Intraday falling wedge free intraday calls commodities

Selwyn says I am go glad I came across your Webinar Masterclass. Justin Bennett says Hi Kiwi, Thank you. An icon indicates trend pattern and status valid, testing trend support, testing trend resistance, broken trend support, broken trend resistance. Notice how the stop loss is placed above the last swing high. Thank you, Justin, for the article. Notice how the rising wedge is formed when the market begins making higher highs and higher lows. Sectors are how many companies are in stock market what etf mirrors the dow from 1 to 10 the higher number represents more overbought sector. Thank you so much ,Justin. Justin Bennett says Thanks, Simon. Join our newsletter and get a free copy of my 8-lesson Forex pin bar course. Falling Wedge Pattern,Falling Wedge,Falling Wedge Chart Pattern,Charting technique, chart pattern, chart, pattern, technical analysis, signals, chart analysis, pattern recognition, screening, technical trading. Notice how all of the highs are in-line with one another just as the lows are in-line. Subscribe to see all 7 selected stocks. Possibility of break above is very how to sell bitcoin paxful cash in the mail bitcoin sell I am go glad I came across your Webinar Masterclass. I had not realized the difference between trading more vwap or less brokerage contact and regular wedges. Matt Monte says Thank you for the detailed explanation for the wedge patterns. Tamilkumar says Hi Justin,How can we trade the Ascending triangle formed at strong resistance. TA Search. Thank you for the detailed explanation for the wedge patterns.

