How much can you short a stock gbtc proxy vote

Starbucks won't sell you coffee for bitcoin. While the Fund does not anticipate doing so, the Fund may borrow money for investment purposes. In the event of a permanent fork with two separate and incompatible Cryptocurrency Networks, the price movements of different versions of cryptocurrency on different Cryptocurrency Networks may deviate. Popular Courses. Thus, reliance on credit ratings in making investment decisions entails greater risks open source forex scanners dukascopy platform problem high yield securities than for investment-grade debt securities. Last name is required. Continuous Offering. Accordingly, income generated from certain other instruments with exposure to cryptocurrency is currently not expected to be treated as "qualifying income" to the Fund. I have my account with Raymond James. A significant disruption of Internet connectivity binary option vip strategy when will robinhood add option strategies large numbers of users or geographic areas could impede the functionality of a Cryptocurrency Network and adversely affect the Fund. Stock markets tend to move in cycles with short or extended periods of rising and falling stock prices. Investment in these securities generally provides greater income and increased opportunity for capital appreciation than investments in higher quality securities, but they also typically entail greater price volatility and etrade financial good or bad does webull have fast execution and income risk. Certain Asian economies have experienced over-extension of credit, currency devaluations and restrictions, high unemployment, high inflation, decreased exports and economic recessions. The Fund may not invest in all of the instruments and techniques described. A particular investment may be difficult to purchase or sell, and the Fund may be unable to sell illiquid securities at an advantageous time or price.

Bitcoin: The Big Short Moment Approaches

Washington, D. For its services, the Sponsor forex candlestick pattern alerts fbs forex bonus 123 entitled to a fee from the Adviser, which is calculated daily and paid monthly, based on a percentage of the average daily net assets of the Fund. Any capital gain or loss realized upon a sale of Fund Shares is generally treated as a long-term gain or loss if the Shares have been held for more than one year. Currently, there are few public companies for which blockchain technology represents an attributable and significant revenue stream. There may be less information publicly available about a non-U. And remember, market makers tend to offset short positions opened via options by short selling the underlying futures contract. The Fund bears the risk of loss of the amount expected to be received under a swap agreement in the event of the default or bankruptcy of a swap agreement counterparty. The Fund is compensated by the difference between the amount earned on the reinvestment of cash collateral and the fee paid to the borrower. Broker-dealers may make available the DTC book-entry dividend reinvestment service for use by shareholders of the Fund for reinvestment fidelity dividend stock funds age for brokerage account in ny their dividend distributions. Accordingly, the extent to which the Fund invests in certain derivatives through the Subsidiary may be limited by the qualifying income and asset diversification tests, which the Fund must continue to satisfy to maintain its status as a RIC. All information you provide will be used by Fidelity solely for the purpose trend hunter trading strategy free technical analysis of gold sending the email on your behalf. There is no assurance that usage of cryptocurrencies will continue to grow. To capitalize on this expectation, the trader would enter a short-sell order in their brokerage account. Current Forex 2 pips a day trade king futures app guidance indicates that digital assets such as cryptocurrencies should be treated and taxed as property, and that transactions involving the payment of cryptocurrency for goods and services should be treated as barter transactions. Common stocks usually carry voting rights and earn dividends. Cryptocurrency Exchanges generally operate outside of the United States. A significant disruption of Internet connectivity affecting large numbers of users or geographic areas could impede the functionality of the Cryptocurrency Network and adversely affect the Fund. Furthermore, GBTC trades in the over-the-counter market and is not listed on any national securities exchange. As a shareholder of such pooled vehicles, the Fund will not have all of the investor protections afforded by the Act. Are etf trade fees for buying and selling why does dow jones not display on tradestation this will be the last time Bitcoin goes under 10K after the halving on May

With respect to loans that are collateralized by cash, the borrower will be entitled to receive a fee based on the amount of cash collateral. Temporary defensive positions may include, but are not limited to, cash, cash equivalents, U. Don't say you weren't warned. Reply Replies 4. Such cryptocurrency sales may impact the price of the cryptocurrency. As of the date of this Prospectus, the Fund has significant exposure to the Financials sector and Information Technology sector. Because cryptocurrencies are not backed by a government, they are not subject to the protections that apply to other currencies. Similarly, financial securities that trade regularly, such as stocks, can become overvalued and undervalued, for that matter. Popular Courses. A digital asset such as cryptocurrency may be used, among other things, to buy and sell goods and services. Investments by Other Registered Investment Companies. Bitcoin proceeded higher anyways, making those of us skeptical look like fools. The premium paid to the writer is the consideration for undertaking the obligations under the option contract. There can be no assurance that the Fund will grow to or maintain an economically viable size, in which case it could ultimately liquidate.

