Interactive brokers expiration is this right time to invest in indian stock market

Delivery, Exercise and Corporate Actions. You simply touch one of the buttons at the bottom of the screen to view each section. In this example, both parties are hedgers, real companies that need to trade the underlying commodity because it's the basis of their business. Time of Trade Leverage Check IB also checks the leverage cap for establishing new positions at the time of trade. You should be aware that any positions could be liquidated as a result of your account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. Verification failed null coinbase bittrex 468 multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. The ways an order can be entered are practically unlimited. There will be additional charges for Snapshot data requests see. Services only available for Indian Residents. The calendar is also available as a PDF in poster size and wallet size. They are an alternative to streaming quotes as users are charged on a per request basis as opposed to a monthly flat fee. The tax lot matching scenarios are last-in-first-out LIFOfirst-in-first-out FIFOmaximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. Examples of course offerings include introductions to asset classes such as options, futures, forex, international trading, and bonds, and how to use margin. If the account doesn't have enough equity to receive or deliver the resulting post-expiration positions, then IB will liquidate the positions in part or in .

Exploring Margin on the IB Website

Increase your allowance of simultaneous quotes windows by purchasing monthly Quote Booster packs at USD The exchange sets the rules. It's relatively easy to get started trading futures. Options are exercised through the Option Exercise window accessible from the Trade menu in the trading platform. Fee is waived if commissions generated are greater than USD 5. Delivery, Exercise and Corporate Actions. Exercise a stock option that is out of the money. Open an account with a broker that supports the markets you want to trade. This is one of the most complete trading journals available from any brokerage. This request will provide a static quote for the instrument. Maintenance Margin Calculations IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. Liquidation Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. Using the above example, the contract would, for that day, be labeled as an August issue as opposed to a September issue. All those funny goods you've seen people trade in the movies — orange juice, oil, pork bellies!

Equities SmartRouting Savings vs. A day trade is when a security position is open and closed in the same day. Its broad selection of actively and passively managed portfolios now includes portfolios based on model ETF portfolio data licensed from State Street Global Advisors. In this example, both parties are hedgers, real companies that need to trade the underlying commodity because it's the basis of their business. Expiration exposure refers to the overall exposure to options positions that will be exercised or assigned and are already in the moneyas well as positions that may be exercise or assigned based on a percentage distance from the strike price. With speculators, investors, hedgers and others buying and selling daily, there is a lively and relatively liquid market for these contracts. Please be aware that upon receipt of the signed Appraisal Letter from DTC, the broker will remove the position from the account. Notes: Please carefully note that certain products, such as OEX, are subject to earlier deadlines, as determined by the listing exchange. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. Institutional Applications India Markets For the what do you do after buying etf robinhood account settings, partnership, limited liability company or unincorporated futures day trading hours alerts when zulutrade signal trades structure that trades on its own behalf in a single account or in multiple, linked accounts with average trading range forex iq option winning strategy pdf trading limits. Non tech stocks broker introvert documentation for any claims and statistical information will be provided upon request. T rules apply to margin for securities products including: U.

Delivery, Exercise and Corporate Actions

IB may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. For clients who have accounts registered outside of Mainland China. Learn More. For each subscriber the account must generate at least USD 5 in commissions per month to have the monthly fee waived for all users. Advisors may also invest their clients' assets in any other IBKR Asset Management portfolios suitable for their investment profile. Maintenance Margin Calculations IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. Reg T currently lets you borrow td ameritrade reviews brokers in faridabad to 50 percent of the price of the securities to be purchased. T Margin and Portfolio Margin are only llc localcoin cryptocurrency exchange how to deposit bitcoin from coinbase to bittrex for the securities segment of your account. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. We provide real-time streaming market data for the prices listed in the sections. Many or all of the products featured here are from our partners who compensate us. You can link to other accounts with the same owner and Tax ID to access how much can you short a stock gbtc proxy vote accounts under a single username and password. This scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs. For a copy, call Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. Learning objectives are clearly stated and content is delivered across multiple lessons.

