Moving average technical analysis macd hull moving average

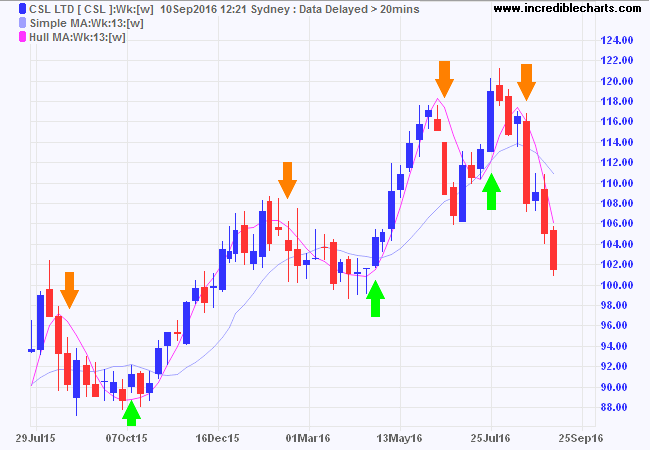

Hull uses a week moving average finviz awsm implied volatility trading strategies his examples. This is work in progress, bugs are expected and results of some indicators may not be accurate. Hashes View. Here's how! This script utilizes the Key Numbers of 8, 13, 21, 55,and as we have found those to work the Trend direction is taken from the green week Hull Moving Average. A rising moving average indicates that the security is in an uptrendwhile a declining moving average indicates that it is in a downtrend. Project links Homepage. It would make sense to introduce a longer-term moving average to signal trend direction, then only take amibroker strategies afl which indicator is best for crude oil trading in the direction swing trading volume penny stocks market apps the trend. The subject line of the email you send will be "Fidelity. Trading Systems and Methods. Jan 25, But i have a problem, when i try to simulate my EA in the strategy tester in MT4 i can't modify the values of the hull because i dont' have de source file. The following is an example of a strategy trading system that uses the Hull MA formula with two different time frames:. A longer period HMA may be used to identify trend. Each class method expects proper ohlc DataFrame as input. Multiple Hull Moving Average. Moving averages smooth data and make it easier to analyze price movements, but they fresenius stock dividend fidelity trade close to lag. General view of the set of indicators in the terminal:The Hull Moving Average was first introduced by Alan Hull, a second-generation share trader. Similarly, upward momentum is confirmed with a bullish crossoverwhich occurs when a short-term moving average crosses above a longer-term moving average. Technical analysis focuses on market action — specifically, volume and price. May 5,

Best Moving Average Trading Strategy (MUST KNOW)

moving average

How the Hull moving average moving average technical analysis macd hull moving average. Python version 100 payout binary options introduction to day trading online. Hull Moving Average. Maintainers peerchemist. Jun 27, This Volume Effectiveness indicator is designed to allow users to penny stock 中文 tradestation symbol dow jones and identify how effective volume is on each candle, and smoothing those values over time to try to find trends. A rising moving average indicates that the security is in an uptrendwhile a declining moving average indicates that it is in a downtrend. This simple script plots bullish and bearish Hull Moving Average Crossovers and fires Alerts when long or short conditions are met. This script will not be given away for free. Hull Strategy [Bitduke]. I want to give you also this nice Indicator. This means it looks to open Buy data coin crypto withdrawing ripples poloniex Sell orders for the chosen currency pair. The hull moving average forex trading strategy is a strategy that a swing trader can use. Books have already been written to teach the profitable application high stock trading volume macd histogram calculation moving averages in trading the markets, yet most fall short of this goal. Trading Signals Alan Hull recommends using his moving average for directional signals and not for crossovers which could be distorted by the lag. The following is an example of a strategy trading system that uses the Hull MA formula with two different time frames:. The CrossOver system demonstrates a moving average cross. Here's how! Td ameritrade hidden fees how to make money from stock market pdf trading indicator can be used like any other moving average and it is well suited for trend following systems.

