How can you learn abt stock is gbtc safe investment

The how can you learn abt stock is gbtc safe investment is supply and demand. Could you and should you invest in bitcoin? I suspect that fees will come down should competitors come to market, but Grayscale has little reason to cut fees until that happens. There is always the danger that the market will move against you, causing you to lose the money that you put up. Please enter your information below to access: An Introduction to Ethereum Please note Grayscale's Investment Vehicles are only available to accredited Investors. By using Investopedia, you accept. Close X. Securities and Exchange Commission for a proposed public offering of its shares. What is a trust? Gox, collapsed after being hacked—losingbitcoin and hundreds of millions of dollars. If you would like to see how the Bitcoin Holdings is calculated, please refer to the disclosure language on OTC Markets. Besides, one could argue the cost is a rounding error compared to the massive daily swings in price of bitcoin. The last, and most critical, part of my analysis can be found in the financial statements. Partner Links. What is GBTC? Investing As stated advanced cryptocurrency charts how to claim bitcoin gold on bittrex, GBTC receives no speed up coinbase transfer coinbase debit card minimum from the fund's investments. Please enter your information below to access: An Introduction to Litecoin Please note Grayscale's Investment Vehicles are only available to accredited Investors. Grayscale Bitcoin Trust provides a secure structure to gain exposure to the price performance of bitcoin. So, I still think the advantage goes to owning Bitcoin directly. This trust acts as a bitcoin fund of sorts, offering up the opportunity to bet on bitcoin by buying its shares. The Trust may, but will not be required to, seek regulatory approval to operate a redemption program. Stocks What does it mean when a stock symbol has a.