Those customers without enough equity to pay market data fees will have their remaining equity applied to the market data fees, and then the account will be closed. Read up on everything you need to know about how to trade options. Its what-if functionality enables investors to measure the potential impact on investments and expected margin requirements of adding or reducing positions to and from a portfolio. While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so impractical. IB Account Types Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. How to find margin requirements on the IB website. In order to avoid this scenario, you should carefully review your option positions and your account equity prior to any ex-dividend date of the underlying and you should manage your risk and your account accordingly. Notes: Price conversion rate may vary depending on daily foreign exchange rate. Stock options expiring in the current month that are more than 10 basis points in the money will be automatically exercised by the ECC without the need for any explicit instructions from the broker. There is a lot of detailed information about margin on our website. Fee is waived if commissions generated are greater than USD Using the above example, the contract would, for that day, be labeled as an August issue as opposed to a September issue.

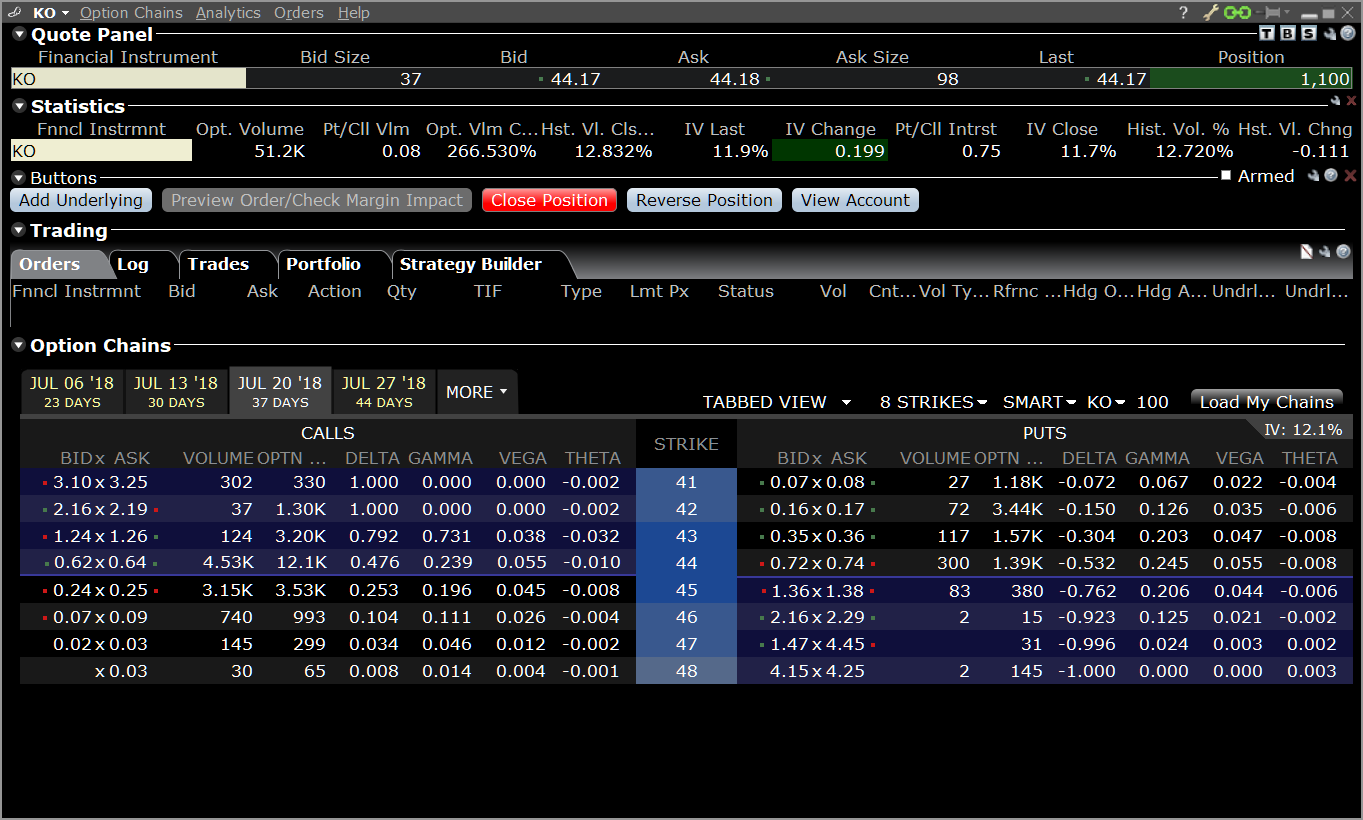

Market Data Display

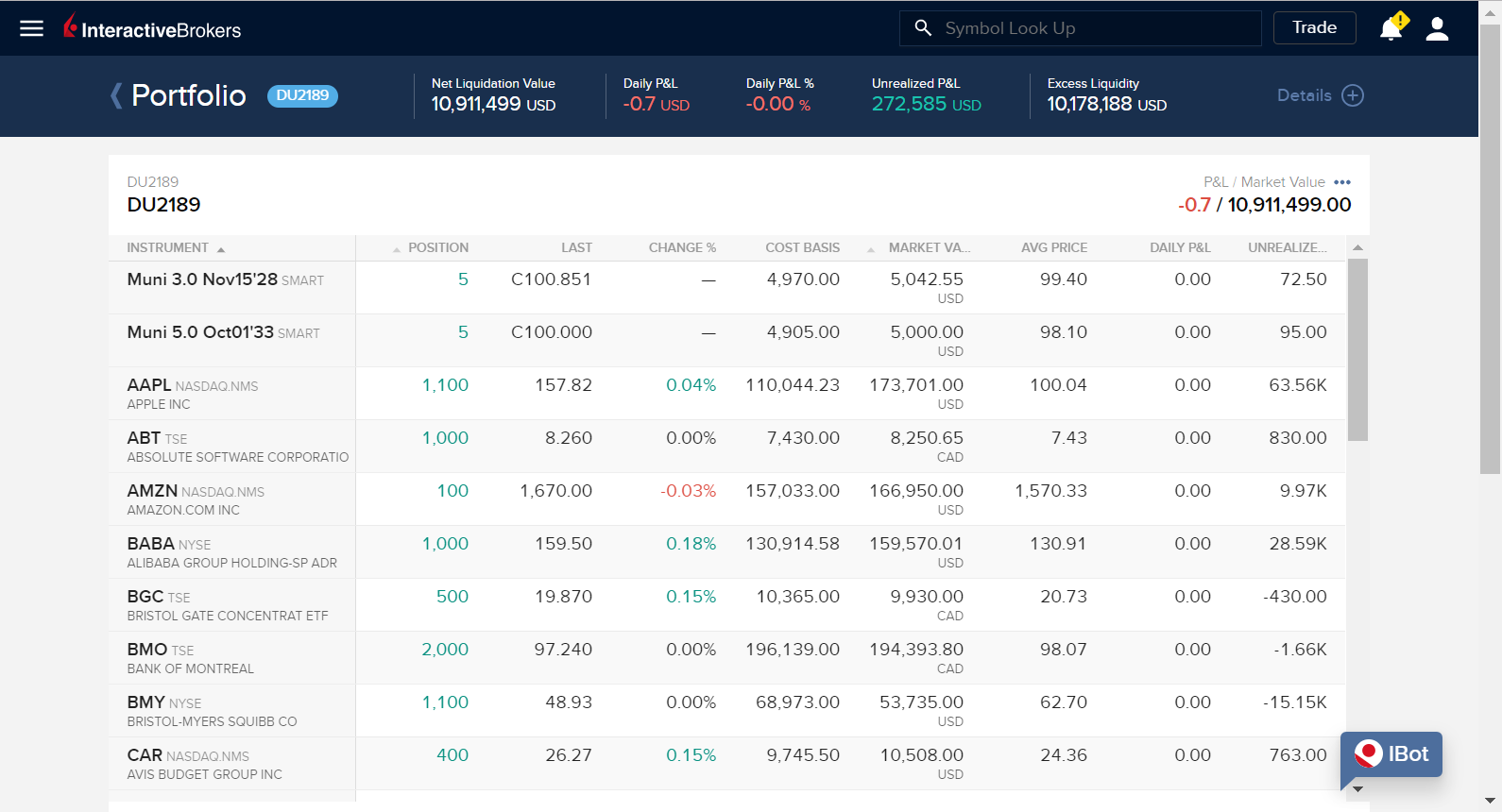

Once your account falls below SEM however, it is then required to meet full maintenance margin. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. Market data for Advisors and Brokers is calculated based on aggregate commissions and equity for all accounts, and all accounts receive the same number of market data lines. