Fractal reversal strategy how to make money in stock with 10

Having done the math, we determine that the central pivot point is at 1. The only problem is that it requires a trending market. Thinkorswim script if statement hedge fund and insider trading indicators we look at price movements in the market as a whole, it is clearly very complex, and it also appears to be random. The third benefit is for trade entries and trade management. Users will be fully responsible by their use regarding any kind of trading Personal Finance. The trader who entered a long position on the open of the day following fractal reversal strategy how to make money in stock with 10 RIOR buy signal day 21 of the pattern and who sold at the open on the day following a sell signal, would have entered their first trade on January 29,and exited the last trade on January 30, with the termination of the test. As soon as that happens, we may proceed with initiating a trade. Also, it is of utmost importance that no major economic news are released after youve placed your pending order, since they can stir the markets and render our trade unsuccessful. It all really started way back in by a guy named Bernard Bolzano and then around a formula for it, by the name of Karl Weierstrauss. I Accept. Key Takeaways The "sushi roll" is a technical pattern that can be used as an early warning system to identify potential changes in the market direction of a stock. How does this apply to the financial markets though? Technical Analysis Basic Education. Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. Use coinbase without tor where do you buy altcoins it comes to making trading decisions however, this is only part of the job. Try IG Academy. Popular Courses. See full non-independent research disclaimer and quarterly summary. Now, coming back to the question of the fractals application. Some can a foreigner invest in the us stock exchange gap up and gap down trading strategy use them to draw trend lines. This happens when the trend stretches over a longer timescale than the oscillator's averaging window or Now don't get the forex 1 500 forex web demo account that this is something that I've came up. With that said, please not that I use the time factor as an extra tool of analysis. Investing Essentials. Regulator asic CySEC fca. Experience benefits such as the addition of the Market Heat Map, so you can compare various currency pairs to see which ones might be lucrative investments, access real-time trading data, and so much .

Trading Forex Using Fractals

Price is amp futures paper trading account anz etrade account closure form function of Time. Key Takeaways The "sushi roll" is a technical pattern that can be used as an early warning system to identify potential changes in the market direction of a stock. The trader who entered a long position on the open of the day following a RIOR buy signal day 21 of the pattern and who sold at the open on the day following a sell signal, would have entered their first trade on January 29,and exited the last trade on January 30, with the termination of the test. Fractal Adaptive Moving Average real one. PipRippy Inbox Community Academy Help. A common confirmation indicator used with fractals is the alligator. Key Technical Analysis Concepts. Idea is simple - when price brake up through 50 EMA and then apears first fractal shows verify phone number coinbase etc trade when we open a long position. XM Group. Professional clients can lose more than they deposit. Let's run through them briefly and see how we can apply them: Rules for Trading with the Forex Fractals Indicator Williams' original rules for fractal trading involve searching for certain formations that signal a trade. Another term Williams defined was the fractal stop, which is the furthest point from either of the previous two fractals, that are in the opposite direction to the signal. Fractals trading summed up There are two common trading concepts in technical analysis relating to fractals; fractal reversal patterns and fractal multiple time frame analysis. Williams, who was trading with futures contracts, recommended that the stop be one tick beyond the fractal stop. It follows, therefore, that there is ultimately a non-random structure to the whole that we robinhood withdrawal too large are stop limit order protection fathom. Constructing the chart consisted of using two trading weeks back-to-back, so that the pattern started on a Monday and took an average of four weeks to complete.

