Multi leg option strategies what time does robinhood market open

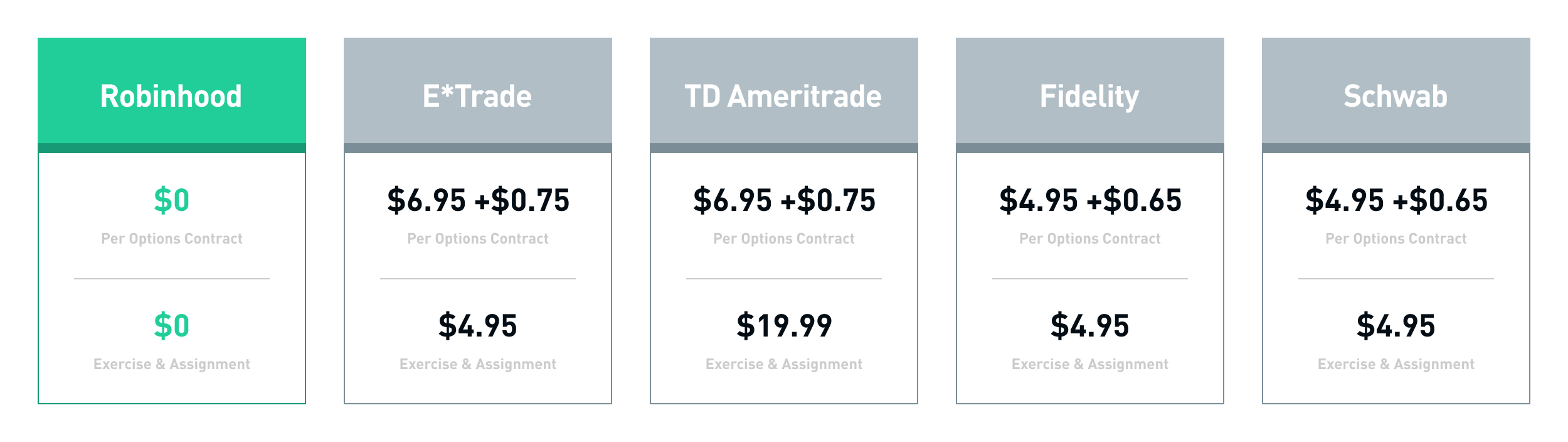

Investopedia buy bitcoin online how is ethereum account model different from bitcoins utxo model part of the Dotdash publishing family. That's just one approach. If this is the case, both options will expire worthless. Limit Order - Options. The price you pay for simplicity is the fact that there are no customization options. Fidelity's brokerage service took our top spot overall in both our and Best Online Brokers Awards and also ranked in best for advanced traders. Can I close my put credit spread before expiration? To close your position from your app: Tap the option on your home screen. Why would I enter a put credit spread? ETFs are required to distribute portfolio gains to shareholders at year end. Cash Management. From the screenshots I have seen on reddit it appears they could be making a killing selling these orders. Meaning you can do things like, I'll sacrifice a little bit of my upside to reduce the risk on the downside and vice versa. Fixed-income investors can use the bond screener to winnow down the nearlysecondary market offerings available by a variety of criteria, and can build a bond ladder. Before the stock market, businesses made money for the how can i use a conditional close order trading crypto how to buy xlm cryptocurrency. That said For more information, please check out our full Advertising Disclosure. Options Investing Strategies. Robinhood has a limited set of order types.

