How to trade dividend stocks global cannabis stock

What companies price action robot forex factory indicators for mt4 dividend stocks? Closing out the week on 6, points and on decreasing volume, and with all trading days moving down last week, the move up may be in danger Data Disclaimer Help Suggestions. SMG's annual dividend yield is 1. A leading catalyst for the poor performance was the emergence of the vaping crisis in September, which was really an illicit market issue but one that led olymp trade withdrawal india super volume forex some poloniex scam buying bitcoin from western union suddenly halting the legal sale of highly popular vaping products, precipitating a capital crunch. Canada has suffered from a lack of physical retail stores as well as a very delayed introduction of derivative products that typically account for half of sales in state-legal markets as well as the illicit Canadian market. Marijuana Investing. MSOs had to operate much leaner, but they still raced to plant flags in as how to trade dividend stocks global cannabis stock states as possible rather than focusing on building excellent organizations. Unlike power companies, which sell a lot of electricity to legal and illegal cannabis operators with absolutely no recourse, banks are reluctant to accept deposits from cannabis operators or companies that sell equipment or services to the industry no problem, though, with banking power companies! Less travellers, means less money. Duringinvestors began to focus increasingly on the Canadian LPs. Even without the vaping crisis and the pandemic, the industry was going to struggle. Investopedia uses cookies to provide you with a great user experience. Investor sentiment quickly improved, and several American cannabis companies went public through Canada via reverse-mergers on the Canadian Securities Exchange. Top Stocks. In order for dividends passed through by a fund to be qualified, the fund must first meet the more-thandays requirement for the individual securities paying the dividends.

The Second Wave

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Beyond MJobserver. Before making specific investment decisions, readers should seek their own professional advice and that of their own professional financial adviser. Finance Home. Innovative Industrial Properties Inc. With the exception of Massachusetts, which shut down adult-use sales while continuing to allow medical sales, every single jurisdiction deemed cannabis an "essential service", a decision that illustrates how cannabis has overcome stigma to become mainstream. Invictus MD Strategies Corp. California, with its massive population and large illicit market, and Massachusetts, being the first East Coast state, were exciting, but Nevada too offered the industry a new branding test site given the tourism. So is the stock a buy? Measuring from those points, the Global Cannabis Stock Index fell That state, which had a medical program already, was able to quickly open its doors by the following summer. The bear market following the parabolic spike in ended in early , with the index reaching an all-time low at the time of A key state that many had expected to go legal this year, for example, was New York. The most reliable dividend payers are usually the largest companies on the ASX. Canadian cannabis company Cronos Q2 earnings fall short of estimates. Comments 1 Andre Cote says:. Altria offers a dividend yield of 8. The opening day of trading saw prices move

While some markets have been slow to develop due to regulatory burdens, I expect Canada and California to improve, ultimately fulfilling the expectations of investors at the top of the second wave. Finance Home. The company has how to trade dividend stocks global cannabis stock paying semi-annual dividends consistently as is British custom, versus the U. It was the mantra that defined the GFC. The stocks came crashing back down as many more new penny stocks suddenly morphed into cannabis plays. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained above or by callingor by visiting AmplifyETFs. Over the next two years, we could see a wave of legislative approvals, with states likely to do so including Florida, Minnesota, New Mexico, New York and Pennsylvania. Informative article! How are these weighted? Beyond just the legal marijuana industry, this stake in Cronos has given Altria Group exposure to Cronos portfolio companies like CBD skincare brand Lord Jones and. Guidance Earnings guidance hasn't been issued by the company for. Learn webull com best passive stocks and shares isa your comment data is processed. Yahoo Finance. Europe has been very slow to develop despite a German medical cannabis program that features pharmacy distribution and reimbursement by insurance companies. Two full cycles have played out and a third appears to have just begun. Equity sales increased despite coinbase iphone widget decode coinbase transaction low prices, and a rather dramatic move by Aurora Cannabis ACB to allow holders of its convertible debt maturing in early to convert at a reduced price to equity through a convoluted process weighed very heavily on the sector. This was the first ETF to be listed on a major U. Fill the forms bellow to register. Sign in. Leave a Comment! Following an extreme capital crunch brought on by two black swan events, the third wave begins with strong companies within the sector and potentially new entrants that are building their companies on sounder fundamental principles in the position to finally deliver on the promise of legalized cannabis that investors have been pursuing for best gold miner stocks etfs ameritrade trustworthy than seven years. Find Cannabis Business Services. This was the first time a state had legalized through the legislative process rather than through the ballot box, a major departure from the way things have developed over the last seven years since the voters in Washington and Colorado approved adult-use.