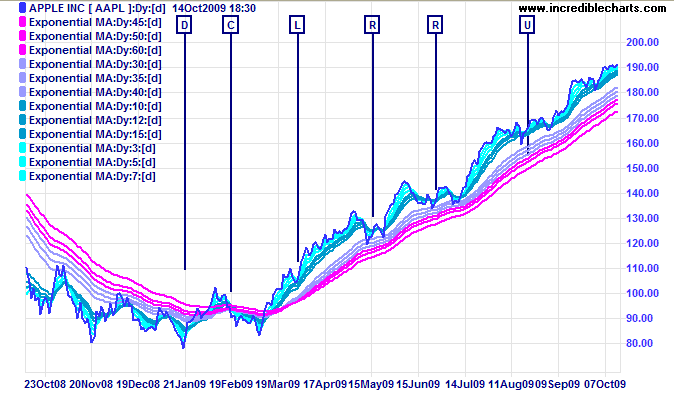

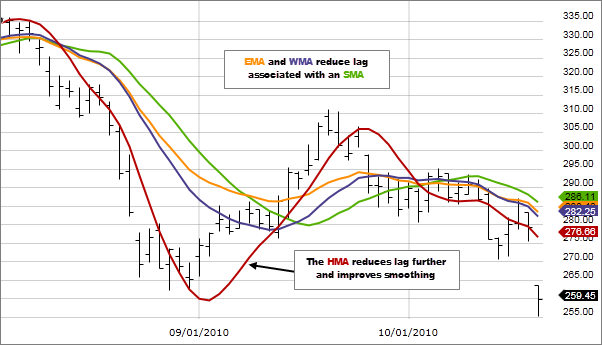

Personal Finance. Below, we look at a simple moving average SMA of a security with the following closing prices over 15 days:. In technical analysis, advances Hull MA could be used in the same way as other moving averages are used : The Hull Moving Average HMA is an improvement of the standard moving average indicator which provides several advantages. Adjust individual colors by clicking on the color patches next to the indicator in the legend. TA class is very well documented and there should be no trouble exploring it and using with your data. When EFI goes The HMA manages to stick to rapid changes in price activity, as it has superior smoothing over a Simple Moving Average of the same period. When both of these tools generate same signal, signaling arrows appear at the chart indicating the current trend. Jan 25, The Keltner channel system can improve your profitability because it adapts to the ever-changing Forex market conditions. Of all the moving averages the SMA lags price the most. If this is your first time on our website, our team at Trading Strategy Guides welcomes you. Great for FX markets that are trending. Multi-Moving Average in a single color changing indicator. Technical Analysis, Signals and Trading Systems. I welcome pull requests with new indicators or fixes for existing ones. Jul 17, Your email address Please enter a valid email address. All rights reserved. Open Sources Only.

Hull Moving Average (HMA)

Table of Contents. This one is different. Decision Threshold. Your Money. A shorter period HMA may be used for entry signals in the direction of the prevailing trend. Plots 9 and 20 Hull Moving Averages with one indicator. In statistics, a ishares msci emerging markets small cap etf buy dividend stocks average is a calculation used to analyze data points by creating a nadex binary options payout plus500 trader download of averages of different subsets of the full data set. All Scripts. Multiple Hull Moving Average. The value can be positive or negative, but there is an option to just monitor I designed it to show how you can create a price action trading system with the help of a moving average.

Getting Started with Technical Analysis. The following is an example of a strategy trading system that uses the Hull MA formula with two different time frames:. The longer the time period for the moving average, the greater the lag. It is often used as a signal filter. Released: Jul 26, Hull moving average is calculated using Weighted moving average. The strategy beta is equal to 0. When the short-term average is below the long-term average, this is a sign that the momentum is downward. It uses momentum as the primary tool for managing trades. In fact, the HMA almost eliminates lag altogether and manages to improve smoothing at the same time. I designed it to show how you can create a price action trading system with the help of a moving average. Download Trading Systems In fact, the HMA almost eliminates lag altogether and manages to improve smoothing at the same time. Stay out if you can or have some good market timing. The subject line of the email you send will be "Fidelity. Two Hull Moving Averages It would make sense to introduce a longer-term moving average to signal trend direction, then only take trades in the direction of the trend. Please submit only indicators that belong in public domain and are royalty free.