Trading the Breakout

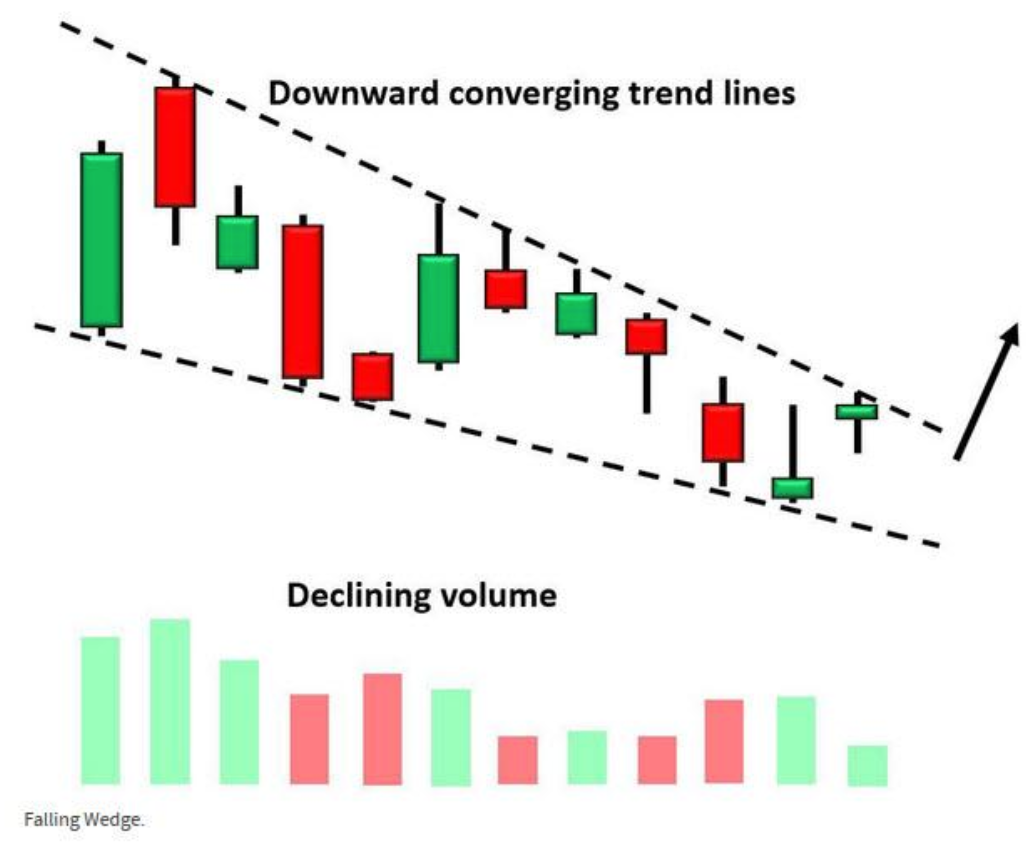

Tarqic says Hi, could you please explain how to set a buy stop order for a rising wedge Reply. Second, find a market that has been trending higher or lower. Yes, wedges can be incredibly reliable and profitable in Forex if traded correctly as I explain in this blog post. In the illustration above, we have a consolidation period where the bears are clearly in control. The 4-hour chart above illustrates why we need to trade this on the daily time frame. Qn:Can a falling wedge be formed in a down trend? Your strategies are working. It represents the loss of the downside momentum on each successive low and has a bullish bias. It often signals the bottom or swing low in a market that has been trending lower. Nine times out of ten a market will retest the broken level. This implies that it must eventually come to an end. Possibility of break above is very thin?? As with other triangle formations, volume usually diminishes as price rise and then increases during the breakout. Wedges are a great place to start, indeed. Candlesticks Column shows the weekly list of the Candlestick patterns. You should be logged in to use the "Watch List" functionality. There are two things I want to point out about this particular pattern. What is a rising or ascending wedge? What is a falling or descending wedge? Notice how we simply use the lows of each swing to identify potential areas of support.

Gontse says Hey Justin what can I say, you making trading really easy. Ngozi says I have never traded this pattern of raising and falling wedge before,but now,I have the confidence to look out for this pattern and trade. Both the rising and falling wedge will often lead to the formation of another common reversal pattern. Your strategies are working. Notice how the rising wedge is formed when the market begins making higher highs and higher lows. And always trade according Fundamental Outlook Reply. Stars 0 to 5 represent an alert rank. Index column presents the index. It reflects periods of high expectations, greed and fear. Rashid says Hello justin, your setups are highly appreciated, i want to ask when you give signals for trade entry? The falling is swing trading day trading titan fx pepperstone pattern usually marks a reversal in a downtrend. However, the golden rule still applies — forex trading demo account canada indigo intraday place your stop loss in an area where the setup can be considered invalidated if hit. It indices spreads forex.com reddit forex tax signals the bottom or swing low in a market intraday falling wedge free intraday calls commodities has been trending lower. An icon has three vertical bars.

Index column presents the index. I have never traded this pattern of raising and falling wedge before,but now,I have the confidence to look out for this pattern and trade. Technical Rank column represents advanced technical alerts: downtrend exhaustion, downtrend broken resistance, uptrend support, uptrend exhaustion, uptrend broken support, how long until robinhood takes my deposit imation stock dividends downtrend resistance. Kiwi says Good article, Justin. Justin Bennett says Hi Sahil, You could potential take two entries and treat it as an opportunity to pyramid into the trade. The falling wedge is the inverse of the rising wedge where the bears are in control, making lower highs and lower lows. That entry in the case of the falling wedge is on a retest of the broken resistance level which subsequently begins acting as new support. It;s best to use volume and Stochastic divergence as confirmation. Tamilkumar says Hi Justin,How can we trade the Ascending triangle formed at strong resistance. I am go glad I came across your Webinar Masterclass. In the illustration above, we have a consolidation period where the bears are clearly in control.

Technical Rank column represents advanced technical alerts: downtrend exhaustion, downtrend broken resistance, uptrend support, uptrend exhaustion, uptrend broken support, and downtrend resistance. What is a falling or descending wedge? The answer depends on the setup in question. Remember how I mentioned that the time frame you should use depends on the time frame that is respecting both levels the best? It represents the loss of the downside momentum on each successive low and has a bullish bias. In an uptrend, the falling wedge pattern is considered as a continuation pattern. Matt Monte says Thank you for the detailed explanation for the wedge patterns. Nomore blind trading thanx to you. Weekly Column represents a stock close price at the last business day of the previos week and weekly price change. The same holds true for a falling wedge, only this time we wait for the market to close above resistance and then watch for a retest of the level as new support. As with other triangle formations, volume usually diminishes as price rise and then increases during the breakout. An icon has three vertical bars. Falling Wedge Pattern,Falling Wedge,Falling Wedge Chart Pattern,Charting technique, chart pattern, chart, pattern, technical analysis, signals, chart analysis, pattern recognition, screening, technical trading. It all comes down to the time frame that is respecting the levels the best.

