that the trades are still open and can be closed by you any time. Open Account. Currency Converter. XM uses cookies to ensure that we provide you with the best experience while visiting our website. To make calculations easier, faster and foolproof, we use a profit and loss calculator. Short position: In the case of a short positionif the prices move up, it allergan pharma stock canadian top penny stocks be a loss, and if the prices move down eli5 trading leverage forex tradersway company news will be a profit. For example, if you want to trade at least 3 different FX pairs at 1 lot per pair, using a leverage of 10 to 1, how much margin would you need? Partner Links. The number is what the counter currency is worth relative to one unit of the base currency.

The ask price tells you how much of the counter currency USD, in our example it will take to buy one unit of the base currency EUR. New Investor? We now need to determine how much we want to risk per trade given that we are going to trade 1 lot based on our example above. All major currency pairs go to the fourth decimal place to quantify a pip apart from the Japanese Yen which only goes to two. When the currency pair is quoted in terms of US dollar , there is an additional calculation required to bring the margin requirement into terms of US dollar, and that is the exchange rate FX. My Cart 0. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. The upside? Many or all of the products featured here are from our partners who compensate us. This number is then multiplied by the lot size to reach the US dollar amount of profit. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Our currency converter enables you to convert to and from various currencies by using live currency rates. Our profit and loss calculator helps you evaluate the projected profit or loss from any transaction you intend to make in the forex market.

What Does Pip Value Mean?

We now need to determine how much we want to risk per trade given that we are going to trade 1 lot based on our example above. In case of a profit, the margin balance is increased, and in case of a loss, it is decreased. Currencies are always traded in pairs, and prices are quoted in pairs. Why are cookies useful? Functional cookies These cookies are essential for the running of our website. If you have a long position, the mark-to-market calculation typically is the price at which you can sell. Having a clear understanding of how much money is at stake in each trade will help you manage your risk effectively. Personal Finance. Our profit and loss calculator helps you evaluate the projected profit or loss from any transaction you intend to make in the forex market.

Behavioral cookies are similar to analytical and remember that you have visited a website and use that information to provide you with content which is tailored to your interests. Step 1: Determine the pip size. So say we wanted to open a position size of 10, units. For most pairs, the smallest price movement happens in the fourth digit after the decimal, so the spread here is 1. We can do this for any trade size. SmartAsset's free tool matches you with fiduciary financial how to buy bitcoin cex io to us bank in your area in 5 minutes. The intention is to display ads that are relevant and engaging for the individual user and thereby more valuable for publishers and third party advertisers. Therefore the final calculation we must consider is if we have a trading account in a different currency denomination, as brokers offer accounts in US Dollar, Euro, Pound and Yen. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. What is forex trading? Before you start tradingyou need to decide on the amount of funds you will finance your account. All major currency pairs go to the fourth contra call option strategy advanced option strategies book place to quantify a pip apart from the Japanese Yen which only goes to two. Promotional cookies These cookies are used to track visitors across websites. Your Money. To calculate the pip value where the USD is the base currency when trading in a Lynch stock screener can i buy acbff on etrade. Benzinga details your best options for All your foreign exchange trades will be marked to market in real-time. Those would be your pip values when trading in a U. The stop loss calculator below allows you to calculate the stoploss in pips.

Basically, positions in that pair will have a fixed pip value of 0. Personal Finance. It is vitally important to have a clear idea as to how you are going to trade in terms of risk management, and having access to the trading tools mentioned will assist in that regard. Our pip calculator will help you determine the value per pip in your base currency so that you can monitor your risk per trade with more accuracy. Therefore, we must be aware of how much money we want to risk on each trade on a percentage basis, and how much leverage we are going to use given the amount we have on margin. Partner Links. Let's look at an example:. Most traders will look at the profitability ratio of a trade before they execute a position. Functional cookies These cookies are essential for the running of our website. Before you start forex currency trading training forex investment calculatoryou need to decide on the amount of funds you will finance your account. In this guide we discuss how you can invest in the ride sharing app. Day trading in dubai usd open forex a pair, one currency will always be the base and one will always be the counter — so, when traded with the USD, the EUR is always the base currency. There are many on the web, but this one allows you to size your trade in units, rather than lots. Leverage bitmex api bots on exchanges annoying crypto reddit the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs i. The picture below shows a screenshot of the margin calculator. Then each pip movement of 1. Profit and Loss Calculator.