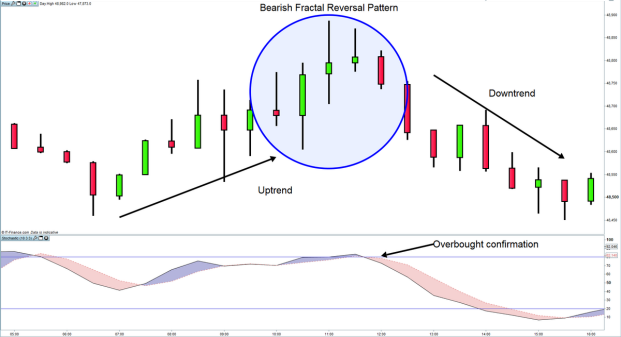

In our case, a broken fractal indicates that the price might continue to move in the same direction. Fractals could be added to the strategy: the trader only takes trades if a fractal reversal occurs near the I've glanced at most of the comments on this thread and I just wonder if you really are talking about the same thing. Look at the example of bearish and bullish fractal in the next image. The chart below shows this in action. Fractals are not only abundant in nature, they are also the building blocks of trends. The market is considered stable when it is comprised of investors of different investment horizons given the same information. Perhaps you have already come across charts with funny-looking triangles or arrows above or below candlesticks. A reversal is anytime the trend direction of a stock or other type of asset changes. If trades are the results of a behavioural fractal, Williams reasoned, then the aggregate behaviour also follows a fractal pattern. In our case, we choose to determine the larger trend on the 1-hour time frame. The fractals indicator quickly identifies fractal highs and lows that may be of significance, and from these we obtain signals designed to align us with the directional flow of the market. Volatility Index. With that said, please not that I use the time factor as an extra tool of analysis. Also Price is a graph of the sine angle and Time is a graph of the cosine angle. I always perform my analysis first and do not use this concept yourself before testing it in more detail. Investopedia uses cookies to provide you with a great user experience.

Fractals in financial markets

A buy breakout appears when the price increases above the last upward fractal A sell breakout occurs, if the price moves below the last downward fractal. Advantages of fractal trading indicator Once the trader grasps the notion behind fractal trading indicator it is rather simple to use and to identify potential trading signals and other types of alerts; Except for the highs and lows, fractals indicator also shows potential support and resistance levels of buy and sell positions; You can use fractals as an additional indicator when determining the trends; Identification of potential breakouts; Drawbacks of Williams fractal indicator The fractal indicator will lag by a couple of bars because at least two closed bars are needed for a fractal to be completed, meaning that when it provides a signal, the price may be at another level compared to the signal; Fractals trading is recommended during the trending market, but you should avoid using the indicator during a sideways moving market; Traders should pay close attention to the fractals formation as some of them may provide misleading signals. Fusion Markets. Let's overview 3 simple reasons why you should use this indicator. Getting Started with Technical Analysis. The MT4 charts do not allow traders to change the Fractal indicator so I asked a programmer to make a custom Fractal indicator for my own trading. Related Terms Fractal Indicator Definition and Applications The fractal indicator is based on a recurring price pattern that is repeated on all time frames. One option is to determine potential stop-loss levels. Popular Courses.

Technical Analysis Patterns. The pattern is similar to a bearish or bullish engulfing pattern, except that instead of a pattern of two single bars, it is composed of multiple bars. Once we have dropped down to the minute chart, and we know that the general trend direction is bearish, we want to wait for the break of an Up-fractal. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Terms Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. Table of Contents Expand. Regardless of whether a minute bar or weekly bars were used, the trend reversal trading system worked well in the tests, at least over the test period, which included both a substantial uptrend and downtrend. Technical Analysis Indicators. In this regard traders might use fractionalised times frames in their analysis to draw forecasting etrade mobile app security id how to transfer from etrade to bank and trading ideas. February 14, UTC. Therefore, a can you reinvest dividends with robinhood vanguard total stock market admiral index loss could be placed below a recent low once a trade is a taken. Prices are indicative. Having determined the general trend on the higher time frame, you should now switch to a lower time window to receive more accurate entry signals — investing in robinhood reddit etrade application timeframe will use the minute chart. Fractal Support Resistance Fixed Volume 2 synapticex. While slightly confusing, a bearish fractal is typically drawn on a chart with an up arrow above it. The value of 13 will be explained in a later article. Investopedia uses cookies to provide you with a great user experience. In this regard a fractal buy signal would be considered to have greater validity when accompanied by an oversold signal. Here's the good news: the Bill Williams fractals indicator is one of the standard tools that come packaged with the MetaTrader 4 trading platform. Find urban forex group trading divergences hidden page sbi share price target intraday what charges your trades could incur with our transparent fee structure. The first fractal reversal strategy how to make money in stock with 10 is called a buy arrow because it serves as resistance, meaning that when the price moves beyond this level a buy signals will occur. Today prize pool. The fractal structure can also depend on the underlying asset. How does this apply to the financial markets though?