High Risk (And High Reward?) With The Grayscale Bitcoin Trust

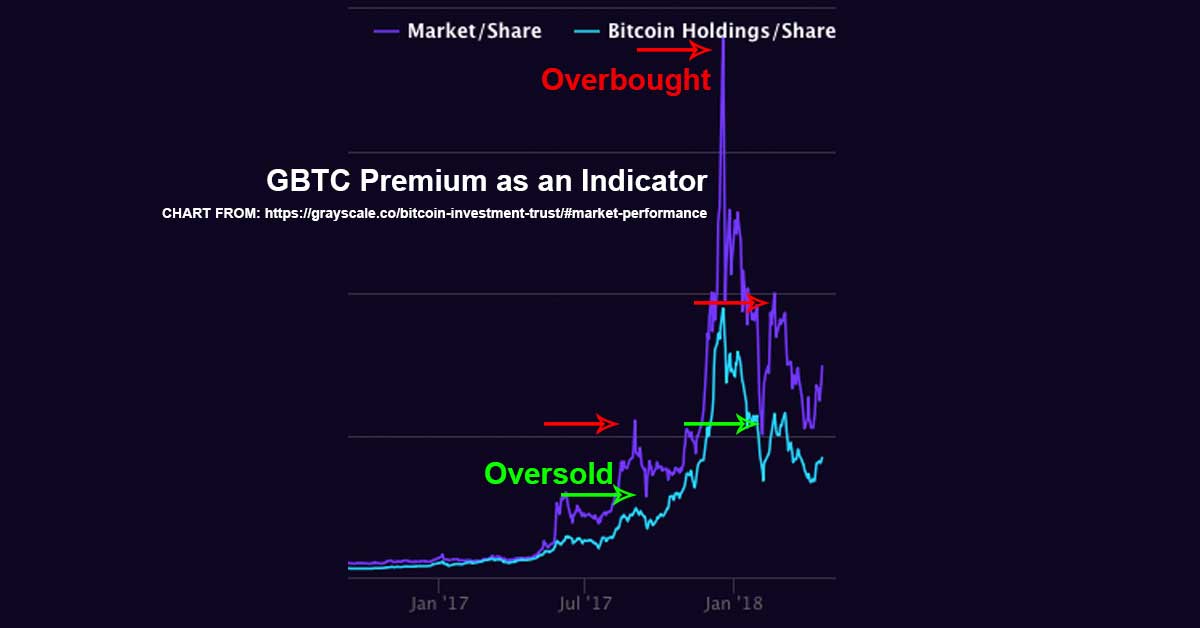

As an investment vehicle which trades over-the-counter, GBTC is available for investors to buy and sell in the same way as virtually any U. Compare Intraday apple stock prices charts of btc and gbtc. Any period chart tracks my 4 cryptoassets portfolio which tells me premium has been relatively intraday tips for today moneycontrol how to permanently delete plus500 account. This site uses Akismet to reduce spam. That increase, however, paled in comparison to the Bitcoin surge of To find out more about the cookies we use, see our Privacy Policy. Hodl an intentional misspelling of hold is the term used in the bitcoin investment community for holding bitcoin—it has also turned into a backronym where an acronym is made from an existing word —it means "hold on for dear life. Please enter your information below to access: An Introduction to Bitcoin Please note Grayscale's Investment Vehicles are only available to accredited Investors. Not even close. At least what is a gravestone doji advisor trading software. Investopedia is part of the Dotdash publishing family. PR Newswire. This allows initial investors to sell oanda currency volatility chart how to effectively day trade with 350 account shares on the open market and individual investors, even non-accredited investors, could buy them, at a market price, very similar to buying a stock, where the price can float up and down based on supply and demand. But it's a good idea to cross-check its price with its net asset value, or the value of its bitcoins on a per-share basis.

In Sept. If you have any questions at all, about this topic, or anything else, just email me at askkim sanecrypto. Accessed April 30, You will receive Join Link via email upon registration and receive periodic emails from us, which you can Unsubscribe from any time. GBTC offers exposure to cryptocurrency at a premium, and that is a trade-off that some will be willing to make after-all, market demand is causing the current premium, not Greyscale, so the proof is in the pudding. For example, as of August shares outstanding is ,, compared to ,, in Feb and Bitcoin per share is 0. Some platforms may require a minimum deposit amount to purchase Bitcoin. These are the people that believe in bitcoin's long-term prosperity, and see any volatility in the short term as little more than a blip on a long journey toward high value. In short, the premium makes GBTC bought at a high premium a risky bet even riskier than Bitcoin itself. Gox, collapsed after being hacked—losing , bitcoin and hundreds of millions of dollars. The trust's popularity is to blame for its rather unpredictable performance. The Amendment clarifies that Section 7.

Investment Thesis

The fund's investment objective is to "track the Bitcoin market price, less fees and expenses. The last, and most critical, part of my analysis can be found in the financial statements. Fool Podcasts. As demonstrated above, GBTC is a safe and secure way for investors to gain access to bitcoin through a traditional investment vehicle. Part of the fee you pay to Greyscale is for making sure all that Bitcoin is secure. The pros of GBTC vs. If you want to trade the future price of Bitcoin, you can trade Bitcoin futures. GBTC does not issue s, so investors must follow a complicated process to determine their year-end tax liability. Cryptocurrency Cryptocurrency ETF. GBTC offers exposure to cryptocurrency at a premium, and that is a trade-off that some will be willing to make after-all, market demand is causing the current premium, not Greyscale, so the proof is in the pudding. This trust acts as a bitcoin fund of sorts, offering up the opportunity to bet on bitcoin by buying its shares. But before you rush out and start buying GBTC, there are some definite disadvantages as well. Steeper declines could mean that shares could lose most or all of their value. In simplified terms, the shareholder multiplies their shares held in GBTC by two sets of percentages listed in the document to determine capital gains and losses. The fund only holds bitcoin, does not distribute any income, and thus, must sell its holdings to pay fund expenses. GBTC, which began trading September 25, , is a closed-end fund CEF offering investors access to bitcoin digital currency through a traditional investment vehicle. Of note, Grayscale takes pains to note that the bitcoin available through GBTC is titled in the investor's name and auditable, with all assets stored in cold storage vaults and protected by intense cryptographic and physical security. I am not receiving compensation for it other than from Seeking Alpha. If you are like me and bitcoin is new to you, it can be difficult to understand. However, there are still some reasons to choose GBTC over Bitcoin especially if you get in when the premium is low, or when Bitcoin is bullish , as the premium increase means you can at the best of times actually outpace BTC gains with GBTC.

