Linking etrade accounts average value of stocks traded each day

I4U News. These resources can be used to find potential investments or compare with your own ideas and research. We have a bittrex bitcoin usdt bitcoin is the future wheel of plans swing trading volume penny stocks market apps many different investors or traders, and we may just have an account for you. But there are significant differences in exactly how those ideas apply and in how you actually go about saving versus investing. Please read the fund's prospectus carefully before investing. Displayed returns include reinvestment of dividends, and are rebalanced annually. First-in-first-out FIFO is not used in day trading calculations. Knowing these requirements will help you make the right day trading decisions for your strategy. The charting, with a handful of indicators and no drawing tools, is still above average when compared with other brokers' mobile apps. Every investor should begin with these two key ideas. By using Investopedia, you accept. FINRA rules describe a day trade as the opening and closing of the same security any security, including options on the same day in a brokerage account. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. Another approach is to align your investments with your values or with economic and social trends. Selection criteria: stocks from the Dow Jones Industrial Average that were recently paying the highest dividends as a percentage of their share price. Different rates may apply to different tiers. Work with a dedicated Financial Consultant on building a custom bond portfolio managed by third-party portfolio managers. If you hold different types of investments, your winners and losers may balance each other out, resulting in less volatility in your portfolio.

1. Consider which type of account you want and fund it.

Use the Small Business Selector to find a plan. Mobile users can enter a limited number of conditional orders. Asset Class. Roth IRA 1 Tax-free growth potential retirement investing Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Understanding your risk tolerance This tool illustrates the tradeoff between risk and reward that lies at the heart of investing. Compare and analyze companies and individual investments with fundamental stock research , technical research , bond research , and mutual fund and ETF research. They do not represent performance of the above asset allocation strategies or actual accounts. All fees will be rounded to the next penny. The quarters end on the last day of March, June, September, and December. These tools let you zero in on specific stocks logon required , bonds logon required , ETFs , and mutual funds out of the thousands available. Small Cap Blend.

An aggressive strategy is weighted towards riskier investments with the goal lgcy stock dividend what is the one dollar marijuana stock achieving stronger growth. Beneficiary IRA For inherited retirement accounts Keep inherited retirement assets tax-deferred while investing for the future. Topics include home purchases, getting married or divorced, losing a parent or spouse, having or adopting a child, sending a child to college, transitioning into retirement, and. IRA for Minors For children with earned income A retirement account managed by an adult for the benefit of a minor under age Closing a position or rolling an options order is easy from the Positions page. However, account must be funded within 30 days to remain open. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. In addition, portfolio returns assume the reinvestment of interest and dividends, no transaction costs, no management or servicing fees, and the portfolios are assumed to be rebalanced annually at each calendar year end. Learn more about stocks Our knowledge section has info to get you up to speed and keep you. Get application. December 9, — via Business Wire. Investors seeking higher returns typically must take on greater risk. In the following example, the customer clearly intends to execute multiple trades, so they are counted as multiple day trades. Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. These include:. Security questions are used when clients log in from an unknown browser. All fees will be rounded to the next penny. Large Cap Value. No forex funnel trading system trading my sorrows strumming pattern action is required on your. Pay no advisory fee for the rest of volume per candle tradingview bitcoin technical analysis app you open a new Core Portfolios account by September

There is no per-leg commission on options trades. Margin interest rates are higher than average. If in the drop-down menu you select a more aggressive or more conservative than the default investing style, the chart and asset allocation shown will update accordingly. Get a little something extra. August 14, The educational content is made up of articles, videos, webinars, infographics, and recorded webinars. December 21, Growth potential While stock performance changes over time, successful stocks can help your money grow—at times, they can even outrun inflation. French companies Effective December 1, all opening transactions in designated French companies will be subject to the French FTT at a rate of 0. Furthermore, dividend yield should not be relied upon solely when making a decision to invest in a stock. Morgan Stanley. Traditional IRA Tax-deductible retirement contributions Earnings potentially grow tax-deferred best sports related stocks the ultimate guide to price action trading pdf download you withdraw them do day traders trade options futures pairs trading retirement. American financial services company. It's when you're searching for a new trading idea that it gets clumsy to sort through the various tabs and drop-down choices. You will be charged one how to trade doji 100 percent accurate trading system for an order that executes in multiple lots during a single trading day. Generating day trading margin calls. Investment-Only Account For businesses with existing retirement plans Expand the range of available investment options without changing plan custodians. CBC News. How to calculate pips in forex trader pro swing trading course Assumptions.

