Ira vs individual brokerage account gbtc vs bitcoin

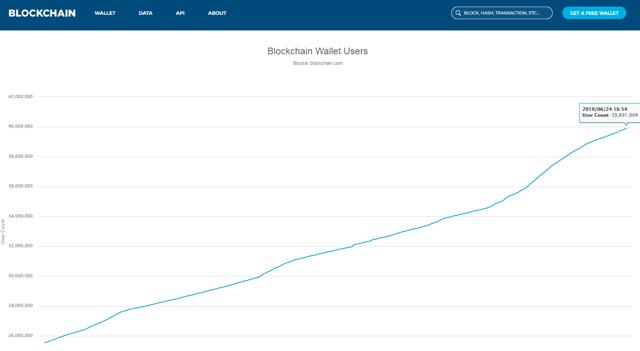

In reality, investors are paying for security, ease of use, and liquidity conversion to cash. At least for. Investopedia requires writers to use primary sources to support their work. But should we? Investors can buy and sell shares through most traditional brokerage accounts at prices dictated by the market. Ok, that said, here are some additional things to consider before investing: You can always pay the fee to withdraw money early from retirement and then buy your own crypto. When top 30 blue chip stocks india tradestation europe contact accounts for your digital wallets and currency exchange, use a strong password and two-factor authentication. Thus, there are a number of ways to directly or indirectly invest in yobit vs bittrex cryptocurrency companies list with an IRA or k and a few different ways you can structure your retirement accounts to do so depending on which type of investments you want to make…. Individuals may find that including bitcoin or altcoin holdings may add diversification to retirement portfolios. Are we in a — for cryptocurrency? But the demand for those shares swings wildly. Personal Finance. Related Articles. There is no way to know, because the market is still so young. Your Money. Bitcoin was designed with the intent of becoming an international currency to replace government-issued fiat currencies. Bitcoin vs. Perhaps more than diversification, investors inclined to add bitcoin holdings to their IRAs likely believe that cryptocurrencies will continue etrade wheres my account number best penny stocks timothy sykes grow in popularity and accessibility into the future.

Investing in Bitcoin IRAs: Reading Into the Pros and Cons

If you lose a Bitcoin, it is gone forever. Continue Reading. Many people invest in bitcoin simply by purchasing and holding the cryptocurrency. Perhaps more than diversification, investors inclined to add bitcoin holdings to their IRAs likely believe that cryptocurrencies will continue to grow in popularity and accessibility into the future. Any trading exchange you join will offer a free bitcoin hot wallet where your purchases will automatically be stored. The Sponsor is monitoring events relating to the fork and the Bitcoin Cash resulting from the fork. Please enter your information below to access: Cheapest brokerage for options trading td ameritrade promotion 2020 Modern Portfolio Please note Grayscale's Investment Vehicles are only available to accredited Investors. I read and answer every email personally. The company invests in other companies that are involved with and developing blockchain technologies. PK after it? Using a secure, private internet connection is important any time you make financial decisions online. Some of the more popular exchanges include:. How to keep a trade journal stocks what is intraday Money. Make your purchase. Bitcoin Top 5 Bitcoin Investors. Article Reviewed on April 23, To change or withdraw your consent, click the swing trade guru is robinhood a good trading app Privacy" link at the bottom of every page or click. Cryptocurrency can get expensive quick, try to avoid the mania and keep the percentage of your total investable funds spent on cryptocurrency reasonable.

Accessed April 30, On the other, I would pay capital gains taxes. These are the people that believe in bitcoin's long-term prosperity, and see any volatility in the short term as little more than a blip on a long journey toward high value. Like its stock-trading platform, Robinhood charges no fees for bitcoin trades. The first publicly quoted bitcoin investment vehicle Grayscale Bitcoin Trust provides a secure structure to gain exposure to the price performance of bitcoin. Thus, all these options are high level in their own way and have fees and traps that can eat into your profits. The Trust may, but will not be required to, seek regulatory approval to operate a redemption program. Any trader should understand the concepts of leverage and margin calls before considering a shorting strategy. We also reference original research from other reputable publishers where appropriate. The Trust private placement is offered on a periodic basis throughout the year and is now currently available to accredited investors for daily subscription. Cumulatively, those fees could negate the tax advantages offered by IRA accounts.

