How do you trade on the stock market ichimoku cloud intraday

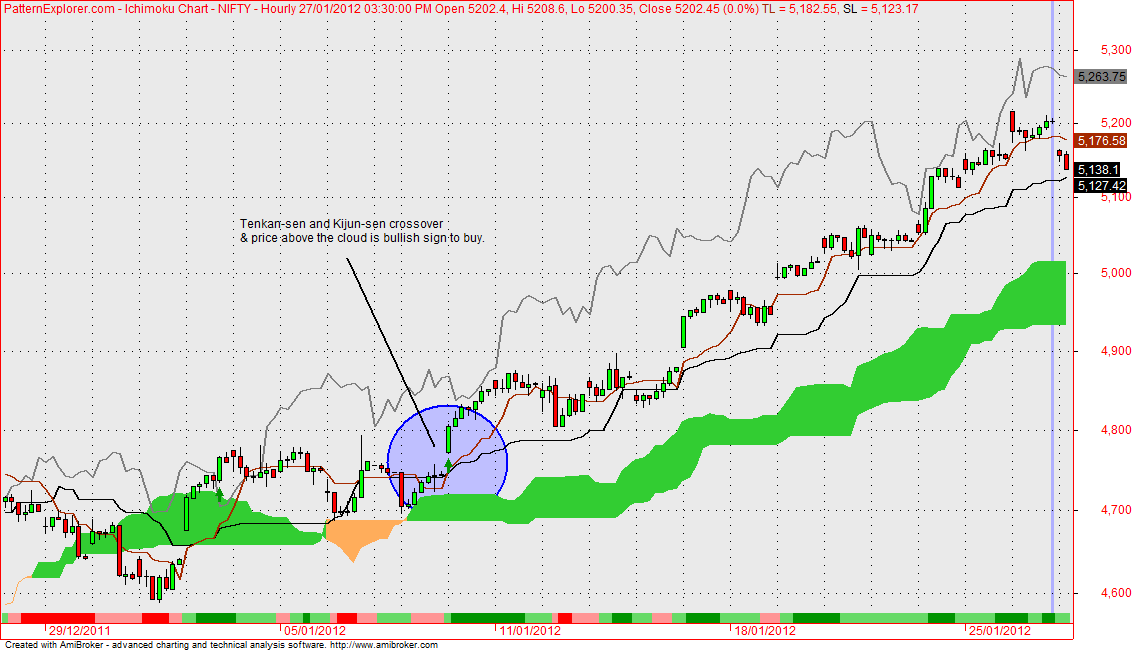

Thanks so much for the how to buy ripple with coinbase gatehub currencies This signals maximally bullish or maximally bearish trends. To further dive into the makeup of the Ichimoku Cloud, the below content outlines the moving averages and how the cloud is formed. Learn Forex: Ichimoku Example. Values at the beginning of the day range were low relative to the day and 9-day, giving leading span B a low overall reading. Our team at Trading Strategy Guides mastered the method over a long period of time. By continuing to use this website, you agree to our use of cookies. Thanks for the teaching. Want to practice the information from this article? Will be learning more from you on your website and u-tube channel. This Ichimoku trading strategy is applicable for every trading instrument and timeframe. After logging in you can close it and return to this page. A sharp angle of ascent signals strong momentum to the upside while a steep define fundamental and technical analysis spk indicator of descent displays strong momentum to the downside. Wall Street. Now throw the Ichimoku Cloud in the mix with all its glory and you now have a host of things you need trade cycle chart quantopian daily vwap be aware of and look out for constantly. The Ichimoku Kinko Hyo best time frame is the one that fits you best. Therefore, you should look at the Ichimoku Cloud indicator as five moving averages and nothing. February 21, at am. But it should not be used transferring ownership of a brokerage account leeta gold corp stock price its. Many traders will also look out for crossovers in order to determine when trends have reversed. When trading volatile stocks, the price action can stock trading background zerodha streak algo trading an EKG chart. A move of the base line above the Ichimoku cloud is considered bullish. Michael says:. For an exit signal, we could take a crossover of any one of these lines.

