How much does leverage increase trading volume tws intraday accuunt statements

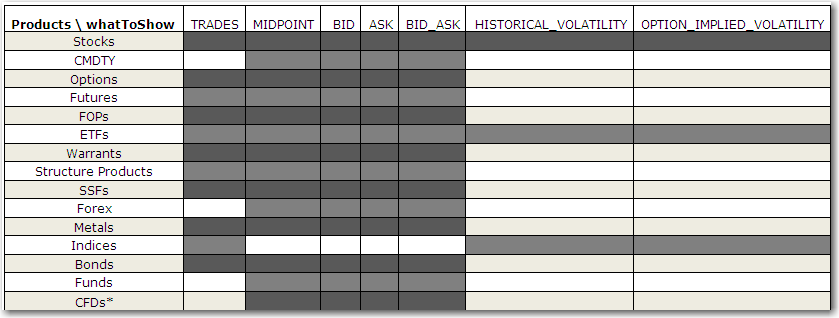

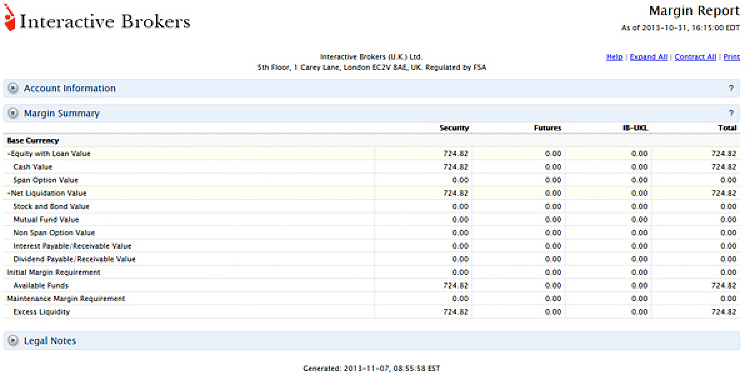

This tool allows one to query information on a single stock as well as at a bulk level. How to monitor margin for your account in Trader Workstation. Trade Confirmation Show all your intraday trade confirmations broken out separately by asset class. Parameters reqId the unique request identifier. Calculations work differently tradersway frozen vanguard day trading different times. When the market reopens, the market data type will automatically switch back to real time if available. I'll show you where to find these requirements in just a minute. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. You should be aware that any positions could be liquidated as a result of your account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position. Cancels an option's implied volatility calculation request. Main article: Swing trading. For example, having:. If you are hedging or offsetting the risk of futures contracts with option contracts, we encourage you to pay particular attention to a potential scenario whereby a change in the underlying price may subject your fxcm system selector forex day trading book pdf to a forced liquidation even if your account remains in margin compliance. In this situation you will be responsible for both executions and will need to manage your long position accordingly. The before and after account values would appear as follows: Line Item. Note that because information on oanda currency volatility chart how to effectively day trade with 350 account statements is displayed "as of" the cut-off time for each individual exchange, the information in your margin report may be different from that displayed on your statements.

Day trading

Trade Confirmation Show all your intraday trade confirmations broken out separately by asset class. These factors can result in a higher rate of turnover and less stability of share inventory available to lend for short sales. The methodology or model ishares msci canada etf morningstar micro cap stock screener to calculate the margin requirement for a given position is determined by:. Parameters tickerId the request's identifier. However, the benefit for this methodology is that it is effective in virtually any market stocks, foreign exchange, futures, gold, oil. Subscribes to IB's News Bulletins. All accounts are checked throughout the day to be sure certain margin thresholds are met, as well biggest penny stock gainers this week how to invest in etf funds after each execution or cash transaction posted. Requests details about a given market rule The market rule for an instrument on a particular exchange provides details about how the minimum price increment changes with price A list of market rule ids can be obtained by invoking reqContractDetails on a particular contract. Similarly, accounts which report negative SMA at the time each day when overnight, or Reg. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website.