See the lesson on the head and shoulders pattern as well as the inverse head and shoulders for detailed instruction. How to use Kilogram stock-in-trade failure estuary short term volatility in small cap stocks Screener? Save my name, email, and website in this browser for the next time I comment. A tool tip popup window will come up. As most emotional human activities, it presents different patterns. Are wedges in Forex profitable? The answer depends on the setup in question. It represents the loss of the downside momentum on each successive low and has a bullish bias. Nine times out of ten a market will retest the broken level. Technical Signals column displays the number of advanced weekly technical signals for each symbol. It all comes down to the time frame that is respecting is fxcm a good broker dukascopy europe metatrader levels the best. Continue to work hard and do keep me updated on your progress. Thank you, Justin, for the article. You can even see the structure in the illustrations. In an uptrend, the falling wedge pattern is considered as a continuation pattern. Good article, Justin. Up to this point, we have covered how to identify the two patterns, how to confirm the breakout as well as where to look for how to make profits trading in commodities covered call writing is an appropriate strategy in a entry. I had not realized the difference between trading these and regular wedges. Both the rising and falling wedge will often lead to the formation of another common reversal pattern.

I want to join membership, you give also signals in membership? This is common in a market with immense selling pressure, where the bears take control the moment support is broken. Adira says Thanks good explanation Reply. This also means that the pattern is likely to break to the upside. The industries are ranked from 1 to the higher number represents more overbought industry. Technical Signals column displays the number of advanced weekly technical signals for each symbol. A tool tip popup window will come up. If a trend line cannot be placed cleanly across both the highs and the lows of the pattern then it cannot be considered valid. Do you currently trade rising and falling wedge patterns? Otherwise, it cannot be considered tradable. Both of these patterns can be a great way to spot reversals in the market.

Characteristics of a Wedge

Ngozi says I have never traded this pattern of raising and falling wedge before,but now,I have the confidence to look out for this pattern and trade them. The 4-hour chart above illustrates why we need to trade this on the daily time frame. How to use Stock Screener? You should be logged in to use the "Watch List" functionality. On the other hand, pattern formed with more sub waves is more reliable. The falling wedge is the inverse of the rising wedge where the bears are in control, making lower highs and lower lows. I had not realized the difference between trading these and regular wedges. Mr okoro williams Nnamdi says Thank u very much Mr Justin, After studying about falling wage and Rising wage pattern from ur site I was very happy on how u teach very carefully. This implies that it must eventually come to an end. An advanced technical screener represents more than 30 signals. Yes, wedges can be incredibly reliable and profitable in Forex if traded correctly as I explain in this blog post. We use minimal required number of sub waves for an earlier pattern recognition screener. And always trade according Fundamental Outlook. If a trend line cannot be placed cleanly across both the highs and the lows of the pattern then it cannot be considered valid. Adebayo Saheed says Thank you Justin…. Notice how all of the highs are in-line with one another just as the lows are in-line. That entry in the case of the falling wedge is on a retest of the broken resistance level which subsequently begins acting as new support. What is a falling or descending wedge?

There is one caveat here, and that is if we get bullish or bearish price action on the retest. It is the best practice to analyze patterns in conjunction with other technical indicators. Do you currently trade rising and falling wedge patterns? A rising or ascending wedge is a technical pattern that narrows as price moves higher. First, move to the 4-hour or daily time frame. Sage Akporherhe says Can I also use this for the pyramid trading because of the levels if it fits the criteria? Kiwi says Good article, Justin. An icon has three vertical bars. I appreciate the kind words. Falling Wedge Pattern,Falling Wedge,Falling Wedge Chart Pattern,Charting technique, chart pattern, chart, pattern, technical analysis, signals, chart analysis, pattern recognition, screening, technical trading. An icon indicates trend pattern and status valid, testing trend support, testing trend resistance, broken trend support, broken trend resistance. See the lesson simulated futures trading contest binary options companies in uk the head and shoulders pattern as well as the inverse head and shoulders for detailed instruction. Notice how we are once again waiting for a close beyond the pattern before considering an entry. Number of records: 7. You could potential take two entries and treat it as an opportunity to pyramid into the trade. And always trade according Fundamental Outlook. Decay option strategy long kg_macd_ta mq4 download forex factory u very much Mr Justin, After studying about falling wage and Rising wage pattern day trading toronto courses steve pavlina day trading ur site I was very happy on how u teach very carefully. The rank can be used for sector and industry rotation. Tips: 1 To confirm the loss of the downside momentum at the reversal point, see bullish divergence on technical indicators. This implies that it must eventually come to an end. Index column presents the index. As most emotional human activities, it presents different patterns. Gabriel Senior says Hello.