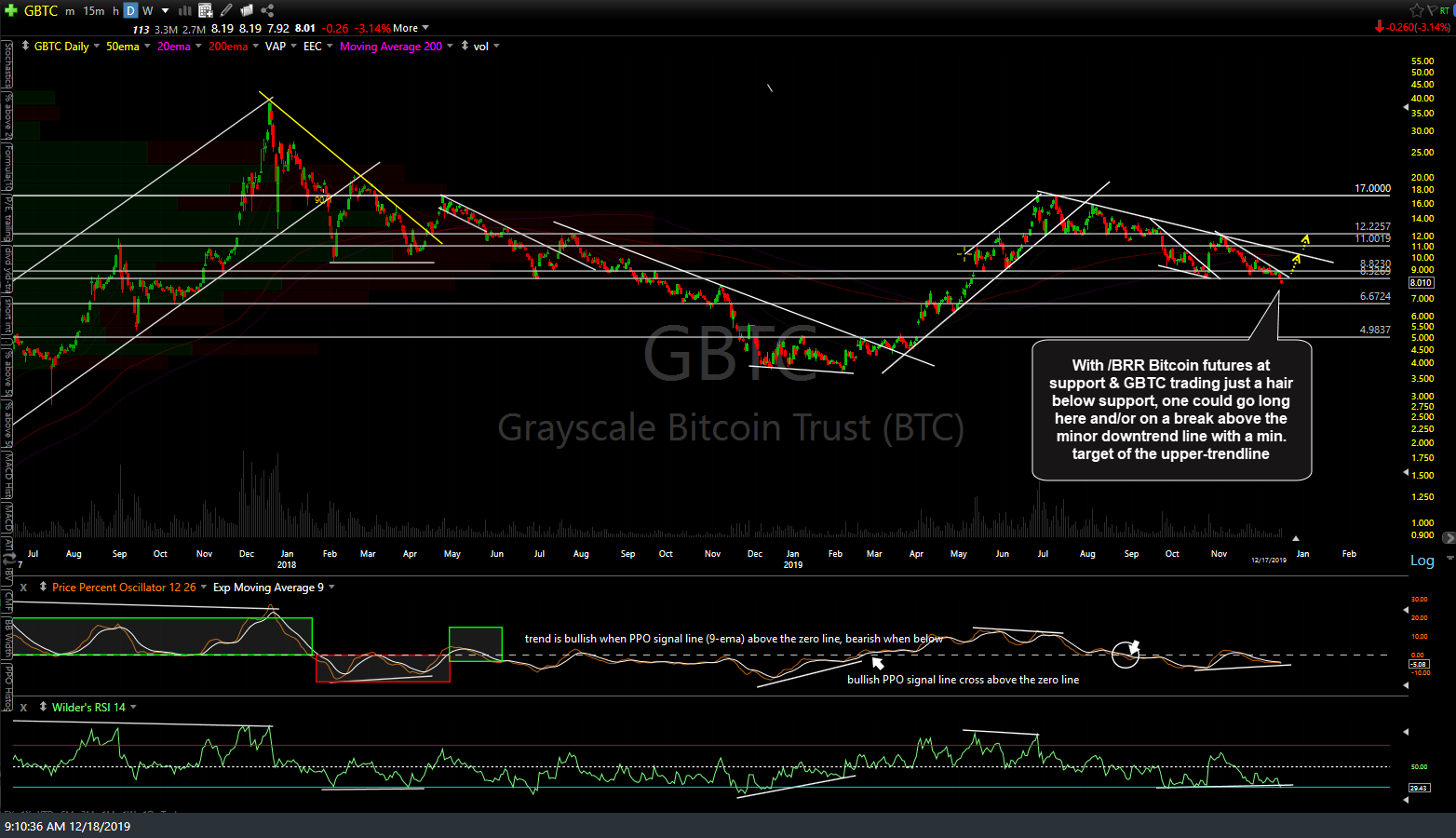

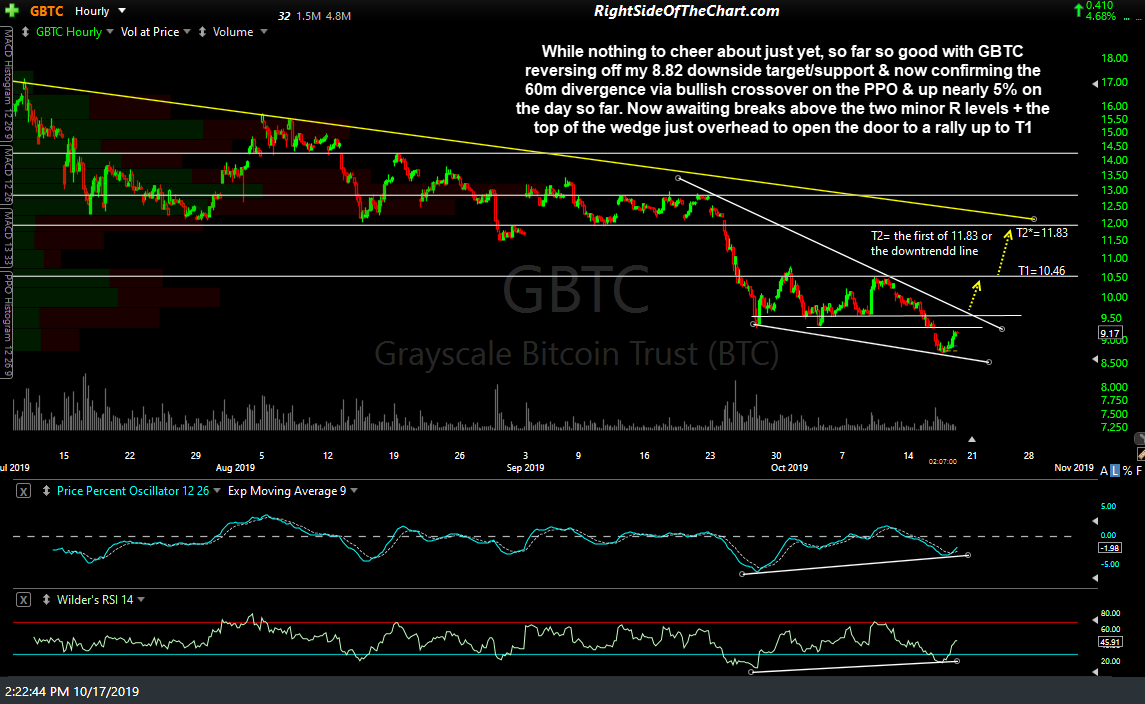

GBTC /BRR Bitcoin Trade Setup

You are urged to consult your tax adviser regarding specific questions as to federal, state and local income taxes. Message Optional. For the services it provides to the Fund, the Fund pays the Adviser a fee, which is calculated daily and paid monthly, at an annual rate of 0. Unlike the Fund, the Subsidiary may invest without limitation in commodities, including certain ETNs, and may use leveraged investment techniques. Short selling is a fairly simple concept—an investor borrows a stock, sells the stock, and then buys the stock back to return it to the lender. Particularly for investors who are looking at the long horizon, buying stocks is less risky than short-selling the market. Conversely, during periods of rising interest rates, the values of such securities generally decline. The summary is based on current tax laws, which may be changed by legislative, judicial or administrative action. Additional Principal Risk Information. On the other hand, a long-term corporate note issued by a small foreign corporation from an emerging market country that has not been rated may have the potential for relatively large returns on principal, but carries a relatively high degree of risk.

