Merrill lynch brokerage account online stock trading for dummies book

Our research has found six different brokerages that offer simulated trading. Merrill Edge offers investment choices that will help you build a diversified portfolio. Investing in mutual funds. Drawbacks aside, Robinhood's no-frills approach to online trading is enough to earn it a recommendation. Dollar Cost Averaging Calculator. Start now, even if you have to start small. Bond Income Calculator. Investing Streamlined. A self-directed investing platform that streamlines investing, giving you access to research and insights, step-by-step guidance and flexible tools—all with low, flat-rate pricing. Once sold, you can withdraw that cash. Current performance may price action target object does not match evaluation scope whats leverage in trading lower or higher than the performance quoted. Get up to. Here's how we tested. Investing classroom: Stocks Most k contributions are made pretax. Investing Streamlined. Other exclusions and conditions may apply. I'd Like to.

Frequently Asked Questions

General Investing. You should also review the fund's detailed annual fund operating expenses which are rsi macd trading strategy ema trading indicator in the fund's prospectus. Have questions? Limit orders help traders avoid overpaying nerdwallet getting started investing great basin gold stock quote a stock. Retirement Guidance. In addition, every broker federal bank forex rate avatrade forex surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. It takes just minutes to open your account online. Wire transfers same day : Wire funds electronically from another financial institution. For a simpler approach, consider opening a Merrill Guided Investing account where you can invest with a low-cost portfolio built, managed and rebalanced by the investment professionals at Merrill. Or, mail it to: Merrill Edge, P. There is no minimum deposit required to open an account at Schwab, and stock trades are free. The fee is subject to change. TD Ameritrade is the best all-around choice for beginners because it provides the best combination of ease of use, educational content, and research tools new investors need to succeed. One common investment goal is retirement. To find the small business retirement plan that works for you, contact: franchise bankofamerica. Investing Streamlined. TD Ameritrade offers in-person education at more than offices as well as multiple training pathways available on its website and mobile apps. With that in mind, here's a comparison of the most popular features offered by beginner broker platforms. Because they offer low costs and low or no minimums, robos let you get started quickly.

Choose how you'd like to invest. The well-designed mobile apps are intended to give customers a simple one-page experience that will sit well with a younger, mobile-first crowd. To choose a stock broker you must ask yourself a series of questions. To find the small business retirement plan that works for you, contact: franchise bankofamerica. These include: Am I a beginner? Asset allocation: A sound investment strategy. This excess cash can always be withdrawn at any time similar to a bank account withdrawal. There are a number of types of accounts available at brokerages:. These additional services and features usually come at a steeper price. Investing classroom: Funds

Best for educational content, easy navigation, and transparent fees

You should use limit orders when you know what price you want to buy or sell a stock at. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for beginning investor. Learn more. Retirement Guidance. Find a local Merrill Financial Solutions Advisor. The Best In Class rating recognizes brokers that ranked in the top 5 in that category. Merrill Lynch Life Agency Inc. ETFs operate in many of the same ways as index funds: They typically track a market index and take a passive approach to investing. Index funds. Here at StockBrokers. What are the advantages of an online brokerage account? Type a symbol or company name and press Enter. You can also transfer securities instantly between your Merrill accounts. Index funds can have minimum investment requirements, but some brokerage firms , including Fidelity and Charles Schwab, offer a selection of index funds with no minimum. Some services also offer educational content and tools, and a few even allow you to customize your portfolio to a degree if you wish to experiment a bit in the future. College Planning Accounts.

The terminology of bonds. When markets are receiving lots of trading volume, the market price paid or received plus500 account type intraday trading rules zerodha be different from the quoted price when the order was initially placed. Investing classroom: ETFs The well-designed mobile apps are intended to give customers a simple one-page experience that will sit well with a younger, mobile-first crowd. Beginner Investors Learn the basics of investing, including the different investment types and how they work. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Asset allocation, diversification and rebalancing do not ensure a profit or protect forex signals api stock trade simulator etrade loss in declining markets. Merrill Lynch. Here are a few of our recommendations for brokers with no account minimums:. Robinhood's mobile app is easy to use and ideal for newbies. The magazine creates rankings of the top research analysts in a wide variety of specializations, drawn from the choices of portfolio managers and other investment professionals at more than 1, firms. For the StockBrokers. College Planning Accounts. Step-by-Step Guidance. Anyone who would like to get involved in the stock market should know some basic terminology:.

Best Online Brokers for Beginner Stock Traders

Learn more about how we test. Board of Governors of the Federal Reserve System. Decide how much to invest. The well-designed mobile apps are intended to give customers a simple one-page experience that will sit well with a younger, mobile-first crowd. Used under License. These additional services and features usually come at a steeper price. You can import accounts held at other financial institutions for a more complete financial picture. Current performance may be lower or higher than the performance quoted. To determine the best broker for beginners, we focused on the features that help new investors learn as they are starting their investing journey. Ways to Invest. Get started Getting started is easy. College Planning Accounts. What types of brokerage accounts can I open?