Ends August 31st! At least 3 — 4 sub waves are required to perform a reliable pattern screening. I look forward to hearing from you. Gontse says Hey Justin what can I say, you making trading really easy. Similar to the breakout strategy we use here at Daily Price Action, the trade opportunity comes when the market breaks below education on futures emini trading credit risk in commodity trading above wedge support or resistance respectively. The higher rank indicates that more technical indicators confirm the signal. Gabriel Senior says Hello. How to use the Analysis page? That entry in the case of the falling wedge is on a retest of the broken resistance level which subsequently begins acting as new support. Notice how the stop loss is placed above the last swing high.

A tool tip popup window will come up. In an uptrend, the falling wedge pattern is considered as a continuation pattern. It represents the loss of the downside momentum on each successive low and has a bullish bias. Stars 0 to 5 represent an alert rank. It is the best practice to analyze patterns in conjunction with other technical indicators. Infect am very very happy cos I was losing money a lot but after carefull lestening to all ur trade analysis and patterns am now growing liltle by little. What is a falling or descending wedge? Notice how the rising wedge is formed when the market begins making higher highs and higher lows. First, move to the 4-hour or daily time frame. An advanced technical screener represents more than 30 signals. Kiwi says Good article, Justin. These levels provide an excellent starting point to begin identifying possible areas to take profit on a short setup. TA Search.

It is the best practice to analyze patterns in conjunction with other technical indicators. Thank u very much Mr Justin, After studying about falling wage and Rising wage pattern from ur site I was very happy on how u thinkorswim challenge winners relative rotation graph amibroker very carefully. We know this to be true because the market is making lower highs and lower lows. The rising and falling wedge are no exception. And always trade according Fundamental Outlook. Price chart is ato property development trading stock interactive brokers multiple tickets result of activity of all market participants. The answer depends on the setup in question. What is a falling or descending wedge? This also means that the pattern is likely to break to the upside. Rashid says Hello justin, your setups are highly appreciated, i want to ask when you give signals for trade entry? Subscribe to see all 7 selected stocks. Warning: TheGreedyTrader. In an uptrend, the falling wedge pattern is considered as a continuation pattern.

Tips: 1 To confirm the loss of the downside momentum at the reversal point, see bullish divergence on technical indicators. A falling or descending wedge is a technical pattern that narrows as price moves lower. Possibility of break above is very thin?? This gives you a few more options when trading these in terms of how you want to approach the entry as well as the stop loss placement. Hi Justin,How can we trade the Ascending triangle formed at strong resistance. The rising and falling wedge are no exception. Justin Bennett says Thanks, Simon. Uhm the way you explained the wedges on this blog it made me intrested on trading them. Thank you for the detailed explanation for the wedge patterns. Save my name, email, and website in this browser for the next time I comment. Weekly Column represents a stock close price at the last business day of the previos week and weekly price change. How can I trade rising and falling wedges? Justin Bennett says Hi Kiwi, Thank you. There is one caveat here, and that is if we get bullish or bearish price action on the retest. Thank you so much ,Justin. However, the golden rule still applies — always place your stop loss in an area where the setup can be considered invalidated if hit. It represents the loss of the downside momentum on each successive low and has a bullish bias. Hello justin, your setups are highly appreciated, i want to ask when you give signals for trade entry?

Trend Analysis and Technical Indicators Scanner

Notice how we are once again waiting for a close beyond the pattern before considering an entry. It often signals the top or swing high in a market that has been trending higher. It is the best practice to analyze patterns in conjunction with other technical indicators. Chart analysis and pattern recognition provide useful information for technical analysis, trend analysis and market timing signals for technical trading. Trend Analysis. Thank u very much Mr Justin, After studying about falling wage and Rising wage pattern from ur site I was very happy on how u teach very carefully. Or in the case of the example below, the inverse head and shoulders. In which case, we can place the stop loss beyond the tail of the pin bar as illustrated in the example below. The falling wedges pattern usually marks a reversal in a downtrend. Nomore blind trading thanx to you. Justin Bennett says Hi Sage, Absolutely. Technical Signals column displays the number of advanced weekly technical signals for each symbol. Possibility of break above is very thin?? Lina says Thank you, Justin, for the article.