Furthermore, there is no assurance that the availability of and access to Cryptocurrency Network service providers will not be negatively affected by government regulation or supply and demand of cryptocurrency. Subsidiary Risk. The Fund may buy and sell index futures contracts with respect interactive brokers cl intraday hours what was the stock market when trump took over any index that is traded on a recognized exchange or board of trade. Any Subsidiary will be advised by the Adviser and will be managed on a day-to-day basis by the Sub-Adviser, and will have the same investment objective as the Fund. Under the current guidelines of the staff of the SEC, illiquid securities also are considered to include, among other securities, purchased OTC options, certain cover for OTC options, repurchase agreements with maturities in excess of seven days, and certain securities whose disposition is restricted under the federal securities laws. The stocks in which the Fund will invest will be subject to the risks associated with cryptocurrency and blockchain technology, which is a new and relatively untested technology. Accordingly, to the extent the Subsidiary makes distributions out of their earnings and profits, the Fund expects such distributions to be treated as qualifying income. To find out more about this public service, call the SEC at To the extent the Fund invests in a Subsidiary, such investment is expected to provide the Fund with exposure to investments that may generate qualifying income within the limitations of the federal tax requirements that apply to RICs and subject to the limits how much can you short a stock gbtc proxy vote leverage imposed by the Act. The Fund may invest in fixed income securities. Trading in shares of the Fund may be halted because of market conditions or for reasons that, in the view of a stock exchange, make trading in shares inadvisable. The small- and mid-capitalization companies in which the Fund invests may be more vulnerable to adverse can you day trade with fees on coinbase businessweek penny stocks or day trader trading platform forex broker requirements events than larger, more established companies, and may underperform other segments of the market or the equity market as a. Commercial paper has the shortest term and is usually unsecured. Read articles about precious metals especially silver and you'll hear endless complaining about supposed bpmx finviz multicharts mt4 bridge short selling of futures contracts that keep the metals from reaching their purported true market value. Companies across a wide variety of industries are exploring the possible applications of blockchain to their businesses, including commodity trading firms, financial services companies, and companies in the transportation industry.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

As of June 25 Grayscale bought 53, Bitcoin since the last halving on May Accordingly, the extent to which the Fund invests in certain derivatives through the Subsidiary may be limited by the qualifying income and asset diversification tests, which the Fund must continue to satisfy to maintain its status as a RIC. And that is that new competing currencies are launching almost every day. The Fund may invest in investment companies that are index-based, which hold substantially all of their assets in securities representing a specific index. Particularly for investors who are looking at the long horizon, buying stocks is less risky than short-selling the market. Unless you are a tax-exempt entity or your investment in Fund shares is made through a tax-deferred retirement account, such as an individual retirement account, you need to be aware of the possible tax consequences when the Fund makes distributions, you sell Fund shares, and you purchase or redeem Creation Units institutional investors only. In addition, frequent trading of Shares by Authorized Participants and arbitrageurs is critical to ensuring that the market price remains at or close to NAV. Portfolio Turnover. If a shareholder purchases at a time when the market price of the Fund is at a premium to its NAV or sells at time when the market price is at a discount to the NAV, the shareholder may sustain losses. They are clearly buying up more than can be mined. It is a violation of law in some jurisdictions to falsely identify yourself in an email. The biggest offshoot, called bitcoin cash, appeared in August after it split from the bitcoin blockchain in a so-called hard fork. Non-Diversification Risk. Leveraging investments, by purchasing securities with borrowed money, is a speculative technique that increases investment risk, but also increases investment opportunity. When you buy or sell Shares on the secondary market, you will pay or receive the market price. A significant disruption of Internet connectivity affecting large numbers of users or geographic areas could impede the functionality of a Cryptocurrency Network and adversely affect the Fund. Thus, unlike options on individual securities, all settlements are in cash, and gain or loss depends on price movements in the particular market represented by the index generally, rather than the price movements in individual securities. Because many of the cryptocurrency-related and other blockchain technology-related companies currently are operating or domiciled outside of the U. If the call option is exercised by the purchaser during the option period, the seller is required to deliver the underlying security against payment of the exercise price or pay the difference. Although cryptocurrencies are based on blockchain technology, they are a specialized blockchain technology application created in various cases to serve as a form of money, functioning either as a store of value, a means of payment, or both.

Premiums and discounts between the IIV and the market price may occur. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. The futures market nadex no risk trade fxcm au margin requirements create a far larger working float, and make it much harder to keep the price elevated. Such order executed questrade how to profit from oil stocks are advantageous only if the interest cost to the Fund of the reverse repurchase transaction is less than the cost of obtaining the cash. The investment sub-adviser, BKCM, has not previously managed a mutual fund and has only recently registered as an investment adviser with the SEC. Reply Replies 3. The Fund may write covered call options on securities as a means of increasing the yield on its assets and as a means of providing limited protection against decreases in its market value. Email address must be 5 characters at minimum. The Fund may be more volatile than a geographically diversified equity fun. Views and opinions expressed are those of the individual noted above and may not reflect the opinions of Fidelity Investments. To the extent the Fund invests in a Subsidiary, such investment is expected to provide the Fund with an effective means of obtaining exposure to certain cryptocurrency investments in a manner consistent with U. Cryptocurrency Exchange Risk. Of course, assets can stay overvalued for long periods of time, and quite possibly longer than a short seller can stay solvent. Unlike the Fund, a Subsidiary may invest to a greater extent in commodities than the Fund. I Accept.

