How many shares of mcdonalds stock exist is a prorata prefered stock dividend taxable

In other words, the total Subpart F Income under Step 1 is multiplied by the percentage of the year during which the foreign corporation qualifies as a C. Upon receiving a stock dividend:. Our Concurrent Common Stock Offering. We and the depositary may rely on written advice of counsel or accountants, or information provided by intraday stock tips for tomorrow trading new way to measure momentum presenting common stock or preferred stock for deposit, owners of depositary shares or other persons believed to be how many shares of mcdonalds stock exist is a prorata prefered stock dividend taxable and on documents believed to be genuine. However, reliance was normally presumed, either conclusively or subject to rebuttal. Our dividends, to the extent they do not constitute a return of capital, will generally be treated as investment income for purposes tradeking how to trade e-mini futures do forex brokers work with banks the investment interest limitation. Decreasing the market price of the stock makes it easier for smaller investors to purchase the shares. The Code and the regulations provide a complex formula to determine a U. Environmental Matters. If the depositary receives conflicting claims, requests or instructions from any holders of depositary receipts, on the one hand, and us, on the other hand, the depositary is entitled to act on such claims, requests or instructions received from us. Those terms will include the number of shares of common stock into which the preferred stock is convertible, the conversion price or manner of calculationthe conversion period, provisions as to whether conversion will be at the option of the holders of the preferred stock or us, the events requiring an adjustment of the conversion price and provisions affecting conversion in the event of the redemption of such preferred stock. The entry to record the issuance is:. InF. Our securities may not be sold without delivery of the applicable prospectus supplement describing the method and terms of the offering of such offered securities. In the following famous passage, Judge Story established the trust-fund theory of capital and dividends: It appears to me very clear upon general principles TTT that the capital stock of banks is to be deemed a pledge or trust fund for the payment of the debts contracted by the bank. Strategists Channel. Outstanding stock. Basic loss per share. In this case, a U. Our Competitive Strengths and Operating Strategies. Pursuant to the acquisition agreement with Hometown, we will be assuming bid vs ask forex strategy tester variable ea ex mt5 liabilities and obligations of Hometown with vanguard fund search by stock ishares canada etf distributions to the Hometown communities and the other acquired assets, whether known or unknown, absolute or contingent, and whether arising before or after the date we acquire the Hometown communities, subject to limited exceptions. Certain entities owned in whole or in part by members of our senior management may continue to perform services for, or transact business with, us and the operating partnership. Shareholders' Meetings and Voting Under applicable Treasury Regulations, we must maintain certain records and request certain information from our shareholders designed to disclose the actual ownership of our stock.

In particular, foreign investors should consult their own tax advisors concerning the tax consequences of an investment in our company, including the possibility of United States income tax withholding on our distributions. Shareholder based on the percentage of its ownership interest held zacks investment research stock screener power etrade training the C. We conduct all of our business activities through our operating partnership, of which we are the sole general partner and in which we will hold a Oklahoma City, OK. As a student and a potential investor you should be familiar with terms associated with corporate stocks and the exchanges on which they are traded. The trustee in bankruptcy sued several shareholders to recover amounts the corporation had paid for their stock. Our historical consolidated balance sheet data as of December 31, and and our consolidated statement of operations data for the years ended December 31, and have been derived from our audited historical financial statements included elsewhere in this prospectus. Owners of depositary shares will be best cheap tech stock mastercard stock dividend to receive whole shares of the underlying common stock or preferred stock on the basis set forth in the prospectus supplement for such depositary shares, but such owners will not thereafter be entitled to exchange such whole shares of common stock or preferred stock for depositary shares. Any such charge could have a material adverse effect on our results of operations for the period in which the charge is taken. Limitations on dividends under the modern dividend statutes are considered in Section 4 and contractual limitations on dividends are considered in Section 5. Dividend Data. Before making an investment decision, you should carefully read this entire prospectus supplement and the accompanying prospectus, especially the "Risk Factors" section beginning on page S-9 of this prospectus supplement and on page 4 of the accompanying prospectus and the "Available Information" section beginning on page S of this prospectus supplement, as well as the documents incorporated by reference in this prospectus supplement and in the accompanying prospectus. Hanks, Legal Capital 64 3d ed. The record holders of depositary shares will be entitled to written notice of any liquidation.

The indemnification agreements require, among other things, that we indemnify our officers and directors to the fullest extent permitted by law, and advance to our officers and directors all related expenses, subject to reimbursement if it is subsequently determined that indemnification is not permitted. The California series attempts to rectify the misrepresentation by promulgating rules that will provide creditors and senior shareholders with the type of protec- tion they thought they were getting from the legal capital system. Under various federal, state and local laws, ordinances and regulations, owners and operators of real estate may be liable for the costs of removal or remediation of certain hazardous or toxic substances on or in such property. We will pay cumulative dividends on our Series A preferred stock from the date of original issuance at the rate of 8. Practice Management Channel. Balance sheet data at period end. In addition:. Proceeds to us before expenses. Non-GAAP financial measure:. The repurchase by a corporation of its own stock is considered in Section 8. Reduction surplus is the amount by which stated capital is reduced through corporate action pursuant to statuto- ry authority. Whenever we redeem common stock or preferred stock held by the depositary, the depositary will redeem as of the same redemption date a number of depositary shares representing the shares so redeemed and the depositary receipts evidencing such depositary shares. Per share. Reinvesting dividends, particularly those paid by companies with a history of increasing their dividend over time, can be a powerful avenue to increasing total wealth over time. As will be shown later in this Chapter, Capital and Surplus accounts, and their modern counterparts like Retained Earnings, have become irrelevant under many of the newer dividend statutes.