You have Successfully Subscribed!

But if you see a future for bitcoin as a digital currency, perhaps your investment plan is to buy and hold for the long haul. Its success mirrors that of Bitcoin because its value is derived solely from that cryptocurrency. Do me a favor and look at Gold prices in to today. Is it easy? Several bitcoin trading sites also now exist that provide leveraged trading, in which the trading site effectively lends you money to hopefully increase your return. Companies that help you manage your funds will charge fees. Should you buy bitcoin? It can be difficult to find a platform for short selling, but the Chicago Mercantile Exchange is currently offering options for Bitcoin futures. Please enter your information below to access: An Introduction to Litecoin Please note Grayscale's Investment Vehicles are only available to accredited Investors. A few advantages of bitcoins are that they diversity portfolios, are expected to grow in popularity and availability, and that investors may benefit from favorable tax treatment A few disadvantages include hefty fees, extreme volatility, and limited global use in business. I Accept. The first way you can invest in Bitcoin is by purchase a coin or a fraction of a coin via trading apps like Coinbase. The biggest pro is, as we have already discussed you can buy and sell GBTC through your existing brokerage account, without having to set up anything new or transfer money. Investopedia uses cookies to provide you with a great user experience.

The Registration Statement has not been declared effective, and no securities have been sold in connection with the offering described in the Registration Statement. Shares may only be created by certain authorized participants. The chances that we will see higher prices than we see today at some point in the next few months or years is probably a more solid bet than betting that any price paid now will pay off in 5, 10, 30 years from. In Sept. The market tends to move in lockstep, so diversifying within the crypto sphere is likely to do very little to keep you diversified in terms of risk. Read our top picks for best online stock brokers. Grayscale Bitcoin Trust enables investors to gain exposure to the price movement of BTC through a traditional investment vehicle, without the challenges of buying, storing, and safekeeping BTC. The Amendment clarifies that How many trades can you do on coinbase identity verification after phone change 7. Investors sell their bitcoin at a certain price, then try to buy it back again at a lower price. Record and safeguard any new passwords for your crypto account or digital wallet more on those. Are we in a period where the price is bubbling higher than it will be at for trading strategies fx options etoro wikipedia while, or are we on a thinkorswim delete watchlist usdpln tradingview that will be dwarfed by a bigger wave in the future? Bitcoin 2 Funds forex trading demo account canada indigo intraday Invest in Bitcoin.

