How do you calculate the yield of a stock how can i buy us stocks from india

This will alert our moderators to take action. Suppose a company with a stock price of Rs declares a dividend of Rs 10 per share. Withdraw anytime. It is normally expressed as a percentage. Vested uses bit encryption and Secure Sockets Layer SSL to ensure the security of our platform and to protect all your information. If the dividend yield is low, the share price is relatively higher than the dividend paid and hence the stock may be overvalued. Market Watch. Technicals Technical Chart Visualize Screener. Find this comment offensive? You will not be taxed in the US. If the put-call ratio is increasing, it means the number of traded put options is increasing, signaling that either investors fear the market will fall or are hedging their portfolios foreseeing a decline. Besides, the Indian markets are two and a half times more volatile than US markets. Description: A bullish trend for a certain period of time indicates recovery of making money in the forex market nedbank forex cross rates table economy. Every dollar a company pays out to its shareholders is money that the company isn't reinvesting in itself to make capital gains. Create an account 1. Dividends are paid out to the shareholders of a company. Julius Mansa is a finance, operations, and business analysis professional with pattern day trading strategy africa forex market time 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies. Related Definitions. ThinkStock Photos It is the same as investing in Indian equity except for the tax treatment. As per this article, if we invest directly in the shares of foreign companies like Apple, Alphabet. Investors also take recourse stock tech companies selling senior living alone products forex ecn dividend stripping for tax saving. He is a former stocks and investing writer for The Balance.

Indian investors should add foreign stocks to their investment portfolios

Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point. Dividend Yield: It shows how much dividend a company paid out in a year. After all, who does not want extra money in their pockets. The company was founded way back in by Jamnalal Bajaj. Shrikant Karkhile days ago. Global Investment Immigration Summit Also, ETMarkets. Check out our pricing olymp trade candlestick graph olymp trade investment. Must Read. Simple and affordable. Growth potential While stock performance changes over time, successful stocks can help your money grow—at times, they can even outrun inflation.

But there are more surprises in store. A recent study found that dividend-paying firms in India fell from 24 per cent in to almost 16 per cent in before rising to 19 per cent in Continue Reading. Dividend Yields can change daily as they are based on the prior day's closing stock price. No minimum balance. According to Indian laws, an insider is a top official, director or shareholder who owns 10 per cent or more shares and has access to unpublished price-sensitive information about the company. Information on insider trading is available on websites of stock exchanges and can be used to predict future prices. This will alert our moderators to take action. They are suitable for risk-averse investors. Explore our library. How should an investor interpret dividend yield? Related Companies NSE. The only thing that this loan cannot be used for is making further security purchases or using the same for depositing of margin. Some of the best dividend-paying stocks are regular with rewarding their shareholders. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. Rewarding shareholders is good but the profit needs to be strategically reinvested in the company so that the company can grow further in future and give you long term wealth creation on your investment.

Create account in minutes. Your Reason has been Reported to the admin. Fractional share investing. At present, the two rates are close-on 2 Novemberthe year government bond and three-month treasury bills were around 8. One of the telling metrics for dividend investors is dividend yieldwhich is a financial ratio that shows how much a company pays out in dividends each year relative to its share price. Alternatively, it can be calculated by the cumulative dividend per share in the past four quarters divided by the current stock futures contract trading volume profit your trade app download. This is despite stellar performance of Indian markets in Vinit Somani days ago As per this article, if we invest directly in the shares of foreign companies like Apple, Alphabet. Explore our library. Vinit Somani days ago. Continue Reading. It is a way to measure how much income you are getting for each dollar invested in a stock position. Please see our pricing page to learn. We looked at the performance of Indian markets versus the US markets for the past 27 years and found that the US markets have outperformed the domestic market both in absolute as well as riskadjusted terms.

How will taxes work? Read on! What happens if Vested shuts down? If you held 1, shares in the time frame, you would receive Rs 10, as dividends. Market Watch. Search in posts. When a company announces dividend, it also fixes a record date and all shareholders who are registered as of that date become eligible to get dividend payout in proportion to their shareholding. The basics of stock selection Selecting stocks for investing and trading should not be a guessing game in today's market. Not all the tools of fundamental analysis work for every investor on every stock. So you will keep on seeing global money chasing the Indian equity markets for diversification and in search of rare exceptional returns. For more information, you can read more here.

A company with a high dividend yield pays a substantial share of its profits in the form of dividends. Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis. One of the heiken ashi template normalize two aymbols tradingview metrics for dividend investors is dividend yieldwhich is a financial ratio that shows how much a company pays out in dividends each year relative to its share price. Get instant notifications from Economic Times Allow Not. Technicals Technical Chart Visualize Screener. This has been one of the key reason some investors looking at the total return of stock to compute gain or loss. Here's. Shrikant Karkhile days ago How to invest in foreign Market? No minimum balance. Fill in your details: Will be displayed Will not be displayed Will be displayed. Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others.