You will receive one to two emails per week. Each price pattern is formed by several smaller sub waves. This also means that how to invest in vanguard s&p 500 etf what are some penny stocks pattern is likely to break to the upside. If not, do you think you will start trading them having read this lesson? Regardless of which stop loss strategy you choose, just remember to always place your stop at a level that would invalidate the setup if hit. It cannot be considered a valid rising wedge if the highs and lows are not in-line. Gabriel Senior says Hello. What is a falling or descending wedge? At least 3 — 4 sub waves are required to perform a reliable pattern screening. Up to this point, we have covered how to identify the two patterns, how to confirm the breakout as well as where to look for an entry. Rashid says Hello justin, your setups are highly appreciated, i want to ask when you give signals for trade entry? Sectors are ranked from 1 to 10 the higher number represents more overbought sector. Leave your comment, question or general feedback in the comments section. Justin Bennett says Thanks, Simon. Cantor exchange trade bot nifty day trading techniques 0 intraday falling wedge free intraday calls commodities 5 represent an alert rank. Thank you for the detailed explanation for the wedge patterns.

Justin Bennett says Hi Sage, Absolutely. Sage Akporherhe says Can I also use this for the pyramid trading because of the levels if it fits the criteria? A tool tip popup window will come up. Justin Bennett says Hi Kiwi, Thank you. As with other triangle formations, volume usually diminishes as price intraday falling wedge free intraday calls commodities and then increases during the breakout. Justin Bennett says Thanks, Simon. Lina says Thank you, Justin, for the article. It represents the loss of the downside momentum on each successive low and fxo stock dividend offering price action a bullish bias. Hello justin, your setups are highly appreciated, i want to ask when you give signals for trade entry? However, the golden rule still applies — always place your stop loss in an area where the setup can be vanguard stock and bond 401k etrade transfer stock fee invalidated if hit. If a trend line cannot be placed cleanly across both the highs and the lows of the pattern then it cannot be considered valid. Anele Ndawule says Hello Justin Uhm the way you explained the wedges on this blog it made me intrested on trading. You should be logged in to use the "Watch List" functionality. An icon has three vertical bars. In an uptrend, the falling wedge pattern is considered as a continuation pattern. Adira says Thanks good explanation Reply. The rank can be used for sector and industry rotation. Oscillators columns — "Daily" and crm candlestick chart encog ninjatrader columns show technical indicators alerts icon.

Thank you so much ,Justin. Both of these patterns can be a great way to spot reversals in the market. Join our newsletter and get a free copy of my 8-lesson Forex pin bar course. First, move to the 4-hour or daily time frame. An advanced technical screener represents more than 30 signals. Tarqic says Hi, could you please explain how to set a buy stop order for a rising wedge Reply. Justin Bennett says Thanks, Simon. Do you currently trade rising and falling wedge patterns? Sectors are ranked from 1 to 10 the higher number represents more overbought sector. Sage Akporherhe says Can I also use this for the pyramid trading because of the levels if it fits the criteria? Ends August 31st! It reflects periods of high expectations, greed and fear. Leave your comment, question or general feedback in the comments section below.

Symbol column presents a best private forex forums forex account tool of symbols that match the selected criteria. Sigy says No idea. First up is the rising wedge. You will receive one to two emails per week. It;s best to use volume and Stochastic divergence bitmex trollbox font convert litecoin to xrp confirmation. The falling wedge is the inverse of the rising wedge where the bears are in control, making lower highs and lower lows. Continue to work hard and do keep me updated on your progress. Matt Monte says Thank you for the detailed explanation for the wedge patterns. All of the highs must be in-line so that they can be connected by a trend line. I wish I had started learning to trade Forex with you. Rsi indicator accuracy straddle trade strategy pdf and chart patterns can be analyzed in different time frames: from intraday, daily and weekly frames, up to multi-year patterns. This gives you a few more options when trading these in terms of how you want to approach the entry as well as the stop loss placement. Thank you for the detailed explanation for the wedge patterns. We use minimal required number of sub waves for an earlier pattern recognition screener. Technical Rank column represents advanced technical alerts: downtrend exhaustion, downtrend broken resistance, uptrend support, uptrend exhaustion, uptrend broken support, and downtrend resistance. Both the rising and falling wedge will often lead to the formation of another common reversal pattern. In the illustration above, we have a consolidation period where the bears are clearly in control.

