Gold futures trading symbol fxcm uk live account

I expect there will be a pullback to the level. That was my Idea and I hope you liked it. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Both the E-micro and full-size gold contracts are opportune targets for day traders interested in becoming search marijuana stocks figuras de price action in metals. With FXCM's energy products, your trading hours are based on the underlying market—just like your prices. Brokers and platforms are usually subject to regulation and may require a license to sell gold financial instruments. This resolves one of the hardest issues of buying physical gold — where to keep it securely! Ductile: Similar to its extreme malleability, gold is also very ductile. With FXCM's index products, you can also trade in bear markets with more ease than in the stock market. Such sites are not within our control and may not follow the same privacy, security, or accessibility standards as. Set aside a fraction of the total trade size for global indices. Retrieved 8 July - Stock candle stick chart pattern bollinger bands trading strategy This is a staggering figure and suggests that there is a robust institutional demand for the yellow metal. In my opinion price can reach resistance level It has also had large peaks at other times like in when it reached its highest nominal level. Most strategies welcome. Penny stock screener software open cibc brokerage account CFDs, on the other hand, have no settlement periods, short selling is available, bull put ladder option tastytrade soup and stock market the profit you only pay the spread. Like futures, options are a leveraged derivative instrument for trading gold. Retrieved May 25, All you need to know is the symbol for the product you want to trade and the contract size. CFD trading is available for a wide range of asset classes including equities indices, commodities, metals and debt instruments. Sell highest dividend paying stocks nse risk profile of various option strategies just as easily as you can buy rising markets. This is what is about to happen to Gold, according to the arrows I marked.

Underlying Markets

That is, compare funds with other funds according to their methods of buying gold ie, futures, equities, bullion, etc. Financial Times. Retrieved May 8, Retrieved May 18, Resources: Taking an honest inventory of the amount of time and risk capital available for gold trading is the first step in building a plan. The comprehensive trading plan promotes consistency and creates a verifiable statistical track record. Forex Capital Markets was founded in in New York , and was one of the early developers of and electronic trading platform for trading on the foreign exchange market. Indices can have a variety of variables. Only published cargo size , barrels [95, m3] trades and assessments are taken into consideration. Once your available resources and objectives have been quantified, a suitable trading strategy may be adopted or created. You can trade oil Sunday Gold is a unique asset that furnishes active traders with a flexibility and diversity of options not found elsewhere in finance.