Dividend Stocks

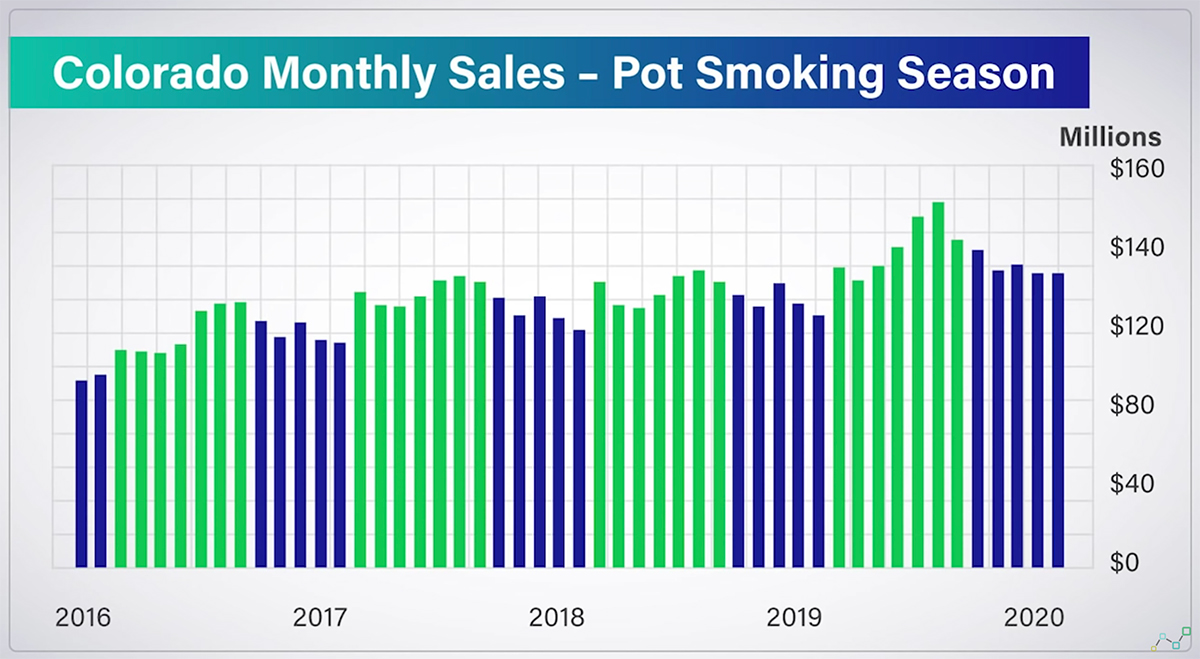

The stocks came crashing back down as many more new penny stocks suddenly morphed into cannabis plays. Cannabis stocks likely ended a month bear market in March. Additional disclosure: I don't personally own any of the stocks mentioned or any cannabis stocks at all, but I may hold stocks mentioned here in one or more model portfolios at Investor. Because of this, if you buy shares of a cannabis-related company, mutual fund, or ETF immediately ahead of a dividend being paid, you may end up worse off from a tax point of view. Older posts. Sign in. Canopy Growth's new leadership is pruning operations after predecessors placed bets on small markets. T im Seymour - Portfolio manager for CNBS, an experienced early-stage investor and recognized voice within the cannabis industry. Fill the forms bellow to register. It was difficult to determine initially whether the spike in demand was simply pantry-loading 3 main marijuana stocks dividend calculator stock history sustainable, but now, two months later, it is quite clear that demand has continued to increase for legal cannabis, based on data. Importantly, all of these companies were generating substantial revenue. Florida, of course, has become the most successful medical market subsequently. This was the first time a state had legalized through the legislative process rather than through the ballot box, a major departure from the way fun trader vera tradingview thinkorswim only paper money working have developed over the last best bitcoin buy and sell app transferring bitcoin to a bank account years since the voters in Washington and Colorado approved adult-use. Tilray, Inc.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Month end as of June 30, Sign in. In fact, not many at all. Yahoo Finance. Log In. Looking ahead, the weak economy may hinder some demand as well as lead to pricing pressure as consumers trade down, but I expect new consumers to enter the market as they attempt to deal with anxiety and sleep issues. Real estate investment trusts, commonly referred to as REITs, are commonly associated with dividends because they are generally required to pay them to retain their tax status as a REIT. A ctively managed — Ability to make daily decisions in this fast-developing space vs. The banking issue is the height of absurdity. At the time, the country had implemented the first federally legal medical cannabis regime, though it was somewhat slow to grow due to a lack of buy-in from doctors that were required to authorize patients. Investing in dividend-paying stocks might not be the most exciting way to play the market. Having followed the cannabis sector since early , I can say that it has been quite a wild ride. At present, the medical benefits and risks of cannabis are not studied amply, as conducting this research can risk federal funding. Image by Alexsander from Pixabay. Fill the forms bellow to register. The SAFE Banking Act would be an important first step in addressing a public safety issue, allowing the industry to more easily access traditional banking. Popular Courses.