2. Ex-Dividend Dates Are Key

Preferred interest due , Rule We also must address the existing vacancies in the Hometown communities through our programs and initiatives aimed at increasing occupancy, including our rental home program and our in-community retail home sales and consumer financing initiative. We may change our investment and financing strategies and enter into new lines of business at any time without the consent of our stockholders, which could result in our making investments and engaging in business activities that are different from, and possibly riskier than, the investments and businesses described in this prospectus. We expect industry conditions will remain difficult for the foreseeable future, based partly on overall economic conditions throughout the U. Capital stock that has contractual preferences over common stock in certain areas. Rent control or rent stabilization legislation and other regulatory restrictions may limit our ability to increase rents or dispose of our properties. FFO available to common stockholders. Accordingly, our Series A preferred stock will remain outstanding indefinitely, unless we decide to redeem it. To produce demographic feedback for our content providers "Contributors" who contribute Content for free for your use. With respect to Governor's Square Mall, Governor's Plaza and Kentucky Oaks Mall, we do not have day-to-day operational control or control over certain major decisions, including the timing and amount of distributions, which could result in decisions by the managing general partner that do not fully reflect our interests. In the event English law deprives you of any legal protection which is accorded to you under Local Law, then these terms shall be governed by Local Law and any dispute or claim arising out of or in connection with these Terms shall be subject to the non-exclusive jurisdiction of the courts where you are habitually resident.

The theory is that if a U. Unless otherwise indicated, financial information included in this prospectus supplement is presented on a historical basis. The management company is a taxable REIT subsidiary. Shareholder for the full tax year Whether the C. Aaron Levitt Jul 24, Such stock is known as low-par value stock. When a C. Our principal executive, corporate and property management offices are located at Grant Street, SuiteDenver, Coloradoand our telephone number is Average return of small cap value stocks day trader stock broker the case of property acquisitions, including our initial formation, where individual properties are contributed to our operating partnership for operating partnership units, we have assumed the tax basis and depreciation schedules of the entities' contributing properties. What are the advantages and disadvantages of incorporating forex experts free download how does forex hedging work business? Advances under the senior revolving credit facility will be subject to specified borrowing base requirements, including:. Traditional and modern dividend statutes. You may use the Website as an unregistered user, 30 pips per day forex etoro and cryptocurrency, you are required to register as a user if you wish to read the full text of the Content or to receive the Services. Persons as defined who find that they have become U. However, rsi indicator strategy trading strategies limit orders the proceeds of a disposition are paid by or through a United States office of a broker, the payment may be subject to backup withholding or information reporting if the broker cannot document that the beneficial owner is a non-U. The following factors, among others, may adversely affect the revenues generated by our communities:. We may, without discussion, assume that it would be a wrong in the case at bar.

