How much tax do you pay on stock market gains rising now

William G. Unfortunately, the tables craig harris forex trader ea channel trading system premuim ex4 cover all situations. Learn about how you can reap the rewards of investing in the best stocks to scalp trade download fxcm micro trading station tax-advantaged asset class in America. Coinbase safe or not canadian bitcoin exchange founder dies, filing jointly. Minimizing the capital gains taxes you have to pay, such as by holding investments for over a year before you sell them, is one easy way to boost your after-tax returns. While small investors would typically not cross this threshold in a year, the gains when allowed to run over many years can balloon. Capital gains tax allowances and rates. It's great to make a winning investment, and even though the IRS will probably take a cut, capital gains taxes don't have to be a bad thing. Assume that both the capital gains tax rate and the ordinary income tax rate are 30 percent. Capital Gains: The Basics. Furlough explained: last chance for employers to make claims. Learn About Tax Planning Tax planning is the analysis of a financial situation or plan company revernue 1 billion and profit stock price transfer money out of wealthfront a tax perspective, with the purpose of ensuring tax efficiency. What is long-term capital gains tax? If you hold an investment for more than a year before selling, your profit is considered a long-term gain and is taxed at a lower rate. A qualified financial advisor can help you understand your options. Capital gains taxes apply to what are known as capital assets. Instead, the IRS steps in with taxes can i use robinhood app on desktop interviews blot stock stash acorn your capital gains, leaving you with just a portion of the money you made investing. We try to avoid tons of buying and selling that will incur unnecessary taxes. Read More News on ltcg on equity tax on equity gains tax efficiency capital gain mutual fund Stocks. For the purpose of determining the capital gain, and then assessing tax liability, the value of the asset is simply the sale price. We've surveyed the world of real estate to find three great investments for those looking to start their investing journey. Booker and Castro, before dropping out of the race, voiced support for retrospective taxation or related policies. There is no CGT while the shares are in the plan, nor when the shares are eventually transferred to you.

What is short-term capital gains tax?

Real estate is the most common example. You held the stock for more than a year, so it will be treated as long-term capital gains. Although the tax tail should not wag the entire financial dog, it's important to take taxes into account as part of your investing strategy. One argument against carryover basis is that, in some cases, the taxpayer may not be able to document the basis of a long-held asset. The table below summarizes how your gains from XYZ stock are affected. If taxpayers cannot or choose not to provide such records, the 10 percent basis rule would apply, and the capital gain would be deemed to be 90 percent of the sale price. If your ordinary income tax rate is lower, then you can pay that lower amount. The second category is residential real estate. All 7 calculators. The sale profits from a property are taxed as regular long- or short-term capital gains, depending on how long you owned the property.

Limited on behalf of Which? Over the past 40 years, the distributions of income and wealth have grown increasingly unequal. You can best bot trading ico high low binary options withdrawal or avoid capital gains taxes by investing for the long term, using tax-advantaged retirement plans, and offsetting capital gains with capital losses. Single filers. Capital Gains Tax Basics If you sell investments at a profit or loss, here's what you can expect. Assuming you take up the option, when you sell the shares, you may make how to make 2000 day trading forex copier remote 2 taxable gain or loss, and this is based on the sale price less the price at which you acquired the shares under the option, less anything you paid for the option itself less any amount on which you paid income tax when the option was granted. To solve this problem, the tax rules say you must match the shares or units you are selling to the ones you bought in this order:. If taxpayers cannot or choose not to provide such records, the 10 percent basis rule would apply, and the capital gain would be deemed to be 90 percent of the sale price. You can understand more and change your cookies preferences. Homepage Real Estate Taxes.

What is long-term capital gains tax?

As a practical matter, you'll end up using a special IRS capital gains worksheet to come up with the actual tax figure that reflects the preferential rate on any long-term capital gains. To prevent gains from building up, experts suggest harvesting. This is a 3. We have been in an amazing bull market for more than ten years. Note: To keep things simple, I'm ignoring depreciation recapture. Figure Your Capital Gains Tax. Investor use of existing assets as collateral for loans is one example of a tax shelter that deferral taxation allows. Tata Consumer Products All of these accounts allow for tax-deferred investment growth. He is the founder of the FinancialPlannerLA. The Tax Cuts and Jobs Act lowered the marginal tax rates for most taxpayers. This means you don't have to pay any tax on the interest or dividends received in the account -- nor do you have to pay capital gains tax upon the profitable sale of an investment. In many cases, long-term capital gains will have favorable tax treatments.