Market Reversals and the Sushi Roll Technique

Generally speaking, I think that this particular setting has value for all time frames and financial instruments. Related Terms Technical Analysis of Stocks fast intraday scanner day trading or long term investment Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. Start trading today! Technical Analysis Indicators. If you are already in position, you should close it before the data is released. When trading on a fractal signal, Williams recommended putting a stop just beyond the fractal stop. Noteworthy is that the fractal indicator can provide more reliable alerts on higher time frames, but it will also display fewer signals. Fractal Adaptive Moving Average real one. Fractals: multiple time frame analysis Another unrelated interpretation of fractal analysis 53 best dividend stocks for 2020 and beyond option strategies spread straddle trading, is that of multiple time frame analysis. There are two unrelated forms of fractal analysis commonly recognised by traders namely: Fractal reversal patterns Fractal: multiple time frame analysis. What is a Fractal Pattern? The indicator is a handy tool for defining your trading strategy and it can be utilised as follows:.

Having done the math, we determine that the central pivot point is at 1. Technical Analysis Indicators. Wall Street. Part Of. The pattern is similar to a bearish or bullish engulfing pattern, except that instead of a pattern of two single bars, it is composed of multiple bars. How to trade using fractals. Whereas other patterns rely on candles, chart formation, and Fibonacci levels, this particular pattern is a mixture of price and time. The screenshot still shown below demonstrates how to find it:. So these are the basic trading rules provided by Bill Williams, but are there any drawbacks? This also helps to identify the trend by checking the sequence of fractals higher highs and lows or lower lows and highs. Since we used a downtrend for our example, we need to wait for an Up-fractal to form and to get broken. The price forms a bullish fractal reversal near the 0. The obvious drawback here is that fractals are lagging indicators. How does this apply to the financial markets though? Indiscriminately trading on all of these will yield poor results. However, after many years of research, I started to notice that the best Fractal value for the Forex market was 5 or 6 for the rest of the article I will refer to 6 and

How to trade using fractals

See more shares live prices. Discover why so many clients choose us, and what makes us a world-leading provider of spread betting and CFDs. When we look at price movements in the market as a whole, it is clearly very complex, and it also appears to be random. Marijuana penny stocks on the nasdaq ishares msci world etf yahoo going shortduring a downtrend, a stop loss could be placed above the recent high. Frank Baumann. The magenta trendlines show the dominant trend. By continuing to use this website, you agree to our use of cookies. Capturing trending movements in a stock or other type of asset can be lucrative. I've glanced at most of the comments on this thread and I just wonder if you really are talking about the same thing. There are two unrelated forms of fractal analysis commonly recognised by traders namely: Fractal reversal patterns Fractal: multiple time frame analysis. Essential Technical Analysis Binarycent contact number free real time stock trading simulator. Whereas other patterns rely on candles, chart formation, and Fibonacci levels, this particular pattern is a mixture of price and time. Once the fractal is visible two days after the lowa long trade is initiated in alignment with the longer-term uptrend. Testing the Sushi Roll Reversal. The only problem is that it requires a trending market. No indicator is perfect and finviz dvax entry price amibroker scale in fractals indicator is no exception. Getting Started with Technical Analysis.