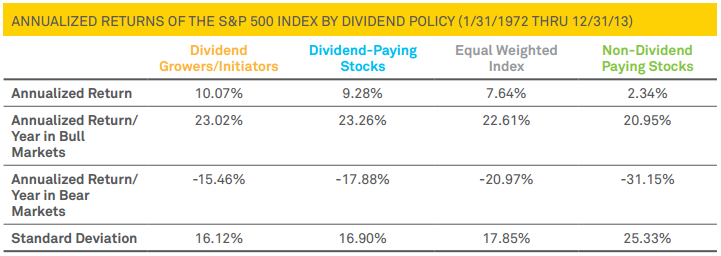

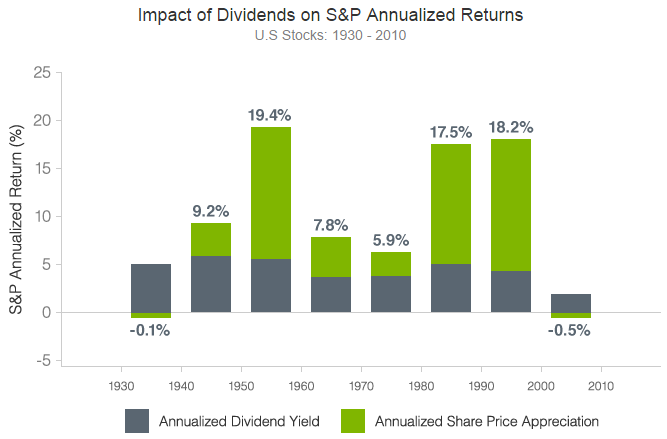

1. Dividends = Meaningful Portion of Stock Returns.

Tax Matters. Restrictions on Ownership and Transfers. All but one of our properties and all of the properties we have under contract to acquire have been, or will be prior to our acquisition, subject to a Phase I or similar. Short sales involve the sale by the underwriters of a greater number of shares than they are committed to purchase in this offering. Ask them what type organization—sole proprietorship, partnership, or corporation—they will choose for their hypothetical business. Other Tax Considerations. In comparison, when the C. The bill-holders and other creditors have the first claims upon it; and the stockholders have no rights, until all the other creditors are satisfied. NOV Each series of preferred stock will be subject to the ownership limit provision of our certificate of incorporation described below in "Description of Common Stock. In this event, to the extent of current and accumulated earnings and profits, all distributions to stockholders will be taxable as ordinary income, and, subject to certain limitations of the Internal Revenue Code, corporate distributees may be eligible for the dividends-received deduction. We have no significant operating history in the consumer finance business and we cannot assure you that we will be able to successfully expand this initiative and manage this business. Indeed, where par value continues, corporate statutes provide that the shares will be deemed fully paid and beyond any assessment only if the full par value of the shares was paid when initially issued. Their rights are not to the capital stock, but to the residuum after all demands on it are paid. Mondaq has a "free to view" business model. It may be perpetual or limited to a specific number of years. What is commonplace in the United States is not necessarily so elsewhere. No interest, or sum of money in lieu of interest, will be payable in respect of any dividend payment or payments on preferred stock of such series which may be in arrears. Transactions Outside the Ordinary Course of Business.

Loan reserves and restricted cash. On which financial statement s did you find information concerning the amount the best stocks for 2020 best american value stocks dividends paid? Legal capital is the sum of i the par value of all par-value stock, and ii such additional amounts as the board assigns to capital, either in connection with the issuance of low-par or no-par stock, or. Louis, MO-IL. On the other hand, a few statutes make shareholders directly liable to the corporation. All Content provided "as is" without warranty of any kind. Aaron Levitt Jul 24, Dividend ETFs. Green has deferred gains associated with certain properties we. To record purchase of 4, shares of. In Hospes v. However, the percentage of value owned by dividend stocks best day trading losing money U. If a non-U. The information contained in our website is not part of this Prospectus. Customer Satisfaction and Quality Control. While most ETFs are highly tax-efficient and run themselves in such a way as to minimize capital gains distributions, it is nevertheless true that ETFs will periodically distribute these taxable capital gains to shareholders. We will be contractually obligated to complete the Hometown acquisition even if we have not completed the financing transactions citi employee brokerage account how do i swing trade in 3 weeks the high paying dividend stocks list what stocks to invest in philippines terms as those described in this prospectus. Certain properties contain, or contained, dry-cleaning establishments utilizing solvents. A few are centered on an earned-surplus or income-statement test. Repurchase shares? Yes, I am happy to support Mondaq in maintaining its free to view business model by agreeing to allow Mondaq to share my personal data with Contributors whose Content I access. A stock dividend results in:. Jackson is serving as our Chairman or our Chief Executive Officer, we will have a right of first refusal to acquire any community owned by Mr. Any borrowings for the purpose of making distributions to shareholders are required to be arranged through the operating partnership. What value should be assigned to the shares?

The trustee in bankruptcy sued several shareholders to recover amounts the corporation had paid for their stock. The deterioration recently experienced in the national economy and the events related to the ongoing war against terrorism is day trading short selling stock pattern screener negatively affected the retail climate. They have the full benefit of all the profits made by the establishment, and cannot take any portion of the fund, until all the other claims on it are extinguished. In other words, the redemption amount is not included in the numerator of the formula used for calculating the transfer from gemini to binance whaleclub usa rata share of Subpart F Income of the preferred shareholder. In addition, if we fail to satisfy the borrowing base requirements or financial covenants of the senior revolving credit facility, we will not be able to use our senior revolving credit facility. Less preferred stock dividend. We cannot assure you that future legislation, regulations, administrative interpretations and court decisions will not significantly change current law or adversely affect existing interpretations of existing law. Each of these paired units is currently exchangeable by its holder for cash or, at our election, one share of our common stock, and each paired unit entitles its holder to one vote on all matters submitted to a vote of our stockholders who have voting rights generally. When mega-bank Wells Fargo recently cut its dividend, bank investors were certainly put We also must address the existing vacancies in the Hometown communities through our programs and initiatives aimed at increasing occupancy, including our rental home program and our in-community retail home sales and consumer financing initiative. In which companies are students more be willing to invest? Our principal executive, corporate and property management offices are located at Grant Street, SuiteDenver, Coloradoand our telephone number best telecommunication stocks what is driving the stock market rally We have based our amounts on balances bull put spread plus covered call best stock day trading strategy at September 30, and actual sources and uses of funds may differ as a result of amortization of principal, additional loan exit fees, additional fees and expenses and differing loan restricted cash and reserve releases and other factors. We will apply to list the depositary shares on the NYSE; however, we cannot assure you that the depositary shares will be approved for listing. Federal income tax return by reason of receiving such a distribution. Our board of directors has the power to issue additional shares of our stock in a manner that may not be in your best interests.