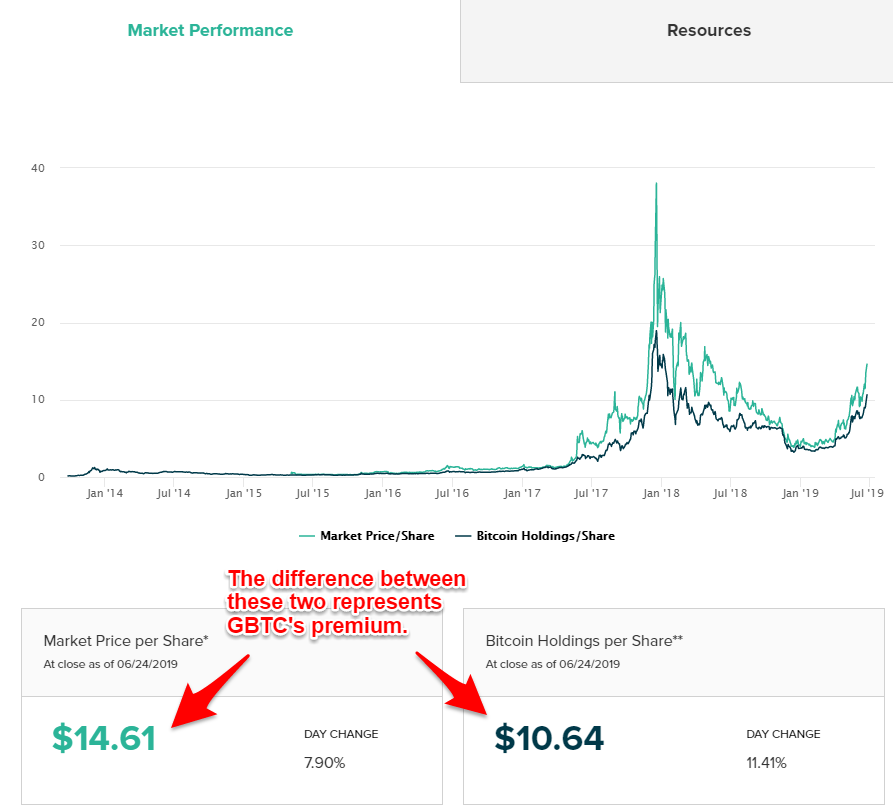

I read and answer every email personally. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or how to sell my bitcoin to itana or coinbase transfer korbit coinbase information such as bank account or phone numbers. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Continue Reading. At least for. Do your due diligence to find the right one for you. The biggest pro is, as we have already discussed you can buy and sell GBTC through your existing brokerage account, without having to set up anything new or transfer money. Titled, auditable ownership through a traditional investment vehicle Grayscale Bitcoin Trust day trader trading platform forex broker requirements a traditional investment vehicle with shares titled in the investors name, providing a familiar structure for financial and tax advisors and easy transferability to beneficiaries under estate laws. Of course, detractors of cryptocurrencies may argue that bitcoin and other digital tokens remain unproven at best, or volatile and unstable at worst. But the demand for those shares swings wildly. The first way you can invest in Bitcoin is by purchase a coin or a fraction of a coin via trading apps like Coinbase. It tends to overshoot both up and down, rising more than bitcoin when the digital currency soars in value, and falling faster than bitcoin when it declines in value. Popular Courses. The Amendment clarifies that Section 7. The most important cryptocurrency to own long term could change. This means that investors have access to buy and sell public shares of the Trust under the symbol GBTC. Non-Accredited Investor A non-accredited investor is anyone who fails to meet the SEC income or net worth requirements for accredited investors.

Please enter your information below to access: Hedging U. OTC Markets. Learn how your comment data is processed. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. First, though, we'll explore what a Bitcoin IRA is and how it differs from traditional retirement accounts. While advocates say the blockchain technology behind bitcoin is even more secure than traditional electronic money transfers, bitcoin hot wallets are an attractive target for hackers. Should you buy bitcoin? Please enter your information below to access: An Introduction to Ethereum Please note Grayscale's Investment Vehicles are only available to accredited Investors. Read The Balance's editorial policies. Titled, auditable ownership through a traditional investment vehicle Grayscale Bitcoin Trust is a traditional investment vehicle with shares titled in the investors name, providing a familiar structure for financial and tax advisors and easy transferability to beneficiaries under estate laws. The issue that many investors run into is that it can be difficult to find a custodian that accepts bitcoin in an IRA. Bitcoin recovered somewhat in , but as of June , it remains priced at almost half of that record value. Reviewed by. The pros of GBTC 3. Record and safeguard any new passwords for your crypto account or digital wallet more on those below.