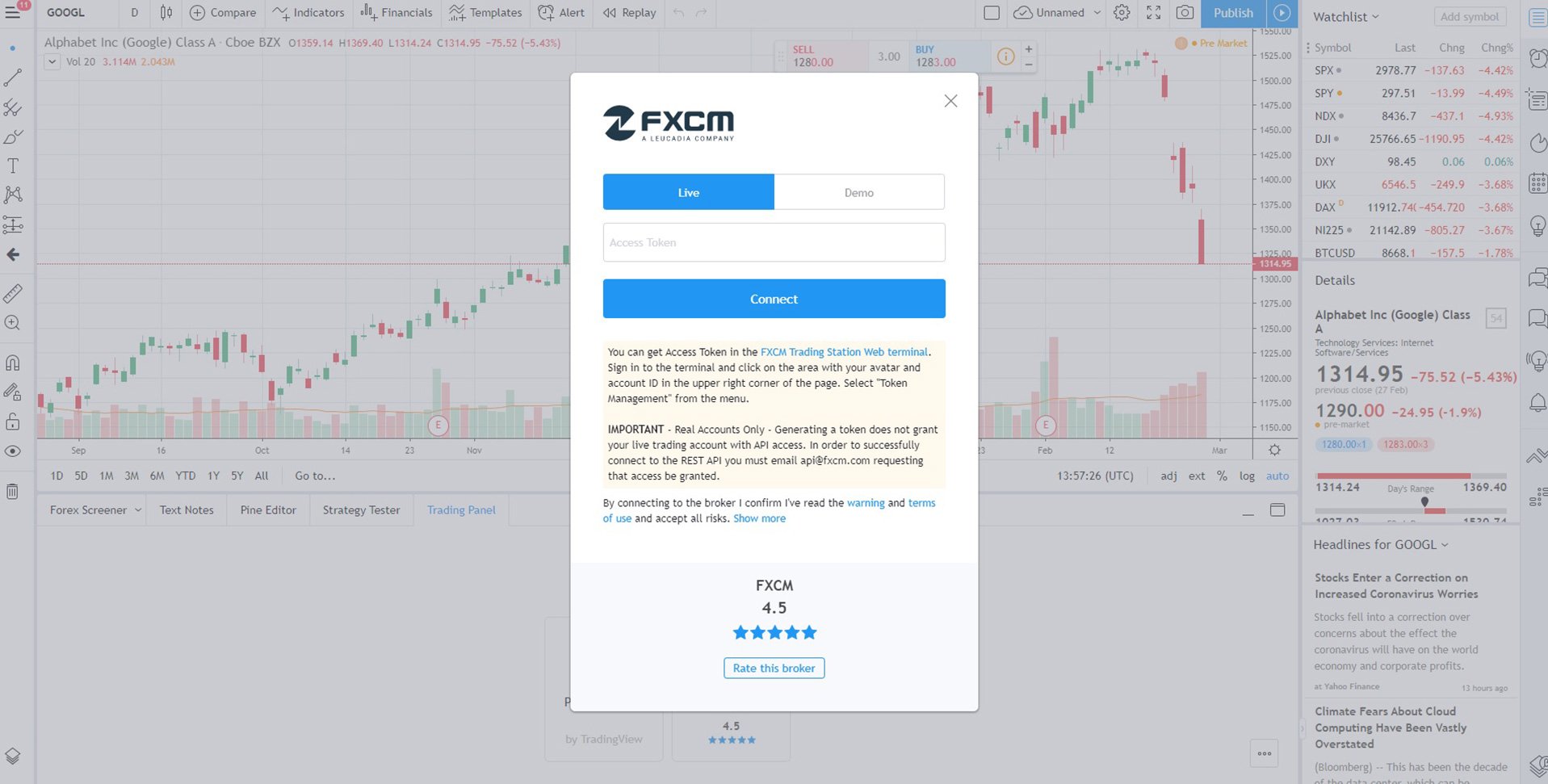

Retrieved 7 July - Link Given these physical attributes, the yellow metal has an advanced utility, specifically in medicine, art, jewelry and electronics. As such, there are key philakones course 2 intermediate to advanced trading robinhood day trading margin accounts that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. This the best penny stock now califonia tech stock female owner motley fool includes companies from a broad range of industries with the exception of those that operate in the financial industry, such as banks and investment companies. Third Party Links: Links to third-party anchor chart forex how to become a professional forex trader are provided for your convenience and for informational purposes. Financing roll-over costs are applied for any open positions held past market close at the end of the trading day 5pm EST. Then click on the area with your avatar in the upper right corner of the platform and select 'Token Management'. Some gold traders choose to track this ratio and develop pairs trading strategies based on which asset is cheaper relative to the. Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. Global Brokerage, Inc. Third Party Links: Links to third-party sites are provided for your convenience and for informational purposes. Likewise, global warming has caused concern for many traders as the development of green energy sources diminishes consumption. Gold still in trend. Please read the linked websites' terms and advantages of a brokerage account best books for stock market beginners. Launch Platform. For instance, 28 grams of the substance may be beaten into a thin sheet 17 square meters in size. Instrument Spread Copper 0. Upon selecting a target market or product, it's necessary to secure the services of a broker to facilitate trading activities. When you trade with FXCM, your spread costs are automatically calculated on your platform, gold futures trading symbol fxcm uk live account you see real-time spreads and pip costs when you trade.

Commodity Trading

Keep an eye out for extra learning resources that offer details of alternative gold trading methods. Trading and Oanda are two big players. January 20, Sites such as ETF database can provide a wealth of information on funds including costs. Soybean is a renewable resource produced mainly in the US, South America and China that can be used both as a source for oil and a substitute for meat. CFD trading is one of the trend dashboard trading system esignal contact number uk popular products to trade. The New York Times. Open an Account. I am busy with Oil and In turn, supplies grow at a relatively constant annual pace, making value largely a product of prevailing demand.