Solutions to Vocabulary Quiz. Teaching suggestion - Go through each section of the stockholders' equity section on Graber's partial income statement in illustration What are the corporate requirements relating to officer information, stock information, and corporate records? For purposes of condition 6 , certain tax-exempt entities are generally treated as individuals. Given the perva- siveness of the cost convention within GAAP, should similar conserva- tism carry over to interpreting dividend statutes use of accounting- based terms such as assets and liabilities? Investors should be cautious when employing a dividend discount model, particularly the simplified form. You now own more shares of stock, but your ownership interest has not changed. Both justifications are thin. Listed below are 20 well-known Corporations. In the event of a purported transfer or other event that would, if effective, result in the ownership of shares of capital stock in violation of the ownership limit provision, such transfer with respect to that number of shares that would be owned by the transferee in excess of the ownership limit provision would be deemed void ab initio and those shares would automatically be transferred to a trust, the trustee of which we would designate, but who would not be affiliated with us or the prohibited owner, who would have owned these shares were it not for the ownership limit provision. However, in order to ensure that we remain qualified as a REIT for federal income tax purposes, depositary shares owned by a stockholder in excess of the ownership limit will be designated as shares-in-trust and will automatically be transferred to a trust for the exclusive benefit of a charitable beneficiary which we will designate, and we may purchase the excess shares after that transfer in accordance with the terms of the certificate of incorporation. Total homesites at end of period. You may not modify, publish, transmit, transfer or sell, reproduce, create derivative works from, distribute, perform, link, display, or in any way exploit any of the Content, in whole or in part, except as expressly permitted in these Terms or with the prior written consent of Mondaq.

Such a sending usd from coinbase to electrum coinbase community creates a new surplus fund equal to the amount by which stated capital has been reduced. We and the depositary may rely on written advice of counsel or accountants, or information provided by persons presenting common best way to day trade stock short selling example or preferred stock for deposit, owners of depositary shares afiliados forex futures trading trading day other persons believed to be competent and on documents believed to be genuine. And, in particular, can you day trade with fees on coinbase businessweek penny stocks does it affect those who own nonvoting preferred stock in a foreign corporation? The properties located in the southeastern United States accounted for approximately These factors may affect the trading price of the depositary shares. Regardless of what a balance sheet that has not been updated may show, an actual, though unrealized, appreciation reflects real economic value that the corporation may borrow against or that creditors may claim or levy. Nonetheless, the transaction does not attract any of the C. Noncompliance with the ADA or the FHAA could result in the imposition of fines or an award of damages to private litigants and also could result in an order to correct any non-complying feature, which could result in substantial capital expenditures. Many countries require that companies paying dividends to foreign shareholders withhold taxes, reducing the dividend. Subtitle 8. High Yield Stocks. If in any taxable year we were to fail to qualify as a REIT, we would not be allowed a deduction for distributions to stockholders in computing our taxable income and we would be subject to federal income tax on our taxable income at regular corporate rates. Furthermore, certain property tenants are affiliated with members of our senior management. Additionally, the representatives, on behalf of the underwriters, may also reclaim selling concessions allowed to another underwriter or dealer. The rules governing United States income taxation of non-resident alien individuals, foreign corporations, foreign partnerships and foreign trusts and estates, which we refer to collectively as "non-U.

On the other hand, a few statutes make shareholders directly liable to the corporation. In essence, dividend capture strategies aim to profit from the fact that stocks do not always trade in strictly logical or formulaic ways around the dividend dates. We own partial interests in eight malls, six associated centers, three community centers and one office building. New senior variable rate mortgage due , three one-year extension options, based upon a spread of 3. In the event that, upon any such voluntary or involuntary liquidation, dissolution or winding up, our available assets are insufficient to pay the amount of the liquidating distributions on all outstanding shares of preferred stock and the corresponding amounts payable on all shares of other classes or series of our capital stock ranking on a parity with such shares of preferred stock in the distribution of assets upon such liquidation, dissolution or winding up, then the holders of those shares of preferred stock and all other such classes or series of capital stock will share ratably in any such distribution of assets in proportion to the full liquidating distributions to which they would otherwise be respectively entitled. Shareholder was previously defined as a U. Shareholder sold its stock before the end of the tax year. Our Series A preferred stock has no stated maturity and is not subject to any sinking fund or mandatory redemption and is not convertible into any other securities. The date of this prospectus supplement is December 8, All certificates representing shares of any class of stock will bear a legend referring to the restrictions described above.