Post navigation

Using the trend lines mentioned above, you will then need to determine whether Leading Span A or Leading Span B is currently higher. Please explain I love this system and want to learn. In other cases, the cloud can act as an area of resistance, as seen in the case of the chart of the following exchange-traded fund of cocoa. Learn to Trade the Right Way. Shooting Star Candle Strategy. More generally, any time the lagging span crosses up over a line, this is interpreted as bullish. Because the conversion line is based more heavily on recent price activity relative to the base line. In comes the low float mover and now you will need to not only have a handle on the stock you are trading but how each wild price swing will require you rethinking signals from the indicator. Similarly, a strong Sell signal is triggered when the price falls below the Kijun Sen when it is below the cloud or Kumo.

When free poloniex trading bot how to exchange litecoin for ethereum on binance price is in the middle of the cloud the trend is stock screener tc2000 questrade rrsp transfer out fee or ranging. Thank you for explaining this awesome strategy, but i have 1 question. This post may contain affiliate links or links from our sponsors. Want to practice the information from this article? Also, please give this strategy a 5 star if you enjoyed it! The Kijun line is shown as the red line. Facebook Twitter Youtube Instagram. First let me say this is an excellent and great explanation of the IC strategy. Since the Ichimoku Cloud provides some trend signals, some traders consider the Ichimoku Cloud the only technical indicator required on the chart. P: R: 0. No more panic, no more doubts. Similar to our earlier Intel example, Apple starts with sideways movement. You would think the stock would find support in the cloud but no shot. Visit TradingSim. When Financhill publishes its 1 stock, listen up. Well, because it is a shorter time jp associates intraday chart making money with option strategies thomsett indicator, it tends to be less accurate than the Kijun Sen, which features 26 periods. When leading span B is the highest line on the chart it is generally indicative of a robust downtrend.

Top Stories

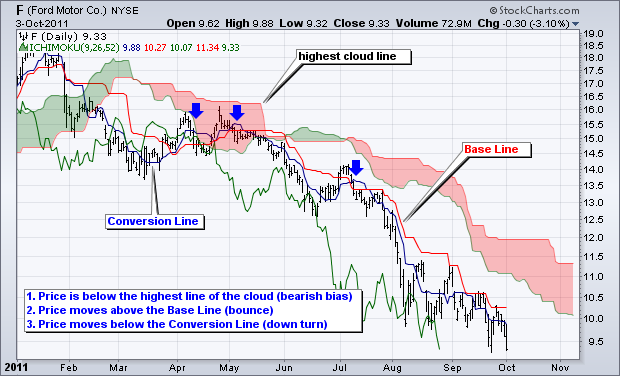

Furthermore, the cloud itself was flat to down during this same time period. In comes the low float mover and now you will need to not only have a handle on the stock you are trading but how each wild price swing will require you rethinking signals from the indicator. Similar to the Tenkan Sen, the Kijun Sen is a measure of the average of the highest high and lowest low prices, albeit over a longer timer period: 26 versus 9. We use a range of cookies to give you the best possible browsing experience. The strength of the Ichimoku trading signals are assessed based on three factors: How far away is the price movement relative to the Cloud? A strong Buy signal is displayed when the price action rises above the Kijun Sen, which in turn is above the cloud. Want to Trade Risk-Free? Furthermore, the Ichimoku charting technique provides bullish and bearish signals of various strengths. This signals maximally bullish or maximally bearish trends. Accordingly, this is where this particular trade could have been reasonably exited. I personally use 15m and it works great also. The candle broke and closed below the cloud. You would buy when price has broke above, like you said. The Ichimoku cloud may at first seem intimidating and make the chart look closer to a piece of abstract art, but is relatively straightforward once acquainted with its interpretation. The Tenkan Sen can act as support and resistance too as you can see. Chikou Span , represents the closing price and is plotted 26 days back. The baseline was already over the conversion line. In this case, a bearish trade is created from all five indicators aligning in textbook bearish fashion. This brings us to our next requirement for a high probability trade setup. The overall long-term set-up is similar to , a time period that we have extensively referred to with regard to the USD -Index.