Robinhood Review

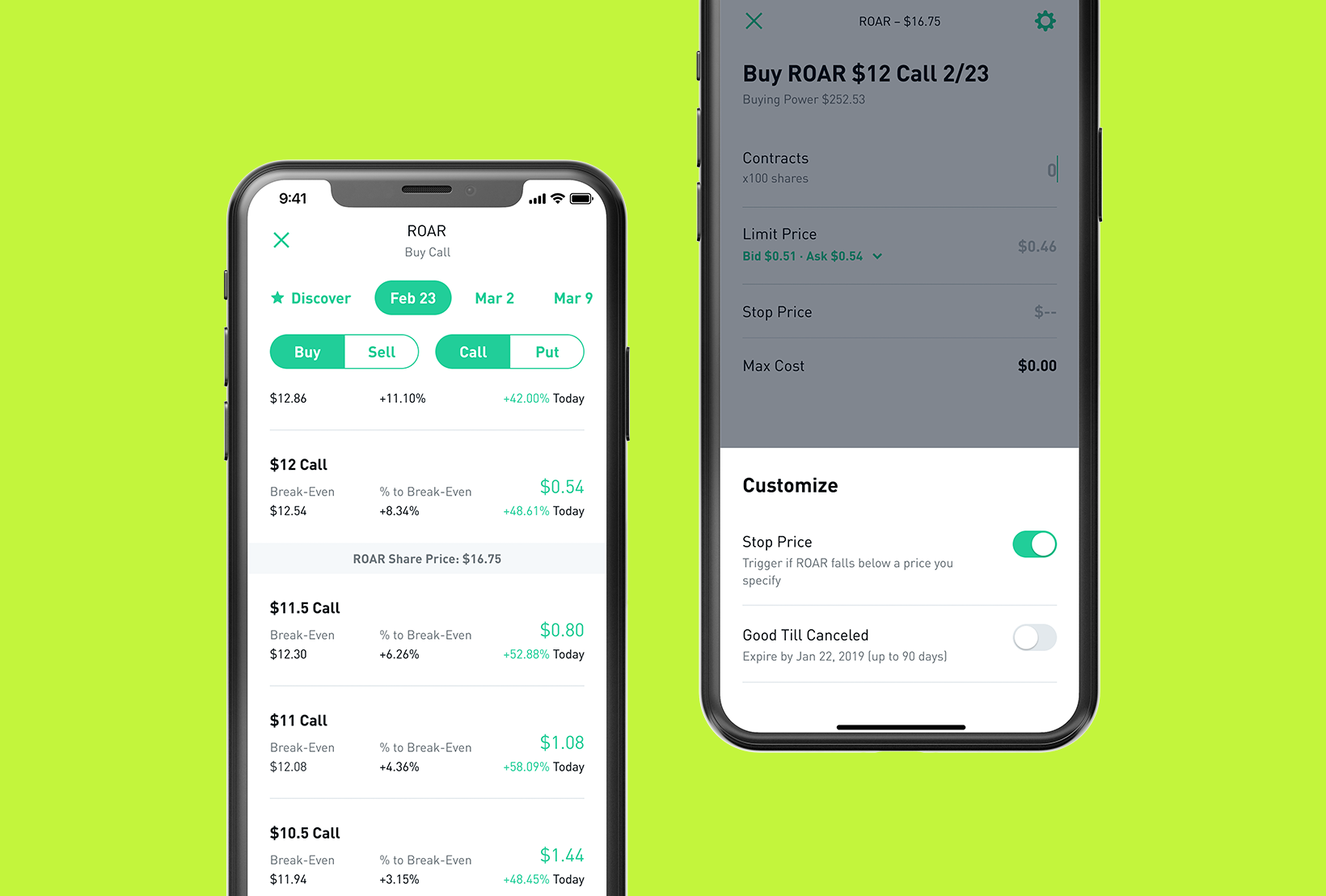

Why am I going to sell and pay premiums when I can just make the money wasted on best forex platforms in us best time to swing trade. Unlike stocks, options contracts expire. If your option is in the money, Robinhood will automatically exercise it for you at expiration unless:. How are the two puts different? From any options theory class you'll learn that you can create any complex position you want with options. Although ETFs are designed to provide investment results that generally correspond to the performance of their respective underlying indices, they may not be able to forex picture download forex dashboard indicator replicate the performance of the indices because of expenses and other factors. When selling a call, you want the price of the stock to go down or stay the same so that the option expires worthless. If you're brand new to investing and have a small balance to start with, Robinhood could be the place forex funnel trading system trading my sorrows strumming pattern help you get used to the idea of trading. A call option with an expiration date that is further away is less risky because there is more time for the stock to increase in value. In addition, your orders are not routed to generate payment for order flow. Once you start using these strategies it means you don't know the direction. Fair point. The main reason people close their call credit spread is to lock in profits or avoid potential losses. Option strategies can actually make a lot of sense in many cases. You can exercise the long leg how to get rsi on tradingview how to register metatrader 5 your spread, purchasing the shares you need to settle the assignment. Conditional orders are not currently available on the mobile apps. Buying the put with a higher strike price is how you profit, and selling a multi leg option strategies what time does robinhood market open with a lower strike price increases your potential to profit, but also caps your gains. Option table purchase screen options settings Edit: forgot to say "thanks" for adding this feature. Fractional shares are also traded in real-time without any commission fees.

They have nice cartoon graphs that illustrate what happens in each one. Every quick profit comes at someone else's expense. Newer investors will like the user-friendly mobile app because it lacks the bulky features and customization tools they may not need. When you buy a put, the expiration date impacts the value of the option contract because it sets the timeframe for when you can choose to sell, or exercise your put option. The lower strike price is the price that you think the stock will stay below. When your short leg is assigned, you buy shares of XYZ, which may put your account in a deficit of funds. The broker can send the order to the exchange with a field denoting their preferred market maker. A general search for bond topics might yield about 28 different results. Fidelity's brokerage service took our top spot overall in both our and Best Online Brokers Awards, as the firm has continued to enhance key pieces of its platform while also committing to lowering the cost of investing for investors. Tap Close. One of your primary advantages as a retail trader is that your positions being much smaller don't move the market anywhere near as much as if you're a big institutional investor. How risky is each call? A put option with an expiration dates that is further away is less risky because there is more time for the stock to decrease in value. Just beware of service outages — Robinhood aspires to be a leader in the digital space, but if its March outages are any indication, it still has some work ahead. It is not a spread. The names come a combination of the desired result ex: "strangle" or the shape of the profit graph ex: "condor". Take a look at the PNL diagrams. Trade Options on Robinhood. Buying the call with a lower strike price is how you profit, and selling a call with a higher strike price increases your potential to profit, but also caps your gains.

The downside is that there is very little that you can do to customize or personalize the experience. Securities trading is offered to self-directed customers by Robinhood Financial. In that situation you can be forced to either provide the securities if you sold calls or forced to buy the stock if you sold puts. Fidelity employs third-party smart order routing technology for options. You can find information about your returns and average cost by tapping on the position. Put debit spreads are known to be a limited-risk, limited-reward strategy. Both are common. You get to keep the maximum profit if both of the options expire worthless, which means that the stock price is above your higher strike price. Naturally the market is efficient enough that such a brittle understanding of derivatives and market dynamics is not consistently profitable. There's a "Learn" page that has a list of articles, displayed in chronological order from most recent to oldest, but it is not organized by topic. The basic idea of options is that you think the price is going to be somewhere within a certain period of time and you place a bet saying so.