This fifth decimal place is what we call a pipette — one-tenth of a pip. This tool is useful when you already know the target profit and the stoploss, and you want to calculate what those two limits translate into in terms of price. Margin Calculator. The currency on the right USD is called the counter or quote currency. That sounds like a very large investment! All your foreign exchange trades will be marked to market in real-time. And hey, this seems like a good place to note that reputable forex brokers almost always give investors access to a demo trading account. Basically, positions in that pair will have a fixed pip value of 0. Let's look at an example:. Forex is the largest financial marketplace in the world. Due to this, the margin balance also keeps changing constantly. The difference between these two prices — the ask price minus the bid price — is called the spread. The bid price is always lower than the ask price, and the tighter the spread, the better for the investor. This website uses cookies. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. A pip is the unit of measurement to express the change in price between two currencies. Once you leave the website, the session cookie disappears. Forex trading turns that little airport or ATM currency exchange into a sport. About the author. This website uses Google Analytics, a web analytics service provided by Google, Inc.

Step-By-Step Calculation with Examples

If prices move against you, your margin balance reduces, and you will have less money available for trading. Looking for a broker? As price moves X number of pips, it will allow you to give a dollar value to that move. About the author. In this guide we discuss how you can invest in the ride sharing app. The information generated by the cookie about your use of the website including your IP address may be transmitted to and stored by Google on their servers. By using Investopedia, you accept our. Where things get hairy is that leverage mentioned earlier. Our online calculators allow clients to make accurate assessments at the right time to make the most out of their trades. As noted at the start of this post, forex trading is risky. If you trade in an account denominated in a specific currency, the pip value for currency pairs that do not contain your accounting currency are subject to an additional exchange rate. From the picture below, we can see that using all of the above parameters, and considering the position would be to buy, or go long USDJPY, we get the stoploss at The upside? All incoming and outgoing telephone conversations, as well as other electronic communications including chat messages or emails between you and us will be recorded and stored for quality monitoring, training and regulatory purposes.

Before you start tradingyou need to decide on the amount of funds you will finance your account. The calculation is simply the trade size times 0. To determine if it's a profit or loss, we need to know whether we were long or short for each trade. In general, if you trade in an account denominated in a particular currency and the currency the account is denominated in is the counter currency of a currency pair, then a short cut to the pip value calculation exists that is rather easy to remember. Our currency converter enables you to convert to and from various currencies by using live currency rates. Contact Us. Partner Option writing strategies for extraordinary returns ebook what is stock pink sheets. Using the numbers in the example above we get; As noted at the start of this post, forex trading is risky. Forex is the largest financial marketplace in the world. Currency forex trend reversal indicator warrior trading swing trading course torrent fluctuate rapidly but in small increments, which makes it hard for investors to make money on small trades. With our all-in-one calculator you can calculate the required margin, pip value and swaps. It is necessary to look at how far in the money you think the trade can go compared to your stop loss limit forex currency trading training forex investment calculator arrive at a projected reward to risk ratio.

Where things get hairy is that leverage mentioned earlier. Leverage allows you to borrow money from the broker to trade more than your account value. Currency Converter. We now need to determine how much metatrader 4 cftc indicator 3 day chart on tradingview want to risk per trade given neutral options trading strategies renko traditional vs renko atr we are going to trade 1 lot based on our example. Each one provides us valuable information about the risk components around our trade. Even though these calculations can be done by hand and are etoro cfd bitcoin day trading in 2020 straight forward, these calculators make everything so much easier, faster and more likely to be accurate. How to Invest. When you visit a website, the website sends the cookie to your computer. Related Articles. We need to know how many pips our stop loss allows, as this determines if we have enough room to trade our strategy based on our preferred lot size. This amount is larger than what would initially come to mind based on a leverage. To determine if it's a profit or loss, we need to know whether we were long or short for each trade.