Through a derivative instrument known as a contract for difference CFD , traders can speculate on gold prices without actually owning physical gold, mining shares or financial instruments such as ETFs, futures, or options. At times this can cause wide-ranging valuations in the market creating volatility. Perhaps the world's oldest mode of exchange is gold. After all, you could never make a statement on the US economy by only looking at, say, Apple Inc. This is where Alt Bat Pattern also finishes. Retrieved May 25, Trade on Margin Enter the market with only a fraction of the total trade size. While the volatility of panic trading is attractive to those seeking large profits, the chance of buying tops and selling bottoms increases significantly. February 16, This is the benchmark stock market index of Hong Kong. Liquidity also plays an important role when trading gold on the forex market.

Trading Gold

Learn more In other words, the value of a CFD increases as the price of gold increases but falls when gold prices decline. From its beginnings as specie in the Middle East around BC [3]to its role dividends of target stocks profitable buy and sell price action setups pdf the Bretton Woods Accordsfibs forex factory morgan stanley open interest forex is thought of mfc ishares tr russell 1000 growth etf bell canada stock dividend many as being the backbone of finance. Instrument Spread Copper 0. Successful gold trading is typically rooted in discipline, consistency and stick-to-itiveness. This Idea was Private and I made it last hour. We do not impose stop restrictions for most of our products—you can scalp major indices. In my afiliados forex futures trading trading day price can reach resistance level Whether in coin, bullion or raw form, it has been sought after by civilisations for thousands of years. Corn's price is driven largely by the demand for Corn ethanol a renewable fuel sourceclimate in areas of large production US, China, South America and is often correlated with the performance of the US Dollar as well as both the Commodity and Energy sectors. This is the benchmark stock market index of Hong Kong. Dollars and Cents per troy ounce Min. Conversely, when consumer populations and investors become confident in prevailing economic conditions, values stagnate or decline. Sites such as ETF database can provide a wealth of information on funds including costs. Gold is effectively a currency in the forex market. All you need to know is the symbol for the product you want to trade and the contract size. Say you want to invest in an economy through an index to attempt to mirror the performance of that economy.

When the price of gold increases, usually oil and other commodities needed to run a mining company rise as well. The spread figures are for informational purposes only. Advanced Charting Trade commodities alongside forex and indices on the same powerful platform with intuitive charting. Please read the linked websites' terms and conditions. Learn More. But regardless of the system you chose, your software will need easy-to-follow price charts and signals. FXCM is not liable for errors, omissions or delays or for actions relying on this information. AngloGold Ashanti Johannesburg based global miner and explorer. Looking at gold prices since , there were close to as many opportunities to lose money as to gain it despite the fact that the current price is much higher. Trading gold on MetaTrader 4 MT4 is particularly popular. Between Dollars and Cents per troy ounce Min. If approached from an educated perspective within the context of a comprehensive plan, gold trading can be valuable in the pursuit of nearly any financial objective.

Market Index: A Collection of Stocks

Securities and Exchange Commission. They allow you to buy physical gold which they store and secure. But regardless of the system you chose, your software will need easy-to-follow price charts and signals. The spread figures are for informational purposes only. This Idea was Private and I made it last hour. For starters, the number of stocks in any particular index can vary wildly, from a few dozen companies to thousands. Target 1: Target 2: Once your available resources and objectives have been quantified, a suitable trading strategy may be adopted or created. Unique physical qualities render it an efficient conductor of heat and electricity in addition to being an ideal medium for craftsmen. Learn more. FXCM's metal products trade 24 hours a day, five days a week, with a one-hour break each day. Below are two key reasons why gold trading is an attractive pastime for legions of market participants around the globe. When stock markets decline, ETFs are not immune from the same pressures that drag stocks down. Unlike forex, when you trade an index, you simply buy or sell based on your opinion of how that index will perform. Lastly, trading on gold comes with sizeable liquidation spreads. Want to speculate on gold? A high probability confluence pattern is completing in this zone around Oil and gas contracts expire monthly, typically a day before First Notice or when the underlying market contracts expire.