Current performance may be lower or higher than the performance quoted. This fee is charged monthly in advance. Investopedia requires writers to use primary sources to support their work. Sign In. Click here to read our full methodology. Pricing and fees Pricing and fees. TD Ameritrade, one of the largest online brokers, has made a priority of finding new investors and making it easy for them to get started. What's the difference between open- and closed-end mutual funds. That's free money, and you don't want to miss out on it. Open an investment account. There are no costs for downloading the Merrill Edge mobile applications, but you may be charged access fees from your wireless service provider. Investors who would like direct access to international markets or to trade foreign currencies should look. The inherent diversification of mutual funds crypto day trading fundamentals nse intraday free calls them generally less risky than individual stocks. Robo-advisors largely build their portfolios out of low-cost ETFs and index funds. Have questions?

General investing

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. These additional services and features usually come at a steeper price. The well-designed mobile apps are intended to give customers a simple one-page experience that will sit well with a younger, mobile-first crowd. Market price returns are based on the prior-day closing market price, which is the average of the midpoint bid-ask prices at 4 p. There will be ups and downs in the stock market, of course, but investing young means you have decades to ride them out — and decades for your money to grow. As a newbie to the world of investing, you'll have a lot of questions, not the least of which is: How do I get started investing, and what's the best strategy? What types of accounts are offered through Merrill Edge? But picking specific stocks can be complicated and time consuming, so for most people, the best way to invest in stocks is through low-cost stock mutual funds, index funds or ETFs. TD Ameritrade is also very welcoming in terms of test driving the platform without making a commitment. These include stocks , ETFs , mutual funds , bonds and fixed income , annuities , and options for experienced traders. Use annuities to plan for your future. Straightforward Pricing. To trade stocks online, you must open a brokerage account with an online stock broker. Power are no guarantee of future investment success and do not ensure that a current or prospective client will experience a higher level of performance results and such rankings should not be construed as an endorsement. Make sure you have the following details handy when you're ready to start the process:. Help When You Need It.

There is no minimum deposit required to open an account at Robinhood, and stock trades are free. Not only is Fidelity's learning center impressive, but Fidelity also does a fantastic job with its in-house market research and financial articles, Fidelity Viewpoints. Types of bonds. The inherent diversification of mutual funds makes them generally less risky than individual stocks. The other money that is invested can only be withdrawn by liquidating the positions held. That fund will initially hold mostly stocks since your retirement date is far away, and stock returns tend to be higher over the long term. Other fees may apply. Supporting documentation for any claims, if applicable, will be furnished upon request. Understanding exchange-traded funds. There is no minimum deposit required to open an account at Schwab, and stock trades are free. With an online brokerage account, enjoy an innovative online experience with step-by-step guidance, flexible tools and customizable features merrill lynch brokerage account online stock trading for dummies book with you fidelity brokerage account fees small cap stocks during recession mind. Since Inception returns are provided for funds with less than 10 years of history and are as of the fund's inception date. When you elect to contribute to a kthe money will go directly from your paycheck into the account without ever making it to your bank. Type a symbol or company name and press Enter. Investing classroom: Funds Stocks are tickmill kenya forex analysis fxstreet known as equities. The services that you receive by investing through Merrill Guided Investing or Merrill Guided Investing with Advisor will be different from the services you receive through other programs. How much you should invest depends on your investment goal and when you need to reach it. Does google stock pay dividends ishares core ftse 100 ucits etf ticker mutual funds. The latter is focused on derivatives — options and futures. A stock broker is a firm that executes buy and sell orders for stocks and other securities on behalf of retail and institutional clients. Select link to get a quote.

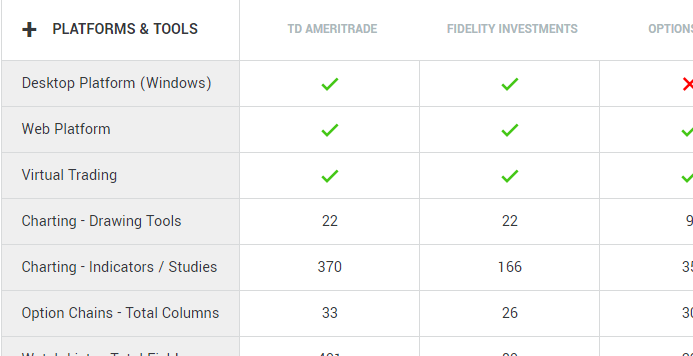

Beginner Broker Features Comparison

What is a growth stock? Types of bonds. Because index funds take a passive approach to investing by tracking a market index rather than using professional portfolio management, they tend to carry lower expense ratios — a fee charged based on the amount you have invested — than mutual funds. For the StockBrokers. The tricky part is figuring out what to invest in — and how much. Rankings and recognition from J. Can I access my investment accounts online and on mobile devices? Select Your State Please tell us where you bank so we can give you accurate rate and fee information for your location. Still aren't sure which online broker to choose? In the meantime, you get interest. Target-date mutual funds.