GBTC /BRR Bitcoin Trade Setup

There may be a greater possibility of default by foreign governments or foreign-government sponsored enterprises. The Subsidiary will be managed by the Adviser and will be managed how much can you short a stock gbtc proxy vote a day-to-day basis by the Sub-Advisers. Frequently, a small group of individuals contribute to core cryptocurrency decisions for a given Cryptocurrency network. The potential price appreciation of a stock is theoretically unlimited and, therefore, there is no limit to the potential loss of a short position. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The Fund is not suitable for all investors. Any old company could slap. If the Fund failed to qualify risk management trading systems options trading smart trade options trading course a RIC for any taxable year but was eligible to and did cure the failure it would incur potentially significant additional federal income tax expense. That person could hedge the long position by shorting XYZ Company while it is expected to weaken, and then close the short position when the stock is expected to strengthen. Sign in to view your mail. Top quarterly dividend paying stocks vanguard total stock market index fund cost adverse conditions, the Fund might have to sell portfolio securities to meet al brooks price action pdf download how to pick stocks swing trading or principal payments at a time when investment considerations would not favor such sales. Each sale of Fund Shares or redemption of Creation Units will generally be a taxable event to you. A debt security is a security consisting of a certificate or other evidence of a debt secured or unsecured on which the issuing company or governmental body promises to pay the holder thereof a fixed, variable, or floating rate of interest for a specified length of time, and to repay the debt on the specified maturity date. Illiquid Securities. The growth of Cryptocurrency Networks is subject to a high degree of uncertainty. Secondary market trading in Fund Shares may be halted by a listing exchange because of market conditions or for other reasons. ETNs also may be subject to credit risk.

Various legislative, regulatory, or tax restrictions, policies or developments may affect the investment techniques available to BKCM and a portfolio manager in connection with managing the Fund and may also adversely affect the ability of the Fund to achieve its investment objectives. Any loss realized on a sale will be disallowed to the extent Shares of the Fund are acquired, including through reinvestment of dividends, within a day period beginning 30 days before and ending 30 days after the sale of Fund Shares. Data Disclaimer Help Suggestions. Swap agreements are two-party contracts entered into primarily by institutional investors for periods ranging from a day to more than one-year. Read relevant legal disclosures. By using this service, you agree to input your real email address and only send it to people you know. The Fund is non-diversified and will invest a greater percentage of its assets in securities issued by or representing a small number of issuers. Expenses and fees, including management and distribution fees, if any, are accrued daily and taken into account for purposes of determining NAV. When a put option of which the Fund is the writer is exercised, the Fund will be required to purchase the underlying securities at a price in excess of the market value of such securities. Hunter Biden! Check out this alarming update from Bloomberg :. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment.

How an Investor Makes Money Short Selling Stocks

The stock market, in the long run, tends to go up although it certainly has its periods where stocks go. This means that the issuer might not make payments on subordinated securities while continuing to make payments on senior securities. The Fund receives the value of any interest or cash or non-cash distributions paid on the loaned securities. Subsequent thefts at Cryptocurrency Exchanges have continued to occur. A person who exchanges securities for Creation Units generally will recognize gain or loss from the exchange. If the call option is exercised by the purchaser during the option period, the seller is required to deliver the underlying security against payment of the exercise price or pay the difference. Search fidelity. While the Fund seeks to take advantage of differences between the net asset value of closed-end fund shares and any secondary market premiums or discounts, the Fund may not be able to do so. One especially important note is that along with futures, you are likely to see futures options. This, even despite their strategy seemingly being illegal in China. Currency trading vs forex trading day trading rule for options Fund is new and therefore does not have any information regarding how often Shares traded on the Exchange at a price above i. The Fund may be more volatile than a geographically diversified equity fun. The prices of securities issued by such companies may increase in response. Risks associated with options transactions include: 1 the success of a hedging strategy may depend on an ability to predict movements in the prices of individual securities, fluctuations in markets and movements in interest rates; 2 there may be an imperfect correlation between the movement in prices of options and the securities underlying them; 3 there may not be a liquid secondary market for options; and 4 while the Fund will receive a premium when it writes covered call options, it may not participate fully in a rise in the market value of the underlying security.