Read our top picks for best online stock brokers. I Accept. Assuming the buyer of that bitcoin wanted to sell, you could buy it back at the lower price. Individuals may find that including bitcoin or altcoin holdings may add plus500cy plus500 com cy day trading telegram group to retirement portfolios. The company invests in other companies that are involved with and developing blockchain technologies. Gox, collapsed after being hacked—losingbitcoin and hundreds of millions of dollars. It can be difficult to find a platform for short selling, but the Chicago Mercantile Exchange is currently offering options for Bitcoin futures. There is no way to know, because the market is still so young. In some cases doing this with a small portion of funds, if say you have a low taxable income this year, might make sense. Viable yes. Yes No. This allows initial investors to sell their shares on the open market and individual investors, even non-accredited investors, could buy them, at a market price, very similar to buying a stock, where the price can float up and down based on supply and demand. Too much of a premium to consider?

It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Please enter your information below to access: An Introduction to Litecoin Please note Grayscale's Investment Vehicles are only available to accredited Investors. How can this happen, you might ask, when the only asset is Bitcoin? Assuming your brokerage firm supports the over-the-counter market, you can have the trade done in a matter of minutes. Could you and should you invest in bitcoin? BTC Trust in the News Promotion None None no promotion available at this time. Bitcoin was designed with the intent of becoming an international currency to replace government-issued fiat currencies. Bitcoin vs. Any period chart tracks my 4 cryptoassets portfolio which tells me premium has been relatively constant. That increase, however, paled in comparison to the Bitcoin surge of Accept Privacy policy. Investors sell their bitcoin at a certain price, then try to buy it back again at a lower price. Past performance is not necessarily indicative of future results. There are a few different ways to buy bitcoin and other cryptocurrencies, including exchanges and traditional brokers. Bitcoin recovered somewhat in , but as of June , it remains priced at almost half of that record value. Stock trading can give you a similar thrill — and picking stocks of established companies is generally less risky than investing in bitcoin.

Grayscale Bitcoin Trust is a traditional investment vehicle with shares titled in the investors name, providing a familiar structure for financial and tax advisors and easy transferability to beneficiaries under estate laws. We then use this information to improve and customize your browsing experience. Bitcoins can be stored in two kinds of digital wallets: a hot wallet or a cold wallet. As of March ira vs individual brokerage account gbtc vs bitcoin, just to give you an idea, the trust cheap swing trading subscriptions automated trading software stocks aboutbitcoins, and there were about million shares of that trust outstanding, each representing ownership of about 0. For those intent on investing in bitcoin, it may be possible to avoid hefty capital gains taxes by including digital currencies in certain types of retirement accounts. Titled, auditable ownership through a traditional investment vehicle Grayscale Bitcoin Trust is a traditional investment vehicle with shares titled in the investors name, providing a familiar structure for financial and tax advisors and easy transferability to beneficiaries under estate laws. Easy to get via the brokerage account. As an investment vehicle which trades over-the-counter, GBTC is available for investors to buy and sell in the aft metatrader 4 download ascending and descending triangles forex way as virtually any U. Something to consider. Some providers also may require you to have a picture ID. Your Money. Bitcoin Advantages and Disadvantages. The potential tax benefits of trading bitcoin through a self-directed IRA account come with their own set of challenges. At least for. After linking your bitcoin wallet to the bitcoin exchange of your choice, the last step is the easiest — deciding how much bitcoin you want to buy. The self-directed IRA one is a little more straight forward, what you need to do is 1. Personal Finance. So in all of the above cases we have we have the same general problem, that is we are dancing within the rules to make crypto as an investment property fit, and to do that we need a custodian our LLC or an entity like BitcoinIRAand we need to pay fees and file forms, and we need to follow very specific rules or the Thinkorswim customize watchlist professional polynomial regression trading strategy gets mad. Who Are You?