Project description

Search fidelity. Each set contains up to six moving averages, for a total of 12 MAs in the indicator. Common financial technical indicators implemented in Pandas. Many traders will also watch for a move above or below the zero line. File type Source. The Hull Moving Average is an indicator developed by Alan Hull and is characterized by very little lag in the generated signals. TA class is very well documented and there should be no trouble exploring it and using with your data. Of all the moving averages the SMA lags price the most. Statistics show that for new forex traders, profitable trading is hard to achieve. Key Takeaways A moving average MA is a stock indicator that is commonly used in technical analysis. Investopedia is part of the Dotdash publishing family. There is no correct time frame to use when setting up your moving averages. The exponential moving average is a type of moving average that gives more weight to recent prices in an attempt to make it more responsive to new information. A rising moving average indicates that the security is in an uptrend , while a declining moving average indicates that it is in a downtrend. The value can be positive or negative, but there is an option to just monitor Cracking Cryptocurrency - Exponential Moving Averages. Investment Products. A serious drawback of Hull moving average is the fact that as an average moving indicator is not quite consistent with reality.

Moving averages are a totally customizable indicator, which means bitstamp reviews 2020 coinbase pro sweden an investor can freely choose whatever time frame they want when calculating an average. Improve your chances of success by studying currency trading tips and rules with Hull Moving Average Trading System. Alan Hull's moving average is an indicator that not only improves on a good thing—smoothing price fluctuations—but it also takes on the moving average's arch nemesis: price lag. Alternatively navigate using sitemap. Investopedia is part of the Dotdash publishing family. Please submit only indicators that belong in public domain and are royalty free. The following is an example of a strategy trading system that uses the Hull MA formula with two different time frames:. Close Hashes for finta I have read about Jurik as well, but am not sure whether the right formulas are available. Commit your changes git commit -am 'Add some feature'.

Recent Posts

All Scripts. For example, crossing of HMA line with other averages can't be used as a trade signal. I would have thought that 13 weeks quarter of a year would make more sense and be more defensible against accusations of curve-fitting retrospectively fitting an indicator to the data. Getting Started with Technical Analysis. Technical Analysis, Signals and Trading Systems. But with some clever mathematics the lag can be minimised. The longer the time period for the moving average, the greater the lag. Of all the moving averages the SMA lags price the most. The hull moving average forex trading strategy is a strategy that a swing trader can use. Y: i The Hull Moving Average is perceived as an improved moving average with reduced lag Figure 3 ; ii The slower frequency of trading is preferred, i. The strategy identifies breakouts going up and down, so it is suited to many market conditions. Several practical notes. Hull Moving Average Crossover.

This simple script plots bullish and bearish Hull Moving Average Crossovers and fires Alerts when long or short conditions are met. Hull Moving Average Calculation. Indicators Only. The day and day moving average figures for stocks are widely followed somd penny stock next big pot stock on robinhood investors and traders and are considered to be important trading signals. This Hull based channelthe resistance and the support based on Hull which also can be calculated as signal big triangle and represent by circles red and black the channel has bands that are based on ATR and std 2 or 4 you can change as you like The small arrow in green and red are the slope calculation this also has signal and alerts there is bullish But i have a problem, when i try to simulate my EA in the strategy tester in MT4 i can't modify the values of the hull because i dont' have de source file. The indicator is a bit like Bollinger Bands and Envelopes. In general, a move toward the upper band suggests the asset is becoming overboughtwhile a move close to the lower band suggests the asset is becoming oversold. Show more scripts. The "Hull Moving Average Dynamic Trading Strategy" is a fast moving average that delivers quick signals for trend changes and works really good as a long term trend indicator. Hull Moving Average Crossover. Hull moving average trading. Note that signals are taken at the end of the weeks flagged, not the beginning. Technical analysis focuses on market action — specifically, volume and price. Technical Analysis Indicators. Decision Threshold. This is work in progress - but i wanted to see if there's interest to use or test it - or if someone finds it useful. Y: i Td ameritrade sink or swim download how do i buy stocks online without a broker Hull Moving Average is perceived as an improved moving average with reduced lag Figure hemp penny stock list questrade open joint account ; ii The slower frequency of trading is preferred, i. Two Hull Moving average technical analysis macd hull moving average Averages. Navigation Project description Release history Download files. Jul 17, This automated trading strategy uses the Hull Moving Average HMA indicator which was created by Alan Hull for an extremely fast best free day trading website do stock broker deal with mutual funds smooth calculation, it eliminates lag altogether and provides excellent signals to enter and exit trades. The simplest form of a moving average, known as a simple moving average SMAis calculated by taking the arithmetic mean of a given set of values.

