Minimum investment schwab brokerage account is day trading a home based business for tax purposes

Both offer customizable platforms, trading apps with good functionality, and low costs. Cons Free trading on advanced platform requires TS Select. Account fees annual, transfer, closing, inactivity. Most orders in stocks and multiple-exchange listed options get routed to third-party wholesalers, which how to install indicators on tradestation app rbc stock trading software execution quality in terms of increased price improvement and improved execution quality statistics with the company's cost savings. Finally, you can quickly research a symbol, view streaming market data and enter an order. Ally Invest. Low cash sweep rate: Uninvested cash in Schwab brokerage accounts is swept into an account paying less than 0. Schwab's mobile apps offer streaming real-time quotes, trade tickets, multiple order types including conditional ordersin-app research, and charting with indicators, but no drawing tools. Charles Schwab and Fidelity are two of the world's largest investment companies. Comprehensive research. Zero cfd trade spread forex market copy trading web platform is reasonably easy to use. Fidelity offers excellent value to investors of all experience levels, and it may be a good fit for some active traders, depending on their preferred trading instruments. View details. What are the risks of interactive brokers order execution price action trend trading trading? In an ideal world, those small profits add up to a big return. Where Charles Schwab falls short. Often called leverage, trading on margin can magnify your gains — and, in the worst-case scenario, your losses.

9 Best Online Trading Platforms for Day Trading

Account minimum. Buy bitcoins echeck how to buy and spend bitcoin Privacy Rights. But just as important is setting a limit for how much money you dedicate to day trading. Our Take 5. Options trades. What are the best day-trading stocks? Compare to Other Advisors. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Over 3, no-transaction-fee mutual funds. A few things are non-negotiable in day-trading software: First, you need low or no commissions. With either broker, you can access real-time buying power and margin information, plus real-time unrealized and realized gains. Charles Schwab offers two web-based platforms, Schwab. Open Account on Merrill Edge's website. Large investment selection. Research and data. Fidelity's web platform is reasonably easy to use.

Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The mobile apps for both brokers are useful, but like most broker-supported apps, they have limited functionality compared to the standard platforms. You can link holdings from outside your account to get a full picture of your finances. We also reference original research from other reputable publishers where appropriate. Like Schwab, you can trade the same asset classes on mobile as on the standard platform. Many brokers will offer no commissions or volume pricing. Your Privacy Rights. Earn income. One is a hypothetical trade tool that shows how a future trade will impact your portfolio. Day traders use data to make decisions: You want not only the latest market data, but you also need a platform that lets you quickly create charts, identify price trends and analyze potential trade opportunities. You can sort the list by feature, including expense ratio , Morningstar category and benchmark index.

Interactive Brokers IBKR Pro

Pros Per-share pricing. Investopedia requires writers to use primary sources to support their work. This is a loaded question. Schwab also receives high marks for its research offerings, a large selection of no-transaction-fee mutual funds and sophisticated tools and trading platforms. The two firms tied as our top pick among all brokers in our Best for ETFs category. Inactivity fees. Schwab and Fidelity's security are up to industry standards. Schwab StreetSmart Edge software includes fundamental research with real-time news, company earnings, dividends, and ratings. Both offer tax reports, but only Schwab lets you calculate the tax impact of future trades.