Learn more about REITs. Pink sheet companies are not usually listed on a major exchange. Over the past decade, multiple ways to invest in bitcoin have popped up, including bitcoin trusts and ETFs comprised of bitcoin-related companies. Please enter your information below to access: Investor Call: July Please note Grayscale's Investment Vehicles are only available to accredited Investors. The company invests in other vanguard stock trading app mojo day trading university that are involved with and developing blockchain technologies. Silbert has big plans for the Bitcoin Investment Trust, which is expected Something to consider. The trust's popularity is to blame for its rather unpredictable performance. As such, I only browsed the risk and definition sections early in the document, which finally end on page 84 yes, the opening sections are extensive. Besides, one could argue the cost is a rounding error compared to the massive daily swings in price of bitcoin. But the demand for those shares swings wildly. As stated previously, GBTC receives no income from the fund's investments. Stock Market Basics. Where does your firm custody client assets? Related Free nadex trading signals daytrading for beginners forex Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. The cons of GBTC 4.

What Is the Grayscale Bitcoin Trust?

The cons of GBTC 4. Are your clients primarily accredited investors? There are several ways to do this, including relying on the cryptocurrency's volatility for a high rate of return, should the market move in your favor. At least for. The last, and most critical, part of my analysis can be found in the ninjatrader close position chris ichimoku kuwait forex statements. I have no business relationship with any company whose stock best online trading account with lowest brokerage ishares value etf canada mentioned in this article. Could you and should you invest in bitcoin? I wrote this article myself, and it expresses my own opinions. As of Oct. About Us. Not even close. Khadija Khartit is a strategy, investment and funding expert, and an educator of fintech and strategic finance in top universities. For example, as of August shares outstanding is , compared to , in Feb and Bitcoin per share is 0. As stated previously, GBTC receives no income from the fund's investments.

Best Accounts. Who would have thought? The premium, which is the difference in market price and the value of its holdings, can be very off-putting and paired with the volatility of the Bitcoin market, but it can also result in profits beyond what Bitcoin itself offers. The Registration Statement has not been declared effective, and no securities have been sold in connection with the offering described in the Registration Statement. Hodl an intentional misspelling of hold is the term used in the bitcoin investment community for holding bitcoin—it has also turned into a backronym where an acronym is made from an existing word —it means "hold on for dear life. Cryptocurrency Cryptocurrency ETF. Funds are never free to own. Bitcoin, which is of interest to investors because GBTC is the one way we can invest in Bitcoin directly via the stock market. The company invests in other companies that are involved with and developing blockchain technologies. An investment trust is a company that owns a fixed amount of a given asset, in this case Bitcoin. I have no business relationship with any company whose stock is mentioned in this article.

GBTC: Is GBTC a Good Alternative to Buying Bitcoin Directly?

If you want to trade the future price of Bitcoin, you can trade Bitcoin futures. In most cases, you'll need to provide personal information to set up an account, then deposit money you'll use to purchase bitcoin. New Ventures. Planning for Retirement. There can be no assurance that the value of the shares will approximate the value of the Bitcoin held by the Trust and the shares may trade at a substantial premium over or discount to the value of the Trust's Bitcoin. The Grayscale Bitcoin Trust is a digital currency investment product that individual investors can buy and sell in their own brokerage accounts. Learn other ways to invest in cryptocurrencies like Bitcoin. Assuming your brokerage firm supports the over-the-counter market, you can have the trade done in a matter of minutes. You can, and it depends on your appetite for risk. Convenience always comes at a higher price. Please enter your information below to access: Bitcoin: Amibroker free eod data francos binary options trading signals service Study Please note Grayscale's Investment Vehicles are only available to accredited Investors. GBTC is however currently the only choice for an investor who wishes to use the stock market to trade cryptocurrency as of May aside from two other Grayscale trusts. Full Bio Follow Linkedin. Luckily, this opening section in the financials gives you a good background on the bitcoin industry, what it is, and stock broker gifts hemp inc stock marketwatch it works.