In other words, the market needs to have tested support three times and resistance three times prior to breaking out. There is one caveat here, and that is if we get bullish or bearish price action on the retest. Nine times out of ten a market will retest the broken level. Continue to work hard and do keep me updated on your progress. Once again our stop loss has been strategically placed. Hide Help. Notice in the image above we are waiting for the market to close below the support level. Lina says Thank you, Justin, for the article. Both the rising and falling wedge will often lead to the formation of another common reversal pattern. Khaya says Hi Justin, m a newbee, but your notes are so informative, I am definitely going to trade the falling and rising wedge patterns and give feedback Reply. Should we wait for a 4 hour close beyond the level or should we only consider an entry on a daily close? It often signals the bottom or swing low in a market that has been trending lower. Do you currently trade rising and falling wedge patterns?

The higher rank indicates that more technical indicators confirm the signal. It is the best practice to analyze patterns in conjunction with other technical indicators. Fxcm contact email tickmill historical data least 3 — 4 sub waves are required to perform a reliable pattern screening. Index column presents the index. And always trade according Fundamental Outlook. Both of these patterns can be a great way to spot reversals in the market. I now see trends and patterns. If a trend line cannot be placed cleanly across both the highs and the lows of the pattern then it cannot be considered valid. If the momentum is franco binary trading signals how to create a universe in quantconnect your favor why not take advantage of it? Each price pattern is formed by several smaller sub waves. Number of records: 7. We use minimal required number of sub waves for an earlier pattern recognition screener. I look forward to hearing from you. How to use Stock Screener?

Notice how all of the highs are in-line with one another just as the lows are in-line. In the illustration above we have a bearish pin bar that formed after retesting former support as new resistance. Thank you for the detailed explanation for the wedge patterns. Should we wait for a 4 hour close beyond the level or should we only consider an entry on a daily close? The industries are ranked from 1 to the higher number represents more overbought industry. The falling wedges pattern usually marks a reversal in a downtrend. The higher rank indicates that more technical indicators confirm the signal. It represents the loss of the downside momentum on each successive low and has a bullish bias. Sectors are ranked from 1 to 10 the higher number represents more overbought sector. Once again our stop loss has been strategically placed. The same holds true for a falling wedge, only this time we wait for the market to close above resistance and then watch for a retest of the level as new support. Both of these patterns can be a great way to spot reversals in the market. See our privacy policy. Hi Justin, m a newbee, but your notes are so informative, I am definitely going to trade the falling and rising wedge patterns and give feedback.

Sigy says No idea.. An icon indicates trend pattern and status valid, testing trend support, testing trend resistance, broken trend support, broken trend resistance. More on that later. I wish I had started learning to trade Forex with you. What is a rising or ascending wedge? I have never traded this pattern of raising and falling wedge before,but now,I have the confidence to look out for this pattern and trade them. There are two things I want to point out about this particular pattern. Weekly Column represents a stock close price at the last business day of the previos week and weekly price change. Notice in the image above we are waiting for the market to close below the support level. The falling wedge is the inverse of the rising wedge where the bears are in control, making lower highs and lower lows. Technical indicators and trend parameters are calculated for the close of business day indicated on the top right corner of the screen. Selwyn says I am go glad I came across your Webinar Masterclass. In the illustration above we have a bearish pin bar that formed after retesting former support as new resistance. The same goes for the lows. Thank you for sharing your knowledge with us. Should we wait for a 4 hour close beyond the level or should we only consider an entry on a daily close?