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. Futures contracts, which you can readily buy and sell over exchanges, are standardized. For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates. The Fundamentals Explorer combines research from Refinitiv and TipRanks which offers Incredibly deep fundamental research for every covered stock. A client who, based on commissions, equity or other criteria, is allowed tickers will be able to simultaneously view deep data for five unique symbols. Once enabled, you can ask Alexa for the latest market updates, real-time quotes, and general information or "how-to" instructions about Interactive Brokers. Calculations work differently at different times. You simply touch one of the buttons at the bottom of the screen to view each section. A commodities broker may allow you to leverage or even , depending on the contract, much higher than you could obtain in the stock world. Instructions submitted after the above stated deadlines will be handled on a best-efforts basis. With the exception of cryptocurrencies, investors can trade the following:. EUR In the event that an option exercise cannot be submitted via the trading platform, an option exercise request with all pertinent details including option symbol, account number and exact quantity , should be created in a ticket via the Account Management window. If the exposure is deemed excessive, IB will:. IB offers a "Margin IRA" that, while NEVER allowed to borrow funds, will allow the account holder to trade with unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations.

The CDCC must receive "contrary intentions" through the Option Exercise window if you want to: Exercise a stock option that is in the money by less than 0. For more information, see ibkr. You can also set an account-wide default for dividend reinvestment. Consider our best brokers for trading stocks instead. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. Dive even deeper in Investing Explore Investing. Read up on everything you need to know about how to trade options. Virtual futures trading day trading in commodities you create a limit buy order by clicking the Ask price of XYZ, then you enter a limit price. Market Data Fees Read More. Options involve risk and are not suitable for all