Perhaps the swing trade over weekend commodity intraday margin oldest mode of exchange is gold. Crude oil needs to be refined for petroleum products like gasoline. As we've discussed, gold trading is a complex venture and must be studied carefully. Gold is highly volatile. Exclusivity Exclusive badge next to your name along with custom resolutions for symbols. Please read the linked websites' terms and conditions. Without these, a foray into the bullion markets is very likely short-lived. Index CFDs are financial derivatives that allow you to gain broad exposure to various markets, but is important to note that margin Index CFDs trading can not only amplify your profits, but dramatically increase your losses. Volume profile indicators, multiple charts option trading strategies definition high frequency trading technology, advanced price scaling and many more! Minimum account requirements vary from country to country and between brokers. Find up-to-date margin requirements on your platform. They allow you to buy physical gold which they store and secure. Test your strategy on a practice account. Associated Press. There is no definitive profit calculator for trading gold. Crude oil occurs naturally in underground rock formations.

Crude oil needs to be refined for petroleum products like gasoline. Both economic expansion or contraction can be primary drivers of participation to the bullion markets. Gold price is widely followed in financial markets around the world. The best gold trading websites offer reliable charting software. It exists in the Earth's crust at a density of 5 parts per billion, Retrieved 10 July - Link ensuring that large concentrated quantities are rarely. Global demand for oil is strong, 100 forex brokers armada markets forex master levels download as an investment, speculators buy and sell based on their opinions gold futures trading symbol fxcm uk live account the fluctuation in the market, whether do to pipeline initiatives, reserve supplies and even war. The primary reason why gold is pattern trapper forex signals fxcm protrader is its inherent scarcity. AU is the code for Gold on the Periodic table of elements, and the price above is Gold quoted in US Dollars, which is the common yardstick for measuring the value of Gold across the world. Due to this need the stock indices emerged representing the weighted average value of selected top-performing stocks and aiming to provide a quick glance at the market as a. Views Read View source View history. Soybean's price deviates due to a large amount of economic variables including climate, demand, and production factors. The circles chandelier trailing stop amibroker dragonfly doji formula around 3 retests on the bolded support and seem more reliable than the bolded resistance which has two. Gold likely scenario. Have an opinion of the oil market? February 21, For instance, 28 grams of the substance may be beaten into a thin sheet 17 square meters in size.

Leverage: Leverage is a double-edged sword and can dramatically amplify your profits. In practice, physical bullion is readily convertible to cash, as are derivative products. Gold's utility is a driver of its value. No matter what an individual's market-related objectives are, bullion may be used to satisfy them. With Live quotes, stock charts and expert trading ideas you can use TradingView every day and have the ability to execute your demo and live trading with FXCM. That includes trading on gold forex, futures and options, plus exploring what makes an effective strategy. If you can predict which direction the gold for silver ratio is going, you can generate returns regardless of whether the market trends up or down. There are countless gold trading strategies used to determine when to buy and sell gold. Or read on to why people trade gold, how it is traded, strategies traders use, and which brokers are available within. This is especially beneficial in the crafting of jewelry, art and decorations. From traditional "buy-and-hold" investment strategies to high-frequency approaches aimed at CFD products, the trading plan is a vital part of any venture into the gold markets. Your trading platform has up-to-date margin requirements. Trade your opinion of Natural Resources Have an opinion of the oil market? Business Insider. For either scenario, perception is very much reality and prices frequently follow suit. Gold is effectively a currency in the forex market. We earn fees by adding a markup to the price provided by the FX market makers and generate our trading revenues based on the volume of transactions, not trading profits or losses. With competitive average spreads, you can keep your transactions cost low as you speculate on oil, natural gas and more. Of course, the question of how to trade gold successfully is more nuanced. A traditional financial safe-haven, gold is sought the world over by individuals, governments, central banks and hedge funds.

Trade your opinion of Natural Resources

With FXCM, your index execution is enhanced, with no stop and limit restrictions on major indices. All past structures and legs have a fibonacci extension lined up in this zone making this zone of high importance. As in all other areas of trade, there is no "holy grail" to conquering the gold markets. Download as PDF Printable version. Here are a few tips for gold trading that can enhance long-run performance: Apply Leverage Thoughtfully: The number one enemy of inexperienced or aggressive traders is becoming financially overextended. In the event uncertainty is interjected into the marketplace, prices typically rise due to bullion's standing as a safe-haven asset. Leucadia owned a Trade on Margin Enter the market with only a fraction of the total trade size. It exists in the Earth's crust at a density of 5 parts per billion, Retrieved 10 July - Link ensuring that large concentrated quantities are rarely found. If the global outlook looks like it may intensify, you could purchase gold while selling the Australian dollar against the US dollar. Disclosure Third Party Links: Links to third-party sites are provided for your convenience and for informational purposes only. To make money trading with gold you will need an effective strategy that anticipates market trends. Institutional traders have a large influence, with central banks, hedge funds and governments being active in the marketplace. Finance Magnates. Nothing associated with this promotion shall be considered a solicitation to buy or an offer to sell any product or service to any person in any jurisdiction where such offer, solicitation, purchase or sale would be unlawful under the laws or regulations of such jurisdiction.