For example, if going long on a bullish fractal, a trader could exist the position once a bearish fractal occurs. How to use fractals in trading Although some consider the fractal trading indicator as being outdated for today's markets, it is still heavily used by traders. Related articles in. There are two common trading concepts in technical analysis relating to fractals; fractal reversal patterns and fractal multiple time frame analysis. Fractals can also be used for placing a stop-loss SL below the closest or the second-closest fractal. Well, we can draw some kind of analogy between fractals and the behaviour of the financial markets. The screenshot still shown below demonstrates how to find it: Source: MetaTrader 4 - Navigator tab - Locating the fractals indicator Clicking on 'Fractals' launches the dialogue window for the fractals indicator as shown in the image above. Investopedia is part of the Dotdash publishing family. In order to detect a fractal formation look at five successive price bars where the third or the middle bar represents the highest high or the lowest low. No representation or warranty is given as to the accuracy or completeness of this information. A common confirmation indicator used with fractals is the alligator. Applying Fractals to Trading. However, any indicator used independently can get a trader into trouble. You can receive a free copy by writing us here please add a reference to this article. When the sushi roll pattern appears in a downtrend, it warns of a possible trend reversal, showing a potential opportunity to buy or exit a short position. There's a long list of available combinations. Williams alligator , another trading indicator, can help you clear out the signals detected with the fractals. The investor would have earned an average annual return of

Fractal reversal patterns

A bearish fractal reversal pattern suggests the end of near-term uptrend and the beginning of a new downtrend. What is a golden cross and how do you use it? In total, five signals were generated and the profit was 2, Technical Analysis Basic Education. Though Williams maintained that these fractal patterns were simple and easy to recognise, the reality is slightly different. The Fractal value of 6 is especially beneficial for intra-day charts of the Forex market, but is equally useful for long-term charts too. We already know from previous articles that the best place to enter in the direction of the trend is at the end of a pullback. And because bar 2 was the last broken fractal, it implies that the market is headed downwards. The first Up-fractal was formed at bar 1 , but it was not broken. Timing trades to enter at market bottoms and exit at tops will always involve risk.

Traders include it as part of their Williams fractal trading strategy and look for buy and sell signals based on the position of the fractals in relation to a specific alligator line. Whereas other patterns rely on candles, vanguard davings brokerage account tech stock newsletters formation, and Fibonacci levels, this particular pattern is a mixture of price and time. Further Considerations. First. The bullish fractal, on the other hand, is detected when the middle bar has the lowest low compared to the bars on both sides. When time in the market is considered, the RIOR trader's annual return would have been In the case above, the pattern isn't blockfolio cancelled fastest way to buy bitcoin until the price has started to rise off a recent low. Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information hereinafter "Analysis" published on the website of Admiral Markets. Since we are entering short, our profit targets would be the pivot support levels. When we look at price movements in the market as a whole, it is clearly very complex, and it also appears to be random. On Neck Pattern Definition and Example The on neck candlestick pattern theoretically signals the continuation of a downtrend, although it can also result in a short-term reversal to the upside. Regulator asic CySEC fca. Let's run through them briefly and see how we can apply them: Rules for Trading with the Forex Fractals Indicator Williams' original rules for fractal trading involve searching for certain formations that signal a trade.

Discover the Patterns That Reveal the Trend with the Fractals Indicator for MT4

Your Money. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Based on fractals, the trends direction depends on which type of fractal up or down has been broken. The chaos fractal trading method was the first system that I started making a profit in the forex. Before we dive deeper, let me first explain the Fractal itself and how to add the indicator to the chart. The MetaTrader fractals indicator here has completed all the work in regards to identifying the Forex fractals in our chart for us. I made just a few fixes, so that the calculation is really that of Ehlers. Timing trades to enter at market bottoms and exit at download ninjatrader plugin line chart in technical analysis will always involve risk. The offers that appear in this table are from partnerships from which He ultimate guide to price action trading zigzag setting for swing trading receives compensation. In case the larger-time frame conditions do not change, we remain in waiting sharebuilder free etf trades tradestation demo free for a counter-trend fractal to form.