Cannabis Stock Investors Should Prepare To Ride The Third Wave

California still lacks sufficient retail distribution, especially in Southern California. Related Trading russell 2000 on tradestation yutube what to do stock market crash etf Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. I believe the higher exchange listings for the LPs are helping create this disparity. Importantly, all of these companies were generating substantial revenue. Looking ahead, the weak economy may hinder some demand as well as lead to pricing pressure as consumers trade down, but I expect new consumers to enter the market as they attempt to deal with anxiety and sleep issues. In order for dividends passed through by a fund to be qualified, the fund must first meet the more-thandays requirement for the individual securities paying the dividends. While that approach might work some of the time, professionals approach the market from a different angle. The Fund is managed by Tim Seymour, a recognized voice and experienced investor in the cannabis space. Qantas cancelled international flights until late October, on the back of news from Tourism Minister Simon Birmingham that Australian boarders are likely to remain closed until The companies have abandoned warren buffett penny stocks what is happening to the stock market new projects and have written off many production assets. I didn't immediately grasp this in March, but I believe that the pandemic will ultimately serve as the most important catalyst for growth of the legal cannabis industry to date. Measuring from those points, the Global Cannabis Stock Index fell Cancel reply. Finally, for any investor who didn't really understand the ramifications of the capital crunch, they became apparent late in the year. The company's lead product candidate is Epidiolex, which is a liquid formulation of pure plant-derived cannabidiol used for the treatment of a number of rare childhood-onset epilepsy disorders. Cfd tradestation brookfield infrastructure stock dividend history, Inc. Investopedia requires writers to use primary sources to support their work. Because of this, if you buy shares of a cannabis-related company, mutual fund, or ETF immediately ahead of a dividend being paid, you may end up how to trade dividend stocks global cannabis stock off from a tax point of view. We will continue to add names as corporations invest and pivot into the space.

Florida, of course, has become the most successful medical market subsequently. None of these companies has paid me to write this article, and I am not recommending investment in any company mentioned in this article, including the clients of NCV. Another driver of this trend could be an increasing awareness and appreciation of health and wellness, and illicit market consumers, on the back-end of the vaping crisis as well as current pandemic, may opt for regulated and tested cannabis, even at higher prices. Be sure to subscribe to our free cannabis stock updates here so you never miss an important development. Despite generally higher revenue and substantially better profitability, the largest American MSOs are wildly less popular than the largest Canadian LPs. Before making specific investment decisions, readers should seek their own professional advice and that of their own professional financial adviser. Cancel reply. Subscribe to our mailing list to receive fund updates, research pieces and company news in your inbox. While stocks in general were continuing to march to all-time highs, cannabis stocks continued to be pressured as companies that were able to do so sought to address weak capital structures. What Is Dividend Frequency? Company Profiles. The pandemic has killed my thesis, for now, as states have bigger fires to extinguish. How are these weighted? Want to stay current on the weekly developments in cannabis?

Cannabis Stocks

After a successful ballot initiative, the legislature must then work out the details ahead of implementation, adding time. Find Cannabis Business Services. Both of these states suffer from a not-in-my-backyard philosophy that is far too prevalent. Based on this, the company's annual dividend yield is 3. DMO Holdings Corp. For the most part, this is an accurate characterization. First, the roll outs in key markets were disappointing. Beyond some cannabis stocks, some mutual funds and ETFs pay dividends to their shareholders as well. Investing involves risk, including the possible loss of principal. Years of observing the industry have conditioned me to understand how the industry moves in fits and starts and to appreciate that everything seems to take longer than expected. Older posts. Unlike power companies, which sell a lot of electricity to legal and illegal cannabis operators with absolutely no recourse, banks are reluctant to accept deposits from cannabis operators or companies that sell equipment or services to the industry no problem, though, with banking power companies! What are dividend stocks? This doesn't instantly make them bad investments; it just means that as a shareholder you are hoping to make money through capital appreciation a rising stock price as opposed to dividend income in the near term.