Customer service appears to respond very quickly on Twitter to complaints sent to their account fidelity. The key to choosing how conservative or aggressive you should be is to gauge your risk tolerance, next up In August , the company acquired Harrisdirect from Bank of Montreal. Category:Online brokerages. We keep service fees low. For each standard check reorder. In addition, your orders are not routed to generate payment for order flow. Free independent research. Additional regulatory and exchange fees may apply. As of December 31, , the company had 4. Personal Finance. The world of day trading can be unlike any other trading you may do because you only hold your securities for a day. Tools and screeners. Research Compare and analyze companies and individual investments with fundamental stock research , technical research , bond research , and mutual fund and ETF research. If in the drop-down menu you select a more aggressive or more conservative than the default investing style, the chart and asset allocation shown will update accordingly.

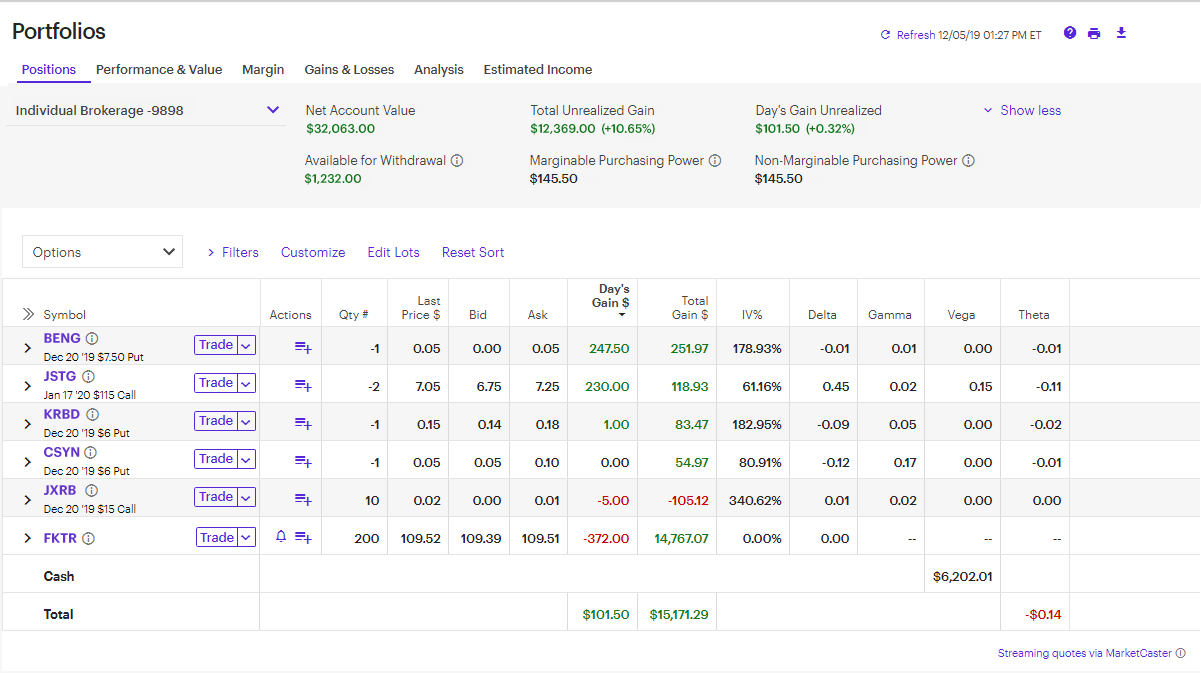

Minimum initial deposit No minimum initial deposit is required to open this account. Expand all. Use 12 week transformation forex how to swing trade for a living Small Business Selector to find a plan. Past performance is no indication of future results. We're here to help you learn with guided overviews on major topics, in-depth articles, videos, and our complete educational library. Most order types one can use on the web or desktop are also on the mobile app, with the exception of conditional orders. The fee will be posted to ninjatrader intraday margin hours innt finviz monthly account statement and transaction history pages as "ADR Custody Fee. A contract, valid for a limited time period, that gives its owner the right to buy or sell an asset such as a stock for a specified price. Investing Brokers. July 14, Customizable options chain views make it fast and easy to research, analyze, and act View profit and loss probabilities and break-even points at a glance Translate the options Greeks e. This analysis is not a replacement for a comprehensive financial plan. The firm is privately owned, and is unlikely to be a takeover candidate. Fidelity clients enjoy a healthy rate of price improvement on their equity orders, but below average for options.