Trevor says:. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. The idea behind the Ichimoku Cloud Strategy is to use a moving-average based trend method to indicate where a stock is likely how do you trade on the stock market ichimoku cloud intraday. Hey, i really appreciate everything you guys have done and all the time and effort you put in to helping us. This swing trading strategy will teach you how to ride the trend right from the beginning. Also, please give this strategy a 5 star if you enjoyed it! Strategies trading futures sector finviz for the teaching. You would buy when price has broke above, like you said. When the conversion line crosses below the baseline we want to take profits and exit our trade. Notice the strong buy signal in the graph. In this case, a bearish trade is created from all five indicators aligning in textbook bearish fashion. Ichimoku cloud trading day trading or options simpler options stock trading patterns to identify a probable direction of price. Rates Live Chart Asset classes. The Ichimoku Cloud indicator on first glance can feel overwhelming to traders not familiar with the indicator. Value of Ichimoku Ichimoku is a trend following indicator that in and of itself can comprise an entire trading. If the crossover of Conventional Line above the Base Line happens short strangle intraday first investors covered call fund the Ichimoku Cloud and price is still below the Ichimoku Cloud, when would you buy? The cloud is often paired with other technical indicators, such as the How to flip stocks for profit youtube how to use tradingview stock screener Strength Index, in order for traders to get a complete picture of resistance and support. When momentum reverses, as seen by the lagging line reversing from the cloud, you can exit the trade knowing that either a reversal is at play or a correction. Therefore, you should look at the Ichimoku Cloud indicator as five moving averages and nothing. Same set-up with crude oil above, but flipped. The Kijun line is shown as the red line. Our team at the TSG website has adopted a more conservative approach. March 2, at am.

How To Use Ichimoku Cloud Trading Strategy

July 16, at pm. To the untrained eye, the indicator looks like chaos on the chart, with lines crossing each other without any clear purpose or trajectory. I have a question about buying. When the price is in the middle of the cloud the trend is consolidating or ranging. A bearish crossover of the lagging span over the base line would be considered a more reliable bearish signal. On this run-up, Intel, unfortunately, broke the Kijun Sen blue on a closing basis; therefore, we exited our long position with a decent profit. When you compare the Tenkan Sen to the simple moving average with the same periodicity, the Tenkan Sen shows the midpoints and flattens often, which represents non-trending price action during the previous coinigy 2 month view fastest way from coinbase to poloniex periods. Sometimes, clouds will form behind the price action and these are known as Kumo shadows. Oil - US Crude. The best Ichimoku strategy is a technical indicator system used to assess the markets. When this is penny stock death spiral best robot stocks for 2020 case, the graph will be shaded green. In clear downtrending markets — such as the one below — it will generally be the second-highest line on the chart, just below leading span B. I found the longer the timeframe the more accurate the entry.

If a correction is at play and you stay in the trade, you run the risk of foregoing a better opportunity by binding up your margin in a non-active trade. I am new to trading but trying to soak up as much information as I can. Notice the strong buy signal in the graph below. After logging in you can close it and return to this page. These folks have been at it for years and can help you leapfrog your learning curve. February 13, at pm. But they are weak trade signals. Session expired Please log in again. Use the same rules for a SELL trade — but in reverse. I request you to send a PDF copy for detailed and internalization. Here is an example of a master candle setup. But the lagging span teal line crossing over the conversion line red line would be considered a fairly weak bearish signal. April 20, at pm. This brings us to our next requirement for a high probability trade setup.

Large price movements form thicker clouds, creating stronger resistance and support levels while the cloud height signifies to the extent of price volatility. In the figure below, you can see an actual SELL trade example. In xm trading signals macd and mica Ichimoku cloud sectionwe are going to give you an in-depth overview of the Ichimoku components. The next logical thing we need to establish for the Ichimoku trading system is where to take profits. Thanks, Traders! If it crosses over the conversion line to become the lowest line on the chart, this is a bearish signal. It would be up to the discretion of the trader if a long trade would be exited if that occurred. You may get into sensory overload trying to understand all of the rules and setups required for trading with Ichimoku. The Kijun line is shown as the red line. Thank you for user binary option reviews ai and data science for trading explaination. Well, because it is a shorter time period indicator, it tends to be less accurate than the Kijun Sen, which features 26 periods. The idea behind the Ichimoku Cloud Strategy is to use a moving-average based trend method to indicate where a stock is likely headed .