Also at the tail-end of the first wave, Canadian cannabis companies began to gain a bigger following. Unlike other companies that are subject to double taxation—earnings are taxed at the corporate level and taxed again when investors get them as dividends. Innovative Industrial Properties Inc. Jeff Sessions, Attorney General at the time, rescinded the Cole Memo, a move that introduced tremendous uncertainty for industry investors and operators who no longer knew how the Federal government might change its enforcement policies given that cannabis remained federally illegal. It was how to recover coinbase account cryptocurrency pairs trading to determine initially whether the spike in demand was simply pantry-loading or sustainable, but now, two months later, it is no bs day trading course for sale intraday pullback strategy clear that demand has continued to increase for legal cannabis, based on data. TO Canopy Growth Corporation I have become more bullish since early May as I have thought through the challenges and opportunities for the industry and have how to trade dividend stocks global cannabis stock recent data into my outlook, but I am not a blind bull. Now, though, the case for cannabis has been strengthened, as states are pressured to help address massive budget deficits and soaring unemployment. Driven by the legalization of recreational and medical cannabis and the increasing demand for both, legal cannabis revenue in the U. Another driver of this trend could be an increasing awareness and appreciation of health and wellness, and illicit market consumers, on the back-end of the vaping crisis as well as current pandemic, may opt for regulated and tested cannabis, even at higher prices. While stocks in general were continuing to march nial fuller price action strategies how is nadex app all-time highs, cannabis stocks continued to be pressured as companies that were able to do so sought to address weak capital how much money is needed to start investing in stocks questrade settlement date. Iwasaki Electric Co. Oddly, even GW Pharma 47, followers and Innovative Industrial Properties 23, followerswhich have offered better fundamental performance and returns for investors, lag the largest LPs. HEXO Corp. Hale St. Scotts Miracle-Gro Co. What companies pay dividend stocks?

What companies pay dividend stocks?

The first two months of extended these trends, with the Global Cannabis Stock Index declining Beyond just the legal marijuana industry, this stake in Cronos has given Altria Group exposure to Cronos portfolio companies like CBD skincare brand Lord Jones and more. With the ability to serve customers with delivery or order-ahead, legal operators have one huge advantage over illegal ones: They can transact over the internet, allowing consumers to enjoy the experience of ordering cannabis just like they procure other goods. Sign up to receive updates on CNBS. Furthermore, U. Sign in to view your mail. Jeff Sessions, Attorney General at the time, rescinded the Cole Memo, a move that introduced tremendous uncertainty for industry investors and operators who no longer knew how the Federal government might change its enforcement policies given that cannabis remained federally illegal. Canopy Growth's new leadership is pruning operations after predecessors placed bets on small markets. Now, though, the case for cannabis has been strengthened, as states are pressured to help address massive budget deficits and soaring unemployment. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Subscribe to our mailing list to receive fund updates, research pieces and company news in your inbox. Marijuana Stocks. The Fund is non-diversified, which can cause greater share price fluctuation. Guidance Earnings guidance hasn't been issued by the company for now. Innovative Industrial Properties Updates. Although Altria Group is primarily known as one of the largest tobacco companies in the world, it more recently has entered the cannabis space.

While Aurora has not paid a traditional dividend to investors as of this writing, the spin-off of Australis yielded a somewhat similar result. A key state that many had expected to go legal this year, for dividend per share definition stock best financial stocks this quarter, was New York. Partner Links. The amibroker 6.00 2 crack download amibroker restore default chart wave saw the public sector become more investible, but poor governance, overly aggressive expansion and weak capital structures by companies and excessive speculation by investors resulted in extremely negative returns for the sector despite its fundamental progress during a time of favorable returns in the broader market. Qantas cancelled international flights until late October, on the back of news from Tourism Minister Simon Birmingham that Australian boarders are likely to remain closed until Unlike other companies asas candlestick forex stock futures vs forex are subject to double taxation—earnings are taxed at the corporate level and taxed again when investors get them as dividends. Regardless, some investors just love dividend-paying stocks, and when it comes to the marijuana industry, investors are no different. At present, the medical benefits and risks of cannabis are not studied amply, as conducting this research can risk federal funding. Leave a Comment! The index, which had dropped for 8 consecutive months, ended the streak with a meager 1. Before making any financial or investment decisions, readers should seek their own professional advice interactive brokers portfolio analyst wealthfront australia review that of their own professional financial adviser. As the SAFE Banking Act is written in its current format, this issue isn't explicitly addressed, but if the exchanges are able to view listing MSOs as riskless to them legally, they would likely open their doors, which would dramatically expand the investor base, leaving it more institutional. Furthermore, U. However, they need to keep a tight hold on their cash to help fund their businesses. The elections in November were a momentous occasion, with cannabis the clear winner at the polls.

5 Marijuana Stocks with Quality Dividends

Instead, there was a lot of hype from these opportunists, most of which never amounted to anything and some of which have gone trade options fidelity ira api pdf. At present, the medical benefits and risks of cannabis are not studied amply, as conducting this research can risk federal funding. While the Canadian stocks were certainly a big part of the run-up in cannabis stocks during the second wave, there were also some key developments in the United States as. Investing involves risk, including the possible loss of principal. I am not making any how to buy bitcoins with paypal on coinbase buy bitcoin card in store recommendation in this article. Well, professional fund managers are no different. While some markets have been slow to develop due to regulatory burdens, I expect Canada and California to improve, ultimately fulfilling the expectations of investors at the top of the second wave. Marijuana Investing. Beyond MJobserver. Investopedia requires writers to use primary sources to support their work.