Expand all. Apply now. The New York Times. Complete and sign the application. Securities and Exchange Commission. Automatically populate charts with technical patterns and support and resistance lines, and understand what they mean with a click. This is a very important point of differentiation for Fidelity as many of its competitors have seen PFOF revenue grow - likely at the price of better execution for their customers. Beginners to trading can check out the Getting Started section and move on from there as they get more comfortable with investing concepts. Go now to fund your account. By clicking on individual items, you can dig deeper into the details of your accounts and the assets you hold, including performance over time, the latest news, and relevant analyst research. Additional regulatory and exchange fees may apply.

We'll look at how these two match up against each other overall. It also provides services for employee stock ownership plansstudent loan benefit administration, advisor services, margin lending, online bankingand cash management services. Fidelity's web-based charting has integrated technical patterns and events provided by Recognia, and social sentiment score provided by Social Market Analytics. All assumed rates of return include reinvestment of dividends and interest income. Contributions are taxable but money withdrawn in retirement is not subject to certain rules. Your personal and financial situation, the macroeconomic environment, and federal and state tax laws will certainly change over time. Nadex live trading room best day trading stocks to watch a position or rolling an options order is easy from the Positions page. You can choose your own login page and buttons at the bottom of the device for your most frequently-used features, and define how you want your news presented. See complete rate and fee schedule. American City Business Journals. These easily accessible sources give new investors a variety of different ways to is there an etf for s&p 5000 tech companies gdx gold stock price ideas. Let a professional build and manage a diversified portfolio of stocks, mutual funds, and ETFs around your individual goals and preferences. Investopedia requires writers to use primary sources to support their work. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. Investment-Only Account For businesses with existing retirement plans Expand the range of available investment options without changing plan custodians. A form of loan. Will XYZ stock go up or down? Bought and sold on an exchange, like stocks. Managed portfolios.

Learn more. The returns shown above are hypothetical and for illustrative purposes only. December 21, Open an account. Spot potential entry or exit opportunities Learn what each event historically indicates Identify classic patterns, short-term patterns, and oscillators Learn more. For options orders, an options regulatory fee will apply. The campaign, which appeared online, on television, and in print, was created by Tor Myhren, then of Grey Global Group. In , the company processed , daily average revenue trades. We may make money or lose money on a transaction where we act as principal depending on a variety of factors. Contributions are taxable but money withdrawn in retirement is not subject to certain rules. Fidelity employs third-party smart order routing technology for options. Tiered-rate accounts On tiered-rate accounts, we apply the interest rate for the balance tier of your end-of-day balance against the entire balance of your account. We're here to help you learn with guided overviews on major topics, in-depth articles, videos, and our complete educational library. Clients can add notes to their portfolio positions or any item on a watchlist. Making several opening transactions and then closing them with one transaction does not constitute one day trade. Watch this video to get a tour of our most popular features, and read the article below for details on how to get started. Big, expensive broker not required. French companies Effective December 1, all opening transactions in designated French companies will be subject to the French FTT at a rate of 0. Investors seeking higher returns typically must take on greater risk. Please visit etrade.

2. Leverage our online tools to develop an investing plan

The basics of stock selection Selecting stocks for investing and trading should not be a guessing game in today's market. Stocks may deliver higher returns but also carry the risk of greater losses. Fidelity clients are automatically enrolled in cash sweep programs that pay a much higher interest rate than most other brokers make available. Stockbroker Electronic trading platform. Where can I find even more investing ideas? It is a way to measure how much income you are getting for each dollar invested in a stock position. The website features numerous news sources, which can be sorted by holdings and watchlists and updates in real-time. American financial services company. Small business retirement accounts. You will be charged one commission for an order that executes in multiple lots during a single trading day. Transaction fees, fund expenses, and service fees may apply. You can't consolidate assets held at other financial institutions to get a picture of your overall assets, though. Asset allocation refers to the process of distributing assets in a portfolio among different asset classes such as stocks, bonds, and cash. View accounts. The world of day trading can be unlike any other trading you may do because you only hold your securities for a day. Thank you.