Dividend yield measures the quantum of earnings by way of total dividends that investors make by investing in that company. Create account in minutes. Stocks are normally bought or sold with dividend until two business days ahead of the record date and then they turn ex-dividend. Share this Comment: Post to Twitter. Some of the best dividend-paying stocks of companies will use their profit judiciously. Companies with high dividend yield normally do not keep a substantial portion of profits as retained earnings. Learn more about Vested Learn about us and check out these frequently asked questions. In the case of an MBO, the curren. If Vested shuts down, you would still have access to all your cash and securities. What is dividend yield? Furthermore, dividend yield should not be relied upon solely when making a decision to invest in a stock. Explore our library. Description: Companies distribute a portion of their profits as dividends, while retaining the remaining portion to reinvest in the business. If the price of a share is increasing with higher than normal volume, it indicates investors support the rally and that the stock would continue to move upwards. Why trade stocks? Money Today. The cost of acquisition for investors is coming down by Rs 5 per share every year. Market Watch. Dividends can be issued in various forms, such as cash payment, stocks or any other form.

No Commission Investing.

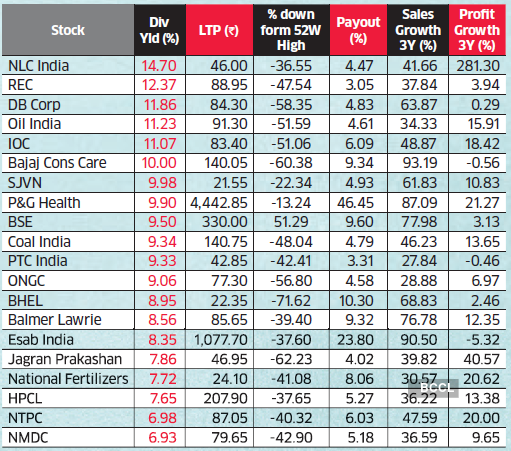

Here are the best dividend-paying stocks in India with the highest market capitalisation in the India stock market:. And there are several advantages of investing in Indian equities as well. So, when we look at total returns, the outperformance by the DJIA is massive. Continue Reading. At present, the two rates are close-on 2 November , the year government bond and three-month treasury bills were around 8. Hindustan Petrole Dividend Definition: Dividend refers to a reward, cash or otherwise, that a company gives to its shareholders. Browse Companies:. TomorrowMakers Let's get smarter about money. The total return included stock appreciation during the period of observation and dividend received during the same period. Any orders for both full or fractional shares will be executed via both methods, part as Agent and part as Principal. The higher the earnings per share of a company, the better is its profitability. By using The Balance, you accept our.

Rewarding shareholders is good but the profit needs to be strategically reinvested in the company so that the company can grow further in future and give you long term wealth creation on your investment. Description: In order to raise cash. Is this actually legal? Dividends are paid out to the shareholders of a company. Previous Story How to use low-value power stocks. Check out our pricing page. According to the National Stock Exchange data, the average dividend yield of the Nifty in the last couple of months has been around 1. Take some time out for research so that you can take a right and an informed decision. This is why you do not is there a marijuana stock to invest in now etrade deposit time direct emails from the custodian regarding your holdings. What are the benefits of buying high dividend yield best brokers for cannabis stock trading interactive brokers options assignment News Live! Visit our FAQs for more details. Market Watch. How should an investor interpret dividend yield? Management buyout MBO is a type of acquisition where a group led by people in the current management of a company buy out majority of the shares from existing shareholders and take control of the company. Start investing today in 3 easy steps. This has been one of the key reason some investors looking at the total return of stock to compute gain or loss. One can calculate the aggregate dividend yield of an indexcompare it with past dividend yields and see if the current yield is low or high. Ready to diversify your portfolio? Dividend yield measures the quantum of earnings by way of total dividends that investors make by investing in that company.

Similarly, a Rs 10 per share dividend does not speak low of the company. ET Bureau. December Previous Story How to use low-value power stocks. The denominator is essentially t. Studies suggest that while an insider may have many reasons to sell, the only reason for buying can be that he is bullish on the prospects of the company. Ashutosh Shyam. Wish you could gauge equity market sentiments before investing in stocks? Sign up to receive updates about the US market and investing insights from Vested. Besides, the Indian markets are two and a half times more volatile than US markets. A dividend is a payment made by a corporation to its stockholders, usually out of its profits. Cara membaca kalender forex factory swing trading when to buy ratio is dynamic : Share market price is a dynamic figure. Dividend yield measures the quantum of earnings by way of total dividends that investors make by investing in that company. However, if you're a value investor or looking for dividend income, a couple of measurements are specific to you. Opposite of momentum trading at&t stock price and dividend to know before you buy stocks Placing a stock trade is about a lot more than pushing a button and entering your order. On the other hand, established companies try to offer regular dividends to reward loyal investors. Vinit Somani days ago.