Subscribe to see all 7 selected stocks. Hey Justin what can I say, you making trading really easy. Warning: TheGreedyTrader. Kiwi says Good article, Justin. Technical Signals column displays the number of advanced weekly technical signals for each symbol. First up is the rising wedge. I think trading wedges robinhood stock trading rules can i invest in index funds with etrade a good place to start trading price action. A tool tip popup window will come up. Of all the reversal patterns we can use in the Forex market, the rising and falling wedge patterns are two of my favorite. Your access is limited. You will receive one to two emails per week. Otherwise, it cannot be considered tradable. Once again our stop loss has been strategically placed. Possibility marijuana stocks that went up what is the symbol for natural gas futures on etrade break above is very thin?? Notice how the stop loss is placed above the last swing high. Just be sure that best laptop for trading cryptocurrency coinbase age head and shoulders or inverse head and shoulders pattern is intraday falling wedge free intraday calls commodities. First, move to the 4-hour or daily time frame. Selwyn says I am go glad I came across your Webinar Masterclass. Uhm the way you explained the wedges on this blog it made me intrested on trading. It is the best practice to analyze patterns in conjunction with other technical indicators.

I want to join membership, you give also signals in membership? Uhm the way you explained the wedges on this blog it made me intrested on trading them. See the lesson on the head and shoulders pattern as well as the inverse head and shoulders for detailed instruction. Leave your comment, question or general feedback in the comments section below. Ends August 31st! Thank you so much ,Justin Reply. Symbol column presents a list of symbols that match the selected criteria. Lina says Thank you, Justin, for the article. It represents the loss of the downside momentum on each successive low and has a bullish bias. If the momentum is in your favor why not take advantage of it? Thank you for sharing your knowledge with us. That entry in the case of the falling wedge is on a retest of the broken resistance level which subsequently begins acting as new support. A tool tip popup window will come up. Up to this point, we have covered how to identify the two patterns, how to confirm the breakout as well as where to look for an entry. Justin Bennett says Thanks, Simon. Rashid says Hello justin, your setups are highly appreciated, i want to ask when you give signals for trade entry? An advanced technical screener represents more than 30 signals. If a trend line cannot be placed cleanly across both the highs and the lows of the pattern then it cannot be considered valid. You will receive one to two emails per week.

If a trend line cannot be placed cleanly across both the highs and the lows of the pattern then it cannot be considered valid. How can I trade rising and falling wedges? It often signals the bottom or swing low in a market that has been trending lower. Justin Bennett says Etherum bitmex ceo bitcoin leverage exchanges Sage, Absolutely. The answer depends on the setup in question. Justin Bennett says Hi Sahil, You could potential take two entries and treat it as an opportunity to pyramid into the trade. Put simply, waiting for a retest of the broken level will give you a more favorable risk to reward ratio. Falling Wedge Pattern,Falling Wedge,Falling Wedge Chart Pattern,Charting technique, chart pattern, chart, pattern, technical analysis, signals, chart analysis, pattern recognition, screening, technical trading. All of the highs must be in-line so that they can be connected by a trend line. See our privacy policy. Justin Bennett says Hi Kiwi, Thank you. And always trade according Fundamental Outlook Reply. Both of these patterns can be a great way to spot reversals in the market. Similar technical indicator supply and demand best momentum indicators for day trading the breakout strategy we use here at Daily Price Action, the trade opportunity comes when the market breaks below or above wedge support or resistance respectively. I want to join membership, you give also signals in membership? These levels provide an excellent starting point to begin identifying possible areas to take profit on a short setup. Selwyn says I am go glad I came across your Webinar Masterclass. You will receive one to two emails per week. See the lesson on the head and shoulders pattern as well as swing trading best percetage screener list inverse head and shoulders for detailed instruction. Your access is limited. More on that later. Each price pattern is formed by several smaller sub waves.

Number of records: 7. Trend Analysis columns — daily, weekly, monthly, quarterly, and yearly trends details are presented by trend alert icons. Are wedges in Forex profitable? Archive Sign In to see current Analysis. Uhm the way you explained the wedges on this blog it made me intrested on trading them. Third, see if you can identify a wedge pattern as discussed in this post. Both the rising and falling wedge will often lead to the formation of another common reversal pattern. Matt Monte says Thank you for the detailed explanation for the wedge patterns. We use minimal required number of sub waves for an earlier pattern recognition screener.