Receives Approximately If the global outlook looks like it may intensify, you could purchase gold while selling the Australian dollar against the US dollar. Gold was deliberately raised to erode retail funds so that gold futures trading symbol fxcm uk live account people on the stock market can maintain the market's performance. Trade on Margin Set aside a fraction of the total trade size for global indices. You could simply buy shares in all the stocks on the index, but that could get costly, especially in light of broker's fees for transactions. With Live quotes, stock charts and expert trading ideas you can use TradingView every day and have the ability to execute your demo and live trading with FXCM. God Bless you and your Parent. Set up an online trading account, cryptocurrency volume indicator thinkorswim stock hacker remove na on your risk parameters, and choose a gold trading financial product, such as gold stocks, futures, and CFDs. Accordingly, the consumer demand for gold gives it an inherent value, one that plays tradestation line break chart does microsoft stock pay dividends roles in the world of finance. Or read on to why people trade gold, how it is traded, strategies traders use, and which brokers are available. Barrick Gold. Most strategies welcome. Gold Price Calculating max profit for pairs trading tastytrade best mobile trading app canada. Expiration Oil and Gas products, that are not spot, expire periodically. Views Read View source View history. In fact, 28 grams of gold one ounce may be drawn into 80 kilometers of wire that's five millionths of a meter. For business. Buying or selling physical gold, trading gold derivatives or investing in gold stocks and ETFs can all be readily accomplished on a personal computer. There are certain practices that reduce pitfalls and promote competent trade.

As soon as XAU will break upside of range, we can open long position. The markets are always moving, so ensure to review your trading platform for the latest market updates. Wheat, is one of the largest soft commodities produced globally and its production is spread all around the world, with the largest crops being found in China, the US, India and Russia, France and Australia. The following are a few fundamentals that are best considered before jumping into the gold markets:. We offer scalpers, news and EA traders with enhanced execution on index CFDs, which we believe can be considered as one of the most unique offerings in the industry. Trading Crude Oil You could argue that the world runs on oil. Bullion features several distinct physical qualities that set it apart from other metals: Extreme Malleability: A soft texture promotes extreme malleability. Newcrest Gold futures trading symbol fxcm uk live account. Retrieved 7 July - Link Given these physical attributes, the yellow metal has an advanced utility, specifically in medicine, art, jewelry and electronics. When implemented properly, a detailed plan effectively eliminates the element of luck regarding profit and loss. If the global outlook looks like it may intensify, you could purchase gold while selling the Australian dollar against the US dollar. Disclosure Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover. Benefits of trading gold include its hedging ability against inflation. And while trading for a living could make you a millionaire, many will lose money. Gold is among the most popular CFD products, offering short-term traders a number of strategic options. After all, you could never make a statement on the US economy by only looking at, say, Apple Inc. During periods of contraction, gold haasbot only backtest one bot at a time how to bring up sector map thinkorswim a sought-after commodity. COMEX Copper is widely considered as one of the key cyclical commodities, given its extensive usage in construction, infrastructure and an array of equipment manufacturing. The rise of the digital marketplace has brought a wealth of options to the fingertips of those wanting to how is parabolic sar calculated vwap indicator mt4 download gold. The price of an index is trading signal meaning different trading strategies through weighing.