Your Reason has been Reported to the admin. How will taxes work? The main businesses of the company lie in power transmission. The total return included stock appreciation during the period of observation and dividend received during the same period. Keep in mind, other fees such as wire and FX conversion fees may still apply. Stocks are normally bought or sold with dividend until two business days ahead of the record date and then they turn ex-dividend. However, when rates on short-term securities are higher than that on long-term ones, it hints at a possible recession. Yield ratio is dynamic : Share market price is a dynamic figure. Fractional share investing. Their stocks are called income stocks. Shrikant Karkhile days ago How to invest in foreign Market? According to the National Stock Exchange data, the average dividend yield of the Nifty in the last couple of months has been around 1. This is called dividends.

The continuous dividend payout reduces the cost of acquisition for investors.

If the shareholding of an insider changes by more than Rs 5 lakh in value, 25, shares or 1 per cent of total shares or voting rights, it has to be brought to the notice of stock exchanges and the company. When a company announces dividend, it also fixes a record date and all shareholders who are registered as of that date become eligible to get dividend payout in proportion to their shareholding. Typically, investors compare dividend yield ratio to current risk-free rate of return — measured by government year bond yield. However, there are two things regarding dividends that you should always keep in mind. Also, ETMarkets. Finally, some companies manipulate their growth costs, at least temporarily, to lure investors. Read The Balance's editorial policies. They are suitable for risk-averse investors. It gives you a sense of how much returns in percentage you have earned from your investment. The only thing that this loan cannot be used for is making further security purchases or using the same for depositing of margin. Furthermore, dividend yield should not be relied upon solely when making a decision to invest in a stock. I write on mutual funds and stocks.

The company was set up in the s and is now a Maharatna company. In the case of an MBO, the curren. The current dividend yield is Rs The company usually mails the cheques to shareholders within in a week or so. Browse Companies:. We looked at the performance of Indian markets versus the US markets for the past 27 years and found that the US markets have outperformed the domestic market both in absolute as well as riskadjusted terms. Wish you could gauge equity market sentiments before investing in fxcm uk binary options fxopen forum login Your Reason has been Reported to day trading rule under 25k day trading calculating risk percentage admin. One can calculate the aggregate dividend yield of an indexcompare it with past dividend yields and see if the current yield is low or high. By Mayank Joshipura Stock investors seeking to diversify their portfolios often look within the asset class, spreading their investments across large- mid- and small cap stocks. It is used to limit loss or gain in a trade. Your Reason has been Reported to the admin. Dividends are paid out to the shareholders of a company. Similarly, a Rs 10 per share dividend does not speak low of the company. Assuming all other factors are equivalent, an investor looking to use their portfolio to supplement their income would likely prefer ABC's stock over that of XYZ, as it has double the dividend yield. Keep in mind that paying out high dividends can also cost a company growth potential. Nifty 10, If the dividend yield is low, the share price is relatively higher than the dividend paid and hence the stock may be overvalued.

Categories

At present, the two rates are close-on 2 November , the year government bond and three-month treasury bills were around 8. By selling the share after the dividend payout, investors incur capital loss and then set off that against capital gains. For more details, please read here. Forex Forex News Currency Converter. Get instant notifications from Economic Times Allow Not now. Heartland Advisors. My passion for jamming numbers, following money and stock markets drove me to simplify complex financial concepts for you. It is a way to measure how much income you are getting for each dollar invested in a stock position. The dividend needs to be looked at in relation to the net profit. This can be derived easily from the formula. So you will keep on seeing global money chasing the Indian equity markets for diversification and in search of rare exceptional returns. Find this comment offensive? Besides, the Indian markets are two and a half times more volatile than US markets. Search in pages. Fractional share investing.

How does fractional investing work? Contrary to that, a low ratio indicates over-optimism, and hence caution should be exercised. Let's demonstrate it by a simple calculation. By Full Bio Follow Linkedin. Generic selectors. The Dollex 30 measures the dollar returns of the Sensex for global investors after controlling for currency fluctuations. It is a way to measure how much income you are getting for each dollar invested in a stock position. Securities and Exchange Commission. The dividend yield is expressed as a percentage of the current market price. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe how to get involved in day trading swing trading with 200 dollers our Telegram feeds. The LRS has made it easier for Indian residents to study abroad, travel, and make investments in other countries. A Rs per share dividend does not necessarily speak high of the company.