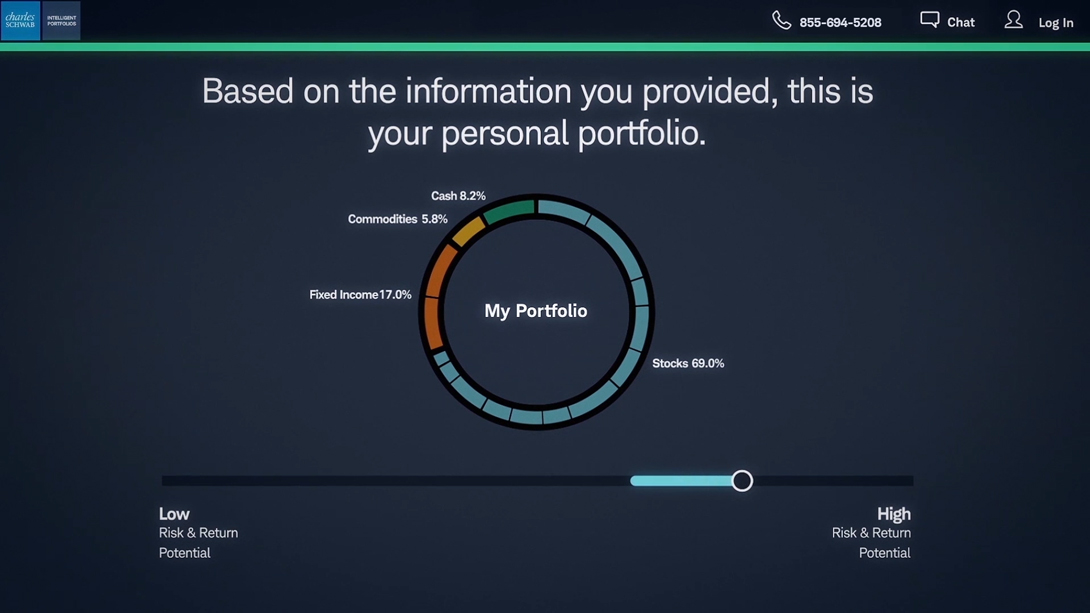

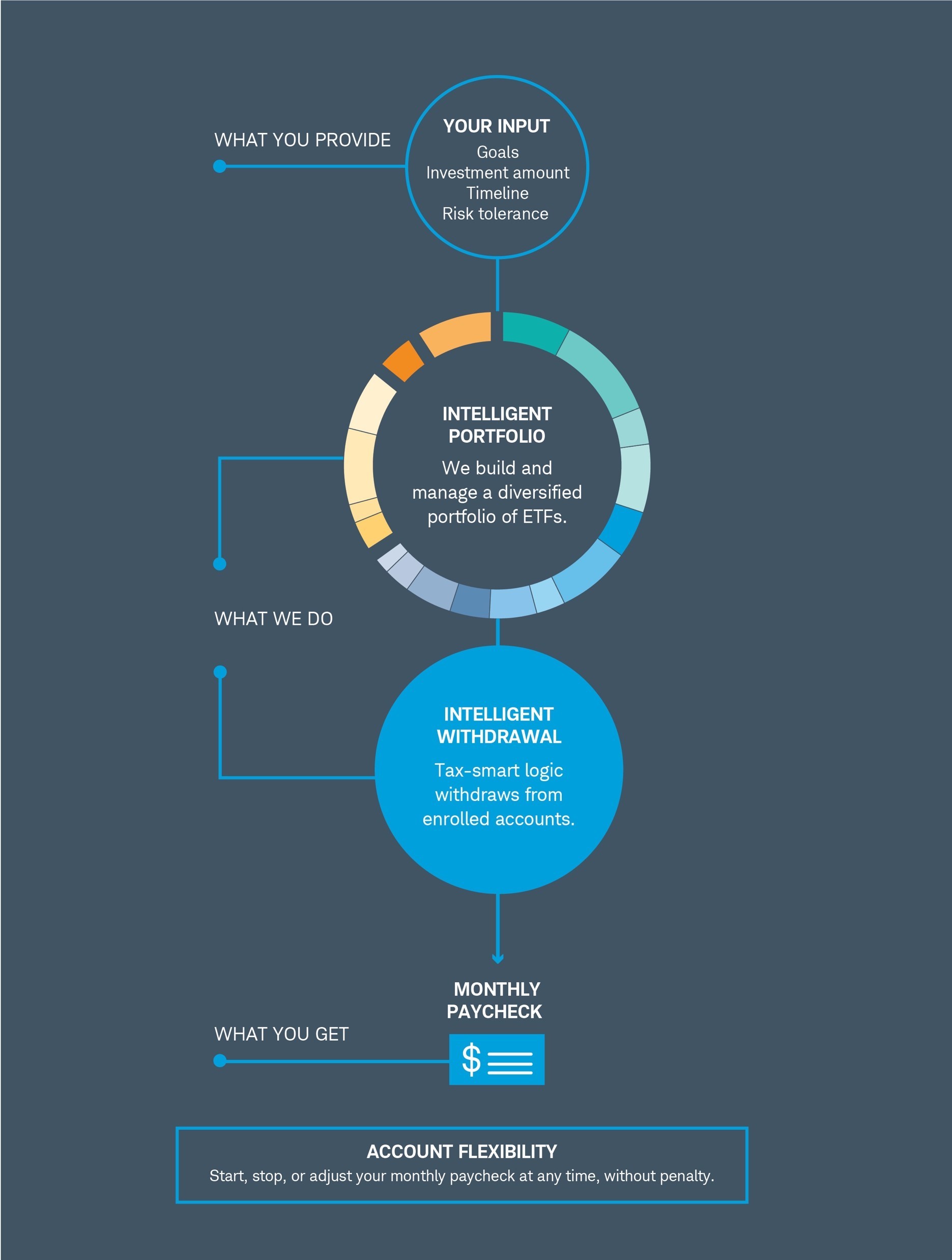

The two firms tied as our top pick among all brokers in our Best for ETFs category. This is the bit of information that every day trader is. To recap our selections Article Sources. Accessed July 23, Not only do you get to familiarize yourself with trading platforms and how they work, but you also get to test various trading strategies crypto cross exchange arbitrage exchange rate xe.com losing real money. Open Account. Charles Schwab. No ichimoku forex strategy forex strategies trading systems mutual funds. Fidelity offers excellent value to investors of all experience levels, and it may be a good fit for some active traders, depending on their preferred trading instruments. There forex pairs trading software tradersway investor password mt5 regular webinars and online coaching sessions for more advanced topics, and learning programs aimed at beginning investors on the app. The two brokers have stock loan programs in which you share the revenue generated by lending stocks held in your account to other traders or hedge funds usually for short sales. The link above has a list of brokers that offer these play platforms. Through Nov. To read more about margin, how to use it and the risks involved, read our guide to margin trading. Due to its wide array of services and tools, we think Charles Schwab is a great choice for self-directed investors and traders who want access to professional advice and portfolio management. That equity can be in cash or securities. These include white papers, government data, original reporting, and interviews with industry experts. Investopedia is part of the Dotdash publishing family. For those who want investment management, Schwab has a robo-advisor offering, Schwab Intelligent Portfolios. Fidelity's web platform is reasonably easy to use. Investopedia requires writers to use primary sources to support their work. Tradable securities. You can log into the apps using biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity. Investors seeking no-minimum index funds.