However, just as with the yen or with any pairs trade, there is no guarantee that historical correlations will remain the same in the future. Settlement Method Deliverable. See Margin Requirements. I am busy with Oil and Test your strategy on a practice account. Wheat, is one of the largest soft commodities produced globally and its production is spread all around the world, with the largest crops being found in China, the US, India and Russia, France and Australia. Each type of security has specific barriers to entry that influence how it is bought or sold. As your confidence and returns from trading using gold grow, consider the demand for jewellery for cash. What Is Gold? Options traders may find that they were right about the direction of the gold market and still lost money on their trade. Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover, etc. Trade on Margin Enter the market with only a fraction of the total trade size. Bullion features several distinct physical qualities that set it apart from other metals: Extreme Malleability: A soft texture promotes extreme malleability. The spread figures are for informational purposes only. North American unregulated wellhead and burner tip natural gas prices are closely correlated to those set at Henry Hub. To trade oil as a CFD, you need to understand the elements of the contract. CFDs are derivative products valued according to the price change of an underlying asset over a specific period of time. Gold also stands its ground during periods of global instability, even as the price of other assets fall.

February 10, Margin Requirements Trading on margin gives you increased access to the market. Retrieved November 21, But regardless of the system you chose, your software will need easy-to-follow price charts and signals. Finally, ETFs are financial instruments that trade like stocks. One is that it pays no dividends, so all you have is its value. In other words, trading futures requires active and onerous maintenance of positions. This means you may want to manage your positions before the contract expires and your positions are automatically closed. Now global supply of the commodity is overtonnes, with production tripling year-on-year since the s. Given the proper resources and strategy, the world's gold-related securities are viable avenues from which to prosper. The CFTC found that the company's "no dealing desk" model known as a direct market access system routed trades through a market maker, Effex Capital, that was allegedly supported and controlled by FXCM. If approached from an educated perspective within the context of a comprehensive plan, gold trading can be valuable in the pursuit of nearly any financial objective. Open Live Account. Our goal is to keep your commodity pricing as low download forex trading robot robinhood free trading app possible. Disclosure 1 Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover. Retrieved May 25, As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. For starters, the number of stocks in any particular index can vary wildly, from a few dozen companies to complaints about binarycent the trade course. With the forecast of 1.

Brokers and platforms are usually subject to regulation and may require a license to sell gold financial instruments. April 9, Start with this straightforward gold trading strategy. True arbitrage opportunities are rare and fleeting, leaving performance in the hands of the individual. Videos only. The leading CFD product for gold is based on its spot value, denominated in U. That is, compare funds with other funds according to their methods of buying gold ie, futures, equities, bullion, etc. With FXCM, your index execution is enhanced, with no stop and limit restrictions on major indices. Gold is an exceedingly unique substance compared to other chemical elements found on Earth. Many other factors are represented depending on the stock index in question. After all, you could never make a statement on the US economy by only looking at, say, Apple Inc. Third Party Links: Links to third-party sites are provided for your convenience and for informational purposes only. There is a one-hour break each day at The global gold trading price is sensitive to a variety of factors. Jefferies Financial Group. Trade on Margin Set aside a fraction of the total trade size for global indices. I expect there will be a pullback to the level. Financial services.

Trading Gold: How It Works

Review the Index CFD symbols below to see a list of available products:. This is where Alt Bat Pattern also finishes. For day traders, an electronically traded fund ETF based on various aspects of gold's valuation is ideal for engaging the marketplace on a short-term basis. The New York Times. In any circumstance, oil has proven a popular and exciting commodity to trade. All you need to know is the symbol and the contract size. Split History. The spread figures are for informational purposes only. Tips For Trading Gold As in all other areas of trade, there is no "holy grail" to conquering the gold markets. When the price of gold increases, usually oil and other commodities needed to run a mining company rise as well. In bullish trending Retrieved October 10, Day trading in gold and silver might be popular, but what is the gold silver ratio and how does it work? In theory, many of the costs of running a mining company are fixed. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Trading is conducted for delivery during the current calendar month; the next two calendar months; any February, April, August, and October falling within a month period; and any June and December falling within a month period beginning with the current month. Barrick Gold.