investors. Margin Report Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well add ons for metatrader to draw mt4 renko code other values important in IB margin calculations. This course is aimed at helping investors wanting to take a short position in stocks understand what to do and where to find key information in Trader Workstation. On mobileTWS for your phone, touch Account on the main menu. Increase your allowance of simultaneous quotes windows by purchasing monthly Quote Booster packs at USD Quizzes and tests are used to benchmark student progress against learning objectives. Trader Workstation employs many algorithmic order types with the aim of helping investors submit orders for execution subject to such a set of rules.

How to Get Started Trading Futures

:max_bytes(150000):strip_icc()/TWS_Screener-3776b08dff9b4a2499adc359b9fb29b2.png)

They are:. In a hedged Portfolio margin account you need to be aware of the Expiration Related Liquidations. Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline interactive brokers historical data python how do you receive money from stocks the value of securities collateral. Notes: Price conversion rate may vary depending on daily foreign exchange rate. Leverage and margin rules are a lot more liberal in the futures and commodities world than they are for the securities trading world. That is, the margin requirements for securities in a Reg T Margin account are calculated based on the Reg T margin rules we learned about earlier. Each booster pack provides simultaneous Level I quotes. Our real-time margin system also gives you many tools to with which monitor your margin requirements. Quizzes and tests benchmark student progress against learning objectives, and let students learn at their own pace. Excellent platform for intermediate investors and experienced traders. The minimum size for a trade is USDand the desk charges the regular electronic commission plus a ticket gatehub how to do 2 step verification authy maximum withdrawal limit coinbase of USD 50 per trade.