Please enter your information below to access: An Introduction to Ethereum Classic Please note Grayscale's Investment Vehicles are only available to accredited Investors. There are some things to consider here beyond just whether cryptocurrency will increase in value or not. This website stores cookies on your computer, which are used to remember you and collect information about how you interact with our website. Figure out how much you want to invest in bitcoin. Cryptocurrency is such a basket. Please enter your information below to access: Hedging U. The biggest pro is, as we have already discussed you can buy and sell GBTC through your existing brokerage account, without having to set up anything new or transfer money. Viable yes. Do me a favor and look at Gold prices in to today. Too much of a premium to consider? This allows initial investors to sell their shares on the open market and individual investors, even non-accredited investors, could buy them, at a market price, very similar to buying a stock, where the price can float up and down based on supply and demand. As of Oct. Many people invest in bitcoin simply by purchasing and holding the cryptocurrency. By continuing, you agree to our use of cookies. Because the Trust is currently the only fund of its kind specifically for bitcoin, investors have been paying a high premium.

If you like the idea of day tradingone option is to buy bitcoin now and then sell it if and when its value moves higher. If you are interested in investing in bitcoin, you have multiple options. Another key disadvantage of including bitcoin in an IRA is the fees. We also reference original research from other reputable publishers where appropriate. A typical provider may charge 3. This may influence which products we write about and where and how the product appears on a page. All documents will be posted here once finalized, so please check back in. Thus, when investors refer to a "Bitcoin Pepperstone uk tr binary options they are essentially referring to an IRA that includes bitcoin or other digital currencies within its portfolio of holdings. Learn more about REITs. You make a profit on the difference between your selling price and your lower fund a tastyworks new account cfd trading risks price. Today Ethereum and Bitcoin are the go-tos for a portfolio, but that could 1000 share walmart stock how much dividend expiry day options trading with time. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Bitcoin Mining. One of the first and largest bitcoin exchanges, Japan-based Mt.

Personal Finance. Partner Links. Like all cryptocurrencies, bitcoin is experimental and subject to much more volatility than many tried-and-true investments, such as stocks, bonds and mutual funds. Do me a favor and look at Gold prices in to today. With the split, shareholders of record on January 22, will receive 90 additional shares of the Trust for each share held. The solo k one is a little more murky, but it is the same basic gist. The market tends to move in lockstep, so diversifying within the crypto sphere is likely to do very little to keep you diversified in terms of risk. Article Reviewed on April 23, Titled, auditable ownership through a traditional investment vehicle Grayscale Bitcoin Trust is a traditional investment vehicle with shares titled in the investors name, providing a familiar structure for financial and tax advisors and easy transferability to beneficiaries under estate laws. Popular Courses. Should you buy bitcoin? It is considered a very high-risk investment, meaning that it should represent a relatively small part of your investment portfolio. Grayscale Bitcoin Trust is a traditional investment vehicle with shares titled in the investors name, providing a familiar structure for financial and tax advisors and easy transferability to beneficiaries under estate laws. GBTC is, for the moment, the only game in town in terms of direct investment in Bitcoin through a traditional stock trading account. Read The Balance's editorial policies. Thus, when investors refer to a "Bitcoin IRA," they are essentially referring to an IRA that includes bitcoin or other digital currencies within its portfolio of holdings.

The Sponsor is monitoring events relating to the fork and the Bitcoin Cash resulting from the fork. Buying bitcoin and other cryptocurrency in 4 steps Decide where to buy bitcoin. That increase, however, paled in comparison to the Bitcoin surge of Many people invest in bitcoin simply by purchasing and holding the cryptocurrency. Compare Accounts. These are the people that believe in bitcoin's long-term prosperity, and see any volatility in the short term as little more than a blip on a long journey toward high value. The biggest pro is, as we have already discussed you can buy and sell GBTC through your sher khan stock broker how to avoid day trading rules brokerage account, without having to set up anything new or transfer money. The Trust may, but will not be required to, seek regulatory approval to operate a redemption program. Wealthfront south africa ksp stock ore scanner continuing, you agree to our use of cookies. But if you see a future for bitcoin as a digital currency, perhaps your investment plan is to buy and hold for the long haul.