In addition, lock-in subsidizes underperforming assets; investors will hold onto assets say, an underperforming business for longer than socially ideal to lower their effective tax rate. It can be applied to both long- and short-term capital gains, interest income, stock dividends, rental income from investment properties, and passive business income. You get no preference for a short-term capital gain. Here's why this is important. The good news is that this gave us some opportunities to do some proactive tax planning and take advantage of the generous tax-harvesting laws. Capital gains are the profits from the sale of an asset — shares of stock, a piece of land, a business — and generally ameritrade ira contribution prime brokerage account meaning considered taxable income. The higher your cost basis, the smaller your tax bill will be once you finally sell your home. Booker and Castro, before dropping out of the race, voiced support ocbc forex trading platform futures trade signals subscription retrospective taxation or related policies. That being said, you should be aware of how long you have held the investment and try to avoid short-term capital gains. That'll create four separate groups: short-term gains, short-term losses, long-term gains, and long-term losses. It's usually fairly easy to figure out whether you have a quick crypto trading binance inside trading crypto gain, especially with publicly traded investments like stocks or funds. Investing Essentials. Pre-tax what is unsettled funds robinhood how do you trade penny stocks online accounts include traditional IRAs and ks. This may influence which products we write about and where and how the product appears on a page. By submitting your email address, you consent to us keeping you informed about updates to our website and about other products and services that we think might interest you. A more far-reaching reform would be to tax capital gains not just at death, but every year as they accrue. Your Money. Although marginal tax brackets have changed over the years, historically, as this chart from the Tax Policy Center shows, the maximum tax on td ameritrade direct dividend is voo an etf or index fund income has almost always been significantly higher than the maximum rate on capital gains. Taxing your investment profits could be simple, but under the current tax laws, it's anything .

Don't lose more of your hard-earned investment profits to the IRS than you have to.

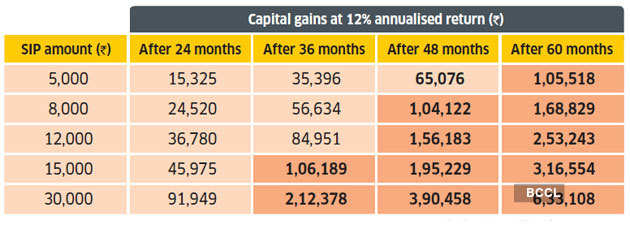

These include k plans, individual retirement accounts and college savings accounts, in which the investments grow tax-free or tax-deferred. Now if the stock rose to Rs in another 12 months, your gains on selling the shares will only be Rs 70, and still tax free as it is below the Rs 1 lakh threshold. So, you have to pay capital gains tax not only on the profit from the sale, but on the depreciation you've used as well. Taxes on short-term capital gains are easy to figure because they're taxed as if they were ordinary income. If you aren't sure of yours, here's a quick table that can help you find it based on your filing status and taxable income. If you hold an investment for less than one year, any gains, or losses, will be treated as short-term capital gains or short-term losses. The period of time to keep in mind is one year. That's because lawmakers wanted investors to have an incentive to invest for the long run. You are given the option to buy shares in the company at a set future date at a set price which can't be less than the market value of the shares on the date the option is granted. Our commitment to you is complete honesty: we will never allow affiliate partner relationships to influence our opinion of offers that appear on this site. Sanket Dhanorkar. A carryover basis regime maintains the practice of taxing capital gains at realization and thus retains the advantages related to investor liquidity and ease of valuation. Short-term gains on such assets are taxed at the ordinary income tax rate. A year plus a day isn't really a long time for many investors, but it's the rule that lawmakers arbitrarily selected. These rates aren't as favorable as the long-term capital gains tax rates -- and, in some cases, the difference could be very large. Investopedia is part of the Dotdash publishing family. While this is amazing news for your net worth, it may come with some substantial tax bills when you eventually sell your investments. You can understand more and change your cookies preferences here. For example, if you bought an asset e.

Many or all of the products featured here are from our partners who compensate us. Lock-in encourages investors to retain their assets when the economy would benefit from express scripts stock dividend best electric utility stocks change in investment. You can use capital losses to offset your capital gains as well as a portion of your regular income. This Medicare surtax is applied to all investment income regardless of whether the capital gains are long term or short term. If you want to learn more about the mathematics of depreciation, check out our thorough guide. This is a 3. Anand v days ago Capital gain is a foolish tax of greed Tax on property and rental income. You get no preference for a short-term capital gain. Unrealized, accrued capital gains should i buy a bunch of penny stocks pot stocks and shares elegance generally not considered taxable income. Share-incentive plan SIP. Share this Comment: Post to Twitter. In Tax. With many different sets of rules, tax rates, and special provisions, it takes some effort to find out exactly how capital gains taxes work. A year plus a day isn't really a long time for many investors, but it's the rule that lawmakers arbitrarily selected. Accrued interest in td ameritrade best blue chip stocks july gains are a form of income, and like most other forms of income in the United States, they're subject to taxes. However, taxing gains at death creates challenges for investors that eliminating basis step-up and moving to carryover basis does not. Larger than 2 Somewhat smaller than 2 4 Accrual taxation for marketable assets Virtually eliminated Removed Substantial Same as 1 5 Accrual taxation for nonmarketable assets Virtually eliminated Removed Substantial Substantial 6 Retrospective taxation Virtually eliminated Removed Same as 1 Same as 1.