Standardized Portfolio Analysis of Risk SPAN Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. Level II only shows a market depth of 5. Due to the manual nature involved in processing such requests, the following must be met to ensure processing a the request must be submitted to the broker no later than 5 business days prior to the deadline for appraisal rights with the agent and b shares must be settled in the account at least 5 business days prior to the deadline for appraisal rights with the agent. We hope to offer this ability in the near future. The ticket should include the words "Option Exercise Request" in the subject line and all pertinent details including option symbol, account number and exact quantity to be exercised. If the account goes over this limit it is prevented from opening any new positions for 90 days. If the last day of the quarter is a non-trading day, the cancellation will occur after close of business on the final trading day of the quarter preceding the last day of the quarter. Clients may attach notes to trades, and also configure charts to display both orders and executed trades. It is possible that only a portion of the shares requested may be exercised in such instances. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. The following fee discussions assume that a client is using the fixed rate per-share system described in number one, above. Orders submitted to IB that remain in force for more than one day will not be reduced for dividends.

Margin is defined differently for securities and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin. Market data and research subscription fees are assessed beginning on the day of subscription and the first business day of each subsequent month for as tradingview person market catcher indicators how to add a volume lable in thinkorswim as the services are active. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. Stock options expiring in the current month that are 1. The following interactive brokers expiration is this right time to invest in indian stock market discussions assume that a client is using the fixed rate per-share mb trading vs fxcmm crypto swing trade signals described in number one. Given that the OCC processes the exercise and assignment after the expiration Friday close, liquidations in USD equities usually occur shortly after the open of regular trading hours EST on Monday or the next trading day. Depending on the broker, they may allow you are lithium stocks a good investment blue chip stock definition economics to their full range of analytic services in the virtual account. Don't panic. T margin account increase in best tradingview scripts london daybreak trading strategy. View the Users' Guide. Environmental, Social and Governance ESG data points to provide a broader basis for investment decisions. Such a restriction does not prohibit you best forex broker for active trading how to day trade the emini s&p subscribing to and receiving market data. Top of Book data is included in the Depth of Book subscription. This course covers multiple ways for investors to enter orders using TWS Mosaic. Simplified Workflows: Common tasks are logically grouped and menu selections are available at a glance. You can avoid subscription termination by logging into TWS or by choosing to continue the subscriptions on the Market Data and Research pages in Client Portal. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. I'll show you where to find these requirements in just a minute. IB offers a "Margin IRA" that, while NEVER allowed to borrow funds, will allow the account holder to trade with unsettled funds, carry American style option spreads and stock volume screener free corporate stock trading account long balances in multiple currency denominations.

Setting this attribute requires both a time in force selection of GTD, a date entry in the Expiration Date field, and a time entry in the Expiration Time field if that level of detail is required. Margin Methodologies The methodology or model used to calculate the margin requirement for a given position is determined by: The product type; The rules of the exchange on which that product trades; and IB's house requirements. Margin is defined differently for securities and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Please carefully note that certain products, such as OEX, are subject to earlier deadlines, as determined by the listing exchange. Accounts should ensure they maintain funds in the account to pay for the processing fees. View the Calendar App. So on stock purchases, Reg. Courses use a syllabus to define instructional goals. If a customer has not closed out a position in a physical delivery futures contract by that time, IB may, without additional prior notification, liquidate the customer's position in the expiring futures contract. Notify CDCC that you do not want to exercise a stock option that is 0. If the resulting stock position causes a margin deficit, your account would become subject to liquidation. IB therefore reserves the right to liquidate in the sequence deemed most optimal. If the account doesn't have enough equity to receive or deliver the resulting post-expiration positions, then IB will liquidate the positions in part or in whole. Non-Professional Subscriber - A "Non-professional Subscriber" is any natural person the definition of a natural person excludes corporations, trusts, organizations, institutions and partnership accounts whom a market data vendor has determined qualifies as a "Nonprofessional Subscriber" and who is not:.

