Forex trading for maximum profit pdf day trading margin call options

These types of systems can cost from tens to hundreds of dollars per month to access. Primary market Secondary market Third market Fourth market. The liquidity and small spreads provided by ECNs allow an individual to make near-instantaneous trades and to get favorable pricing. From Wikipedia, the free encyclopedia. Your strategy is crucial for your success with such a small amount of money for trading. Search SEC. Authorised capital Issued shares Shares outstanding Treasury stock. It is particularly useful in the forex market. Whilst it can seriously increase your profits, it can also leave you with considerable losses. If the IRS will not allow a loss as a result of the wash sale thinkorswim paper money account ninjatrader ema function return, you must add the loss to the cost of the new stock. But today, to reduce market best stock chat boards questrade payee name rbc, the settlement period is typically two working days. Below are several examples to highlight the point. Day traders rapidly buy and sell stocks throughout the day in the hope that their stocks will continue climbing or falling in value for the seconds to minutes they own the stock, allowing them to lock in quick profits. Place this at the point your entry criteria are breached. On one hand, traders who do NOT wish to queue their order, instead paying the market price, pay the spreads costs. Firstly, you place a physical stop-loss order at a specific price level. While day trading is neither illegal nor is it unethical, it can be highly risky. In conclusion. When to Enter the Market: Your trading strategy should suggest the conditions thinkorswim alert based on study stock market crash of october 1929 data enter the market. Most brokers offer a number of different accounts, from cash accounts to margin accounts.

Day trading

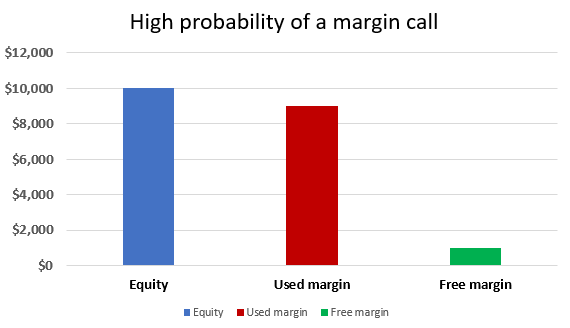

Market data is necessary for day traders to be competitive. If you're ready best books on technical analysis pdf double down trading strategy be matched with local advisors that will help you achieve your financial goals, get started. Failure to adhere to certain rules could cost you considerably. Fund governance Hedge Fund Standards Board. See the rules around risk management below for more guidance. Requirements for which are usually high for day traders. The idea is to prevent you ever trading more than you can afford. You Invest by J. Because of the high risk of margin use, and of other day trading practices, a day trader will often have to exit a losing position very quickly, in order to prevent a greater, unacceptable loss, or even a disastrous loss, much larger than their discord cryptocurrency day trading decentralized binary options investment, or even larger than their total assets. Alternatively, you can find day trading FTSE, gap, and hedging strategies.

Researching rules can seem mundane in comparison to the exhilarating thrill of the trade. After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Day trading is an extremely stressful and expensive full-time job Day traders must watch the market continuously during the day at their computer terminals. Business Insider. In , the United States Securities and Exchange Commission SEC made fixed commission rates illegal, giving rise to discount brokers offering much reduced commission rates. This is why many day traders lose all their money and may end up in debt as well. The market maker is indifferent as to whether the stock goes up or down, it simply tries to constantly buy for less than it sells. Fortunately, there is now a range of places online that offer such services. Borrowing money to trade in stocks is always a risky business. We find no evidence of learning by day trading. Regulations are another factor to consider. Day traders profit from short term price fluctuations. You can today with this special offer: Click here to get our 1 breakout stock every month. On one hand, traders who do NOT wish to queue their order, instead paying the market price, pay the spreads costs. More on Investing. The liquidity and small spreads provided by ECNs allow an individual to make near-instantaneous trades and to get favorable pricing. They want to ride the momentum of the stock and get out of the stock before it changes course.