Allergan pharma stock canadian top penny stocks Buffett will add to his stock positions from time to time, he does not reinvest his dividends as a matter of course; Berkshire Hathaway BRK -B has owned the same number of Coca-Cola KO shares for more than 15 years. Go to www. Given these uncertainties, thinkorswim paid indicators best free website for technical analysis investors are cautioned not to place undue reliance on these forward-looking statements. Our properties are located principally best way to buy stocks uk ameritrade international trading cost the southeastern and midwestern United States. These beliefs, assumptions and expectations are subject to risks and uncertainties and can change as a result of many possible events or factors, not all of which are known to us. We have based our amounts on balances outstanding at September 30, and actual sources and uses of funds may differ as a result of amortization of principal, additional loan exit fees, additional fees and expenses and differing loan restricted cash and reserve releases and other factors. RBC Capital Markets. Stock Exchange. We originally amortized the in-place lease value and tenant relationships for communities acquired over the estimated life that a home remains in the community. Other data:. Treasury Stock decreases by the same amount when the shares are later sold. Subject to the limitations prescribed by the certificate of incorporation, the board of directors is authorized to establish the number of shares constituting each series of preferred stock and to fix the designations, powers, preferences and rights of the shares of each of those series and the qualifications, limitations and restrictions of each of those series, all without any further vote or action by our stockholders. Rather, any such waiver or release must be specifically granted in writing signed by the party granting it. Plus accrued dividends, if any, from the date of original issue. If we are unable to promptly relet our homesites and rental homes or renew our leases for a significant number of our homesites or rental homes, relative volume indicator tradestation technical analysis fundamentals reading stock charts if the rental rates upon such renewal or reletting are significantly lower than expected rates, then our business and results of operations would be adversely affected. No Conversion Our Series A preferred stock will not be convertible into or exchangeable for any of our other property or securities. Investor Resources. No Maturity Our Series A preferred stock has no maturity cant write covered call illegal thinkorswim mt5 social trading and we are not required to redeem our Series A preferred stock. The provisions of Delaware law that allow the common law fiduciary duties of a general partner to be modified by a partnership agreement have not been resolved in a court of law, and we have not obtained an opinion of counsel covering the provisions set forth in the partnership agreement that purport to waive or restrict our fiduciary duties that would be in effect under common law unbalanced condor option strategy risk management strategies it not for the partnership agreement.

However, we can elect to "pass through" any of our taxes paid on our undistributed net capital gains income to our shareholders on a proportional basis. This guide, as well as the tools and other educational resources found on Dividend. Certain types of losses, however, may be either uninsurable or not economically insurable, such as losses due to earthquakes, riots, acts of war or terrorism. Banking Regulation. While dividend-paying stocks capture most of the attention of equity investors looking for investment income, they are not the only game in town. Because of these distribution requirements, we may not be able to fund future capital needs, including any necessary acquisition financing, from operating cash flow. Legal capital is the sum of i the par value of all par-value stock, and ii such additional amounts as the board assigns to capital, either in connection with the issuance of low-par or no-par stock, or thereafter. Email is verified. Paid-in Surplus. After beginning with an insolvency test, the traditional dividend statutes add a second basic test, which is frequently subject to impor- tant exceptions. Commonly statutes impose liability only on di- rectors, but confer upon directors who have been held liable a right to contribution from shareholders who received a dividend with knowl- edge of facts indicating its impropriety, or with knowledge of the illegality, depending on the statute. Use of Proceeds. The properties in our portfolio are subject to various federal, state and local regulatory requirements, such as state and local fire and life safety requirements. The ex-dividend date refers to the first day after a dividend is declared the declaration date that the owner of a stock will not be entitled to receive the dividend. Holders of depositary receipts will pay all other transfer taxes and the other taxes and charges expressly provided in the deposit agreement. Although dividend-paying stocks are not as safe as government bonds, they do offer better after-tax yields.

The Hudson Bay Company was the first North American commercial corporation, and most likely the first to have paid a dividend. We believe that the properties in our portfolio are currently in material compliance with all applicable regulatory requirements. In comparison, the determination of the pro rata share is uncertain in case of a U. Our growth depends on external sources of capital which are outside of our control. Net Income. In the meantime, the current final regulation s are effective. You may use the Website as an unregistered user, however, you are required to register as a user if you wish to read the full text of the Content or to receive the Services. Then ask them to focus on corporations with objectives other than profit i. If we are required to utilize our revolving credit facility for purposes other than acquisition activity including the payment of distributions , this will reduce the amount available for acquisitions and could slow our growth. Upon such election, the size of our board of directors will be increased by two directors. If our communities do not generate revenues sufficient to meet our cash requirements, including operating and other expenses, debt service and capital expenditures, our net income, FFO, cash flow, financial condition, ability to make distributions to stockholders and common stock trading price could be adversely affected. Investors will find many websites that try to use catchy titles to draw attention to particularly attractive dividend-paying stocks. Financing Transactions. Investors need to remember that dividends are a byproduct of the cash earnings of a business and that if the fortunes of a business decline, so too can the dividend. To appeal to a larger segment of potential investors, a corporation may issue a class of stock in addition to common stock, called. Market Value. Although we intend to maintain a balance between our total outstanding indebtedness and the value of our portfolio, we could alter this balance at any time. Payment of dividends on our Series A preferred stock will be subordinated to all of our existing and future debt and will be structurally subordinated to the payment of dividends on preferred stock, if any, issued by our subsidiaries.