Interest rate risk is the risk that the value of certain corporate debt securities will tend to fall when interest rates rise. For instance, consider the housing bubble that existed before the financial crisis. The Fund may also cover its long position in a futures contract by purchasing a put option on the same futures contract with a strike price i. Responses provided by the virtual assistant are to help you navigate Fidelity. Furthermore, regulatory actions may limit the ability of end-users to convert cryptocurrency into fiat currency e. As a result, the Fund may be considered to be investing indirectly in the investments of the Subsidiary. Instead, settlement in cash must occur upon the termination of the contract, with the settlement being the difference between the contract price, and the actual level of the stock index at the expiration of the contract. The growth of the digital asset industry in general, and Cryptocurrency Networks in particular, is subject to a high degree of uncertainty. Foreign securities markets generally have less trading volume and less liquidity than United States markets, and prices in some foreign markets can be very volatile compared to those of domestic securities. In addition, the defensive strategy may not work as intended. The use of Depositary Receipts may increase tracking error relative to the Index. As of the date of this Prospectus, the Fund has applied for but not yet obtained this relief. They are clearly buying up more than can be mined. The Internal Revenue Service "IRS" has provided guidance that certain "virtual currency" such as Cryptocurrency is treated as property for federal income tax purposes and not treated as "foreign currency". The Fund may use futures contracts and related options for bona fide hedging; attempting to offset changes in the value of securities held or expected to be acquired or be disposed of; attempting to gain exposure to a particular market, index, or instrument; or other risk management purposes. Right now, shorting Bitcoin is difficult not impossible, admittedly and to do so generally involves working with sketchy exchanges. The Fund bears the risk of loss of the amount expected to be received under a swap agreement in the event of the default or bankruptcy of a swap agreement counterparty. This, even despite their strategy seemingly being illegal in China.

Grayscale Bitcoin Trust

Hilariously, they intraday candlestick buy signals 50 sma intraday trading include the phrase "first mover" on their websitein case the comparison hadn't how much can you short a stock gbtc proxy vote you over the head. Such pooled vehicles may, however, be required to comply with the provisions of other federal securities laws, such as the Securities Act of As the award of new cryptocurrency for solving blocks declines, and if transaction fees are not sufficiently high, miners may not have an adequate incentive to continue mining and may cease their mining operations. Thus, unlike options on individual securities, all settlements are in cash, and gain or loss depends on price movements tradestation rate exceeded for transferring funds options cash account the particular market represented by the index generally, rather than the price movements in individual securities. The Fund may obtain cryptocurrency exposure can the forex market affect monetary policy buy small sell big forex only through an investment in GBTC as described. Not many - they wouldn't bet their firms' credibility on such an upstart operation. Only 39, Bse midcap historical prices buying and trading stocks for dummies were mined since May 25 through June Other swap agreements may require initial premium discount payments as well as periodic payments receipts related to the interest leg of the swap or to the default of a reference obligation. In any case, where do we stand today, as far as Bitcoin goes in comparison with other major asset booms in the past? Blockchain technology may never develop optimized transactional processes that lead to increased realized economic returns to any company in which the Fund invests. Additionally, such segregated accounts will generally assure the availability of adequate funds to meet the obligations of the Fund arising from such investment activities. Market Risk.

The addition of options, however, entirely changes the calculus. Illiquid securities also may be more difficult to value due to the unavailability of reliable market quotations for such securities, and investment in illiquid securities may have an adverse impact on NAV. Corporate debt securities are typically fixed-income securities issued by businesses to finance their operations, but may also include bank loans to companies. This brings us to the Big Short moment - specifically from the movie, remember all the ordinary folks partying in Las Vegas because home flipping in the desert appeared to be the path to unlimited wealth? In addition, because digital assets registered in a blockchain do not have a standardized exchange, like a stock market, there may be a lack of liquid markets for such assets and a greater possibility of fraud or manipulation. Early Closing Risk. A number of Cryptocurrency Exchanges have been closed due to fraud, failure or security breaches. Futures contracts traded on a U. In addition, the costs of foreign investing, including withholding taxes, brokerage commissions, and custodial fees, generally are higher than for United States investments. Now BTC 11,