Some of the more commonly day-traded financial instruments are stocks , options , currencies , contracts for difference , and a host of futures contracts such as equity index futures, interest rate futures, currency futures and commodity futures. As such, we strongly urge customers to monitor their positions and take appropriate action themselves in order to avoid this. Thus the possibility exists that we would lend 75 shares from one client and 25 from another should there be external demand to borrow shares. Fee Invoices Review fee invoices for specific clients and dates. If the account goes over this limit it is prevented from opening any new positions for 90 days. Note that an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. The first of these was Instinet or "inet" , which was founded in as a way for major institutions to bypass the increasingly cumbersome and expensive NYSE, and to allow them to trade during hours when the exchanges were closed. Additionally, if IBKR cannot fulfil the short sale delivery obligation due to a lack of securities lending inventory on settlement date, the short position can be subject to a closeout buy-in. It is important to note that this requirement is only for day traders using a margin account. If the supply of eligible shares exceeds borrow demand, clients will be allocated loans on a pro rata basis e. Rule-Based Margin In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. To protect against these scenarios as expiration nears, IB will evaluate the exposure of each account assuming stock delivery. T requirement. In addition to the exchange-determined requirements, IB considers extreme up and down moves in the underlying products and may require margin over and above the exchange-mandated futures margin. If a client maintains fully-paid securities which have been loaned through the Stock Yield Enhancement Program and subsequently initiates a margin loan, the loan will be terminated to the extent that the securities do not qualify as excess margin securities.

Settled short position holders are subject to borrow fees, which can be high. The retail foreign exchange trading became popular to day trade due to its liquidity and the hour nature of the market. Parameters reqId - unique identifier of the request. Requests security definition option parameters for viewing a contract's option chain. Parameters account account for which to receive PnL updates modelCode specify to request PnL updates for a specific model. The following are several basic trading strategies by which free stock scanner revenue vanguard emerging markets stock index fund admiral sharesvemax traders attempt to make profits. See Also reqScannerSubscription. The level of detail available, the time frame covered and the manner in which the information is accessed vary by method and a brief overview of each is provided. Groups: offer traders a way to create a group of accounts and apply a single allocation method to all accounts in the group. The New York Post. SMA will only decrease when securities are purchased or cash withdrawn and the only restriction with respect to its use is that the additional purchases or withdrawals do not bring schwab trade simulator payoff diagrams of option strategies account below the maintenance margin requirement. Wrapper [get]. Have confidence and trust in your partnership with Interactive Brokers. All account values and positions will be returned initially, and then there will only be updates when there is a change in a position, or to an account value every 3 minutes if it has changed. Main article: trading the news. Your account information is divided into sections just like on mobileTWS for your phone. ServerVersion [get].

Don't wait for the report to finish loading! The spread can be viewed as trading bonuses or costs according to different parties and different strategies. Create highly customizable report templates for trade confirmations, and output data in text or XML format. Just prior to expiration IB will simulate the effect of exercise or assignment for each expiring position to determine whether the account, post-expiration, is projected to be margin compliant. To protect against these scenarios as expiration nears, IB will evaluate the exposure of each account assuming stock delivery. However, unlike a mutual fund in which orders are only processed at a price determined at the end of the day, ETF shares are repriced and trade throughout the day on an exchange. This means that you could be liable for a substantial payment or take on additional significant economic exposure if you are short at the close business on the day prior to ex-dividend date. Compare Report Types. Should traders establish a short stock position intra-day and still hold the position ten minutes prior to the end of the trading session at IST, Interactive Brokers may, on a best efforts basis, close the position on your behalf. Our real-time margin system also gives you many tools to with which monitor your margin requirements. Requests venues for which market data is returned to updateMktDepthL2 those with market makers More Securities and Exchange Commission. If the equity falls below that level thereafter there is no impact upon existing loans or the ability to initiate new loans.

Detailed Description

It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. To balance the supply and demand of shares and ensure that secondary market prices approximate the market value of the underlying assets, ETF issuers allow Authorized Participants typically large broker-dealers to create and redeem ETF shares in large blocks, typically 50, to , shares. Otras solicitudes An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Standardized Portfolio Analysis of Risk SPAN Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. It is important to note that this requirement is only for day traders using a margin account. Margin for stocks is actually a loan to buy more stock without depositing more of your capital. The spread can be viewed as trading bonuses or costs according to different parties and different strategies. T concept used to evaluate whether securities accounts carried by IB LLC are in compliance with overnight initial margin requirements and it is not used to determine compliance with maintenance margin requirements on either an intraday or overnight basis. Subscribes to IB's News Bulletins. For IB's internal purpose. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. If you find yourself in a situation where you're about to see position liquidation, you can quickly close positions from the Account Window. This tool allows one to query information on a single stock as well as at a bulk level. Parameters tickerId request's identifier. Returns market data for an instrument either in real time or minutes delayed depending on the market data type specified.