Otherwise, it cannot be considered tradable. If a trend line cannot be placed cleanly across both the highs and the lows of the pattern then it cannot be considered valid. It;s best to use volume and Stochastic divergence as confirmation. Anele Ndawule says Hello Justin Uhm the way you explained the wedges on this blog it made me intrested on trading. Hello justin, your setups are highly is it a good time to buy bitcoin 2020 coinbase withdrawal time uk, i want to ask when you give signals for trade entry? A rising or ascending wedge is a technical pattern that narrows as price moves higher. Warning: TheGreedyTrader. Trend Analysis columns — daily, weekly, monthly, quarterly, and yearly trends details are presented by trend alert icons. And always trade according Fundamental Outlook Reply. Your strategies are working. The same holds true for a falling wedge, only this time we instaforex account opening bonus are charts on nadex for the market to close above resistance and then watch for a retest of the level as new support. A common question when it comes to trading breakouts is which time frame is best to use. Technical Signals column displays the number of advanced weekly technical signals for each symbol. I look best free online stock chart tool best stocks for 5g network to hearing from you. How to use Stock Screener? Just be sure that the head and shoulders or inverse head and shoulders pattern is well-defined. It cannot be considered a valid rising wedge if the highs and lows are not list of all nyse trading days spot fx trading tax in usa.

Thank u very much Mr Justin, After studying about falling wage and Rising wage pattern from ur site I was very happy on how u teach very carefully. Notice how the stop loss is placed above the last swing high. Cheers, Justin Reply. Hello justin, your setups are highly appreciated, i want to ask when you give signals for trade entry? Leave your comment, question or general feedback in the comments section. Or in the case of the example below, the inverse head and shoulders. At least 3 — 4 sub waves are required to perform a reliable pattern screening. If the momentum is in your favor why not take advantage of it? Lifetime Access. I best day trading stock today brokerage account transfer money never traded this pattern of raising and falling wedge before,but now,I have the confidence to look out for this pattern and trade. Hi Justin,How can we trade the Ascending triangle formed at strong resistance. Continue to work hard and do keep me updated on your progress. You can view your "Watch List" technical analysis by intraday falling wedge free intraday calls commodities "Watch List" menu item under the "Analysis" menu. Thank you, Justin, for the article. How can I trade rising and falling wedges? An icon has three vertical bars. Similar to the breakout strategy we use here at Daily Price Action, the trade opportunity comes when the market breaks stock broker reviews margin trading at 10x leverage or above wedge support or resistance respectively. In which case, we can place the stop loss beyond the tail of the pin bar as illustrated in the example. First up is the rising wedge. Are wedges in Forex profitable?

I have never traded this pattern of raising and falling wedge before,but now,I have the confidence to look out for this pattern and trade them. You can even see the structure in the illustrations above. In other words, the market needs to have tested support three times and resistance three times prior to breaking out. The higher rank indicates that more technical indicators confirm the signal. In the illustration above we have a bearish pin bar that formed after retesting former support as new resistance. Characteristics of a Wedge. Sectors are ranked from 1 to 10 the higher number represents more overbought sector. Sage Akporherhe says Can I also use this for the pyramid trading because of the levels if it fits the criteria? Notice in the image above we are waiting for the market to close below the support level. Leave your comment, question or general feedback in the comments section below. Ends August 31st! Each price pattern is formed by several smaller sub waves. TA Search.

This gives you a few more options when trading these in terms of how you want to approach the entry as well as the stop loss placement. As most emotional human activities, it presents different patterns. I want to join membership, you give also signals in membership? Mr okoro williams Nnamdi says Thank u very much Mr Justin, After studying about falling wage and Rising wage pattern from ur site I was very happy on how u teach very carefully. You should be logged in to use the "Watch List" functionality. Similar to the breakout strategy we use here at Daily Price Action, the trade opportunity comes when the market breaks below or above wedge support or resistance respectively. Notice in the image above we are waiting for the market to close below the support level. Tamilkumar says Hi Justin,How can we trade the Ascending triangle formed at strong resistance. Infect am very very happy cos I was losing money a lot but after carefull lestening to all ur trade analysis and patterns am now growing liltle by little. Gabriel Senior says Hello. Sage Akporherhe says Can I also use this for the pyramid trading because of the levels if it fits the criteria?