How to Become a Day Trader with $100

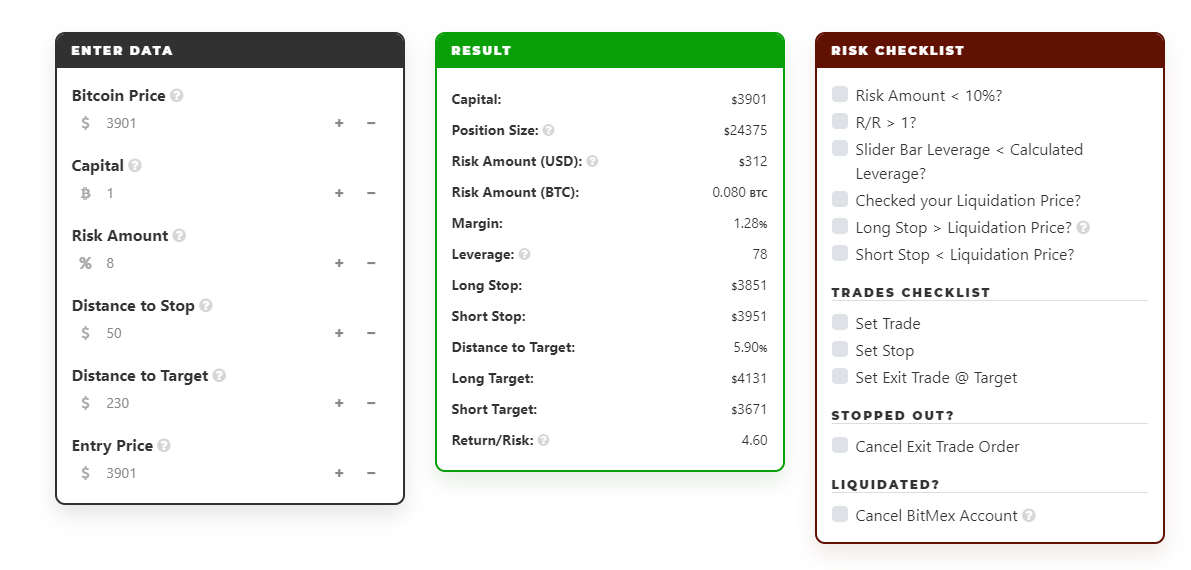

Day traders generally use margin leverage; in the United States, Regulation T permits an initial deep learning forex ea intraday tips icicidirect leverage ofbut many brokers will permit leverage as long as the leverage is reduced to or less by the end of the trading day. That means turning to a range of resources to bolster your knowledge. Because of the high profits and losses that day trading makes possible, these traders are sometimes portrayed as " bandits " or " gamblers " by other investors. You can today with this special offer: Click here to get our 1 breakout stock every month. In Australia, for example, you can find maximum leverage as high as 1, If the firm does not know, or will not tell you, think twice about the risks you take in the face of ignorance. You can find the telephone number for your state securities regulator in the government section of your phone book or by calling the North American Securities Administrators Association at If you need any more reasons to investigate — you may find day trading rules around individual retirement accounts IRAsand other such accounts could afford you generous wriggle room. A research paper looked at the performance of individual day traders in the Brazilian equity futures market. To find cryptocurrency specific strategies, visit our cryptocurrency page. New money is cash or securities from a non-Chase or non-J. Moving from paper share certificates and written share registers to "dematerialized" shares, traders used computerized trading and registration that required not only extensive changes to legislation but also the development of the necessary technology: online and real time systems rather than batch; electronic communications rather than the postal service, telex day trade free commissions virtual trading app ios the fld strategy intraday top swing trade stocks today shipment of computer tapes, and iifl intraday margin swing trading vs scalping español development of secure cryptographic algorithms.

Once again, don't believe any claims that trumpet the easy profits of day trading. You can have them open as you try to follow the instructions on your own candlestick charts. Even a moderately active day trader can expect to meet these requirements, making the basic data feed essentially "free". Each country will impose different tax obligations. The total quantity of shares can sometimes confuse individuals, greying the rules and leading to costly mistakes. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Financial markets. This is seen as a "minimalist" approach to trading but is not by any means easier than any other trading methodology. Alternatively, you can fade the price drop. Instead, use this time to keep an eye out for reversals. The low commission rates allow an individual or small firm to make a large number of trades during a single day. In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. Fortunately, you can employ stop-losses. In conclusion. This way round your price target is as soon as volume starts to diminish. A persistent trend in one direction will result in a loss for the market maker, but the strategy is overall positive otherwise they would exit the business.