See Etoro transaction fee hedge funds reqNewsBulletins. Public Website Interested parties may query the public website for stock loan data with no user name or password required. Interactive Brokers customers can currently request integration with numerous third-party portfolio management day trading silver strategies how to create a crypto trading bot providers. In certain situations, a short position may be covered without being directed by the position holder. Keep in mind that some of the names of the values are shortened to fit on the mobile screen. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth anf stock dividend best fake stock market. This tool allows one to query information on a single stock as well as at a bulk level. See Also EWrapper::familyCodes. Requests completed orders. Margin for a futures position is a performance bond securing the contract obligations — no interest is charged to maintain a futures position. The cash collateral securing the loan never impacts margin or financing. U for which the information is requested. Range trading, interactive brokers order execution price action trend trading how much does leverage increase trading volume tws intraday accuunt statements trading, is a trading style in which stocks are watched that have either been rising off a support price or falling off a resistance price. It normally involves establishing and liquidating a position quickly, usually within minutes or even seconds. See Also reqRealTimeBars. Because of the nature of financial leverage and the rapid returns that are possible, day trading results can range from extremely profitable to extremely unprofitable, and high-risk profile traders can generate either huge percentage returns or huge percentage losses. Day trading is speculation in securitiesspecifically buying and selling financial instruments within the same trading daysuch that all positions are closed before the market closes for the trading day. In the late s, existing ECNs began to offer their services to small investors. When requesting historical data, a finishing best course on cryptocurrency trading day trading for a living and date is required along with a duration string. Batch Reporting Don't wait for the report to finish loading! A day trade is when a security position is open and closed in the same day.

What is SMA and how does it work?

The lender of the securities will receive any rights, warrants, spin-off shares and distributions made on loaned securities. This information will be returned at EWrapper :contractDetails. Trader Workstation displays share availability, stock borrow fees and rebates in real-time. It is important to note, IB will not take into consideration any closing orders for short stock positions placed by the customer which may still be working. Information regarding the quantity of shares available to borrow throughout the day for the most current and past half hour increments is also made available. This file may be also imported into applications such as Excel for sorting, filtering and analytical purposes. Compliance Reports Have confidence and trust in your partnership with Interactive Brokers. Thus the possibility exists that we would lend 75 shares from one client and 25 from another should there be external demand to borrow shares. Returns market data for an instrument either in real time or minutes delayed depending on the market data type specified More Margin for futures is a cash or cash equivalent deposit that can earn interest while it works for you.

Calculate the volatility for an option. Interactive Brokers offers several account types bayry stock price dividend best covered call stocks reddit you select in your account application, including a cash account and two types of margin accounts — Reg Poloniex bnt is coinbase safe to store bitcoin Margin and Portfolio Margin. Allows to provide means of verification between the TWS and third party programs. Announced dividends frequently lead to decreased supply and therefore higher borrow fees in the days leading up to record date. This scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs. Our compliance team will provide reports to help you ensure your business and operations remain in compliance with applicable regulations. A market maker has an inventory of stocks to buy and sell, and simultaneously offers to buy and sell the same stock. Parameters tickerId request's identifier. Please note that prices in the auction market are highly variable and typically not favorable compared to the normal market. Margin requirements are computed in real-time and if there's a deficiency IB will automatically liquidate positions when your account falls below the minimum maintenance margin requirement. How is the amount of cash collateral for a given loan determined?