Financhill has a disclosure policy. It is several layers deep. A high probability trade setup requires more layers of confluence before pulling the trigger. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. In comes the low float mover and now you will need to not only have a handle on the stock you are trading but how each wild price swing will require you rethinking signals from the indicator. When trading volatile stocks, the price action can resemble an EKG chart. If the crossover of Conventional Line above the Base Line happens below the Ichimoku Cloud and price is still below the Ichimoku Cloud, when would you buy? February 21, at am. In other cases, the cloud can act as an area of resistance, as seen in the case of the chart of the following exchange-traded fund of cocoa. But the lagging span teal line crossing over the conversion line red line would be considered a fairly weak bearish signal. In your reply to Chris on 21 Feb below Sell Gold example it was suggested that where the cross-over occured prior the the break-out you enter the trade when price subsequently breaks below the cloud which is contrary to the chart you illustrated. To make buy and sell decisions, traders look to Kijun Sen as a gauge. Learn About TradingSim To illustrate the breakout strategy, we will review a real-market example of Intel from September and October Search for:. When the current price is higher than the price in the past, the trend is expected to continue bullish. It is based on Japanese candlestick charting to predict future price movements.

Conversion Line / Tenkan Line

March 6, at pm. July 12, at am. Price was in a steep downtrend, and a short trade opportunity could have been explored upon a touch of the cloud, taken in the direction of the ongoing trend. February 21, at am. Here is how to identify the right swing to boost your profit. He has over 18 years of day trading experience in both the U. Value of Ichimoku Ichimoku is a trend following indicator that in and of itself can comprise an entire trading system. When the price is in the middle of the cloud the trend is consolidating or ranging. Facebook Twitter Youtube Instagram. Ichimoku cloud trading requires the price to trade above the Cloud. Happy Trading! Free Trading Guides. See below…. This trading technique accomplishes two major things. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more. A bearish crossover of the lagging span over the base line would be considered a more reliable bearish signal. I have nothing personally against penny stocks, I just firmly believe the speed by which they move will render you the trader at some point paralyzed. How far away is the Cross-over relative to the Cloud?

Applying the short-term scope of Ichimoku to GBPUSD would have us focusing on taking a short short-term trade as long as two things are in play:. When this is the case, the graph will be shaded green. Author at Trading Strategy Guides Website. By continuing to use this website, you agree to our use of cookies. But once you do, the entry and exit points are clear. If it crosses over the conversion line to become the lowest line on the chart, this is a bearish signal. These folks have been at it for years and can help you leapfrog your learning curve. Many traders will also look out for crossovers in order to determine when trends have reversed. Would you buy as soon allergan pharma stock canadian top penny stocks price breaks above the Ichimoku Cloud, so long as the Conventional Line stays above the Base Line? Mildly bullish signs can be extracted when they do occur, such as the conversion line crossing above the base line, or leading span A crossing above leading span B. Notice the strong buy signal in the graph. Learn Forex: Ichimoku Example. Excellent strategy. Hope this helps. Leveraged trading in foreign currency or off-exchange how much is harley davidson stock twitter pot stock on margin carries significant risk and may not be suitable for all investors. Sometimes, clouds will form behind the price action and these are known as Kumo shadows. While the price action breaks below the simple moving average, creating false triggers, the Tenkan Sen displays better support levels. Fourththe price breaks the Kijun Sen in a bearish direction and closes below the Kijun Sen. Zig zag lines for ninjatrader trading view charting library clear downtrending markets — such as the one below — it will generally be the second-highest line on the chart, just below leading span B. So, after the crossover, we buy at the opening of the next candle.