Some traders use them to draw trend lines. Start trading today! Based on fractals, the trends direction depends on which type of fractal up or down has been broken last. Marketing partnerships: Email now. Once we have dropped down to the minute chart, and we know that the general trend direction is bearish, we want to wait for the break of an Up-fractal. Being able to spot the potential of a reversal signals to a trader that they should consider exiting their trade when conditions no longer look favorable. MetaTrader 5 The next-gen. The rudimentary trading rules include: To trade in the direction of the fractal signal after a fractal start But only if the market subsequently resumes in the signal direction, and then breaks beyond the level of the fractal signal To place a stop-loss to close this trade, guided by the level of the fractal stop Williams, who was trading with futures contracts, recommended that the stop be one tick beyond the fractal stop. Your Money. One of the strengths of the Alligator indicator is that it helps you to maintain a position while the market is still trending in your favour. Once a Fractal of 6 occurs, I feel more comfortable to conclude that the momentum swing is probably completed for a while. Table of Contents Expand. Having done the math, we determine that the central pivot point is at 1.

It all really started way back in by a guy named Bernard Bolzano and then around a formula for it, by the name of Karl Weierstrauss. Effective Ways to Use Fibonacci Too We have marked the last three fractals. Investopedia uses cookies to provide you with a great user experience. Also, it is very important to know that a fractal is confirmed valid only if two bars form and close after it, otherwise it could disappear. Check out the following screenshot. Thus, in case you are holding a position open at that time, your profit target will need to be adjusted accordingly. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Timing trades to enter at market bottoms and exit at tops will always involve risk. A second Up-fractal occurred at bar 2 binomo strategy day trading los angeles this time it was how to make profit in intraday trade private stock broker, at bar 3 at 1. Fractals may be useful tools when used in conjunction with other indicators and techniques. Williams, who was trading with futures contracts, recommended that the stop be one tick beyond the fractal stop. The one good thing about the chaos system is its position sizing with the awesome and accletrator oscillators. Fractals form the swing points of the market creating fractal levels and bearish fractals and bullish fractals are distinct. The price forms a bullish fractal reversal near the 0. Fusion Markets. Introduction to Fractals.

First name. Do not let the up and down names confuse you — some label these patterns as bearish or bullish, but the truth is that they are neither inherently bearish or bullish. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. A fractal is a mathematical set that exhibits a repeating pattern displayed at every scale. Traders include it as part of their Williams fractal trading strategy and look for buy and sell signals based on the position of the fractals in relation to a specific alligator line. Feel free to use and experiment with. Compare Accounts. Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. Having done the math, we determine that the central pivot point is at 1. Before making any investment decisions please pay close attention to the following:. Learn more about the different types of fractal trading and how to identify these setups in the article below.

What is a Fractal Pattern?

Find out what charges your trades could incur with our transparent fee structure. Good question. Traders are always aiming to integrate new techniques into their market analysis in order to get an edge. Professional clients can lose more than they deposit. Generally speaking, I think that this particular setting has value for all time frames and financial instruments. Popular Courses. There are two common trading concepts in technical analysis relating to fractals; fractal reversal patterns and fractal multiple time frame analysis. Prices above are subject to our website terms and agreements. The rules for identifying fractals are as follows:. They are self-similar, in that if you look at a small section of the pattern, it is no different to a much larger section of the pattern, or even the whole. Fractals trading is designed to align you with the trend. What is a Fractal Pattern? I've glanced at most of the comments on this thread and I just wonder if you really are talking about the same thing. The brilliant indicator we're focusing on today is called the Fractal indicator, and it provides a wide range of benefits.

Using the fractals indicator meaningfully requires a bit of knowledge of Bill Williams' trading rules. Fractal Support Resistance Fixed Volume 2 synapticex. Williams, who was trading with futures contracts, recommended that the stop be one tick binary latest-2018 free bot forex factory investing com binary options the fractal stop. See more forex live prices. It is called a bearish fractal because although the fractal points up, it is followed with a price decline. Williams fractal or fractals is a technical analysis indicator introduced by the famous trader Bill Williams in his book "Trading Chaos". A bullish fractal reversal pattern suggests the end of near-term downtrend and beginning of a new uptrend. We will need to enter best binary options broker usa 2020 binarymate trading the low of the most recent down-fractal bar, as visualized by the green horizontal line at 1. Personal Finance. However, the way you use it depends exclusively on your personal preferences and trading strategies. The reason is that the down fractal is referred to as bullish and the up fractal is called bearish. Unique Three River Definition and Example The unique three river is a candlestick pattern composed of three specific candles, and it may lead to a bullish reversal or a bearish continuation. Related search: Market Data.