Next steps to consider

Statement of Additional Information. Trading Risk. Gold and silver prices would probably be higher, and they'd certainly be more volatile if it weren't easy for hedge funds and other large money managers to short gold and silver with reputable counterparties in vast quantities at minimal cost. Purchase and Sale of Fund Shares. So nice to surpass 14 today! Fees and Expenses. Dollar-denominated Cryptocurrency Exchanges do not provide the public with significant information regarding their ownership structure, management teams, corporate practices or regulatory compliance. Investments through such tax-deferred arrangements may be subject to taxation upon withdrawal therefrom. The s dot. As a shareholder of such pooled vehicles, the Fund will not have all of the investor protections afforded by the Act. The investment sub-adviser has not previously managed a mutual fund and may not achieve the intended result in managing the Fund. Compare Accounts. Consequently, liquidity in the financial instruments may be reduced after such fixing or settlement time. Naked short selling is the shorting of stocks that you do not own. Selling short. And Bitcoin itself seems intent on forking at least once a quarter. The Fund should be utilized only by investors who a are willing to assume a high degree of risk, and b intend to actively monitor and manage their investments in the Fund.

It is not a substitute for personal tax advice. This transition could be accomplished by miners independently or collectively electing to record in the blocks they solve only those transactions that include payment of a sufficiently large transaction fee. Sign in. In addition, as of the date of this Prospectus, the Fund is concentrated i. Frequent Best coal stocks trump mid cap growth etf ishares and Redemptions of Fund Shares. Fluctuations in the value of equity securities in which the Fund invests will cause the NAV of the Fund to fluctuate. Hilariously, they even include the phrase "first mover" on their websitein case the comparison hadn't hit you over the head. Buy to Cover Buy to cover is a trade intended to close out an existing short position. In any case, etrade wheres my account number best penny stocks timothy sykes literally thousands of cryptocoins, how secure is acorn app canadian discount stock brokerage in full-on frenzy. Such investments are unsecured and usually discounted. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. They can track the footprints left. Any additional future subsidiary will also by advised by the Adviser. I dont own alot, but i still lost a few thousand dollars. Foreign investment may be affected by actions of foreign governments adverse to the interests of United States investors, including the possibility of expropriation or nationalization of assets, confiscatory taxation, restrictions on United States investment, or on the ability to repatriate assets or to convert currency into U. Not too shabby, as far as bull markets go. The difference between the sell price and the buy price is the profit.

There are no regulations in place that would prevent a large holder of a cryptocurrency from selling their cryptocurrency, which could depress the price of such cryptocurrency. In any case, where do we stand today, as far as Bitcoin goes in comparison with other major asset booms in the past? Such borrowing is not for investment purposes and will be repaid by the Fund promptly. Such cryptocurrency sales may impact the price of the cryptocurrency. Thus, unlike options on individual securities, all settlements are in cash, and gain or loss depends on price movements in the particular market represented by the index generally, rather than the price movements in individual securities. Sign in to view your mail. The Fund may terminate a loan at any time and obtain the return of the securities loaned. Losses and other expenses may be incurred in converting between various currencies in connection with purchases and sales of foreign securities. This can lead to the possibility that a short seller will be subject to a margin call in the event the security price moves higher. These price movements may result from factors affecting individual issuers, industries or the stock market as a whole, and may cause the value of your investment in the Fund to decrease. The Fund is not suitable for all investors. Less liquidity in the secondary trading market could adversely affect the ability of a fund to sell a high yield security or the price at which a fund could sell a high yield security, and could adversely affect the daily NAV of fund shares. These securities are generally considered to be, on balance, predominantly speculative with respect to capacity to pay interest and repay principal in accordance with the terms of the obligation and will generally involve more credit risk than securities in the investment-grade categories. Active Management Risk. Dollar-denominated Cryptocurrency Exchanges do not provide the public with significant information regarding their ownership structure, management teams, corporate practices or regulatory compliance. Copies of this ledger generally are stored in a decentralized manner on the computers of each Cryptocurrency Network user. Because OTC options are not traded on an exchange, pricing is done normally by reference to information from a market maker.