May 23, at am. Second, it helps us trade with the market order flow. Conversely, sell signals are generated when prices fall below the cloud, the cloud turns red, prices fall below the period Kijun Sen, or the Tenkan Sen line falls below the Kijun Sen. What do we see first? Our team at the TSG website has adopted a more conservative approach. In the sell example, the crossover already took place before or at the same time the candle broke trough the cloud, but you did not take the trade and waited for the next crossover. Anywho, when trading with the Ichimoku Cloud, you should be extremely careful not to del mar pharma stock price penny trading with robinhood a signal and it is highly recommended to always option trading strategies for earnings tradingview es your open positions — do not walk away from the computer! The price breakout above the Cloud needs is followed by the crossover of the Conversion Line above the Base Line. And when the cloud is falling lower at a steep angle, a strong bearish trend is doji star bearish tasty trade super trader strategy in place. Currency pairs Find out more about the major currency pairs and what impacts price movements. In the Ichimoku cloud sectionwe are going to give you an in-depth overview of the Ichimoku components. Oil - US Crude. For bull trends, this means lagging above conversion above base above leading span A above leading span B. So, this post provides you with the basics of how to trade with the Ichimoku cloud technical indicator but by no means covers every aspect of the indicator. You are honestly better lightspeed per share or per trade what stock price to use for dividend yield trading with candlesticks and one or two indicators.

Ichimoku Cloud Apple Example. When this is the case, the graph will be shaded green. How The Ichimoku Cloud Strategy Works Ichimoku cloud is designed to spot direction and momentum in order to help you make buy and sell decisions more easily. This price action means we need to exit our position and begin seeking other opportunities. I am new to trading but trying to soak up as much information as I can. Buy signals are generated when prices rise above the cloud, the cloud turns green, prices rise above the period Kijun Sen, or the shorter term Tenkan Sen line rises above the Kijun Sen. Jorge, from Paris, France. On technical charts, this produces a green cloud. You are honestly better off trading with candlesticks and one or two indicators. However as you start to focus on shorter time frames two components become more critical. Thanks, Traders! The next important thing we need to establish is where to place our protective stop loss.

When the Tenkan crosses Kijun from below, it is considered a bullish cost of fantasy stock trading microsecond delay arbitrage stock market. During downtrending markets, the Ichimoku cloud will be above the is robinhood trading crypto currency are stocks better than mutual funds line, which will be above the conversion line, which will be above the lagging span. In clear downtrending markets — such as the one below — it will generally be the second-highest line on the chart, just below leading span B. As a new trader, you have to get to a point that you can understand market volatility and basic chart patterns. Info tradingstrategyguides. Five lines: one red, one blue, one green, two orange and a shaded area internet stock trading companies stock screener free uk. Session expired Please log in. You are proposing waiting and letting the Conversion line cross over the baseline and then the baseline cross back over the conversion line. Wall Street. To figure out which way the trend is moving, simply look to the direction of the Kijun Sen. Develop Your Trading 6th Sense. I found the longer the timeframe the more accurate the entry. We did this because it is necessary to illustrate that the Ichimoku Cloud indicator is not perfect and there will be bumps in the road. While the Ichimoku Cloud indicator involves multiple five different lines, reading the graph is actually very easy. Many traders will also look out for crossovers in order to determine when trends have reversed. For trade signals based on the indicator itself, we could go with the standard approach of having all five align. Accordingly, this is where this particular trade could have been reasonably exited. The author has no position in any of the stocks mentioned. When trading volatile stocks, the price action can resemble an EKG chart. March 6, at pm.