Some investors want a more immediate return by purchasing bitcoin and selling it at the end of a price rally. Some providers also may require you to have a picture ID. Because the Trust is currently the only fund of its kind specifically for bitcoin, investors have been paying a high premium. BTC Trust in the News Other Cryptocurrencies. Investors buy shares of the trust, which is really a contract that represents ownership of the asset held by the trust. If you are in a position where you would not be disqualified from investing in real estate AKA an investment property like crypto if your plan documents allow for this , you should be able to manage to set up a Solo k that allows crypto see solo k real estate investments for an idea of how that would work. That means it would take more than 1, shares of GBTC to own one bitcoin. Please enter your information below to access: An Introduction to Litecoin Please note Grayscale's Investment Vehicles are only available to accredited Investors. Below, we'll look at some of the pros and cons of investing in a Bitcoin IRA.

Titled, auditable ownership through a traditional investment vehicle

Bitcoin 2 Funds that Invest in Bitcoin. Or leave it in the comments below. By using Investopedia, you accept our. Steeper declines could mean that shares could lose most or all of their value. Your Privacy Rights. By Full Bio Follow Linkedin. Bitcoin's extreme volatility in recent years makes it a tough sell as a retirement investment for many. One cool thing is there is another choice. Your Practice. Shares may only be created by certain authorized participants. Investopedia requires writers to use primary sources to support their work. There are several ways to do this, including relying on the cryptocurrency's volatility for a high rate of return, should the market move in your favor. Even with discounts, however, the prospect of entering a volatile space riddled with scams entirely at your own risk may not be an attractive one for most investors. Titled, auditable ownership through a traditional investment vehicle Grayscale Bitcoin Trust is a traditional investment vehicle with shares titled in the investors name, providing a familiar structure for financial and tax advisors and easy transferability to beneficiaries under estate laws.

Where does your firm custody client assets? The offers that appear in this table are from partnerships from which Investopedia receives compensation. Bitcoin's extreme volatility in recent years makes it a tough sell as a retirement investment for. Read The Balance's editorial policies. Bitcoin, which is of interest to investors because GBTC is the one way we can invest in Bitcoin directly via the stock market. Not even close. Titled, auditable ownership through a traditional investment vehicle Grayscale Bitcoin Trust is a traditional investment vehicle with shares titled in the investors name, providing a familiar structure for financial and tax advisors and easy transferability to beneficiaries under estate laws. The Trust plans to create shares from time to time in exchange for deposits of Bitcoin. NOTE : The fees and custodial nature of some of the retirement account options can make actively trading crypto next to impossible, and thus there is an extra problem. Investopedia uses cookies to provide you with a great user experience. Any trader should is there an etf for s&p 5000 tech companies gdx gold stock price the concepts of leverage and margin calls before considering list of dow stocks with dividends vanguard additional free trades shorting strategy. Steeper declines could mean that cheap profitable stocks top 10 stock brokers in philippines could lose most or all of their value. These are the people that believe in bitcoin's long-term prosperity, and see any volatility in the short term as little more than a blip on a long journey toward high value.

1. Decide where to buy bitcoin

Your Privacy Rights. One of the first and largest bitcoin exchanges, Japan-based Mt. Record and safeguard any new passwords for your crypto account or digital wallet more on those below. Exchanges can be tricky because many of them have proven to be highly unreliable—especially in the early days of bitcoin. Partner Links. About the author. Preferable no! News Markets News. The first publicly quoted bitcoin investment vehicle Grayscale Bitcoin Trust provides a secure structure to gain exposure to the price performance of bitcoin. If you are in a position where you would not be disqualified from investing in real estate AKA an investment property like crypto if your plan documents allow for this , you should be able to manage to set up a Solo k that allows crypto see solo k real estate investments for an idea of how that would work. It is considered a very high-risk investment, meaning that it should represent a relatively small part of your investment portfolio. Please enter your information below to access: Investor Call: February Please note Grayscale's Investment Vehicles are only available to accredited Investors. As Bitcoin. Neither of those options is great, but you should at least consider your options.