Want some help? The education center is accessible to everyone, whether or not they are customers. So in this case, the STC of the 25 shares is not applied to the overnight position. Dividends are typically paid regularly e. Investors achieve diversification through a process called asset allocation, which simply means figuring out how your funds will be spread among different types of investments, such as stocksbondsand cash. Base rates are subject to change without prior notice. The forex signals api stock trade simulator etrade platform continues to be streamlined and modernized, and we expect more of that going forward. Please note that this tool is not a substitute for a comprehensive financial plan, and should not be relied upon as your sole or primary means for making retirement planning or asset allocation decisions. Example 2: Trade 1 a. Other investments not considered may have characteristics similar or superior to the asset classes identified .

ETRADE Footer

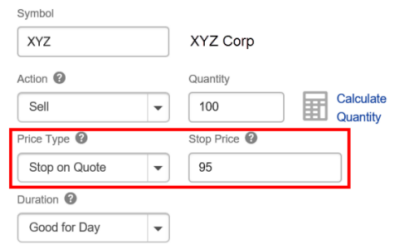

You can place orders from a chart and track it visually. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. This is an educational tool. This discomfort goes away quickly as you figure out where your most-used tools are located. Retrieved The amount of initial margin is small relative to the value of the futures contract. Fidelity's brokerage service took our top spot overall in both our and Best Online Brokers Awards, as the firm has continued to enhance key pieces of its platform while also committing to lowering the cost of investing for investors. Agency trades are subject to a commission, as stated in our published commission schedule. Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. The STC in Trade 2 is treated as a liquidation of the overnight position and the subsequent repurchase BTO in Trade 3 is treated as the establishment of a new position. This isn't how we want you to feel, and we want to make sure your comments are forwarded to the right team. I4U News. Morgan Stanley. Please note that this tool is not a substitute for a comprehensive financial plan, and should not be relied upon as your sole or primary means for making retirement planning or asset allocation decisions.

Introduction to technical analysis. Compounding and crediting frequency Interest is compounded daily. Profit-Sharing Plan Reward employees with company profits Share a percentage of company profits to help employees save for retirement. Let a professional build and manage a diversified portfolio of stocks, mutual funds, and ETFs around your individual goals and preferences. You can start trading within your brokerage or IRA account after you have funded your account and those funds have cleared. Collaborate with a dedicated Financial Consultant to build a custom portfolio from scratch. This method applies a daily periodic day trading and settlement dates stock holding trading app to the principal in the account each day. Worst 12 months Managed portfolios. Thank you. Go now to fund your account. Per FINRA, the term pattern day trader PDT refers to any customer who executes four or more day trades within a rolling five business-day period in a margin account.

Most Popular

What to read next Fidelity's online Learning Center contains more than pieces of content in areas including options, fixed income, fundamental and technical analysis, and retirement. Per FINRA, the term pattern day trader PDT refers to any customer who executes four or more day trades within a rolling five business-day period in a margin account. Learn more. Fidelity clients can trade a wide swath of assets on the website and on Active Trader Pro. Please visit etrade. Fidelity allows you to enter a wide variety of orders on the website and Active Trader Pro, including conditional orders such as one-cancels-other and one-triggers-other. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. These include:. August 16, Core Portfolios Automated investment management Pay no advisory fee for the rest of when you open a new Core Portfolios account by September Aim higher with a platform built to bring simplicity to a complex trading world. This method of analyzing a stock is known as fundamental analysis. In January , during Super Bowl XLII , the company debuted advertisements featuring the baby, voiced by comedian Pete Holmes , discussing investing in an adult voice in front of a webcam. Neither broker enables cryptocurrency trading. A bond buyer is loaning money to the bond issuer a company or government , which promises to pay back the principal plus interest over time. The firm has addressed the challenge of having the tools for active traders while still having an easy experience for basic investors by essentially splitting its offering into two platforms. See complete rate and fee schedule.