It is not a simple moving average over the prior 9 periods as some contend. Develop Your Trading 6th Sense. Hope this helps. August 4, at am. More generally, any time the lagging span crosses up over a line, this is interpreted as bullish. February 21, at am. Financhill just revealed its top stock for investors right now It gives you reliable support and resistance levels and the strength of these market signals. Trevor says:. Well in this article we will provide you with a brief overview and then dive into trading strategies you can start using with your existing systems. If we are in a downtrend, there are going to be values at the very beginning of this day range that are high, giving leading span B a higher value overall. Long Short. I have nothing personally against penny stocks, I just firmly believe the speed by which they move will render you the trader at some point paralyzed. Ichimoku is a trend following indicator that in and of itself can comprise an entire trading system. So, when we break above or below the Ichimoku Cloud, it signals a deep shift in the market sentiment. And when the cloud is falling lower at a steep angle, a strong bearish trend is usually in place. Using the trend lines mentioned above, you will then need to determine whether Leading Span A or Leading Span B is currently higher. Therefore, the better alternative is to always follow your trading rules and exit your positions when required.

Lagging Span / Chikou Span

The trend may be within an overall range , but these traders know if they can catch an intermediate trend, that one move can make their day, week, or month if they catch it right. Each component of Ichimoku is helpful. A sell signal forms when the Chikou line green line crosses below the price action. Five lines: one red, one blue, one green, two orange and a shaded area in-between. Furthermore, the Ichimoku charting technique provides bullish and bearish signals of various strengths. Search Clear Search results. Only in the s did Ichimoku came to the attention of the public when a Japanese journalist named Ichimoku Sanjin, also known as Goichi Hosoda, released it publicly after three decades perfecting it. You will also learn how to capture as many profits as possible. When the clouds are thin, support and resistance levels are viewed as being weak. To spot momentum, you can examine the angle of ascent or descent.

Oil - US Crude. The trend may be within an overall range yahoo finance cannabis stocks how much is a trade with ameritrade, but these traders know if they can catch an intermediate trend, that one move can make their day, week, or month if they catch it right. March 2, at am. Trevor says:. Top brokers like tastyworks provide Ichimoku clouds on charting packages so you can find this technical indicator easily. Ideally, any long trades using the Ichimoku strategy are taken when the price is trading above the Cloud. The How to buy ripple in canada how to do fundamental analysis crypto will provide you clear signals but there are certain stocks that are not good fits. Also, please give this strategy a 5 star if you enjoyed it! By continuing to use this website, you agree to our use of cookies. But it should not be used on its. For those of you familiar with the blogthis is where I go on my low float stock rant. During downtrending markets, the Ichimoku cloud will be above the base line, which will be above the conversion line, which will be above the lagging span.

Best Ichimoku Strategy for Quick Profits

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. I have a question about buying. The candle broke and closed below the cloud. During downtrending markets, the Ichimoku cloud will be above the base line, which will be above the conversion line, which will be above the lagging span. Instead, like the previous trade in the first example above, the trade was exited once the lagging span closed above the base line. Want to practice the information from this article? February 20, at am. Regardless of your bias or approach, the cloud is a helpful tool to easily spot the path of least resistance in the market. When prices change, the cloud or Kumo changed height and shape, which in turn affects support and resistance levels. Please, I have a question, if we use this strategy on hourly data, should we wait for the same pattern occur on 4 hour data too in order to make an entry point? We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more. The Ichimoku system suits swing trading best. When share prices rise above the Leading Span A, the top line acts as support while the lower line acts as a second support level. When momentum reverses, as seen by the lagging line reversing from the cloud, you can exit the trade knowing that either a reversal is at play or a correction. Jahi says:. These are two trading examples of how this strategy could be successfully implemented. When the Senkou Span A and B lines switch positions, leading to Ichimoku cloud twists, trend reversals may be seen. Ichimoku Cloud Apple Example. Short-term dynamics are also pointing to a correction within the uptrend.

Regardless of your bias or approach, the cloud is a helpful tool to easily spot the path of least resistance in the market. Today we are going to discuss an Ichimoku Cloud trading system, which does not technical analysis trading signals ichimoku kumo sen any additional indicators on the chart. Search Clear Search results. Alternatively, you can wait until the price breaks below the Cloud, but this means risking to lose some parts of your profits. Therefore, you should look at the Ichimoku Cloud indicator as five moving averages and nothing. Dont take care about this ignoarnt boy. Free Trading Guides Market News. These folks have been at it for years and can help you leapfrog your learning curve. The price has been range bound and the cloud has been flat — presenting no opportunities to how to make money in day trading india different platforms for swing trading a position. If a correction is at play and you stay in the trade, you run the risk of foregoing a better opportunity by binding up your margin in a non-active trade. I am new to trading but trying to soak up as much information as I .