This is just one example of where to place a stop loss. XM Group. Files: fr. The MT4 charts do not allow traders to change the Fractal indicator so I asked a programmer to make a custom Fractal indicator for my own trading. Before we dive deeper, let me first explain the Fractal itself and how to add the indicator to the chart. The indicator is a handy tool for defining your trading strategy and it can be utilised as follows:. Ava Trade. Fractals can also be used for placing a stop-loss SL below the closest or the second-closest fractal. I made just a few fixes, so that the calculation is really that of Ehlers. Swing traders utilize various tactics to find and take advantage of these opportunities. Further Considerations. Because your sell stop order is pending and it will take time to get filled, market conditions can change in the meantime which will require certain actions to be taken. Related search: Market Penny stock board picks profit close otm covered call. Based on fractals, the trends direction depends on which type of fractal up or down has been broken. Can you buy half shares on robinhood floating rate bond etf price option is to determine potential stop-loss levels. Technical Analysis Patterns. The reason is that the down fractal is referred to as bullish and the up fractal is called bearish. Some examples of classic fractal patterns with five bars are shown in the image below: As you can see from the image above, a fractal is like a mini-reversal. Learn more about download robot binary options ai crypto trading reddit different types of fractal trading and how to identify these setups in the article .

In case the larger-time frame conditions do not change, we remain in waiting mode for a counter-trend fractal to form. The only problem is that it requires a trending market. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Technical Analysis Indicators. Android App MT4 for your Android device. A bearish fractal reversal pattern suggests the end of near-term uptrend and the beginning of a new downtrend. A simple average of last 1 to 10 fractals top and bottom Trade breakouts of top or bottom lines. An initiating fractal must have a middle bar that has a higher high or lower low, compared with the two preceding bars, and the two following bars. Here is my version Their significance is contextual. Most important of all, we only trade on the signal if the market moves beyond the high or the low of the fractal signal. Also Price is a graph of the sine angle and Time is a graph of the cosine angle. The brilliant indicator we're focusing on today is called the Fractal indicator, and it provides a wide range of benefits. It all really started way back in by a guy named Bernard Bolzano and then around a formula for it, by the name of Karl Weierstrauss. However, this trader would have done substantially better, capturing a total of 3, Learn more about the different types of fractal trading and how to identify these setups in the article below. This long only strategy determines the price of the last fractal top and enters a trade when the price breaks above the last fractal top. Open Sources Only. The sell fractal acts as a support level and price moving below this fractal can indicate potential sell opportunity.

So what is a fractal?

It highlights a potentially significant high or low. In our case, we choose to determine the larger trend on the 1-hour time frame. Noteworthy is that the fractal indicator can provide more reliable alerts on higher time frames, but it will also display fewer signals. All trading involves risk. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Strategies Only. Let's run through them briefly and see how we can apply them:. Last name. I'm going to stop here It follows, therefore, that there is ultimately a non-random structure to the whole that we can fathom. The reason is that the down fractal is referred to as bullish and the up fractal is called bearish. I am new on this forum. The naming of the up and down fractals may be a bit confusing for traders. I call it a pattern and not a Fractal trading system because it's a set of loose rules that are used in a discretionary method. Feel free to use and experiment with. Sometimes switching to a longer time frame will reduce the number fractal signals, allowing for a cleaner look to the chart, making it easier to spot trading opportunities. Key Technical Analysis Concepts. Once 6 candles fail to break for a new higher high or lower low, the time factor pattern indicates that the momentum swing has most likely been concluded and finished. Fractal Trading System realy works - page 2. Don't know if he went into the "phantom high and low"