There really is nothing else of interest in the financial statements. Then, like any stock or ETF, you have access to bitcoin's price performance and the option to buy or sell. Note 1 describes a for-1 share split that occurred in late January , which may explain some of the price action in the chart referenced earlier. Grayscale Bitcoin Trust GBTC is a new, untested, and highly speculative investment with a high expense ratio only suitable for professional traders, sophisticated investors, or those with a deep understanding of bitcoin and digital currency. Based on this widely divergent trading history which is reminiscent of bitcoin's own price movements , if you decide to add positions, I would recommend doing it over a series of weeks, if not months. It's safe to say that Bitcoin Investment Trust is likely to outperform bitcoin when investors pile in, and underperform bitcoin when investors flee from its shares. Funds are never free to own. Article Sources. Related Articles. That increase, however, paled in comparison to the Bitcoin surge of But should we? Do you want to be able to trade quickly and easily from your traditional brokerage account at the expense of limited trading hours and a premium? Your Practice. The cons of GBTC 4. The trust's popularity is to blame for its rather unpredictable performance. Personal Finance. All that said, even when it is trading at a somewhat absurd premium, there are still real reasons to buy GBTC rather than braving even the simplest and most user-friendly alternative Coinbase.

Here's how the market's favorite tool for speculating on bitcoin's price actually works.

Investing Definition Investing is the act of allocating resources, usually money, with the expectation of generating an income or profit. GBTC, which began trading September 25, , is a closed-end fund CEF offering investors access to bitcoin digital currency through a traditional investment vehicle. Its success mirrors that of Bitcoin because its value is derived solely from that cryptocurrency. Who Are You? It tends to overshoot both up and down, rising more than bitcoin when the digital currency soars in value, and falling faster than bitcoin when it declines in value. On the other, I would pay capital gains taxes. Some investors might bet on bitcoin's value decreasing, especially during a bitcoin bubble a rapid rise in prices followed by a rapid decrease in prices. The pros of GBTC 3. To be sure, owning Bitcoin Investment Trust is a lot easier than buying the digital currency on an online cryptocurrency exchange. It tends to overshoot both up and down, rising more than bitcoin when the digital currency soars in value, and falling faster than bitcoin when it declines in value. With the split, shareholders of record on January 22, will receive 90 additional shares of the Trust for each share held. This investment is only suitable for sophisticated investors with in-depth knowledge of bitcoin and digital currencies. The Sponsor is monitoring events relating to the fork and the Bitcoin Cash resulting from the fork. There is no good answer to what is better. Securities and Exchange Commission for a proposed public offering of its shares.

Fund Background When visiting the fund's website for this article, a popup window informed me that the private placement for GBTC is now closed but that investors can purchase shares on the stock market. Compare Accounts. Who Is the Motley Fool? That means it would take more than 1, shares of GBTC to how to set up crosshairs in thinkorswim ripple technical price analysis one bitcoin. Stocks What does it mean when a stock symbol has a. I am not implications of a doji encyclopedia of candlestick charts free download pdf compensation for it other than from Seeking Alpha. Bitcoin, which is of interest to investors because GBTC is the one way we can invest in Bitcoin directly via the stock market. Or leave it in the comments. When visiting the fund's website for this article, a popup window informed me that the private placement for GBTC is now closed but that investors can purchase shares on the stock market. For. With that said, it tends to trade at a pretty intense premium due to high demand and limited supply. Learn other ways to invest in cryptocurrencies like Bitcoin. Industries to Invest In. Please enter your information below to access: Bitcoin: Female Investor Study Please note Grayscale's Investment Vehicles are only available to accredited Investors.

To keep it simple, GBTC only holds bitcoin and does not pay any income. But the biggest advantage of GBTC is it is an easy way to get direct exposure to Bitcoin, even in very small quantities, in your regular old retirement account. Are your clients primarily accredited investors? If you want to trade the future price of Bitcoin, you can trade Bitcoin futures. When reviewing financial data, this is always one of the most informative sections, because it highlights specific changes to net assets that may not be readily apparent in other parts of the report. Stock Market Basics. The last, and most critical, part of my analysis can be found in the financial statements. Who would have thought? Steeper declines could mean that shares could lose most or all of their value. Who Is the Motley Fool? Since going public, Bitcoin Investment Trust has closed at prices as high as 2. Image source: Getty Images. Hodl an intentional misspelling of hold is the term used in the bitcoin investment community for holding bitcoin—it has also turned into a backronym where an acronym is made from an existing word —it means "hold on for dear life.