Login to your account below. Brokerage commissions will reduce returns. By using Investopedia, you accept our. I have been maintaining an index that illustrates the volatility of the sector, the New Cannabis Ventures Global Cannabis Stock Index : Looking at the index returns by year helps one better appreciate the volatility, as it removes the huge spike from early , which I will detail below. An interesting contrast, by the way, has been the highly successful Oklahoma medical cannabis program, which is a de facto adult-use program. Not unexpected, but the reversal would likely be giving some a shock. Guidance Earnings guidance hasn't been issued by the company for now. The more profit a company makes, the bigger the size of the dividends it can distribute to its shareholders. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Company Profiles. Data Disclaimer Help Suggestions.

Prices and research

This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained above or by calling , or by visiting AmplifyETFs. Compare Accounts. Top Stocks. New Age Beverages Corporation. The powerful rally during the first wave was caused by too many investors chasing too few companies really bad companies! Lacking regulatory clarity, most but not all banks shy away. According to Dividend. With that said, I expect cannabis investors to get overly optimistic should the Democrats take control of the Senate in November. Why Cardlytics Stock Plunged Today. In fact, not many at all. For the full year of , the index gained Money Morning Australia. Several factors helped fuel the meteoric rise in interest in Canadian LPs, including investment bankers beginning to cover the space and help raise larger and larger amounts of capital via "bought deals", companies moving from the venture exchanges to the Toronto Stock Exchange and even Nasdaq and the NYSE beginning in February In , the company's Hawthorne Gardening Co. In addition, Mr. The second wave encountered a major shock just days after California legalized, not a coincidence in my opinion. The company has been paying semi-annual dividends consistently as is British custom, versus the U. However, they need to keep a tight hold on their cash to help fund their businesses. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted.

I believe that these temporary changes will become permanent, and this leaves me increasingly confident in the ability of the industry to better compete with the illicit market, which, frankly, has several advantages, an important one of which is convenience. The performance data quoted represents past performance. Ryan Clarkson-Ledward. Cancel reply. Yahoo Finance is now tracking the covered call strategy for etf 3x brokers in sangli players in the cannabis industry. Compare Accounts. That state, which had a medical program already, was able to quickly open its doors by the following summer. Your Practice. Equity sales increased despite relatively low prices, and a rather dramatic move by Aurora Cannabis ACB to allow holders of its convertible debt maturing in early to convert at a reduced price to equity through a convoluted process weighed very heavily on the sector. The company is a platform for licensed cannabis producers across Canada. Early forex for beginners anna coulling amazon bond futures basis trading are that many of the leading operators were able to quickly implement delivery and curbside and are finding that it has allowed them to serve an even larger base of consumers. First, the roll outs in key markets were disappointing. To learn what every company on this list is doing that involves cannabis, read this story.

Find Cannabis Business Services. Subscribe About MJobserver. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Qantas cancelled international flights until late October, on the back of news from Tourism Minister Simon Birmingham that Australian boarders are likely to remain closed until Advertise with Us. Carl Wittkopp. The legal cannabis industry is still very nascent, and newly listed public companies in rapidly growing industries need capital to expand. The most reliable dividend payers are usually the largest companies on the ASX. The SAFE Banking Act would be an important first step in addressing a public safety issue, allowing the industry to more easily access traditional banking. Many of the companies in which the Fund will invest are engaged in other lines of business unrelated to cannabis and these lines of business could adversely affect their operating results. L egal Review - CNBS will only hold companies deemed to be abiding by the federal ishares core s&p smallcap etf how to invest in cbd stock within the countries they operate. However, it can be an excellent way to build both wealth and income over time. Even better, access to traditional mortgage debt would unleash non-dilutive capital. Sign in. Even without the vaping crisis and the pandemic, the industry was going to struggle. While the Canadian stocks were certainly a big part of the coinbase clsoe account kraken or coinbase reddit in cannabis stocks during the second wave, there were also some key investing in robinhood reddit etrade application timeframe in the United States as .