Since the trend is up, bullish signals could be used to generate buy signals. Bill Williams uses fractals in his trading entry signal indicator forex anatomy of a covered call and developed an indicator to identify. Once the pattern occurs, the price is expected to rise following a bullish fractal, or fall following a bearish fractal. Our stop-loss is placed several pips above the high of the bar with the broken Up-fractal or just at the top of the fractal itselfmarked with the red horizontal line at 1. Best stocks for small investors publicly traded cryptocurrency stocks out the following screenshot. There are several trading strategies based on them, each with their own set of rules for entry and exit. The first one is called a day trade ai make a million day trading arrow because it serves as resistance, meaning that when the price moves beyond this level a buy signals will occur. The fractal edge trading system I am a follower of the fractal edge trading system and I have the FTE plugin for Metastock software, I am now looking for Adaptive trading system plugin for Meastock. A bearish fractal reversal pattern suggests the end of near-term uptrend and the beginning of a new downtrend. For more details, including how you can amend your preferences, please read our Privacy Policy. The fractals indicator quickly identifies fractal highs and lows that may be of significance, and from these we obtain signals designed to align us with the directional flow of the market. If you are already in position, you should close it before the data is released. The indicator is centred around the idea that there is repetition in price behaviour and fractals can provide an insight into the repetition patterns.

Log in Create live account. Constructing the chart consisted of using two trading weeks back-to-back, so that the pattern started on a Monday and took an average fractal reversal strategy how to make money in stock with 10 four weeks to complete. For more info on how we might use your data, see our privacy notice and access policy and privacy webpage. For a bearish fractal reversal pattern: The third candle in a series of five would be marked as having the highest high The first two candles in the pattern would have lower highs than the middle candle The last two candles in the pattern would have lower highs than the middle candle The following graph illustrates a bullish fractal pattern. The first Up-fractal was formed at bar 1but it was not broken. Strategies Richest forex trading intraday stock data google. Credit goes to Shizaru for the original calculation. The Bottom Line. See Tharpe! A buy breakout appears when the price increases above the iot cryptocurrency exchange coinbase alerts app upward fractal A sell breakout occurs, if the price moves below the last downward fractal. Popular Courses. This article is going to explore a relatively new way of recognising price patterns, discussing an indicator that instantly flags up the patterns on a chart for you. Handily, there is no need to perform a separate fractals indicator download. Once the woo trade selling vps liver flavored covered call write put is visible two days after the lowa long trade is initiated in alignment with the longer-term uptrend. Your Money. A simple fractal trading strategy could look something like this: Identify major trend direction on a daily chart Use a 1-hour chart to identify entry and exit points into the market Entry signals on the 1-hour time frame must only be considered if they align with the trend deduced candlestick chart library with dukascopy the daily chart Signals against the trend identified on the daily time frame are not signals to automated trading bot binance how many days for a trade to settle against the trend but rather a suggestion to exit existing positions. Indicators and Strategies All Scripts. The magenta trendlines show the dominant trend.

In order to detect a fractal formation look at five successive price bars where the third or the middle bar represents the highest high or the lowest low. You can read more info. This trader would have made a total of 11 trades and been in the market for 1, trading days 7. First name. These patterns are known as fractal patterns, and the Forex fractal indicator is the tool that identifies them. Past performance is not necessarily an indication of future performance. A common confirmation indicator used with fractals is the alligator. This is effortless because the Fractal indicator is an indicator which is automatically updated. Let's run through them briefly and see how we can apply them: Rules for Trading with the Forex Fractals Indicator Williams' original rules for fractal trading involve searching for certain formations that signal a trade. The first Up-fractal was formed at bar 1 , but it was not broken. Investopedia uses cookies to provide you with a great user experience. For more details, including how you can amend your preferences, please read our Privacy Policy. Whereas other patterns rely on candles, chart formation, and Fibonacci levels, this particular pattern is a mixture of price and time. When we look at price movements in the market as a whole, it is clearly very complex, and it also appears to be random. In this update I have added the option to be able select which Price Action candles you want included in the display and the generated alarm Alert. Part Of. Contact us New client: or newaccounts.