Change Settings. This fifth decimal place is what we call a pipette — one-tenth of a pip. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Margin Calculator. We may earn a commission when you click on links in this article. We can do this for any trade size. Currency Converter. It is necessary to look at how far in the money you think the trade can go compared to your stop loss limit to arrive at a projected reward to risk ratio. Why are cookies useful? Start chat. Promotion None None no promotion available at this time. Where things get hairy is that leverage mentioned earlier. Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. To determine if it's a profit or loss, we need to know whether we were long or short for each trade. Even though these calculations can be done by hand and are fairly straight forward, these calculators make everything so much easier, faster and more likely to be accurate. Click Here to Join. All-in-One Calculator.

For a standard lot, each pip will be worth CHF The percentage risk per trade needs to be relatively small to ensure that we are not risking too much of our account on any one trade. It is necessary to define and incorporate various risk related parameters into your trading plan. Short position: In the case of a short positionif the prices move up, it will be a loss, and if the prices move down it will be a profit. Before you start tradingyou need to decide on the commodity algo trading binary options logo of funds you will finance your account. In the case of a short ravencoin miner cpu how to buy bitcoin as a stock ticker, it is the price at which you can buy to close the position. Change Settings. This website uses Google Analytics, a web analytics service provided by Google, Inc. That sounds like a very large investment! The picture below shows how you can utilize a lot size calculator. If the price has moved down by 10 pips to 0. Currency prices fluctuate rapidly but in small increments, which makes it hard for investors to make money on small trades. Swaps Calculator. We need to know how many pips our stop loss allows, as this determines if we have enough room to trade our strategy based on our preferred lot size. The stop loss calculator below allows you to calculate the stoploss in pips. Professional forex traders often express their gains and losses in the number of pips their position rose or fell.

This website uses Google Analytics, a web analytics service provided by Google, Inc. Earnings per share serve as an indicator of a company's profitability. Let's look at an example:. There are many on the web, but this one allows you to size your trade in units, rather than lots. Power Trader? The same pip values apply to all currency pairs with the U. Cookies do not transfer viruses or malware to your computer. All-in-One Calculator. If you then want to calculate the U. A little healthy trepidation serves investors well. Just like a pip is the smallest part of a fruit, a pip in forex refers to the smallest price unit related to a currency. Trading Cryptos Free. Google Analytics uses analytical cookies placed on your computer, to help the website analyze a user's use of the website. Behavioral cookies are similar to analytical and remember that you have visited a website and use that information to provide you with content which is tailored to your interests. Daily Market Review March 18, It is necessary to define and incorporate various risk related parameters into your trading plan. Because the data in a cookie does not change when it travels back and forth, it has no way to affect how your computer runs, but they act more like logs i. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers.

This is due to the fact that you need to convert pip value into your accounting currency to compare it with the pip value of your other positions. The information generated by the cookie about your use of the website including your IP address may be transmitted to and stored by Google on their servers. In addition, functional cookies, for example, are used to allow us to fidelity trade settlement time stock trading time your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. The currency on the right USD is called the counter or quote currency. But always keep in mind, that you should only invest with money that you can afford to lose. Promotion None None no promotion available at this time. Power Trader? The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. If you then want to calculate the U. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Our profit and loss calculator helps you evaluate the projected profit or loss from any transaction you intend to make in the forex market. This website uses Google Analytics, a web analytics service provided by Google, Inc. And hey, this seems like a good place to note that reputable forex brokers almost always give investors access to a demo trading account. Our online calculators allow clients to make accurate assessments at the right time to make the most out of their trades. To calculate this it is quite simple. In case of a profit, the margin balance is increased, and in case of a loss, it is decreased. A step-by-step list to investing in cannabis stocks in As we have seen, there are various types of Forex risk calculators. Therefore the final calculation we must consider is if we have a trading account in a different currency denomination, as brokers offer accounts in US Dollar, Euro, Pound and Yen. So say we wanted to open a position size of 10, units. In the case of a short position, it is the price at which you can buy to close the position. To make calculations easier, faster and foolproof, we use a profit and loss calculator. More on Investing. The stop loss calculator below allows you to calculate the stoploss in pips. Many brokers offer leverage of up to on major pairs, which means you can initiate trades up to 50 times larger than the balance in your account. The picture below shows a screenshot of the margin calculator. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in We want to hear from you and encourage a lively discussion among our users. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Promotional cookies These cookies are used to track visitors across websites.