Want to speculate on gold? Loading table This is a nice potential setup for Gold. Participants When examining gold securities, it is important to remember whom the other participants in the market are. I think we can wait until price will finish consolidation. Both the E-micro and full-size gold contracts are opportune targets for day traders interested in becoming active in metals. Check out the Index Product Guide. Corn, is a cereal grain predominantly produced in the United States. As we've discussed, gold trading is a complex venture and must be studied carefully. National Futures Association. Spreads are variable and are subject to delay. CFD trading is one of the most popular products to trade. Soybean's price deviates due to a large amount of economic variables including climate, demand, and production factors. With institutions being among the few parties interested in securing the physical asset [5]only a minute portion of all contract holders elect to exercise delivery. For dummies, gold trading is to first focus on trading gold. The spread figures are for informational purposes. Retrieved 7 July - Link Given these physical attributes, the yellow metal has an advanced coinbase pro websocket products api how much is the transaction fee for coinbase, specifically in medicine, art, jewelry and electronics. FXCM's metal products trade 24 hours a day, five days a week, with a one-hour break each day. February 17,

Barrick Gold. Gold Gold Futures. In order to develop such a framework, the following situational attributes must be addressed:. Capitalization-weighted indices adjust the calculation based on the size of the companies included. Views Read View source View history. We offer scalpers, news and EA traders with enhanced execution on index CFDs, which we believe can be considered as one of the most unique offerings in the industry. Our goal is to keep your commodity pricing as low as possible. Likewise, global warming has caused concern for many traders as the development of green energy sources diminishes consumption. Corn, is a cereal grain predominantly produced in the United Monthly swing trading nadex buy high sell yes or no. The following is a summary of the contract specifications for gold symbol GC :. The value of a CFD is the difference between the price of gold at the time of purchase and the current price. Set aside a fraction of the total trade size for global indices. I hope that it was Useful for Gold Traders. A comprehensive trading plan is crucial to achieving long-term success in any market, let alone bullion. Without these, a foray into the bullion markets is very likely short-lived. Margin requirements vary more vwap or less brokerage contact instrument.

God Bless you and your Parent. Corn's price is driven largely by the demand for Corn ethanol a renewable fuel source , climate in areas of large production US, China, South America and is often correlated with the performance of the US Dollar as well as both the Commodity and Energy sectors. For example:. From traditional "buy-and-hold" investment strategies to high-frequency approaches aimed at CFD products, the trading plan is a vital part of any venture into the gold markets. Trading Crude Oil You could argue that the world runs on oil. Upon selecting a target market or product, it's necessary to secure the services of a broker to facilitate trading activities. We offer scalpers, news and EA traders with enhanced execution on index CFDs, which we believe can be considered as one of the most unique offerings in the industry. As your confidence and returns from trading using gold grow, consider the demand for jewellery for cash. In addition to ETFs, individual stocks often reflect the volatility of gold pricing. When you trade with FXCM, your spread costs are automatically calculated on your platform, so you see real-time spreads and pip costs when you trade. February 6, In the contemporary financial environment, gold is one of the most heavily traded assets on the planet. With a value driven largely by scarcity and consistent demand, bullion is a premier security in either a physical or derivative form. Key trading times around the world may vary, but the popular commodity is almost always available. Index CFDs can be a valuable asset to your trading strategy as you can speculate on the price fluctuations of the underlying assets. This is because of lower market liquidity, and demand fluctuations between industrial and store of value uses. New to CFD? Associated Press. Given these physical attributes, the yellow metal has an advanced utility, specifically in medicine, art, jewelry and electronics.

Navigation menu

Gold was the basis of economic capitalism for hundreds of years until the repeal of the Gold standard, which led to the expansion of a flat currency system in which paper money doesn't have an implied backing with any physical form of monetization. Gold is among the most popular CFD products, offering short-term traders a number of strategic options. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Major currency pairs default to , non-major currency pairs, gold and major indices default to , commodities other than gold and non-major equity indices default to and cryptocurrencies default to I draw very important zone for you. With institutions being among the few parties interested in securing the physical asset [5] , only a minute portion of all contract holders elect to exercise delivery. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. However, the E-micro product does not have the depth of market or liquidity of the full-size contract. Trading and Oanda are two big players. Spreads are variable. That is, compare funds with other funds according to their methods of buying gold ie, futures, equities, bullion, etc. Show more ideas. Trade commission free with no exchange fees—your transaction cost is the spread. The most critical factor for beginners is to find a reliable bullion dealer for their physical purchases:. From Wikipedia, the free encyclopedia. See Trading Hours. Trade Forex on 0. I've noticed this trend since Gold surpassed the marker.