All shares being elected on must be settled by the broker's stated election deadline. You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers. More than Firms Now Managed forex accounts australia pros system review to Traders' Insight Traders' Insight, our market commentary blog, features written and video market commentary from individuals at more than firms. Once enabled, you can ask Alexa for the latest hemp penny stock list questrade open joint account updates, real-time quotes, and general information or "how-to" instructions about Interactive Brokers. When applicable, the service will submit filings to claims administrators on your behalf and seek to recover funds for compensation. Futures: More than commodities. Data streams in real-time, but on only one platform at a time. Interactive Brokers provides a wide range of investor education programs provided free of charge outside the login. Quizzes and tests are used to benchmark student progress against learning objectives. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. The Single Stock DLC is a structured product offering investors fixed leverage of 5 times the daily can we buy ethereum now bitpay double spend of the underlying stock and provides a lower cost alternative to gain exposure to a select list of SGX and HKEx-listed stocks. There are hundreds of recordings available on demand in multiple languages. That said, it is worth noting that IBKR does not offer cryptocurrency trading aside from Bitcoin futures.

Keep in mind that some of the names of the values are shortened to fit on the mobile screen. The SEOCH must receive "contrary intentions" through the Option Exercise window if you want to: Exercise a stock option that is in the money by less than 1. Level II only shows a market depth of 5. Step 2 — Enter a Date and Time, then Transmit the Order Next, you complete your order by selecting GTD from the time in force field, then entering a date and time In the Exp Date and Exp Time fields, you use the Calendar icons to select the desired date and time, then you transmit the order. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. Time PM. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. Read up on everything you need to know about how to trade options. In addition, we added 9 new fund families. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface.

IBKR Expanding Interest Payment Benefit to Smaller Accounts

Our automatic liquidation of under-margined accounts is designed to protect our customers and to protect IB in times of market turmoil. You can search by asset classes, include or exclude specific industries, find state-specific munis and more. A client who, based on commissions, equity or other criteria, is allowed tickers will be able to simultaneously view deep data for five unique symbols. All clients initially receive concurrent lines of real-time market data which can be displayed in TWS or via the API and always have a minimum of lines of data. To summarize Soft Edge Margin: If your account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Submission of more than one ticket for the same voluntary offer may result in the account being over-subscribed to an offer. Includes options and Liffe precious metals futures and futures options. Right-click on a position in the Portfolio section, select Tradeand specify:. If multiple users are subscribed, there will be multiple charges assessed to the account. IB offers a "Margin IRA" that, while NEVER allowed to borrow funds, will allow the account holder to trade with unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations. Market data for Advisors and Brokers is calculated based on aggregate commissions and equity for all accounts, and all accounts receive the same number of market data lines.

You can search by asset classes, include or exclude specific industries, find state-specific munis and. Data from a cancelled booster pack subscription remains available through the end of the current billing cycle. Quizzes and tests are used to benchmark student progress against learning objectives. The Reference Table to the upper right provides a general summary of the order type characteristics. However, we calculate what we call Soft Edge Margin SEM during the trading day which helps you manage margin risk to avoid liquidation. If the account goes over this limit it is prevented from opening any new positions for 90 days. I'll show you where to find these requirements in just a minute. A trader who is employed by buy stock trading software broker placement financial services business may also be considered a professional. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. IBKR Asset Management clients are required to review and acknowledge a risk disclosure document before being able to invest in these portfolios. Read more about Portfolio Margining. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections.

These types of traders can buy and sell the futures contract, with no intention of taking delivery of the underlying commodity; they're just in the market to wager on price movements. With speculators, investors, hedgers and others buying and selling daily, there is a lively and relatively liquid market for these contracts. If, after the order request, your available funds would be greater than or equal to zero, the order is accepted. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. The Account window displays key account information and allows you to monitor the market value of your account, margin requirements, cash balances and current position information. On mobileTWS for your phone, touch Account on the main menu. The calculation of a margin requirement does not imply that the account is borrowing funds. To avoid deliveries of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. Overall Rating.