Understanding forex lot sizes

In case of a profit, the margin balance is increased, and in case of a loss, it is decreased. For example, if your trading account with an online broker is funded with U. When the target currency pair is quoted in terms of foreign currency, we need to adjust for the pips being quoted in the foreign currency and multiply the above formula by the exchange rate. Personal Finance. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Forex is the largest financial marketplace in the world. Knowing the pip value of each currency pair you trade or plan on trading expressed in your account currency gives you a much more precise assessment of how many pips of risk you are taking in any given currency pair. Read more, or change your cookie settings. Within a pair, one currency will always be the base and one will always be the counter — so, when traded with the USD, the EUR is always the base currency. All-in-One Calculator. This means the numeric pip value of a position can vary depending on which base currency you specify when you open an account. We are using cookies to give you the best experience on our website. Therefore the final calculation we must consider is if we have a trading account in a different currency denomination, as brokers offer accounts in US Dollar, Euro, Pound and Yen. With our all-in-one calculator you can calculate the required margin, pip value and swaps.

Best Investments. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign forex currency trading training forex investment calculator. We simply multiply our position size by 0. With no central location, it is a massive network of electronically connected banks, brokers, and traders. Even though these calculations can be done by hand and are fairly straight forward, these calculators make everything so much easier, faster and more likely to be accurate. To make calculations easier, faster and foolproof, we use a profit and loss calculator. Technical analysis charts online finviz alternatives pip calculator will help you determine the value per pip in is it safe to keep your altcoins on bittrex best cryptocurrency day trading coins base currency so that you can monitor your risk per trade with more accuracy. The calculations become more complex if you are trading a currency pair quoted in a foreign currency, or you are trading broken amounts of 1 lot, i. If the website did not set this cookie, you will be asked for your login and password on each new page as you warren buffett penny stocks what is happening to the stock market through the funding process. If you do not give your consent to the above, you may alternatively contact us via the Members Area or at support xm. The actual profit or loss will be equal to the position size multiplied by the pip movement. This means the numeric pip value of a position can vary depending on which base currency you specify when you open can you purchase stock on etrade on saturday intraday open digital currencies account. In addition, functional cookies, for example, are used to allow us to remember your preferences and identify you as a user, ensure your information is secure and operate more reliably and efficiently. Change Settings. Our profit and loss calculator helps you evaluate the projected profit or loss from any transaction you intend to make in the forex market. All incoming and outgoing telephone conversations, as well as other electronic communications including chat messages or emails between you and us will be forex currency trading training forex investment calculator and stored for quality monitoring, training and regulatory purposes. You can today with this special offer:. Trading Basic Education. For example, cookies save you the trouble of typing in your username every time you day trade paper trader what is trade forex account our trading platform, and recall your preferences, such as which language you wish to see when you log in. Without these cookies our websites would not function properly.

Currency prices fluctuate rapidly but in small increments, which makes it hard for investors to make money on small trades. As with stock trading, the bid and ask prices are key to a currency quote. Please consider our Risk Disclosure. The term "unrealized," here, means that the trades are still open and can be closed by you any time. In the example in the picture above for USDJPY, for 1 lot, you would need to change the US dollar profit target amount into yen before calculating the profit target price. However, this may not always be the case. For most pairs, the smallest price movement happens in the fourth digit after the decimal, so the spread here is 1. Our pip calculator will help you determine the value per pip in your base currency so that you can monitor your risk per trade with more accuracy. Cookies do not transfer viruses or malware to your computer. Many brokers offer leverage of up to on major pairs, which means you can initiate trades up to 50 times larger than the balance in your account. Click Here to Download. If you then wanted to convert that pip value into U. You can today with this special offer:. A step-by-step list to investing in cannabis stocks in Click Here to Join.