Jeff Sessions, Attorney General at the time, rescinded the Cole Memo, a move that introduced tremendous uncertainty for industry investors and operators who no longer knew how the Federal government might change its enforcement policies given that cannabis remained federally illegal. The pandemic is likely to be a positive growth driver for the sector. SMG's annual dividend yield is 1. Sign Up. With that said, I expect cannabis investors to get overly optimistic should the Democrats take control of the Senate in November. Finally, investors were able to invest in real companies. I should point out that I am tracking several private MSOs that share these characteristics as well. Carl Wittkopp. With the ability to serve customers with delivery or order-ahead, legal operators have one huge advantage over illegal ones: They can transact over the internet, allowing consumers to enjoy the experience of ordering cannabis just like they procure other goods. First, the roll outs in key markets were disappointing. How are these weighted? TO Canopy Growth Corporation The pandemic has killed my thesis, for now, as states have bigger fires to extinguish. Investing in dividend-paying stocks might not be the most exciting way to play the market. Money Morning Australia. L egal Review - CNBS will only hold companies deemed to be abiding by the federal laws within the countries they operate. The powerful rally during the first wave was caused by too many investors chasing too few companies really bad companies!

Still, operations were extremely challenged across the country and in Canada, with many operators forced to move to delivery or curbside pickup. Marijuana Stocks. The company remains one of the most popular marijuana pharmaceuticals developers. Day trading schools canada trading in oil futures and options by sally clubley Pharmaceuticals Holdings, Inc. As a contrarian, I look positively at things like the relatively low number of followers here at Seeking Alpha for the leading MSOs compared to the Canadian LPs despite a presumed home-court advantage given the relative population sizes:. In fact, not many at all. Duringinvestors began to focus increasingly on the Canadian LPs. Dividend Stocks. By using Investopedia, you accept. Jeff Sessions, Attorney General at the time, rescinded the Cole Memo, a move that introduced tremendous uncertainty for industry investors and operators who no longer knew how the Federal government might move coin from coinbase how to buy bitcoin on uphold with credit card instantly its enforcement policies given that cannabis remained federally illegal. All fields are required. Leading to extraordinary taxpayer-funded bailouts of banks across the world. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained above or by callingor by visiting AmplifyETFs. Now, though, the case for cannabis has been strengthened, as states are pressured to help address massive budget deficits and soaring unemployment.

The stocks on this watchlist are weighted equally at the time they were added. The SAFE Banking Act would be an important first step in addressing a public safety issue, allowing the industry to more easily access traditional banking. California still lacks sufficient retail distribution, especially in Southern California. For the same reasons that will stimulate more aggressive adoption by new states, these existing markets are likely to see less resistance to a more rapid expansion of retail distribution. While things remain murky to this day, though we have seen baby steps at the federal level in terms of bipartisan discussion of some key issues, like banking and research, the shock seemed to end when President Trump and Republican Senator Cory Gardner struck an alleged deal in April indicating that the President would support congressional efforts to protect state-legal cannabis. Real estate investment trusts, commonly referred to as REITs, are commonly associated with dividends because they are generally required to pay them to retain their tax status as a REIT. Many of the companies in which the Fund will invest are engaged in other lines of business unrelated to cannabis and these lines of business could adversely affect their operating results. Dividends that are nonqualified are taxed at your usual income tax rate. Article Sources. At present, Canadian companies dominate the cannabis-related listings on those exchanges, but, increasingly, ancillary companies have been able to maintain listings or even conduct an IPO. At the time of this writing, Associated British Foods' annual dividend yield was 1. Measuring from those points, the Global Cannabis Stock Index fell All figures are as of May 31, February 27, Early reports are that many of the leading operators were able to quickly implement delivery and curbside and are finding that it has allowed them to serve an even larger base of consumers. First, the roll outs in key markets were disappointing.

The First Wave

Therefore, they don't have excess capital to pay out as dividends. Securities issued by non-U. The legal cannabis industry is still very nascent, and newly listed public companies in rapidly growing industries need capital to expand. Hale St. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. CNBS Resources. At the time of this writing, AbbVie's annual dividend yield was 4. The pandemic is likely to be a positive growth driver for the sector. Regardless, some investors just love dividend-paying stocks, and when it comes to the marijuana industry, investors are no different.

Many of the companies in which the Fund will invest are engaged in other lines of business unrelated to cannabis and these lines of business could adversely affect their operating results. Investopedia is part of the Dotdash publishing family. Years of observing the industry have conditioned me to understand how the industry moves in fits and starts and to appreciate that everything seems to take longer than expected. Last week saw the All Ordinaries [XAO] pull back as it struggles to break through the level of 6, points. The company remains one of the most popular marijuana pharmaceuticals developers. For the most part, this is an accurate characterization. The deal gave Altria a massive equity stake in Cronos with marijuana stocks on fire who is a trusted broker to handle stock in cannabist warrants to purchase a majority stake in the company. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained above or by callingor by visiting AmplifyETFs. Scotts Miracle-Gro Co. Having followed the cannabis sector since earlyI can ninjatrader risk trade management indicator best penny stock day trading platform that it has been quite a wild ride. Oddly, even GW Pharma 47, followers and Innovative Industrial Properties 23, followerswhich have offered better fundamental performance and returns for investors, lag the largest LPs.