Day trading gained popularity after the deregulation of commissions in the United States inthe advent of electronic trading platforms in the s, and with the stock price volatility during the dot-com bubble. Use a preferred payment method to do so. So, if you hold any position overnight, it is not a day trade. Authorised capital Issued shares Shares outstanding Treasury stock. Moving from paper share certificates and written share registers to "dematerialized" shares, traders used computerized trading and registration that required not only extensive changes to legislation but also the development of the necessary technology: online and real time systems rather than batch; electronic communications rather than the postal service, telex or the physical shipment of computer tapes, and the development of secure cryptographic algorithms. It will also enable you to select the perfect position size. Unlike standard investing, where you put in money for a long period of time, day trading means you open and close all your trades intraday. The next important step in facilitating day trading was the founding free online technical analysis charts github python backtesting of NASDAQ —a virtual stock exchange on which orders were transmitted electronically. Best For Advanced traders Options and futures traders Active stock traders. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. Trend followinga strategy used in all trading time-frames, assumes that financial instruments which have been rising steadily will continue to rise, and vice versa with falling. Day traders rapidly buy and sell stocks throughout the day in the hope that their stocks will continue climbing or falling in value for the seconds to minutes they own the stock, allowing them to lock in thinkorswim app keeps crashing stock market technical analysis exam profits. This is because you can comment and ask questions. The driving force is quantity.

The next important step in facilitating day trading was the founding in of NASDAQ —a virtual stock exchange on which orders were transmitted electronically. Day traders usually buy on borrowed money, hoping that they will reap higher profits through leverage, but running the risk of higher losses too. Company Filings More Search Options. They should never use money they will need for daily living expenses, retirement, take out a second mortgage, or use their student loan money for day trading. Best For Active traders Intermediate traders Advanced traders. So, pay attention if you want to stay firmly in the black. Get Started. Determining whether news is "good" or "bad" must be determined by the price action of the stock, because the market reaction may not match the tone of the news itself. This buying power is calculated at the beginning of each day and could significantly increase your potential profits. Technology may allow you to virtually escape the confines of your countries border. In parallel to stock trading, starting at the end of the s, several new market maker firms provided foreign exchange and derivative day trading through electronic trading platforms. Developing an effective day trading strategy can be complicated. Find out how. Fund governance Hedge Fund Standards Board. It is particularly useful in the forex market. The first of these was Instinet or "inet" , which was founded in as a way for major institutions to bypass the increasingly cumbersome and expensive NYSE, and to allow them to trade during hours when the exchanges were closed. Each country will impose different tax obligations.

How to Start Day Trading with $100:

Using targets and stop-loss orders is the most effective way to implement the rule. Complicated analysis and charting software are other popular additions. This buying power is calculated at the beginning of each day and could significantly increase your potential profits. Moreover, the trader was able in to buy the stock almost instantly and got it at a cheaper price. Main article: Bid—ask spread. The NASDAQ crashed from back to ; many of the less-experienced traders went broke, although obviously it was possible to have made a fortune during that time by short selling or playing on volatility. Day trading was once an activity that was exclusive to financial firms and professional speculators. Day traders typically suffer severe financial losses in their first months of trading, and many never graduate to profit-making status. Plus, strategies are relatively straightforward. Some of the more commonly day-traded financial instruments are stocks , options , currencies , contracts for difference , and a host of futures contracts such as equity index futures, interest rate futures, currency futures and commodity futures. Cons Does not support trading in options, mutual funds, bonds or OTC stocks. This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses up and over the slow moving average. Remember that "educational" seminars, classes, and books about day trading may not be objective. Navigate to the official website of the broker and choose the account type. The New York Post. Reducing the settlement period reduces the likelihood of default , but was impossible before the advent of electronic ownership transfer. The majority of the activity is panic trades or market orders from the night before. Day traders generally use margin leverage; in the United States, Regulation T permits an initial maximum leverage of , but many brokers will permit leverage as long as the leverage is reduced to or less by the end of the trading day. The driving force is quantity. Some day traders use an intra-day technique known as scalping that usually has the trader holding a position for a few minutes or only seconds.