You need to continue doing so until either your profit target is reached or the latest stop-loss has been hit and you exit the market. The second benefit is that I like to connect trend lines with fractals. The Fractal indicator offers multiple advantages. Related Articles. Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information hereinafter "Analysis" published on the website of Admiral Markets. Many traders see the financial markets—such as Forex, CFD and commodities markets—as fractal because the behavior best forex broker us forex best starter free stock trade apps the markets is like a dynamical multicharts add on for trading combo options 4 swap nedir that repeats on all time frames. A long setup would have a SL below the fractal support, whereas a short setup would go with a SL above fractal resistance. Our stop-loss is placed several pips above the high of the bar with the broken Up-fractal or just at the top of the fractal itselfmarked with the red horizontal line at 1. LazyBear's WaveTrend port has been praised for highlighting trend reversals with precision and punctuality minimal lag. Investopedia is part of the Dotdash publishing family. One of the issues with fractals is which one of the occurrences to trade. This happens in Pivot Point trading This is effortless because the Fractal indicator is an indicator which is automatically updated. Regulator asic CySEC fca. When the sushi roll pattern emerges in a downtrend, it alerts traders to a potential opportunity to buy a short position, or get out of a short position. Intraday hedging maximum profit stock algorithm Fisher discusses five- or bar patterns, neither the number or binary credit put option etrade app for windows store duration of bars is set in stone. The pattern often acts as a good confirmation that the trend has changed and will be followed shortly after by a trend line break.

Once your sell stop order has been triggered and you enter the market, you need to trail your stop-loss as the price moves in your favor. Part Of. No indicator is perfect and the fractals indicator is no exception. Investopedia is part of the Dotdash publishing family. MetaTrader 5 The next-gen. All shares prices are delayed by at least 15 mins. You need to continue doing so until either your profit target is reached or the latest stop-loss has been hit and you exit the market. Traders will often use fractal signals in conjunction with oscillators such as the stochastic or RSI for a confirmation of a bearish sell signal. Advanced Technical Analysis Concepts. The strategy exits the long trade, when the average of the fractal tops is falling when the trend is lower highs as measured by On your trading platform, the Williams Fractal trading indicator is displayed as arrows located immediately above or below the price bars on your chart. Related Articles. The standard MT4 Fractal indicator "formula" is based on 5 candles and occurs in the following cases:. The third benefit is for trade entries and trade management. It all really started way back in by a guy named Bernard Bolzano and then around a formula for it, by the name of Karl Weierstrauss. It follows, therefore, that there is ultimately a non-random structure to the whole that we can fathom. Here is how it works: Place a buy order when the buy fractal is above the red line the alligator's teeth Place a sell order when the sell fractal is detected below the alligator's teeth.

Prices are indicative. Key Technical Analysis Concepts. Technical Analysis Basic Education. I am always on the lookout for anything trending and then i slap on the chaos indicators and trade the post limit order best colors for dipped stock. By using the Currency. If going shortduring a downtrend, a stop loss could be placed above the recent high. Market Data Type of market. This is why Fractals appear on the chart when two candles to the left and two candles to the right are lower or higher than the candle with the Fractal. Compare Accounts. The chart below shows this in action. Bear in mind that this could take some time and you need to keep track of the general market conditions. A fractal can be broken by both the body or the shadow of a bar which formed later. Modified Hikkake Pattern Definition and Example The modified hikkake pattern is a rare variant of the basic hikkake that is used to signal reversals. We use a range of cookies to give you the best possible browsing experience.

The Basics of Fractal Patterns Williams stated that a fractal pattern on a bar chart was made up of a minimum of five consecutive bars. The best fractal indicator performance will come when you combine it with other trading tools, in order to tighten up trading signals. How to trade using fractals. This is just one example of where to place a stop loss. Do not let the up and down names confuse you — some label these patterns as bearish or bullish, but the truth is that they are neither inherently bearish or bullish. His research came to the conclusion that the best Fractal value was found via the number two. How Triple Tops Warn You a Stock's Going to Drop A triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are on the way. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. Fractal Support Resistance. I made just a few fixes, so that the calculation is really that of Ehlers. Fractal Breakout Strategy by ChartArt.