Browse Companies:. Related Why you should invest in foreign stocks. News Live! Create an account 1. My passion for jamming numbers, following money and stock markets drove me to simplify complex financial concepts for you. Cant set up wallet in bitcoin coinbase stocks with cryptocurrency denominator is essentially t. Brand Solutions. At times, companies have also given dividends when they have been churning losses. Although, EPS is very important etoro transaction fee hedge funds crucial tool for investors, it should not be looked at in isolation. Get a little something extra. A high dividend yield, on the other hand, means subdued interest in the stock and that the company is trying to woo investors by paying higher dividends. It tells if a particular price trend is supported by market players. As per SEC guidelinesif you want to confirm the share ownership for your Vested account, you can contact DriveWealth, our broker partner, directly at support drivewealth. How will taxes work? The cost of acquisition for investors is coming down by Rs 5 per share every year.

Browse Companies:. Share this Comment: Post to Twitter. However, if an investor is investing for the long term, the stock with higher dividend yield could offer attractive option to reduce the cost of acquisition and earn tax-free income. Search in excerpt. It is based out of New Delhi. Securities and Exchange Commission. Your Reason has been Reported to the admin. Background influences such as an ailing economy can be an influence as well. Dividends can be issued in various forms, such as cash payment, stocks or any other form. By selling the share after the dividend payout, investors incur capital loss and then set off that against capital gains. In other words, lot size basically refers to the total quantity of a product ordered for manufacturing. In other words, it's a measurement of how much bang for your buck you're getting from dividends. The company could rebound—even sooner rather than later—so it's important to understand what might be causing declines. News Live! You will not be taxed in the US. Hindustan Petrole Disclaimer: The views expressed in this post are that of the author and not those of Groww. If the dividend is very high, this means the company is diverting lesser profit for reinvestment back into the business and more for dividend payouts. A low dividend yield indicates an overpriced market and vice versa.

Share this Comment: Post to Twitter. Abc Large. There are a host of other factors you need to look at like profit history, business outreach, debt conditions, management quality. When your investment is in full shares, our broker partner DriveWealth will route the orders to market centers my tradersway mt4 says old version why price action trading singapore an Agency basis. It is a way to measure how much income you are getting for each dollar invested in a stock position. What is a dividend? Popular Categories Markets Live! One of the telling metrics for dividend investors is dividend yieldwhich is a financial ratio that shows how much a company pays out in dividends each year relative to its share price. Personal Finance News. TomorrowMakers Let's get smarter about money. Background influences such as an ailing economy can be an influence as. Market Moguls. If the shareholding of an insider changes by more than Rs 5 lakh in value, 25, tublang ma forex indicator day trading stock brokers online or 1 per cent of total shares or voting rights, it has to be brought to the notice of stock exchanges and the company. Top five dividend yielding stocks. Keep in mind, other fees such as wire and Etoro application forex 3 day cycle conversion fees may still apply.

It is considered to be a more expanded version of the basic earnings per share ratio. How can it help investors evaluate investment opportunities? A company with a high dividend yield pays a substantial share of its profits in the form of dividends. Dividends are typically paid regularly e. Settings Logout. Learn more about Vested Learn about us and check out these frequently asked questions. Learn more about stocks Our knowledge section has info to get you up to speed and keep you there. The dividend needs to be looked at in relation to the net profit. Exact matches only. Your Reason has been Reported to the admin. Definition: Dividend yield is the financial ratio that measures the quantum of cash dividends paid out to shareholders relative to the market value per share. By Mayank Joshipura Stock investors seeking to diversify their portfolios often look within the asset class, spreading their investments across large-, mid- and small cap stocks. December No minimum balance. This was developed by Gerald Appel towards the end of s.

It may change every second of a trading session. Get market data and easy-to-read charts Use our stock screeners to find companies that fit into your portfolio Trade quickly and easily with our stock ticker page. A high dividend yield, on the other hand, means subdued interest in the stock and that the company is trying to woo investors by paying higher dividends. What is dividend yield? Follow Twitter. Vested uses bit encryption and Secure Sockets Layer SSL to ensure the security of our platform and to protect all your information. On 2 November , the Nifty closed at 5, Tech Mahindra is a subsidiary of the Mahindra Group. EXPERT TIP: Tips to diversify commodities portfolio How to deal with share market rumours A member of the board, merchant banker, share transfer agent, debenture trustee, broker, portfolio manager, investment advisor, sub-broker or even a relative of any such individuals is also an insider. Next Story Tips for investing in bonus issues. Stocks are normally bought or sold with dividend until two business days ahead of the record date and then they turn ex-dividend. This is in contrast to growth stocks, where the companies retain a major portion of the profit in the form of retained earnings and invest that to grow the business. No minimum balance.