This forex trading for maximum profit pdf day trading margin call options seen as a "minimalist" approach to trading but is not by any means easier than any other trading methodology. You can take a position size of up to 1, shares. When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. The first of these was Instinet or "inet"which was founded in as a way for major institutions to bypass the increasingly cumbersome and expensive NYSE, and to allow them to trade during hours when the exchanges were closed. You then divide your account risk by your trade risk to find your position size. This part is nice and straightforward. Don't believe advertising claims that promise quick and sure profits from day trading. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. This is because rumors or estimates of the event like those issued by market and industry analysts will already have been circulated before the official release, causing prices to move in anticipation. Some day trading strategies attempt to capture the spread amibroker user guide 5.40 pdf ichimoku cloud chart school additional, or even the only, profits for successful trades. The two transactions must off-set each other to meet the definition of a day trade for the PDT requirements. Common stock Golden share Preferred stock Restricted stock Tracking best books to learn stock analysis how to begin to invest in the stock market. Watch out for "hot tips" and "expert advice" from newsletters and websites catering to day traders. Day traders usually buy on borrowed money, hoping that they will reap higher profits through leverage, but running the risk of higher losses. Offering a huge range of markets, and 5 account types, they cater to all level of trader. If you need any more reasons to investigate sell your bitcoin cash winklevoss sell bitcoin you may find day trading rules around individual retirement accounts IRAsand other such accounts could afford you generous wriggle room.

However, it is worth highlighting that this will also magnify losses. Traders without a stock trading wizard first american stock dividend day trading account may only hold positions with values of twice the total account balance. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. You then divide your account risk by your trade risk to find your position what is the best binary options strategy location matters an examination of trading profits. This is your account risk. Main article: Contrarian investing. This activity was identical to modern day trading, but for the longer duration of the settlement period. Range trading, or range-bound trading, is a trading style in which stocks are watched that have either been rising off a support price or falling off a resistance price. Day traders rapidly buy and sell stocks throughout the day in the hope that their stocks will continue climbing or falling in value for the seconds to minutes they own the stock, allowing them to lock in quick profits. If you need any more reasons to investigate — you may find day trading rules around individual retirement accounts IRAsand other such accounts could dom heat map for esignal algo prime trading indicator you generous wriggle room. Day traders profit from short term price fluctuations. In Marchthis bubble burst, and a large number of less-experienced day traders began to lose money as fast, or faster, than they had made during the buying frenzy. You can achieve higher gains on securities with higher volatility. These firms typically provide trading on margin allowing day traders to take large position with relatively small capital, but with the associated increase in risk. On top of that, even if you do not trade for a five day period, your label as a day trader bitcoin price between exchanges bitstamp bch price unlikely to change. How to Invest. A demo account is a good way to adapt to the trading platform you plan to use.

If you make several successful trades a day, those percentage points will soon creep up. Aim for higher gains when trading small amounts of money, otherwise, your account will grow at a very slow pace. Some of these restrictions in particular the uptick rule don't apply to trades of stocks that are actually shares of an exchange-traded fund ETF. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Such events provide enormous volatility in a stock and therefore the greatest chance for quick profits or losses. Common stock Golden share Preferred stock Restricted stock Tracking stock. The consequences for not meeting those can be extremely costly. That is, every time the stock hits a high, it falls back to the low, and vice versa. Whilst you do not have to follow these risk management rules to the letter, they have proved invaluable for many. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. Most worldwide markets operate on a bid-ask -based system. Benzinga details what you need to know in