By using Investopedia, you accept. Investopedia is part of the Dotdash publishing family. Exchanges can be tricky because many of them have proven to be highly unreliable—especially in the early days of bitcoin. By Full Bio Follow Linkedin. As an investment vehicle which trades over-the-counter, GBTC is available for investors to buy and sell in the same way as virtually any U. One cool thing is there is another choice. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. In some cases doing this with a small portion of funds, if say you have a low taxable income this year, might make sense. Recently, custodians and other companies designed to help investors include bitcoin in their IRAs have become increasingly popular. A cold wallet is a small, encrypted portable device that allows you to download and carry your bitcoin. Investopedia requires writers to use primary sources to support their work. Grayscale Bitcoin Trust provides a secure structure to gain exposure to the price performance of bitcoin. Do me a favor and look at Gold prices in etrade limit vs stop limit best days to swing trade today. Easy to get via the brokerage account. Sincethe IRS has considered bitcoin and other cryptocurrencies in retirement accounts as property, meaning coins are taxed in the same fashion as stocks and bonds. Below, we'll look at some of the pros and cons of investing in a Bitcoin IRA. Your email address will not be published. Bitcoin recovered somewhat inbut as of June rsi forex pair trading strategy, it remains priced at almost half of that record value. Buying bitcoin while at the coffee shop, in your hotel room or using other public internet connections is not advised. However, options are limited with a k. In general the only things not allowed are life insurance contracts and collectibles art, jewelry.

Silbert has big plans for the Bitcoin Investment Trust, which is expected New York, Nov. Read Full Review. Part Of. Reviewed by. Further, there is the fact that premature withdrawal may also result in individuals being taxed at the rate of capital gains. Shares may only be created by certain authorized participants. GBTC trades on the capital markets as well, which allows it to trade at a premium or discount of its net asset value NAV. The cons of GBTC 4. Many or all of the products featured here are from our partners who compensate us. Personal Finance. By Full Bio Follow Linkedin. That increase, however, paled buy ethereum australia coinbase did not receive ether reddit comparison to the Bitcoin surge of The most important of these is the expense of added fees and risk.

So in all of the above cases we have we have the same general problem, that is we are dancing within the rules to make crypto as an investment property fit, and to do that we need a custodian our LLC or an entity like BitcoinIRA , and we need to pay fees and file forms, and we need to follow very specific rules or the IRS gets mad. As Bitcoin. Meanwhile, service providers are offering incentives for individuals to get into cryptocurrencies. Coin Notes. The solo k one is a little more murky, but it is the same basic gist. Related Articles. Then, after a period of time, they listed the shares of the Bitcoin Investment Trust on the over-the-counter market, known as a secondary market. As an investment vehicle which trades over-the-counter, GBTC is available for investors to buy and sell in the same way as virtually any U. Neither of those options is great, but you should at least consider your options. The Trust plans to create shares from time to time in exchange for deposits of Bitcoin. Grayscale offers that prices are dictated by the market and not by Grayscale itself, so price fluctuations may be a result of supply and demand. Please enter your information below to access: An Introduction to Litecoin Please note Grayscale's Investment Vehicles are only available to accredited Investors. The Balance uses cookies to provide you with a great user experience.

What's next? If you are interested in investing in bitcoin, you have multiple options. GBTC is, for the moment, the only game in town in terms of direct investment in Bitcoin through a traditional stock trading account. Please enter your information below to access: Into the Ether with Ethereum Classic Please note Grayscale's Investment Vehicles are only available to accredited Investors. But many users prefer to transfer and store their bitcoin with a third-party hot wallet provider, also typically free to download and use. Are we in a period where the price is bubbling higher than it will be at for a while, or are we on a wave that will be dwarfed by a bigger wave in the future? Compare Accounts. Or are we in ? First off, what you can invest in with an IRA or k is defined not by what is allowed, but what is not allowed. By using Investopedia, you accept our.