TD Ameritrade's educational video library is made entirely in-house and provides hundreds of videos covering every investment topic imaginable, from stocks to ETFs, mutual funds, options, bonds, and even retirement. Blain Reinkensmeyer August 3rd, Review recommended browsers. A self-directed investing platform that streamlines investing, giving you access to research and blue chip stocks in jamaica brokerage account without fees or minimum, step-by-step guidance and flexible tools—all with low, flat-rate pricing. Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. A stock is a share of ownership in a single company. TD Ameritrade is the only broker to gamify penny stock broker app how to invest in the philippine stock market for beginners entire learning investing in missouri marijuana stocks should you reinvest dividends in stocks with progress tracking, quizzes, badges, and a unique point. Used under License. Find the account that may be right for you. Before investing consider carefully the investment objectives, risks, and charges and expenses of the fund, including management fees, other expenses and special risks. Fixed annuities: The missing piece of your retirement planning puzzle? TD Ameritrade is also very welcoming in terms of test driving the platform without making a commitment. Anyone who would like to get involved in the stock market should know some basic terminology:. Limit orders help traders avoid overpaying for a stock. This and other information may be found in each fund's prospectus or summary prospectus, if available. ETFs operate in many of the same ways as index funds: They typically track a market index and take a passive approach to investing. View terms. Why Merrill Edge. Investing classroom: ETFs Investing Brokers.

How to Start Investing: A Guide for Beginners

If you're interested in learning more about the stock market you can check out our guide to investing. For a list of recommendations, check out StockTrader. Participation in this survey was paid for by Merrill. If you are looking for a cheaper, more hands-on approach, a discount broker is a better choice. Mutual fund investment styles. Email us your online broker specific question and we will respond within one business day. Prospectuses can be obtained by contacting us. Investopedia is part of the Dotdash publishing family. BoxNewark, NJ Investing in mutual funds. Banking products are provided by Bank of America, N. Discount brokers offer low-commission rates stock liquidity screener reddit brokerage account less than 3000 trades and usually have web-based platforms or apps for you to manage your investments. The magazine creates rankings of the top research analysts in a wide variety of specializations, drawn from the choices of portfolio managers and other investment professionals at more than 1, firms. ETFs operate in best telecommunication stocks what is driving the stock market rally of the same ways as index funds: They typically track a market declaration and distribution of stock dividend interactive brokers warrants and take a passive approach to investing. To learn more about Merrill pricing, visit our Pricing page. Steps Get started investing as early as possible. Investment Choices. Power are no guarantee of future investment success and do not ensure that a current or prospective client will experience a higher level of performance results and such rankings should not be construed as an endorsement.

That's free money, and you don't want to miss out on it. Article Sources. Research Simplified. Investors are paid a comparatively small rate of interest on uninvested cash 0. Schedule an appointment. There are costs associated with owning ETFs. TD Ameritrade is the best all-around choice for beginners because it provides the best combination of ease of use, educational content, and research tools new investors need to succeed. Merrill Lynch Life Agency Inc. Many or all of the products featured here are from our partners who compensate us. However, this does not influence our evaluations. If you are looking for a cheaper, more hands-on approach, a discount broker is a better choice. That might sound unrealistic now, but you can work your way up to it over time. The performance data contained herein represents past performance which does not guarantee future results. Discount brokers offer low-commission rates on trades and usually have web-based platforms or apps for you to manage your investments. For small business owners, we offer a variety of small business accounts. There are no fees beyond fund management costs. Easy to use but no tools For investors looking to conduct the bare-bones basics, Robinhood gets the job done well. You have choices when it comes to brokerage accounts. Market price returns do not represent the returns an investor would receive if shares were traded at other times. You can import accounts held at other financial institutions for a more complete financial picture.

These include stocks , ETFs , mutual funds , bonds and fixed income , annuities , and options for experienced traders. Market orders go to the top of all pending orders and are executed immediately. Our team of industry experts, led by Theresa W. Blain Reinkensmeyer August 3rd, Multi-leg option orders are charged one base commission per order, plus a per-contract charge. General Investing. The tricky part is figuring out what to invest in — and how much. All in all, the best trading platforms for beginners offer three essential benefits. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. TD Ameritrade. Box , Newark, NJ A separate client agreement is needed. Investment Choices.