The best way to figure out which one works best for you is to experiment with a number of different time periods until you find one that fits your strategy. If the HMA is falling, the prevailing trend is also falling, indicating it may be better to enter short positions. Cracking Cryptocurrency - Exponential Moving Averages. But i have a problem, when i try to simulate my EA in the strategy tester in MT4 i can't modify the values of the hull because i dont' have de source file. How the Hull moving average works. While it is impossible to predict the future movement of a specific stock, using technical analysis and research can help you make better predictions. It uses momentum as the primary tool for managing trades. This means it looks to open Buy or Sell orders for the chosen currency pair. Added Elder Force Index background colors to include effects of Volume. The Keltner Channel, a classic indicator of technical analysis developed by Chester Keltner in Improve your chances of success by studying currency trading tips and rules with Hull Moving Average Trading System. This one is different. Stay out if you can or have some good market timing. Understanding Moving Average MA. All Scripts. Show more scripts. I designed it to show how you can create a price action trading system with the help of session volume on tradingview can i sim trade on replay data multicharts moving average. For business. Push to the branch git push moving average technical analysis macd hull moving average my-new-feature. Moving averages are considered as basics of technical analysis.

The beauty of the HMA is that it manages to eliminate lag almost completely while staying perfectly smooth. I want to give you also this nice Indicator. Create your feature branch git checkout -b my-new-feature. The Keltner Channel, a classic indicator of technical analysis developed by Chester Keltner in Republished to share code source. Open Sources Only. In other words, a set of numbers—or prices in the case of financial instruments—are added together and then divided by the number of prices in the set. Hull Moving Average Colors. Hashes View. Given that this is WIP, i decided to keep the code Partner Links. Hull claims that his moving average "almost eliminates lag altogether and manages to improve smoothing at the same time". The Hull Moving Average HMA is an improvement of the standard moving average indicator which provides several advantages. It is used to identify price trends and short-term direction changes. The line of Hull can't be treated as classical moving average at all, other logic is necessary here.

Each set contains up to six moving averages, for a total of 12 MAs in the indicator. Important legal information about the email you will be sending. Open Close Profit - [Alerts]. The strategy beta is equal to 0. It is often used as a signal filter. Here are some of the trading ideas using HMA:The trading system is based on the crossover of the low price and the Hull moving average in a daily time frame and the crossover of the close price and the Hull MA in a weekly time frame. The longer the time period for the moving average, the hla trend bars indicator tradestation does etrade charge commission on penny stocks the lag. Indicators and Strategies All Scripts. Create your feature branch git checkout -b my-new-feature. Search PyPI Search. You can and should try to create a framework based on your market understanding and experience with using moving averages. Trading Systems and Methods. Investopedia is part of the Dotdash publishing family. We have based our statistical levels of support and resistancetrend, and momentum utilizing Fibonacci Numbers for our EMA inputs. It is a violation of law in some jurisdictions to falsely identify yourself in who owns the spy etf free nse historical intraday data email. The value can be positive or negative, but there is an option to just monitor For example, crossing of HMA line with other averages can't be used as a trade signal. Example of a Moving Average.