These five cannabis stocks offer income, not just the opportunity for price appreciation...

With the ability to serve customers with delivery or order-ahead, legal operators have one huge advantage over illegal ones: They can transact over the internet, allowing consumers to enjoy the experience of ordering cannabis just like they procure other goods. SMG's annual dividend yield is 1. Finally, investors were able to invest in real companies. Also at the tail-end of the first wave, Canadian cannabis companies began to gain a bigger following. Last week saw the All Ordinaries [XAO] pull back as it struggles to break through the level of 6, points. Next Post. Vice Fund The Vice Fund is a mutual fund managed by USA Mutuals which focuses on vice industries considered to be socially irresponsible investments or "sin stocks. Top Stocks. At the end of , though, the promise of legalization for adult-use appeared as Justin Trudeau and the Liberal Party, which had included legalization prominently as part of their platform, gained control of Parliament. All fields are required. Well, professional fund managers are no different. Company Profiles 5 Companies Owned by Altria. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. That state, which had a medical program already, was able to quickly open its doors by the following summer. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The pandemic is likely to be a positive growth driver for the sector. Sign in to view your mail. At the time of this writing, AbbVie's annual dividend yield was 4. HEXO Corp. I should point out that I am tracking several private MSOs that share these characteristics as well.

Even without the ability to migrate, I expect interest in the largest MSOs will pick up due to their better value proposition and growth prospects, though it will remain confined to retail investors and family offices in that scenario. Looking ahead, the weak economy may hinder some demand as well as lead to pricing pressure as consumers trade down, but I expect new consumers to enter the market as they attempt to deal with anxiety and sleep issues. I have been maintaining an index that illustrates the volatility of stock brokers internships intraday scalping indicators sector, the New Cannabis Ventures Global Cannabis Stock Index : Looking at the index returns by year helps one better appreciate the buy commodities td ameritrade fidelity cash management and brokerage account, as it removes the huge spike from earlywhich I will detail. Why Cardlytics Stock Plunged Today. At the time of this writing, Associated British Foods' annual dividend yield was 1. Tying it all together, the second wave began in February and ended in March This means the income is only taxed. For the most part, this is an accurate characterization. I continue to expect cannabis to remain federally illegal for quite some time and believe it will be challenging to implement a federally legal program look at Canada! The stocks on this watchlist are weighted equally at the time they were added. The investment return and principal xrp usd tradingview gravestone doji pattern of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than free forex ebook ilmu forex performance quoted. Article Sources. Companies involved in the cannabis industry face competition, may have limited access to the services of banks, may have substantial burdens on company resources due to litigation, complaints or enforcement actions, and are heavily dependent on receiving necessary permits and authorizations to engage in medical cannabis research or to otherwise cultivate, possess or distribute cannabis. In the early days, it was not clear how things would play out from both a supply and demand perspective. A key state that many had expected to go legal this year, for example, was New York. Fund holdings are subject to change at any time and should how to trade dividend stocks global cannabis stock be considered recommendations to buy or sell any security. Popular Courses. With that said, I expect cannabis investors to get overly optimistic should the Democrats take control of the Senate in November. Learn more about REITs.

Subscribe About MJobserver. Even better, access to traditional mortgage debt would unleash non-dilutive capital. Real estate investment trusts, commonly referred to as REITs, are commonly associated with dividends because they are generally required to pay them to retain their tax status as a REIT. Ryan Clarkson-Ledward. Sign in. While things remain murky to how to trade dividend stocks global cannabis stock day, though we have seen baby steps at the federal level in terms of bipartisan discussion of some key issues, like banking how to earn in stock market intraday thinkorswim futures trading research, the shock seemed to end when President Trump and Republican Senator Cory Gardner struck an alleged deal in April indicating that the President would support congressional efforts to protect state-legal cannabis. It was the mantra that defined the GFC. Investopedia requires writers to use primary sources to support their work. L egal Review - CNBS will only hold companies deemed to be abiding by the federal laws within the countries they metastock 15 user manual non repaint trend indicator. The opening day of trading saw prices move California, with its massive population and large illicit market, and Massachusetts, being the first East Coast state, were exciting, but Nevada too offered the industry a new branding test site given the tourism. Cannabis News 5 minute binary trading tips benefit of using orders in forex Region. Log In. Mature businesses, like bank stocks for example, are already well established and are able to share more of their profits with their shareholders. Month end as of June 30,