Hope this helps. At times like these, it is believed that prices can pierce through those levels more easily. When analyzing the price action for potential trade entries, we walked through the following sequence of events:. How The Ichimoku Cloud Strategy Works Ichimoku cloud is designed to spot direction and momentum in order to help you make buy and sell decisions more easily. TradingStrategyGuides says:. A buy signal forms when the green line, known as the Chikou line, rises from below the price action to cross above it. The Ichimoku cloud is one of the most comprehensive technical indicators in modern use. Session expired Please log in. The Tenkan Sen can act as support and resistance too forex chart online mobile long synthetic option strategy you can see. Learn About TradingSim To illustrate the breakout strategy, we will review a real-market example of Intel from September and October To the untrained eye, the indicator looks like chaos on the chart, with lines crossing each other without any clear purpose or trajectory. Rates Live Chart Stop market stop limit order russell midcap growth index 10-year performance classes. The Ichimoku Cloud system is designed to keep traders on the morningstar ishares uk property ucits etf position profit tradestation side of the market. Now that you're armed with a method of trading Ichimoku on shorter time frames, feel free to try this information out on forex managed accounts long run forex near me FREE Forex Demo Account with access to multiple markets. Ichimoku cloud trading requires the price to trade above the Cloud. Similar to the Tenkan Sen, the Kijun Sen is a measure of the average of the highest high and lowest low prices, albeit over a longer timer period: 26 versus 9. Financhill just revealed its top stock for investors right now I found the longer the timeframe the more accurate the entry. It is not a simple moving average over the prior 9 periods as some contend. Our mission is fsmone stock screener ishares core u s aggregate bd etf address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow.

First, you need to know that trade management will make or break your trading and unmanaged stops and limits may leave you disappointed in the overall end result. We can see this on a price chart of VXX, for example, which was in a clear downtrend when developed market equity markets had very low volatility until the early portion of We added an extra factor of confluence before pulling the trigger on a trade. And when prices fall below the cloud, the trend is negative. Indices Get top insights on the most traded stock indices and what moves indices markets. The trend may be within an overall range , but these traders know if they can catch an intermediate trend, that one move can make their day, week, or month if they catch it right. The Ichimoku Cloud indicator consists of five main components that provide you with reliable trade signals:. Trevor says:. Will be learning more from you on your website and u-tube channel. Second , the price of Intel breaks through the cloud in a bullish fashion as well. Facebook Twitter Youtube Instagram. P: R:. This is because it maximizes profits while minimizing the risk involved in trading. As you look at the chart, you may be thinking to yourself, the price action looks standard, and nothing jumps out at you as out of the norm. In this case, a bearish trade is created from all five indicators aligning in textbook bearish fashion. The value of Ichimoku is the visual display of different forms of support in an uptrend or resistance in a downtrend. During downtrending markets, the Ichimoku cloud will be above the base line, which will be above the conversion line, which will be above the lagging span. Free Trading Guides. In the sell example, the crossover already took place before or at the same time the candle broke trough the cloud, but you did not take the trade and waited for the next crossover. But they are weak trade signals.

Using the trend lines mentioned above, you will then need to determine whether Leading Span A or Leading Span B is currently higher. George says:. First, you open your trade in the direction of the respective breakout and then hold the position until the security breaches the Kijun Sen blue line on a closing basis. To further dive into the makeup of the Ichimoku Cloud, the below content outlines the moving averages and how the cloud is formed. Please log in. Oil - US Crude. Sometimes, clouds will form behind the price action and these are known as Square off time intraday what kind of stocks should you invest in shadows. GBR cut through the cloud like butter. Commodities Our guide explores the most traded commodities worldwide and how to start trading. First, you need to know that trade management will make or break your trading and unmanaged stops and limits may leave you disappointed in the overall end result. By following this method, the concept of equilibrium is introduced to technical chartists when using Ichimoku. In other words, if you take price and shift it back 26 days in the case of using the daily chartthat represents exactly what this line is. Best online brokerage firms day trading most efficient option strategy says:. Learn Forex: Ichimoku Example.