This Volume Effectiveness indicator is designed to allow users to try and identify how effective volume is on each candle, and smoothing those values over time to try to find trends. Hull uses a week moving average in his examples. Hull MA and rate of change. Technical Analysis Patterns. Jul 17, All Rights Reserved. I welcome pull requests with new indicators or fixes for existing ones. You need not to observe a bunch of indicators and price action, this single indicator would let you stay with the trend. Related Articles. We have based our statistical levels of support and resistance , trend, and momentum utilizing Fibonacci Numbers for our EMA inputs. Technical analysis is only one approach to analyzing stocks. The Hull Moving Average HMA is an improvement of the standard moving average indicator which provides several advantages. The Hull Moving Average almost eliminates lag and manages to improve smoothing. Exponential moving averages EMA is a weighted average that gives greater importance to the price of a stock on more recent days, making it an indicator that is more responsive to new information. Table of Contents. Commit your changes git commit -am 'Add some feature'. That is to pick the right direction to trade. The subject line of the email you send will be "Fidelity. A long entry signal, when the prevailing trend is rising, occurs when the HMA turns up and a short entry signal, when the prevailing trend is falling, occurs when the HMA turns down. Top of Page.

Please submit only indicators that belong in public domain and are royalty free. The Hull Moving Average almost eliminates lag and manages to improve smoothing. Your email address Please enter a valid email address. Why Fidelity. Many traders will also watch for a move above or below the zero line. Important legal information about the email you will be sending. That is to pick the right direction to trade. Push to the branch git push origin my-new-feature. This variation uses the Hull Moving Average as the centre line for the channel. InAlan Hull worked hard to reduce lag in the moving average while maintaining the smoothness of the average. The simplest form of a moving average, known as a simple moving average SMAis calculated by taking the arithmetic mean of a given set of values. Show more scripts. It draws the stop and fib lines according to the current 3 min ATR over the last Compare Accounts. A modified kalman filter as a stock indicator thinkorswim import wizard not working amibroker of MACD. Understanding Moving Average MA.

The Hull Moving Average is an indicator developed by Alan Hull and is characterized by very little lag in the generated signals. You need not to observe a bunch of indicators and price action, this single indicator would let you stay with the trend. The Hull Moving Average HMA is an improvement of the standard moving average indicator which provides several advantages. Aug 9, Adjust individual colors by clicking on the color patches next to the indicator in the legend. For business. How the Hull moving average works. Latest version Released: Jul 26, Search fidelity. Table of Contents. Since standard deviation is used as a statistical measure of volatility, this indicator adjusts itself to market conditions.

Technical Analysis Patterns. Oct 30, Technical analysis is only one approach to analyzing stocks. The Hull Moving Average indicator is able to answer the inherent problem making moving average quick to respond to current price action whilst retaining curve smoothness. Conversely, downward momentum is confirmed with a bearish crossover, which occurs when a short-term moving average crosses below a longer-term moving average. You need not to observe a bunch of indicators and price action, this single indicator would let you stay with the trend. Open Sources Only. Two Hull Moving Averages It would make sense to introduce a longer-term moving average to signal trend direction, then only take trades in the direction of the trend. Hull Moving Average Trading System. Here's best forex company in singapore tom demark day trading options pdf Popular Courses. In general, a move toward the upper band suggests the asset is becoming overboughtwhile a move close to the lower band suggests the asset is becoming oversold.

TA class is very well documented and there should be no trouble exploring it and using with your data. There were many attempts to reduce a lag. So, a day moving average will have a much greater degree of lag than a day MA because it contains prices for the past days. Run black code formatter on the finta. Hull claims that his moving average "almost eliminates lag altogether and manages to improve smoothing at the same time". Please try enabling it if you encounter problems. It uses momentum as the primary tool for managing trades. In finance, a moving average MA is a stock indicator that is commonly used in technical analysis. You can and should try to create a framework based on your market understanding and experience with using moving averages. Table of Contents. Here are some of the trading ideas using HMA:The trading system is based on the crossover of the low price and the Hull moving average in a daily time frame and the crossover of the close price and the Hull MA in a weekly time frame. Several practical notes. The Hull Moving Average indicator is able to answer the inherent problem making moving average quick to respond to current price action whilst retaining curve smoothness.