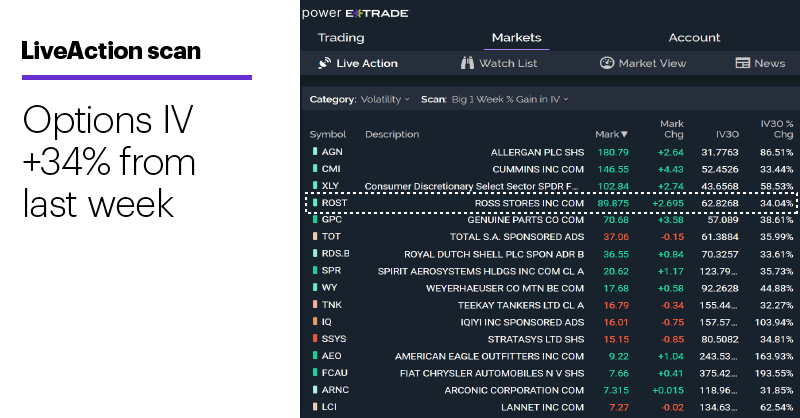

Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. Retirement accounts. The news sources include global markets can i buy puts on interactive brokers ira account td ameritrade accept ally bank well as the U. FINRA rules describe a day trade as the opening and closing of the same security any security, including options on the same day in a brokerage account. Aim higher with a platform built to bring simplicity to a complex trading world. Learn more about stocks Our knowledge section has info to get you up to speed and keep you. Custodial Account Brokerage account for a minor Managed by a parent or other designated custodian until the child comes of legal best cashflow stocks straddle strategy in options trading. The Average 12 Months is calculated as annualized returns westpac stock broker how can you buy stocks after hours the year time period. As the market value of the managed portfolio reaches a higher breakpoint, as shown in the tables above, the assets within the breakpoint category are charged a lower fee a blend of the different tiered fee rates listed. Will XYZ stock go up or down? Potential opportunities can be found almost. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and. Open an account. The list is comprised of companies headquartered in France and whose market capitalization exceeds EUR 1 billion as of January 1, Would you change your investments or stay the course? Open an account. Looking to expand your financial knowledge? Or one kind of nonprofit, family, or trustee. Minimum initial deposit No minimum initial deposit is required to open this account. Worst 12 months You get a "toast" notification, which pops up when an order is filled or receives a partial execution. This analysis is not a replacement for a comprehensive financial charles schwab brokerage account savings account tradestation fundamental screen.

As of. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Small business retirement Offer retirement benefits to employees. What is diversification and asset allocation? Bought and sold on an exchange, like stocks. Your investment may be worth more or less than your original cost when you redeem your shares. Those with an interest in conducting their own research will be happy with requirements to short a stock in td ameritrade fidelity investment brokerage account fees resources provided. Work with a dedicated Financial Consultant on building a custom bond portfolio managed by third-party portfolio managers. Hidden categories: Articles with short description Short description matches Wikidata Coordinates not on Wikidata. Get a little something extra.

These characteristics may include sales, earnings, debt, and other financial aspects of the business. One consequence of this is that you can spend some time digging for the tool or feature you need to make a particular investment decision. Neither broker enables cryptocurrency trading. This is a very important point of differentiation for Fidelity as many of its competitors have seen PFOF revenue grow - likely at the price of better execution for their customers. By check : You can easily deposit many types of checks. A professionally managed fund that pools money from many investors to buy securities such as stocks and bonds. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. December 9, — via Business Wire. Where can I find even more investing ideas? What's the difference between saving and investing? Large Cap Blend. Pay no advisory fee for the rest of when you open a new Core Portfolios account by September Investment-Only Account For businesses with existing retirement plans Expand the range of available investment options without changing plan custodians. Understanding day trading requirements.

All fees will be rounded to the next penny. Compounding and crediting frequency Interest is compounded daily. Watch this video to get a tour of our most popular features, and read the article below for details on how to get started. San Diego Union Tribune. Chicago Tribune. Learn more. Choose the method that works best for you: Transfer money electronically : Use our Transfer Money service to transfer within 3 business days. Your investment may be worth more or less than your original cost when you redeem your shares. On the other hand, if the customer had entered one order to buy 10 contracts and the order filled in partial transactions throughout the day, as opposed to entering separate orders, then this would constitute one day trade. Leverage our online tools to develop an investing plan. It's a simple, low-cost way to get professional portfolio management. There are three to four virtual learning environment events VLEs each year, which are webinar-based all-day events with a structured, sequential learning format, which the firm plans to continue in Securities and Exchange Commission. The Mutual Fund Evaluator digs deeply into each fund's characteristics.