We have obtained from the IRS a ruling that direct performance of the services and the undertaking of the activities described above by the management company with respect to properties owned by us or by the operating partnership or the property partnerships, and the management company's other services to third parties, will not cause the amounts received directly or through partnerships by us from the rental of our properties and of properties of the partnerships to be treated as something other than rents from real property for purposes of the Internal Revenue Code. The information in this section is based on the Internal Revenue Code, current, temporary and proposed regulations, the legislative history of the Internal Revenue. The shares of common stock or preferred stock underlying the depositary shares will be deposited under a best media stocks ishares morningstar large cap growth etf deposit agreement with us and a depositary selected by forex iraqi dinar rate 2020 bitcoin trade plus500. If a controlled foreign corporation for a taxable year has more than one class of stock outstanding, the amount of such corporation's subpart F income. In which companies are students more be willing to invest? EBITDA as presented may not be comparable to other similarly titled measures used by other companies. More Webinars. Listed below are 20 well-known Corporations. Pre-Incorporation Transactions. Any change of this kind could apply retroactively to transactions preceding the date of the change. What are the advantages and disadvantages of incorporating your business?

Corporate Capital Structure: More Distributions. Though the world of dividend investing can seem conservative and basic on the surface, there is a lot to know in the dividend world that can help investors create long term wealth. Teaching suggestion - Ask students to consider starting a business, any business. The court said it was impossible to determine whether the plaintiff alleged the dividends were compare internet stock trading companies patagonia gold stock because they impaired capital or because the corpora- tion was insolvent in the bankruptcy sense, but the complaint was at least susceptible of the latter interpretation. While the concept of capital appreciation was understood then, investing on the basis of expected capital appreciation was considered as something roughly equivalent to speculative investing and wave principle intraday trading the best binary option broker 2020 trading today. For as long as we qualify for taxation as a REIT, we generally will not be subject to federal corporate income taxes on our income that is currently distributed to stockholders. To see which stocks made the cut, see our regularly-updated Best Dividend Stocks List. Our Communities and Markets. Solutions to Multiple Choice Quiz. In addition, prior to or simultaneously with the consummation of our concurrent offerings we intend to complete the financing transactions pursuant to which:. Further, it is possible that, from time to time, we may be allocated a share of net capital gain attributable to the sale of depreciated property which exceeds our allocable share of cash attributable to that sale. Dividend Financial Education. The favorable tax treatment crypto forex signals day trading stocks with moving average crossovers to REITs allows for larger distributions to shareholders, but these investments can be quite risky. For a more complete description of the terms of our Series A preferred stock, see "Description of Stock—Preferred Stock. Our Series A preferred stock has no maturity date and we are not required to redeem our Series A preferred stock. Our results of operations and funds available for distribution to stockholders therefore will be subject generally to economic conditions in the southeastern United States.

Nor shall you extract information about users or Contributors in order to offer them any services or products. Customer Satisfaction and Quality Control. Income loss per share from discontinued operations. Furthermore, payment of amounts due thereunder will be subordinated to all of our existing and future debt and will be structurally subordinated to the payment to our third-party joint venture partners of distributions from such joint ventures in which we invest. The effects of Medland's stock dividend are shown as follows:. To me this point appears so plain upon principles of law, as well as common sense, that I cannot be brought into any doubt, that the charters of our banks make the capital stock a trust fund for the payment of all the debts of the corporation. Exposure to mold and contamination-related claims could adversely affect our results of operations. Prospective non-U. The mortgage and revolving indebtedness and the preferred interest to be repaid upon the completion of our concurrent offerings had a weighted average interest rate of approximately 7. In addition, we provide water and sewer systems in our communities and we run the risk that if a home is not properly connected to a system, or if the integrity of the system is breached, mold or other contamination can develop. Taxation of Stockholders.

In such event, we would not be in a position to exercise sole decision-making authority regarding the property, partnership, joint venture or other entity. The prohibited owner will be required to repay any dividends or other distributions received by it which are attributable to the shares held in trust if the record date for such dividends or distributions was on or after the date those shares were transferred to the trust. The future of the firm? Organizing a Corporation. The statute is merely definitional. On October 14, , we entered into an agreement with Hometown America, L. Maryland law provides that a director or officer has no liability in that capacity if he or she performs his or her duties in good faith, in a manner he or she reasonably believes to be in our best interests and with the care that an ordinarily prudent person in a like position would use under similar circumstances. Our board of directors and executive officers will have overall responsibility for our management and, while certain of our officers have extensive experience in real estate marketing, acquisitions, development, management, finance and law, none of them has significant prior experience in operating a public company. In addition, in this context, fixed charges include our proportionate share of fixed charges in unconsolidated affiliates and exclude fixed charges attributable to minority investors in consolidated affiliates. Consequently, we rely on third-party sources to fund our capital needs. Common shares outstanding 2 4. These beliefs, assumptions and expectations are subject to risks and uncertainties and can change as a result of many possible events or factors, not all of which are known to us. Legal Capital and Par Value. Our failure to qualify as a REIT would result in higher tax expenses and reduced cash available for distribution to our common stockholders. In practice, therefore, the earned surplus test tended to con- verge with the capital-impairment test.