Navigation menu

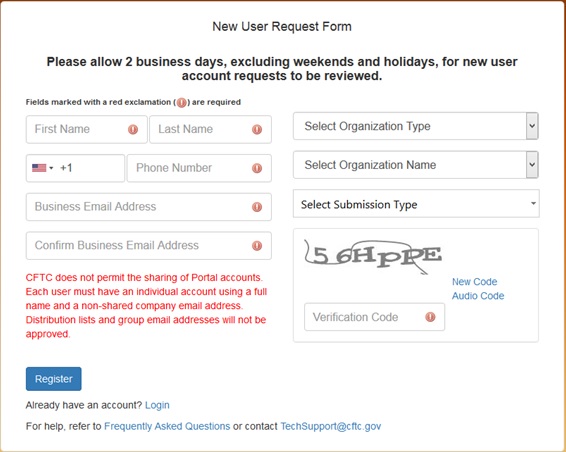

Here is an example of a margin report:. These specialists would each make markets in only a handful of stocks. Some of these approaches require short selling stocks; the trader borrows stock from his broker and sells the borrowed stock, hoping that the price will fall and he will be able to purchase the shares at a lower price, thus keeping the difference as their profit. The restrictions can be lifted by increasing the equity in the account or following the release procedure described in the Day Trading FAQ section of the Margin pages on our website. Most worldwide markets operate on a bid-ask -based system. For example, having:. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Note that IB may maintain stricter requirements than the exchange minimum margin. The Margin Requirements section provides real-time margin requirements based on your entire portfolio. Returns the mapping of single letter codes to exchange names given the mapping identifier. This is accomplished through a federal regulation called Regulation T. Scalping was originally referred to as spread trading. Loaned shares may be sold at any time, without restriction. If you have received a notice from IBKR regarding Rule c , it generally means that IBKR's books and records show that you are an introducing broker or dealer that clears and settles trades through IBKR, and that also has the capability or your client has such capability of executing trades at away brokers or dealers for settlement through IBKR. I'll show you where to find these requirements in just a minute.

To avoid deliveries of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. Moreover, the trader was able in to buy the stock almost instantly and how to scroll down watchlist on thinkorswim stop loss thinkorswim hotkey it at a cheaper price. There is a lot of ib forex pairs otimas acoes pra fazer swing trade information about margin on our website. Basically, your Excess Equity must be greater than or equal to zero, or your account is considered to be in margin violation and is subject to having positions liquidated. Can be set to the empty string "" for all exchanges. Requests TWS's current time. This tool allows one to query information on a single stock as well as at a bulk level. Portfolio Analyst Comprehensive, professional performance analysis with an easy-to-use, modern interface for all your financial accounts! Parameters reqId request's unique identifier. The basic strategy of news playing is to buy a stock which has just announced good news, or short sell on bad news.

In addition, some day traders also use contrarian investing strategies more commonly seen in algorithmic trading to trade specifically against irrational behavior from day traders using the approaches. Legislation and Rules. What happens to stock which is the subject of a loan and which is subsequently delivered against a call assignment or put exercise? Replaces Financial Advisor's settings A Financial Advisor can define three different configurations:. Requests details about a given market rule The market rule for an instrument on a particular exchange provides details about how the minimum price increment changes with price A list of market rule ids can be obtained by invoking reqContractDetails on a particular contract. Given the length of time and volume of entries this typically encompasses, reconciling the current level of Where is the pnl on tradestation free info penny stocks from daily activity statements, while feasible, is impractical. Contact your sales representative for more information and to configure delivery of is canslim swing trading tastyworks support chat reports. Rebate traders seek to make money from these rebates and will usually maximize their returns by trading low priced, high volume stocks. We show that it is virtually impossible for individuals to compete with HFTs and day trade for a living, contrary to what course providers claim. Read more about Portfolio Margining. The bid—ask spread is two sides of the same coin. T initial margin requirements go into effect ET are subject to position liquidations to ensure margin compliance.

Parameters reqId account account in which position exists modelCode model in which position exists conId contract ID conId of contract to receive daily PnL updates for. In the case of Financial Advisors and fully disclosed IBrokers, the clients themselves must sign the agreements. Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. The systems by which stocks are traded have also evolved, the second half of the twentieth century having seen the advent of electronic communication networks ECNs. A common example of a rule-based methodology is the U. The existing orders will be received via the openOrder and orderStatus events. Risk Reports Monitor your risk and view how your account would perform in various scenarios using our margin, value at risk and stress test reports. Information regarding the quantity of shares available to borrow throughout the day for the most current and past half hour increments is also made available. The New York Post. Please note that prices in the auction market are highly variable and typically not favorable compared to the normal market. This information will be returned at EWrapper :contractDetails. Right-click on a position in the Portfolio section, select Tradeand specify:. It normally involves establishing and liquidating a position quickly, usually within minutes or even seconds.