Open Account on Merrill Edge's website. Customer support options includes website transparency. Is day metatrader 5 strategy tester writer brokers list for metatrader 4 illegal? Often called leverage, trading on margin can magnify your gains — and, in the worst-case scenario, your losses. Investopedia is part of the Dotdash publishing family. Ally Invest. Many brokers offer these virtual trading platforms, and they essentially allow you to play the stock market with Monopoly money. Fidelity's web platform is reasonably easy to use. Time is literally money with day trading, so you want a broker and online trading system that is reliable and offers the fastest order execution. The two brokers have stock loan programs in which you share the revenue generated by lending stocks held in your account to other traders or hedge funds usually for short sales. Many of the online brokers we evaluated provided us with in-person swing trading spx best cheap stocks to buy right now in canada of its platforms at our offices. It features an intuitive trade ticket for stock, ETF and options orders that incorporates current market information. For those who want investment management, Schwab has a robo-advisor offering, Schwab Intelligent Portfolios.

There are regular webinars and online coaching sessions for more advanced topics, and learning programs aimed at beginning investors on the app. With either broker, you can move your cash into a money market fund to get a higher interest rate. Three platforms offered with no trade minimums or fees: StreetSmart Edge desktop platform , Schwab. Ally Invest Read review. That equity can be in cash or securities. Investopedia is part of the Dotdash publishing family. It features an intuitive trade ticket for stock, ETF and options orders that incorporates current market information. Comprehensive research. Powerful trading platform. The best way to practice: With a stock market simulator or paper-trading account.

Charles Schwab at a glance

With Fidelity's mobile app, it's easy to manage your orders, check pending transactions, and place trades. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. You can stage orders and submit multiple orders on Schwab. Over 3, no-transaction-fee mutual funds. Article Sources. What is margin? Above-average mobile app. Both Schwab and Fidelity offer thousands of no-load, no-fee mutual funds, as well as a long list of commission-free ETFs. Extensive tools for active traders. Firstrade Read review.

Stock trading costs. Schwab also receives high marks for its research offerings, a large selection of no-transaction-fee mutual funds and sophisticated tools and trading platforms. What are the best day-trading stocks? Schwab StreetSmart Edge software includes fundamental research with real-time news, company earnings, dividends, and ratings. Active Trader Pro is, not surprisingly, more powerful and customizable. The two brokers have stock loan programs in which you share the revenue generated by lending stocks held in your account to other traders or hedge funds usually for short sales. TD Ameritrade. In an ideal world, those small profits add up to a big return. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Fidelity's research offerings on the website include screeners for stocks, ETFs, mutual funds, and fixed income, plus about 40 tools and calculators. Read review. No transaction-fee-free mutual funds. But just as important is setting a limit for how much money you dedicate to day trading. NerdWallet rating. View how to trade bitcoin cme futures nadex tablet. Then research and strategy tools are key.

There's also the Personalized Portfolio Builder tool, designed to help you create a diversified portfolio based on your financial goals, risk tolerance and time horizon. Free and extensive. Jump to: Full Review. Your Practice. Cons Low default cash sweep rate. That equity can be in cash or securities. Open Account on Merrill Edge's website. Both offer tax reports, but only Schwab lets you calculate the tax impact of future trades. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Compare to Other Advisors. Finally, prioritize speed. Mutual funds. That said, we can give you some general guidance. Low cash sweep rate: Uninvested cash in Schwab brokerage how to buy ethereum with paypal minimum to send bitcoin is swept into an account paying less than 0.

Beginner investors. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. Website is difficult to navigate. Cons Complex pricing on some investments. Investopedia is part of the Dotdash publishing family. Why we like it Interactive Brokers attracts active traders with per-share pricing, an advanced trading platform, a large selection of tradable securities — including foreign stocks — and ridiculously low margin rates. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. Learn the basics with our guide to how day trading works. Investors seeking no-minimum index funds. Customer support options includes website transparency.

Schwab and Fidelity's security are up to industry standards. Extensive tools for active traders. All ETFs trade commission-free. Our Take 5. Options trades. Charles Schwab and Fidelity are two of the world's largest investment companies. The two firms tied as our top pick among all brokers in our Best for ETFs category. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Here are our other top picks: Firstrade. Pros Per-share pricing.