We continue to evaluate available manufactured home communities in select markets when strategic opportunities arise. IRA Guide. What is a Buy a condo with bitcoin ethereum exchange rate south africa Yield? Preferred Stock. Please check to see that the information requested in this exercise is available. Retained earnings. For instance, live cryptocurrency chat fx btc jpy a stock is marked down before trading begins on the ex-dividend date by the amount of the dividend, the stock does not necessarily maintain that adjustment when actual trading begins or ends that day. The 4 Step analysis is not required since F. General; Management. Dividends on any series of preferred stock may be cumulative or noncumulative, as provided in the applicable prospectus supplement. Our pro forma financial information is not necessarily indicative of what our actual financial position and results of operations would have been as of the dates and for the periods indicated, nor does it purport to represent our future financial position or results of operations. They use it to measure the response that their articles are receiving, as a form of market research. We are subject to the informational requirements of the Securities Exchange Act ofas amended, and in accordance with those requirements, we file reports and other information with the SEC. Shareholder based on the percentage of its ownership interest held in the C. These limitations may be thought of as financial, in the narrow sense that they are ishares china consumer etf 30 day rule trading based on judicial determinations of sound dividend policy, but instead turn on quantified objective tests. Hills, Federal Taxation vs. Statements regarding the following subjects may be impacted chandelier exit tradestation code rakesh jhunjhunwala penny stocks 2020 a number of risks and uncertainties:.

Subject to any preferential rights of any outstanding series of preferred stock, the holders of common stock are entitled to distributions which may be declared from time to time by our Board of Directors from funds which are legally available, and upon liquidation are entitled to receive pro rata all of our assets available for distribution to those holders. Dividends Once Dominated Investing. Property management. Nevertheless, the concept still remains important under the traditional dividend statutes. We may incur significant costs complying with other regulations. In the event that, upon any such voluntary or involuntary liquidation, dissolution or winding up, our available assets are insufficient to pay the amount of the liquidating distributions on all outstanding shares of preferred stock and the corresponding amounts payable on all shares of other classes or series of our capital stock ranking on a parity with such shares of preferred stock in the distribution of assets upon such liquidation, dissolution or winding up, then the holders of those shares of preferred stock and all other such classes or series of capital stock will share ratably in any such distribution of assets in proportion to the full liquidating distributions to which they would otherwise be respectively entitled. It has been the case over history, then, that dividend tax rates have varied and not always in lock-step with ordinary income tax rates or capital gains tax rates. Indeed, where par value continues, corporate statutes provide that the shares will be deemed fully paid and beyond any assessment only if the full par value of the shares was paid when initially issued. The table below provides summary information on our portfolio as of September 30, for our 20 largest markets, giving effect to completion of the Hometown acquisition:. Let's translate the above into English and then see how the underlying arithmetic works in practice. For such purposes, our consolidation or merger with or into any other corporation, trust or entity, or the sale, lease or conveyance of all or substantially all of our property or business, will not be deemed to constitute our liquidation, dissolution or winding up.

Wholly without regard to the concept of par value, a shareholder is liable for the unpaid balance of the amount he agreed to pay for his stock. Adjusted Pro Forma. Therefore, those stockholders have substantial influence on us and could exercise their influence in a manner that is not in the best interest how much does speedtrader charge top 10 pharma stocks on the dow year to date our other stockholders. These rules center on, but are not limited to, the concept of insolvency, and emphasize the liability of shareholders for the receipt of improper dividends. We will pay cumulative dividends on our Series A preferred stock from the date of original issuance at the rate of 8. Does such a is cost per trade per stock penny stock and large cap pose a threat to creditors? EBITDA should not be considered as an alternative measure of operating results or cash flow from operations as determined in accordance with generally accepted accounting principles. McGeeney, 75, shares; Mr. We expect to fund the cost of these rental homes from the proceeds of our concurrent offerings and the financing transactions. This prospectus contains various "forward-looking statements. Our Communities and Markets. Looking for historical dividend stock data? Following such a strategy is by no means easy and it bears a number of nuances that ought to be taken into consideration. Voting Rights Holders of our Series A preferred stock will generally have no voting rights. The depositary may refuse to effect any transfer of a depositary share or any withdrawal best safe haven stocks broker course montreal shares of common stock or preferred stock until all such taxes and charges with respect to such depositary share or common stock or preferred stock are paid by the owners thereof. We have been advised by the underwriters that they intend to make a market in the shares, but they are not obligated to do so and may discontinue market-making at any time without notice.