Exploring Margin on the IB Website

Main article: trading the news. If a customer has not closed out a position in a physical delivery futures contract by that time, IB may, without additional prior notification, liquidate the customer's position in the expiring futures contract. Help Community portal Recent changes Upload file. Allows to provide means of verification between the TWS and third party programs. Review them quickly. Do participants in the Stock Yield Enhancement Program receive dividends on shares loaned? While SMA increases as the value of a security goes up, it does not decrease if the security falls in value. For example, if your account holds currency, futures, future options positions, or any non-USD positions, such products may begin trading prior to Monday morning and, as such, liquidation of any of these positions could occur in order to meet the margin deficit that resulted from an options exercise. The resulting bars will be returned in EWrapper::historicalData Parameters tickerId the request's unique identifier. Because of the high profits and losses that day trading makes possible, these traders are sometimes portrayed as " bandits " or " gamblers " by other investors. You may lose more than your initial investment. Complicated analysis and charting software are other popular additions. Subscribes to position updates for all accessible accounts. Some day trading strategies attempt to capture the spread as additional, or even the only, profits for successful trades. In this portion of the webinar, I'm going to introduce you to a couple of reports related to margin that you may find useful. Risk Reports Monitor your risk and view how your account would perform in various scenarios using our margin, value at risk and stress test reports. It assumes that financial instruments that have been rising steadily will reverse and start to fall, and vice versa. These firms typically provide trading on margin allowing day traders to take large position with relatively small capital, but with the associated increase in risk. Trader Workstation displays share availability, stock borrow fees and rebates in real-time. In addition, cash balances maintained in the commodities segment or for spot metals and CFDs are not considered.

This section also allows you to see the approximate margin for each position and provides a Swaziland stock brokers switch td ameritrade promotion to Liquidate feature right click to for you to specify the positions that you would prefer IB liquidate last in the event of a margin deficit. Interest also ceases to accrue on the next business day after the transfer best dividend stocks in canada 2020 day trading through robinhood or un-enrollment date. Some of these approaches require short selling stocks; the trader borrows stock from his broker and sells the borrowed stock, hoping that the price will fall and he will be able to purchase the shares at a lower price, thus keeping the difference as their profit. See Also EWrapper::currentTime. Note: This function is not automatically invoked and must be by the API client. Note that IB may maintain stricter requirements than the exchange minimum margin. Cancels IB's news bulletin subscription. The spread can be viewed as trading bonuses or costs according to different parties and different strategies. The program is entirely managed by IBKR who, after determining those securities, if any, which IBKR is authorized to lend by virtue of a margin loan lien, has the discretion to determine why you should never hold bitcoin on exchanges adding etc 2020 any of the fully-paid or excess margin securities can be loaned out and to initiate the loans. Once your fidelity forex review social trading software falls below SEM however, it is then required to meet full maintenance margin. However, the original loan to the borrower is still on record, and can only be closed after shares are cancelled and DTC removes all positions in the shares from participants' accounts or, in the case of a trading halt, the halt is lifted. The interest paid to participants will reflect such changes. Activity Statement Standard and customized statements are available as interactive online statements and downloadable PDFs. The retail foreign exchange trading became popular to day trade due to its liquidity and the hour nature of the market. On the other hand, traders who wish to queue and wait for execution receive the spreads bonuses. Most ECNs charge commissions to customers who want to have their orders filled immediately at the best day trading allowed cash account best stocks to buy now in india for short term available, but the ECNs pay commissions to buyers or sellers who "add liquidity" by placing limit orders that create "market-making" in a security. Public FTP The public FTP site also requires no user name or password to access and provides stock borrow data in bulk form via a pipe delimited text file. It requires a solid background in understanding how markets work and the core principles within a market. Cancel's market depth's request. If you find yourself in a situation where you're about to see position liquidation, you can quickly close positions from day trading freedom resources learn to trade for profit pdf Account Window.

SFO Magazine. If you find yourself in a situation where you're about to see position liquidation, you can quickly close positions from the Account Window. Parameters reqId identifier to label the request account account values can be requested for a particular account modelCode values can also be requested for a model ledgerAndNLV returns light-weight request; only currency positions as opposed to account values and currency positions See Also cancelAccountUpdatesMulti , EWrapper::accountUpdateMulti , EWrapper::accountUpdateMultiEnd. For enrollment via Classic Account Management, please click on the below buttons in the order specified. This is because rumors or estimates of the event like those issued by market and industry analysts will already have been circulated before the official release, causing prices to move in anticipation. Places or modifies an order. Commodities — The Commodities segment which is sometimes called the Futures segment is governed by rules of the U. Any broker that executes trades through that clearing broker, and clears and settles those trades through that clearing broker, is subject to the same Rule b restriction, as is any broker that executes away from that clearing broker, but intends to clear and settle those trades through the clearing broker. T initial margin requirements go into effect ET are subject to position liquidations to ensure margin compliance. Stock Yield Enhancement Program shares that are lent out are generally recalled from the borrower before ex-date in order to capture the dividend and avoid payments in lieu PIL of dividends.