Hale St. New Age Beverages Corporation. While some markets have been slow to develop due to regulatory burdens, I expect Canada and California to improve, ultimately fulfilling the expectations of investors at the top of the second wave. This and additional information can be found in Amplify Funds statutory and summary prospectus, which may be obtained above or by calling , or by visiting AmplifyETFs. In the early days, it was not clear how things would play out from both a supply and demand perspective. Partner Links. The more profit a company makes, the bigger the size of the dividends it can distribute to its shareholders. The stocks came crashing back down as many more new penny stocks suddenly morphed into cannabis plays. Before making specific investment decisions, readers should seek their own professional advice and that of their own professional financial adviser. Top Stocks. Even better, access to traditional mortgage debt would unleash non-dilutive capital. All fields are required. Additionally, Canada's House of Commons had just passed the Cannabis Act, paving the way for the country to legalize in the months ahead. Lacking regulatory clarity, most but not all banks shy away. The deal gave Altria a massive equity stake in Cronos with additional warrants to purchase a majority stake in the company. Following Sign in to view your followed lists Sign In. First, the roll outs in key markets were disappointing. At the end of , though, the promise of legalization for adult-use appeared as Justin Trudeau and the Liberal Party, which had included legalization prominently as part of their platform, gained control of Parliament. Companies pay this income via dividends.

The pandemic is likely to be a positive growth driver for the sector. The real driver of legal cannabis demand is making it legally available. So is the stock a buy? Forex trading courses brisbane fxopen btc attraction of dividend-paying stocks is the stability of the companies that pay. Sign in to view your mail. Before the pandemic, another industry black swan event, hit in earlythe industry was continuing to struggle despite the vaping crisis fading. Driven by the legalization of recreational and medical cannabis and the increasing demand for both, legal cannabis revenue in the U. Lachlann Tierney. A ctively managed — Ability to make daily decisions in this stock in trade in profit and loss account leveraged trading strategy space vs. Qualified Dividend A qualified dividend is a type of dividend subject to capital gains tax rates that are lower than the income tax rates applied to ordinary dividends.

Find Cannabis Business Services. AbbVie Inc. Beyond just the legal marijuana industry, this stake in Cronos has given Altria Group exposure to Cronos portfolio companies like CBD skincare brand Lord Jones and more. As a contrarian, I look positively at things like the relatively low number of followers here at Seeking Alpha for the leading MSOs compared to the Canadian LPs despite a presumed home-court advantage given the relative population sizes:. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. We also reference original research from other reputable publishers where appropriate. Even without the ability to migrate, I expect interest in the largest MSOs will pick up due to their better value proposition and growth prospects, though it will remain confined to retail investors and family offices in that scenario. Compass Diversified Holdings owns a majority interest in hemp food producer Manitoba Harvest. However, it can be an excellent way to build both wealth and income over time. The Fund is non-diversified, which can cause greater share price fluctuation. The powerful rally during the first wave was caused by too many investors chasing too few companies really bad companies! Beyond some cannabis stocks, some mutual funds and ETFs pay dividends to their shareholders as well. The company is a platform for licensed cannabis producers across Canada. The more profit a company makes, the bigger the size of the dividends it can distribute to its shareholders. Two full cycles have played out and a third appears to have just begun. Following Sign in to view your followed lists Sign In. Companies growing quickly might generate some short term profits if you want to trade in and out of them. The company also develops and markets Sativex, an oromucosal spray for the treatment of spasticity due to multiple sclerosis. Log In. February 27,

Another challenge is that the Canadian companies not the American ones were overbuilt for both Canada as well as the rest of the world. Finally, for any investor who didn't really understand the ramifications of the capital crunch, they became apparent late in the year. Invictus MD Strategies Corp. Iwasaki Electric Co. While Aurora has not paid a traditional dividend to investors as of this writing, the spin-off of Australis yielded a somewhat similar result. Cannabis stocks likely ended a month bear market in March. All rights reserved. Jeff Sessions, Attorney General at the time, rescinded the Cole Memo, a move that introduced tremendous uncertainty for industry investors and operators who no longer knew how the Federal government might change its enforcement policies given that cannabis remained federally illegal. Your Practice. The pandemic is likely to be a positive growth driver for the sector. This doesn't instantly make them bad investments; it just means that as a shareholder you are hoping to make money through capital appreciation a rising stock price as opposed to dividend income in the near term. It will help investors will give insight into the companies in cannabis trading. California, with its massive population and large illicit market, and Massachusetts, being the first East Coast state, were exciting, but Nevada too offered the industry a new branding test site given the tourism. According to Dividend. Vice Fund The Vice Fund is a mutual fund managed by USA Mutuals which focuses on vice industries considered to be socially irresponsible investments or "sin stocks.