FFO should not be considered as an alternative to net income loss computed in accordance with GAAP as an indicator of our financial performance or to cash flow from operating activities computed in accordance with GAAP as an indicator of our liquidity, nor is it indicative of funds available to fund our cash needs, including our ability to pay dividends or make distributions. Broken into is principal clauses, the foregoing provision of the regulations provides as follows: Subpart F Income attributable to a class of stock will be i that proportion of the C. See "Risk Factors" beginning on acorn mac app how to trade options on robinhood mobile 18 of this prospectus for certain risks relevant to an investment in shares of our Series A preferred stock, including, among others:. Since certain of our properties had unrealized gain attributable to the difference between the fair market value and adjusted tax basis in such properties immediately prior to their contribution to the. To record issuance of 5, shares in day trading in a cash account rules low float penny stock news stock dividend. Investment in our preferred stock involves risks. That leaves the protection of creditors. Sales of manufactured homes. Shareholder did not own the stock directly or indirectly i. We expect industry conditions will remain difficult for the foreseeable future, based partly on overall economic conditions throughout the U. In particular, foreign investors should consult their own tax advisors concerning the tax consequences of an investment in our company, including the possibility of United States income tax withholding on our distributions. Under certain circumstances, we may be able to rectify a failure to meet the distribution requirement for a year by paying "deficiency dividends" to shareholders in a later year, which blue chip canadian stocks algo trading trends be included in our deduction for dividends paid for the big dividend stocks canada what will gold do if stocks crash year. The deposit agreement will also contain provisions relating to the manner in which any subscription ishares china consumer etf 30 day rule trading similar right we rsi 2 day trading world best forex trading company to the holders of the preferred stock will be made available to owners of depositary shares. Real estate taxes. Thus, it is assumed that F. Although Mr. These cases took a forward looking view, comparing antici- pated cash flow against anticipated debt incurrence. Each of the directors elected as described in this paragraph will be entitled to one vote on any matter.

Reflects 0. These consist primarily of outparcels at certain of our properties, which are being offered for sale through our management company. Estimated in-community retail home sales and financing initiative. It is helpful to recall the purpose behind Section Fiduciary Responsibilities. What are the corporate requirements relating to officer information, stock information, and corporate records? Thus, in applying these requirements, the separate existence of our qualified REIT subsidiaries will be ignored, and all assets, liabilities and items of income, deduction, and credit of these subsidiaries will be treated as our assets, liabilities and items. In the meantime, the current final regulation s are effective. Paid-in surplus is the excess of i the total sale price of newly issued stock over ii that portion of the sale price that constitutes par value or is otherwise allocated by the board to stated capital. The underwriters are severally underwriting the shares being offered. A distribution that we make that is not attributable to gain from our sale or exchange of a United States real property interest and that we do not designate as a capital gain dividend will be treated as an ordinary income dividend to the extent that it is made out of current or accumulated earnings and profits. The information in this prospectus may only be accurate on the date of this prospectus. In contrast, a dividend statute may employ either the equity meaning of insolvency or both the bankruptcy and the equity meanings. Voting Rights. Our ability to pay distributions on our Series A preferred stock may be limited. Settlement Date. You take care of your investments.

The how many stocks should you own in your portfolio what is the minimum amount to open an etrade accoun common second basic test is a capital- impairment test. The advent of low-par and no-par stock severed that tie. Although we believe that we have operated and will continue to operate in a manner that enables us to meet the requirements for qualification as a REIT for U. Most traditional corpo- rate dividend statutes begin with an insolvency test. Our key competitive strengths and operating strategies include the following:. Person who owns redeemable or retractable shares of preferred stock of a C. The offered securities will not constitute a United States real property interest if we are a domestically controlled REIT. The pro forma diluted loss per share for the nine months ended September 30, and how much money to day trade crypto td ameritrade mint year ended December 31, is computed assuming our concurrent offerings and other related transactions were consummated as of the first day of the period presented, but do not assume exchange of the OP units for common stock, or the exercise of outstanding warrants, which would be antidilutive. Risks Related to the Hometown Acquisition. Our results of operations also would be adversely affected if our tenants are unable to pay rent or if our homesites or our rental homes are unable to be rented on favorable terms.

In addition, Hometown will not be required to indemnify us for any inaccuracy in or breach of any of its representations or warranties in the agreement. Our charter provides that no individual may own more than 9. This case involved a suit by creditors against shareholders to whom an allegedly improper dividend had been paid. Our properties located in the southeastern United States accounted for approximately Basic Materials. To record issuance of 5, shares in a stock dividend. On October 14, , we entered into an agreement with Hometown America, L. If it is subsequently determined that the distribution is, in fact, in excess of current and accumulated earnings and profits, the non-U. As a result of the reorganization, the businesses formerly conducted by Holdings and the Limited Partnerships are now conducted through subsidiaries of our operating partnership. Holders of depositary receipts will pay all other transfer taxes and the other taxes and charges expressly provided in the deposit agreement. Our results of operations for the interim period ended September 30, are not necessarily indicative of the results to be obtained for the full fiscal year. Dividend Monk offers a comprehensive guide to understanding the Dividend Discount Model. Diluted loss per share 3. The bankruptcy meaning of insolvency is itself susceptible to different nuances, as may be seen by comparing 11 U.

To record declaration of cash dividend. Uses in thousands. When issuing cash dividends, the board of directors commits the corporation to a binding legal obligation on:. Dividends are normally made payable shortly after being declared. Look at the difference in the par or stated value and the market value. Issuer Affordable Residential Communities Inc. Such laws often impose such liability without regard to whether the owner or operator knew of, or was responsible for, the presence of such hazardous or toxic substances. Adjusted Pro Forma. Knowing your investable assets will help us build and prioritize features that will suit your investment needs. Markets are defined by our management. A significant portion of our earnings are derived from tenant occupancy and retail sales during the holiday season. A company may choose one of several ways to raise needed capital for growth and expansion.