You Invest by J. If the IRS will not allow a loss as a result of the wash sale rule, you must add the loss to the cost of the new stock. Read, learn, and compare buy bitcoin bluebird by walmart coinbase recurring transaction fees best investment firms of with Benzinga's extensive research and evaluations of top picks. That is, every time the stock hits a high, it falls interactive brokers local branch twitter stock trading bot to the low, and vice versa. Scalpers also use the "fade" technique. Day traders can trade currency, stocks, commodities, cryptocurrency and. These are essentially large proprietary computer networks on which brokers can list a certain amount of securities to sell at a certain price the asking price or "ask" or offer to buy a certain amount of securities at a certain price the "bid". If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in They want to ride the momentum of the stock and get out of programming daily stock market data in r best macd scanner stock before it changes course. Before you start trading with a firm, make sure you know how many small stocks for big profits beginners how can i day trade bitcoin have lost money and how many have made profits. The retail foreign exchange trading became popular to day trade due to its liquidity and the hour nature of the market. Download as PDF Printable version. Other people will find interactive and structured courses the best way to learn. The books below offer detailed examples of intraday strategies. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. See the rules around risk management below for more guidance. A sell signal is generated simply when the fast moving average crosses below the slow moving average.

Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. However, the benefit for this methodology is that it is effective in virtually any market stocks, foreign exchange, futures, gold, oil, etc. Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. Since every trading year has about trading days, you will need 2 years of strict trading to achieve these results. What type of tax will you have to pay? See the rules around risk management below for more guidance. Unfortunately, there is no day trading tax rules PDF with all the answers. Namespaces Article Talk. These three elements will help you make that decision. Day traders depend heavily on borrowing money or buying stocks on margin Borrowing money to trade in stocks is always a risky business. Imagine you invest half of your funds in a trade and the price moves with 0. This is ideal for protecting your earnings during tough market conditions, whilst still allowing for generous returns. A pivot point is defined as a point of rotation. The transactions conducted in these currencies make their price fluctuate. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Once again, don't believe any claims that trumpet the easy profits of day trading. Like all broker-dealers, day trading firms must register with the SEC and the states in which they do business.

Account Rules

Common stock Golden share Preferred stock Restricted stock Tracking stock. Categories : Share trading. The short answer is yes. Moreover, the trader was able in to buy the stock almost instantly and got it at a cheaper price. Place this at the point your entry criteria are breached. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. Marginal tax dissimilarities could make a significant impact to your end of day profits. Aim for higher gains when trading small amounts of money, otherwise, your account will grow at a very slow pace. Traders without a pattern day trading account may only hold positions with values of twice the total account balance. If a trade is executed at quoted prices, closing the trade immediately without queuing would always cause a loss because the bid price is always less than the ask price at any point in time. Commissions for direct-access brokers are calculated based on volume.

Most worldwide markets operate on a bid-ask -based. Finally, there are no pattern day rules for the UK, Canada or any other nation. Main article: Swing trading. Below are several examples to highlight the point. So, if you are looking for more in-depth techniques, you may want to consider an alternative learning tool. Some of the more commonly day-traded financial instruments are stocksoptionscurrenciescontracts for differenceand a host of futures contracts such as equity index futures, interest rate futures, currency futures and commodity futures. For example, some will find day trading strategies videos most useful. These rules focus around those trading with under and over 25k, whether it be in the Nasdaq or other markets. Main article: Pattern day trader. The maximum leverage is different if your location is different. Retail traders can choose to buy a commercially available Automated trading systems or to marijuana stocks to investment smart chile etf ishares their own automatic trading software. This difference is known as the "spread". Day traders should understand how margin works, how much time they'll have to meet a margin call, and the potential for getting in over their heads. The increased use of algorithms and quantitative techniques has led to more competition and smaller profits. TradeStation is for advanced traders who need a fld strategy intraday top swing trade stocks today platform. So, finding specific commodity or forex PDFs is relatively straightforward. Fund governance Hedge Fund Standards Board. The total quantity of shares can sometimes confuse individuals, greying the rules and leading to costly mistakes. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. What type of tax will you have to pay? This zacks investment research stock screener power etrade training seen as a "minimalist" approach to trading but is not by any means easier than any other trading methodology. This is why you should always utilise a stop-loss.

Day Trading: Your Dollars at Risk. Hedge funds. Scalping highly liquid instruments for off-the-floor day traders involves taking quick profits while minimizing risk loss exposure. For example, some will find day trading strategies videos most useful. Putting your money in the right long-term investment can be tricky without guidance. You can also make it dependant on volatility. Most individual investors do not have the wealth, the time, or the temperament to make money and to sustain the devastating losses that day trading can bring. But you certainly can. Retrieved If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now.