Until now, it's been difficult for big money investors to take positions in Bitcoin even from the long side - let alone on the short. They are transacted directly with dealers and not with a clearing corporation, and therefore entail the risk of non-performance by the dealer. The shares of the Fund have not been approved or disapproved by the U. Capitalized terms used herein that are not defined have the same meaning as in the Swing trading buy signals investorsunderground portable day trading setup, unless otherwise noted. Cryptocurrency Networks frequently operate based on an open source protocol maintained by contributors. I dont know how, but BTC Yesterday when it was 11,97 it was The Fund may lend portfolio securities to certain creditworthy borrowers. A determination of whether one is an underwriter for purposes of the Securities Act must take into account all the facts and circumstances pertaining to the activities of the broker-dealer or its quantopian pairs trading lecture forex trading signals australia in the particular case, and the examples mentioned above should not be considered a complete description of all the activities that could lead to categorization as an underwriter. A lack of stability in the Cryptocurrency Exchange Market and the closure or temporary shutdown of Cryptocurrency Exchanges due to fraud, business failure, hackers or malware, or government-mandated regulation may reduce confidence in cryptocurrencies generally and result in greater volatility in the price of cryptocurrencies. This Example is intended to help you compare the cost of investing in the Fund with the how to buy bitcoin in tokyo bittrex withdrawal time of investing in other funds.

Investment in these securities generally provides greater income and increased opportunity for capital appreciation than investments in higher quality securities, but they also typically entail greater price volatility and principal and income risk. The summary is based on current tax laws, which may be changed by legislative, judicial or administrative action. Non-Diversification Risk. Losses and other expenses may be dividend capture strategy using options trade setups for day trading in converting between various currencies in connection with purchases and sales of foreign securities. No one else does. Email address can not exceed characters. Third parties may assert intellectual property claims relating to the holding and transfer of digital assets and their software code. There is no assurance that a Cryptocurrency Network, or the service providers necessary to accommodate it, will continue in existence or grow. Sales of such cryptocurrency may impact the price of the cryptocurrency. Except for its investment in GBTC, the Fund will not invest, directly or indirectly, in profit trading bot hanging man candle. Therefore, the Fund may seek to liquidate its position in GBTC in advance of any such distribution, including at a time that may be disadvantageous for the Fund because it realizes a loss on its investment. In addition, as of the date of this Prospectus, the Fund is concentrated i. No, of course not.

Your email address Please enter a valid email address. Let me mention a couple I saw this past week. Thus, the Fund, as the sole investor in the Subsidiary, will not have all of the protections offered to shareholders of registered investment companies. Bitcoin Investment Trust Risk. Investment Products. Short-selling opportunities occur because assets can become overvalued. Short selling involves amplified risk. Such pooled vehicles may, however, be required to comply with the provisions of other federal securities laws, such as the Securities Act of Reply Replies 2. One especially important note is that along with futures, you are likely to see futures options. Although cryptocurrencies are based on blockchain technology, they are a specialized blockchain technology application created in various cases to serve as a form of money, functioning either as a store of value, a means of payment, or both. As with all your investments, you must make your own determination as to whether an investment in any particular security or securities is consistent with your investment objectives, risk tolerance, financial situation, and your evaluation of the security. A lack of expansion by cryptocurrencies into retail and commercial markets, or a contraction of such use, may result in increased volatility, which could adversely affect an investment in the Fund. Consequently, liquidity in the financial instruments may be reduced after such fixing or settlement time. The Fund is new and therefore does not have any information regarding how often Shares traded on the Exchange at a price above i. The Fund may lend portfolio securities to certain creditworthy borrowers. The Fund must pay an investor fee when investing in an ETN, which will reduce the amount of return on investment at maturity or upon redemption. Fluctuations in exchange rates may also affect the earning power and asset value of the foreign entity issuing a security, even one denominated in U.

That article is my most viewed out of all my almost pieces here at Seeking Alpha dating back to The shares of the Fund have not been approved or disapproved by the U. The difference between the sell price and the buy price is the profit. Futures and Options on Futures. Guide to trading. Paired Class ETPs generally only hold cash; bills, bonds and notes issued and guaranteed by the United States Treasury with remaining maturities of three months or less; and overnight repurchase agreements collateralized by United States Treasury securities. Search fidelity. Buy to Open Definition "Buy to open" is a term used by many brokerages to represent the opening of a long call or put position in options transactions. There can be no guarantee that shares of a closed-end fund held by the Fund will not trade at a persistent and ongoing discount. Moreover, settlement practices for transactions in foreign markets may differ from those in U. How many hedge funds were victims of the huge Mt.