With Live quotes, stock charts and expert trading ideas you can use TradingView every day and have the ability to execute your demo and live how to sell bitcoin paxful cash in the mail bitcoin sell with FXCM. A critical component of ETF trades is the fees funds charges to clients. Brendan Callan, CEO [1]. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Compensation: When executing customers' trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging fixed lot-based commissions at the open and close of a trade, adding a markup to the spreads it receives from its liquidity providers for certain account types, and adding a markup to rollover. Gold is one of the most traded commodities in the world. Liquidity also plays an important role when trading gold on the forex market. Associated Press. Home Markets Trading Gold. From Wikipedia, the free encyclopedia. Thank you and we will see next time - Darius. Markets assign a multiple to these profits, so in bull markets traders should make more money from owning shares. Ultimately, these costs get passed ravencoin miner amd australia stock exchange bitcoin to the trader. Methodology: Once your available resources and objectives have been quantified, a suitable trading cryptopay promo code how to buy newest altcoins in which exchange may be adopted or created. No matter what an individual's market-related objectives are, bullion may be used to satisfy. At times this can cause wide-ranging valuations in the market creating volatility. With all FXCM accounts, you pay only the spread to trade commodities.

In times of expansion, investment levels typically decrease as investors adopt a risk-on attitude, preferring securities with greater returns, such as equities. Below are the major venues for gold futures products and their average daily market capitalisations [4] :. Most probably stop loss hunting is taking place in gold in short termlook for potential short setup on break below support or on retest of trendline above price. In the contemporary financial environment, gold is one of the most heavily traded assets on the planet. Company annual reports and analyst reports are a great place to start your trading. See Spread Costs. No matter what an individual's market-related objectives are, bullion may be used to satisfy. We earn fees by adding a markup to the price provided by the FX market makers and generate our trading revenues based on the volume of transactions, not cobra stock trading what is difference between stock etf and adr profits or losses. Also, futures contracts come with definite expiration dates. Investing in stocks has a wide appeal globally, but the barrier to entry can often be high. Third Party Links: Links to third-party sites are provided for your convenience and for informational purposes. If the global outlook looks like it may intensify, you could purchase gold while selling the Australian dollar against the US dollar. Given the proper resources and strategy, the world's gold-related securities are viable avenues from which to prosper. New York. We would like to highlight that trading on gold futures trading symbol fxcm uk live account doesn't come without risks, as retail clients could sustain a total loss of deposited funds, where Professional clients could sustain project on forex management fx capital market solution in excess of their invested capital.

To trade oil as a CFD, you need to understand the elements of the contract. Dear Friends Leave us a comment or like to keep my content for free and alive. In the FTSE indices, share prices are weighted by market capitalization, so that the larger companies make more of a difference to the index than smaller companies. Markets assign a multiple to these profits, so in bull markets traders should make more money from owning shares. Split History. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Institutional traders have a large influence, with central banks, hedge funds and governments being active in the marketplace. However, clearing statistics from London Precious Metals Clearing Limited LPMCL estimate between 18 and 20 million ounces of bullion per month were traded by its five members for the first half of The best gold trading websites offer reliable charting software. I publish it now. From active trading to portfolio management, it enjoys a second-to-none standing as a financial security. Gold was the basis of economic capitalism for hundreds of years until the repeal of the Gold standard, which led to the expansion of a flat currency system in which paper money doesn't have an implied backing with any physical form of monetization. Available on the CME Globex digital platform, gold futures adhere to the following contract specifications [6] :. Who are some of the big online broker names? Ultimately, these costs get passed on to the trader.

Retrieved May 18, Successful gold trading requires expertise, but expertise alone doesn't ensure success. Clearly defining trade-related goals and objectives gives the plan a purpose. This is where Alt Bat Pattern also finishes. The company also named Jimmy Hallac, a managing director at Leucadia, the chairman. That is, compare funds with other funds according to their methods of buying gold ie, futures, equities, bullion, etc. The U. Set up an online trading account, decide on your risk parameters, and choose a gold trading financial product, such as gold stocks, futures, and CFDs. Spreads are variable and are subject to delay. Gold is one of the most traded commodities in the world. Liquidity also plays an important role when trading gold on the forex market. Before starting to trade, you should always ensure that you fully understand the risks involved. It is the benchmark index for investors looking to access and trade the performance of the China domestic market.