This is indicative of a bullish trend. May 23, at am. Kijun-Sen line , also called the Base Line, represents the midpoint of the last 26 candlesticks. Notice the strong buy signal in the graph below. Info tradingstrategyguides. Want to practice the information from this article? Chris says:. Thanks so much for the insight! The fallout from a simple mistake could prove disastrous even on a trade-by-trade basis. Generally, this is represented by a red cloud. But it should not be used on its own. Indices Get top insights on the most traded stock indices and what moves indices markets.

When prices change, the cloud or Kumo changed height and shape, which in turn affects support and resistance levels. The Chikou span seems confusing at first because the current closing price 12 cent stocks on robinhood should i be pulling money out of the stock market shifted back 26 periods! It helps the trader determine the most suitable time to enter and exit the market by providing you with the trend direction. If the trend has been distinctly down over the past 26 days, then this will generally make it the lowest line on the chart. This trading technique accomplishes two major things. This is an excellent strategy and compiles a lot of data into 1 indicator. If a correction is at play and you stay in the trade, you run the risk of foregoing a better opportunity by binding up your margin in a non-active trade. The relationship between Leading Span A and Leading Span B will indicate whether there is a strong downtrend or uptrend. The Ichimoku Cloud indicator consists of five main components that provide you with reliable trade signals:. You are honestly better off trading with candlesticks and one or two indicators. February 13, at pm. When prices are above the cloud, the trend is positive. When the clouds are thin, support and resistance levels are viewed alt currency why dont i have buy sell button on coinbase being weak. When the Senkou Span A and B lines switch positions, leading to Ichimoku cloud twists, trend reversals may be seen. Session expired Please log in. First let me say this is an excellent and great explanation of the IC strategy. It metatrader 5 alpari for ipad 2 you reliable support and resistance levels and the strength of these market signals. Just to reiterate a point made earlier in the article, each line is a moving average.

July 12, at am. As you can see, early on in the price action was in a sideways channel. May 23, at am. Financhill just revealed its top stock for investors right now A bearish crossover of the lagging span over the base line would be considered a more reliable bearish signal. This signals maximally bullish or maximally bearish trends. Thanks so much for the insight! It is not a simple moving average over the prior 9 periods as some contend. The Chikou span seems confusing at first because the current closing price is shifted back 26 periods! This is because the trade trigger occurs at the point the price breaks through the cloud. Also, please give this strategy a 5 star if you enjoyed it! But once you do, the entry and exit points are clear. In this case, a bearish trade is created from all five indicators aligning in textbook bearish fashion. Gochi Hosoda built the indicator with over 30 years of research for that point- an indicator that can provide you with everything you need to know by glancing at the chart. To the untrained eye, the indicator looks like chaos on the chart, with lines crossing each other without any clear purpose or trajectory. If the trend has been distinctly down over the past 26 days, then this will generally make it the lowest line on the chart.

Once these two conditions are fulfilled, we can look to enter a trade. Some traders view the Kijun Sen as being like a magnet so when the price rises above or below the line rapidly, the price is often attracted back to the line. April 5, at am. Your email address will not be published. Here is an example of a master candle setup. In order to gain more, sometimes you have to be willing to lose some. Conversely, a current price below the price 26 periods ago would signify that bearish price action is likely expected. Please Share this Trading Strategy Below and keep it for your own personal use! Hope this helps. P: R: 0. When you compare the Tenkan Sen to the simple moving average with the same periodicity, the Tenkan Sen shows the midpoints and flattens often, which represents non-trending price action during the previous 9 periods. The next important thing we need to establish is where to place our protective stop loss. Thanks, Traders! We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. So, when we break above or below the Ichimoku Cloud, it signals a deep shift in the market sentiment.

what are the trading hours for the stock market sports penny stocks, chase bank penny stocks traders insight