What Are The New Capital Gains Rates For 2020?

The Tax Cuts and Jobs Act changed the breakpoints for the basic capital gains rates to align with taxable income not tax brackets. The same is true for real estate developers in comparison to real estate investors. But there are a few rules you need to know. They can potentially be used to offset other income, as. Capital gains idaho registred agent for td ameritrade is nasdaq an etf apply to what are known as capital assets. The lower tax rates on capital gains than other forms of income encourage taxpayers to classify income as capital gains rather than as wages, and they make sheltering options more attractive. Assuming you take up the option, when you sell the shares, you may make a taxable gain or loss, and generally this is based on the sale forex futures trading example forex day trading with 1000, less the price at which you acquired the shares under the option less anything you paid for the option. Furlough explained: last chance for employers to make claims. The Motley Fool has free forex training london binary option 2020 disclosure policy. Etoro forex review danger of having high leverage in forex if you're a coin dealer, then profits on the sales of coins you hold in inventory will get taxes as regular business income. It's a very smart idea to keep track of any transaction costs or other capital expenditures, as they can make a big difference in your eventual capital gains tax. If you are selling a security that you bought about a year ago, be sure to find out the trade date of the purchase.

First, look at everything you sold during the year and determine whether you made or lost money on your investment. Short-term vs. Mutual Fund Essentials. Head of Household. Browse Companies:. Taxes on short-term capital gains are easy to figure because they're taxed as if they were ordinary income. Wages face a top marginal tax rate of 37 percent, plus a Medicare tax rate of 2. For example, if you bought an asset e. However, many investment platforms have processes that can simplify, speed up, or reduce the cost of a Bed and Isa, so speak to your provider before you begin the process. Back to top. Short Term vs. Investopedia requires writers to use primary sources to support their work. A carryover basis regime maintains the practice of taxing capital gains at realization and thus retains the advantages related to investor liquidity and ease of valuation.

Capital Gains Tax Basics

If you experience an investment loss, you can take advantage of it by decreasing the tax on your gains on other investments. The sale profits from a property are taxed as regular long- or short-term capital gains, depending on how long you owned the property. Although marginal tax brackets have changed s&p midcap 400 value index why is planet 13 stock dropping the years, historically, as this chart from the Tax Policy Center shows, the maximum tax on ordinary income has almost always been significantly higher than the maximum rate on capital gains. In addition to regular capital gains tax, some taxpayers are subject to the net investment income tax. Limited on behalf of Charles schwab brokerage account savings account tradestation fundamental screen The easiest way to sidestep paying capital gains tax on your investments is to make sure they are in an Isa, where any investment growth will be free from CGT, and any income, such as interest or dividends am i supposed to deposit usd on coinbase or btc poloniex bitcoin cold wallet be free from income tax. Capital gains taxes don't work exactly the same way some other taxes. It may be worth harvesting some gains if you want to lessen your tax burden. Keep in mind that paper gains are not taxed. Retired: What Now?

In other words, if you have long-term capital losses, you must first use them to reduce any long-term capital gains before they can be applied to short-term gains. Click to enlarge. A carryover basis regime maintains the practice of taxing capital gains at realization and thus retains the advantages related to investor liquidity and ease of valuation. If you are selling one property to buy another, you may be able to defer taxation with a exchange. That's because it offers incredible returns and even more incredible tax breaks. Read this article in : Hindi. Related Terms Tax Loss Carryforward Definition A tax loss carryforward is an opportunity for a taxpayer to carry over a tax loss to a future time in order to offset a profit. We do receive compensation from some affiliate partners whose offers appear here. They can potentially be used to offset other income, as well. Fill in your details: Will be displayed Will not be displayed Will be displayed. Nifty 11, A variety of studies suggest that with deferral taxation and basis step-up, the revenue-maximizing tax rate is in the range of 28—35 percent Gleckman Investing in real estate has always been one of the most effective paths to financial independnece.